Atossa Genetics Inc. (Nasdaq: ATOS), a clinical-stage

biopharmaceutical company developing novel therapeutics and

delivery methods to treat breast cancer and other breast

conditions, today announced financial results for the second

quarter ended June 30, 2019 and provided an update on recent

company developments.

Steven C. Quay, M.D., Ph.D., Atossa Genetics’ President and CEO

commented, "During the quarter we were very pleased to have

achieved our primary endpoint in our Phase 2 trial of topical

Endoxifen to reduce mammographic breast density (MBD). We are now

focusing our efforts on the oral formulation of Endoxifen and are

developing a modified-release oral tablet which is being tested in

a Phase 1 study and that we plan to use in a Phase 2 study to

reduce MBD. The Phase 2 study is scheduled to start in the fourth

quarter and should be completed by mid-2020. We completed the

quarter with $17.1 million in cash, which will enable us to

continue to make clinical progress with our programs."

Recent Developments

Recent developments include the following:

- July 2019 – Provided update on expanded access program, which

now allows physicians and patients to visit the company website to

obtain information on compassionate use access

- July 2019 – Initiated a Phase 1 study of our proprietary

modified-release oral Endoxifen tablet

- June 2019 – Successfully reached the primary endpoint of MBD

reduction using the topical formulation of Endoxifen in a Phase 2

study

Q2 2019 Financial Results

For the three and six months ended June 30, 2019 and 2018, we

have no source of sustainable revenue and no associated cost of

revenue.

Total operating expenses were approximately $7,286,000 and

$11,350,000 for the three and six months ended June 30, 2019,

respectively, consisting of research and development (R&D)

expenses of approximately $2,612,000 and $4,063,000 respectively,

and general and administrative (G&A) expense of approximately

$4,674,000 and $7,287,000, respectively. Total operating expenses

were approximately $4,143,000 and $6,017,000 for the three and six

months ended June 30, 2018, respectively, consisting of research

and development expenses of approximately $1,468,000 and

$1,939,000, respectively, and general and administrative expenses

of approximately $2,675,000 and $4,078,000, respectively.

R&D expenses for the three months ended June 30, 2019, were

approximately $2,612,000, an increase of approximately $1,144,000

or 78% from total R&D expenses for the three months ended June

30, 2018 of approximately $1,468,000. R&D expenses for the six

months ended June 30, 2019, were approximately $4,063,000, an

increase of approximately $2,124,000 or 110% from total R&D

expenses for the six months ended June 30, 2018 of approximately

$1,939,000. The increase in R&D expenses for the period

ended June 30, 2019, is mainly attributed to an increase in

stock-based compensation expense (non-cash). We expect our R&D

expenses to increase throughout 2019 as we commence an additional

Phase 2 clinical study of oral Endoxifen, develop and manufacture

our modified release tablet form of oral Endoxifen, continue our

clinical trial of Fulvestrant administered via our intraductal

technology and continue the development of other indications and

therapeutics, including CAR-T and immunotherapies administered via

our intraductal technologies.

G&A expenses were approximately $4,674,000 for the three

months ended June 30, 2019, an increase of approximately

$1,999,000, or 75% from the total G&A expenses for the three

months ended June 30, 2018, of approximately $2,675,000.

G&A expenses were approximately $7,287,000 for the

six months ended June 30, 2019, an increase of approximately

$3,209,000, or 79% from the total G&A expenses for the

six months ended June 30, 2018, of approximately

$4,078,000. G&A expenses consist primarily of personnel and

related benefit costs, facilities, professional services,

insurance, and public company related expenses. The increase in

G&A expenses for the period ended June 30,

2019, is mainly attributed to an increase in stock-based

compensation expense (non-cash). Additionally, payroll

expenses have increased resulting from salary increases over the

prior year.

As of June 30, 2019, Atossa had approximately $17.1 million in

cash and cash equivalents and working capital of approximately

$17.4 million.

About Atossa Genetics

Atossa Genetics Inc. is a clinical-stage biopharmaceutical

company developing novel therapeutics and delivery methods to treat

breast cancer and other breast conditions. For more information,

please visit www.atossagenetics.com.

Forward-Looking Statements

Forward-looking statements in this press release, which Atossa

undertakes no obligation to update, are subject to risks and

uncertainties that may cause actual results to differ materially

from the anticipated or estimated future results, including the

risks and uncertainties associated with any variation between

preliminary and final clinical results, actions and inactions by

the FDA, the outcome or timing of regulatory approvals needed by

Atossa including those needed to commence studies, lower than

anticipated rate of patient enrollment, estimated market size of

drugs under development, the safety and efficacy of Atossa's

products and services, performance of clinical research

organizations and investigators, obstacles resulting from

proprietary rights held by others with respect to fulvestrant, such

as patent rights, potential market sizes for Atossa's drugs under

development and other risks detailed from time to time in Atossa's

filings with the Securities and Exchange Commission, including

without limitation its periodic reports on Form10-K and 10-Q, each

as amended and supplemented from time to time.

Atossa Genetics Company Contact: Atossa Genetics Inc. Kyle Guse

CFO and General Counsel Office: 866 893-4927

kyle.guse@atossagenetics.com

Investor Relations Contact: Scott Gordon Core IR377 Oak

StreetConcourse 2Garden City, NY 11530Office:(516)

222-2560scottg@corprominence.com

Source: Atossa Genetics Inc.

ATOSSA GENETICS INC.CONDENSED

CONSOLIDATED BALANCE SHEETS

| |

|

As of June 30, |

|

|

|

As of |

|

| |

|

2019 |

|

|

December 31, |

|

| Assets |

|

(Unaudited) |

|

|

2018 |

|

|

Current assets |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

17,058,527 |

|

|

$ |

10,380,493 |

|

| Restricted cash |

|

|

110,000 |

|

|

|

110,000 |

|

| Prepaid expenses |

|

|

813,168 |

|

|

|

509,833 |

|

| Research and development tax

rebate receivable |

|

|

406,306 |

|

|

|

518,098 |

|

| Other current assets |

|

|

140 |

|

|

|

30,942 |

|

| Total current assets |

|

|

18,388,141 |

|

|

|

11,549,366 |

|

| |

|

|

|

|

|

|

|

|

| Furniture and equipment,

net |

|

|

44,174 |

|

|

|

54,487 |

|

| Intangible assets, net |

|

|

83,958 |

|

|

|

99,375 |

|

| Right-of-use asset |

|

|

75,822 |

|

|

|

- |

|

| Other assets |

|

|

17,218 |

|

|

|

17,218 |

|

| Total Assets |

|

$ |

18,609,313 |

|

|

$ |

11,720,446 |

|

| |

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

|

|

|

|

| Current liabilities |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

318,266 |

|

|

$ |

353,328 |

|

| Accrued expenses |

|

|

53,485 |

|

|

|

177,074 |

|

| Payroll liabilities |

|

|

589,445 |

|

|

|

935,070 |

|

| Stock-based compensation

liability |

|

|

- |

|

|

|

1,410,025 |

|

| Lease liability |

|

|

51,795 |

|

|

|

- |

|

| Other current liabilities |

|

|

19,838 |

|

|

|

39,939 |

|

| Total current liabilities |

|

|

1,032,829 |

|

|

|

2,915,436 |

|

| Long term liabilities |

|

|

|

|

|

|

|

|

| Lease liability long term |

|

|

24,027 |

|

|

|

- |

|

| Total Liabilities |

|

|

1,056,856 |

|

|

|

2,915,436 |

|

| |

|

|

|

|

|

|

|

|

| Commitments and

contingencies |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Stockholders' equity |

|

|

|

|

|

|

|

|

| Preferred stock - $0.001 par

value; 10,000,000 shares authorized; 676 and 2,379shares issued and

outstanding as of June 30, 2019 and December 31, 2018,

respectively |

|

|

1 |

|

|

|

2 |

|

| Additional paid-in capital-

Series B convertible preferred stock |

|

|

675,999 |

|

|

|

2,378,997 |

|

| Common stock - $0.18 par

value; 175,000,000 shares authorized, and 9,129,563 and5,846,552

shares issued and outstanding, as of June 30, 2019 and December 31,

2018, respectively |

|

|

1,643,309 |

|

|

|

1,052,372 |

|

| Additional paid-in

capital |

|

|

103,400,247 |

|

|

|

82,204,902 |

|

| Accumulated deficit |

|

|

(88,167,099 |

) |

|

|

(76,831,263 |

) |

| Total Stockholders'

Equity |

|

|

17,552,457 |

|

|

|

8,805,010 |

|

| |

|

|

|

|

|

|

|

|

| Total Liabilities and

Stockholders' Equity |

|

$ |

18,609,313 |

|

|

$ |

11,720,446 |

|

| |

|

|

|

|

|

|

|

|

ATOSSA GENETICS INC. CONDENSED

CONSOLIDATED STATEMENTS OF

OPERATIONS(UNAUDITED)

| |

|

For the Three MonthsEnded June

30, |

|

|

For the Six MonthsEnded June

30, |

|

|

| |

|

|

|

|

2018 |

|

|

|

|

|

2018 |

|

| |

|

2019 |

|

|

(as restated) |

|

|

2019 |

|

|

(as restated) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

|

$ |

2,611,948 |

|

|

$ |

1,467,736 |

|

|

$ |

4,063,184 |

|

|

$ |

1,938,712 |

|

| General and

administrative |

|

|

4,674,121 |

|

|

|

2,674,920 |

|

|

|

7,287,214 |

|

|

|

4,078,385 |

|

| Total operating expenses |

|

|

7,286,069 |

|

|

|

4,142,656 |

|

|

|

11,350,398 |

|

|

|

6,017,097 |

|

| Operating loss |

|

|

(7,286,069 |

) |

|

|

(4,142,656 |

) |

|

|

(11,350,398 |

) |

|

|

(6,017,097 |

) |

| Other income |

|

|

23,540 |

|

|

|

79 |

|

|

|

14,562 |

|

|

|

138 |

|

| Loss before income taxes |

|

|

(7,262,529 |

) |

|

|

(4,142,577 |

) |

|

|

(11,335,836 |

) |

|

|

(6,016,959 |

) |

| Income taxes |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

| Net loss |

|

$ |

(7,262,529 |

) |

|

$ |

(4,142,577 |

) |

|

$ |

(11,335,836 |

) |

|

$ |

(6,016,959 |

) |

| Deemed dividends attributable

to preferred stock |

|

|

- |

|

|

|

(11,479,308 |

) |

|

|

- |

|

|

|

(11,479,308 |

) |

| Net loss applicable to common

shareholders |

|

$ |

(7,262,529 |

) |

|

$ |

(15,621,885 |

) |

|

$ |

(11,335,836 |

) |

|

$ |

(17,496,267 |

) |

| Loss per common share - basic

and diluted |

|

$ |

(0.80 |

) |

|

$ |

(5.08 |

) |

|

$ |

(1.44 |

) |

|

$ |

(6.11 |

) |

| Weighted average shares

outstanding - basic and diluted |

|

|

9,126,153 |

|

|

|

3,073,803 |

|

|

|

7,852,907 |

|

|

|

2,864,033 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

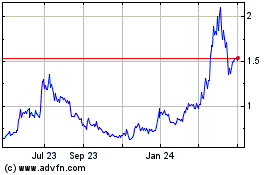

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Atossa Therapeutics (NASDAQ:ATOS)

Historical Stock Chart

From Apr 2023 to Apr 2024