AstraZeneca Begins Tender Offer to Acquire CinCor Pharma, Inc.

January 23 2023 - 7:00AM

Business Wire

AstraZeneca is commencing today, through a subsidiary, a tender

offer to purchase all outstanding shares of CinCor Pharma, Inc.

(CinCor), for $26 per share in cash at closing, plus a non-tradable

contingent value right of $10 per share in cash payable upon a

specified regulatory submission for a baxdrostat product. On 9

January 2023, AstraZeneca announced that it had entered into a

definitive agreement to acquire CinCor. Following the successful

closing of the tender offer, CinCor will become a subsidiary of

AstraZeneca.

AstraZeneca will file today with the U.S. Securities and

Exchange Commission (the SEC) a tender offer statement on Schedule

TO, which provides the terms of the tender offer. Additionally,

CinCor will file with the SEC a solicitation/recommendation

statement on Schedule 14D-9 that includes the recommendation of the

CinCor board of directors that CinCor stockholders accept the

tender offer and tender their shares.

The tender offer will expire at one minute past 11:59 p.m.

Eastern Time, on 23 February 2023, unless extended or earlier

terminated in accordance with the merger agreement and the

applicable rules and regulations of the SEC. The closing of the

tender offer is subject to certain conditions, including the tender

of shares representing at least one more than 50% of the total

number of CinCor’s outstanding shares, receipt of applicable

regulatory approvals, and other customary conditions. The

transaction is expected to close in the first quarter of 2023.

Important information about the tender offer

This press release is for informational purposes only and is

neither an offer to purchase nor a solicitation of an offer to sell

any shares of the common stock of CinCor or any other securities,

nor is it a substitute for the tender offer materials described

herein. A tender offer statement on Schedule TO, including an offer

to purchase, a letter of transmittal and related documents, will be

filed today by AstraZeneca PLC (AstraZeneca), AstraZeneca Finance

and Holdings Inc. and Cinnamon Acquisition, Inc., a wholly-owned

indirect subsidiary of AstraZeneca, with the Securities and

Exchange Commission (the SEC), and a solicitation/recommendation

statement on Schedule 14D-9 will be filed by CinCor with the

SEC.

INVESTORS AND SECURITY HOLDERS ARE URGED TO CAREFULLY READ

BOTH THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A

RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER

DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON

SCHEDULE 14D-9 REGARDING THE OFFER, AS THEY MAY BE AMENDED FROM

TIME TO TIME, WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD

CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR

SECURITIES.

Investors and security holders may obtain a free copy of the

Offer to Purchase, the related Letter of Transmittal, certain other

tender offer documents and the Solicitation/Recommendation

Statement (when available) and other documents filed with the SEC

at the website maintained by the SEC at www.sec.gov or by directing

such requests to the information agent for the tender offer, which

will be named in the tender offer statement. In addition, CinCor

files annual, quarterly and current reports and other information,

and AstraZeneca files annual reports and other information with the

SEC, which are available to the public from commercial

document-retrieval services and at the SEC’s website at

www.sec.gov. Copies of the documents filed with the SEC by

AstraZeneca may be obtained at no charge on the investor relations

page of AstraZeneca’s internet website at www.astrazeneca.com.

Copies of the documents filed with the SEC by CinCor may be

obtained at no charge under the “Investors” section of CinCor’s

internet website at www.cincor.com.

Forward-looking statements

This announcement may include statements that are not statements

of historical fact, or “forward-looking statements,” including with

respect to AstraZeneca’s proposed acquisition of CinCor. Such

forward-looking statements include, but are not limited to, the

ability of AstraZeneca and CinCor to complete the transactions

contemplated by the acquisition agreement, including the parties’

ability to satisfy the conditions to the consummation of the offer

contemplated thereby and the other conditions set forth in the

merger agreement, statements about the expected timetable for

completing the transaction, AstraZeneca’s and CinCor’s beliefs and

expectations and statements about the benefits sought to be

achieved in AstraZeneca’s proposed acquisition of CinCor, the

potential effects of the acquisition on both AstraZeneca and

CinCor, the possibility of any termination of the acquisition

agreement, as well as the expected benefits and success of

baxdrostat and any combination product. These statements are based

upon the current beliefs and expectations of AstraZeneca’s and

CinCor’s management and are subject to significant risks and

uncertainties. There can be no guarantees that the conditions to

the closing of the proposed transaction will be satisfied on the

expected timetable or at all or that baxdrostat or any combination

product will receive the necessary regulatory approvals or prove to

be commercially successful if approved. If underlying assumptions

prove inaccurate or risks or uncertainties materialise, actual

results may differ materially from those set forth in the

forward-looking statements.

Risks and uncertainties include but are not limited to,

uncertainties as to the timing of the offer and the subsequent

merger; uncertainties as to how many of CinCor’s stockholders will

tender their shares in the offer; the risk that competing offers or

acquisition proposals will be made; the possibility that various

conditions to the consummation of the offer and the merger

contemplated by the acquisition agreement may not be satisfied or

waived; the ability to obtain necessary regulatory approvals or to

obtain them on acceptable terms or within expected timing; the

effects of disruption from the transactions contemplated by the

acquisition agreement and the impact of the announcement and

pendency of the transactions on CinCor’s business; the risk that

stockholder litigation in connection with the offer or the merger

may result in significant costs of defense, indemnification and

liability; the possibility that the milestone related to the

contingent value right will not be achieved; general industry

conditions and competition; general economic factors, including

interest rate and currency exchange rate fluctuations; the impact

of COVID-19; the impact of pharmaceutical industry regulation and

health care legislation in the United States and internationally;

competition from other products; and challenges inherent in new

product development, including obtaining regulatory approval.

Neither AstraZeneca nor CinCor undertakes any obligation to

publicly update any forward-looking statement, whether as a result

of new information, future events or otherwise, except to the

extent required by law. Additional factors that could cause results

to differ materially from those described in the forward-looking

statements can be found in AstraZeneca’s Annual Report on Form 20-F

for the year ended 31 December 2021, CinCor’s Annual Report on Form

10-K for the year ended 31 December 2021 and CinCor’s Quarterly

Reports on Form 10-Q for the three months ended 31 March 2022, 30

June 2022 and 30 September 2022, in each case as amended by any

subsequent filings made with the SEC. These and other filings made

by AstraZeneca and CinCor with the SEC are available at the SEC’s

Internet site (www.sec.gov).

AstraZeneca in CVRM

Cardiovascular, Renal and Metabolism (CVRM), part of

BioPharmaceuticals, forms one of AstraZeneca’s main disease areas

and is a key growth driver for the Company. By following the

science to understand more clearly the underlying links between the

heart, kidneys and pancreas, AstraZeneca is investing in a

portfolio of medicines for organ protection and improve outcomes by

slowing disease progression, reducing risks and tackling

co-morbidities. The Company’s ambition is to modify or halt the

natural course of CVRM diseases and potentially regenerate organs

and restore function, by continuing to deliver transformative

science that improves treatment practices and CV health for

millions of patients worldwide.

AstraZeneca

AstraZeneca (LSE/STO/Nasdaq: AZN) is a global, science-led

biopharmaceutical company that focuses on the discovery,

development, and commercialisation of prescription medicines in

Oncology, Rare Diseases, and BioPharmaceuticals, including

Cardiovascular, Renal & Metabolism, and Respiratory &

Immunology. Based in Cambridge, UK, AstraZeneca operates in over

100 countries and its innovative medicines are used by millions of

patients worldwide. Please visit astrazeneca.com and follow the

Company on Twitter @AstraZeneca.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230122005024/en/

For details on how to contact the Investor Relations Team,

please click here. For Media contacts, click here. Adrian

Kemp Company Secretary AstraZeneca PLC

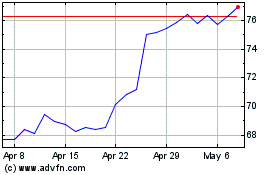

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

From Mar 2024 to Apr 2024

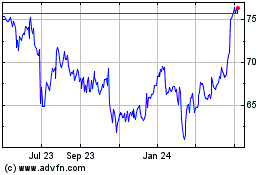

AstraZeneca (NASDAQ:AZN)

Historical Stock Chart

From Apr 2023 to Apr 2024