Applied Materials Up 10.3% After Earnings, Analyst Notes

November 15 2019 - 11:43AM

Dow Jones News

By Michael Dabaie

Applied Materials Inc. (AMAT) shares were up 10.3% to $62.84 in

heavy volume Friday morning.

The materials engineering solutions company reported fourth

quarter revenue of $3.75 billion, beating the FactSet consensus for

$3.68 billion.

Adjusted per-share earnings were 80 cents, above the FactSet

consensus of 76 cents.

Applied guided for first quarter sales of about $4.1 billion,

plus or minus $150 million. The company forecast adjusted per-share

earnings of 87 cents to 95 cents.

J.P Morgan set its December 2020 price target at $72 and

maintained the stock at Overweight. 2020 is setting up for a solid

recovery for Applied Materials' semiconductor business, with memory

demand improving and as Foundry/Logic investments remain strong,

the JPM note said.

Nomura upgraded the company to Buy from Neutral and boosted the

target price to $68 from $40. "AMAT's reported sales for the

October period that were above the original guidance midpoint, and

guidance for the January 2020 quarter was meaningfully above

consensus estimates and our expectations. We think that there are

signs that a recovery in semiconductor equipment spending has

begun, though we believe there remain uncertainties as to the

quarter-to-quarter pattern of demand through 2020," the Nomura note

said.

Stifel increased its target price to $72 from $67 and rates

Applied Materials at Buy. Stifel said it believes Applied is well

positioned to outperform the industry based on its market mix and

efforts to gain share at the leading edge.

Write to Michael Dabaie at michael.dabaie@wsj.com

(END) Dow Jones Newswires

November 15, 2019 11:28 ET (16:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

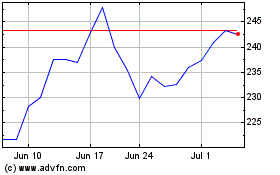

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

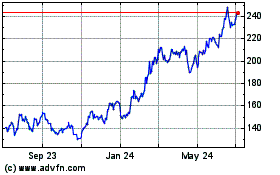

Applied Materials (NASDAQ:AMAT)

Historical Stock Chart

From Apr 2023 to Apr 2024