- Worldwide revenue of $115.9 million – an increase of 17.9% year

over year

- U.S. revenue of $95.5 million – an increase of 16.8% year over

year

- Achieved 20% growth on revenues from open appendage management

devices in the U.S.

- International revenue of $20.5 million – an increase of 23.3%

year over year

- Positive cash flow generation of $16.3 million in third quarter

2024

AtriCure, Inc. (Nasdaq: ATRC), a leading innovator in surgical

treatments and therapies for atrial fibrillation (Afib), left

atrial appendage (LAA) management and post-operative pain

management, today announced third quarter 2024 financial

results.

“Our broad-based growth in the third quarter reflects strong,

ongoing adoption trends throughout our business,” said Michael

Carrel, President and Chief Executive Officer at AtriCure. “During

the quarter, we launched several new products in the United States

and Europe, leading to an acceleration in growth along with

continued improvement in profitability and positive cash flow

generation. Our results are a testament to our commitment to expand

access to our innovative solutions for patients and providers

worldwide.”

Third Quarter 2024 Financial

Results

Revenue for the third quarter 2024 was $115.9 million, an

increase of 17.9% over third quarter 2023 revenue (17.8% on a

constant currency basis), reflecting continued adoption of our

products by physicians globally for the treatment of patients with

Afib, LAA management and post-operative pain management. On a

sequential basis, worldwide revenue for the third quarter 2024

decreased approximately 0.3% from the second quarter 2024 due to

normal seasonality of procedures in summer months.

U.S. revenue was $95.5 million, an increase of $13.8 million or

16.8%, compared to the third quarter 2023. U.S. revenue growth was

driven by sales across key product lines, including the ENCOMPASS®

clamp in open ablation, AtriClip® Flex·V® device in appendage

management and cryoSPHERE® probes for post-operative pain

management. International revenue increased $3.9 million or 23.3%

(22.4% on a constant currency basis) to $20.5 million, realizing

significant growth across all franchises in Europe and most of our

other major geographic regions.

Gross profit for the third quarter 2024 was $86.8 million

compared to $73.9 million for the third quarter 2023. Gross margin

was 74.9% for the third quarter 2024, a decrease of 27 basis points

from the third quarter 2023, reflecting less favorable geographic

and product mix. Loss from operations for the third quarter 2024

was $7.4 million, compared to $8.1 million for the third quarter

2023. Basic and diluted net loss per share was $0.17 for the third

quarter 2024, compared to $0.20 for the third quarter 2023.

Adjusted EBITDA for the third quarter 2024 is $7.9 million, an

increase of $3.2 million from third quarter of 2023. Adjusted loss

per share for the third quarter 2024 was $0.17, compared to $0.20

for the third quarter 2023.

Constant currency revenue, adjusted EBITDA and adjusted loss per

share are non-GAAP financial measures. We discuss these non-GAAP

financial measures and provide reconciliations to GAAP measures

later in this release.

2024 Financial Guidance

AtriCure now expects full year 2024 revenue of approximately

$459 million to $462 million, reflecting growth of approximately

15% to 16%. Management continues to expect full year 2024 Adjusted

EBITDA of approximately $26 million to $29 million, with

improvements annually thereafter. Projected full year 2024 adjusted

EBITDA represents a 34% to 49% increase over full year 2023. Full

year 2024 adjusted loss per share is expected to be in the range of

$0.74 to $0.80.

Conference Call

AtriCure will host a conference call at 4:30 p.m. Eastern Time

on Tuesday, October 29, 2024 to discuss third quarter 2024

financial results. To access the webcast, please visit the

Investors page of AtriCure’s corporate website at

https://ir.atricure.com/events-and-presentations/events.

Participants are encouraged to register more than 15 minutes before

the webcast start time. A replay of the presentation will be

available for 90 days following the presentation.

About AtriCure

AtriCure, Inc. provides innovative technologies for the

treatment of Afib and related conditions. Afib affects more than 37

million people worldwide. Electrophysiologists, cardiothoracic and

thoracic surgeons around the globe use AtriCure technologies for

the treatment of Afib, reduction of Afib related complications, and

post-operative pain management. AtriCure’s Isolator® Synergy™

Ablation System is the first medical device to receive FDA approval

for the treatment of persistent Afib. AtriCure’s AtriClip® Left

Atrial Appendage Exclusion System products are the most widely sold

LAA management devices worldwide. AtriCure’s Hybrid AF™ Therapy is

a minimally invasive procedure that provides a lasting solution for

long-standing persistent Afib patients. AtriCure’s cryoICE

cryoSPHERE® probes are cleared for temporary ablation of peripheral

nerves to block pain, providing pain relief in cardiac and thoracic

procedures. For more information, visit AtriCure.com or follow us

on X (formerly known as Twitter) @AtriCure.

Forward-Looking

Statements

This press release contains “forward-looking statements”– that

is, statements related to future events that by their nature

address matters that are uncertain. This press release also

includes forward-looking projected financial information that is

based on current estimates and forecasts. Actual results could

differ materially. For details on the uncertainties that may cause

our actual results to be materially different than those expressed

in our forward-looking statements, visit

http://www.atricure.com/forward-looking-statements as well as our

Annual Reports on Form 10-K and Quarterly Reports on Form 10-Q

which contain risk factors. Except where otherwise noted, the

information contained in this release is as of October 29, 2024. We

assume no obligation to update any forward-looking statements

contained in this release as a result of new information or future

events or developments, except as may be required by law.

Use of Non-GAAP Financial

Measures

To supplement AtriCure’s condensed consolidated financial

statements prepared in accordance with accounting principles

generally accepted in the United States of America, or GAAP,

AtriCure provides certain non-GAAP financial measures in this

release as supplemental financial metrics.

Revenue reported on a constant currency basis is a non-GAAP

measure, calculated by applying previous period foreign currency

exchange rates to each of the comparable periods. Management

analyzes revenue on a constant currency basis to better measure the

comparability of results between periods. Because changes in

foreign currency exchange rates have a non-operating impact on

revenue, the Company believes that evaluating growth in revenue on

a constant currency basis provides an additional and meaningful

assessment of revenue to both management and investors.

Adjusted EBITDA is calculated as net income (loss) before other

income/expense (including interest), income tax expense,

depreciation and amortization expense, share-based compensation

expense, acquisition costs, legal settlement costs, impairment of

intangible assets and change in fair value of contingent

consideration liabilities. Management believes in order to properly

understand short-term and long-term financial trends, investors may

wish to consider the impact of these excluded items in addition to

GAAP measures. The excluded items vary in frequency and/or impact

on our continuing results of operations and management believes

that the excluded items are typically not reflective of our ongoing

core business operations and financial condition. Further,

management uses adjusted EBITDA for both strategic and annual

operating planning. A reconciliation of adjusted EBITDA reported in

this release to the most comparable GAAP measure for the respective

periods appears in the table captioned “Reconciliation of Non-GAAP

Adjusted Income (Adjusted EBITDA)” later in this release.

Adjusted loss per share is a non-GAAP measure which calculates

the net loss per share before non-cash adjustments in fair value of

contingent consideration liabilities, impairment of intangible

assets, debt extinguishment and legal settlements. A reconciliation

of adjusted loss per share reported in this release to the most

comparable GAAP measure for the respective periods appears in the

table captioned “Reconciliation of Non-GAAP Adjusted Loss Per

Share” later in this release.

The non-GAAP financial measures used by AtriCure may not be the

same or calculated in the same manner as those used and calculated

by other companies. Non-GAAP financial measures have limitations as

analytical tools and should not be considered in isolation or as a

substitute for AtriCure’s financial results prepared and reported

in accordance with GAAP. We urge investors to review the

reconciliation of these non-GAAP financial measures to the

comparable GAAP financials measures included in this press release,

and not to rely on any single financial measure to evaluate our

business.

ATRICURE, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In Thousands, Except Per

Share Amounts)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

United States Revenue:

Open ablation

$

30,601

$

25,844

$

90,661

$

77,988

Minimally invasive ablation

11,117

10,893

35,263

31,900

Pain management

16,314

12,591

44,059

36,249

Total ablation

58,032

49,328

169,983

146,137

Appendage management

37,420

32,364

111,257

98,647

Total United States

95,452

81,692

281,240

244,784

International Revenue:

Open ablation

8,607

8,007

25,679

23,015

Minimally invasive ablation

1,681

1,578

5,559

4,820

Pain management

1,590

547

3,768

1,214

Total ablation

11,878

10,132

35,006

29,049

Appendage management

8,580

6,466

24,784

18,869

Total International

20,458

16,598

59,790

47,918

Total revenue

115,910

98,290

341,030

292,702

Cost of revenue

29,117

24,421

86,125

72,147

Gross profit

86,793

73,869

254,905

220,555

Operating expenses:

Research and development expenses

20,960

20,354

61,221

53,119

Selling, general and administrative

expenses

73,238

61,604

219,174

185,451

Total operating expenses

94,198

81,958

280,395

238,570

Loss from operations

(7,405

)

(8,089

)

(25,490

)

(18,015

)

Other expense, net

(126

)

(919

)

(2,882

)

(2,416

)

Loss before income tax expense

(7,531

)

(9,008

)

(28,372

)

(20,431

)

Income tax expense

322

47

758

218

Net loss

$

(7,853

)

$

(9,055

)

$

(29,130

)

$

(20,649

)

Basic and diluted net loss per share

$

(0.17

)

$

(0.20

)

$

(0.62

)

$

(0.45

)

Weighted average shares used in computing

net loss per share:

Basic and diluted

47,105

46,411

46,912

46,262

ATRICURE, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In Thousands)

(Unaudited)

September 30,

2024

December 31,

2023

Assets

Current assets:

Cash, cash equivalents, and short-term

investments

$

130,335

$

137,285

Accounts receivable, net

54,909

52,501

Inventories

76,546

67,897

Prepaid and other current assets

7,496

8,563

Total current assets

269,286

266,246

Property and equipment, net

43,537

42,435

Operating lease right-of-use assets

6,100

4,324

Goodwill and intangible assets, net

293,133

298,767

Other noncurrent assets

3,012

2,160

Total Assets

$

615,068

$

613,932

Liabilities and Stockholders'

Equity

Current liabilities:

Accounts payable and accrued

liabilities

$

71,716

$

72,036

Current lease liabilities

2,715

2,533

Total current liabilities

74,431

74,569

Long-term debt

61,865

60,593

Finance and operating lease

liabilities

12,548

11,368

Other noncurrent liabilities

1,203

1,234

Total Liabilities

150,047

147,764

Stockholders' Equity:

Common stock

49

48

Additional paid-in capital

851,306

824,170

Accumulated other comprehensive loss

(147

)

(993

)

Accumulated deficit

(386,187

)

(357,057

)

Total Stockholders' Equity

465,021

466,168

Total Liabilities and Stockholders'

Equity

$

615,068

$

613,932

ATRICURE, INC. AND

SUBSIDIARIES

RECONCILIATION OF GAAP RESULTS

TO NON-GAAP RESULTS

(In Thousands)

(Unaudited)

Reconciliation of Non-GAAP Adjusted

Income (Adjusted EBITDA)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net loss, as reported

$

(7,853

)

$

(9,055

)

$

(29,130

)

$

(20,649

)

Income tax expense

322

47

758

218

Other expense, net

126

919

2,882

2,416

Depreciation and amortization expense

4,928

4,111

13,907

10,634

Share-based compensation expense

10,364

8,661

30,020

26,416

Gain from legal settlements

—

—

—

(4,412

)

Non-GAAP adjusted income (adjusted

EBITDA)

$

7,887

$

4,683

$

18,437

$

14,623

Reconciliation of Non-GAAP Adjusted

Loss Per Share

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Net loss, as reported

$

(7,853

)

$

(9,055

)

$

(29,130

)

$

(20,649

)

Loss on debt extinguishment

—

—

1,362

—

Gain from legal settlements

—

—

—

(4,412

)

Non-GAAP adjusted net loss

$

(7,853

)

$

(9,055

)

$

(27,768

)

$

(25,061

)

Basic and diluted adjusted net loss per

share

$

(0.17

)

$

(0.20

)

$

(0.59

)

$

(0.54

)

Weighted average shares used in computing

adjusted net loss per share

Basic and diluted

47,105

46,411

46,912

46,262

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241029706905/en/

Angie Wirick AtriCure, Inc. Chief Financial Officer (513)

755-5334 awirick@atricure.com

Marissa Bych Gilmartin Group Investor Relations (415) 937-5402

marissa@gilmartinir.com

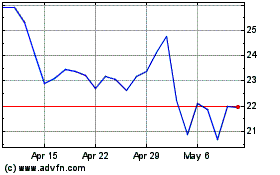

AtriCure (NASDAQ:ATRC)

Historical Stock Chart

From Oct 2024 to Nov 2024

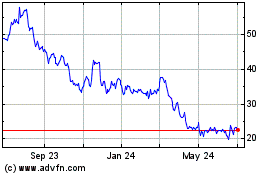

AtriCure (NASDAQ:ATRC)

Historical Stock Chart

From Nov 2023 to Nov 2024