Auburn National Bancorporation, Inc. (Nasdaq: AUBN) reported net

earnings of $2.2 million, or $0.62 per share, for the third quarter

of 2019, compared to $2.0 million, or $0.54 per share, for the

third quarter of 2018. Net earnings for the first nine months

of 2019 were $7.1 million, or $1.97 per share, compared to $6.4

million, or $1.77 per share, for the first nine months of 2018.

“The Company’s third quarter results reflect strong

earnings per share growth,” said Robert W. Dumas, Chairman,

President and CEO. Mr. Dumas continued, “Total revenues grew by 5%

due to increased net interest income and mortgage lending

income.”

Net interest income (tax-equivalent) was $6.7

million for the third quarter of 2019, a 2% increase compared to

$6.6 million for the third quarter of 2018. This increase was

primarily due to loan growth and improved yields on

interest-earning assets. Average loans were up 3% to $472.7

million in the third quarter of 2019 compared to $458.0 million in

the third quarter of 2018. The Company’s net interest margin

(tax-equivalent) was 3.41% in the third quarter of 2019 and 2018,

respectively.

Nonperforming assets were $0.2 million or 0.02% of total assets

at September 30, 2019, compared to $1.1 million or 0.13% of total

assets at September 30, 2018. The allowance for loan losses

was 1.03% of total loans at September 30, 2019, compared to 1.04%

of total loans at September 30, 2018. The Company recorded no

provision for loan losses in the third quarter of 2019 and 2018.

The provision for loan losses is based upon various estimates

and judgments, including the absolute level of loans, loan growth,

credit quality and the amount of net charge-offs.

Noninterest income was $1.0 million for the third quarter of

2019, compared to $0.8 million for the third quarter of 2018.

The increase in noninterest income was primarily due to an increase

in mortgage lending income as lower interest rates for mortgage

loans positively affected refinance activity.

Noninterest expense was $4.8 million for the third quarter of

2019 and 2018, respectively.

The Company paid cash dividends of $0.25 per share in the third

quarter of 2019, an increase of 4.2% from the same period in

2018. The Company repurchased 5,702 shares of its common

stock in the latest quarter and 77,907 shares of its common stock

year to date in 2019. At September 30, 2019, the Bank’s

regulatory capital was well above the minimum amounts required to

be “well capitalized” under current regulatory standards.

About Auburn National Bancorporation,

Inc.

Auburn National Bancorporation, Inc. (the “Company”) is the

parent company of AuburnBank (the “Bank”), with total assets of

approximately $825 million. The Bank is an Alabama state-chartered

bank that is a member of the Federal Reserve System, which has

operated continuously since 1907. Both the Company and the Bank are

headquartered in Auburn, Alabama. The Bank conducts its business in

East Alabama, including Lee County and surrounding areas. The Bank

operates eight full-service branches in Auburn, Opelika, Valley,

and Notasulga, Alabama. The Bank also operates loan

production offices in Auburn and Phenix City, Alabama. Additional

information about the Company and the Bank may be found by visiting

www.auburnbank.com.

Cautionary Notice Regarding Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the Securities Act of 1933 and the Securities

Exchange Act of 1934, including, without limitation, statements

about future financial and operating results, costs and revenues,

economic conditions in our markets, loan demand, mortgage lending

activity, changes in the mix of our earning assets (including those

generating tax exempt income) and our deposit and wholesale

liabilities, net interest margin, yields on earning assets,

securities valuations and performance, interest rates (generally

and those applicable to our assets and liabilities), loan

performance, nonperforming assets, other real estate owned,

provision for loan losses, charge-offs, other-than-temporary

impairments, collateral values, credit quality, asset sales,

insurance claims, and market trends, as well as statements with

respect to our objectives, expectations and intentions and other

statements that are not historical facts. Actual results may

differ from those set forth in the forward-looking statements.

Forward-looking statements, with respect to our beliefs, plans,

objectives, goals, expectations, anticipations, estimates and

intentions, involve known and unknown risks, uncertainties and

other factors, which may be beyond our control, and which may cause

the actual results, performance, achievements, or financial

condition of the Company or the Bank to be materially different

from future results, performance, achievements, or financial

condition expressed or implied by such forward-looking

statements. You should not expect us to update any

forward-looking statements.

All written or oral forward-looking statements attributable to

us are expressly qualified in their entirety by this cautionary

notice, together with those risks and uncertainties described in

our annual report on Form 10-K for the year ended December 31,

2018 and otherwise in our other SEC reports and filings.

Explanation of Certain Unaudited Non-GAAP Financial

Measures

This press release contains financial information determined by

methods other than U.S. generally accepted accounting principles

(“GAAP”). The attached financial highlights includes certain

designated net interest income amounts presented on a

tax-equivalent basis, a non-GAAP financial measure, and the

presentation and calculation of the efficiency ratio, a non-GAAP

measure. Management uses these non-GAAP financial measures in its

analysis of the Company’s performance and believes the presentation

of net interest income on a tax-equivalent basis provides

comparability of net interest income from both taxable and

tax-exempt sources and facilitates comparability within the

industry. Similarly, the efficiency ratio is a common measure

that facilitates comparability with other financial

institutions. Although the Company believes these non-GAAP

financial measures enhance investors’ understanding of its business

and performance, these non-GAAP financial measures should not be

considered an alternative to GAAP. Along with the attached

financial highlights, the Company provides reconciliations between

the GAAP financial measures and these non-GAAP financial

measures.

For additional information, contact: Robert W.

Dumas Chairman, President and CEO (334) 821-9200

| Reports Third

Quarter Net Earnings |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Highlights (unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Quarter ended September 30, |

|

|

Nine months ended September 30, |

|

(Dollars in thousands, except per share amounts) |

|

2019 |

|

|

|

2018 |

|

|

|

|

2019 |

|

|

|

|

2018 |

|

|

Results of Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest income (a) |

$ |

6,707 |

|

|

$ |

6,575 |

|

|

|

$ |

20,215 |

|

|

|

$ |

19,484 |

|

|

Less: tax-equivalent adjustment |

|

140 |

|

|

|

153 |

|

|

|

|

431 |

|

|

|

|

461 |

|

|

|

Net interest income (GAAP) |

|

6,567 |

|

|

|

6,422 |

|

|

|

|

19,784 |

|

|

|

|

19,023 |

|

|

Noninterest income |

|

991 |

|

|

|

791 |

|

|

|

|

3,036 |

|

|

|

|

2,483 |

|

|

|

Total revenue |

|

7,558 |

|

|

|

7,213 |

|

|

|

|

22,820 |

|

|

|

|

21,506 |

|

|

Provision for loan losses |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

|

Noninterest expense |

|

4,824 |

|

|

|

4,750 |

|

|

|

|

14,064 |

|

|

|

|

13,478 |

|

|

Income tax expense |

|

527 |

|

|

|

488 |

|

|

|

|

1,699 |

|

|

|

|

1,594 |

|

|

Net earnings |

$ |

2,207 |

|

|

$ |

1,975 |

|

|

|

$ |

7,057 |

|

|

|

$ |

6,434 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net earnings: |

$ |

0.62 |

|

|

$ |

0.54 |

|

|

|

$ |

1.97 |

|

|

|

$ |

1.77 |

|

|

Cash dividends declared |

$ |

0.25 |

|

|

$ |

0.24 |

|

|

|

$ |

0.75 |

|

|

|

$ |

0.72 |

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Basic and diluted |

|

3,568,287 |

|

|

|

3,643,834 |

|

|

|

|

3,586,642 |

|

|

|

|

3,643,750 |

|

|

Shares outstanding, at period end |

|

3,566,146 |

|

|

|

3,643,868 |

|

|

|

|

3,566,146 |

|

|

|

|

3,643,868 |

|

|

Book value |

$ |

27.12 |

|

|

$ |

23.45 |

|

|

|

$ |

27.12 |

|

|

|

$ |

23.45 |

|

|

Common stock price: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

High |

$ |

47.38 |

|

|

$ |

53.50 |

|

|

|

$ |

47.38 |

|

|

|

$ |

53.50 |

|

| |

Low |

|

32.33 |

|

|

|

38.31 |

|

|

|

|

30.61 |

|

|

|

|

35.50 |

|

| |

Period-end: |

|

47.38 |

|

|

|

38.32 |

|

|

|

|

47.38 |

|

|

|

|

38.32 |

|

| |

|

To earnings ratio |

|

18.08 |

x |

|

|

16.96 |

x |

|

|

|

18.08 |

x |

|

|

|

16.96 |

x |

| |

|

To book value |

|

175 |

% |

|

163 |

% |

|

|

175 |

% |

|

|

163 |

% |

|

Performance ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on average equity (annualized) |

|

9.25 |

% |

|

9.08 |

% |

|

|

10.17 |

% |

|

|

9.84 |

% |

|

Return on average assets (annualized) |

|

1.06 |

% |

|

0.97 |

% |

|

|

1.14 |

% |

|

|

1.04 |

% |

|

Dividend payout ratio |

|

40.32 |

% |

|

44.44 |

% |

|

|

38.07 |

% |

|

|

40.68 |

% |

|

Other financial data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net interest margin (a) |

|

3.41 |

% |

|

3.41 |

% |

|

|

3.48 |

% |

|

|

3.36 |

% |

|

Effective income tax rate |

|

19.28 |

% |

|

19.81 |

% |

|

|

19.40 |

% |

|

|

19.86 |

% |

|

Efficiency ratio (b) |

|

62.67 |

% |

|

64.49 |

% |

|

|

60.49 |

% |

|

|

61.36 |

% |

|

Asset Quality: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Nonperforming (nonaccrual) loans |

$ |

174 |

|

|

$ |

934 |

|

|

|

$ |

174 |

|

|

|

$ |

934 |

|

|

|

Other real estate owned |

|

— |

|

|

|

137 |

|

|

|

|

— |

|

|

|

|

137 |

|

|

|

|

Total nonperforming assets |

$ |

174 |

|

|

$ |

1,071 |

|

|

|

$ |

174 |

|

|

|

$ |

1,071 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net charge-offs (recoveries) |

$ |

44 |

|

|

$ |

(35 |

) |

|

|

$ |

(17 |

) |

|

|

$ |

(28 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for loan losses as a % of: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loans |

|

1.03 |

% |

|

1.04 |

% |

|

|

1.03 |

% |

|

|

1.04 |

% |

| |

Nonperforming loans |

|

2,763 |

% |

|

512 |

% |

|

|

2,763 |

% |

|

|

512 |

% |

|

Nonperforming assets as a % of: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Loans and other real estate owned |

|

0.04 |

% |

|

0.23 |

% |

|

|

0.04 |

% |

|

|

0.23 |

% |

| |

Total assets |

|

0.02 |

% |

|

0.13 |

% |

|

|

0.02 |

% |

|

|

0.13 |

% |

|

Nonperforming loans as a % of total loans |

|

0.04 |

% |

|

0.20 |

% |

|

|

0.04 |

% |

|

|

0.20 |

% |

|

Annualized net charge-offs (recoveries) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

as a % of average loans |

|

0.04 |

% |

|

(0.03 |

)% |

|

|

— |

% |

|

|

(0.01 |

)% |

|

Selected average balances: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities |

$ |

247,114 |

|

|

$ |

248,684 |

|

|

|

$ |

243,666 |

|

|

|

$ |

256,667 |

|

|

Loans, net of unearned income |

|

472,747 |

|

|

|

457,969 |

|

|

|

|

474,438 |

|

|

|

|

452,627 |

|

|

Total assets |

|

829,761 |

|

|

|

813,531 |

|

|

|

|

826,213 |

|

|

|

|

825,249 |

|

|

Total deposits |

|

729,608 |

|

|

|

721,566 |

|

|

|

|

729,126 |

|

|

|

|

731,411 |

|

|

Long-term debt |

|

— |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

1,367 |

|

|

Total stockholders' equity |

$ |

95,400 |

|

|

$ |

86,958 |

|

|

|

$ |

92,555 |

|

|

|

$ |

87,183 |

|

|

Selected period end balances: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities |

$ |

251,152 |

|

|

$ |

243,336 |

|

|

|

$ |

251,152 |

|

|

|

$ |

243,336 |

|

|

Loans, net of unearned income |

|

465,108 |

|

|

|

460,327 |

|

|

|

|

465,108 |

|

|

|

|

460,327 |

|

|

Allowance for loan losses |

|

4,807 |

|

|

|

4,785 |

|

|

|

|

4,807 |

|

|

|

|

4,785 |

|

|

Total assets |

|

824,963 |

|

|

|

808,951 |

|

|

|

|

824,963 |

|

|

|

|

808,951 |

|

|

Total deposits |

|

723,071 |

|

|

|

719,306 |

|

|

|

|

723,071 |

|

|

|

|

719,306 |

|

|

Total stockholders' equity |

$ |

96,720 |

|

|

$ |

85,459 |

|

|

|

$ |

96,720 |

|

|

|

$ |

85,459 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a) Tax equivalent. See “Explanation of Certain Unaudited Non-GAAP

Financial Measures” and “Reconciliation of GAAP |

| |

to non-GAAP Measures

(unaudited).” |

| (b) Efficiency ratio

is the result of noninterest expense divided by the sum of

noninterest income and tax-equivalent |

| |

net interest

income. |

| Reports Third

Quarter Net Earnings |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation

of GAAP to non-GAAP Measures (unaudited): |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

Quarter ended September 30, |

|

Nine months ended September 30, |

|

|

(Dollars in thousands, except per share amounts) |

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

Net interest income, as reported (GAAP) |

$ |

6,567 |

|

$ |

6,422 |

|

$ |

19,784 |

|

$ |

19,023 |

|

|

Tax-equivalent adjustment |

|

140 |

|

|

153 |

|

|

431 |

|

|

461 |

|

|

Net interest income (tax-equivalent) |

$ |

6,707 |

|

$ |

6,575 |

|

$ |

20,215 |

|

$ |

19,484 |

|

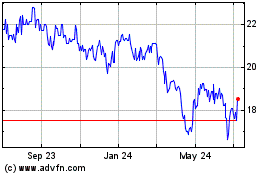

Auburn National Bancorpo... (NASDAQ:AUBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

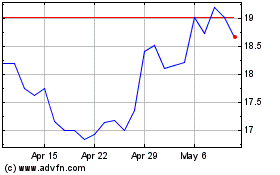

Auburn National Bancorpo... (NASDAQ:AUBN)

Historical Stock Chart

From Apr 2023 to Apr 2024