UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT

PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

|

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

|

|

|

☒

|

Definitive Proxy Statement

|

|

|

|

|

☐

|

Definitive Additional Materials

|

|

|

|

|

☐

|

Soliciting Material Pursuant to Section 240.14a-12

|

ARAVIVE, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (check the appropriate box):

|

☒

|

No fee required.

|

|

|

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

|

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

(4)

|

Date Filed:

|

3730 Kirby Drive, Suite 1200

Houston, Texas 77098

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held on April 1, 2022

To the Stockholders of Aravive, Inc.:

NOTICE IS HEREBY GIVEN that a special meeting of stockholders (the “2022 Special Meeting”) of Aravive, Inc., a Delaware corporation (the “Company”), will be held on April 1, 2022, at 8:00 a.m., Eastern Time at The Umstead Hotel and Spa, located at 100 Woodland Pond Drive, Cary, North Carolina 27513. The Company is monitoring coronavirus (COVID-19) developments and the related recommendations and protocols issued by public health authorities and federal, state, and local governments. The health and well-being of our stockholders is a high priority. If we determine that it is not possible or advisable to hold the 2022 Special Meeting in person, we will announce alternative arrangements for the 2022 Special Meeting, which may include a change in venue or holding the 2022 Special Meeting solely by means of remote communication. We will announce any such change and the details on how to participate by press release, which will be available at the “Investors” section of our website at http://www.aravive.com and filed with the Securities and Exchange Commission as additional proxy materials. If you are planning to attend the 2022 Special Meeting, please check our website or our filings with the Securities and Exchange Commission prior to the meeting date.

At the 2022 Special Meeting, stockholders will be asked to vote on the following matters:

|

|

(1)

|

to approve, for the purposes of complying with Listing Rule 5635(b) of The Nasdaq Stock Market LLC (“Nasdaq”), the issuance of up to 4,545,455 shares of the Company’s common stock, par value $0.0001 per share, in the aggregate (subject to adjustment under certain circumstance), upon exercise of the pre-funded warrant (the “Pre-Funded Warrant”) issued by the Company on January 5, 2022 to Eshelman Ventures, LLC, a North Carolina limited liability company, pursuant to the terms of that certain Investment Agreement (the “Investment Agreement”) entered into on January 3, 2022 by and among the Company, Eshelman Ventures, LLC and, solely for purposes of Article IV and Article V of the Investment Agreement, Fredric N. Eshelman, Pharm.D. (the “Issuance Proposal”);

|

|

|

|

|

|

|

(2)

|

to approve the adjournment of the 2022 Special Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the 2022 Special Meeting to approve the Issuance Proposal (the “Adjournment Proposal”); and

|

|

|

|

|

|

|

(3)

|

to transact such other business as may properly come before the 2022 Special Meeting or any adjournment or postponement thereof.

|

The matters listed in this notice of meeting are described in detail in the accompanying proxy statement. The Board of Directors has fixed the close of business on February 3, 2022 as the record date (the “Record Date”) for determining those stockholders who are entitled to notice of and to vote at the 2022 Special Meeting or any adjournment or postponement of the 2022 Special Meeting. The list of the stockholders of record as of the Record Date will be made available for inspection at the 2022 Special Meeting and will also be available for inspection during the ten (10) days preceding the meeting at the Company’s offices located at 3730 Kirby Drive, Suite 1200, Houston, Texas 77098.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2022 SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 1, 2022.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE 2022 SPECIAL MEETING, PLEASE SUBMIT A PROXY TO HAVE YOUR SHARES VOTED AS PROMPTLY AS POSSIBLE BY USING THE INTERNET OR THE DESIGNATED TOLL-FREE TELEPHONE NUMBER, OR BY SIGNING, DATING AND RETURNING BY MAIL THE PROXY CARD ENCLOSED WITH THE PROXY STATEMENT. IF YOU DO NOT RECEIVE THE PROXY MATERIALS IN PRINTED FORM AND WOULD LIKE TO SUBMIT A PROXY BY MAIL, YOU MAY REQUEST A PRINTED COPY OF THE PROXY MATERIALS (INLCUDING THE PROXY) AND SUCH MATERIALS WILL BE SENT TO YOU.

On behalf of the Board of Directors and the employees of Aravive, Inc. we thank you for your continued support.

|

|

|

|

|

/s/ Gail McIntyre, Ph.D.

Gail McIntyre, Ph.D.

|

|

|

Chief Executive Officer and Director

|

February 11, 2022

3730 Kirby Drive, Suite 1200

Houston, Texas 77098

PROXY STATEMENT

For the 2022 Special Meeting of Stockholders to be held on April 1, 2022

GENERAL INFORMATION

The Company is providing this proxy statement in connection with the solicitation by its Board of Directors (the “Board of Directors”) of proxies to be voted at the 2022 Special Meeting to be held on April 1, 2022, at 8:00 a.m., Eastern Time, and any adjournment or postponement thereof at The Umstead Hotel and Spa, located at 100 Woodland Pond Drive, Cary, North Carolina 27513. The Company is monitoring coronavirus (COVID-19) developments and the related recommendations and protocols issued by public health authorities and federal, state, and local governments. The health and well-being of our stockholders is a high priority. If we determine that it is not possible or advisable to hold the 2022 Special Meeting in person, we will announce alternative arrangements for the 2022 Special Meeting, which may include a change in venue or holding the 2022 Special Meeting solely by means of remote communication. We will announce any such change and the details on how to participate by press release, which will be available at the “Investors” section of our website at http://www.aravive.com and filed with the Securities and Exchange Commission as additional proxy materials. If you are planning to attend the 2022 Special Meeting, please check our website or our filings with the Securities and Exchange Commission prior to the meeting date. Please see the “Questions and Answers” section below for more details.

The Board of Directors is soliciting votes (1) FOR the issuance of up to 4,545,455 shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), in the aggregate (subject to adjustment under certain circumstance), upon exercise of the pre-funded warrant (the “Pre-Funded Warrant”) issued by the Company on January 5, 2022 to Eshelman Ventures, LLC, a North Carolina limited liability company, pursuant to the terms of that certain Investment Agreement (the “Investment Agreement”) entered into on January 3, 2022 by and among the Company, Eshelman Ventures, LLC, and, solely for purposes of Article IV and Article V of the Investment Agreement, Fredric N. Eshelman, Pharm.D. (the “Issuance Proposal”); and (2) FOR the adjournment of the 2022 Special Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the 2022 Special Meeting to approve the Issuance Proposal (the “Adjournment Proposal”).

2022 SPECIAL MEETING ADMISSION

Only stockholders as of February 3, 2022 (the “Record Date”) may attend the 2022 Special Meeting. If you attend, please note that you will be asked to present government-issued identification (such as a driver’s license or passport) and evidence of your share ownership of our Common Stock on the Record Date. Such evidence of ownership can be your proxy card. If your shares are held beneficially in the name of a bank, broker or other holder of record and you plan to attend the 2022 Special Meeting, you will be required to present proof of your ownership of our Common Stock on the Record Date, such as a bank or brokerage account statement or voting instruction card, to be admitted to the 2022 Special Meeting.

No cameras, recording equipment or electronic devices will be permitted in the 2022 Special Meeting.

Information on how to obtain directions to attend the 2022 Special Meeting is available at: https://aravive.com/.

ADDITIONAL INFORMATION ABOUT THESE PROXY MATERIALS AND VOTING

We are providing you with these proxy materials because the Board of Directors, is soliciting your proxy to vote at the 2022 Special Meeting including at any adjournments or postponements thereof, to be held on Friday, April 1, 2022 at 8:00 a.m. Eastern Time.

You are invited to attend the 2022 Special Meeting to vote on the proposals described in this Proxy Statement. However, you do not need to attend the 2022 Special Meeting to vote your shares. Instead, you may simply follow the instructions below to submit your proxy. The purpose of the 2022 Special Meeting and the matters to be acted on are stated in the accompanying Notice of Special Meeting of Stockholders. The Board of Directors knows of no other business that will come before the 2022 Special Meeting. The proxy materials, including this Proxy Statement, are being distributed and made available on or about February 15, 2022.

QUESTIONS AND ANSWERS

|

Q:

|

Why is the 2022 Special Meeting being held?

|

|

|

|

|

A:

|

Since you owned shares of the Common Stock at the close of business on the Record Date, February 3, 2022, you are considered a stockholder entitled to receive notice of and to attend and vote at the 2022 Special Meeting, or any postponement or adjournment thereof. Accordingly, we are providing these proxy materials in connection with the solicitation by our Board of Directors of proxies to be voted at the 2022 Special Meeting in connection with the issuance of the Common Stock upon the exercise of the Pre-Funded Warrant.

On January 3, 2022, the Company entered into that certain Investment Agreement (the “Investment Agreement”) with Eshelman Ventures, LLC, a North Carolina limited liability company, and, solely for purposes of Article IV and Article V of the Investment Agreement, Fredric N. Eshelman, Pharm.D. On January 3, 2022, Dr. Eshelman was appointed the Executive Chairman of the Company. Dr. Eshelman has served as a director and non-executive Chairman of the Company’s Board of Directors since April 2020. Dr. Eshelman also controls Eshelman Ventures, LLC. On January 5, 2022, pursuant to the Investment Agreement, Eshelman Ventures, LLC purchased the Pre-Funded Warrant to purchase up to 4,545,455 shares (the “Warrant Shares”) of Common Stock, subject to adjustment under certain circumstances, at a price of $2.20 per share, which was the consolidated closing bid price of the Common Stock on The Nasdaq Global Select Market on December 31, 2021, for an aggregate purchase price of $10,000,001.

Pursuant to Nasdaq Listing Rule 5635(b), stockholder approval is required prior to the issuance of securities when the issuance or potential issuance will result in a change of control of the Company. Nasdaq has not formally defined a “change of control,” but Nasdaq guidance suggests that a change of control occurs when, as a result of the issuance, an investor or a group would own, or have the right to acquire, 20% or more of the outstanding shares of common stock or voting power and such ownership or voting power would be the largest ownership position.

Exercises of the Pre-Funded Warrant could result in Eshelman Ventures, LLC owning 20% or more of the Company’s outstanding common stock after such issuances, with Eshelman Ventures, LLC continuing to be the largest stockholder of the Company.

In light of these rules, the Pre-Funded Warrant and the Investment Agreement provide that, unless the Company obtains the approval of its stockholders, the aggregate number of Warrant Shares that may be issued under the Pre-Funded Warrant and the Investment Agreement may not exceed the maximum number of shares of Common Stock which the Company may issue without stockholder approval under Nasdaq Listing Rule 5635(b).

Accordingly, the 2022 Special Meeting is being held to approve the issuance of the full amount of Warrant Shares issuable pursuant to the Pre-Funded Warrant and the Investment Agreement without any limit.

|

|

|

|

|

Q:

|

What proposals are being presented for a stockholder vote at the 2022 Special Meeting?

|

|

A:

|

The following proposals are being presented for stockholder vote at the 2022 Special Meeting:

|

|

|

●

|

Proposal 1—the approval, for the purposes of Nasdaq Listing Rule 5635(b), of the issuance of up to 4,545,455 Warrant Shares in the aggregate (subject to adjustment under certain circumstances), pursuant to the Pre-Funded Warrant; and

|

|

|

|

|

|

|

●

|

Proposal 2—the approval of the adjournment of the 2022 Special Meeting, if necessary, to solicit additional proxies in the event that there are not sufficient votes at the time of the 2022 Special Meeting to approve the Issuance Proposal.

|

|

|

Proposal 2—the Adjournment Proposal will only be presented at the 2022 Special Meeting if there are not sufficient votes to approve Proposal 1—the Issuance Proposal.

|

|

|

|

|

Q:

|

How does the Board of Directors recommend that I vote?

|

|

A:

|

The Board of Directors unanimously recommends that you vote:

|

|

|

●

|

“FOR” Proposal 1—the Issuance Proposal; and

|

|

|

●

|

“FOR” Proposal 2—the Adjournment Proposal.

|

|

Q:

|

What does it mean to vote by proxy?

|

|

A:

|

When you vote “by proxy,” you grant another person the power to vote stock that you own. If you vote by proxy in accordance with this proxy statement, you will have designated the following individuals as your proxy holders for the 2022 Special Meeting: Gail McIntyre, the Company’s Chief Executive Officer and Director; and Vinay Shah, the Company’s Chief Financial Officer.

Any proxy given pursuant to this solicitation and received in time for the 2022 Special Meeting will be voted in accordance with your specific instructions. If you provide a proxy, but you do not provide specific instructions on how to vote on each proposal, the proxy holder will vote your shares “FOR” Proposal 1—the Issuance Proposal and “FOR” Proposal 2—the Adjournment Proposal. With respect to any other proposal that properly comes before the 2022 Special Meeting, the proxy holders will vote in their own discretion according to their best judgment, to the extent permitted by applicable laws and regulations.

|

|

|

|

|

Q:

|

Why am I receiving these materials?

|

|

A:

|

We have sent you these proxy materials because the Board of Directors is soliciting your proxy to vote at the 2022 Special Meeting, including at any adjournments or postponements of the 2022 Special Meeting.

|

|

|

|

|

Q:

|

Who can vote at the 2022 Special Meeting?

|

|

A:

|

Only stockholders of record on the Record Date, close of business on February 3, 2022, will be entitled to vote at the 2022 Special Meeting. On the Record Date, there were 21,077,509 shares of Common Stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If on February 3, 2022, your shares were registered directly in your name with the Company’s transfer agent, American Stock Transfer & Trust Company, LLC, then you are a stockholder of record. As a stockholder of record, you may directly vote your shares or submit a proxy to have your shares voted. We urge you to fill out and return the enclosed proxy card or submit a proxy on the internet or telephone as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on February 3, 2022, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the 2022 Special Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You will receive voting instructions from your broker, bank or nominee describing the available processes for voting your stock.

|

|

Q:

|

What information is contained in the Proxy Statement?

|

|

A:

|

The information included in this proxy statement relates to the proposals to be voted on at the 2022 Special Meeting, the voting process and other required information.

|

|

Q:

|

What shares can I vote?

|

|

A:

|

You may vote or cause to be voted all shares owned by you as of the close of business on February 3, 2022, the Record Date. These shares include: (1) shares held directly in your name as a stockholder of record; and (2) shares held for you, as the beneficial owner, through a broker or other nominee, such as a bank.

|

|

Q:

|

How may I vote?

|

|

|

|

|

A:

|

With respect to the Issuance Proposal and the Adjournment Proposal, you may vote FOR, AGAINST, or ABSTAIN. On these proposals, if you ABSTAIN, it has the same effect as a vote AGAINST and will not affect the outcome of the proposals.

|

|

|

The procedures for voting are fairly simple:

|

|

|

Stockholder of Record: Shares Registered in Your Name

|

|

|

If you are a stockholder of record, you may have your shares voted by proxy using the enclosed proxy card, or submit your proxy through the internet or by telephone. We urge you to have your shares voted by proxy to ensure your vote is counted.

|

|

|

●

|

By mail. To have your shares voted using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the 2022 Special Meeting, the proxyholder will vote your shares as you direct.

|

|

|

|

|

|

|

●

|

By internet or telephone. To have your shares voted through a proxy submitted by the internet, go to http://www.voteproxy.com to complete an electronic proxy card. If you vote by telephone call 1-800-776-9437 in the United States or 1-718-921-8500 from foreign countries and follow the instructions. You will be asked to provide the Company number and control number from the enclosed proxy card. Your internet or telephonic proxy must be received by 11:59 p.m., Eastern Time on March 31, 2022 to be counted.

|

|

|

|

|

|

|

●

|

By attending the 2022 Special Meeting. You may attend the 2022 Special Meeting and vote your shares.

|

|

|

Beneficial Owner: Shares Registered in the Name of Broker or Bank

|

|

|

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a voting instruction form with these proxy materials from that organization rather than from the Company. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

|

|

Q:

|

How many votes do I have?

|

|

A:

|

On each matter to be voted upon, you have one vote for each share of Common Stock you own as of February 3, 2022.

|

|

Q:

|

What happens if I do not vote?

|

|

|

Stockholder of Record: Shares Registered in Your Name

|

|

|

If you are a stockholder of record and do not vote in person or proxy by completing your proxy card or submitting your proxy through the internet or by telephone, your shares will not be voted.

|

|

|

Beneficial Owner: Shares Registered in the Name of Broker or Bank

|

|

|

If you are a beneficial owner and do not instruct your broker, bank, or other agent how to vote your shares, the question of whether your broker or nominee will still be able to vote your shares depends on whether the New York Stock Exchange (the “NYSE”) deems the particular proposal to be a “routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under the rules and interpretations of the NYSE, “non-routine” matters are matters that may substantially affect the rights or privileges of stockholder, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported.

|

|

|

The Company expects that (i) Proposal 1—the Issuance Proposal and (ii) Proposal 2—the Adjournment Proposal will be considered non-routine matters. If all of the proposals are considered non-routine as expected, banks, brokers and nominees will not be able to vote at the 2022 Special Meeting unless they receive voting instructions from the beneficial owners. Accordingly, there would not be any broker non-votes.

|

|

Q:

|

What if I return a proxy card or otherwise submit a proxy but do not make specific choices?

|

|

A:

|

If you are a record holder and return a signed and dated proxy card or otherwise submit a proxy without marking voting selections, your shares will be voted, as applicable, FOR Proposal 1—the Issuance Proposal and FOR Proposal 2—the Adjournment Proposal. If any other matter is properly presented at the 2022 Special Meeting, your proxyholder (one of the individuals named on your proxy card) will vote your shares in accordance with the Board of Directors’ recommendations.

|

|

Q:

|

Can I change my vote or revoke my proxy?

|

|

|

|

|

A:

|

You may change your vote or revoke your proxy at any time before the final vote at the 2022 Special Meeting. To change how your shares are voted or to revoke your proxy if you are the record holder, you may (1) notify our Corporate Secretary in writing at Aravive, Inc., 3730 Kirby Drive, Suite 1200, Houston, Texas 77098; (2) submit a later-dated proxy (either by mail or internet), subject to the voting deadlines that are described on the proxy card or voting instruction form, as applicable; or (3) deliver to our Corporate Secretary another duly executed proxy bearing a later date. You may also revoke your proxy by attending the 2022 Special Meeting and voting in person.

|

|

|

For shares you hold beneficially, you may change your vote by following the instructions provided by your broker or bank.

|

|

Q:

|

Who can help answer my questions?

|

|

A:

|

If you have any questions about the 2022 Special Meeting or how to vote, submit a proxy or revoke your proxy, or you need additional copies of this Proxy Statement or voting materials, you should contact the Corporate Secretary, Aravive, Inc., 3730 Kirby Drive, Suite 1200, Houston, Texas 77098, or by phone at (936) 355-1910. In addition, we have retained D.F. King & Co., Inc. to aid in the solicitation of proxies for the 2022 Special Meeting. Please contact (800) 578-5378 with any questions you may have regarding our proposals.

|

|

Q:

|

What is a quorum and why is it necessary?

|

|

A:

|

Conducting business at the 2022 Special Meeting requires a quorum. A quorum will be present if stockholders holding at least a majority of the outstanding shares of Common Stock entitled to vote on February 3, 2022 are present at the 2022 Special Meeting in person or by proxy. Abstentions are treated as present for purposes of determining whether a quorum exists. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote at the 2022 Special Meeting. Because, as mentioned above, banks, brokers and other nominee holders of record do not have discretionary voting authority with respect to any of the proposals to be considered at the 2022 Special Meeting as described in this proxy statement, if a beneficial owner of shares held in “street name” does not give voting instructions to the broker, bank or other nominee holder of record, then those shares will not be present in person or represented by proxy at the 2022 Special Meeting and will not count for purposes of determining if a quorum is present at the 2022 Special Meeting. As a result, we do not expect there to be any broker non-votes present at the 2022 Special Meeting as described in this proxy statement. If there is no quorum, the 2022 Special Meeting may be adjourned by the chairperson of the 2022 Special Meeting or the vote of the stockholders holding a majority of the shares present at the 2022 Special Meeting in person or represented by proxy may adjourn the 2022 Special Meeting to another date.

|

|

Q:

|

What is the voting requirement to approve each of the proposals?

|

|

A:

|

Proposal 1— Issuance Proposal. Approval, for the purposes of Nasdaq Listing Rule 5635(b), of the issuance of shares of the Company’s Common Stock upon exercise of the Pre-Funded Warrant requires the affirmative vote of a majority of the issued and outstanding shares of the Common Stock, represented in person or by proxy at the meeting and entitled to vote thereon. Abstentions, which are considered present and entitled to vote on this matter, will have the same effect as a vote “AGAINST” this proposal and will have no effect on the outcome of this proposal. If you are a beneficial owner whose shares are held by a broker, bank or other nominee, you must instruct the broker, bank or nominee how to vote your shares. If you do not provide voting instructions, your shares will not be voted on proposals on which brokers do not have discretionary authority. Broker non-votes are not expected to be present at this meeting because there are no routine matters expected to be voted on. If there were to be any broker non-votes, they would have no effect on the vote with respect to this proposal.

Proposal 2—Adjournment Proposal. Approval of the adjournment of the 2022 Special Meeting requires the affirmative vote of a majority of the issued and outstanding shares of the Company’s Common Stock, represented in person or by proxy at the meeting and entitled to vote thereon. Abstentions, which are considered present and entitled to vote on this matter, will have the same effect as a vote “AGAINST” this proposal and will have no effect on the outcome of this proposal. Broker non-votes are not expected to be present at this meeting because there are no routine matters expected to be voted on. If there were to be any broker non-votes, they would have no effect on the vote with respect to this proposal.

|

|

|

|

|

Q:

|

What should I do if I receive more than one Proxy Statement?

|

|

A:

|

You may receive more than one Proxy Statement. For example, if you are a stockholder of record and your shares are registered in more than one name, you will receive more than one Proxy Statement. Please follow the voting instructions on all of the Proxy Statements to ensure that all of your shares are voted.

|

|

Q:

|

Where can I find the voting results of the 2022 Special Meeting?

|

|

A:

|

We intend to announce preliminary voting results at the 2022 Special Meeting and publish final results in a Current Report on Form 8-K, which will be filed within four (4) business days of the 2022 Special Meeting. If final voting results are not available to us in time to file a Current Report on Form 8-K within four (4) business days after the 2022 Special Meeting, we intend to file a Current Report on Form 8-K to publish preliminary results and, within four (4) business days after the final results are known to us, file an additional Current Report on Form 8-K to publish the final results.

|

|

Q:

|

What happens if additional matters are presented at the 2022 Special Meeting?

|

|

A:

|

Other than the two (2) items of business described in this Proxy Statement, we are not aware of any other business to be acted upon at the 2022 Special Meeting. If you grant a proxy, the persons named as proxy holders, Dr. Gail McIntyre, our Chief Executive Officer, and Mr. Vinay Shah, our Chief Financial Officer, will have the discretion to vote your shares on any additional matters properly presented for a vote at the 2022 Special Meeting.

|

|

Q:

|

How many shares are outstanding and how many votes is each share entitled?

|

|

A:

|

Each share of our Common Stock that is issued and outstanding as of the close of business on February 3, 2022, the Record Date, is entitled to be voted on all items being voted on at the 2022 Special Meeting, with each share being entitled to one vote on each matter. As of the Record Date, close of business on February 3, 2022, there were 21,077,509 shares of Common Stock issued and outstanding.

|

|

Q:

|

Who will count the votes?

|

|

A:

|

One or more inspectors of election will tabulate the votes.

|

|

Q:

|

Is my vote confidential?

|

|

A:

|

Proxy instructions, ballots, and voting tabulations that identify individual stockholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed, either within the Company or to anyone else, except: (1) as necessary to meet applicable legal requirements; (2) to allow for the tabulation of votes and certification of the vote; or (3) to facilitate a successful proxy solicitation.

|

|

|

|

|

Q:

|

Who will bear the cost of soliciting votes for the 2022 Special Meeting?

|

|

A:

|

The Board of Directors is making this solicitation on behalf of the Company, which will pay the entire cost of preparing, assembling, printing, mailing, and distributing these proxy materials. Certain of our directors, officers, and employees, without any additional compensation, may also solicit your vote in person, by telephone, or by electronic communication. In addition, we have retained D.F. King & Co., Inc. to aid in the solicitation of proxies for the 2022 Special Meeting. Please contact (800) 578-5378 with any questions you may have regarding our proposals. On request, we will reimburse brokerage houses and other custodians, nominees, and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to stockholders. In addition to the use of the mail, proxies may be solicited by personal interview, telephone, telegram, facsimile and advertisement in periodicals and postings, in each case by our directors, officers and employees without additional compensation. Brokerage houses, nominees, fiduciaries and other custodians will be requested to forward solicitation materials to beneficial owners and will be reimbursed for their reasonable expenses incurred in so doing. We will pay D.F. King & Co., Inc. fees of $10,000 plus expense reimbursements for its services.

|

|

|

|

|

Q:

|

What will be the ownership of Eshelman Ventures, LLC and Dr. Eshelman be if the Company’s stockholders approve the Issuance Proposal?

|

|

A:

|

If the stockholders approve the Issuance Proposal, Eshelman Ventures, LLC will have the right to exercise the Pre-Funded Warrant and purchase all 4,545,455 Warrant Shares for $0.0001 per Warrant Share. Pursuant to the terms of the Pre-Funded Warrant, upon obtaining stock approval of Proposal No. 1, Eshelman Ventures, LLC will have ten (10) calendar days to exercise the Pre-Funded Warrant. If such exercise does not occur on tenth (10th) day following such stockholder approval, the Pre-Funded Warrant will be automatically exercised via cashless exercise. If and when such exercise is made in full on a cash basis, based on the Company’s outstanding Common Stock as of the Record Date, Eshelman Ventures, LLC will own approximately 32.6% of the Company’s total shares of outstanding Common Stock and Dr. Eshelman will beneficially own 32.7% of the Company’s outstanding Common Stock after such issuances.

|

PROPOSAL 1—THE ISSUANCE PROPOSAL

On January 3, 2022, the Company entered into the Investment Agreement with Eshelman Ventures LLC, a North Carolina limited liability company, and, solely for purposes of Article IV and Article V of the Investment Agreement, Fredric N. Eshelman, Pharm.D. On January 3, 2022, Dr. Eshelman was appointed the Executive Chairman of the Company. Dr. Eshelman has served as a director and non-executive Chairman of the Company’s Board since April 2020. Dr. Eshelman also controls Eshelman Ventures, LLC. On January 5, 2022, pursuant to the Investment Agreement, Eshelman Ventures, LLC purchased the Pre-Funded Warrant to purchase up to 4,545,455 Warrant Shares, subject to adjustment under certain circumstances, at a price of $2.20 per share, which was the consolidated closing bid price of the Common Stock on The Nasdaq Global Select Market on December 31, 2021, for an aggregate purchase price of $10,000,001.

The Pre-Funded Warrant provides that until the Company obtains the Requisite Stockholder Approval (as defined below), no Warrant Shares will be issued or delivered upon any proposed exercise of the Pre-Funded Warrant, and the Pre-Funded Warrant will not be exercisable to the extent that such issuance, delivery, exercise or exercisability would result in Eshelman Ventures LLC or a “person” or “group” (within the meaning of Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) beneficially owning in excess of nineteen and ninety-nine-one-hundredths percent (19.99%) of the then-outstanding shares of Common Stock following such exercise (the restrictions set forth in this sentence, the “Beneficial Ownership Limitation”). For these purposes, beneficial ownership and calculations of percentage ownership will be determined in accordance with Rule 13d-3 under the Exchange Act. “Requisite Stockholder Approval” means the stockholder approval contemplated by Nasdaq Listing Rule 5635(b) with respect to the issuance of the Warrant Shares in excess of the limitations imposed by such rule.

Pursuant to Nasdaq Listing Rule 5635(b), stockholder approval is required prior to the issuance of securities when the issuance or potential issuance will result in a change of control of the Company. Nasdaq has not formally defined a “change of control,” but Nasdaq guidance suggests that a change of control occurs when, as a result of the issuance, an investor or a group would own, or have the right to acquire, 20% or more of the outstanding shares of common stock or voting power and such ownership or voting power would be the largest ownership position.

Pursuant to the terms of the Pre-Funded Warrant, upon obtaining the Requisite Stockholder Approval of this Proposal No. 1, Eshelman Ventures, LLC will have ten (10) calendar days to exercise the Pre-Funded Warrant. If such exercise does not occur on tenth (10th) day following such stockholder approval, the Pre-Funded Warrant will be automatically exercised via cashless exercise. If and when such exercise is made in full on a cash basis and assuming no additional shares are purchased before such exercise of the Pre-Funded Warrant, Eshelman Ventures, LLC will own approximately 32.6% of the Company’s outstanding Common Stock and Dr. Eshelman will beneficially own 32.7% of the Company’s outstanding Common Stock, with Eshelman Ventures, LLC continuing to be the largest stockholder of the Company.

In light of these rules and as stated above, the Pre-Funded Warrant and the Investment Agreement provide that, unless the Company obtains the approval of its stockholders, the aggregate number of Warrant Shares that may be issued under the Pre-Funded Warrant and the Investment Agreement may not exceed the maximum number of shares of Common Stock which the Company may issue without stockholder approval under the Nasdaq Listing Rule 5635(b). In addition, unless the Company obtains the approval of its stockholders, the Pre-Funded Warrant may not be exercised, and elections to purchase under the Investment Agreement may not be made, to the extent that, after giving effect to such exercise or election, Eshelman Ventures, LLC or Dr. Eshelman together with their affiliates collectively would beneficially own in excess of 19.99% of the Company’s Common Stock.

Accordingly, the 2022 Special Meeting is being held to approve all Warrant Shares issuable pursuant to the Pre-Funded Warrant and the Investment Agreement without any limitation.

Use of Proceeds

The Company currently intends to use the net proceeds from the issuance and sale of the Pre-Funded Warrant primarily for research, development and manufacturing of product candidates, and for other general corporate purposes including, to acquire, license or invest in complementary businesses, technologies, product candidates or other intellectual property. Pending these uses, the Company expects to invest the net proceeds in short-term, interest-bearing securities. The Company has broad discretion in determining how these proceeds will be used, and its discretion is not limited by the aforementioned possible uses.

Interests of Certain Persons in Matters to be Acted Upon

As discussed above, Dr. Eshelman, our Executive Chairman of the Board, also controls Eshelman Ventures, LLC. Exercises of the Pre-Funded Warrant would result in Eshelman Ventures, LLC owning approximately 32.6% of the Company’s outstanding Common Stock after such issuances and Dr. Eshelman beneficially owning 32.7% of the Company’s outstanding Common Stock, with Eshelman Ventures, LLC continuing to be the largest stockholder of the Company. Upon such issuance, Dr. Eshelman will exercise a significant level of control over all matters requiring stockholder approval, including the election of directors, mergers, acquisitions and other extraordinary transactions. Eshelman Ventures, LLC and Dr. Eshelman may vote the shares of Common Stock that they own as of the Record Date for this Proposal No. 1.

Reasons for the Transactions and Effect on Current Stockholders

The Company’s Board of Directors determined that the issuance of the Pre-Funded Warrant pursuant to the Investment Agreement and the Warrant Shares upon exercise of the Pre-Funded Warrant was in the best interests of the Company and its stockholders. In making this determination, the Board of Directors considered certain factors including, without limitation, the Company’s need for capital, the cost of capital and the Company’s short- and long-term goals.

The Board of Directors also considered the price of the Pre-Funded Warrant under the Investment Agreement, which was $2.20 per share and was at market with no discount (the consolidated closing bid price of the Common Stock on The Nasdaq Global Select Market on December 31, 2021), for an aggregate purchase price of $10,000,001. The Board of Directors also considered the risk that the Pre-Funded Warrant may remain outstanding and unexercised.

The issuance of the Warrant Shares upon exercise of the Pre-Funded Warrant will not affect the rights of the holders of outstanding Common Stock, but such issuances will have a dilutive effect on the existing stockholders, including the voting power and economic rights of the existing stockholders. See “Effect of the Issuance Proposal on Current Stockholders–Potential Dilutive Effect to Existing Stockholders”.

Effect on Current Stockholders if this Proposal is Not Approved

If our stockholders do not approve this proposal, the Pre-Funded Warrant may not be exercised for Warrant Shares if such exercise would cause the holder, together with certain related parties, to beneficially own a number of shares of Common Stock that would exceed 19.99% of the Company’s then outstanding Common Stock following such exercise. Pursuant to the terms of the Pre-Funded Warrant and Investment Agreement, we are obligated to use our reasonable best efforts to obtain the Requisite Stockholder Approval of the issuance of the Warrant Shares upon full exercise of the Pre-Funded Warrant and if, despite our reasonable best efforts such approval is not effected on or prior to May 5, 2022, to hold an additional stockholder meeting every six (6) months thereafter until such approval is obtained.

Effect of the Issuance Proposal on Current Stockholders-Potential Dilutive Effect to Existing Stockholders

The Pre-Funded Warrant provides that immediately upon obtaining the Requisite Stockholder Approval, the holder of the Pre-Funded Warrant shall have ten (10) calendar days to exercise the Pre-Funded Warrant. If such exercise does not occur on tenth (10th) day following Stockholder Approval, the Pre-Funded Warrant will be automatically exercised via cashless exercise as set forth in the Pre-Funded Warrant.

If the Issuance Proposal is approved, and the Pre-Funded Warrant is exercised in full for cash, an additional 4,545,455 Warrant Shares will be issued upon exercise of the Pre-Funded Warrant, representing approximately 17.7% of the shares of our Common Stock outstanding following exercise of the Pre-Funded Warrant. After such issuance Dr. Eshelman will beneficially own 32.7% of the outstanding shares of Common Stock. Common Stock issuances could have a dilutive effect on book value per share and any future earnings per share. Additional issuances of Common Stock, including as a result of the exercise of the Pre-Funded Warrant, could also cause prevailing market prices for our Common Stock to decline. Upon such issuance, Dr. Eshelman will exercise a significant level of control over all matters requiring stockholder approval, including the election of directors, mergers, acquisitions and other extraordinary transactions. This concentration of ownership may have the effect of delaying, preventing or deterring a change of control of the Company. In addition, Dr. Eshelman and Eshelman Ventures, LLC will not require approval under Nasdaq Listing Rule 5635(b) for future issuance that are deemed to be above market issuances so long as they beneficially own in excess of 20% of our outstanding shares of common Stock at the time of such issuances.

The Company filed a registration statement, which was declared effective on January 18, 2022 by the Securities and Exchange Commission (the “SEC”), to fulfill the Company’s contractual obligations under the Investment Agreement with Eshelman Ventures to provide for the resale by Eshelman Ventures, LLC of the Warrant Shares issuable upon exercise of the Pre-Funded Warrant. Pursuant to the Investment Agreement, the Company agreed to file such registration statement within six (6) months following the date of the Investment Agreement. The Company agreed to pay all expenses, other than underwriting discounts and commissions, related to the registration statement and agreed to pay up to $50,000 for Eshelman Ventures’ legal, accounting and other fees, costs and expenses incurred in connection with the Investment Agreement and the transactions contemplated thereby, including fees incurred in reviewing the registration statement.

Description of Common Stock and Pre-Funded Warrant

The following summary describes the material terms of our outstanding capital stock, which includes the material terms of the Common Stock and Pre-Funded Warrant. This is a summary only and does not purport to be complete. It is subject to and qualified in its entirety by reference to: (i) in case of the Common Stock, to the Company’s Amended and Restated Certificate of Incorporation, and Amended and Restated Bylaws, each of which are incorporated by reference as an exhibit to our most recent Annual Report on Form 10-K, and (ii) with respect to the Pre-Funded Warrant, the Form of Pre-Funded Common Stock Warrant of Aravive, Inc. that is filed as Exhibit 4.1 to the Form 8-K that was filed with the SEC on January 4, 2022. We encourage you to read our Amended and Restated Certificate of Incorporation, our Amended and Restated Bylaws, the applicable provisions of the Delaware General Corporation Law, and the Pre-Funded Warrant for additional information.

Common Stock

Voting Rights

Each holder of our Common Stock is entitled to one vote for each share of Common Stock held on all matters submitted to a vote of stockholders, except as otherwise required by statute. Except as otherwise provided by statute or by applicable stock exchange rules, in all matters other than the election of directors, stockholders may take action with the affirmative vote of the majority of shares present in person, by remote communication, if applicable, or represented by proxy at a stockholder meeting and entitled to vote generally on the subject matter. Cumulative voting for the election of directors is not provided for in our Amended and Restated Certificate of Incorporation. Except as otherwise provided by statute, stockholders may elect directors by a plurality of the votes of the shares present in person, by remote communication, if applicable.

Dividends

Subject to preferences that may apply to any shares of preferred stock outstanding at the time, the holders of outstanding shares of our Common Stock are entitled to receive dividends out of funds legally available at the times and in the amounts that the Board of Directors may determine.

Liquidation Rights

Upon our liquidation, dissolution or winding-up, the assets legally available for distribution to our stockholders would be distributable ratably among the holders of our Common Stock and any participating convertible preferred stock outstanding at that time after payment of liquidation preferences, on any outstanding shares of convertible preferred stock and payment of other claims of creditors.

Rights and Preferences

The rights, preferences, and privileges of holders of our Common Stock are subject to, and may be adversely affected by, the rights of holders of shares of any series of preferred stock that we may designate and issue in the future.

Preemptive or Similar Rights

Our Common Stock is not entitled to preemptive rights and is not subject to conversion or redemption.

Fully Paid and Nonassessable

All of the Company’s issued and outstanding shares of Common Stock are fully paid and nonassessable.

Pre-Funded Warrant

The following is a summary of the material terms of the Pre-Funded Warrant:

Duration and Exercise Price

The Pre-Funded Warrant has an initial exercise price per share equal to $0.0001. The Pre-Funded Warrant is immediately exercisable, subject to the Beneficial Ownership Limitation and may be exercised at any time until the Pre-Funded Warrant is exercised in full. The exercise price and number of Warrant Shares are subject to appropriate adjustment in the event of stock dividends, stock splits, reorganizations or similar events affecting the Common Stock and the exercise price.

Exercisability; Stockholder Approval

The Pre-Funded Warrant provides that until we obtain the Requisite Stockholder Approval for the issuance of all of the Warrant Shares, no Warrant Shares will be issued or delivered upon any proposed exercise of the Pre-Funded Warrant, and the Pre-Funded Warrant will not be exercisable to the extent, that such issuance, delivery, or exercise would result in the Investor or a “person” or “group” (within the meaning of Section 13(d)(3) of the Exchange Act) beneficially owning in excess of the Beneficial Ownership Limitation.

We are obligated to hold an annual or special meeting of stockholders (the “Stockholder Meeting”) for the purpose of obtaining the Requisite Stockholder Approval for the issuance of all of the Warrant Shares. The Stockholder Meeting shall be held no later than one-hundred and twenty (120) days (one hundred and fifty days (150) if the SEC reviews the proxy statement for the annual or special meeting of stockholders) following the date of Investment Agreement. We agreed to use our reasonable best efforts to obtain the Requisite Stockholder Approval and to cause our Board of Directors to recommend to the stockholders that they approve such matter. If, despite our reasonable best efforts Requisite Stockholder Approval is not received on or prior to May 5, 2022, we will cause an additional Stockholder Meeting to be held every six (6) months thereafter until such Requisite Stockholder Approval is obtained.

Fractional Shares

No fractional shares of Common Stock will be issued in connection with the exercise of the Pre-Funded Warrant. In lieu of fractional shares of Common Stock, the Company will, at its discretion, pay the holder of the Pre-Funded Warrant an amount in cash equal to the fractional amount multiplied by the exercise price of such Pre-Funded Warrant or round up to the next whole share.

Cashless Exercise

In lieu of making the cash payment otherwise contemplated to be made to us upon exercise of the Pre-Funded Warrant and in payment of the aggregate exercise price, the holder may instead elect to receive upon such exercise (either in whole or in part) the net number of Warrant Shares determined according to a formula set forth in the Pre-Funded Warrant.

Automatic Exercise

Immediately upon obtaining the Requisite Stockholder Approval, the holder of the Pre-Funded Warrant shall have ten (10) calendar days to exercise the Pre-Funded Warrant. If such exercise does not occur on tenth (10th) day following Stockholder Approval, the Pre-Funded Warrant will be automatically exercised via cashless exercise as described above and as set forth in the Pre-Funded Warrant.

Subsequent Rights Offerings

If the Company grants, issues or sells any Common Stock Equivalents (as such term is defined in the Pre-Funded Warrant) or rights to purchase stock, warrants, securities or other property pro rata to all of the record holders of any class of shares of Common Stock (the “Purchase Rights”), then the holder of the Pre-Funded Warrant will be entitled to acquire, upon the terms applicable to such Purchase Rights, the aggregate Purchase Rights which the holder of the Pre-Funded Warrant could have acquired if the holder of the Pre-Funded Warrant had held the number of shares of Common Stock acquirable upon complete exercise of the Pre-Funded Warrant (without regard to any limitations on exercise of the Pre-Funded Warrant, including without limitation, the Beneficial Ownership Limitation) immediately before the date on which a record is taken for the grant, issuance or sale of such Purchase Rights, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the grant, issue or sale of such Purchase Rights.

Pro Rata Distributions

During such time as the Pre-Funded Warrant is outstanding, if we declare or make any dividend or other distribution of our assets (or rights to acquire our assets) to all holders of our Common Stock, by way of return of capital or otherwise (including, without limitation, any distribution of cash, stock or other securities, property or options by way of a dividend, spin-off, reclassification, corporate rearrangement, scheme of arrangement or other similar transaction) (a “Distribution”), at any time after the issuance of the Pre-Funded Warrant, then, in each such case, the holder of the Pre-Funded Warrant will be entitled to participate in such Distribution to the same extent that the holder of the Pre-Funded Warrant would have participated therein if the holder had held the number of shares of Common Stock acquirable upon complete exercise of the Pre-Funded Warrant (without regard to any limitations on exercise of the Pre-Funded Warrant, including without limitation, the Beneficial Ownership Limitation) immediately before the date of which a record is taken for such Distribution, or, if no such record is taken, the date as of which the record holders of shares of Common Stock are to be determined for the participation in such Distribution.

Fundamental Transaction

In the event of a fundamental transaction, as described in the Pre-Funded Warrant and generally including any reorganization, recapitalization or reclassification of our Common Stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or merger with or into another person, any holder of the Pre-Funded Warrant will be entitled to receive upon exercise of the Pre-Funded Warrant the kind and amount of securities, cash or other property that the holder of the Pre-Funded Warrant would have received had the such holder exercised the Pre-Funded Warrant immediately prior to such fundamental transaction.

Transferability

Subject to applicable laws, the Pre-Funded Warrant may be transferred at the option of the holder of the Pre-Funded Warrant upon surrender of the Pre-Funded Warrant to us together with the appropriate instruments of transfer.

Exchange Listing

We have not and do not intend to list the Pre-Funded Warrant on any securities exchange or nationally recognized trading system.

Liquidated Damages

If we do not timely deliver Warrant Shares upon exercise of the Pre-Funded Warrant, we are required to pay the holder of the Pre-Funded Warrant certain liquidated damages.

Rights as a Stockholder

Except as otherwise provided in the Pre-Funded Warrant or by virtue of such holder’s ownership of shares of Common Stock, the holder of the Pre-Funded Warrant does not have the rights or privileges of holders of Common Stock, including any voting rights, until the holder exercises the Pre-Funded Warrant.

Effects of Authorized but Unissued Stock

We have shares of Common Stock and preferred stock available for future issuance without stockholder approval, subject to any limitations imposed by the listing standards of The Nasdaq Global Select Market. We may utilize these additional shares for a variety of corporate purposes, including for future public offerings to raise additional capital, or facilitate corporate acquisitions or for payment as a dividend on our capital stock. The existence of unissued and unreserved Common Stock and preferred stock may enable our Board of Directors to issue shares to persons friendly to current management or to issue preferred stock with terms that could have the effect of making it more difficult for a third party to acquire or could discourage a third party from seeking to acquire, a controlling interest in our company by means of a merger, tender offer, proxy contest or otherwise. In addition, if we issue preferred stock, the issuance could adversely affect the voting power of holders of Common Stock, and the likelihood that such holders will receive dividend payments and payments upon liquidation.

Anti-Takeover Effects of Our Charter Documents and Some Provisions of Delaware Law

Delaware Law

We are incorporated in the State of Delaware. As a result, we are subject to Section 203 of the Delaware General Corporation Law, which prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years after the date that such stockholder became an interested stockholder, with the following exceptions:

|

|

●

|

before such date, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

|

|

|

●

|

upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction began, excluding for purposes of determining the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned (1) by persons who are directors and also officers and (2) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

|

|

|

●

|

on or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting of the stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned by the interested stockholder.

|

In general, Section 203 defines a “business combination” to include the following:

|

|

●

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

●

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

|

|

●

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

|

|

●

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock or any class or series of the corporation beneficially owned by the interested stockholder; or

|

|

|

●

|

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits by or through the corporation.

|

In general, Section 203 defines an “interested stockholder” as an entity or person who, together with the person’s affiliates and associates, beneficially owns, or within three years prior to the time of determination of interested stockholder status did own, 15% or more of the outstanding voting stock of the corporation. A Delaware corporation may “opt out” of these provisions with an express provision in its certificate of incorporation. We have not opted out of these provisions, which may as a result, discourage or prevent mergers or other takeover or change of control attempts of us; however, our Board of Directors has approved the issuance of the Common Stock in excess of 15% or more of our outstanding voting stock to Eshelman Ventures, LLC for purposes of Section 203.

Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws

Our Amended and Restated Certificate of Incorporation provides for our Board of Directors to be divided into three classes with staggered three-year terms. Only one class of directors is elected at each annual meeting of our stockholders, with the other classes continuing for the remainder of their respective three-year terms. Because our stockholders do not have cumulative voting rights, stockholders holding a majority of the shares of Common Stock outstanding are able to elect all of our directors. Our Amended and Restated Certificate of Incorporation and our Amended and Restated Bylaws also provide that directors may be removed by the stockholders only for cause upon the vote of 66 2/3% of our outstanding Common Stock. Furthermore, the authorized number of directors may be changed only by resolution of the Board of Directors, and vacancies and newly created directorships on the Board of Directors may, except as otherwise required by law or determined by the Board of Directors, only be filled by a majority vote of the directors then serving on the Board of Directors, even though less than a quorum.

Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws also provide that all stockholder actions must be effected at a duly called meeting of stockholders and eliminates the right of stockholders to act by written consent without a meeting. Our Amended and Restated Bylaws also provide that only our chairman of the Board, chief executive officer or the Board of Directors pursuant to a resolution adopted by a majority of the total number of authorized directors may call a special meeting of stockholders.

Our Amended and Restated Bylaws also provide that stockholders seeking to present proposals before a meeting of stockholders to nominate candidates for election as directors at a meeting of stockholders must provide timely advance notice in writing and specify requirements as to the form and content of a stockholder’s notice.

Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the stockholders cannot amend many of the provisions described above except by a vote of 66 2/3% or more of our outstanding Common Stock.

The combination of these provisions makes it more difficult for our existing stockholders to replace our Board of Directors as well as for another party to obtain control of us by replacing our Board of Directors. Since our Board of Directors has the power to retain and discharge our officers, these provisions could also make it more difficult for existing stockholders or another party to effect a change in management. In addition, the authorization of undesignated preferred stock makes it possible for our Board of Directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to change our control.

These provisions are intended to enhance the likelihood of continued stability in the composition of our Board of Directors and its policies and to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to reduce our vulnerability to hostile takeovers and to discourage certain tactics that may be used in proxy fights. However, such provisions could have the effect of discouraging others from making tender offers for our shares and may have the effect of delaying changes in our control or management. As a consequence, these provisions may also inhibit fluctuations in the market price of our stock that could result from actual or rumored takeover attempts. We believe that the benefits of these provisions, including increased protection of our potential ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure our company, outweigh the disadvantages of discouraging takeover proposals, because negotiation of takeover proposals could result in an improvement of their terms.

Choice of Forum

Our Amended and Restated Certificate of Incorporation provides that the Court of Chancery of the State of Delaware will be the exclusive forum for:

|

|

●

|

any derivative action or proceeding brought on our behalf;

|

|

|

●

|

any action asserting a breach of fiduciary duty; any action asserting a claim against us arising pursuant to the Delaware General Corporation Law, our Amended and Restated Certificate of Incorporation or our Amended and Restated Bylaws; or

|

|

|

●

|

any action asserting a claim against us that is governed by the internal affairs doctrine.

|

A Delaware corporation is allowed to mandate in its corporate governance documents a chosen forum for the resolution of state law-based shareholder class actions, derivative suits and other intra-corporate disputes.

Our management believes limiting state law-based claims to Delaware will provide the most appropriate outcomes as the risk of another forum misapplying Delaware law is avoided, Delaware courts have a well-developed body of case law and limiting the forum will preclude costly and duplicative litigation and avoids the risk of inconsistent outcomes. Additionally, Delaware Chancery Courts can typically resolve disputes on an accelerated schedule when compared to other forums.

While management believes limiting the forum for state law-based claims is a benefit, stockholders could be inconvenienced by not being able to bring a state law-based action in another forum they find favorable.

This exclusive forum provision would not apply to suits brought to enforce any liability or duty created by the Securities Act of 1933, as amended (the "Securities Act") or the Securities Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. To the extent that any such claims may be based upon federal law claims, Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. Furthermore, Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. Although our Amended and Restated Certificate of Incorporation contains the choice of forum provision described above, it is possible that a court could rule that such a provision is inapplicable for a particular claim or action or that such provision is unenforceable. Several lawsuits involving other companies have been brought challenging the validity of choice of forum provisions in certificates of incorporation, and it is possible that a court could note such provision is inapplicable or unenforceable. Investors cannot waive compliance with the federal securities laws and the rules and regulations thereunder.

Limitations on Liability and Indemnification of Officers and Directors

Our Amended and Restated Certificate of incorporation limits the personal liability of directors for breach of fiduciary duty to the maximum extent permitted by the Delaware General Corporation Law and provides that no director will have personal liability to us or to our stockholders for monetary damages for breach of fiduciary duty as a director. However, these provisions do not eliminate or limit the liability of any of our directors:

|

|

●

|

for any breach of the director’s duty of loyalty to us or our stockholders;

|

|

|

●

|

for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

|

|

|

●

|

for voting or assenting to unlawful payments of dividends, stock repurchases or other distributions; or

|

|

|

●

|

for any transaction from which the director derived an improper personal benefit.

|

Any amendment to or repeal of these provisions will not eliminate or reduce the effect of these provisions in respect of any act, omission or claim that occurred or arose prior to such amendment or repeal. If the Delaware General Corporation Law is amended to provide for further limitations on the personal liability of directors of corporations, then the personal liability of our directors will be further limited to the greatest extent permitted by the Delaware General Corporation Law.

Our Amended and Restated Certificate of Incorporation provides that we must indemnify our directors and officers and we must advance expenses, including attorneys’ fees, to our directors and officers in connection with legal proceedings, subject to very limited exceptions.

We maintain a general liability insurance policy that covers certain liabilities of our directors and officers arising out of claims based on acts or omissions in their capacities as directors or officers.

Indemnification Agreements

We have entered into indemnification agreements with each of our directors and executive officers. Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors or executive officers, we have been informed that in the opinion of the SEC such indemnification is against public policy and is therefore unenforceable.

Transfer Agent and Registrar

The transfer agent and registrar for our Common Stock is American Stock Transfer & Trust Company, LLC. The transfer agent’s address is 6201 15th Avenue, Brooklyn, New York 11219.

Listing on The Nasdaq Global Select Market

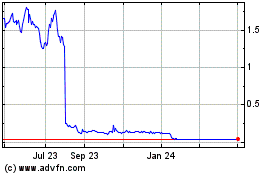

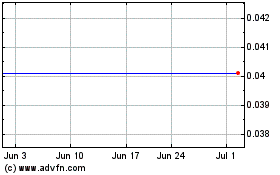

Our Common Stock is listed on The Nasdaq Global Select Market under the symbol “ARAV.”

Required Vote and Recommendation

Approval of the Issuance Proposal requires the affirmative vote of a majority of the issued and outstanding shares of the Company’s Common Stock, represented in person or by proxy at the meeting and entitled to vote thereon. Abstentions will be votes against the proposal and will not affect the outcome of the Issuance Proposal. Broker non-votes are not expected with respect to this proposal. If there were any broker non-votes, they would not affect the outcome of this proposal.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ISSUANCE PROPOSAL.

PROPOSAL NO. 2—ADJOURNMENT PROPOSAL

At the 2022 Special Meeting, if necessary, stockholders will vote on the Adjournment Proposal. If the Adjournment Proposal is adopted, the Board of Directors will have the discretion to adjourn the 2022 Special Meeting to a later date or dates to permit further solicitation of proxies in the event that there are not sufficient votes at the time of the 2022 Special Meeting to approve the Issuance Proposal. It is possible for the Company to obtain sufficient votes to approve the Adjournment Proposal but not receive sufficient votes to approve the Issuance Proposal. In such a situation, the Company could adjourn the meeting for any number of days or hours as permitted under applicable law and attempt to solicit additional votes in favor of such other proposals.

In addition to an adjournment of the 2022 Special Meeting upon approval of the Adjournment Proposal, if a quorum is not present at the 2022 Special Meeting, the Company’s Amended and Restated Bylaws allow the 2022 Special Meeting to be adjourned for the purpose of obtaining a quorum. Any such adjournment may be made without notice, other than the announcement made at the 2022 Special Meeting, by the affirmative vote of a majority of the shares of common stock present in person or by proxy and entitled to vote at the 2022 Special Meeting unless the adjournment is for more than 30 days and then a notice shall be given to each stockholder of record entitled to vote at the 2022 Special Meeting. The Board of Directors also is empowered under Delaware law to postpone the meeting at any time prior to the meeting being called to order. In such event, the Company would issue a press release and take such other steps as it believes are necessary and practical in the circumstances to inform its stockholders of the postponement.

If the stockholders approve the Adjournment Proposal, and the 2022 Special Meeting is adjourned, the Company expects to use the additional time to solicit additional proxies in favor of Proposal No. 1—the Issuance Proposal. Among other things, approval of the Adjournment Proposal could mean that, even if a majority of the Company’s Common Stock has been voted against the Issuance Proposal, the Company could adjourn the 2022 Special Meeting without a vote on such proposal, and seek to convince the holders of those shares to change their votes.

The Adjournment Proposal will only be presented at the 2022 Special Meeting if there are not sufficient votes to approve the Issuance Proposal. If the Adjournment Proposal is presented at the 2022 Special Meeting and is not approved, the Company may not be able to adjourn the 2022 Special Meeting to a later date. As a result, the Company may be prevented from obtaining approval of the Adjournment Proposal.

Required Vote and Recommendation

Approval of the Adjournment Proposal requires the affirmative vote of a majority of the issued and outstanding shares of the Company’s common stock, represented in person or by proxy at the meeting and entitled to vote thereon. Abstentions will be votes against the proposal and will not affect the outcome of the Issuance Proposal. Broker non-votes are not expected with respect to this proposal. If there were any broker non-votes, they would not affect the outcome of this proposal.

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ADJOURNMENT PROPOSAL.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding the beneficial ownership of our common stock as of February 3, 2022 by: (i) each director; (ii) each of the executive officers named in the Summary Compensation Table; (iii) all executive officers and directors of the Company as a group; and (iv) all those known by us to be beneficial owners of more than five percent of its common stock.

|

|

|

Beneficial Ownership(1)

|

|

|

Beneficial Owner

|

|

Number of

Shares

|

|

|

Percent of Total

|

|

|

Greater than 5% stockholders other than executive officers and directors:

|

|

|

|

|

|

|

|

|

|

Invus Public Equities, L.P and its affiliated entities(2)

|

|

|

1,311,291

|

|

|

|

6.2

|

%

|

|

Raymond Tabibiazar, M.D.(3)

|

|

|

1,612,896

|

|

|

|

7.4

|

%

|

|

Eshelman Ventures, LLC (4)

|

|

|

4,278,498

|

|

|

|

19.85

|

%

|

|

Named Executive officers and directors:

|

|

|

|

|

|

|

|

|

|

Fredric N. Eshelman, Pharm. D.(5)

|

|

|

4,314,159

|

|

|

|

19.99

|

%

|

|

Amato Giaccia, Ph.D.(6)

|

|

|

1,146,037

|

|

|

|

5.4

|

%

|

|

Michael W. Rogers(7)

|

|

|

33,923

|

|

|

|

*

|

|

|

Eric Zhang(8)

|

|

|

906,889

|

|

|

|

4.3

|

%

|

|

Vinay Shah(9)

|

|

|

359,170

|

|

|

|

1.7

|

%

|

|

Gail McIntyre(10)

|

|

|

241,753

|

|

|

|

1.1

|

%

|

|

Reshma Rangwala(11)

|

|

|

38,333

|

|

|

|

*

|

|

|

Peter T. C. Ho(12)

|

|

|

22,367

|

|

|

|

*

|

|

|

John Hohneker(13)

|

|

|

21,367

|

|

|

|

*

|

|

|

Sigurd C. Kirk(14)

|

|

|

21,367

|

|

|

|

*

|

|

|

Jay Shepard(15)

|

|

|

0

|

|

|

|

0

|

|

|