Statement of Changes in Beneficial Ownership (4)

March 19 2021 - 4:32PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

BURNEY DAVID C |

2. Issuer Name and Ticker or Trading Symbol

ASTRONICS CORP

[

ATRO

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

VP-FINANCE, CFO |

|

(Last)

(First)

(Middle)

130 COMMERCE WAY |

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/17/2021 |

|

(Street)

EAST AURORA, NY 14052

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| $.01 PV COMMON STOCK | 3/17/2021 | | M | | 1095 | A | $0.00 | 39890 | D | |

| $.01 PV COMMON STOCK | 3/17/2021 | | F(1) | | 495 | D | $18.65 | 39395 | D | |

| $.01 PV CLASS B STOCK | 3/17/2021 | | M | | 164 | A | $0.00 | 191833 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| OPTION | $13.59 | | | | | | | 12/1/2012 | 12/1/2021 | $.01 PV COM STK | 3600 | | 3600 | D | |

| OPTION | $13.59 | | | | | | | 12/1/2012 | 12/1/2021 | $.01 PV CL B STK | 5467 | | 5467 | D | |

| OPTION | $9.20 | | | | | | | 11/29/2013 | 11/29/2022 | $.01 PV COM STK | 6400 | | 6400 | D | |

| OPTION | $9.20 | | | | | | | 11/29/2013 | 11/29/2022 | $.01 PV CL B STK | 7616 | | 7616 | D | |

| OPTION | $28.45 | | | | | | | 12/11/2014 | 12/11/2023 | $.01 PV COM STK | 2600 | | 2600 | D | |

| Option | $28.45 | | | | | | | 12/11/2014 | 12/11/2023 | $.01 PV CL B STK | 2145 | | 2145 | D | |

| OPTION | $30.83 | | | | | | | 12/11/2015 | 12/11/2024 | $.01 PV COM STK | 3150 | | 3150 | D | |

| Option | $30.83 | | | | | | | 12/11/2015 | 12/11/2024 | $.01 PV CL B STK | 1641 | | 1641 | D | |

| Option | $27.72 | | | | | | | 12/3/2016 | 12/3/2025 | $.01 PV COM STK | 4100 | | 4100 | D | |

| Option | $27.72 | | | | | | | 12/3/2016 | 12/3/2025 | $.01 PV CL B STK | 1322 | | 1322 | D | |

| Option | $31.76 | | | | | | | 12/14/2017 | 12/14/2026 | $.01 PV COM STK | 4370 | | 4370 | D | |

| Option | $31.76 | | | | | | | 12/14/2017 | 12/14/2026 | $.01 PV CL B STK | 656 | | 656 | D | |

| Option | $35.61 | | | | | | | 12/12/2018 | 12/12/2027 | $.01 PV COM STK | 6350 | | 6350 | D | |

| Option | $35.61 | | | | | | | 12/12/2018 | 12/12/2027 | $.01 PV CL B STK | 953 | | 953 | D | |

| Restricted Stock Unit | (2) | 3/17/2021 | | M | | | 1095 | (3) | (3) | $.01 PV COM STK | 1095 | $0.00 | 0 | D | |

| Restricted Stock Unit | (4) | 3/17/2021 | | M | | | 164 | (3) | (3) | $.01 PV CL B STK | 164 | $0.00 | 0 | D | |

| Option | $31.57 | | | | | | | 12/13/2019 | 12/13/2028 | $.01 PV COM STK | 8410 | | 8410 | D | |

| Restricted Stock Unit | (2) | | | | | | | (5) | (5) | $.01 PV COM STK | 1106 | | 1106 | D | |

| Option | $30.04 | | | | | | | 12/9/2020 | 12/9/2029 | $.01 PV COM STK | 13600 | | 13600 | D | |

| Restricted Stock Unit | (2) | | | | | | | (6) | (6) | $.01 PV COM STK | 6625 | | 6625 | D | |

| Option | $14.45 | | | | | | | 1/22/2022 | 1/22/2031 | $.01 PV COM STK | 20250 | | 20250 | D | |

| Restricted Stock Unit | (2) | | | | | | | (7) | (7) | $.01 PV COM STK | 8000 | | 8000 | D | |

| Restricted Stock Unit | (2) | | | | | | | (8) | (8) | $.01 PV COM STK | 655 | | 655 | D | |

| Explanation of Responses: |

| (1) | Shares withheld by Astronics Corp. to satisfy applicable withholding tax upon vesting of restricted stock units. |

| (2) | Each restricted stock unit represents the right to receive, at settlement, one share of common stock. |

| (3) | Vesting of these restricted stock units depends on Astronics Corp.'s average annual adjusted EBITDA for the period of January 1, 2018- December 31, 2020. The "target" number of restricted stock units is reported. Between 75% and 115% of the target number of units may vest on December 31, 2020, with the vesting percentage determined based on actual performance. |

| (4) | Each restricted stock unit represents the right to receive, at settlement, one share of Class B stock. |

| (5) | Vesting of these restricted stock units depends on Astronics Corp.'s average annual adjusted EBITDA for the period of January 1, 2019-

December 31, 2021. The "target" number of restricted stock units is reported. Between 75% and 115% of the target number of units may vest on December 31, 2021, with the vesting percentage determined based on actual performance. |

| (6) | Vesting of these restricted stock units depends on Astronics Corp.'s average annual adjusted EBITDA for the period January1, 2020- December

31, 2022. The "target" number of restricted stock units is reported. Between 75% and 115% of the target number of units may vest on December

31, 2022, with the vesting percentage determined based on actual performance. |

| (7) | Vesting of these restricted stock units depends on Astronics Corp.'s average annual adjusted EBITDA for the period January 1, 2021- December 31, 2023. The "target" number of restricted stock units is reported. Between 75% and 115% of the target number of units may vest on December 31, 2023, with the vesting percentage determined based on actual performance. |

| (8) | These restricted stock units vest ratably on each anniversary of the grant date over three years. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

BURNEY DAVID C

130 COMMERCE WAY

EAST AURORA, NY 14052 |

|

| VP-FINANCE, CFO |

|

Signatures

|

| /S/Julie Davis, as power of attorney for David C. Burney | | 3/19/2021 |

| **Signature of Reporting Person | Date |

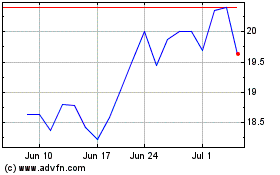

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

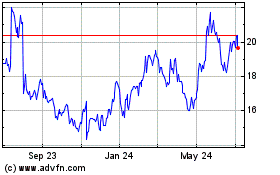

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From Apr 2023 to Apr 2024