Apple and many others that poured tax savings into stock

repurchases show big paper losses

By Michael Rapoport and Theo Francis

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 28, 2018).

Apple Inc. has lost more than $9 billion this year on an

underperforming investment -- its own stock.

Like many large companies, Apple has used much of its windfall

from the 2017 tax overhaul to buy back shares. But the recent

plunge in stock prices has made that look like a bad idea. Apple

and companies including Wells Fargo & Co., Citigroup Inc. and

Applied Materials Inc. repurchased their own shares at rich prices,

only to see their value decline sharply.

In effect, the market has told them they overpaid by billions of

dollars. While Wednesday's rebound mitigated the damage, the

S&P 500 has fallen 15.2% from its September high through

Wednesday's close. The index is down 7.7% for all of 2018.

Companies contend that buybacks are a good way to return excess

capital to shareholders and that the paper losses can reverse

themselves if their stocks rebound. But the sharp declines call

into question their decision to devote so much of their tax savings

to buybacks, rather than using it to invest in their businesses,

raise employee pay or pay higher dividends.

"If they made an acquisition that decreased in value this much,

people would be up in arms," said Nell Minow, vice chairwoman of

ValueEdge Advisors, a corporate-governance consulting firm. "They

have one job, and that is to make good use of capital."

When the market was riding high, companies bought back shares at

a furious pace, juiced by the tax savings they reaped from the

December 2017 passage of the Tax Cuts and Jobs Act. The law

enriched companies by slashing the corporate tax rate to 21% from

35% and making it easier for firms such as Apple to shift foreign

earnings to the U.S.

S&P 500 companies bought back $583.4 billion worth of their

own shares in the first nine months of 2018, according to S&P

Dow Jones Indices, up 52.6% from the same period in 2017 and just

shy of a full-year record.

Nearly 18% of S&P 500 companies reduced their share counts

by at least 4% year-over-year, according to S&P Dow Jones

Indices.

Apple, one of the market's biggest repurchasers, spent about

$62.9 billion on buybacks in the first nine months of 2018,

according to securities filings. But the selloff has weighed on its

shares.

The company's repurchased shares were worth about $53.8 billion

as of Wednesday's close, some $9.1 billion less than it paid for

them. Apple repurchased shares at monthly average prices as high as

$222.07, according to securities filings. The stock closed at

$157.17 Wednesday.

An Apple spokesman declined to comment. In May, Luca Maestri,

Apple's chief financial officer, said the company wanted to be

"particularly thoughtful and flexible" in its buyback approach. In

addition to buybacks, Apple said in January it planned to create

20,000 U.S. jobs and invest $30 billion in U.S. operations over the

next five years.

"Apple makes iPhones. Timing the market is not what they do,"

said Howard Silverblatt, senior index analyst at S&P Dow Jones

Indices. Companies that try to time the market in buying back

shares "are going to be in the red at times."

Some big banks have encountered the same issue. Wells Fargo

spent about $13.3 billion on buybacks from January through

September for shares now worth $10.6 billion, about $2.7 billion

less than they paid. Citigroup spent $9.9 billion on buybacks in

the nine-month period for shares now worth about $7.1 billion,

about $2.8 billion less.

Both banks bought back some shares at monthly average prices

that weren't far below their 52-week highs, and both companies'

share prices have fallen well below those levels. Wells and

Citigroup declined to comment. Big banks' share-buyback plans are

subject to Federal Reserve approval, but the banks have discretion

to spend less on buybacks than their authorized amount.

Applied Materials spent about $4.5 billion for shares now worth

$2.7 billion -- about $1.8 billion less. The stock has declined 40%

this year. Applied Materials bought back many of its shares for

prices above $50; the stock closed Wednesday at $30.64. Applied

Materials didn't respond to requests for comment.

Still, buybacks can help companies in other ways. Buybacks

reduce share counts, boosting the earnings per share companies

report to their investors.

Apple's buybacks this year, for instance, have reduced its

shares outstanding by about 6.7%, raising its earnings per share as

the company's profits are spread across fewer shares. "It's

immediate gratification," Mr. Silverblatt said.

It is possible some companies may take advantage of the

currently beaten-down prices to buy back more shares. But many

companies are heading into their pre-earnings blackout period, when

they can't buy back stock because they know what their forthcoming

quarterly earnings will look like.

And companies remain nervous about the volatility in stock

prices, Mr. Silverblatt said. "It's hard to fight the market."

Write to Michael Rapoport at Michael.Rapoport@wsj.com and Theo

Francis at theo.francis@wsj.com

(END) Dow Jones Newswires

December 28, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

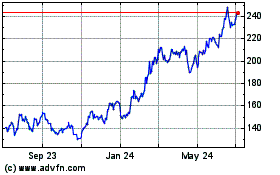

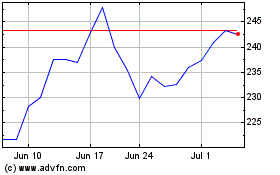

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024