|

PROSPECTUS SUPPLEMENT

|

Filed Pursuant to Rule 424(b)(5)

|

|

(To Prospectus Dated September 6, 2016)

|

Registration No. 333-207600

|

Anavex Life Sciences Corp.

Up to $21,159,993

Common Stock

This prospectus supplement relates to

the issuance and sale of up to $21,159,993 in shares of our common stock, to Lincoln Park Capital Fund, LLC (“Lincoln Park”),

from time to time, in one or more transactions in amounts, at prices, and on terms that will be determined at the time these securities

are offered pursuant to a purchase agreement between us and Lincoln Park, dated as of June 7, 2019 (the “Purchase Agreement”).

See “The Lincoln Park Transaction” for a description of the Purchase Agreement.

Lincoln Park is an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”).

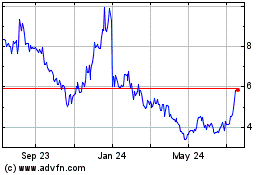

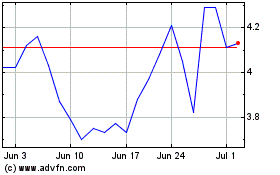

Our common stock is currently traded on

the Nasdaq Capital Market under the symbol “AVXL”. On June 7, 2019, the last reported sale price of our common stock

was $2.98 per share.

We will pay the expenses incurred in registering

the shares, including legal and accounting fees. See “Plan of Distribution”.

Investing in our securities involves

a high degree of risk. See the section entitled “Risk Factors” on page S-4 of this prospectus supplement and the

section entitled “Risk Factors” beginning on page 7

of the accompanying prospectus, and in the documents

we filed with the Securities and Exchange Commission that are incorporated in this prospectus supplement by reference for certain

risks and uncertainties you should consider.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or

accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement

is June 12, 2019.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS

SUPPLEMENT

We are providing information to you about

this offering of our common stock in two separate documents that are bound together: (1) this prospectus supplement, which

describes the specific terms of this offering, and (2) the accompanying base prospectus, which provides general information,

some of which may not apply to this offering. This prospectus supplement may also add to, update or change information contained

in the accompanying base prospectus. If information in this prospectus supplement is inconsistent with the accompanying base prospectus,

you should rely on this prospectus supplement. Generally, when we refer to this “prospectus,” we are referring to

both documents combined.

This prospectus supplement, the accompanying

base prospectus and any free-writing prospectus that we prepare or authorize contain and incorporate by reference information

that you should consider when making your investment decision. We have not, and Lincoln Park has not, authorized anyone to provide

you with additional or different information. If anyone provides you with different or inconsistent information, you should not

rely on it. You should not assume that the information contained in this prospectus supplement or the accompanying base prospectus

is accurate as of any date other than the date on the front of those documents or that any information we have incorporated by

reference is accurate as of any date other than the date of the document incorporated by reference. Our business, financial condition,

results of operations and prospects may have changed since those dates.

This prospectus supplement is part of

a registration statement that we filed with the Securities and Exchange Commission (the “SEC”), using a “shelf”

registration process. Under the shelf registration process, we may from time to time offer and sell any combination of the securities

described in the accompanying prospectus up to a total dollar amount of $100 million, of which this offering is a part.

We are not, and Lincoln Park is not, making

an offer or sale of our common stock in any jurisdiction where such offer or sale is not permitted.

The information in this prospectus supplement

is not complete. You should carefully read this prospectus supplement and the accompanying base prospectus, including the information

incorporated by reference herein and therein, before you invest, as these documents contain information you should consider when

making your investment decision.

None of Anavex Life Sciences Corp., Lincoln

Park or any of their representatives are making any representation to you regarding the legality of an investment in our common

stock by you under applicable laws. You should consult with your own advisors as to legal, tax, business, financial and related

aspects of an investment in our common stock.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement contains forward-looking

statements. All statements other than statements of historical facts contained in this prospectus supplement, including statements

regarding our anticipated future clinical and regulatory milestone events, future financial position, business strategy and plans

and objectives of management for future operations, are forward-looking statements. The words “believe,” “may,”

“estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,”

“forecast,” “could,” “suggest,” “plan,” and similar expressions, as they relate

to us, are intended to identify forward-looking statements. Such forward-looking statements include, without limitation, statements

regarding:

|

|

●

|

our ability to successfully conduct clinical and preclinical

trials for our product candidates;

|

|

|

●

|

our ability to raise additional capital on favorable terms;

|

|

|

●

|

our ability to execute our development plan on time and on budget;

|

|

|

●

|

our products ability to demonstrate efficacy or an acceptable

safety profile;

|

|

|

●

|

our ability to obtain the support of qualified scientific collaborators;

|

|

|

●

|

our ability, whether alone or with commercial partners, to successfully

commercialize any of our product candidates that may be approved for sale;

|

|

|

●

|

our ability to identify and obtain additional product candidates;

|

|

|

●

|

our ability to obtain and maintain sufficient intellectual property

protection for our product candidates;

|

|

|

|

|

|

|

●

|

our ability to comply with our intellectual property licensing

agreements;

|

|

|

|

|

|

|

●

|

our ability to defend against claims of intellectual property

infringement;

|

|

|

●

|

our ability to comply with the maintenance requirements of the

government patent agencies;

|

|

|

|

|

|

|

●

|

our ability to protect our intellectual property rights throughout

the world;

|

|

|

|

|

|

|

●

|

competition;

|

|

|

●

|

the anticipated start dates, durations and completion dates

of our ongoing and future clinical studies;

|

|

|

●

|

the anticipated designs of our future clinical studies;

|

|

|

●

|

our anticipated future regulatory submissions and our ability

to receive regulatory approvals to develop and market our product candidates;

|

|

|

●

|

our anticipated future cash position; and

|

|

|

|

|

|

|

●

|

our ability to generate any revenue or to continue as a going

concern.

|

We have based these forward-looking statements

largely on our current expectations and projections about future events, including the responses we expect from the U.S. Food

and Drug Administration, or FDA, and other regulatory authorities and financial trends that we believe may affect our financial

condition, results of operations, business strategy, preclinical and clinical trials and financial needs. These forward-looking

statements are subject to a number of risks, uncertainties and assumptions including without limitation the risks described in

“Risk Factors” in “Part I, Item 1A” of or Annual Report on Form 10-K for the fiscal year ended September

30, 2018. These risks are not exhaustive. We operate in a very competitive and rapidly changing environment. New risk factors

emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of

all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially

from those contained in any forward-looking statements. You should not rely upon forward-looking statements as predictions of

future events. We cannot assure you that the events and circumstances reflected in the forward-looking statements will be achieved

or occur and actual results could differ materially from those projected in the forward-looking statements. Except as required

by applicable laws including the securities laws of the United States, we assume no obligation to update or supplement forward-looking

statements.

PROSPECTUS

SUPPLEMENT SUMMARY

This summary highlights information

contained elsewhere in this prospectus supplement and the accompanying base prospectus. It does not contain all of the information

that you should consider before making an investment decision. You should read this entire prospectus supplement, the accompanying

base prospectus and the documents incorporated herein by reference for a more complete understanding of this offering of common

stock. Please read “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended September 30, 2018 for

information regarding risks you should consider before investing in our common stock.

Throughout this prospectus supplement,

when we use the terms “Anavex,” “we,” “us,” “our” or the “Company,”

we are referring either to Anavex Life Sciences Corp. in its individual capacity or to Anavex Life Sciences Corp. and its operating

subsidiaries collectively, as the context requires.

Our Company

Overview

Anavex Life Sciences Corp. is a clinical

stage biopharmaceutical company engaged in the development of differentiated therapeutics by applying precision medicine to central

nervous system (“CNS”) diseases with high unmet need. Anavex analyzes genomic data from clinical studies to identify

biomarkers, which select patients that will receive the therapeutic benefit for the treatment of neurodegenerative and neurodevelopmental

diseases.

Our lead compound, ANAVEX

®

2-73,

is being developed to treat Alzheimer’s disease, Parkinson’s disease and potentially other central nervous system

diseases, including rare diseases, such as Rett syndrome, a rare severe neurological monogenic disorder caused by mutations in

the X-linked gene, methyl-CpG-binding protein 2 (“MECP2”).

Clinical Studies Overview

In November 2016, we completed a Phase

2a clinical trial, consisting of PART A and PART B, which lasted a total of 57 weeks, for ANAVEX

®

2-73 in mild-to-moderate

Alzheimer’s patients. This open-label randomized trial met both primary and secondary endpoints and was designed to assess

the safety and exploratory efficacy of ANAVEX

®

2-73 in 32 patients. ANAVEX

®

2-73 targets sigma-1 and

muscarinic receptors, which have been shown in preclinical studies to reduce stress levels in the brain believed to restore cellular

homeostasis and to reverse the pathological hallmarks observed in Alzheimer’s disease. In October 2017, we presented positive

pharmacokinetic (PK) and pharmacodynamic (PD) data from the Phase 2a study, which established a concentration-effect relationship

between ANAVEX

®

2-73 and study measurements. These measures obtained from all patients who participated in the entire

57 weeks include exploratory cognitive and functional scores as well as biomarker signals of brain activity. Additionally, the

study appears to show that ANAVEX

®

2-73 activity is enhanced by its active metabolite (ANAVEX19-144), which also

targets the sigma-1 receptor and has a half-life approximately twice as long as the parent molecule.

In March 2016, we received approval from

the Ethics Committee in Australia to extend the Phase 2a clinical trial by an additional 108 weeks, which had been requested by

patients and their caregivers. Subsequently, in May 2018, we received approval from the Ethics Committee in Australia to further

extend the Phase 2a extension trial for an additional two years. The two consecutive trial extensions have allowed participants

who completed the 52-week PART B of the study to continue taking ANAVEX

®

2-73, providing an opportunity to gather

extended safety data for a cumulative time period of five years.

In October 2018, we presented new long-term

clinical data for ANAVEX

®

2-73 in a presentation at the 2018 Clinical Trials on Alzheimer’s Disease (CTAD)

Meeting. At 148 weeks into the five-year extended Phase 2a clinical study, data confirmed a significant association between ANAVEX

®

2-73

concentration and both exploratory functional and cognitive endpoints as measured by the Alzheimer’s Disease Cooperative

Study-Activities of Daily Living (ADCS-ADL) evaluation and the Mini Mental State Examination (MMSE), respectively. The

cohort of patients treated with higher ANAVEX

®

2-73 concentration maintained ADCS-ADL performance compared to the

lower concentration cohort (p<0.0001). As well, the patient cohort with the higher ANAVEX

®

2-73 concentration

performed better at MMSE compared to the lower concentration cohort (p<0.0008). A significant impact on the drug response levels

of both the SIGMAR1 (p<0.0080) and COMT (p<0.0014) genomic biomarkers, identified and specified at week 57, was also confirmed

over the 148-week period. Further, ANAVEX

®

2-73 demonstrated continued favorable safety and tolerability through

148 weeks.

A larger Phase 2b/3 double-blind, placebo-controlled

study of ANAVEX

®

2-73 in Alzheimer’s disease commenced in October 2018, which is independent of the ongoing

Phase 2a extension study. The Phase 2b/3 study will enroll approximately 450 patients for 48 weeks, randomized 1:1:1 to two different

ANAVEX

®

2-73 doses or placebo. The trial is currently taking place in Australia; however, North American sites may

also be added. The ANAVEX

®

2-73 Phase 2b/3 study design incorporates genomic precision medicine biomarkers identified

in the ANAVEX

®

2-73 Phase 2a study. Primary and secondary endpoints will assess safety and both cognitive and functional

efficacy, measured through Alzheimer’s Disease Assessment Scale – Cognition (ADAS-Cog), ADCS-ADL and Clinical Dementia

Rating – Sum of Boxes for cognition and function (CDR-SB).

In February 2016, we presented positive

preclinical data for ANAVEX

®

2-73 in Rett syndrome, a rare neurodevelopmental disease. The study was funded by the

International Rett Syndrome Foundation (“Rettsyndrome.org”). In January 2017, we were awarded a financial grant from

Rettsyndrome.org of a minimum of $0.6 million to cover some of the costs of a multicenter Phase 2 clinical trial of ANAVEX

®

2-73

for the treatment of Rett syndrome. This award is being received in quarterly instalments which commenced during fiscal 2018.

Further, in March 2019, the Company commenced a Phase 2 clinical trial of ANAVEX

®

2-73 for the treatment of Rett

syndrome. The Phase 2 study is taking place in the United States and is a randomized double-blind, placebo-controlled safety,

tolerability, pharmacokinetic and efficacy study of oral liquid ANAVEX

®

2-73 formulation to treat Rett syndrome.

Pharmacokinetic and dose findings will be investigated in a total of 15 patients over a 7-week treatment period including ANAVEX

®

2-73-specific

genomic precision medicine biomarkers. All patients who participate in the study will be eligible to receive ANAVEX

®

2-73

under a voluntary open label extension protocol. This study will be followed by a planned placebo-controlled safety and efficacy

evaluation of ANAVEX

®

2-73 over a 3-month treatment period. Primary and secondary endpoints include safety as well

as Rett syndrome conditions such as cognitive impairment, motor impairment, behavioral symptoms and seizure activity. The ANAVEX

®

2-73

Phase 2 Rett syndrome study design incorporates genomic precision medicine biomarkers identified in the ANAVEX

®

2-73

Phase 2a Alzheimer’s disease study.

In September 2016, we presented positive

preclinical data for ANAVEX

®

2-73 in Parkinson’s disease, which demonstrated significant improvements on all

measures: behavioral, histopathological, and neuroinflammatory endpoints. The study was funded by the Michael J. Fox Foundation.

Additional data was announced in October 2017 from the model for experimental parkinsonism. The data presented indicates that

ANAVEX

®

2-73 induces robust neurorestoration in experimental parkinsonism. The encouraging results we have gathered

in this model, coupled with the favorable profile of this compound in the Alzheimer’s disease trial, support the notion

that ANAVEX

®

2-73 is a promising clinical candidate drug for Parkinson’s disease.

In October 2018, we initiated in Spain,

a double-blind, randomized, placebo-controlled Phase 2 trial with ANAVEX

®

2-73 in Parkinson’s Disease Dementia

(PDD) in Spain, which will study the effect of the compound on both the cognitive and motor impairment of Parkinson’s disease.

The Phase 2 study will enroll approximately 120 patients for 14 weeks, randomized 1:1:1 to two different ANAVEX

®

2-73

doses or placebo. The ANAVEX

®

2-73 Phase 2 PDD study design incorporates genomic precision medicine biomarkers identified

in the ANAVEX

®

2-73 Phase 2a study.

Recent Developments

On June 6, 2019, we announced that we

had dosed the first patient in our AVATAR Phase 2 double blind, randomized, placebo-controlled safety and efficacy trial of ANAVEX®2-73

for the treatment of Rett syndrome.

Corporate Information

Our principal executive office is located

at 51 West 52nd Street, 7th Floor, New York, NY 10019-6163, and our telephone number is 844.689.3939. Our website address is

www.anavex.com

.

No information found on our website is part of this prospectus. Also, this prospectus may include the names of various government

agencies or the trade names of other companies. Unless specifically stated otherwise, the use or display by us of such other parties’

names and trade names in this prospectus is not intended to and does not imply a relationship with, or endorsement or sponsorship

of us by, any of these other parties.

THE OFFERING

|

Common stock offered by us

:

|

●

|

Up to $20,000,000 of shares of our common stock

we may sell to Lincoln Park from time to time until the expiration of the registration statement of which this prospectus

is a part or the earlier termination of the Purchase Agreement by us;

|

|

|

|

|

|

|

●

|

324,383 initial commitment shares valued at $966,661 based on

$2.98 per share, the closing price of our common stock on The Nasdaq Capital Market on June 7, 2019, which are being issued

for no cash consideration as a fee for Lincoln Park’s execution of the Purchase Agreement; and

|

|

|

|

|

|

|

●

|

Up to 64,877 additional commitment shares valued at $193,332

based on $2.98 per share, the closing price of our common stock on The Nasdaq Capital Market on June 7, 2019, which is the

amount of additional we may issue for no cash consideration a to Lincoln Park time to time pro-rata in connection

with the purchase of $20,000,000 of shares of our common stock under the Purchase Agreement.

|

|

Common stock to be outstanding after this offering:

|

Up to 57,509,272 shares assuming (i) the sale of

6,711,410 shares of our common stock (which would be the full amount offered under this prospectus supplement at an offering

price of $2.98 per share, the closing price of our common stock on The Nasdaq Capital Market on June 7, 2019) and (ii) the

issuance of 64,877 additional commitment shares (which is the number of additional commitment shares that will be issued if

we direct Lincoln Park to purchase 6,711,410 shares of our common stock under the Purchase Agreement), and including the 324,383

initial commitment shares being issued to Lincoln Park on the date hereof for no cash consideration as a fee for Lincoln Park’s

execution of the Purchase Agreement. The actual number of shares issued will vary depending on the sales prices under this

offering.

|

|

|

|

|

Use of Proceeds

|

We intend to use the net proceeds from this offering for general

corporate purposes, which may include, among other things, working capital, capital expenditures and funding additional clinical

and preclinical development of our pipeline candidates. See “Use of Proceeds” on page S-5.

|

|

|

|

|

Risk Factors

|

You should read the “Risk Factors” section on page

S-4 of this prospectus supplement and the other risks identified in the documents incorporated by reference herein before

making a decision to purchase common stock in this offering.

|

|

|

|

|

Nasdaq Capital Market symbol

|

“

AVXL.”

|

The number of shares of common stock shown

above to be outstanding after this offering is based on 50,408,602 shares of common stock outstanding as of June 7, 2019 and excludes

the following:

|

|

●

|

8,508,350 shares

of common stock issuable upon the exercise of outstanding stock options, vested and unvested,

with a weighted-average exercise price of $3.59 per share; and

|

|

|

●

|

357,500

shares of common stock issuable upon the exercise of outstanding warrants with a weighted-average

exercise price of $4.12 per share.

|

RISK FACTORS

An investment in our common stock involves

a significant degree of risk. Before you invest in our common stock you should carefully consider those risk factors included

in our most recent Annual Report on Form 10-K, our most recent Quarterly Report on Form 10-Q, any subsequently filed Quarterly

Reports on Form 10-Q and any subsequently filed Current Reports on Form 8-K, which are incorporated herein by reference, and those

risk factors that may be included in any applicable prospectus supplement, together with all of the other information included

in this prospectus supplement, the accompanying base prospectus and the documents we incorporate by reference, in evaluating an

investment in our common stock. If any of the risks discussed in the foregoing documents were to occur, our business, financial

condition, results of operations and cash flows could be materially adversely affected. Please read “Cautionary Statement

Regarding Forward-Looking Statements.”

Risks Relating to the Purchase Agreement

The sale or issuance of our common

stock to Lincoln Park may cause dilution and the sale of the shares of common stock acquired by Lincoln Park, or the perception

that such sales may occur, could cause the price of our common stock to fall.

On June 7, 2019, we entered into the Purchase

Agreement with Lincoln Park, pursuant to which Lincoln Park has committed to purchase up to $50 million of shares of our common

stock (of which $20 million of such shares are registered hereunder). We are issuing 324,383 shares of our common stock to Lincoln

Park for no cash consideration as a fee for Lincoln Park’s execution of the Purchase Agreement, and we may issue up to 162,191

additional commitment shares (of which 64,877 of such shares are registered hereunder) pro-rata in connection with the purchase

of shares of our common stock under the Purchase Agreement. We may sell purchase shares to Lincoln Park pursuant to the Purchase

Agreement at our discretion from time to time for a 36-month period, which commenced on the date of this prospectus supplement.

The purchase price for the shares that

we may sell to Lincoln Park under the Purchase Agreement will fluctuate based on the price of our common stock. Depending on market

liquidity at the time, sales of such shares may cause the trading price of our common stock to fall.

We have the right to control the timing

and amount of any sales of our shares to Lincoln Park in our sole discretion, subject to certain limits on the amount of shares

that can be sold on a given date. Sales of shares of our common stock, if any, to Lincoln Park will depend upon market conditions

and other factors to be determined by us. Therefore, Lincoln Park may ultimately purchase all, some or none of the shares of our

common stock that may be sold pursuant to the Purchase Agreement and, after it has acquired shares, Lincoln Park may sell all,

some or none of those shares. Sales to Lincoln Park by us could result in substantial dilution to the interests of other holders

of our common stock. Additionally, the sale of a substantial number of shares of our common stock to Lincoln Park, or the anticipation

of such sales, could make it more difficult for us to sell equity or equity-related securities in the future at a time and at

a price that we might otherwise wish to effect sales, which could have a materially adverse effect on our business and operations.

You may experience future dilution as a result of future

equity offerings.

To raise additional capital, we may in

the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock

at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any other

offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing

shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we

sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions

may be higher or lower than the price per share paid by investors in this offering.

We may not be able to access sufficient

funds under the Purchase Agreement when needed.

Our ability to sell shares to Lincoln

Park and obtain funds under the Purchase Agreement is limited by the terms and conditions in the Purchase Agreement, including

restrictions on the amounts we may sell to Lincoln Park at any one time, and a limitation on our ability to sell shares to Lincoln

Park to the extent that it would cause Lincoln Park to beneficially own more than 4.99% of our outstanding shares of common stock.

Additionally, we are only registering $20 million of shares of our common stock hereunder, and we will only be able to make sales

to Lincoln Park until September 6, 2019, when the effectiveness of the registration statement of which this prospectus is a part

terminates, at which point we will be unable to sell shares of common stock to Lincoln Park until we file another registration

statement. Therefore, we currently do not and may not in the future have access to the full amount available to us under the Purchase

Agreement. In addition, any amounts we sell under the Purchase Agreement may not satisfy all of our funding needs, even if we

are able and choose to sell all $20 million of our common stock registered under this prospectus supplement.

Our management might apply the net proceeds from this

offering in ways with which you do not agree and in ways that may impair the value of your investment.

We currently intend to use the net proceeds

from this offering primarily for working capital and general corporate purposes. Our management has broad discretion as to the

use of such proceeds and you will be relying on the judgment of our management regarding the application of these proceeds. Our

management might apply these proceeds in ways with which you do not agree, or in ways that ultimately do not yield a favorable

return. If our management applies such proceeds in a manner that does not yield a significant return, if any, on our investment

of such net proceeds, it could compromise our ability to pursue our growth strategy and adversely affect the market price of our

common stock.

USE OF PROCEEDS

We may receive up to $20 million in aggregate

gross proceeds under the Purchase Agreement from any sales to Lincoln Park of shares of common stock registered hereunder pursuant

to the Purchase Agreement after the date of this prospectus supplement. We may sell fewer than all of the shares offered by this

prospectus supplement, in which case our aggregate proceeds will be less. Because we are not obligated to sell any shares of our

common stock under the Purchase Agreement, other than the initial commitment shares, the actual total offering amount and proceeds

to us, if any, are not determinable at this time. There can be no assurance that we will receive any proceeds under or fully utilize

the Purchase Agreement. See “Plan of Distribution” elsewhere in this prospectus supplement for more information.

We intend to use the net proceeds of this

offering for general corporate purposes, which may include, among other things, working capital, capital expenditures and funding

additional clinical and preclinical development of our pipeline candidates.

DILUTION

The sale of our common stock to Lincoln

Park pursuant to the Purchase Agreement will have a dilutive impact on our stockholders. In addition, the lower our stock price

is at the time we exercise our right to sell shares to Lincoln Park, the more shares of our common stock we will have to issue

to Lincoln Park pursuant to the Purchase Agreement and our existing stockholders would experience greater dilution. We calculate

net tangible book value per share by dividing the net tangible book value, which is tangible assets less total liabilities, by

the number of outstanding shares of common stock. Dilution represents the difference between the portion of the amount per share

paid by purchasers of shares in this offering and the as adjusted net tangible book value per share of our common stock immediately

after giving effect to this offering. Our net tangible book value as of March 31, 2019 was approximately $14.2 million, or $0.29

per share.

After giving effect to the sale of common

stock pursuant to this prospectus supplement and accompanying prospectus in the aggregate amount of $20 million at an assumed

offering price of $2.98 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on June 7, 2019,

and after deducting estimated aggregate offering expenses payable by us and accounting for the issuance of all of the commitment

shares registered hereunder, our net tangible book value as of March 31, 2019 would have been $34.2 million, or $0.62 per share

of common stock. This represents an immediate increase in the net tangible book value of $2.36 per share to our existing stockholders

and an immediate dilution in net tangible book value of $0.33 per share to new investors. The following table illustrates this

per share dilution:

|

Assumed public offering price per share

|

|

$

|

2.98

|

|

|

Net tangible book value per share as of March 31, 2019

|

|

$

|

0.29

|

|

|

Increase per share attributable

to new investors

|

|

$

|

0.33

|

|

|

As adjusted net tangible

book value per share as of March 31, 2019 after giving effect to this offering

|

|

$

|

0.62

|

|

|

Dilution per share to new

investors purchasing shares in this offering

|

|

$

|

2.36

|

|

The table above assumes for illustrative

purposes that an aggregate of 6,711,410 shares of our common stock are sold pursuant to this prospectus supplement and the accompanying

prospectus at a price of $2.98 per share, the last reported sale price of our common stock on the Nasdaq Capital Market on June

7, 2019, for aggregate gross proceeds of $20 million, and 64,877 additional commitment shares are issued in connection with such

sales (in addition to the 324,383 initial commitment shares being issued as a commitment fee for Lincoln Park for entering into

the Purchase Agreement). The shares sold in this offering, if any, will be sold from time to time at various prices. An increase

of $1.00 per share in the price at which the shares are sold from the assumed offering price of $2.98 per share shown in the table

above, assuming all of our common stock in the aggregate amount of $20 million is sold at that price, would result in an adjusted

net tangible book value per share after the offering of $0.64 per share and would increase the dilution in net tangible book value

per share to new investors in this offering to $3.34 per share, after deducting estimated aggregate offering expenses payable

by us. A decrease of $1.00 per share in the price at which the shares are sold from the assumed offering price of $2.98 per share

shown in the table above, assuming all of our common stock in the aggregate amount of $20 million is sold at that price, would

result in an adjusted net tangible book value per share after the offering of $0.58 per share and would decrease the dilution

in net tangible book value per share to new investors in this offering to $1.40 per share, after deducting estimated aggregate

offering expenses payable by us.

The above table and discussion are based on 48,173,241 shares

of common stock outstanding as of March 31, 2019 and excludes the following, all as of March 31, 2019:

|

|

●

|

7,298,350

shares of common stock issuable upon the exercise of outstanding stock options, vested

and unvested, with a weighted-average exercise price of $3.67 per share; and

|

|

|

●

|

370,000

shares of common stock issuable upon the exercise of outstanding warrants with a weighted-average

exercise price of $4.03 per share.

|

To the extent that options or warrants

outstanding as of March 31, 2019 have been or are exercised, or other shares are issued, investors purchasing shares in this offering

could experience further dilution. In addition, we may choose to raise additional capital due to market conditions or strategic

considerations, even if we believe we have sufficient funds for our current or future operating plans. To the extent that additional

capital is raised through the sale of equity or convertible debt securities, the issuance of these securities could result in

further dilution to our stockholders.

LINCOLN PARK TRANSACTION

On June 7, 2019,

we entered into the Purchase Agreement and a Registration Rights Agreement (the “RRA”) with Lincoln Park. Pursuant

to the terms of the Purchase Agreement, Lincoln Park has agreed to purchase from us up to $50 million of shares of our common

stock (subject to certain limitations). Pursuant to the terms of the RRA, we are filing this prospectus supplement to cover (i)

the offer and sale of up to $20 million of shares of our common stock (ii) the issuance of 324,383 initial commitment shares as

a commitment fee for Lincoln Park for entering into the Purchase Agreement and (iii) 64,877 additional commitment shares to be

issued pro-rata to Lincoln Park if and when we Direct Lincoln Park to purchase shares of common stock under the Purchase Agreement.

Purchase of

Shares Under the Purchase Agreement

From the date hereof, we may, from time

to time over a 36-month period, in our sole discretion and subject to certain conditions to direct Lincoln Park to purchase up

to 200,000 shares (the “Regular Purchase Share Limit”) of our common stock on any such business day (each such purchase,

a “Regular Purchase”); provided that (i) the Regular Purchase Share Limit may be increased to up to 225,000 shares

if the closing price of our common stock is not below $4.00 on such date and (ii) the Regular Purchase Share Limit may be increased

to up to 250,000 shares if the closing price of our common stock is not below $6.00 on such date; and provided further that we

may also mutually agree with Lincoln Park to increase the Regular Purchase Share Limit to up to 1,000,000 shares and to make multiple

purchases in a given day. Additionally, all such share and dollar amounts shall be appropriately adjusted for any reorganization,

recapitalization, non-cash dividend, stock split or other similar transaction as provided in the Purchase Agreement, and In no

event shall Lincoln Park purchase more than $2,000,000 worth of our common stock pursuant to a Regular Purchase on any single

business day. The purchase price per share for each such Regular Purchase will be equal to the lower of:

|

|

●

|

the lowest

sale price for our common stock on the purchase date of such shares; or

|

|

|

●

|

the arithmetic

average of the three lowest closing sale prices for our common stock during the 10 consecutive

business days ending on the business day immediately preceding the purchase date of such

shares.

|

In addition to Regular Purchases described

above, in the event we have directed Lincoln Park to purchase shares of our common stock not less than the Regular Purchase Share

Limit then in effect, on such purchase date we may also direct Lincoln Park to purchase an additional amount of our common stock

on the following business day (an “Accelerated Purchase”), not to exceed the lesser of:

|

|

●

|

30% of

the aggregate shares of our common stock traded during normal trading hours on the purchase

date; and

|

|

|

●

|

200% of

the number of purchase shares purchased pursuant to the corresponding Regular Purchase.

|

The purchase price per share for each such Accelerated Purchase

will be equal to the lower of:

|

|

●

|

96% of

the volume weighted average price during (i) the entire trading day on the purchase date,

if the volume of shares of our common stock traded on the purchase date has not exceeded

a volume maximum calculated in accordance with the Purchase Agreement, or (ii) the portion

of the trading day of the purchase date (calculated starting at the beginning of normal

trading hours) until such time at which the volume of shares of our common stock traded

has exceeded such volume maximum; or

|

|

|

●

|

the closing

sale price of our common stock on the purchase date.

|

In the event we have directed Lincoln

Park to purchase shares of our common stock in the full amount available for an Accelerated Purchase, on the date of such Accelerated

Purchase, we may also direct Lincoln Park to purchase an additional amount of our common stock under the same terms set forth

above for an Accelerated Purchase (an “Additional Accelerated Purchase”).

In the case of Regular Purchases, Accelerated

Purchases and Additional Accelerated Purchases, the purchase price per share will be adjusted for any reorganization, recapitalization,

non-cash dividend, stock split, reverse stock split or other similar transaction as set forth in the Purchase Agreement.

The Purchase Agreement limits our sales

of shares of common stock to Lincoln Park to 10,076,680 shares of our common stock, representing 19.99% of the shares of common

stock outstanding on the date of the Purchase Agreement unless (i) shareholder approval is obtained to issue more than such

amount or (ii) the average price of all applicable sales of our common stock to Lincoln Park under the Purchase Agreement

equals or exceeds the lower of (A) the closing price of our common stock on the Nasdaq Capital Market immediately preceding on

June 7, 2019 or (B) the average of the closing price of our common stock on the Nasdaq Capital Market for the five Business Days

immediately preceding on June 7, 2019.

Other than as set forth above, there are

no trading volume requirements or restrictions under the Purchase Agreement, and we will control the timing and amount of any

sales of our common stock to Lincoln Park.

Events of Default

Events of default under the Purchase Agreement

include the following:

|

|

●

|

the effectiveness of the

registration statement of which this prospectus forms a part, or any other registration

statement registering securities under the Purchase Agreement, lapses for any reason

(including, without limitation, the issuance of a stop order), or any required prospectus

supplement and accompanying prospectus are unavailable for the sale by Lincoln Park of

our common stock offered hereby, and such lapse or unavailability continues for a period

of 10 consecutive business days or for more than an aggregate of 30 business days in

any 365-day period;

|

|

|

●

|

suspension by our principal

market of our common stock from trading on the Nasdaq Capital Market for a period of

three consecutive business days;

|

|

|

●

|

the delisting of the Common

Stock from the NASDAQ Capital Market; provided, however, that the Common Stock is not

immediately thereafter trading on the New York Stock Exchange, the NASDAQ Global Market,

he NASDAQ Global Select Market, the NYSE American, the NYSE Arca or the OTC Bulletin

Board, OTCQX or OTCQB operated by the OTC Markets Group, Inc. (or nationally recognized

successor to any of the foregoing);

|

|

|

●

|

the transfer agent’s

failure for three business days to issue to Lincoln Park shares of our common stock which

Lincoln Park is entitled to receive under the Purchase Agreement;

|

|

|

●

|

any breach of the representations

or warranties or covenants contained in the Purchase Agreement or any related agreement

which has or which could have a material adverse effect on us subject to a cure period

of five business days;

|

|

|

●

|

any voluntary or involuntary

participation or threatened participation in insolvency or bankruptcy proceedings by

or against us; and

|

|

|

●

|

if at any time we are not

eligible to transfer our common stock electronically or a material adverse change in

our business, financial condition, operations or prospects has occurred.

|

Lincoln Park does not have the right to

terminate the Purchase Agreement upon any of the events of default set forth above. During an event of default, all of which are

outside of Lincoln Park’s control, shares of our common stock cannot be sold by us or purchased by Lincoln Park under the

Purchase Agreement.

Our Termination Rights

We have the unconditional right, at any

time, for any reason and without any payment or liability to us, to give notice to Lincoln Park to terminate the Purchase Agreement.

In the event of bankruptcy proceedings by or against us, the Purchase Agreement will automatically terminate without action of

any party.

No Short-Selling or Hedging by Lincoln

Park

Lincoln Park has agreed that neither it

nor any of its affiliates shall engage in any direct or indirect short-selling or hedging of our common stock during any time

prior to the termination of the Purchase Agreement.

Lincoln Park’s Registration Rights

Although the Purchase Agreement provides

that we may sell up to $50 million of shares of our common stock to Lincoln Park, we are only registering $20 million in shares

of common stock, and we are only registering 64,877 of the 162,191 additional commitment shares (in addition to 324,383 initial

commitment shares issuable to Lincoln Park immediately pursuant to the Purchase Agreement) under this prospectus supplement, as

permitted by the RRA. In the event that we do not sell all of the shares of common stock covered hereunder by September 6, 2019

(the date on which the registration statement of which this prospectus supplement is a part will expire pursuant to Rule 415 under

the Securities Act), pursuant to the RRA we will be required to file a new registration statement registering the shares covered

hereunder that have not been sold and/or issued to Lincoln Park (including any commitment shares that remain unissued). Additionally,

if we do sell all of the shares of common stock covered hereunder, we will be required to file a new registration statement covering

additional shares of common stock to be sold, and issued as additional commitment shares, to Lincoln Park under the Purchase Agreement.

Prior Purchase Agreement

On October 21, 2015, we previously entered

into a purchase agreement (the “2015 Purchase Agreement”) and a registration rights agreement (the “2015 RRA”)

with Lincoln Park. Pursuant to the terms of the 2015 Purchase Agreement, Lincoln Park agreed to purchase from us up to $50 million

of shares of our common stock (subject to certain limitations) from time to time until September 6, 2019. Pursuant to the terms

of the RRA, we filed with the SEC (i) the accompanying base prospectus to this prospectus supplement which covered the secondary

offering of 6,754,609 shares of common stock, which was declared effective September 6, 2016 and which is still effective as of

the date of this prospectus supplement (ii) a new registration Statement in 2017 registering 5,000,000 shares purchased under

the 2015 Purchase Agreement, which was declared effective June 12, 2017 (the “2017 Registration Statement”) and (iii)

a prospectus supplement to the registration statement of which this prospectus supplement is also a part registering $9,711,390

of shares of our common stock purchased or to be purchased under the 2015 Purchase Agreement, of which $8,511,134 of shares of

our common stock remain for sale to Lincoln Park thereunder. As of the date hereof, the Company has sold 14,347,572 shares of

common stock to Lincoln Park for gross proceeds of $48,799,743, and $1,200,257 of shares of common stock remain available for

sale to Lincoln Park at our sole discretion under the 2015 Purchase Agreement.

Until the earlier of (i) September 6,

2019 (ii) such time as we terminate the 2015 Purchase Agreement or (iii) such time as all of the $1,200,257 of shares of common

stock remaining available for purchase under the 2015 Purchase Agreement that are registered under the registration statement

of which this prospectus supplement is a part have been sold to Lincoln Park, we may continue to direct Lincoln Park to purchase

shares of Common Stock under the 2015 Purchase Agreement. After the occurrence of any of the foregoing, we will only sell shares

of our Common Stock to Lincoln Park under the Purchase Agreement.

Amount of Potential Proceeds to be

Received under the Purchase Agreement

Assumed Average

Purchase

Price Per Share

|

|

|

Number of Registered

Shares

to be Issued if Full

Purchase

(1)

|

|

|

Percentage of

Outstanding

Shares After

Giving Effect to

the Issuance to

Lincoln Park

(2)

|

|

|

Proceeds from the

Sale of Shares

Under the Purchase

Agreement Registered

in this Offering

|

|

|

$

|

2.50

|

|

|

|

8,064,877

|

|

|

|

13.72

|

%

|

|

$

|

20,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

2.98

|

(3)

|

|

|

6,776,286

|

|

|

|

11.78

|

%

|

|

$

|

20,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

5.00

|

|

|

|

4,064,877

|

|

|

|

7.42

|

%

|

|

$

|

20,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

7.50

|

|

|

|

2,731,544

|

|

|

|

5.11

|

%

|

|

$

|

20,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

10.00

|

|

|

|

2,064,877

|

|

|

|

3.91

|

%

|

|

$

|

20,000,000

|

|

|

|

(1)

|

Although the Purchase

Agreement provides that we may sell up to $50,000,000 of our common stock to Lincoln

Park, we are registering $21,159,993 of shares hereunder (inclusive of the 324,383 initial

commitment shares issued to Lincoln Park and the 64,877 additional commitment shares

that have been or may be issued to Lincoln Park as a commitment fee) under this prospectus

supplement, which may or may not cover all the shares we ultimately sell to Lincoln Park

under the Purchase Agreement, depending on the purchase price per share. As a result,

we have included in this column only those shares that we have initially reserved.

|

|

|

(2)

|

The denominator

is based on 50,732,985 shares outstanding as of June 7, 2019, which is inclusive of the

324,383 initial commitment shares being issued to Lincoln Park as initial commitment

shares in connection with this offering and the number of shares set forth in the adjacent

column which we would have sold to Lincoln Park at the applicable assumed average purchase

price per share. The numerator includes the 64,877 additional commitment shares that

may be issued to Lincoln Park pro rata. The number of shares in such column does not

include shares that may be issued to Lincoln Park under the Purchase Agreement, or the

2015 Purchase Agreement which are not covered under this prospectus supplement.

|

|

|

(3)

|

The closing price

of our common stock on June 7, 2019.

|

PLAN OF DISTRIBUTION

This prospectus

supplement and the accompanying prospectus relate to the issuance and sale of up to $20 million of shares of our common stock

that we may issue to Lincoln Park from time to time under the Purchase Agreement. This prospectus supplement and the accompanying

prospectus also cover the resale of these shares by Lincoln Park to the public.

We entered into

the Purchase Agreement with Lincoln Park on June 7, 2019. In consideration for entering into the Purchase Agreement, we are issuing

324,383 shares of our common stock to Lincoln Park as initial commitment shares, and may issue up to 162,191 shares of our common

stock as additional commitment shares (of which 64,877 additional commitment shares are registered hereunder) in connection with

the purchase of our common stock by Lincoln Park, all of which are covered by this prospectus supplement. The Purchase Agreement

provides that, upon the terms and subject to the conditions set forth therein, Lincoln Park is committed to purchase an aggregate

of up to $50 million of shares of our common stock ($20 million in shares is registered hereunder) over the 36-month term of the

Purchase Agreement. See “Lincoln Park Transaction.”

Lincoln Park

is an “underwriter” within the meaning of Section 2(a)(11) of the Securities Act. Lincoln Park has informed us that

it will use an unaffiliated broker-dealer to effectuate all sales, if any, of the common stock that it may purchase from us pursuant

to the Purchase Agreement. Such sales will be made on the NASDAQ Capital Market at prices and at terms then prevailing or at prices

related to the then current market price. Each such unaffiliated broker-dealer will be an underwriter within the meaning of Section

2(a)(11) of the Securities Act. Lincoln Park has informed us that each such broker-dealer will receive commissions from Lincoln

Park that will not exceed customary brokerage commissions.

We know of no

existing arrangements between Lincoln Park and any other stockholder, broker, dealer, underwriter, or agent relating to the sale

or distribution of the shares offered by this Prospectus. At the time a particular offer of shares is made, a prospectus supplement,

if required, will be distributed that will set forth the names of any agents, underwriters, or dealers and any compensation from

the selling stockholder, and any other required information.

We will pay all

of the expenses incident to the registration, offering, and sale of the shares to Lincoln Park.

We have agreed

to indemnify Lincoln Park and certain other persons against certain liabilities in connection with the offering of shares of common

stock offered hereby, including liabilities arising under the Securities Act or, if such indemnity is unavailable, to contribute

amounts required to be paid in respect of such liabilities.

Lincoln Park

represented to us that at no time prior to the date of the Purchase Agreement has Lincoln Park or its agents, representatives

or affiliates engaged in or effected, in any manner whatsoever, directly or indirectly, any short sale (as such term is defined

in Rule 200 of Regulation SHO of the Exchange Act) of our Common Stock or any hedging transaction. Lincoln Park agreed that during

the term of the Purchase Agreement, it, its agents, representatives or affiliates will not enter into or effect, directly or indirectly,

any of the foregoing transactions.

We have advised

Lincoln Park that it is required to comply with Regulation M promulgated under the Exchange Act. With certain exceptions, Regulation

M precludes Lincoln Park, any affiliated purchasers, and any broker-dealer or other person who participates in the distribution

from bidding for or purchasing, or attempting to induce any person to bid for or purchase any security which is the subject of

the distribution until the entire distribution is complete. Regulation M also prohibits any bids or purchases made in order to

stabilize the price of a security in connection with the distribution of that security. All of the foregoing may affect the marketability

of the shares offered by this prospectus supplement.

Nevada Agency

and Transfer Company is transfer agent and registrar for the Common Stock.

Our common stock

is listed on The Nasdaq Capital Market under the symbol “AVXL”.

LEGAL MATTERS

The validity of the securities offered

by this prospectus has been passed upon for us by Snell & Wilmer, L.L.P., Reno, Nevada.

EXPERTS

The financial statements as of September

30, 2018 and 2017 and for each of the three years in the period ended September 30, 2018 and management’s assessment of

the effectiveness of internal control over financial reporting as of September 30, 2018 incorporated by reference in this Prospectus

have been so incorporated in reliance on the reports of BDO USA, LLP, an independent registered public accounting firm, incorporated

herein by reference, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current

reports, proxy statements and other information with the SEC. The SEC maintains a website that contains reports, proxy statements

and other information regarding issuers that file electronically with the SEC, including Anavex. The address of the SEC website

is www.sec.gov.

We make available free of charge on our

internet website at www.anavex.com our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on

Form 8-K and any amendments to those reports, as soon as reasonably practicable after we electronically file such material with,

or furnish it to, the SEC. Information contained on our website is not incorporated by reference into this prospectus supplement

and you should not consider such information as part of this prospectus supplement.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to “incorporate

by reference” into this prospectus certain information that we file with the SEC, which means that we can disclose important

information to you by referring you to other documents separately filed by us with the SEC that contain such information. The

information we incorporate by reference is considered to be part of this prospectus and information we later file with the SEC

will automatically update and supersede the information in this prospectus. The following documents filed by us with the SEC pursuant

to Section 13(a) of the Exchange Act and any of our future filings under Sections 13(a), 13(c), 14 or 15 (d) of the Exchange

Act, except for information furnished under Item 2.02 or 7.01 of Current Report on Form 8-K, or exhibits related thereto, made

before the termination of the offering are incorporated by reference herein:

|

|

(1)

|

our Annual Report on

Form 10-K

for the fiscal year ended September

30, 2018, filed with the SEC on December 12, 2018, and the amendment thereto on

Form 10-K/A

filed on January 25, 2019;

|

|

|

(2)

|

our Proxy Statement on

Schedule 14A

filed on February 11, 2019

(excluding those portions that are not incorporated by reference into our Annual Report on Form 10-K);

|

|

|

(3)

|

our Quarterly Reports on Form 10-Q for

quarter ended

December 31, 2018

filed on February 7, 2019 and for the quarter ended

March 31, 2019

filed on May 9, 2019;

|

|

|

|

|

|

|

(4)

|

our Current

Reports on Form 8-K filed with the SEC on

March 18, 2019

and

April 8, 2019

; and

|

|

|

|

|

|

|

(5)

|

the description of our common stock contained in the Registration

Statement on Form 8-A (File No. 001-37606) filed with the SEC on October 23, 2005.

|

Any statement contained herein or in any

document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for the purposes

of this prospectus to the extent that a statement contained herein or in any other subsequently filed document which also is or

is deemed to be incorporated by reference herein modifies or replaces such statement. Any such statement so modified or superseded

shall not be deemed to constitute a part of this prospectus, except as so modified or superseded.

We will provide to each person, including

any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the reports or documents that have been incorporated

by reference in the prospectus contained in the registration statement but not delivered with the prospectus, other than an exhibit

to these filings unless we have specifically incorporated that exhibit by reference into the filing, upon written or oral request

and at no cost to the requester. Requests should be made by writing or telephoning us at the following address:

Anavex Life Sciences

Corp.

51 West 52

nd

Street, 7

th

Floor

New York, NY 10019-6163

(844) 689-3939

PROSPECTUS

Anavex Life Sciences

Corp.

$100,000,000 of

Shares of Common Stock and Warrants

6,754,609 Shares

of Common Stock Offered

by Selling Security Holder

Anavex Life Sciences Corp., a Nevada corporation

(“

us

”, “

we

”, “

our

”, “

Anavex

” or the “

Company

”)

may offer and sell from time to time, in one or more series or issuances and on terms that Anavex will determine at the time of

the offering, shares of our common stock, par value $0.001 per share (“

Common Stock

”) and warrants (“

Warrants

”)

described in this prospectus, up to an aggregate amount of $100,000,000.

This prospectus also covers the resale

by Lincoln Park Capital Fund, LLC (“

Lincoln Park

” or the “

Selling Security Holder

”), of

up to 6,754,609 shares of our Common Stock in one or more transactions in amounts, at prices, and on terms that will be determined

at the time these securities are offered, inclusive of 269,397 shares of Common Stock issued or issuable to the Selling Security

Holder as commitment shares, as described in further detail herein. The shares being offered for resale by the Selling Security

Holder represents approximately 18.9% of the outstanding Common Stock of the Company.

We will not receive any of the proceeds

from the sale of shares of our Common Stock sold by the Selling Security Holder. The Selling Security Holder may sell the shares

of Common Stock described in this prospectus in a number of different ways and at varying prices. See “Plan of Distribution”

for more information about how the Selling Security Holder may sell the shares of Common Stock being registered pursuant to this

prospectus. The Selling Security Holder is an “underwriter” within the meaning of Section 2(a)(11) of the Securities

Act of 1933, as amended (the “

Securities Act

”).

This prospectus provides you with a general

description of the securities offered. We will file prospectus supplements and may provide other offering material at later dates

that will contain specific terms of each offering of securities by us. These supplements may also add, update or change information

contained in this prospectus. You should carefully read this prospectus and the applicable prospectus supplement before you invest

in any of our securities. This prospectus may not be used to consummate sales of securities unless accompanied by a prospectus

supplement.

We may offer and sell the securities described

in this prospectus and any prospectus supplement directly to our stockholders or to other purchasers or through agents on our

behalf or through underwriters or dealers as designated from time to time. If any agents or underwriters are involved in the sale

of any of these securities, the applicable prospectus supplement will provide the names of the agents or underwriters and any

applicable fees, commission or discounts.

Our Common Stock is currently quoted on

the Nasdaq Capital Market under the symbol “AVXL”. On August 30, 2016, the last reported sale price of our Common

Stock was $3.04 per share.

Investing in our securities

involves a high degree of risk. See the section entitled “Risk Factors” on page 7 of this prospectus and in the

documents we filed with the Securities and Exchange Commission that are incorporated in this prospectus by reference for

certain risks and uncertainties you should consider.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or

accuracy of this prospectus. Any representation to the contrary is a criminal offense.

This prospectus is dated September 6,

2016.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus of Anavex Life Sciences

Corp., a Nevada corporation (collectively with all of its subsidiaries, the “Company”, “Anavex”, or “we”,

“us”, or “our”) is a part of a registration statement that we filed with the Securities and Exchange Commission

(“

SEC

”) utilizing a “shelf” registration process. Under this shelf registration process, we may,

from time to time, sell the securities described in this prospectus in one or more offerings up to a total dollar amount of $100,000,000

as described in this prospectus. In addition, Lincoln Park may, from time to time, offer and sell up to an aggregate of 6,754,609

shares of our Common Stock in one or more transactions.

The registration statement containing

this prospectus, including the exhibits to the registration statement, provides additional information about us and the securities

offered under this prospectus. The registration statement, including the exhibits and the documents incorporated herein by reference,

can be read on the SEC website or at the SEC offices mentioned under the heading “Prospectus Summary - Where You Can Find

More Information.”

We may provide a prospectus supplement

containing specific information about the amounts, prices and terms of the securities for a particular offering. The prospectus

supplement may add, update or change information in this prospectus. If the information in the prospectus is inconsistent with

a prospectus supplement, you should rely on the information in that prospectus supplement. You should read both this prospectus

and, if applicable, any prospectus supplement. See “Prospectus Summary — Where You Can Find More Information”

for more information.

We have not authorized any dealer, salesman

or other person to give any information or to make any representation other than those contained or incorporated by reference

in this prospectus or any prospectus supplement. You must not rely upon any information or representation not contained or incorporated

by reference in this prospectus or any prospectus supplement. This prospectus and any prospectus supplement do not constitute

an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which they relate,

nor do this prospectus and any prospectus supplement constitute an offer to sell or the solicitation of an offer to buy securities

in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not

assume that the information contained in this prospectus or any prospectus supplement is accurate on any date subsequent to the

date set forth on the front of such document or that any information we have incorporated by reference is correct on any date

subsequent to the date of the document incorporated by reference, even though this prospectus and any prospectus supplement is

delivered or securities are sold on a later date.

PROSPECTUS

SUMMARY

The items in the following summary

are described in more detail later in this prospectus. This summary does not contain all of the information you should consider.

Before investing in our securities, you should read the entire prospectus carefully, including the “Risk Factors”

beginning on page 7 and the financial statements incorporated by reference.

Overview

Our Current Business

We are a clinical stage biopharmaceutical

company engaged in the development of differentiated therapeutics for the treatment of neurodegenerative and neurodevelopmental

diseases including drug candidates to treat Alzheimer’s disease, other central nervous system (“CNS”) diseases,

pain and various types of cancer. The Company’s lead compound ANAVEX 2-73 is being developed to treat Alzheimer’s

disease and potentially other central nervous system diseases, including rare diseases, such as Rett syndrome.

In December 2014 a Phase 2a clinical trial

was initiated for ANAVEX 2-73, which is being evaluated for the treatment of Alzheimer’s disease. This randomized trial

is designed to assess the safety and exploratory efficacy of ANAVEX 2-73 alone as well as in combination with donepezil (ANAVEX

PLUS) in patients with mild to moderate Alzheimer’s disease. ANAVEX 2-73 targets sigma-1 and muscarinic receptors, which

have been shown in preclinical studies to reduce stress levels in the brain and to reverse the pathological hallmarks observed

in Alzheimer’s disease. ANAVEX 2-73 showed no serious adverse events in a previously performed Phase 1 study. In pre-clinical

studies, ANAVEX 2-73 demonstrated anti-amnesic and neuroprotective properties in various animal models including the transgenic

mouse model Tg2576. In March, 2016, we received approval from the Ethics Committee in Australia to extend the ongoing Phase 2a

clinical trial, which had been requested by patients and their caregivers. The trial extension allows participants who complete

52 weeks in PART B to roll-over into a new trial and continue taking ANAVEX 2-73 for an additional 104 weeks, providing an opportunity

to gather extended safety data. The trial is independent of the Company’s planned larger Phase 2/3 double-blinded, placebo-controlled

study of ANAVEX 2-73 in Alzheimer’s disease.

We intend to identify and initiate discussions

with potential partners in the next 12 months. Further, we may acquire or develop new intellectual property and assign, license,

or otherwise transfer our intellectual property to further our goals.

Our Pipeline

Our pipeline includes one clinical drug

candidate and several compounds in different stages of pre-clinical study.

Our proprietary SIGMACEPTOR™ Discovery

Platform produced small molecule drug candidates with unique modes of action, based on our understanding of sigma receptors. Sigma

receptors may be targets for therapeutics to combat many human diseases, including Alzheimer’s disease. When bound by the

appropriate ligands, sigma receptors influence the functioning of multiple biochemical signals that are involved in the pathogenesis

(origin or development) of disease.

Compounds that have been subjects of our

research include the following:

ANAVEX 2-73

ANAVEX 2-73 may offer a disease-modifying

approach in Alzheimer’s disease (AD) by using ligands that activate sigma-1 receptors.

In AD animal models, ANAVEX 2-73 has shown

pharmacological, histological and behavioral evidence as a potential neuroprotective, anti-amnesic, anti-convulsive and anti-depressive

therapeutic agent, due to its potent affinity to sigma-1 receptors and moderate affinities to M1-4 type muscarinic receptors.

In addition, ANAVEX 2-73 has shown a potential dual mechanism which may impact both amyloid and tau pathology. In a transgenic

AD animal model Tg2576 ANAVEX 2-73 induced a statistically significant neuroprotective effect against the development of oxidative

stress in the mouse brain, as well as significantly increased the expression of functional and synaptic plasticity markers that

is apparently amyloid-beta independent. It also statistically alleviated the learning and memory deficits developed over time

in the animals, regardless of sex, both in terms of spatial working memory and long-term spatial reference memory.

Based on the results of pre-clinical testing,

we initiated and completed a Phase 1 single ascending dose (SAD) clinical trial of ANAVEX 2-73 in 2011. In this Phase 1 SAD trial,

the maximum tolerated single dose was defined per protocol as 55–60 mg. This dose is above the equivalent dose shown to

have positive effects in mouse models of AD. There were no significant changes in laboratory or electrocardiogram (ECG) parameters.

ANAVEX 2-73 was well tolerated below the 55–60 mg dose with only mild adverse events in some subjects. Observed adverse

events at doses above the maximum tolerated single dose included headache and dizziness, which were moderate in severity and reversible.

These side effects are often seen with drugs that target CNS conditions, including AD.

The ANAVEX 2-73 Phase 1 SAD trial was

conducted as a randomized, placebo-controlled study. Healthy male volunteers between the ages of 18 and 55 received single, ascending

oral doses over the course of the trial. Study endpoints included safety and tolerability together with pharmacokinetic parameters.

Pharmacokinetics includes the absorption and distribution of a drug, the rate at which a drug enters the blood and the duration

of its effect, as well as chemical changes of the substance in the body. This study was conducted in Germany in collaboration

with ABX-CRO, a clinical research organization that has conducted several Alzheimer’s disease studies, and the Technical

University of Dresden.

In December 2014 a Phase 2a clinical trial

was initiated for ANAVEX 2-73, which is being evaluated for the treatment of Alzheimer’s disease. The randomized trial is

designed to assess the safety and exploratory efficacy of ANAVEX 2-73 alone as well as in combination with donepezil (ANAVEX PLUS)

in patients with mild to moderate Alzheimer’s disease. ANAVEX 2-73 targets sigma-1 and muscarinic receptors, which have

been shown in preclinical studies to reduce stress levels in the brain and to reverse the pathological hallmarks observed in Alzheimer’s

disease. ANAVEX 2-73 showed no serious adverse events in a previously performed Phase 1 study. In pre-clinical studies ANAVEX

2-73 demonstrated anti-amnesic and neuroprotective properties in various animal models including the transgenic mouse model Tg2576.

The Phase 2a study met both primary and

secondary objectives of the study. The 31-week preliminary exploratory safety and efficacy data from the ongoing Phase 2a study

of ANAVEX 2-73 in Alzheimer’s patients demonstrated favorable safety, maximum tolerated dose, positive dose response, sustained

efficacy response through 31 weeks for both cognitive and functional measures, as well as positive unexpected therapeutic response

events. ANAVEX 2-73 continues to demonstrate a favorable adverse event (AE) profile through 31 weeks in a patient population of

elderly Alzheimer’s patients with varying degrees of physical fragility. The most common side effects across all AE categories

tended to be of mild severity grade 1, and were resolved with dose reductions that were anticipated within the adaptive design

of the study protocol. ANAVEX 2-73 data presented is prerequisite information in order to progress into Phase 2/3 placebo controlled

studies.

Recent preclinical data validates ANAVEX

2-73 as a prospective platform drug for other neurodegenerative diseases beyond Alzheimer’s as well as neurodevelopmental

diseases, more specifically, epilepsy and Rett syndrome. For epilepsy, data demonstrates both significant and dose related improvement