Applied Materials Says Supply-Chain Shortages Pressured 4Q Revenue

November 18 2021 - 4:43PM

Dow Jones News

By Maria Armental

Applied Materials Inc. said sales in the most recent quarter

missed Wall Street targets due to supply-chain challenges.

Chief Executive Gary Dickerson said the company expects

short-term supply shortages of certain silicon components.

Shares fell 8% to $146 in after-hours trading.

Profit for the quarter ended Oct. 31 rose to $1.71 billion from

$1.13 billion a year earlier. On a per-share basis, profit was

$1.89, or $1.94 as adjusted.

Applied Materials expected an adjusted profit of $1.87 to $2.01

a share; while analysts surveyed by FactSet expected $1.93 a share,

or $1.96 a share as adjusted.

Net sales for the quarter rose to $6.12 billion, from $4.69

billion a year earlier, at the low-end of the company's guidance

and short of analysts' projected $6.38 billion.

The chip-making equipment manufacturer ended the year at a $5.89

billion profit on $23.06 billion in sales, compared with a profit

of $3.62 billion and $17.2 billion in sales a year earlier.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

November 18, 2021 16:28 ET (21:28 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

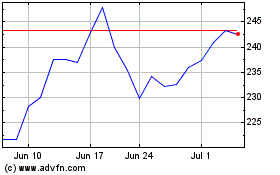

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

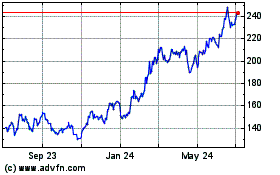

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024