Current Report Filing (8-k)

October 03 2019 - 5:08PM

Edgar (US Regulatory)

false0000821026

0000821026

2019-10-01

2019-10-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

October 1, 2019

|

The Andersons, Inc.

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Ohio

|

|

000-20557

|

34-1562374

|

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

1947 Briarfield Boulevard

|

|

|

|

Maumee

|

Ohio

|

|

43537

|

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

419

|

893-5050

|

Not Applicable

_________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[☐] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[☐] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[☐] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[☐] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

[☐] Emerging growth company

[☐] If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

|

|

|

|

|

|

|

Title of each class:

|

|

Trading Symbol

|

|

Name of each exchange on which registered:

|

|

Common stock, $0.00 par value, $0.01 stated value

|

|

ANDE

|

|

The NASDAQ Stock Market LLC

|

Item 1.01 Entry into a Material Definitive Agreement

On October 1, 2019, the Andersons Inc. (the "Company") entered into an Agreement on Plan of Merger (the "Merger Agreement") with Marathon Renewable Fuels Corporation ("Marathon"), pursuant to which the parties agreed that, subject to the terms and conditions set forth in the Agreement, to merge The Andersons Albion Ethanol LLC, The Andersons Clymers Ethanol LLC, The Andersons Marathon Ethanol LLC and the Company's wholly-owned The Andersons Denison Ethanol LLC into a new legal entity called The Andersons Marathon Holdings LLC ("TAMH"). Subsequent to the successful completion of the merger, The Andersons and Marathon will own 50.1% and 49.9% of TAMH equity, respectively. The transaction will result in the consolidation of TAMH’s results in the Company's financial statements.

Each of the Company's and Marathon's obligation to consummate the Mergers is subject to a number of customary closing conditions as set forth within Article II of Exhibit 10.1, herein.

Effective October 1, 2019, in conjunction with the Merger Agreement noted above, TAMH entered into a Credit Agreement that includes a $70 million term note and a $130 million revolving credit facility with COBANK, ACB as Administrative Agent on the terms and subject to the conditions set forth in Exhibit 10.2, herein. Borrowings under the Credit Agreement bear interest at variable interest rates, which are based on LIBOR plus an applicable spread. Payments on the term loan will be made on a quarterly basis. At the time of this filing, $51.3 million has been drawn on the credit facility for issued letters of credit and no amounts have been drawn on the term note as a result of the merger.

The foregoing description of the merger and the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, a copy of which is filed as Exhibit 10.1 hereto and incorporated herein by reference.

The Merger Agreement and the above description of the Merger Agreement have been included to provide investors and security holders with information regarding the terms of the Merger Agreement, and are not intended to provide any other factual information about the Company, Marathon or their respective subsidiaries or affiliates. The representations, warranties and covenants in the Merger Agreement were made solely for the benefit of the parties to the Merger Agreement for the purpose of allocating contractual risk between those parties, and do not establish these matters as facts. Investors should not rely on the representations, warranties and covenants as characterizations of the actual state of facts or condition of the Company, Marathon or any of their respective subsidiaries or affiliates.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

The information contained in Item 1.01 is incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

(d) The following exhibits are filed or furnished with this report.

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

|

|

10.2

|

|

|

|

99.1

|

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Andersons, Inc.

|

|

|

|

|

|

|

|

|

Date:

|

October 3, 2019

|

|

By:

|

|

/s/ Brian A. Valentine

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name: Brian A. Valentine

|

|

|

|

|

|

|

Title: Senior Vice President and Chief Financial Officer

|

|

|

|

|

|

|

(Principal Financial Officer)

|

Exhibit Index

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

10.1

|

|

|

|

10.2

|

|

|

|

99.1

|

|

|

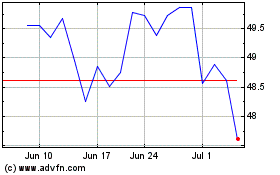

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Mar 2024 to Apr 2024

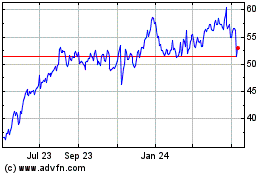

Andersons (NASDAQ:ANDE)

Historical Stock Chart

From Apr 2023 to Apr 2024