Aravive, Inc. (Nasdaq: ARAV), a clinical-stage oncology company

developing transformative therapeutics, today announced recent

corporate updates and financial results for the third quarter ended

September 30, 2020.

“Aravive has made continued progress executing on our strategic

initiatives in the third quarter of 2020, including strengthening

our leadership team, expanding our Board of Directors and advancing

our development plans for AVB-500,” said Gail McIntyre, Ph.D.,

chief executive officer of Aravive. “We expect to initiate a

pivotal trial of AVB-500 in platinum resistant ovarian cancer

during the fourth quarter of 2020 or in the first quarter of 2021

and are on-track to initiate a Phase 1b/2 trial of AVB-500 in clear

cell renal cell carcinoma this year. We are very encouraged by the

AVB-500 clinical trial results to date, and are well-positioned to

continue to advance both the ovarian cancer and renal cancer

programs.”

Recent Corporate

Highlights

- AVB-500 in Platinum Resistant Ovarian

Cancer (PROC): Aravive expects to initiate a pivotal trial

for AVB-500 in PROC during the fourth quarter of 2020/first quarter

of 2021. The study is expected to be a global, randomized,

double-blind, placebo-controlled trial to evaluate efficacy and

tolerability of AVB-500 at a dose of 15 mg/kg in combination with

paclitaxel.

- AVB-500 in Clear Cell Renal Cell Carcinoma

(ccRCC): Aravive is

on-track to initiate a Phase 1b/2 trial of AVB-500 in ccRCC during

the fourth quarter of 2020. This is an open-label study which is

expected to provide safety, pharmacokinetic, and preliminary

clinical activity in 2021.

- Strengthened Leadership Team: The Company

enhanced its clinical development and oncology expertise with the

appointments of Reshma Rangwala, M.D., Ph.D., as Chief Medical

Officer, Randy Anderson, Ph.D., as Senior Vice President of Data

Sciences, Elisabeth Gardiner, Ph.D., as Vice President of

Translational Medicine, and Patrick Simms, as Vice President of

Clinical Operations.

- Expanded Board of Directors: Aravive appointed

Michael W. Rogers, a biopharmaceutical veteran and healthcare

leader with more than 20 years of public company financial

experience, to the Company’s Board of Directors. Mr. Rogers serves

as Chair of Aravive’s Audit Committee.

Third Quarter 2020

Financial ResultsRevenue for the three and nine

months ended September 30, 2020 were $0 for both periods, compared

to $0 and $4.8 million for the same periods in 2019. Revenue for

2019 was derived solely from the Cancer Prevention Research

Institute of Texas (CPRIT) grant.

Total operating expenses for the three and nine months ended

September 30, 2020 were $10.7 million and $26.7 million,

respectively, compared to $7.0 million and $21.4 million for the

same periods in 2019.

Total operating expenses for the three and nine months ended

September 30, 2020 included non-cash stock-based compensation

expense of $0.4 million and $1.6 million, respectively, compared to

$0.8 million and $2.8 million for the same periods in 2019. In

addition, during the three and nine months ended September 30,

2020, there was a non-recurring non-cash charge for impairment of

the Company’s right-of-use asset and leasehold improvements of $2.9

million and $5.8 million, respectively.

For the three and nine months ended September 30, 2020, Aravive

reported a net loss of $10.7 million and $26.5 million, or $0.66

per share and $1.69 per share, respectively, compared to a net loss

of $6.1 million and $13.9 million, or $0.54 per share and $1.23 per

share, for the same periods in 2019.

Cash PositionAs of September 30, 2020, cash and

cash equivalents was $54.0 million, compared to $65.1 million as of

December 31, 2019. The Company expects that its current cash and

cash equivalents will be sufficient to fund its operating plans

into 2022.

About AraviveAravive, Inc. is a

clinical-stage oncology company developing transformative

therapeutics designed to halt the progression of life-threatening

diseases. Aravive’s lead therapeutic, AVB-500, is an ultra-high

affinity decoy protein that targets the GAS6-AXL signaling pathway

associated with tumor cell growth. Aravive recently successfully

completed a Phase 1b trial of AVB-500 in platinum resistant ovarian

cancer and selected 15 mg/kg as the dose for the pivotal trial.

Analysis of all safety data to date showed that AVB-500 has been

generally well-tolerated with no dose-limiting toxicities or

unexpected safety signals. While the Phase 1b trial of AVB-500 in

platinum resistant ovarian cancer was a safety trial and not

powered to demonstrate efficacy, all 5 patients in the 15 mg/kg

cohort experienced clinical benefit, with 1 complete response, 2

partial responses, and 2 stable disease. The Company also intends

to initiate a Phase 1b/Phase 2 trial of AVB-500 in clear cell renal

cell carcinoma later this year. For more information, please

visit www.aravive.com.

Forward-Looking StatementsThis communication

contains forward-looking statements (including within the meaning

of Section 21E of the United States Securities Exchange Act of

1934, as amended, and Section 27A of the United States Securities

Act of 1933, as amended), express or implied, such as initiation of

a pivotal trial of AVB-500 in platinum resistant ovarian cancer

during the fourth quarter 2020/first quarter 2021, initiation of

Phase 1b/2 trial of AVB-500 in clear cell renal cell

carcinoma during the fourth quarter of 2020, the pivotal trial

of AVB-500 in platinum resistant ovarian cancer being a global,

randomized, double-blind, placebo-controlled trial to evaluate

efficacy and tolerability of AVB-500 at a dose of 15 mg/kg in

combination with paclitaxel, the Phase 1b/2 trial of AVB-500 in

clear cell renal cell carcinoma providing safety, pharmacokinetic,

and preliminary clinical activity in 2021 and current cash and cash

equivalents expected to fund operations into 2022. Forward-looking

statements are based on current beliefs and assumptions, are not

guarantees of future performance and are subject to risks and

uncertainties that could cause actual results to differ materially

from those contained in any forward-looking statement as a result

of various factors, including, but not limited to, risks and

uncertainties related to: the Company's ability to design and

obtain approval for a randomized, double-blind, placebo-controlled

trial to evaluate efficacy and tolerability of AVB-500 at a dose of

15 mg/kg in combination with paclitaxel, the ability to properly

fund the Company, the ability to initiate the open-label ccRCC

study and expected pivotal PROC study within the expected

timelines, the ability to provide preliminary safety,

pharmacokinetic and preliminary clinical activity from the ccRCC

study in 2021, the ability to fund operations into 2022 with

current cash and cash equivalents, the ability of the new directors

and management team to deliver on the Company's strategic vision

and execute on its business plan, the impact of COVID-19 on the

Company's clinical strategy, clinical trials, supply chain and

fundraising, the Company's ability to expand development into

additional oncology indications, the Company's dependence upon

AVB-500, AVB-500's ability to have favorable results in clinical

trials and ISTs, the clinical trials of AVB-500 having results that

are as favorable as those of preclinical and clinical trials, the

ability to receive regulatory approval, potential delays in the

Company's clinical trials due to regulatory requirements or

difficulty identifying qualified investigators or enrolling

patients especially in light of the COVID-19 pandemic; the risk

that AVB-500 may cause serious side effects or have properties that

delay or prevent regulatory approval or limit its commercial

potential; the risk that the Company may encounter difficulties in

manufacturing AVB-500; if AVB-500 is approved, risks associated

with its market acceptance, including pricing and reimbursement;

potential difficulties enforcing the Company's intellectual

property rights; the Company's reliance on its licensor of

intellectual property and financing needs. The foregoing review of

important factors that could cause actual events to differ from

expectations should not be construed as exhaustive and should be

read in conjunction with statements that are included herein and

elsewhere, including the risk factors included in the Company's

Annual Report on Form 10-K for the fiscal year ended December 31,

2019, recent Current Reports on Form 8-K and subsequent filings

with the SEC. Except as required by applicable law, the Company

undertakes no obligation to revise or update any forward-looking

statement, or to make any other forward-looking statements, whether

as a result of new information, future events or otherwise.

| |

|

Aravive, Inc.Condensed Consolidated

Statements of Operations(in thousands, except per share

amounts)(unaudited) |

| |

|

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

|

| |

September 30, |

|

September 30, |

|

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

|

|

|

Grant revenue |

$ |

— |

|

$ |

— |

|

$ |

— |

|

$ |

4,753 |

|

| Operating

expenses |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

5,070 |

|

|

3,840 |

|

|

11,085 |

|

|

10,325 |

|

|

General and administrative |

|

2,715 |

|

|

3,158 |

|

|

9,866 |

|

|

11,039 |

|

|

Loss on impairment of long-lived assets |

|

2,914 |

|

|

— |

|

|

5,784 |

|

|

— |

|

| Total operating expenses |

|

10,699 |

|

|

6,998 |

|

|

26,735 |

|

|

21,364 |

|

| Loss from operations |

|

(10,699 |

) |

|

(6,998 |

) |

|

(26,735 |

) |

|

(16,611 |

) |

| Interest income |

|

8 |

|

|

232 |

|

|

251 |

|

|

811 |

|

| Other income (expense),

net |

|

31 |

|

|

624 |

|

|

(13 |

) |

|

1,910 |

|

| Net loss |

$ |

(10,660 |

) |

$ |

(6,142 |

) |

$ |

(26,497 |

) |

$ |

(13,890 |

) |

| Net loss per share- basic and

diluted |

$ |

(0.66 |

) |

$ |

(0.54 |

) |

$ |

(1.69 |

) |

$ |

(1.23 |

) |

| Weighted-average common shares

used to compute basic and diluted net loss per share |

|

16,055 |

|

|

11,285 |

|

|

15,658 |

|

|

11,280 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Aravive, Inc.Condensed Consolidated

Balance Sheets (in thousands) |

| |

|

|

|

|

| |

September 30, |

|

December 31, |

|

| |

2020 |

|

2019 |

|

| |

(unaudited) |

|

|

|

|

|

Assets: |

|

|

|

|

|

|

| Cash and cash equivalents |

$ |

53,967 |

|

$ |

65,134 |

|

| Restricted cash |

|

2,430 |

|

|

2,423 |

|

| Other assets |

|

2,182 |

|

|

5,867 |

|

| Operating lease right-of-use

assets |

|

2,651 |

|

|

8,697 |

|

| Total

assets |

$ |

61,230 |

|

$ |

82,121 |

|

| Liabilities and stockholders'

equity: |

|

|

|

|

|

|

| Accounts payable and accrued

liabilities |

$ |

3,162 |

|

$ |

2,575 |

|

| Operating lease

obligation |

|

8,407 |

|

|

10,233 |

|

| Contingent payable |

|

295 |

|

|

264 |

|

| Total liabilities |

|

11,864 |

|

|

13,072 |

|

| Total stockholders'

equity |

|

49,366 |

|

|

69,049 |

|

| Total liabilities and

stockholders’

equity |

$ |

61,230 |

|

$ |

82,121 |

|

| |

|

|

|

|

|

|

Contacts:Investors:Luke Heagle, W2O

lheagle@w2ogroup.com (910) 726-1372

Media:Sheryl Seapy, W2Osseapy@w2ogroup.com(949) 903-4750

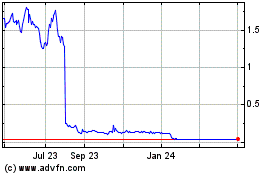

Aravive (NASDAQ:ARAV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Aravive (NASDAQ:ARAV)

Historical Stock Chart

From Apr 2023 to Apr 2024