How Big Tech Got Even Bigger

February 06 2021 - 12:30AM

Dow Jones News

By The staff of The Wall Street Journal

The tech industry's titans were already huge before Covid-19,

the subject of soaring valuations and snowballing antitrust

investigations. The pandemic has only made them bigger. A lot

bigger.

In almost every facet of life -- the tools we use to work,

study, and play; how we shop and interact; the way companies

operate and market their products -- people and businesses have

become more reliant on technology over the past year. Even amid one

of the most punishing economic downturns on record, spending surged

on computers, videogames, online retail, cloud-computing services

and digital advertising.

The result was dizzying growth for some of the largest

corporations in history -- and for their stock prices. At a time

when companies such as airlines and bricks-and-mortar retailers

struggled to survive, combined revenue for the five biggest U.S.

tech companies -- Apple Inc., Microsoft Corp., Amazon.com Inc.,

Google-parent Alphabet Inc., and Facebook Inc. -- grew by a fifth,

to $1.1 trillion. Their aggregate profit rose an even faster 24%.

And their combined market capitalization soared by half over the

past year to a staggering $8 trillion.

Their economic sway expanded in other ways, too, including

employment: Amazon alone added 500,000 new workers in a single

year, roughly equivalent to the entire population of Atlanta.

Lawmakers and regulators may yet find ways to rein them in, but

the economic and societal forces propelling Big Tech to even higher

heights seem likely to outlast Covid-19. Microsoft Chief Executive

Satya Nadella has said that he expects spending on technology to

double to 10% of gross domestic product from its current level of

5%. This month he said he now expects that to happen even

faster.

Here is a closer look at the rise of the big five:

Apple

Apple was one of a number of companies that saw demand soar for

laptops, tablets and other devices as many people stayed home for

work and school due to Covid-19 lockdowns. The Cupertino, Calif.,

company unveiled a variety of new iPhone models in the year, a

device that makes up a substantial portion of its annual profits.

Sales of its Mac computers fell in the January-to-March quarter

compared with the same period in the previous year before shooting

up in the rest of 2020.

Microsoft

Microsoft has enjoyed surging sales as companies and individuals

adapted to pandemic life, with its Xbox videogames, Surface laptops

and myriad cloud-computing services in hot demand. Its Teams

software suite, the company's workplace collaboration tool that

includes video functionality similar to Zoom Video Communications

Inc. and text chat like Slack Technologies Inc., has seen average

daily use numbers more than triple. In the latest quarter, the

business selling ads on its Bing search engine, which struggled

early in the pandemic, also turned the corner. Microsoft shares are

up more than 30% over the past year and trading at all-time highs,

giving the software powerhouse a market valuation above $1.8

trillion, second only to Apple.

Amazon

Pandemic-fueled online shopping powered a rapid shift to

e-commerce among consumers, and few benefited as much as Amazon.

The company's revenue jumped 38% to $386.1 billion last year. To

meet the uptick in demand, Amazon went on a hiring spree, adding

roughly 500,000 workers. It now employs 1.3 million people

globally, and if the rapid pace of hiring continues, Amazon could

overtake Walmart Inc. in the coming years as the largest U.S.

employer.

Alphabet

Google, the advertising behemoth, powered through the pandemic

as more people spent time on the internet and increasingly shifted

their spending to digital channels through the health crisis. The

Alphabet unit was hurt in the first half of 2020 as advertisers

paused spending in the early pandemic months, but the business

rebounded later in the year. The eponymous search engine has been

the advertising breadwinner for years but the company has said

YouTube is seeing strong growth in ad spend.

Facebook

Facebook was already a social-networking giant prior to the

pandemic, but its swath of services including Instagram, WhatsApp

and Messenger continued to add users world-wide through 2020 as

people spent loads of time online as stay-at-home orders grounded

in-person activities.

The company has been introducing new features such as shopping

into Instagram to capitalize on the e-commerce boom and

strengthened the connections among its platforms to help it better

compete with tech rivals. The moves also are aimed to make its

products hard to quit.

(END) Dow Jones Newswires

February 06, 2021 00:15 ET (05:15 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

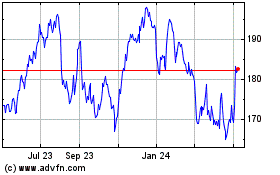

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Mar 2024 to Apr 2024

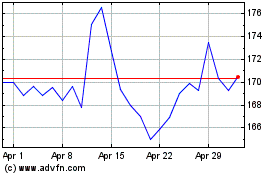

Apple (NASDAQ:AAPL)

Historical Stock Chart

From Apr 2023 to Apr 2024