Current Report Filing (8-k)

July 27 2022 - 4:06PM

Edgar (US Regulatory)

0001820721FALSE00018207212022-07-212022-07-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Earliest Event Reported: July 21, 2022

ARRAY TECHNOLOGIES, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-39613 | | 83-2747826 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

3901 Midway Place NE

Albuquerque, New Mexico 87109

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (505) 881-7567

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| | |

| ☐ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | |

| | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 Par Value | | ARRY | | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 21, 2022, the Compensation Committee (the “Committee”) of the Board of Directors (the “Board”) of Array Technologies, Inc. (the “Company”) approved changes to the Company’s Leadership Incentive Plan for fiscal year 2022 (the “LIP”). As previously disclosed in the Company’s annual proxy statement filed with the US Securities and Exchange Commission on April 18, 2022, the LIP payouts are based 90% on corporate performance and 10% on individual performance objectives of the Company’s Section 16 officers. The Committee originally determined that the metrics for the corporate performance portion of the 2022 LIP determinations should be based on EBITDA and cash conversion cycle of the consolidated operations of the Company and its subsidiaries (as such subsidiaries were organized prior to January 11, 2022, collectively, the “Array Legacy Operations”) and the newly acquired operations pertaining to Soluciones Técnicas Integrales Norland, S.L.U. and its subsidiaries (collectively, the “STI Operations”). The corporate performance portion of the LIP was weighted 60% to EBITDA and 30% to cash conversion cycle.

The changes to the LIP adopted by the Committee on July 21, 2022 (i) reduce the weighting of the EBITDA component of corporate performance from 60% to 50%, (ii) remove the STI Operations from the calculation of EBITDA and cash conversion cycle for purposes of measuring corporate performance under the LIP, and (iii) add a separate category to the corporate performance portion of the LIP based on “STI Integration Success” which will be weighted at 10% of the overall LIP payout criteria. As a result, the new weighted metrics for the corporate performance portion of the LIP will be as follows: (i) EBITDA from Array Operations – 50%, (ii) cash conversion cycle from Array Operations – 30%, and (iii) STI Integration Success – 10%. The remaining 10% of the LIP payout criteria will remain based on individual performance of the Company’s Section 16 officers.

The Company will base the measurement of STI Integration Success 40% on financial targets for 2022 (i.e., Adjusted EBITDA and synergy savings) and 60% on effectiveness of the integration (i.e., development of go-to-market strategy, SOX compliance readiness, and development of a comprehensive management operating system).

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

None

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | Array Technologies, Inc. |

| | | |

| Date: July 27, 2022 | | By: | | /s/ Tyson Hottinger |

| | | | | Name: Tyson Hottinger |

| | | | | Title: Chief Legal Officer |

| | | | |

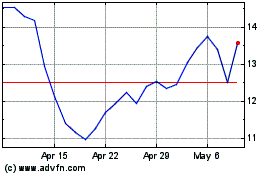

Array Technologies (NASDAQ:ARRY)

Historical Stock Chart

From Mar 2024 to Apr 2024

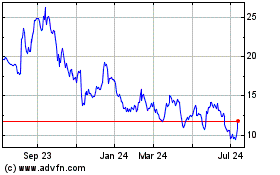

Array Technologies (NASDAQ:ARRY)

Historical Stock Chart

From Apr 2023 to Apr 2024