UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2018

Commission File Number 001-36487

Atlantica Yield plc

(Exact name of Registrant as Specified in its Charter)

Not Applicable

(Translation of Registrant’s name into English)

Great West House, GW1, 17th floor

Great West Road

Brentford, TW8 9DF

United Kingdom

Tel.: +44 20 7098 4384

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

This Report on Form 6-K is incorporated by reference into each of the Registration Statements

on Form F-3 of the Registrant filed with the Securities and Exchange Commission on February 27, 2017 (File No. 333-216253) and August 6, 2018 (File 333-226611).

|

|

|

Page

|

|

PART I – FINANCIAL INFORMATION

|

|

|

|

|

|

Item 1

|

|

11

|

|

|

|

|

|

Item 2

|

|

47

|

|

|

|

|

|

Item 3

|

|

71

|

|

|

|

|

|

Item 4

|

|

73

|

|

|

|

|

|

PART II – OTHER INFORMATION

|

|

|

|

|

|

Item 1

|

|

73

|

|

|

|

|

|

Item 1A

|

|

74

|

|

|

|

|

|

Item 2

|

|

74

|

|

|

|

|

|

Item 3

|

|

74

|

|

|

|

|

|

Item 4

|

|

74

|

|

|

|

|

|

Item 5

|

|

74

|

|

|

|

|

|

Item 6

|

|

74

|

|

|

|

|

|

|

75

|

Definitions

Unless otherwise specified or the context requires otherwise in this quarterly report:

|

●

|

references to “2017 20-F” or “Annual Report” refer to the annual report on Form 20-F for the year ended December 31, 2017 and filed with the U.S. Securities and Exchange

Commission on March 7, 2018;

|

|

●

|

references to “2019 Notes” refer to the 7.000% Senior Notes due 2019 in an aggregate principal amount of $255,000,000 issued on November 17, 2014;

|

|

●

|

references to “AAGES” refer to the joint venture between Algonquin and Abengoa to invest in the development and construction of clean energy and water infrastructure

contracted assets;

|

|

●

|

references to “AAGES ROFO Agreement” refer to the agreement we entered into with AAGES on March 5, 2018, as amended from time to time, which became effective upon completion

of the 25.0% Share Sale, that provides us a right of first offer to purchase any of the AAGES ROFO Assets;

|

|

●

|

references to “AAGES ROFO Assets” refer to any of AAGES’ contracted assets or proposed contracted assets that we expect to evaluate for future acquisition, with certain

exceptions, for which AAGES has provided us a right of first offer to purchase if offered for sale by AAGES;

|

|

●

|

references to “Abengoa” refer to Abengoa, S.A., together with its subsidiaries or any of its subsidiaries independently considered, unless the context otherwise requires;

|

|

●

|

references to “Abengoa ROFO Agreement” refer to the agreement we entered into with Abengoa on June 13, 2014, as amended and restated on December 9, 2014, that provides us a

right of first offer to purchase any of the existing or future contracted assets in renewable energy, efficient natural gas power, electric transmission and water of Abengoa that are in operation, and any other renewable energy, efficient

natural gas power, electric transmission and water asset that is expected to generate contracted revenue and that Abengoa has transferred to an investment vehicle located in the United States, Canada, Mexico, Chile, Peru, Uruguay, Brazil,

Colombia, or the European Union, and four additional assets in other selected regions, including a pipeline of specified assets that we expect to evaluate for future acquisition, for which Abengoa will provide us a right of first offer to

purchase if offered for sale by Abengoa or an investment vehicle to which Abengoa has transferred them;

|

|

●

|

references to “ACBH” refer to Abengoa Concessões Brasil Holding, a subsidiary holding company of Abengoa that is engaged in the development, construction, investment and

management of contracted concessions in Brazil, comprised mostly of transmission lines and which is currently undergoing a restructuring process in Brazil;

|

|

●

|

references to “Algonquin” refer to, as the context requires, either Algonquin Power & Utilities Corp., a North American diversified generation, transmission and

distribution utility, together with its subsidiaries or any of its subsidiaries independently considered, unless the context otherwise requires;

|

|

●

|

references to “Annual Consolidated Financial Statements” refer to the audited annual consolidated financial statements as of December 31, 2017 and 2016 and for the years

ended December 31, 2017, 2016 and 2015, including the related notes thereto, prepared in accordance with IFRS as issued by the IASB (as such terms are defined herein);

|

|

●

|

references to “Asset Transfer” refer to the transfer of assets contributed to us by Abengoa through a series of transactions prior to the consummation of our initial public

offering;

|

|

●

|

references to “Atlantica” refer to Atlantica Yield plc together with its subsidiaries independently considered, unless and, where the context requires;

|

|

●

|

references to “cash available for distribution” refer to the cash distributions received by the Company from its subsidiaries minus all cash expenses of the Company,

including debt service and general and administrative expenses;

|

|

●

|

references to “COD” refer to commercial operation date of the applicable facility;

|

|

●

|

references to “Consolidated Condensed Interim Financial Statements” refer to the consolidated condensed unaudited interim financial statements as of September 30, 2018 and

December 31, 2017 and for the nine-month periods ended September 30, 2018 and 2017, including the related notes thereto, which form a part of this quarterly report;

|

|

●

|

references to “DOE” refer to the U.S. Department of Energy;

|

|

●

|

references to “EMEA” refer to Europe, Middle East and Africa;

|

|

●

|

references to “EPC” refer to engineering, procurement and construction;

|

|

●

|

references to “EURIBOR” refer to Euro Interbank Offered Rate, a daily reference rate published by the European Money Markets Institute, based on the average interest rates at

which Eurozone banks offer to lend unsecured funds to other banks in the euro wholesale money market;

|

|

●

|

references to “euro” or “€” are to the single currency of the participating member states of the European and Monetary Union of the Treaty Establishing the European

Community, as amended from time to time;

|

|

●

|

references to “Federal Financing Bank” refer to a U.S. government corporation by that name;

|

|

●

|

references to “Financial Support Agreement” refer to the Financial Support Agreement we entered into with Abengoa on June 13, 2014, as amended and restated on September 28,

2017, pursuant to which Abengoa agreed to maintain certain guarantees or letters of credit for a period of five years following our IPO;

|

|

●

|

references to “Former Revolving Credit Facility” refer to the revolving credit and guaranty agreement originally entered into on December 3, 2014, amended and restated on

June 26, 2015 and canceled on May 16, 2018;

|

|

●

|

references to “Further Adjusted EBITDA” have the meaning set forth in Note 4 to the Consolidated Condensed Interim Financial Statements included in this quarterly report;

|

|

●

|

references to “gross capacity” or “gross MW” refer to the maximum, or rated, power generation capacity, in MW, of a facility or group of facilities, without adjusting by our

percentage of ownership interest in such facility as of the date of this quarterly report;

|

|

●

|

references to “GW” refer to gigawatts;

|

|

●

|

references to “IASB” refer to International Accounting Standards Board, an independent, private-sector body that develops and approves International Financial Reporting

Standards;

|

|

●

|

references to “IFRS as issued by the IASB” refer to International Financial Reporting Standards as issued by the International Accounting Standards Board;

|

|

●

|

reference to “IPO” refer to our initial public offering of ordinary shares in June 2014;

|

|

●

|

references to “ITC” refer to investment tax credits;

|

|

●

|

references to “ITC Cash Grants” refer to the tax credit cash grant issued by the U.S. Treasury;

|

|

●

|

references to “LIBOR” refer to London Interbank Offered Rate, a benchmark interest rate;

|

|

●

|

references to “MW” refer to megawatts;

|

|

●

|

references to “MMSCFD” refer to million standard cubic feet per day;

|

|

●

|

references to “Revolving Credit Facility” refer to the revolving credit facility entered into on May 10, 2018 by us, as borrower, the guarantors from time to time party

thereto, Royal Bank of Canada, as administrative agent and Royal Bank of Canada and Canadian Imperial Bank of Commerce, as issuers of letters of credit;

|

|

●

|

references to “Note Issuance Facility” refer to the senior secured note facility dated February 10, 2017, of up to €275 million (approximately $319 million), with U.S. Bank

as facility agent and a group of funds managed by Westbourne Capital as purchasers of the notes issued thereunder;

|

|

●

|

references to “O&M” refer to operation and maintenance;

|

|

●

|

references to “operation” refer to the status of projects that have reached COD (as defined above);

|

|

●

|

references to “PV” refer to photovoltaic;

|

|

●

|

references to “PPA” refer to the power purchase agreements through which our power generating assets have contracted to sell energy to various offtakers;

|

|

●

|

references to “ROFO” refer to a right of first offer;

|

|

●

|

references to “Shareholders Agreement” refer to the shareholders agreement signed with Algonquin which became effective upon the 25.0% Share Sale on March 9, 2018 and which

we filed with the SEC on March 12, 2018;

|

|

●

|

references to “16.5% Share Sale” refer to the ongoing sale by Abengoa to Algonquin of 16.5% of our ordinary shares pursuant to an agreement entered into in April 2018, which

the parties to the transaction expect to be completed in the fourth quarter of 2018;

|

|

●

|

references to “25.0% Share Sale” refer to the sale by Abengoa to Algonquin of 25% of our ordinary shares completed on March 9, 2018;

|

|

●

|

references to “UK” refer to the United Kingdom;

|

|

●

|

references to “U.S.” or “United States” refer to the United States of America;

|

|

●

|

references to “U.S. Internal Revenue Code” or “U.S. IRC” refer to the U.S. Internal Revenue Code of 1986;

|

|

●

|

references to “U.S. NOLs” refer to the net operating losses recognized under the U.S. Internal Revenue Code as a result of certain tax-deductible expenses exceeding taxable

revenues for a taxable year;

|

|

●

|

references to “we,” “us,” “our” and the “Company” refer to Atlantica Yield plc and its subsidiaries, unless the context otherwise requires; and

|

|

●

|

references to “ZAR” refer to South African Rand.

|

Cautionary Statements Regarding Forward-Looking Statements

This quarterly report includes forward-looking statements. These forward-looking statements include, but are not limited to, all

statements other than statements of historical facts contained in this quarterly report, including, without limitation, those regarding our future financial position and results of operations, our strategy, plans, objectives, goals and targets,

future developments in the markets in which we operate or are seeking to operate or anticipated regulatory changes in the markets in which we operate or intend to operate. In some cases, you can identify forward-looking statements by terminology such

as “aim,” “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “forecast,” “guidance,” “intend,” “is likely to,” “may,” “plan,” “potential,” “predict,” “projected,” “should” or “will” or the negative of such terms or other similar

expressions or terminology.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that

may or may not occur in the future. Forward-looking statements speak only as of the date of this quarterly report and are not guarantees of future performance and are based on numerous assumptions. Our actual results of operations, financial

condition and the development of events may differ materially from (and be more negative than) those made in, or suggested by, the forward-looking statements. We do not undertake any obligation to update any forward-looking statements to reflect

events or circumstances after the date hereof or to reflect the occurrence of anticipated or unanticipated events or circumstances.

Investors should read the section entitled “Item 3.D—Risk Factors” in our Annual Report and the description of our segments and business

sectors in the section entitled “Item 4.B—Business Overview” in our Annual Report for a more complete discussion of the factors that could affect us. Important risks, uncertainties and other factors that could cause these differences include, but are

not limited to:

|

•

|

Difficult conditions in the global economy and in the global market and uncertainties in emerging markets where we have international operations;

|

|

•

|

Changes in government regulations providing incentives and subsidies for renewable energy, decreases in government expenditure budgets, reductions in government subsidies or

other adverse changes in laws and regulations affecting our businesses and growth plan, including reduction of our revenues in Spain, which are mainly defined by regulation through parameters that could be reviewed at the end of each

regulatory period;

|

|

•

|

Our ability to acquire solar projects due to the potential increase of the cost of solar panels;

|

|

•

|

Political, social and macroeconomic risks relating to the United Kingdom’s exit from the European Union;

|

|

•

|

Changes in general economic, political, governmental and business conditions globally and in the countries in which we do business;

|

|

•

|

Challenges in achieving growth and making acquisitions due to our dividend policy;

|

|

•

|

Inability to identify and/or consummate future acquisitions, under the AAGES ROFO Agreement, the Abengoa ROFO Agreement or otherwise, from third parties or from potential new

partners, including as a result of not being able to find acquisition opportunities on favorable terms or at all.

|

|

•

|

Our ability to close acquisitions under our ROFO agreements with AAGES, Algonquin, Abengoa and others due to, among other things, not being offered assets that fit our

portfolio, not reaching agreements on prices or, in the case of the Abengoa ROFO Agreement, the risk of Abengoa selling assets before they reach COD;

|

|

•

|

Our ability to renew the Abengoa ROFO Agreement after June 2019. The Abengoa ROFO Agreement has an initial term of five years and expires in June 2019. We will be able to

unilaterally extend the term of the Abengoa ROFO Agreement as many times as desired for an additional three-year period, provided that we have executed at least one acquisition in the previous two years after having been offered at least

four projects.

|

|

•

|

Our ability to identify and reach an agreement with new sponsors or partners similar to the ROFO agreements with AAGES, Algonquin or Abengoa;

|

|

·

|

Failure to close acquisitions recently announced;

|

|

·

|

Failure to meet our estimated returns and cash available for distribution

estimations in acquisitions recently announced;

|

|

·

|

Failure of recently built assets to perform as expected, including acquisitions

recently announced of assets which are currently under construction;

|

|

•

|

Legal challenges to regulations, subsidies and incentives that support renewable energy sources; extensive governmental regulation in a number of different jurisdictions,

including stringent environmental regulation;

|

|

•

|

Increases in the cost of energy and gas, which could increase our operating costs;

|

|

•

|

Counterparty credit risk and failure of counterparties to our offtake agreements to fulfill their obligations;

|

|

•

|

Inability to enter into new offtaker agreements or replace expiring or terminated offtake agreements with similar agreements;

|

|

•

|

New technology or changes in industry standards;

|

|

•

|

Inability to manage exposure to credit, interest rates, foreign currency exchange rates, supply and commodity price risks;

|

|

•

|

Reliance on third-party contractors and suppliers;

|

|

•

|

Risks associated with acquisitions and investments;

|

|

•

|

Deviations from our investment criteria for future acquisitions and investments;

|

|

•

|

Failure to maintain safe work environments;

|

|

•

|

Effects of catastrophes, natural disasters, adverse weather conditions, climate change, unexpected geological or other physical conditions, criminal or terrorist acts or

cyber-attacks at one or more of our plants;

|

|

•

|

Insufficient insurance coverage and increases in insurance cost;

|

|

•

|

Litigation and other legal proceedings, including claims due to Abengoa’s restructuring process;

|

|

•

|

Reputational risk, including potential damage caused to us by Abengoa’s reputation;

|

|

•

|

The loss of one or more of our executive officers;

|

|

•

|

Failure of information technology on which we rely to run our business;

|

|

•

|

Revocation or termination of our concession agreements or power purchase agreements;

|

|

•

|

Lowering of revenues in Spain that are mainly defined by regulation;

|

|

•

|

Risk that the 16.5% Share Sale will not be completed;

|

|

•

|

Inability to adjust regulated tariffs or fixed-rate arrangements as a result of fluctuations in prices of raw materials, exchange rates, labor and subcontractor costs;

|

|

•

|

Exposure to electricity market conditions which can impact revenue from our assets;

|

|

•

|

Changes to national and international law and policies that support renewable energy resources;

|

|

•

|

Lack of electric transmission capacity and potential upgrade costs to the electric transmission grid;

|

|

•

|

Disruptions in our operations as a result of our not owning the land on which our assets are located;

|

|

•

|

Risks associated with maintenance, expansion and refurbishment of electric generation facilities;

|

|

•

|

Failure of our assets to perform as expected, including Solana and Kaxu;

|

|

•

|

Failure to receive dividends from all projects and investments, including Solana and Kaxu;

|

|

•

|

Failure or delay to reach the “flip-date” by Liberty Interactive Corporation in its tax equity investment in Solana;

|

|

•

|

Variations in meteorological conditions;

|

|

•

|

Disruption of the fuel supplies necessary to generate power at our efficient natural gas power generation facilities;

|

|

•

|

Deterioration in Abengoa’s financial condition or negative impact potentially caused by Abengoa’s financial plan announced on September 30, 2018, including potential negative

impacts in our assets;

|

|

•

|

Abengoa’s ability to meet its obligations under our agreements with Abengoa, to comply with past representations, commitments and potential liabilities linked to the time

when Abengoa owned the assets, potential clawback of transactions with Abengoa, and other risks related to Abengoa;

|

|

•

|

Failure to meet certain covenants or payment obligations under our financing arrangements;

|

|

•

|

Failure to obtain pending waivers in relation to the minimum ownership by Abengoa and the cross-default provisions contained in some of our project financing agreements;

|

|

•

|

Failure of Abengoa to maintain existing guarantees and letters of credit under the Financial Support Agreement or failure by us to maintain guarantees;

|

|

•

|

Failure of Abengoa to maintain its obligations and production guarantees, pursuant to EPC contracts;

|

|

•

|

Changes in our tax position and greater than expected tax liability, including in Spain;

|

|

•

|

Conflicts of interest which may be resolved in a manner that is not in our best interests or the best interests of our minority shareholders, potentially caused by our

ownership structure and certain service agreements in place with one of our current largest shareholders;

|

|

•

|

The divergence of interest between us and Abengoa, due to Abengoa’s sale of our shares;

|

|

•

|

Potential negative tax implications from being deemed to undergo an “ownership change” under section 382 of the Internal Revenue Code, including limitations on our ability to

use U.S. NOLs to offset future income tax liability;

|

|

•

|

Negative implications from a potential change of control;

|

|

•

|

Negative implications of U.S. federal income tax reform and potential changes in tax regulation in other jusrisdictions;

|

|

•

|

Technical failure, design errors or faulty operation of our assets not covered by guarantees or insurance;

|

|

•

|

Failure to collect insurance proceeds in the expected amounts; and

|

|

•

|

Various other factors, including those factors discussed under “Item 3.D—Risk Factors” and “Item 5.A—Operating Results” in our Annual Report.

|

We caution that the important factors referenced above may not be all of the factors that are important to investors. Unless required by

law, we undertake no obligation to update or revise any forward-looking statement, whether as a result of new information, future events or developments or otherwise. Additional factors affecting our business may arise periodically and we cannot

predict such factors, nor can we assess the impact of all these factors on our business or the extent to which such factors or combination of factors could cause our results to materially differ from those contained in any forward-looking statement.

Additionally, historical trends in our statements should not be interpreted as a guarantee that these trends will continue in the future.

Consolidated condensed statements of financial position as of September 30,

2018 and December 31, 2017

Amounts in thousands of U.S. dollars

|

|

|

|

|

|

As of

September 30,

|

|

|

As of

December 31,

|

|

|

|

|

Note (1)

|

|

|

2018

|

|

|

2017

|

|

|

Assets

|

|

|

|

|

|

|

|

|

|

|

Non-current assets

|

|

|

|

|

|

|

|

|

|

|

Contracted concessional assets

|

|

|

6

|

|

|

|

8,606,943

|

|

|

|

9,084,270

|

|

|

Investments carried under the equity method

|

|

|

7

|

|

|

|

54,776

|

|

|

|

55,784

|

|

|

Financial investments

|

|

|

8&9

|

|

|

|

52,947

|

|

|

|

45,242

|

|

|

Deferred tax assets

|

|

|

|

|

|

|

160,106

|

|

|

|

165,136

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current assets

|

|

|

|

|

|

|

8,874,772

|

|

|

|

9,350,432

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inventories

|

|

|

|

|

|

|

18,785

|

|

|

|

17,933

|

|

|

Clients and other receivables

|

|

|

12

|

|

|

|

297,258

|

|

|

|

244,449

|

|

|

Financial investments

|

|

|

8

|

|

|

|

237,080

|

|

|

|

210,138

|

|

|

Cash and cash equivalents

|

|

|

|

|

|

|

744,636

|

|

|

|

669,387

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current assets

|

|

|

|

|

|

|

1,297,759

|

|

|

|

1,141,907

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets

|

|

|

|

|

|

|

10,172,531

|

|

|

|

10,492,339

|

|

|

(1)

|

Notes 1 to 22 are an integral part of the consolidated condensed interim financial statements.

|

Consolidated condensed statements of financial position as of September 30, 2018 and December 31,

2017

Amounts in thousands of U.S. dollars

|

|

|

|

|

|

As of

September 30,

|

|

|

As of

December 31,

|

|

|

|

|

Note (1)

|

|

|

2018

|

|

|

2017

|

|

|

Equity and liabilities

|

|

|

|

|

|

|

|

|

|

|

Equity attributable to the Company

|

|

|

|

|

|

|

|

|

|

|

Share capital

|

|

|

13

|

|

|

|

10,022

|

|

|

|

10,022

|

|

|

Parent company reserves

|

|

|

13

|

|

|

|

2,066,018

|

|

|

|

2,163,229

|

|

|

Other reserves

|

|

|

|

|

|

|

105,959

|

|

|

|

80,968

|

|

|

Accumulated currency translation differences

|

|

|

|

|

|

|

(59,931

|

)

|

|

|

(18,147

|

)

|

|

Retained earnings

|

|

|

13

|

|

|

|

(363,605

|

)

|

|

|

(477,214

|

)

|

|

Non-controlling interest

|

|

|

13

|

|

|

|

134,768

|

|

|

|

136,595

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity

|

|

|

|

|

|

|

1,893,231

|

|

|

|

1,895,453

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term corporate debt

|

|

|

14

|

|

|

|

622,433

|

|

|

|

574,176

|

|

|

Long-term project debt

|

|

|

15

|

|

|

|

4,908,678

|

|

|

|

5,228,917

|

|

|

Grants and other liabilities

|

|

|

16

|

|

|

|

1,653,451

|

|

|

|

1,636,060

|

|

|

Related parties

|

|

|

11

|

|

|

|

78,734

|

|

|

|

141,031

|

|

|

Derivative liabilities

|

|

|

9

|

|

|

|

266,884

|

|

|

|

329,731

|

|

|

Deferred tax liabilities

|

|

|

|

|

|

|

251,479

|

|

|

|

186,583

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total non-current liabilities

|

|

|

|

|

|

|

7,781,659

|

|

|

|

8,096,498

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-term corporate debt

|

|

|

14

|

|

|

|

19,352

|

|

|

|

68,907

|

|

|

Short-term project debt

|

|

|

15

|

|

|

|

305,997

|

|

|

|

246,291

|

|

|

Trade payables and other current liabilities

|

|

|

17

|

|

|

|

133,632

|

|

|

|

155,144

|

|

|

Income and other tax payables

|

|

|

|

|

|

|

38,660

|

|

|

|

30,046

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

|

|

|

|

497,641

|

|

|

|

500,388

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity and liabilities

|

|

|

|

|

|

|

10,172,531

|

|

|

|

10,492,339

|

|

|

(1)

|

Notes 1 to 22 are an integral part of the consolidated condensed interim financial statements.

|

Consolidated condensed income statements for the nine-month periods ended September 30, 2018 and 2017

Amounts in thousands of U.S. dollars

|

|

|

Note (1)

|

|

|

For the nine-month period ended September 30,

|

|

|

|

|

|

|

|

2018

|

|

|

2017

|

|

|

Revenue

|

|

|

4

|

|

|

|

836,925

|

|

|

|

775,179

|

|

|

Other operating income

|

|

|

20

|

|

|

|

112,214

|

|

|

|

56,499

|

|

|

Raw materials and consumables used

|

|

|

|

|

|

|

(7,652

|

)

|

|

|

(11,209

|

)

|

|

Employee benefit expenses

|

|

|

|

|

|

|

(15,793

|

)

|

|

|

(13,252

|

)

|

|

Depreciation, amortization, and impairment charges

|

|

|

4

|

|

|

|

(243,799

|

)

|

|

|

(236,431

|

)

|

|

Other operating expenses

|

|

|

20

|

|

|

|

(217,333

|

)

|

|

|

(193,673

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit

|

|

|

|

|

|

|

464,562

|

|

|

|

377,113

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial income

|

|

|

19

|

|

|

|

36,603

|

|

|

|

1,131

|

|

|

Financial expense

|

|

|

19

|

|

|

|

(306,340

|

)

|

|

|

(308,570

|

)

|

|

Net exchange differences

|

|

|

|

|

|

|

1,032

|

|

|

|

(4,294

|

)

|

|

Other financial income/(expense), net

|

|

|

19

|

|

|

|

(11,139

|

)

|

|

|

1,302

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial expense, net

|

|

|

|

|

|

|

(279,844

|

)

|

|

|

(310,431

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share of profit/(loss) of associates carried under the equity method

|

|

|

|

|

|

|

4,690

|

|

|

|

3,700

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit/(loss) before income tax

|

|

|

|

|

|

|

189,408

|

|

|

|

70,382

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax

|

|

|

18

|

|

|

|

(59,068

|

)

|

|

|

(25,330

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit/(loss) for the period

|

|

|

|

|

|

|

130,340

|

|

|

|

45,052

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss/(profit) attributable to non-controlling interests

|

|

|

|

|

|

|

(9,828

|

)

|

|

|

(2,470

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit/(loss) for the period attributable to the Company

|

|

|

|

|

|

|

120,512

|

|

|

|

42,582

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of ordinary shares outstanding (thousands)

|

|

|

21

|

|

|

|

100,217

|

|

|

|

100,217

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share (U.S. dollar per share)

|

|

|

21

|

|

|

|

1,20

|

|

|

|

0.42

|

|

|

(1)

|

Notes 1 to 22 are an integral part of the consolidated condensed interim financial statements.

|

Consolidated condensed statements of comprehensive income for the nine-month periods ended September 30, 2018 and 2017

Amounts in thousands of U.S. dollars

|

|

|

For the nine-month period ended September 30,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

Profit/(loss) for the period

|

|

|

130,340

|

|

|

|

45,052

|

|

|

Items that may be subject to transfer to income statement

|

|

|

|

|

|

|

|

|

|

Change in fair value of cash flow hedges

|

|

|

(6,753

|

)

|

|

|

(33,542

|

)

|

|

Currency translation differences

|

|

|

(44,906

|

)

|

|

|

103,485

|

|

|

Tax effect

|

|

|

(1,672

|

)

|

|

|

7,900

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income/(expenses) recognized directly in equity

|

|

|

(53,331

|

)

|

|

|

77,843

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow hedges

|

|

|

51,049

|

|

|

|

54,446

|

|

|

Tax effect

|

|

|

(12,762

|

)

|

|

|

(16,334

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Transfers to income statement

|

|

|

38,287

|

|

|

|

38,112

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income/(loss)

|

|

|

(15,044

|

)

|

|

|

115,955

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income/(loss) for the period

|

|

|

115,296

|

|

|

|

161,007

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive (income)/loss attributable to non-controlling interest

|

|

|

(7,994

|

)

|

|

|

(8,532

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income/(loss) attributable to the Company

|

|

|

107,302

|

|

|

|

152,475

|

|

Consolidated condensed statements of changes in equity for the nine-month periods ended September 30, 2018 and 2017

Amounts in thousands of U.S. dollars

|

|

|

Share

Capital

|

|

|

Parent

company

reserves

|

|

|

Other

reserves

|

|

|

Retained

earnings

|

|

|

Accumulated

currency

translation

differences

|

|

|

Total

equity

attributable

to the

Company

|

|

|

Non-

controlling

interest

|

|

|

Total

equity

|

|

|

Balance as of January 1, 2017

|

|

|

10,022

|

|

|

|

2,268,457

|

|

|

|

52,797

|

|

|

|

(365,410

|

)

|

|

|

(133,150

|

)

|

|

|

1,832,716

|

|

|

|

126,395

|

|

|

|

1,959,111

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit/(loss) for the nine-month period after taxes

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

42,582

|

|

|

|

—

|

|

|

|

42,582

|

|

|

|

2,470

|

|

|

|

45,052

|

|

|

Change in fair value of cash flow hedges

|

|

|

—

|

|

|

|

—

|

|

|

|

21,377

|

|

|

|

—

|

|

|

|

—

|

|

|

|

21,377

|

|

|

|

(473

|

)

|

|

|

20,904

|

|

|

Currency translation differences

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

97,142

|

|

|

|

97,142

|

|

|

|

6,343

|

|

|

|

103,485

|

|

|

Tax effect

|

|

|

—

|

|

|

|

—

|

|

|

|

(8,626

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

(8,626

|

)

|

|

|

192

|

|

|

|

(8,434

|

)

|

|

Other comprehensive income

|

|

|

—

|

|

|

|

—

|

|

|

|

12,751

|

|

|

|

—

|

|

|

|

97,142

|

|

|

|

109,893

|

|

|

|

6,062

|

|

|

|

115,955

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income

|

|

|

—

|

|

|

|

—

|

|

|

|

12,751

|

|

|

|

42,582

|

|

|

|

97,142

|

|

|

|

152,475

|

|

|

|

8,532

|

|

|

|

161,007

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividend distribution

|

|

|

—

|

|

|

|

(76,165

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(76,165

|

)

|

|

|

(4,573

|

)

|

|

|

(80,738

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of September 30, 2017

|

|

|

10,022

|

|

|

|

2,192,292

|

|

|

|

65,548

|

|

|

|

(322,828

|

)

|

|

|

(36,008

|

)

|

|

|

1,909,026

|

|

|

|

130,354

|

|

|

|

2,039,380

|

|

|

|

|

Share

Capital

|

|

|

Parent

company

reserves

|

|

|

Other

reserves

|

|

|

Retained

earnings

|

|

|

Accumulated

currency

translation

differences

|

|

|

Total

equity

attributable

to the

Company

|

|

|

Non-

controlling

interest

|

|

|

Total

equity

|

|

|

Balance as of December 31, 2017

|

|

|

10,022

|

|

|

|

2,163,229

|

|

|

|

80,968

|

|

|

|

(477,214

|

)

|

|

|

(18,147

|

)

|

|

|

1,758,858

|

|

|

|

136,595

|

|

|

|

1,895,453

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Application of new accounting standards (See Note 2)

|

|

|

—

|

|

|

|

—

|

|

|

|

1,326

|

|

|

|

(11,812

|

)

|

|

|

—

|

|

|

|

(10,486

|

)

|

|

|

—

|

|

|

|

(10,486

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of January 1, 2018

|

|

|

10,022

|

|

|

|

2,163,229

|

|

|

|

82,294

|

|

|

|

(489,026

|

)

|

|

|

(18,147

|

)

|

|

|

1,748,372

|

|

|

|

136,595

|

|

|

|

1,884,967

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Profit/(loss) for the nine-month period after taxes

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

120,512

|

|

|

|

—

|

|

|

|

120,512

|

|

|

|

9,828

|

|

|

|

130,340

|

|

|

Change in fair value of cash flow hedges

|

|

|

—

|

|

|

|

—

|

|

|

|

35,982

|

|

|

|

6,517

|

|

|

|

—

|

|

|

|

42,499

|

|

|

|

1,797

|

|

|

|

44,296

|

|

|

Currency translation differences

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(41,784

|

)

|

|

|

(41,784

|

)

|

|

|

(3,122

|

)

|

|

|

(44,906

|

)

|

|

Tax effect

|

|

|

—

|

|

|

|

—

|

|

|

|

(12,317

|

)

|

|

|

(1,608

|

)

|

|

|

—

|

|

|

|

(13,925

|

)

|

|

|

(509

|

)

|

|

|

(14,434

|

)

|

|

Other comprehensive income

|

|

|

—

|

|

|

|

—

|

|

|

|

23,665

|

|

|

|

4,909

|

|

|

|

(41,784

|

)

|

|

|

(13,210

|

)

|

|

|

(1,834

|

)

|

|

|

(15,044

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total comprehensive income

|

|

|

—

|

|

|

|

—

|

|

|

|

23,665

|

|

|

|

125,421

|

|

|

|

(41,784

|

)

|

|

|

107,302

|

|

|

|

7,994

|

|

|

|

115,296

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividend distribution

|

|

|

—

|

|

|

|

(97,211

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

(97,211

|

)

|

|

|

(9,821

|

)

|

|

|

(107,032

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance as of September 30, 2018

|

|

|

10,022

|

|

|

|

2,066,018

|

|

|

|

105,959

|

|

|

|

(363,605

|

)

|

|

|

(59,931

|

)

|

|

|

1,758,463

|

|

|

|

134,768

|

|

|

|

1,893,231

|

|

Consolidated condensed cash flow statements for the nine-month periods ended September 30, 2018 and 2017

Amounts in thousands of U.S. dollars

|

|

|

For the nine-month period ended September 30,

|

|

|

|

|

2018

|

|

|

2017

|

|

|

I. Profit/(loss) for the period

|

|

|

130,340

|

|

|

|

45,052

|

|

|

Financial expense and non-monetary adjustments

|

|

|

494,829

|

|

|

|

528,408

|

|

|

|

|

|

|

|

|

|

|

|

|

II. Profit for the period adjusted by financial expense and non-monetary adjustments

|

|

|

625,169

|

|

|

|

573,460

|

|

|

|

|

|

|

|

|

|

|

|

|

III. Variations in working capital

|

|

|

(97,020

|

)

|

|

|

(47,503

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net interest and income tax paid

|

|

|

(189,816

|

)

|

|

|

(198,667

|

)

|

|

|

|

|

|

|

|

|

|

|

|

A. Net cash provided by operating activities

|

|

|

338,333

|

|

|

|

327,290

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment in contracted concessional assets*

|

|

|

61,084

|

|

|

|

(7,506

|

)

|

|

Other non-current assets/liabilities

|

|

|

(22,506

|

)

|

|

|

(6,609

|

)

|

|

Acquisitions of subsidiaries

|

|

|

(9,327

|

)

|

|

|

-

|

|

|

Dividends received from entities under the equity method

|

|

|

4,432

|

|

|

|

2,454

|

|

|

Other investments

|

|

|

2,521

|

|

|

|

27,361

|

|

|

B. Net cash provided by/(used in) investing activities

|

|

|

36,204

|

|

|

|

15,700

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from Project & Corporate debt

|

|

|

73,767

|

|

|

|

287,051

|

|

|

Repayment of Project & Corporate debt

|

|

|

(248,904

|

)

|

|

|

(388,755

|

)

|

|

Dividends paid to company´s shareholders

|

|

|

(106,956

|

)

|

|

|

(70,803

|

)

|

|

|

|

|

|

|

|

|

|

|

|

C. Net cash provided by/(used in) financing activities

|

|

|

(282,093

|

)

|

|

|

(172,507

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Net increase/(decrease) in cash and cash equivalents

|

|

|

92,444

|

|

|

|

170,483

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at beginning of the period

|

|

|

669,387

|

|

|

|

594,811

|

|

|

|

|

|

|

|

|

|

|

|

|

Translation differences in cash or cash equivalent

|

|

|

(17,195

|

)

|

|

|

28,800

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents at end of the period

|

|

|

744,636

|

|

|

|

794,094

|

|

* Includes proceeds for $60.8 million (see Note 6).

Notes to the consolidated condensed interim financial statements

|

Note 1.- Nature of the business

|

19

|

|

|

|

|

Note 2.- Basis of preparation

|

22

|

|

|

|

|

Note 3.- Financial risk management

|

28

|

|

|

|

|

Note 4.- Financial information by segment

|

28

|

|

|

|

|

Note 5.- Changes in the scope of the consolidated condensed interim financial statements

|

35

|

|

|

|

|

Note 6.- Contracted concessional assets

|

35

|

|

|

|

|

Note 7.- Investments carried under the equity method

|

36

|

|

|

|

|

Note 8.- Financial Investments

|

36

|

|

|

|

|

Note 9.- Derivative financial instruments

|

36

|

|

|

|

|

Note 10.- Fair Value of financial instruments

|

37

|

|

|

|

|

Note 11.- Related parties

|

38

|

|

|

|

|

Note 12.- Clients and other receivable

|

39

|

|

|

|

|

Note 13.- Equity

|

39

|

|

|

|

|

Note 14.- Corporate debt

|

40

|

|

|

|

|

Note 15.- Project debt

|

41

|

|

|

|

|

Note 16.- Grants and other liabilities

|

42

|

|

|

|

|

Note 17.-Trade payables and other current liabilities

|

43

|

|

|

|

|

Note 18.- Income tax

|

44

|

|

|

|

|

Note 19.- Financial income and expenses

|

44

|

|

|

|

|

Note 20.- Other operating income and expenses

|

45

|

|

|

|

|

Note 21.- Earnings per share

|

46

|

|

|

|

|

Note 22.- Subsequent events

|

46

|

Note 1. - Nature of the business

Atlantica Yield plc (“Atlantica” or the “Company”) was incorporated in England and Wales as a private limited company on December 17, 2013 under the name

Abengoa Yield Limited. On March 19, 2014, the Company was re-registered as a public limited company, under the name Abengoa Yield plc. On May 13, 2016, the change of the Company´s registered name to Atlantica Yield plc was filed with the Registrar of

Companies in the United Kingdom.

Atlantica is a total return company that owns, manages and acquires renewable energy, efficient natural gas, electric transmission lines and water assets

focused on North America (the United States and Mexico), South America (Peru, Chile and Uruguay) and EMEA (Spain, Algeria and South Africa).

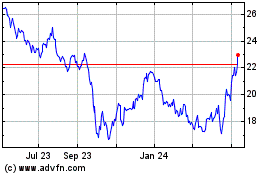

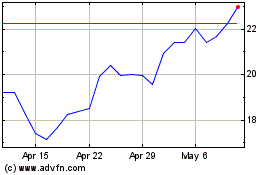

Atlantica’s shares began trading on the NASDAQ Global Select Market under the symbol “ABY” on June 13, 2014. The symbol changed to “AY” on November 11, 2017.

On February 28, 2018, the Company completed the acquisition of a 100% stake in a 4 MW hydroelectric power plant in Perú (“Mini-Hydro”) for approximately $9 million.

On March 9, 2018, Algonquin Power & Utilities (“Algonquin”) announced that it completed the acquisition from Abengoa S.A, (“Abengoa”) of a 25% equity

interest in Atlantica, becoming the largest shareholder of the Company. Algonquin does not consolidate the Company in its consolidated financial statements.

The following table provides an overview of the concessional assets the Company owned as of September 30, 2018:

|

Assets

|

Type

|

Ownership

|

Location

|

Currency

(8)

|

Capacity

(Gross)

|

Counterparty

Credit Ratings

(9)

|

COD

|

Contract

Years

Left

(12)

|

|

|

|

|

|

|

|

|

|

|

|

Solana

|

Renewable

(Solar)

|

100%

Class B

(1)

|

Arizona (USA)

|

USD

|

280 MW

|

A-/A2/A-

|

4Q 2013

|

26

|

|

|

|

|

|

|

|

|

|

|

|

Mojave

|

Renewable

(Solar)

|

100%

|

California

(USA)

|

USD

|

280 MW

|

BBB/Baa1/BBB+

|

4Q 2014

|

22

|

|

|

|

|

|

|

|

|

|

|

|

Solaben 2 & 3

|

Renewable

(Solar)

|

70%

(2)

|

Spain

|

Euro

|

2x50 MW

|

A-/Baa1/A-

|

3Q 2012 &

2Q 2012

|

20&19

|

|

Assets

|

Type

|

Ownership

|

Location

|

Currency

(8)

|

Capacity

(Gross)

|

Counterparty

Credit Ratings

(9)

|

COD

|

Contract

Years

Left

(12)

|

|

Solacor 1 & 2

|

Renewable

(Solar)

|

87%

(3)

|

Spain

|

Euro

|

2x50 MW

|

A-/Baa1/A-

|

1Q 2012 &

1Q 2012

|

19

|

|

|

|

|

|

|

|

|

|

|

|

PS10/PS20

|

Renewable

(Solar)

|

100%

|

Spain

|

Euro

|

31 MW

|

A-/Baa1/A-

|

1Q 2007 &

2Q 2009

|

14&16

|

|

Helioenergy 1 & 2

|

Renewable

(Solar)

|

100%

|

Spain

|

Euro

|

2x50 MW

|

A-/Baa1/A-

|

3Q 2011&

4Q 2011

|

19

|

|

|

|

|

|

|

|

|

|

|

|

Helios 1 & 2

|

Renewable

(Solar)

|

100%

|

Spain

|

Euro

|

2x50 MW

|

A-/Baa1/A-

|

3Q 2012&

3Q 2012

|

20

|

|

|

|

|

|

|

|

|

|

|

|

Solnova 1, 3 & 4

|

Renewable

(Solar)

|

100%

|

Spain

|

Euro

|

3x50 MW

|

A-/Baa1/A-

|

2Q 2010 &

2Q 2010&

3Q 2010

|

17&17&18

|

|

|

|

|

|

|

|

|

|

|

|

Solaben 1 & 6

|

Renewable

(Solar)

|

100%

|

Spain

|

Euro

|

2x50 MW

|

A-/Baa1/A-

|

3Q 2013

|

21

|

|

|

|

|

|

|

|

|

|

|

|

Seville PV

|

Renewable

(Solar)

|

80%

(7)

|

Spain

|

Euro

|

1 MW

|

A-/Baa1/A-

|

3Q 2006

|

18

|

|

|

|

|

|

|

|

|

|

|

|

Kaxu

|

Renewable

(Solar)

|

51%

(4)

|

South Africa

|

Rand

|

100 MW

|

BB/Baa3/BB-

(10)

|

1Q 2015

|

17

|

|

|

|

|

|

|

|

|

|

|

|

Palmatir

|

Renewable

(Wind)

|

100%

|

Uruguay

|

USD

|

50 MW

|

BBB/Baa2/BBB-

(11)

|

2Q 2014

|

16

|

|

|

|

|

|

|

|

|

|

|

|

Cadonal

|

Renewable

(Wind)

|

100%

|

Uruguay

|

USD

|

50 MW

|

BBB/Baa2/BBB-

(11)

|

4Q 2014

|

17

|

|

|

|

|

|

|

|

|

|

|

|

Mini-Hydro

|

Renewable

(Hydraulic)

|

100%

|

Peru

|

USD

|

4 MW

|

BBB+/A3/BBB+

|

2Q 2012

|

15

|

|

|

|

|

|

|

|

|

|

|

|

ACT

|

Efficient natural gas

|

100%

|

Mexico

|

USD

|

300 MW

|

BBB+/Baa3/BBB+

|

2Q 2013

|

15

|

|

|

|

|

|

|

|

|

|

|

|

ATN

|

Transmission

line

|

100%

|

Peru

|

USD

|

362 miles

|

BBB+/A3/BBB+

|

1Q 2011

|

23

|

|

|

|

|

|

|

|

|

|

|

|

ATS

|

Transmission

line

|

100%

|

Peru

|

USD

|

569 miles

|

BBB+/A3/BBB+

|

1Q 2014

|

26

|

|

|

|

|

|

|

|

|

|

|

|

ATN 2

|

Transmission

line

|

100%

|

Peru

|

USD

|

81 miles

|

Not rated

|

2Q 2015

|

15

|

|

|

|

|

|

|

|

|

|

|

|

Quadra 1

|

Transmission

line

|

100%

|

Chile

|

USD

|

49 miles

|

Not rated

|

2Q 2014

|

17

|

|

|

|

|

|

|

|

|

|

|

|

Quadra 2

|

Transmission

line

|

100%

|

Chile

|

USD

|

32 miles

|

Not rated

|

1Q 2014

|

17

|

|

|

|

|

|

|

|

|

|

|

|

Palmucho

|

Transmission

line

|

100%

|

Chile

|

USD

|

6 miles

|

BBB+/Baa1/BBB+

|

4Q 2007

|

20

|

|

Skikda

|

Water

|

34.2%

(5)

|

Algeria

|

USD

|

3.5 M

ft3/day

|

Not rated

|

1Q 2009

|

16

|

|

|

|

|

|

|

|

|

|

|

|

Honaine

|

Water

|

25.5%

(6)

|

Algeria

|

USD

|

7 M ft3/

day

|

Not rated

|

3Q 2012

|

20

|

|

(1)

|

On September 30, 2013, Liberty Interactive Corporation invested $300,000 thousand in Class A membership interests in exchange for the right to receive between 54.06% and

61.20% of taxable losses and distributions until such time as Liberty reaches a certain rate of return, or the “Flip Date”, and 22.60% of taxable losses and distributions thereafter once certain conditions are met.

|

|

(2)

|

Itochu Corporation, a Japanese trading company, holds 30% of the shares in each of Solaben 2 and Solaben 3.

|

|

(3)

|

JGC, a Japanese engineering company, holds 13% of the shares in each of Solacor 1 and Solacor 2.

|

|

(4)

|

Kaxu is owned by the Company (51%), Industrial Development Corporation of South Africa (29%) and Kaxu Community Trust (20%).

|

|

(5)

|

Algerian Energy Company, SPA owns 49% of Skikda and Sadyt (Sociedad Anónima Depuración y Tratamientos) owns the remaining 16.83%.

|

|

(6)

|

Algerian Energy Company, SPA owns 49% of Honaine and Sadyt (Sociedad Anónima Depuración y Tratamientos) owns the remaining 25.5%.

|

|

(7)

|

Instituto para la Diversificación y Ahorro de la Energía (“IDAE”), a Spanish state owned company, holds 20% of the shares in Seville PV.

|

|

(8)

|

Certain contracts denominated in U.S. dollars are payable in local currency.

|

|

(9)

|

Reflects the counterparty’s credit ratings issued by Standard & Poor’s Ratings Services, or S&P, Moody’s Investors Service Inc., or Moody’s, and Fitch Ratings Ltd, or

Fitch.

|

|

(10)

|

Refers to the credit rating of the Republic of South Africa. The offtaker is Eskom, which is a state-owned utility company in South Africa.

|

|

(11)

|

Refers to the credit rating of Uruguay, as UTE (Administración Nacional de Usinas y Transmisoras Eléctricas) is unrated.

|

|

(12)

|

As of December 31, 2017.

|

On November 27, 2015, Abengoa, reported that, it filed a communication pursuant to article 5 bis of the Spanish Insolvency Law 22/2003 with the Mercantile

Court of Seville nº 2. On November 8, 2016, the Judge of the Mercantile Court of Seville declared judicial approval of Abengoa´s restructuring agreement. On March 31, 2017 Abengoa announced the completion of the restructuring. As a result, Atlantica

Yield received Abengoa debt and equity instruments in exchange of the guarantee previously provided by Abengoa regarding the preferred equity investment in Abengoa Concessoes Brasil Holding (“ACBH”).

The financing arrangement of Kaxu contained cross-default provisions related to Abengoa, such that debt defaults by Abengoa, subject to certain threshold

amounts and/or a restructuring process, could trigger defaults under such project financing arrangement. In March 2017, the Company signed a waiver which gives clearance to cross-defaults that might have arisen from Abengoa insolvency and

restructuring up to that date, but does not extend to potential future cross-default events.

In addition, the financing arrangements of Kaxu, Solana and Mojave contained a change of ownership clause that would be triggered if Abengoa ceased to own a

minimum of Atlantica Yield’s shares. Based on the most recent public information, Abengoa currently owns 16.47% of Atlantica Yield shares, all of which are pledged as guarantee of asset-backed notes. On March 9, 2018 Abengoa announced it made

effective the sale of a 25% stake in Atlantica Yield to Algonquin. Additionally, Algonquin announced on April 17, 2018, that it had exercised an option to purchase the 16.47% remaining stake in Atlantica held by Abengoa, subject to approval by the

U.S. Department of Energy (the “DOE”) and other conditions precedent. If Abengoa ceases to comply with its obligation to maintain its 16% ownership of Atlantica Yield

’

s shares, such reduced ownership would put the Company in breach of covenants under the applicable project financing arrangements.