Current Report Filing (8-k)

December 17 2020 - 5:15PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 14, 2020

AMMO,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-13101

|

|

83-1950534

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

7681

E. Gray Rd.

Scottsdale,

Arizona 85260

(Address

of principal executive offices)

(480)

947-0001

(Registrant’s

telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $0.001 par value

|

|

POWW

|

|

The

Nasdaq Stock Market LLC (Nasdaq Capital Market)

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.01 Entry into a Material Definitive Agreement.

On

December 14, 2020, Ammo, Inc., a Delaware corporation (the “Company”) entered into a Debt Conversion Agreement (the

“Agreement”) with Forest Street, LLC, an Arizona limited liability company (“Forest Street”), wholly owned

by Fred Wagenhals, the Company’s Chief Executive Officer. Pursuant to a previously disclosed September 23, 2020 promissory

note (the “Note”), the Company had owed the principal sum of Three Million Five Hundred Thousand & 00/100 Dollars

($3,500,000.00) to Forest Street with such principal accruing interest at 12% per annum. The Note has a maturity date of September

23, 2022 (“Maturity Date”).

Pursuant

to the Agreement, the Company and Forest Street agreed to convert Two Million One Hundred Thousand & 00/100 Dollars ($2,100,000.00)

of the Note’s principal into one million (1,000,000) shares of the Company’s common stock (the “Share Issuance”).

The Share Issuance occurred on December 15, 2020. As a result of the Agreement, the principal of the Note is now One Million

Four Hundred Thousand & 00/100 Dollars ($1,400,000.00) and the Maturity Date remains the same.

The

foregoing description of the Agreement is not complete and is qualified in its entirety by reference to the full text of the Agreement,

which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item

3.02. Unregistered Sales of Equity Securities.

The

disclosures set forth in Item 1.01 are incorporated into this Item 3.02 by reference.

The

Share Issuance was not registered under the Securities Act of 1933, as amended (the “Securities Act”), but qualified

for exemption under Section 4(a)(2) of the Securities Act. The securities were exempt from registration under Section 4(a)(2)

of the Securities Act because the issuance of such securities by the Company did not involve a “public offering,”

as defined in Section 4(a)(2) of the Securities Act, due to the insubstantial number of persons involved in the transaction, size

of the offering, manner of the offering and number of securities offered. The Company did not undertake an offering in which it

sold a high number of securities to a high number of investors. In addition, Forest Street had the necessary investment intent

as required by Section 4(a)(2) of the Securities Act since Forest Street agreed to, and received, the securities bearing a legend

stating that such securities are restricted pursuant to Rule 144 of the Securities Act. This restriction ensures that these securities

would not be immediately redistributed into the market and therefore not be part of a “public offering.” Based on

an analysis of the above factors, the Company has met the requirements to qualify for exemption under Section 4(a)(2) of the Securities

Act.

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements

of Certain Officers.

Effective

December 17, 2020, the Board of Directors (the “Board”) of the Company appointed Jessica M. Lockett as a member

of the Board. The Board determined that Ms. Lockett qualifies as independent under the director independence standards set forth

in the rules and regulations of the Securities and Exchange Commission and applicable NASDAQ listing standards.

There

is no arrangement or understanding between Ms. Lockett and any other persons pursuant to which Ms. Lockett was selected as a director,

and there are no related party transactions involving Ms. Lockett that are reportable under Item 404(a) of Regulation S-K. Ms.

Lockett will receive a director fee of $4,000 per month.

Ms.

Lockett was appointed to serve as Chair of the Board’s Audit Committee. The Board determined Ms. Lockett qualifies as a

“financially sophisticated audit committee member” as defined in the NASDAQ listing standards. In connection with

Ms. Lockett’s appointment, Robert J. Goodmanson resigned from his position on the Audit Committee to enable him to take

on a role with regard to the Company’s operations. Mr. Goodmanson remains a member of the Board.

Below

is a description of Ms. Lockett’s professional work experience.

Jessica

M. Lockett, Age 34, Director

Ms.

Lockett is a corporate and securities law attorney with a focus on representing public and private companies at various stages

of development with corporate governance and securities regulations compliance matters, including Securities Act and Exchange

Act reporting. Ms. Lockett also has experience in Mergers and Acquisitions, financing, fundraising activities, and going public

transactions. Ms. Lockett earned her J.D., cum laude, from Thomas Jefferson School of Law in 2012 and received the CALI and Witkin

Awards in Securities Regulations from Cal Western School of Law. Ms. Lockett graduated from the University of Arizona with a Bachelor

of Arts in Psychology with a law minor. Ms. Lockett has been an attorney with Horwitz + Armstrong, a Professional law corporation

since 2016, and operated her own legal practice prior to joining the firm. Ms. Lockett is an active member of the State Bar of

California.

Item

8.01 Other Events.

On

December 17, 2020, the Company issued a press release announcing the Agreement with Forest Street. A copy of these press release

is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

AMMO,

INC.

|

|

|

|

|

Dated:

December 17, 2020

|

By:

|

/s/

Robert D. Wiley

|

|

|

|

Robert

D. Wiley

|

|

|

|

Chief

Financial Officer

|

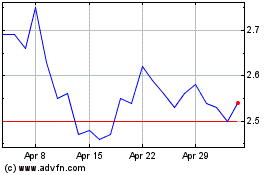

AMMO (NASDAQ:POWW)

Historical Stock Chart

From Mar 2024 to Apr 2024

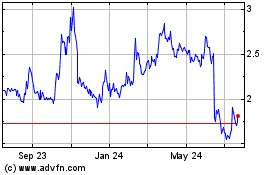

AMMO (NASDAQ:POWW)

Historical Stock Chart

From Apr 2023 to Apr 2024