Current Report Filing (8-k)

May 29 2020 - 4:38PM

Edgar (US Regulatory)

APPLIED MATERIALS INC /DE false 0000006951 0000006951 2020-05-29 2020-05-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 29, 2020

Applied Materials, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

000-06920

|

|

94-1655526

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

3050 Bowers Avenue

P.O. Box 58039

Santa Clara, CA 95052-8039

(Address of principal executive offices)

Registrant’s telephone number, including area code: (408) 727-5555

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbol

|

|

Name of Exchange

on Which Registered

|

|

Common Stock, par value $.01 per share

|

|

AMAT

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act). ☐

|

Item 1.01

|

Entry into a Material Definitive Agreement.

|

On May 29, 2020, Applied Materials, Inc. (“Applied”) completed a registered public offering of senior unsecured notes in the aggregate principal amount of $1.5 billion (collectively, the “Notes”). Applied issued the Notes under an indenture dated as of June 8, 2011 (the “Base Indenture), between Applied and U.S. Bank National Association, as trustee (the “Trustee”), as supplemented by a fourth supplemental indenture dated as of May 29, 2020 (the “Fourth Supplemental Indenture” and together with the Base Indenture, the “Indenture”), between Applied and the Trustee establishing the terms and form of the Notes. The Notes consist of the following tranches: $750 million aggregate principal amount of 1.750% senior unsecured notes due 2030 (the “2030 Notes”) and $750 million aggregate principal amount of 2.750% senior unsecured notes due 2050 (the “2050 Notes”). Interest is payable on the Notes semi-annually in arrears on June 1 and December 1 of each year, commencing December 1, 2020.

Applied intends to use a portion of the net proceeds to redeem or repay Applied’s outstanding $600 million 2.625% senior notes due October 1, 2020 and Applied’s outstanding $750 million 4.300% senior notes due June 15, 2021 and the balance for general corporate purposes.

The Indenture contains limited covenants of Applied. The negative covenants limit the ability of Applied and its subsidiaries to incur debt secured by liens on its principal property or on shares of stock of its principal subsidiaries; to engage in sale and lease-back transactions with respect to any principal property; and to consolidate, merge or sell all or substantially all of its assets. Applied may be required to offer to repurchase the Notes upon a change in control and a contemporaneous downgrade of the Notes below an investment grade rating, and it may elect to redeem the Notes in whole or in part at any time, as further specified in the Indenture.

Events of default under the Indenture include a failure to make payments, non-performance of covenants, and bankruptcy and insolvency-related events. Applied’s obligations may be accelerated upon an event of default, in which case the entire principal amount of the Notes would become immediately due and payable.

The foregoing description of certain terms of the Indenture does not purport to be complete and is qualified in its entirety by reference to the full text of the Base Indenture, which was filed with the Securities and Exchange Commission on June 8, 2011 as Exhibit 4.1 to the Company’s Current Report on Form 8-K and incorporated by reference into the Company’s registration statement on Form S-3 (File No. 333-225577), and the Fourth Supplemental Indenture (including the form of note for the Notes), which is filed with this report as Exhibit 4.1, and incorporated herein by reference.

Cleary Gottlieb Steen & Hamilton LLP, counsel to Applied, has issued an opinion to Applied dated May 29, 2020 regarding the legality of the Notes. A copy of the opinion is filed as Exhibit 5.1 hereto.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Applied Materials, Inc.

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

Dated: May 29, 2020

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Christina Y. Lai

|

|

|

|

|

|

|

|

Christina Y. Lai

|

|

|

|

|

|

|

|

Corporate Secretary

|

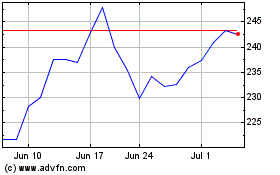

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

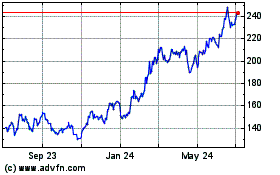

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024