Current Report Filing (8-k)

May 28 2020 - 5:20PM

Edgar (US Regulatory)

APPLIED MATERIALS INC /DE false 0000006951 0000006951 2020-05-26 2020-05-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 26, 2020

Applied Materials, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

000-06920

|

|

94-1655526

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

3050 Bowers Avenue P.O. Box 58039 Santa Clara, CA 95052-8039

(Address of principal executive offices)

Registrant’s telephone number, including area code: (408) 727-5555

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbol

|

|

Name of Exchange

on Which Registered

|

|

Common Stock, par value $.01 per share

|

|

AMAT

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act). ☐

Underwriting Agreement

On May 26, 2020, Applied Materials, Inc. (“Applied”) entered into an underwriting agreement (the “Underwriting Agreement”) with BofA Securities, Inc., Goldman Sachs & Co. LLC and J.P. Morgan Securities LLC, as representatives of the several underwriters named in the agreement. The Underwriting Agreement provides for the issuance and sale by Applied (the “Offering”) of senior unsecured notes in the aggregate principal amount of $1.5 billion (collectively, the “Notes”) in the following tranches:

|

|

•

|

$750 million aggregate principal amount of 1.750% senior unsecured notes due 2030; and

|

|

|

•

|

$750 million aggregate principal amount of 2.750% senior unsecured notes due 2050.

|

The Notes will be issued and sold in a public offering pursuant to a registration statement on Form S-3 (File No. 333-225577) (the “Registration Statement”) and related preliminary prospectus supplement filed with the Securities and Exchange Commission on May 26, 2020, and a related final prospectus supplement filed on May 27, 2020. The Underwriting Agreement contains customary representations, warranties and agreements by Applied, and customary closing conditions, indemnification rights and termination provisions.

Applied expects that the net proceeds from the Offering will be approximately $1.48 billion after deducting underwriting discounts and estimated offering expenses. Applied intends to use a portion of the net proceeds to redeem Applied’s outstanding 2.625% senior notes due October 1, 2020 (the “2020 Notes”) and Applied’s outstanding 4.300% senior notes due June 15, 2021 (the “2021 Notes”) and the balance for general corporate purposes.

The above description of the Underwriting Agreement is qualified in its entirety by reference to the Underwriting Agreement, which is filed as Exhibit 1.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Redemption of 2020 Notes and 2021 Notes

On May 28, 2020, Applied issued a notice to redeem all of the 2020 Notes, of which $600 million aggregate principal amount is outstanding, and all of the 2021 Notes, of which $750 million aggregate principal amount is outstanding (the “Redemption”).

The 2020 Notes will be redeemed in accordance with their terms on June 27, 2020 (the “Redemption Date”) at a price equal to the greater of (a) 100% of the principal amount of the 2020 Notes and (b) the sum of the present values of the remaining scheduled payments of principal and interest on the 2020 Notes discounted to the Redemption Date on a semi-annual basis at the treasury rate plus 20 basis points, plus any accrued interest.

The 2021 Notes will be redeemed in accordance with their terms on the Redemption Date at a price equal to the greater of (a) 100% of the principal amount of the 2021 Notes and (b) the sum of the present values of the remaining scheduled payments of principal and interest on the 2021 Notes discounted to the Redemption Date on a semi-annual basis at the treasury rate plus 20 basis points, plus any accrued interest.

Applied intends to use a portion of the net proceeds from the Offering to fund the Redemption.

Forward-Looking Statements

This report contains forward-looking statements, including those regarding the use of proceeds of the Offering, the completion of the Redemption and the anticipated source of funds for the Redemption. These statements and their underlying assumptions are subject to risks and uncertainties and are not guarantees of future performance. Factors that could cause actual results to differ materially from those expressed or implied by such statements include the risks and uncertainties described in Applied’s most recent Form 10-Q and other SEC filings. These and many other factors could cause actual results to differ materially from expectations based on forward-looking statements made in this report or elsewhere by Applied or on its behalf. All forward-looking statements are based on management’s estimates, projections and assumptions as of the date hereof, and Applied assumes no obligation to update them.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Applied Materials, Inc.

(Registrant)

|

|

|

|

|

|

|

|

Dated: May 28, 2020

|

|

By:

|

|

/s/ Christina Y. Lai

|

|

|

|

|

|

Christina Y. Lai

|

|

|

|

|

|

Corporate Secretary

|

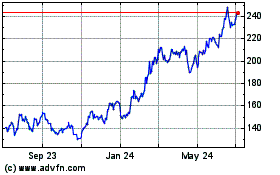

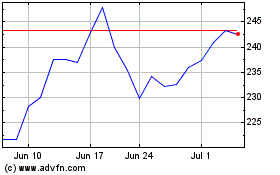

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024