LifeSci Special Opportunities Master Fund Ltd. (“LifeSci Special

Opportunities” or “we”), the holder of 96,976 shares of common

stock of Diffusion Pharmaceuticals Inc. (“Diffusion” or the

“Company”) (NASDAQ: DFFN), or approximately 4.8% of the Company’s

outstanding shares, today issued a statement in response to the

Company’s misleading press release from November 14, 2022 and

announced that it has nominated a slate of high quality director

candidates for election at the Company’s upcoming annual meeting to

be held on December 30, 2022 (the “2022 Annual Meeting”).

LifeSci Special Opportunities Statement

“The Company’s November 14, 2022 press release

announcing that its board of directors (the “Board”) has authorized

a review and evaluation of potential strategic opportunities

appears to have been deliberately timed in order to obscure prior

attempts by third parties, including LifeSci Capital LLC (“LS

Capital”), a commonly-owned affiliate of LifeSci Special

Opportunities, acting on behalf of its clients, to engage the Board

in discussions regarding potential strategic alternatives. The

Company’s press release endeavors to mislead stockholders regarding

the facts as to LS Capital’s efforts to constructively engage with

the Company on possible pathways to unlock significant value for

all of the Company’s stockholders.

Further, the announcement of the strategic

review process appears to be a desperate and thinly veiled effort

to distract stockholders and the market from the Company’s

failures, including the Board’s and management’s inability to

develop their lead asset, Trans Sodium Crocetinate (TSC), and the

catastrophic erosion of Diffusion’s cash balances and stockholder

value that has occurred under their leadership. We believe that

stockholders will be able to see through these transparent attempts

to deflect attention away from the Company’s operational and share

price underperformance, including the fact that the Company’s share

price has declined by approximately 78% from November 15, 2021 to

November 11, 2022.1

We encourage stockholders to review our proxy

materials as they become available, which will include additional

information regarding our concerns with the Company.”

Background Information

On October 17, 2022, on behalf of a client and

unaffiliated investor in the Company, LS Capital presented an

unsolicited offer to the Company to purchase 100% of the Company’s

outstanding common stock not already owned by its client for $6.58

per share in cash, which represented a 20% premium to the Company’s

closing stock price as of the close of business on Friday, October

13, 2022. The Company unceremoniously rejected the offer on October

25, 2022.

Since May 2022, LS Capital had attempted to

engage constructively with the Company on behalf of LS Capital’s

client to discuss potential strategic alternatives that LS Capital

believed would be in the Company’s best interest and unlock value

for all of the Company’s stockholders. Following LS Capital’s

initial contact, the Company ignored all attempts by LS Capital to

continue engaging for nearly four months until mid-September. With

the Board and management continuing to refuse to engage directly,

LS Capital had the opportunity to speak with an investor relations

firm representing the Company, and continued to request to speak

with Diffusion’s management. As a precursor to a call with

management, LS Capital discussed entering into a non-disclosure

agreement with the Company. However, the Company’s proposed

non-disclosure agreement was far from customary in LS Capital’s

experience and sought to impose a multi-year standstill and other

burdensome restrictions, which LS Capital viewed as a deliberate

and troubling attempt by the Board to disenfranchise stockholders

and further ensconce themselves in Diffusion’s failing business.

Ultimately, a call with the Company proceeded without a

non-disclosure agreement in place, and LS Capital shared its

thoughts with the Company on potential strategic options. Following

this call, the Company ceased engaging with LS Capital, refusing

requests for follow-up discussions and negotiations. Not

surprisingly, the Company’s behavior appears to be consistent with

its vague October 25, 2022 press release, which stated

“There is no timeline for this review and there

is no assurance that the Board’s review will result in any

transaction being consummated. Diffusion does not intend to comment

on the process or make further disclosures until it determines an

update is appropriate.”

LifeSci Special Opportunities, as a large

stockholder of the Company, is naturally concerned about the

Board’s motives and willingness to actually engage in substantive

conversations that, in our view, would result in the Company

achieving its stated goal of enhancing shareholder value. LifeSci

Special Opportunities is also concerned that the Company has not

held an annual meeting to elect directors in nearly 17 months,

which appears to be yet another entrenchment tactic by the Board to

maintain the status quo. When the 2022 Annual Meeting of

stockholders is finally held (assuming the Company does not delay

it again), it will be over 18 months since directors were elected

at the 2021 annual meeting of stockholders. Furthermore, it appears

the Company only announced that it would hold the 2022 Annual

Meeting as a reactive measure to external pressure, such as the

third party offer from LS Capital’s client, and did so with very

little notice, which prompted an accelerated timeline for

stockholders to provide notice of any nominations or business

proposals. The timing of the Company’s public announcement of its

strategic review process also seems to be only in response to the

unsolicited offer to acquire the Company rather than any genuine

initiative by leadership to take actions that are in the best

interest of Diffusion stockholders. We also question the

circumstances surrounding the recent and abrupt weekend-resignation

of one of the Company’s directors that was announced concurrently

with the Company’s misleading press release.

In LifeSci Special Opportunities’ view, these

are all clear and unfortunate symptoms of a reactive and troubled

Board that is trying to avoid being held accountable by its

stockholders.

The Urgent Need for Fresh Perspectives

Given the Board’s track record of overseeing

significant value destruction and seeming indifference towards the

Company’s stockholders, the true owners of the Company, we believe

it has become abundantly clear that the current Board and

management are not worthy stewards of our Company. We have serious

concerns about whether they can be trusted to run the strategic

review process, especially given their entrenchment tactics and the

timing of the stated commencement of the review process, which

appears to only have been undertaken in response to an unsolicited

offer.

While we are open to working constructively with

the Company, we do not intend to stand idly by and allow the Board

and management to continue unchecked on this path of value

destruction. To that end, we have nominated the following highly

qualified individuals for election at the 2022 Annual Meeting:

Jill Davidson

- Ms. Davidson has significant

expertise in the pharmaceutical industry and currently serves as

the President of Fast Scripts LLC, an early-stage medical service

provider to those recovering from opioid addiction

- Previously, Ms. Davidson served in

c-suite level roles at medical care providers Omnicare, Inc. and

Clasen Long Term Care Pharmacy. She was also the President of the

Missouri-Illinois Gateway Hemophilia Association and the Vice

President of the National Pharmacy Roundtable.

- Ms. Davidson is the Co-Manager of

SkiProp LLC and the Manager of Davidson LLC, which both own various

rental properties.

Tenzin Khangsar

- Mr. Khangsar is the Principal at

Snowlion Ventures, a Vancouver-based financial consulting firm, and

was previously an advisor to Deloitte Touche and a Managing

Director and Executive Vice President for RCI Capital Group.

- Mr. Khangsar has served as an

executive advisor for privately-held emerging growth companies and

publicly-traded corporations alike, advising on financial strategy

and execution and organizational infrastructure to support

governance matters, among which include Google LLC, Key, Empower

Clinics Inc. and Dapper Labs.

- Mr. Khangsar also previously served

in various government roles in Canada’s Office of the Prime

Minister and the Minister of Immigration, including as Chief of

Staff, and served as Honorary Counsel to the Government of

Mongolia, Chair of the Multicultural Advisory Committee of British

Columbia and Director and President of the Canada-India Business

Council.

- He also previously served on the

board of directors of Northstar Trade Finance, a financial services

provider, and Planterra, a non-profit dedicated to sustainable

community development through travel, and has significant

experience serving in executive roles at non-profit

organizations.

Jeffrey Kimbell

- Mr. Kimbell has extensive

experience in the healthcare industry as well as significant

advisory and government experience, and he currently serves as the

President of Jeffrey J. Kimbell & Associates, a client service

provider to the life sciences industry.

- Mr. Kimbell served on President

George W. Bush’s Transition Team Advisory Committee for the U.S.

Department of Health and Human Services.

- Previously, he served as Founding

Partner of Advyzom, LLC, a leading boutique consulting company

specializing in highly strategic regulatory and development advice

and services for the pharmaceutical and healthcare industries.

- Mr. Kimbell previously served as

the first Executive Director of the Medical Device Manufacturers

Association, one of the leading educational and advocacy

association advancing the interests of innovative and

entrepreneurial medical device manufacturers in the United

States.

Jessica M. Lockett

- Ms. Lockett currently serves as a

Partner at Lockett + Horwitz, PLC.

- Ms. Lockett has extensive knowledge

of the capital markets and securities laws, and as a corporate and

securities law attorney, she has experience representing public and

private companies at various stages of development with corporate

governance and securities matters, as well as advising on mergers

and acquisitions, financing, and fundraising activities.

- Ms. Lockett currently serves on the

board of directors of Ammo, Inc. (NASDAQ: POWW).

Jeffrey Max

- Mr. Max has extensive experience as

a c-suite level executive across a variety of industries. He

currently serves as the CEO of Ascent Solar Technologies, and

previously served as CEO of Agile Space Industries, Inc., Rezolve,

Inc., Venda, Inc. and WhiteLight Systems, Inc., and as President of

Powa Technologies, Inc.

- Mr. Max currently serves as a

director of Orbital Assembly Corporation.

- Mr. Max previously served as a

Managing Partner of La Plata Capital Partners, LLC, and as a Senior

Advisor to Liiv Group, two investment-based companies.

- Mr. Max also previously served as

Managing Director PLR Advisors, Ltd., a capital markets and

technology consulting firm, and Executive Vice President of

OptiMark Technologies Inc., a stock-trading technology

developer.

John Ziegler MD

- Dr. Ziegler is

currently the Chief Medical Officer of Promedim Ltd., a firm

specializing in the oversight of pharmaceutical clinical trials,

and also serves as the Managing Partner of Mountain Anesthesia PLLC

(d/b/a Premier Healthcare Partners).

- Dr. Ziegler has

served as a consultant to the pharmaceutical industry since 2012

and, in that capacity, has acted as the Medical Director of many

clinical trials and drug development programs for a number of

pharmaceutical companies and clinical research organizations, and

is also a Fellow of the American Society of Anesthesiologists.

- Dr. Ziegler

previously served on the board of directors of LifeSci Acquisition

Corp.

About LifeSci Special Opportunities

Master Fund Ltd.

Formed in 2021, LifeSci Special Opportunities is

a public investing arm of LifeSci Partners, a unique life sciences

and healthcare consultancy formed in 2010. The fund invests within

the public healthcare industry focusing on undervalued biotech and

pharmaceutical companies.

CERTAIN INFORMATION CONCERNING THE

PARTICIPANTS

LifeSci Special Opportunities Master Fund Ltd.,

a Cayman Islands exempted company (“LifeSci Special

Opportunities”), together with the other participants named herein

(collectively, “LifeSci”), intends to file a preliminary proxy

statement and accompanying universal proxy card with the Securities

and Exchange Commission (“SEC”) to be used to solicit votes in

connection with the 2022 annual meeting of stockholders of

Diffusion Pharmaceuticals Inc., a Delaware corporation (the

“Company”).

LIFESCI STRONGLY ADVISES ALL STOCKHOLDERS OF THE

COMPANY TO READ THE PROXY STATEMENT AND OTHER PROXY MATERIALS AS

THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT

INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON

THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, THE

PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE

PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS' PROXY

SOLICITOR.

The participants in the proxy solicitation are

anticipated to be LifeSci Special Opportunities, LifeSci Special

Opportunities Partners LP, a Delaware limited partnership (“LifeSci

Opportunities Partners”), LifeSci Special Opportunities Offshore

Fund, Ltd., a Cayman Islands exempted company (“LifeSci Offshore”),

LifeSci Special Opportunities Partners GP, LLC, a Delaware limited

liability company (“LifeSci GP”), LifeSci Management Company LLC, a

Delaware limited liability company (“LifeSci Management”), David

Dobkin, Jill Davidson, Tenzin Khangsar, Jeffrey Kimbell, Jessica M.

Lockett, Jeffrey Max and John S. Ziegler.

As of the date hereof, LifeSci Special

Opportunities beneficially owns 96,976 shares of common stock,

$0.001 par value per share, of the Company (the “Common Stock”).

LifeSci Opportunities Partners, as a feeder fund of LifeSci Special

Opportunities, may be deemed to beneficially own the 96,976 shares

of Common Stock beneficially owned by LifeSci Special

Opportunities. LifeSci Offshore, as a feeder fund of LifeSci

Special Opportunities, may be deemed to beneficially own the 96,976

shares of Common Stock beneficially owned by LifeSci Special

Opportunities. LifeSci GP, as the general partner of LifeSci

Special Opportunities, may be deemed to beneficially own the 96,976

shares of Common Stock beneficially owned by LifeSci Special

Opportunities. LifeSci Management, as the investment manager of

LifeSci Special Opportunities, may be deemed to beneficially own

the 96,976 shares of Common Stock beneficially owned by LifeSci

Special Opportunities. Mr. Dobkin, as managing member of each of

LifeSci GP and LifeSci Management, may be deemed to beneficially

own the 96,976 shares of Common Stock beneficially owned by LifeSci

Special Opportunities. As of the date hereof, none of Messes.

Davidson and Lockett or Messrs. Khangsar, Kimbell, Max and Ziegler

own beneficially or of record any securities of the Company.

1 Represents the date one trading day prior to

LifeSci Special Opportunities’ engagement with the Company becoming

public.

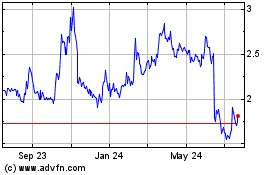

AMMO (NASDAQ:POWW)

Historical Stock Chart

From Mar 2024 to Apr 2024

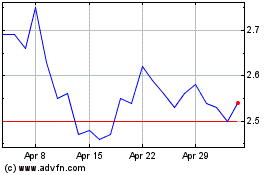

AMMO (NASDAQ:POWW)

Historical Stock Chart

From Apr 2023 to Apr 2024