false

0001815974

0001815974

2025-02-20

2025-02-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): February 20, 2025

ANEBULO

PHARMACEUTICALS, INC

(Exact

name of Registrant as Specified in Its Charter)

| Delaware |

|

001-40388 |

|

85-1170950 |

(State

or Other Jurisdiction

of

Incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

1017

Ranch Road 620 South, Suite 107

Lakeway,

TX |

|

78734 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

Telephone Number, Including Area Code: (512) 598-0931

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value per share |

|

ANEB |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry Into a Material Definitive Agreement

As

previously disclosed, on December 22, 2024, Anebulo Pharmaceuticals, Inc., a Delaware corporation (the “Company”), entered

into a securities purchase agreement (the “Purchase Agreement”) with 22NW Fund, LP (“22NW”), as well as other

institutional accredited investors (the “Investors”), pursuant to which the Company issued to the Investors, in a

private placement priced at-the-market (the “Private Placement”), an aggregate of 15,151,514 shares of Common Stock, of which

10,101,010 of such shares (the “Shares”) were issued to 22NW, a greater than 5% stockholder of the Company that is controlled

by Aron English, a director of the Company. The Private Placement closed on December 23, 2024.

On

February 24, 2025, the Company entered into a lock-up agreement (the “Lock-Up Agreement”) with 22NW pursuant

to which 22NW agreed not to vote, sell, transfer, pledge or otherwise dispose of the Shares that were issued to it in the Private Placement.

Pursuant to the Lock-Up Agreement, the Company agreed to hold a stockholder meeting no later than April 30, 2025 and to submit a proposal

for the removal of the voting and transfer restrictions set forth in the Lock-Up Agreement at such stockholder meeting. The Lock-Up Agreement

further provides that any failure of the Company to hold a stockholder meeting to remove the lock-up restrictions by April 30, 2025 or

to have the restrictions on voting and transfer of the Shares removed after receiving stockholder approval would be deemed a breach of

the Lock-Up Agreement and 22NW would have a right to have the Shares redeemed.

In

conjunction with entering into the Lock-Up Agreement, the Company executed an irrevocable letter (the “Irrevocable Instruction

Letter”), which was acknowledged and agreed to by 22NW, instructing the Company’s transfer agent not to allow the voting

or sale, transfer, pledge or other disposition of the Shares until the Company’s stockholders approve the removal of the

lock-up restrictions at a stockholder meeting held for such purpose. The transfer agent has also been instructed to place a legend

on the Shares noting that they are subject to the terms of the Lock-Up Agreement.

The

foregoing descriptions of the Lock-Up Agreement and Irrevocable Instruction Letter do not purport to be complete and are

qualified in their entirety by reference to such agreements, copies of which are filed as Exhibits 10.1

and 10.2, respectively, to this Current Report on Form 8-K and are each incorporated by reference herein.

Item

3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On

February 20, 2025, the Company received a letter (the “Letter”) from The Nasdaq Stock Market (“Nasdaq”) stating

that the Company failed to comply with Nasdaq Listing Rule 5635(b) (“Rule 5635(b)”), which requires stockholder approval

prior to the issuance of securities when the issuance or potential issuance will result in a change of control of the Company. Prior

to the Private Placement, the Company had two directors, Joseph F. Lawler and Aron English, that each beneficially owned in excess

of 40% of the Company’s outstanding shares of Common Stock; however immediately after consummation of the Private

Placement, Mr. English became the Company’s largest stockholder, beneficially owning in excess of 50% of the voting power

of the Company’s Common Stock. Since immediately after the consummation of the Private Placement 22NW’s purchase of the Shares

increased Mr. English’s beneficial ownership of Common Stock above the beneficial ownership of Common Stock of Joseph F.

Lawler, the Company’s largest stockholder prior to consummation of the Private Placement, Nasdaq determined that there was a change

of control and that the Company was required to obtain prior stockholder approval under Rule 5635(b). At the time the Company entered

into the Purchase Agreement and consummated the Private Placement, the Company did not believe that a change of control of the Company

had occurred. The Letter has no immediate effect on the Company’s continued listing on the Nasdaq Capital Market, subject to the

Company’s compliance with the other continued listing requirements.

Pursuant

to the Nasdaq Listing Rules, the Company had 45 calendar days (until April 6, 2025), to submit a plan to regain compliance (the “Compliance

Plan”). The Company submitted a Compliance Plan to Nasdaq. On February 24, 2025, the Company received a letter from Nasdaq notifying

it that based on the Compliance Plan submitted to Nasdaq, the Nasdaq Staff has determined to grant the Company an extension to regain

compliance with Rule 5635(b), as described below. The Compliance Plan proposed that 22NW and the Company enter into an irrevocable

lock-up agreement pursuant to which 22NW would agree not to vote, sell, transfer, pledge or otherwise dispose of the Shares until

such time as the Company obtained stockholder approval of the removal of such restrictions. In addition, irrevocable instructions

to the Company’s transfer agent would be provided informing the transfer agent that such Shares cannot be voted or sold or transferred.

Furthermore, the Company proposed that the Shares would have a legend noting that they are subject to the terms of the Lock-Up Agreement.

The Company also informed Nasdaq that it intended to file a preliminary proxy with the proposal described above to be voted on at its

upcoming Annual Meeting of Stockholders (the “Annual Meeting”). The Nasdaq Staff determined to grant the Company an extension

until April 10, 2025 to obtain stockholder approval of the proposal and disclose results of the Annual Meeting. In the event the Company

does not satisfy the terms of the Compliance Plan by obtaining stockholder approval of the proposal at the Annual Meeting and/or not

disclosing the results of the Annual Meeting by April 10, 2025, the Staff will provide written notification that the Company’s

securities will be delisted, which the Company may appeal to a hearings panel.

On

February 24, 2025, in accordance with the Company’s proposed Compliance Plan, the Company entered into the Lock-Up

Agreement with 22NW, pursuant to which 22NW has agreed not to vote, sell, transfer, pledge or otherwise dispose of the Shares

unless and until the Company’s stockholders approve removing the lock-up restrictions thereby allowing such Shares to be

voted and/or be sold or otherwise transferred. The Company also provided irrevocable instructions to the Company’s transfer

agent instructing the transfer agent that such Shares cannot be voted, sold, transferred, pledged or otherwise disposed of until the

Company’s stockholders approve the removal of the lock-up restrictions at a stockholder meeting held for such purpose and further

instructed the transfer agent to place a legend on the Shares noting that they are subject to the terms of the Lock-Up Agreement.

The Company plans to submit a proposal to its stockholders at the Annual Meeting, currently scheduled for April 4, 2025, related

to the removal of the lock-up restrictions. By approving the removal of the voting and transfer restrictions on the Shares, stockholders

are also approving and ratifying the issuance of the securities resulting in the change of control because upon removal of the lock-up

restrictions, Mr. English who is the beneficial owner of 51% of the Company’s outstanding shares of Common Stock,

inclusive of the Shares which are currently restricted from voting pursuant to the Lock-Up Agreement, will have voting power over 51%

of our outstanding shares of Common Stock. Joseph Lawler and entities he controls have entered into a Support Agreement with 22NW,

agreeing to vote in favor of the proposal seeking to remove the lock-up restrictions on the Shares.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

ANEBULO

PHARMACEUTICALS, INC. |

| |

|

|

| Date:

February 24, 2025 |

By: |

/s/

Richard Anthony Cunningham |

| |

|

Richard

Anthony Cunningham |

| |

|

Chief

Executive Officer (Principal Executive Officer) |

Exhibit

10.1

LOCK-UP

AGREEMENT

THIS

LOCK-UP AGREEMENT (the “Agreement”) is made and entered into as of the 24th day of February, 2025, between Anebulo

Pharmaceuticals, Inc., a Delaware corporation (the “Company”), and 22NW Fund, LP, sometimes referred to herein as

the “Stockholder.” For all purposes of this Agreement, “Stockholder” includes any “affiliate, controlling

person of Stockholder, agent, representative or other person with whom Stockholder is acting in concert.

WHEREAS,

the Stockholder is the holder of 15,467,300 shares of the Company’s common stock, par value $0.001 per share (the “Common

Stock”), including 10,101,010 shares of Common Stock (the “Subject Shares”) purchased in a private placement

offering (the “Offering”), pursuant to that certain Securities Purchase Agreement, dated December 22, 2024 (the “Purchase

Agreement”), entered into by and between the Company and the purchasers identified on the signature pages thereto, including

the Stockholder; and

WHEREAS,

upon consummation of the Offering, the Investor’s beneficial ownership of Common Stock increased above the beneficial ownership

of Common Stock of Joseph F. Lawler, the Company’s largest shareholder prior to consummation of the Offering, and a change of control

of the Company may be deemed to have occurred as a result of the Offering; and

WHEREAS,

to ensure compliance with the applicable rules and regulations of The Nasdaq Stock Market LLC (“Nasdaq”), the

Company and the Stockholder intend to enter into this Agreement to provide for the circumstances under which the Stockholder may vote,

sell, transfer, pledge, hypothecate or otherwise dispose of the Subject Shares; and

WHEREAS,

the Company and the Stockholder understand that the Stockholder’s failure to comply with the terms and conditions of this Agreement

could have substantial adverse consequences to the Company, its stockholders and any public trading market for the Company’s Common

Stock that cannot be reasonably measured or determined at this time.

NOW,

THEREFORE, in consideration of the foregoing premises and the mutual covenants contained herein, the receipt and sufficiency of which

are hereby acknowledged, the parties hereto agree as follows:

1.

Except as otherwise expressly provided herein, and except as Stockholder may be otherwise restricted from selling shares of Common Stock

under applicable federal or state securities laws, rules and regulations and Securities and Exchange Commission and interpretations thereof,

the Subject Shares are subject to the following conditions:

1.1

The Stockholder shall not be allowed to vote, sell, transfer, pledge or otherwise dispose of the Subject Shares for a period commencing

on the execution and delivery of this Agreement and ending on the effective date of stockholder approval (the “Stockholder Approval”),

of the removal of such restrictions from the Subject Shares (the “Lock-Up Period ”).

1.2

Subsequent to the Lock-Up Period, the Stockholder may immediately vote the Subject Shares without restriction and shall have the same

rights as it did prior to entering into this Agreement to sell, transfer and pledge the Subject Shares.

1.3

The Stockholder agrees that it will not engage in any short selling of the Common Stock of the Company during the Lock-Up Period. The

Company agrees that it will not enter into any transaction which would permit the Stockholder to vote the Subject Shares during the Lock-up

Period.

1.4

The Company agrees that it shall hold a meeting of its stockholders no later than April 30, 2025 and submit to its stockholders at such

meeting a proposal to allow for the voting and resale restrictions set forth in this Lock-Up Agreement to be removed and the Stockholder

agrees to vote all shares of the Company’s Common Stock owned by it, other than the Subject Shares, at such meeting.

2.

All Subject Shares shall be subject to the provisions of this Agreement and the certificates representing such Subject Shares shall bear

the following legend, in addition to any legends that may already be affixed to such certificates:

THE

SALE, ASSIGNMENT, GIFT, BEQUEST, TRANSFER, DISTRIBUTION, PLEDGE, HYPOTHECATION OR OTHER ENCUMBRANCE OR DISPOSITION OF THE SHARES REPRESENTED

BY THIS CERTIFICATE IS RESTRICTED BY AND MAY BE MADE ONLY IN ACCORDANCE WITH THE TERMS OF A LOCK UP AGREEMENT, A COPY OF WHICH MAY BE

EXAMINED AT THE OFFICE OF THE CORPORATION.

3.

Any attempt by the Stockholder to vote the Subject Shares during the Lock-Up Period in violation of this Agreement shall be void and

any alleged vote of the Subject Shares during the Lock-Up Period shall not be counted. Any attempted or purported sale, transfer, pledge

or other disposition of any Subject Shares by the Stockholder in violation or contravention of the terms of this Agreement shall be null

and void ab initio. The Company shall instruct its transfer agent to reject and refuse to transfer on its books any Subject Shares

that may have been attempted to be sold or otherwise transferred in violation or contravention of any of the provisions of this Agreement

and shall not recognize any person or entity.

4.

Any failure of the Company to hold a stockholder meeting by April 30, 2025 or to have the restrictions on voting and transfer of the

Subject Shares removed after receiving stockholder approval of such action shall be deemed a breach of this Agreement and Stockholder

shall have unrestricted redemption rights with respect to the entirety of the Subject Shares if such breach shall occur.

5.

This Agreement may be executed in any number of counterparts with the same force and effect as if all parties had executed the same document.

6.

All notices, instructions or other communications required or permitted to be given pursuant to this Agreement shall be given in writing

and delivered by certified mail, return receipt requested, overnight delivery or hand-delivered to all parties to this Agreement, to

the Company, at 1017 Ranch Road 620 South, Suite 107, Lakeway, Texas 78734, and to the Stockholder, at the address in the Counterpart

Signature Page. All notices shall be deemed to be given on the same day if delivered by hand or on the following business day if sent

by overnight delivery or the second business day following the date of mailing.

7.

The resale restrictions on the Subject Shares set forth in this Agreement shall be in addition to all other restrictions on transfer

imposed by applicable United States and state securities laws, rules and regulations.

8.

The Party who fails to fully adhere to the terms and conditions of this Agreement shall be liable to the other Party for any damages

suffered by any party by reason of any such breach of the terms and conditions hereof. The Parties agree that in the event of a breach

of any of the terms and conditions of this Agreement by either Party, that in addition to all other remedies that may be available in

law or in equity to the non-defaulting Party, a preliminary and permanent injunction, without bond or surety, and an order of a court

requiring such Party to cease and desist from violating the terms and conditions of this Agreement and specifically requiring that Party

to perform his/her/its obligations hereunder is fair and reasonable by reason of the inability of the Parties to presently determine

the type, extent or amount of damages that either Party may suffer as a result of any breach or continuation thereof.

9.

The Stockholder represents and warrants to the Company that the Stockholder was or had the opportunity to be represented by legal counsel

and other advisors selected by Stockholder in connection with this Agreement. The Stockholder has reviewed this Agreement with its legal

counsel and other advisors and understands the terms and conditions hereof.

10.

This Agreement will be binding upon and inure to the benefit of the Company, its successors and assigns, and to the Stockholder and their

respective permitted heirs, personal representatives, successors and assigns.

11.

This Agreement sets forth the entire understanding of the parties hereto with respect to the subject matter hereof, and may not be amended

except by a written instrument executed by the parties hereto.

12.

This Agreement shall be governed by and construed under the laws of the State of Delaware, without regard to the choice of law principles

thereof. Each Party hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts sitting in the State of

Delaware for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby, and hereby

irrevocably waives any objection that such suit, action or proceeding is brought in an inconvenient forum or that the venue of such suit,

action or proceeding is improper. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner

permitted by law. EACH PARTY HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE, AND AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION

OF ANY DISPUTE HEREUNDER OR IN CONNECTION WITH OR ARISING OUT OF THIS AGREEMENT OR ANY TRANSACTION CONTEMPLATED HEREBY.

13.

In the event of default hereunder, the non-defaulting parties shall be entitled to recover reasonable attorney’s fees incurred

in the enforcement of this Agreement.

[Signature

pages follow]

IN

WITNESS WHEREOF, the undersigned have duly executed and delivered this Agreement as of the day and year first above written.

| |

ANEBULO

PHARMACEUTICALS, INC. |

| |

|

|

| |

By: |

/s/

Richard Anthony Cunningham |

| |

Name: |

Richard

Anthony Cunningham |

| |

Title: |

Chief

Executive Officer |

LOCK-UP

AGREEMENT

COUNTERPART

SIGNATURE PAGE

This

Counterpart Signature Page for that certain Lock-Up Agreement (the “Agreement”) dated as of the 24th day of February, 2025,

among Anebulo Pharmaceuticals, Inc., a Delaware corporation (the “Company”), and 22NW Fund, LP, by which the undersigned,

through execution and delivery of this Counterpart Signature Page, intends to be legally bound by the terms of the Agreement, as a Stockholder,

of the number of shares of the Company set forth below or hereafter acquired during the Lock-Up Period, as such terms are defined in

the Agreement.

22NW

FUND, LP

By:

22NW Fund GP, LLC, its General Partner

| By: |

/s/

Aron English |

|

| Name: |

Aron

English |

|

| Title: |

Manager |

|

Address:

590 1st Ave S Unit C-1, Seattle, WA 98104

Number

of shares of Common Stock beneficially owned: _ 15,467,300 _________________________

Number

of Shares subject to the restrictions of the Agreement (Subject Shares): __10,101,010_________________

Dated:

__February 24, 2025

Exhibit

10.2

VIA

ELECTRONIC MAIL

Continental

Stock Transfer & Trust

17

Battery Place

New

York, New York 10004

| |

Re: |

Irrevocable Transfer Agent Instructions |

Ladies

and Gentlemen:

Reference

is made to that certain Securities Purchase Agreement, dated December 22, 2024 (the “Purchase Agreement”),

entered into by and between Anebulo Pharmaceuticals, Inc., a Delaware corporation (the “Company”), and certain

institutional investors (the “Purchasers”), in connection with the issuance and sale of 15,151,514 shares of

the Company’s common stock, par value $0.001 per share (the “Common Stock”) (CUSIP No. 034569103), to

the Purchasers as described in the Purchase Agreement.

Continental

Stock Transfer & Trust (the “Transfer Agent”), as registrar and transfer agent of the Company’s Common

Stock, is hereby irrevocably authorized and directed to restrict the 10,101,010 shares of Common Stock (the “Subject Shares”)

that were issued to 22NW Fund, LP (“22NW”) pursuant to the Purchase Agreement, such that 22NW may not vote,

sell, transfer, pledge or otherwise dispose of the Subject Shares for a period commencing from the date hereof and ending on the effective

date of stockholder approval (the “Stockholder Approval”), of the removal of such restrictions (the “Lock-Up

Period”).

During

the Lock-Up Period, all Subject Shares shall be subject to the provisions of that certain Lock-Up Agreement, dated February 24, 2025,

by and between the Company and 22NW (the “Lock-Up Agreement”). The Company and 22NW intend that these instructions

require the placement of a restrictive legend (the “Lock-Up Legend”) on all applicable share certificates or

book entry statements representing the Subject Shares, in addition to any legends that may already be affixed to such certificates or

book entry statements, as follows:

THE

SALE, ASSIGNMENT, GIFT, BEQUEST, TRANSFER, DISTRIBUTION, PLEDGE, HYPOTHECATION OR OTHER ENCUMBRANCE OR DISPOSITION OF THE SHARES REPRESENTED

BY THIS CERTIFICATE IS RESTRICTED BY AND MAY BE MADE ONLY IN ACCORDANCE WITH THE TERMS OF A LOCK-UP AGREEMENT, A COPY OF WHICH MAY BE

EXAMINED AT THE OFFICE OF THE CORPORATION.

The

Lock-Up Legend set forth above shall be removed, and you are hereby further irrevocably authorized and directed to issue a certificate

without such legend to 22NW, as the holder of any Subject Shares upon which it is stamped, within one (1) Trading Day upon your receipt

of written notice from the Company that the requisite Stockholder Approval has been obtained. The Company agrees to promptly notify you

upon obtaining the requisite Stockholder Approval. You shall have no duty or obligation to confirm the accuracy of the Company’s

written notice advising that Stockholder Approval has been obtained, but 22NW and the Company understand that you reserve the right to

do so in your sole discretion. Nothing herein shall be construed to require you, in your sole discretion, to take any action which would

violate state or federal rules, regulations or law. If an instruction herein would require such a violation, such instructions, but not

any other term herein, shall be void and unenforceable.

The

Company shall indemnify and defend you and your officers, directors, principals, partners, agents and representatives, and hold each

of them harmless from and against any and all loss, liability, damage, claim or expense (including the reasonable fees and disbursements

of its and Transfer Agent’s attorney) incurred by or asserted against you or any of them arising out of or in connection with the

instructions set forth herein, the performance of your duties hereunder and otherwise in respect hereof, including the costs and expenses

of defending yourself or themselves against any claim or liability hereunder including a claim by the Company, except that the Company

shall not be liable hereunder as to matters in respect of which it is determined that you have acted with gross negligence or in bad

faith (which gross negligence, bad faith or willful misconduct must be determined by a final, non-appealable order, judgment, decree

or ruling of a court of competent jurisdiction). You shall have no liability to the Company or 22NW in respect to any action taken or

any failure to act in respect of this if such action was taken or omitted to be taken in good faith, and you shall be entitled to rely

in this regard on the advice of counsel.

The

Company and 22NW expressly understand and agree that nothing in this Irrevocable Transfer Agent Instructions shall require or be construed

in any way to require the you, in your sole discretion as the Transfer Agent, to do, take or not do or take any action that would be

contrary to any Federal or State law, rule, or regulation including but expressly not limited to both the Securities Act of 1933, as

amended, and the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder by the Securities

and Exchange Commission.

The

Company agrees that in the event you resign as the Company’s Transfer Agent, the Company shall engage a suitable replacement transfer

agent that will agree to serve as transfer agent for the Company and be bound by the terms and conditions of these Irrevocable Instructions

within five (5) business days. Furthermore, if the Company decides to terminate you as Transfer Agent in accordance with the terms of

your engagement, the Company agrees to immediately notify 22NW that it has provided such notice to you. The Company and 22NW agree that

any action which names you as a party shall be brought in a court of general jurisdiction in New York, and no other court.

22NW

is intended to be a party to these instructions and is a third-party beneficiary hereof, and no amendment or modification to the instructions

set forth herein may be made without the consent of 22NW.

| |

Sincerely, |

| |

|

| |

/s/ Richard Cunningham |

| |

|

| |

Richard Cunningham |

| |

Chief Executive Officer |

Acknowledged

and agreed:

22NW

FUND, LP

By:

22NW Fund GP, LLC, its General Partner

| By: |

/s/ Aron English |

|

| Name: |

Aron English |

|

| Title: |

Manager |

|

v3.25.0.1

Cover

|

Feb. 20, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 20, 2025

|

| Entity File Number |

001-40388

|

| Entity Registrant Name |

ANEBULO

PHARMACEUTICALS, INC

|

| Entity Central Index Key |

0001815974

|

| Entity Tax Identification Number |

85-1170950

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1017

Ranch Road 620 South

|

| Entity Address, Address Line Two |

Suite 107

|

| Entity Address, City or Town |

Lakeway

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

78734

|

| City Area Code |

(512)

|

| Local Phone Number |

598-0931

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value per share

|

| Trading Symbol |

ANEB

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

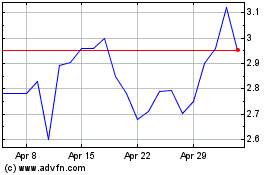

Anebulo Pharmaceuticals (NASDAQ:ANEB)

Historical Stock Chart

From Jan 2025 to Feb 2025

Anebulo Pharmaceuticals (NASDAQ:ANEB)

Historical Stock Chart

From Feb 2024 to Feb 2025