Statement of Changes in Beneficial Ownership (4)

March 12 2021 - 4:23PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Cotter Martin |

2. Issuer Name and Ticker or Trading Symbol

ANALOG DEVICES INC

[

ADI

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

SVP, Ind, Consr, Multi-Markets |

|

(Last)

(First)

(Middle)

ONE ANALOG WAY |

3. Date of Earliest Transaction

(MM/DD/YYYY)

3/10/2021 |

|

(Street)

WILMINGTON, MA 01887

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Non-Qualified Stock Option (right to buy) | $147.11 | 3/10/2021 | | A | | 14158 | | 3/15/2022 (1) | 3/10/2031 | Comm Stock - $.16-2/3 value | 14158.0 | $0 | 14158 | D | |

| Restricted Stock Unit (RSU) | $0.0 | 3/10/2021 | | A | | 3873 | | 3/15/2022 (2) | (2) | Comm Stock - $.16-2/3 value | 3873.0 | $0 | 3873 | D | |

| Performance-Based Restricted Stock Unit | $0.0 (3) | 3/10/2021 | | A |

V

| 3873 | | 3/25/2024 (4) | (4) | Comm Stock - $.16-2/3 value | 3873.0 | $0 | 3873 | D | |

| Performance-Based Restricted Stock Unit | $0.0 (5) | 3/10/2021 | | A |

V

| 3873 | | 3/15/2024 (6) | (6) | Comm Stock - $.16-2/3 value | 3873.0 | $0 | 3873 | D | |

| Explanation of Responses: |

| (1) | This option vests in equal installments on the first, second, third and fourth anniversaries of March 15, 2021. |

| (2) | The Restricted Stock Units granted to the Reporting Person on March 10, 2021 vest in equal installments on the first, second, third and fourth anniversaries of March 15, 2021. Upon each vesting date, each vested RSU shall automatically convert into one (1) share of common stock of the Company. |

| (3) | Each Performance-Based Restricted Stock Unit (RSU) represents the right to receive, following vesting, up to 200% of one share of common stock of the Company. The resulting number of shares of common stock of the Company acquired upon vesting of the Performance-Based RSUs is contingent upon the achievement of pre-established performance parameters relating to the Company's relative total shareholder return (TSR) performance against the median TSR of a defined comparator group of companies, as approved by the Company's Compensation Committee, over a three-year performance period beginning on the grant date and ending on the third anniversary of the grant date. |

| (4) | Unless earlier forfeited under the terms of the Performance-Based RSU, each Performance-Based RSU vests and converts into no more than 200% of one share of common stock of the Company three years and 15 days after the grant date. |

| (5) | Each Performance-Based RSU represents the right to receive, following vesting, up to 200% of one share of common stock of the Company. The resulting number of shares of common stock of the Company acquired upon vesting of the Performance-Based RSUs is contingent upon the achievement of pre-established performance parameters relating to the Company's financial performance, as approved by the Company's Compensation Committee, over a one-year performance period, two-year cumulative performance period and three-year cumulative performance period, and vesting on the third anniversary of March 15, 2021. |

| (6) | Unless earlier forfeited under the terms of the Performance-Based RSU, each Performance-Based RSU vests and converts into no more than 200% of one share of common stock of the Company on the third anniversary of March 15, 2021. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Cotter Martin

ONE ANALOG WAY

WILMINGTON, MA 01887 |

|

| SVP, Ind, Consr, Multi-Markets |

|

Signatures

|

| /s/ Eric French, Senior Corporate Counsel, by Power of Attorney | | 3/12/2021 |

| **Signature of Reporting Person | Date |

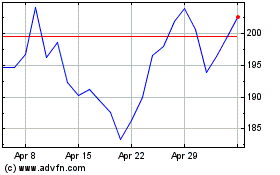

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

From Mar 2024 to Apr 2024

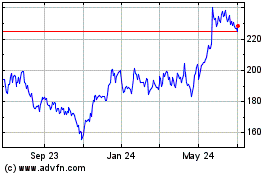

Analog Devices (NASDAQ:ADI)

Historical Stock Chart

From Apr 2023 to Apr 2024