Amphastar Pharmaceuticals, Inc. (NASDAQ: AMPH) (“Amphastar” or the

“Company”) today reported results for the three months ended June

30, 2020.

Second Quarter Highlights

- Net revenues of $85.8 million for the second quarter

- GAAP net loss of $0.2 million, or $0.00 per share, for the

second quarter

- Adjusted non-GAAP net income of $7.6 million, or $0.16 per

share, for the second quarter

Dr. Jack Zhang, Amphastar’s President and Chief Executive

Officer, commented: “We are pleased with Amphastar’s second quarter

and the first half of the year so far. Primatene® Mist has been a

strong performer for the Company, while our epinephrine multi-dose

vial launch continues to gain momentum. Despite the challenges

presented by the COVID-19 pandemic, we remain confident, heading

into our catalyst-rich second half of the year.”

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

|

| |

|

June 30, |

|

June 30, |

|

| |

|

2020 |

|

|

2019 |

|

2020 |

|

2019 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

(in thousands, except per share data) |

|

|

Net revenues |

|

$ |

85,806 |

|

|

$ |

79,047 |

|

$ |

170,494 |

|

$ |

158,837 |

|

| GAAP net (loss) income

attributable to Amphastar |

|

$ |

(192 |

) |

|

$ |

47,787 |

|

$ |

3,757 |

|

$ |

48,655 |

|

| Adjusted non-GAAP net income

attributable to Amphastar* |

|

$ |

7,610 |

|

|

$ |

4,117 |

|

$ |

15,993 |

|

$ |

9,002 |

|

| GAAP diluted EPS attributable

to Amphastar shareholders |

|

$ |

(0.00 |

) |

|

$ |

0.96 |

|

$ |

0.08 |

|

$ |

0.97 |

|

| Adjusted non-GAAP diluted EPS

attributable to Amphastar shareholders* |

|

$ |

0.16 |

|

|

$ |

0.08 |

|

$ |

0.33 |

|

$ |

0.18 |

|

_______________________________* Adjusted non-GAAP net income

attributable to Amphastar and Adjusted non-GAAP diluted EPS

attributable to Amphastar shareholders are non-GAAP financial

measures. Please see the discussion in the section entitled

“Non-GAAP Financial Measures” and the reconciliation of GAAP to

non-GAAP financial measures in Table III of this press release.

Second Quarter Results

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

|

|

|

|

| |

|

June 30, |

|

Change |

|

| |

|

2020 |

|

2019 |

|

Dollars |

|

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(in thousands) |

|

|

|

| Net

revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Primatene® Mist |

|

$ |

12,468 |

|

$ |

2,512 |

|

$ |

9,956 |

|

|

396 |

|

% |

|

Phytonadione |

|

|

10,689 |

|

|

12,441 |

|

|

(1,752 |

) |

|

(14 |

) |

% |

|

Enoxaparin |

|

|

10,218 |

|

|

9,838 |

|

|

380 |

|

|

4 |

|

% |

|

Lidocaine |

|

|

7,608 |

|

|

10,082 |

|

|

(2,474 |

) |

|

(25 |

) |

% |

|

Naloxone |

|

|

8,723 |

|

|

7,833 |

|

|

890 |

|

|

11 |

|

% |

|

Epinephrine |

|

|

6,957 |

|

|

3,139 |

|

|

3,818 |

|

|

122 |

|

% |

|

Other finished pharmaceutical products |

|

|

24,272 |

|

|

27,890 |

|

|

(3,618 |

) |

|

(13 |

) |

% |

| Total finished pharmaceutical products net revenues |

|

$ |

80,935 |

|

$ |

73,735 |

|

$ |

7,200 |

|

|

10 |

|

% |

|

API |

|

|

4,871 |

|

|

5,312 |

|

|

(441 |

) |

|

(8 |

) |

% |

| Total net revenues |

|

$ |

85,806 |

|

$ |

79,047 |

|

$ |

6,759 |

|

|

9 |

|

% |

Changes in net revenues were primarily driven by:

- Increased sales of Primatene® Mist primarily resulting from the

continued success of our nationwide television, radio, and digital

marketing campaign

- Increased epinephrine sales due to the launch of our

newly-approved epinephrine injection, USP 30mg/30mL multiple-dose

vial product as well as increased sales of our epinephrine

pre-filled syringes

- Increased naloxone sales due to higher unit volumes

- Decreased lidocaine sales due to lower demand, largely due to

reductions in elective procedures, in which the jelly form of

lidocaine is often used, during the COVID-19 pandemic

- Decreases in other finished pharmaceutical products were driven

by reductions in products frequently used in elective procedures

including Cortrosyn®, which were partially offset by an increase in

sodium bicarbonate as we were able to utilize our new production

line approved earlier in the year to meet strong demand

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

|

|

|

|

| |

|

June 30, |

|

Change |

|

| |

|

2020 |

|

|

2019 |

|

|

Dollars |

|

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

|

(in thousands) |

|

|

|

|

Net revenues |

|

$ |

85,806 |

|

|

$ |

79,047 |

|

|

$ |

6,759 |

|

9 |

% |

| Cost of revenues |

|

|

52,629 |

|

|

|

46,660 |

|

|

|

5,969 |

|

13 |

% |

| Gross profit |

|

$ |

33,177 |

|

|

$ |

32,387 |

|

|

$ |

790 |

|

2 |

% |

| as % of net revenues |

|

|

39 |

% |

|

|

41 |

% |

|

|

|

|

|

|

Changes in cost of revenues and the resulting decrease to gross

margin were primarily driven by:

- Increase in inventory reserves including a $3.6 million reserve

for crude heparin purchases and commitments at our Chinese

subsidiary, Amphastar Nanjing Pharmaceuticals, Inc.

- Increased sales of Primatene® Mist and the launch of

epinephrine injection multiple-dose vial, both of which have higher

margins, partially offset the inventory reserves

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

|

|

|

|

| |

|

June 30, |

|

Change |

|

| |

|

2020 |

|

2019 |

|

Dollars |

|

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(in thousands) |

|

|

|

| Selling, distribution and

marketing |

|

$ |

4,026 |

|

$ |

2,992 |

|

$ |

1,034 |

|

35 |

% |

| General and

administrative |

|

|

15,924 |

|

|

12,426 |

|

|

3,498 |

|

28 |

% |

| Research and development |

|

|

16,149 |

|

|

15,996 |

|

|

153 |

|

1 |

% |

- Marketing and distribution expenses increased primarily related

to Primatene® Mist, including the cost of a national digital,

television, radio and digital marketing campaign, which began in

July 2019

- General and administrative expenses increased primarily due to

the separation agreement entered into with a former executive, in

which we incurred an expense of $4.9 million relating to cash

compensation and share-based compensation expense

- Research and development expenses increased primarily at our

ANP subsidiary

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

|

|

|

|

|

| |

|

June 30, |

|

Change |

|

| |

|

2020 |

|

2019 |

|

Dollars |

|

% |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| |

|

(in thousands) |

|

|

|

|

Non-operating income (expense), net |

|

$ |

1,418 |

|

$ |

60,120 |

|

$ |

(58,702 |

) |

|

NM |

|

- In June 2019, we recognized a gain of $59.9 million relating to

the settlement of our patent and antitrust litigation with Momenta

Pharmaceuticals, Inc. and Sandoz Inc.

Cash flow provided by operating activities for the six months

ended June 30, 2020, was $31.6 million.

Impact of COVID-19

The increase in sales of Primatene® Mist and certain hospital

products as a result of the COVID-19 pandemic experienced towards

the end of the first quarter continued into the early part of the

second quarter of 2020. We also noticed a decline in demand for

certain products such as Cortrosyn® and lidocaine, which are

frequently used in elective procedures. The Company has not

experienced any significant negative impacts on its cash flows or

operations as a result of the COVID-19 pandemic. All of the

Company’s production facilities continued to operate during the

quarter as they had prior to the COVID-19 pandemic with very little

change, other than for enhanced safety measures intended to prevent

the spread of the virus. It is not possible at this time to

estimate the complete impact that the COVID-19 pandemic

could have on our business, as the impact will depend on future

developments of the pandemic, which are highly uncertain and cannot

be predicted.

Share Buyback Program

On August 4, 2020, the Company’s Board of Directors authorized

an increase of $20 million to the Company’s share buyback program,

which is expected to continue for an indefinite period of time. The

primary goal of the program is to offset dilution created by the

Company’s equity compensation programs.

Purchases may be made through the open market and private block

transactions pursuant to Rule 10b5-1 plans, privately negotiated

transactions, or other means, as determined by the Company’s

management and in accordance with the requirements of

the Securities and Exchange Commission and applicable

laws.

The timing and actual number of shares repurchased will depend

on a variety of factors including price, corporate and regulatory

requirements, and other conditions.

Pipeline Information

The Company currently has five ANDAs filed with the FDA

targeting products with a market size of approximately $1.7

billion, three biosimilar products in development targeting

products with a market size of approximately $13 billion, and nine

generic products in development targeting products with a market

size of approximately $12 billion. This market information is based

on IQVIA data for the 12 months ended June 30, 2020. The Company is

currently developing four proprietary products, including a new

drug application for intranasal naloxone.

Amphastar’s Chinese subsidiary, ANP, currently has 14 Drug

Master Files, or DMFs, on file with the FDA and is developing

several additional DMFs.

Company Information

Amphastar is a specialty pharmaceutical company that focuses

primarily on developing, manufacturing, marketing, and selling

technically-challenging generic and proprietary injectable,

inhalation, and intranasal products. Additionally, the Company

sells insulin API products. Most of the Company’s finished

products are used in hospital or urgent care clinical settings and

are primarily contracted and distributed through group purchasing

organizations and drug wholesalers. More information and

resources are available at www.amphastar.com.

Amphastar’s logo and other trademarks or service marks of

Amphastar, including, but not limited to Amphastar®, Primatene®,

Amphadase® and Cortrosyn®, are the property of Amphastar.

Non-GAAP Financial Measures

To supplement its consolidated financial statements, which are

prepared and presented in accordance with U.S. generally accepted

accounting principles (“GAAP”), the Company is disclosing non-GAAP

financial measures when providing financial results. The Company

believes that an evaluation of its ongoing operations (and

comparisons of its current operations with historical and future

operations) would be difficult if the disclosure of its financial

results were limited to financial measures prepared only in

accordance with GAAP. As a result, the Company is disclosing

certain non-GAAP results, including (i) Adjusted non-GAAP net

income (loss) attributed to Amphastar and (ii) Adjusted non-GAAP

diluted EPS attributed to Amphastar’s shareholders, which exclude

amortization expense, share-based compensation, impairment charges,

executive severance expense, and legal settlements, in order to

supplement investors’ and other readers’ understanding and

assessment of the Company’s financial performance because the

Company’s management uses these measures internally for

forecasting, budgeting, and measuring its operating performance.

Whenever the Company uses such non-GAAP measures, it will provide a

reconciliation of non-GAAP financial measures to their most

directly comparable GAAP financial measures. Investors and other

readers are encouraged to review the related GAAP financial

measures and the reconciliation of non-GAAP measures to their most

directly comparable GAAP measures set forth below and should

consider non-GAAP measures only as a supplement to, not as a

substitute for or as a superior measure to, measures of financial

performance prepared in accordance with GAAP.

Conference Call Information

The Company will hold a conference call to discuss its financial

results today, August 6, 2020, at 2:00 p.m. Pacific Time.

To access the conference call, dial toll-free (800)

708-4540 five minutes before the conference. The passcode for the

conference call is 49844225.

The call can also be accessed on the Investors page

on the Company’s website at www.amphastar.com.

Forward-Looking Statements

All statements in this press release and in the conference call

referenced above that are not historical are forward-looking

statements, including, among other things, statements relating to

the Company’s expectations regarding future financial performance,

backlog, sales and marketing of its products, market size and

growth, the timing of FDA filings or approvals, including the DMFs

of ANP, the timing of product launches, acquisitions and other

matters related to its pipeline of product candidates, its share

buyback program and other future events, such as the impact of the

COVID-19 pandemic and related responses of business and governments

to the pandemic on our operations and personnel, and on commercial

activity and demand across our business operations and results of

operations. These statements are not historical facts but rather

are based on Amphastar’s historical performance and its current

expectations, estimates, and projections regarding Amphastar’s

business, operations, and other similar or related factors. Words

such as “may,” “might,” “will,” “could,” “would,” “should,”

“anticipate,” “predict,” “potential,” “continue,” “expect,”

“intend,” “plan,” “project,” “believe,” “estimate,” and other

similar or related expressions are used to identify these

forward-looking statements, although not all forward-looking

statements contain these words. You should not place undue reliance

on forward-looking statements because they involve known and

unknown risks, uncertainties, and assumptions that are difficult or

impossible to predict and, in some cases, beyond Amphastar’s

control. Actual results may differ materially from those in

the forward-looking statements as a result of a number of factors,

including those described in Amphastar’s filings with the

Securities and Exchange Commission, including in the Annual Report

on Form 10-K for the year ended December 31, 2019, filed with the

SEC on March 16, 2020. In particular, the extent of COVID-19’s

impact on our business will depend on several factors, including

the severity, duration and extent of the pandemic, as well as

actions taken by governments, businesses, and consumers in response

to the pandemic, all of which continue to evolve and remain

uncertain at this time. You can locate these reports through the

Company’s website at http://ir.amphastar.com and on the SEC’s

website at www.sec.gov. The forward-looking statements in

this release speak only as of the date of the release. Amphastar

undertakes no obligation to revise or update information or any

forward-looking statements in this press release or the conference

call referenced above to reflect events or circumstances in the

future, even if new information becomes available or if subsequent

events cause Amphastar’s expectations to change.

Contact Information:

Amphastar Pharmaceuticals, Inc.Bill PetersChief Financial

Officer(909) 980-9484

Table IAmphastar

Pharmaceuticals, Inc.Condensed Consolidated

Statement of Operations(Unaudited; in thousands,

except per share data)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

|

| |

|

June 30, |

|

June 30, |

|

| |

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net revenues |

|

$ |

85,806 |

|

|

$ |

79,047 |

|

|

$ |

170,494 |

|

|

$ |

158,837 |

|

|

| Cost of revenues |

|

|

52,629 |

|

|

|

46,660 |

|

|

|

100,494 |

|

|

|

95,547 |

|

|

| Gross profit |

|

|

33,177 |

|

|

|

32,387 |

|

|

|

70,000 |

|

|

|

63,290 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, distribution, and marketing |

|

|

4,026 |

|

|

|

2,992 |

|

|

|

7,320 |

|

|

|

6,133 |

|

|

|

General and administrative |

|

|

15,924 |

|

|

|

12,426 |

|

|

|

26,670 |

|

|

|

28,753 |

|

|

|

Research and development |

|

|

16,149 |

|

|

|

15,996 |

|

|

|

31,452 |

|

|

|

30,603 |

|

|

| Total operating expenses |

|

|

36,099 |

|

|

|

31,414 |

|

|

|

65,442 |

|

|

|

65,489 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income from

operations |

|

|

(2,922 |

) |

|

|

973 |

|

|

|

4,558 |

|

|

|

(2,199 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-operating income

(expenses), net |

|

|

1,418 |

|

|

|

60,120 |

|

|

|

(257 |

) |

|

|

59,659 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income before income

taxes |

|

|

(1,504 |

) |

|

|

61,093 |

|

|

|

4,301 |

|

|

|

57,460 |

|

|

| Income tax (benefit)

provision |

|

|

(75 |

) |

|

|

14,173 |

|

|

|

2,205 |

|

|

|

12,694 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income |

|

$ |

(1,429 |

) |

|

$ |

46,920 |

|

|

$ |

2,096 |

|

|

$ |

44,766 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to

non-controlling interests |

|

$ |

(1,237 |

) |

|

$ |

(867 |

) |

|

$ |

(1,661 |

) |

|

$ |

(3,889 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income attributable

to Amphastar |

|

$ |

(192 |

) |

|

$ |

47,787 |

|

|

$ |

3,757 |

|

|

$ |

48,655 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (loss) income per share

attributable to Amphastar shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.00 |

) |

|

$ |

1.01 |

|

|

$ |

0.08 |

|

|

$ |

1.04 |

|

|

|

Diluted |

|

$ |

(0.00 |

) |

|

$ |

0.96 |

|

|

$ |

0.08 |

|

|

$ |

0.97 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used to compute net (loss) income per share

attributable to Amphastar shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

46,753 |

|

|

|

47,107 |

|

|

|

46,581 |

|

|

|

46,925 |

|

|

|

Diluted |

|

|

46,753 |

|

|

|

49,894 |

|

|

|

48,458 |

|

|

|

50,155 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Table IIAmphastar

Pharmaceuticals, Inc.Condensed Consolidated

Balance Sheets(Unaudited; in thousands, except

share data)

| |

|

|

|

|

|

|

| |

|

June 30, |

|

December 31, |

| |

|

2020 |

|

|

2019 |

|

| |

|

(unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

87,388 |

|

|

$ |

73,685 |

|

|

Restricted cash |

|

|

1,865 |

|

|

|

1,865 |

|

|

Short-term investments |

|

|

11,101 |

|

|

|

11,675 |

|

|

Restricted short-term investments |

|

|

2,200 |

|

|

|

2,290 |

|

|

Accounts receivable, net |

|

|

49,862 |

|

|

|

45,376 |

|

|

Inventories |

|

|

104,726 |

|

|

|

110,501 |

|

|

Income tax refunds and deposits |

|

|

682 |

|

|

|

311 |

|

|

Prepaid expenses and other assets |

|

|

8,997 |

|

|

|

9,538 |

|

|

Total current assets |

|

|

266,821 |

|

|

|

255,241 |

|

|

|

|

|

|

|

|

|

| Property, plant, and

equipment, net |

|

|

238,236 |

|

|

|

233,856 |

|

| Finance lease right-of-use

assets |

|

|

774 |

|

|

|

887 |

|

| Operating lease right-of-use

assets |

|

|

17,086 |

|

|

|

18,805 |

|

| Goodwill and intangible

assets, net |

|

|

40,271 |

|

|

|

41,153 |

|

| Other assets |

|

|

12,635 |

|

|

|

11,156 |

|

| Deferred tax assets |

|

|

24,235 |

|

|

|

25,873 |

|

|

Total assets |

|

$ |

600,058 |

|

|

$ |

586,971 |

|

| |

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

75,385 |

|

|

$ |

77,051 |

|

|

Income taxes payable |

|

|

2,345 |

|

|

|

2,042 |

|

|

Current portion of long-term debt |

|

|

12,075 |

|

|

|

7,741 |

|

|

Current portion of operating lease liabilities |

|

|

3,481 |

|

|

|

3,175 |

|

|

Total current liabilities |

|

|

93,286 |

|

|

|

90,009 |

|

| |

|

|

|

|

|

|

| Long-term reserve for income

tax liabilities |

|

|

3,425 |

|

|

|

3,425 |

|

| Long-term debt, net of current

portion |

|

|

34,622 |

|

|

|

39,394 |

|

| Long-term operating lease

liabilities, net of current portion |

|

|

14,530 |

|

|

|

16,315 |

|

| Deferred tax liabilities |

|

|

760 |

|

|

|

867 |

|

| Other long-term

liabilities |

|

|

10,998 |

|

|

|

9,433 |

|

|

Total liabilities |

|

|

157,621 |

|

|

|

159,443 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

Preferred stock: par value $0.0001; 20,000,000 shares authorized;

no shares issued and outstanding |

|

|

— |

|

|

|

— |

|

|

Common stock: par value $0.0001; 300,000,000 shares authorized;

54,372,275 and 47,494,909 shares issued and outstanding as of June

30, 2020 and 52,495,483 and 46,576,968 shares issued and

outstanding as of December 31, 2019, respectively |

|

|

5 |

|

|

|

5 |

|

|

Additional paid-in capital |

|

|

396,841 |

|

|

|

367,305 |

|

|

Retained earnings |

|

|

120,127 |

|

|

|

116,370 |

|

|

Accumulated other comprehensive loss |

|

|

(5,173 |

) |

|

|

(4,687 |

) |

|

Treasury stock |

|

|

(114,119 |

) |

|

|

(97,627 |

) |

|

Total Amphastar Pharmaceuticals, Inc. stockholders’ equity |

|

|

397,681 |

|

|

|

381,366 |

|

|

Non-controlling interests |

|

|

44,756 |

|

|

|

46,162 |

|

|

Total equity |

|

|

442,437 |

|

|

|

427,528 |

|

|

Total liabilities and stockholders’ equity |

|

$ |

600,058 |

|

|

$ |

586,971 |

|

|

|

|

|

|

|

|

|

|

|

Table IIIAmphastar

Pharmaceuticals, Inc.Reconciliation of Non-GAAP

Measures(Unaudited; in thousands, except per share

data)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30, |

|

June 30, |

| |

|

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net (loss) income |

|

$ |

(1,429 |

) |

|

$ |

46,920 |

|

|

$ |

2,096 |

|

|

$ |

44,766 |

|

| Adjusted for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangible amortization |

|

|

251 |

|

|

|

256 |

|

|

|

509 |

|

|

|

526 |

|

|

Share-based compensation |

|

|

4,194 |

|

|

|

4,032 |

|

|

|

9,476 |

|

|

|

8,706 |

|

|

Impairment of long-lived assets |

|

|

16 |

|

|

|

46 |

|

|

|

30 |

|

|

|

183 |

|

|

Expense related to executive separation agreement |

|

|

4,869 |

|

|

|

— |

|

|

|

4,869 |

|

|

|

— |

|

|

Gain on litigation settlement |

|

|

— |

|

|

|

(59,900 |

) |

|

|

— |

|

|

|

(59,900 |

) |

|

Income tax (benefit) provision on pre-tax adjustments |

|

|

(1,445 |

) |

|

|

11,955 |

|

|

|

(2,449 |

) |

|

|

11,020 |

|

| Non-GAAP net income |

|

$ |

6,456 |

|

|

$ |

3,309 |

|

|

$ |

14,531 |

|

|

$ |

5,301 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net loss attributable

to non-controlling interests |

|

$ |

(1,154 |

) |

|

$ |

(808 |

) |

|

$ |

(1,462 |

) |

|

$ |

(3,701 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income

attributable to Amphastar |

|

$ |

7,610 |

|

|

$ |

4,117 |

|

|

$ |

15,993 |

|

|

$ |

9,002 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP net income per share

attributable to Amphastar shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.16 |

|

|

$ |

0.09 |

|

|

$ |

0.34 |

|

|

$ |

0.19 |

|

|

Diluted |

|

$ |

0.16 |

|

|

$ |

0.08 |

|

|

$ |

0.33 |

|

|

$ |

0.18 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used to compute non-GAAP net income per

share attributable to Amphastar shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

46,753 |

|

|

|

47,107 |

|

|

|

46,581 |

|

|

|

46,925 |

|

|

Diluted |

|

|

48,668 |

|

|

|

49,894 |

|

|

|

48,458 |

|

|

|

50,155 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Selling, |

|

General |

|

Research |

|

Non-operating |

|

Income |

|

Non-controlling |

| |

|

Cost of |

|

distribution |

|

and |

|

and |

|

income |

|

tax provision |

|

interest |

| |

|

revenue |

|

and marketing |

|

administrative |

|

development |

|

(expense), net |

|

(benefit) |

|

adjustment |

| GAAP |

|

$ |

52,629 |

|

|

$ |

4,026 |

|

|

$ |

15,924 |

|

|

$ |

16,149 |

|

|

$ |

1,418 |

|

$ |

(75 |

) |

|

$ |

(1,237 |

) |

| Intangible amortization |

|

|

(217 |

) |

|

|

— |

|

|

|

(34 |

) |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

11 |

|

| Share-based compensation |

|

|

(970 |

) |

|

|

(123 |

) |

|

|

(2,733 |

) |

|

|

(368 |

) |

|

|

— |

|

|

— |

|

|

|

86 |

|

| Impairment of long-lived

assets |

|

|

(3 |

) |

|

|

— |

|

|

|

(13 |

) |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

6 |

|

| Expense related to executive

separation agreement |

|

|

— |

|

|

|

— |

|

|

|

(4,869 |

) |

|

|

— |

|

|

|

— |

|

|

— |

|

|

|

— |

|

| Income tax provision (benefit)

on pre-tax adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

1,445 |

|

|

|

(20 |

) |

| Non-GAAP |

|

$ |

51,439 |

|

|

$ |

3,903 |

|

|

$ |

8,275 |

|

|

$ |

15,781 |

|

|

$ |

1,418 |

|

$ |

1,370 |

|

|

$ |

(1,154 |

) |

Reconciliation of Non-GAAP Measures

(continued)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, 2019 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Selling, |

|

General |

|

Research |

|

Non-operating |

|

Income |

|

Non-controlling |

| |

|

Cost of |

|

distribution |

|

and |

|

and |

|

income |

|

tax provision |

|

interest |

| |

|

revenue |

|

and marketing |

|

administrative |

|

development |

|

(expense), net |

|

(benefit) |

|

adjustment |

| GAAP |

|

$ |

46,660 |

|

|

$ |

2,992 |

|

|

$ |

12,426 |

|

|

$ |

15,996 |

|

|

$ |

60,120 |

|

|

$ |

14,173 |

|

|

$ |

(867 |

) |

| Intangible amortization |

|

|

(223 |

) |

|

|

— |

|

|

|

(33 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

11 |

|

| Share-based compensation |

|

|

(959 |

) |

|

|

(95 |

) |

|

|

(2,648 |

) |

|

|

(330 |

) |

|

|

— |

|

|

|

— |

|

|

|

56 |

|

| Impairment of long-lived

assets |

|

|

(43 |

) |

|

|

— |

|

|

|

(3 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1 |

|

| Gain on litigation

settlement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(59,900 |

) |

|

|

— |

|

|

|

— |

|

| Income tax (benefit) provision

on pre-tax adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11,955 |

) |

|

|

(9 |

) |

| Non-GAAP |

|

$ |

45,435 |

|

|

$ |

2,897 |

|

|

$ |

9,742 |

|

|

$ |

15,666 |

|

|

$ |

220 |

|

|

$ |

2,218 |

|

|

$ |

(808 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, 2020 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Selling, |

|

General |

|

Research |

|

Non-operating |

|

Income |

|

Non-controlling |

| |

|

Cost of |

|

distribution |

|

and |

|

and |

|

income |

|

tax provision |

|

interest |

| |

|

revenue |

|

and marketing |

|

administrative |

|

development |

|

(expense), net |

|

(benefit) |

|

adjustment |

| GAAP |

|

$ |

100,494 |

|

|

$ |

7,320 |

|

|

$ |

26,670 |

|

|

$ |

31,452 |

|

|

$ |

(257 |

) |

|

$ |

2,205 |

|

$ |

(1,661 |

) |

| Intangible amortization |

|

|

(441 |

) |

|

|

— |

|

|

|

(68 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

22 |

|

| Share-based compensation |

|

|

(2,329 |

) |

|

|

(230 |

) |

|

|

(5,952 |

) |

|

|

(965 |

) |

|

|

— |

|

|

|

— |

|

|

213 |

|

| Impairment of long-lived

assets |

|

|

(13 |

) |

|

|

— |

|

|

|

(17 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

7 |

|

| Expense related to executive

separation agreement |

|

|

— |

|

|

|

— |

|

|

|

(4,869 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

— |

|

| Income tax provision (benefit)

on pre-tax adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,449 |

|

|

(43 |

) |

| Non-GAAP |

|

$ |

97,711 |

|

|

$ |

7,090 |

|

|

$ |

15,764 |

|

|

$ |

30,487 |

|

|

$ |

(257 |

) |

|

$ |

4,654 |

|

$ |

(1,462 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, 2019 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Selling, |

|

General |

|

Research |

|

Non-operating |

|

Income |

|

Non-controlling |

| |

|

Cost of |

|

distribution |

|

and |

|

and |

|

income |

|

tax provision |

|

interest |

| |

|

revenue |

|

and marketing |

|

administrative |

|

development |

|

(expense), net |

|

(benefit) |

|

adjustment |

| GAAP |

|

$ |

95,547 |

|

|

$ |

6,133 |

|

|

$ |

28,753 |

|

|

$ |

30,603 |

|

|

$ |

59,659 |

|

|

$ |

12,694 |

|

|

$ |

(3,889 |

) |

| Intangible amortization |

|

|

(453 |

) |

|

|

— |

|

|

|

(73 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

22 |

|

| Share-based compensation |

|

|

(2,238 |

) |

|

|

(189 |

) |

|

|

(5,439 |

) |

|

|

(840 |

) |

|

|

— |

|

|

|

— |

|

|

|

150 |

|

| Impairment of long-lived

assets |

|

|

(65 |

) |

|

|

— |

|

|

|

(12 |

) |

|

|

(106 |

) |

|

|

— |

|

|

|

— |

|

|

|

49 |

|

| Gain on litigation

settlement |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(59,900 |

) |

|

|

— |

|

|

|

— |

|

| Income tax (benefit) provision

on pre-tax adjustments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11,020 |

) |

|

|

(33 |

) |

| Non-GAAP |

|

$ |

92,791 |

|

|

$ |

5,944 |

|

|

$ |

23,229 |

|

|

$ |

29,657 |

|

|

$ |

(241 |

) |

|

$ |

1,674 |

|

|

$ |

(3,701 |

) |

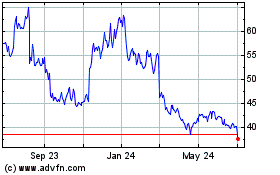

Amphastar Pharmaceuticals (NASDAQ:AMPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amphastar Pharmaceuticals (NASDAQ:AMPH)

Historical Stock Chart

From Apr 2023 to Apr 2024