Current Report Filing (8-k)

March 11 2021 - 5:11PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 11, 2021

AMMO,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-13101

|

|

83-1950534

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

7681

E. Gray Rd.

Scottsdale,

Arizona 85260

(Address

of principal executive offices)

(480)

947-0001

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $0.001 par value

|

|

POWW

|

|

The

Nasdaq Stock Market LLC (Nasdaq Capital Market)

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

8.01 Other Events.

On

March 11, 2021, Ammo, Inc. (the “Company”) issued a press release announcing a proposed underwritten public offering

of its common stock. A copy of this press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

As

previously disclosed in the notes to the Company’s financial statements filed with the Securities and Exchange Commission

(the “Commission”), the Company is a party to a First Amended and Restated Factoring and Security Agreement

(as amended, the “Factoring Agreement”), with Factors Southwest, LLC (“FSW”). FSW may purchase

from time to time the Company’s accounts receivables with recourse on an account by account basis. The Factoring Agreement

contains a maximum advance amount of $5,000,000 on 85% of eligible accounts and has an annualized interest rate of the Prime Rate

published from time to time by the Wall Street Journal plus 4.5%. The Factoring Agreement contains a fee of 3% ($150,000) of the

maximum facility assessed to the Company. Our obligations under this agreement are secured by present and future accounts receivables

and related assets, inventory, and equipment. The Company has the right to terminate the Factoring Agreement, with 30 days written

notice, upon obtaining a non-factoring credit facility. This agreement provides the Company with the ability to convert our accounts

receivables into cash. The Factoring Agreement has a maturity date of June 17, 2022. The foregoing description of the Factoring

Agreement is not complete and is qualified in its entirety by reference to the full text of the Factoring Agreement, which is

filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

As

previously disclosed in the notes to the Company’s financial statements filed with the Commission, the Company is a party

to a Revolving Inventory Loan and Security Agreement (as amended, the “Revolving Loan Agreement”),

with FSW. FSW has established a revolving credit line and makes loans from time to time to the Company for the purpose of providing

capital. The Revolving Loan Agreement has a maturity date of June 17, 2022, is secured by our inventory, among other assets, contains

a maximum loan amount of $2,250,000 on eligible inventory and has an annualized interest rate of the greater of the three-month

LIBOR rate plus 3.09% or 8%. The agreement contains a fee of 2% of the maximum loan amount ($45,000) assessed to the Company.

The foregoing description of the Revolving Loan Agreement is not complete and is qualified in its entirety by reference to the

full text of the Revolving Loan Agreement, which is filed as Exhibit 10.2 to this Current Report on Form 8-K and is incorporated

herein by reference

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

AMMO,

INC.

|

|

|

|

|

Dated:

March 11, 2021

|

By:

|

/s/

Robert D. Wiley

|

|

|

|

Robert

D. Wiley

|

|

|

|

Chief

Financial Officer

|

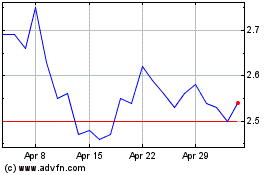

AMMO (NASDAQ:POWW)

Historical Stock Chart

From Mar 2024 to Apr 2024

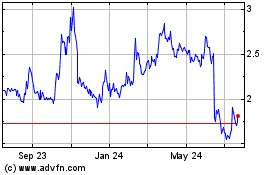

AMMO (NASDAQ:POWW)

Historical Stock Chart

From Apr 2023 to Apr 2024