Amgen Leans on Newer Drugs as Pandemic Hampers Demand

July 28 2020 - 4:31PM

Dow Jones News

By Micah Maidenberg

Amgen Inc. said the Covid-19 pandemic weighed on demand for a

number of its therapies as patients weren't able to visit doctors

but newer products helped it deliver both sales and volume

growth.

Overall, Amgen reported $6.21 billion in revenue for the second

quarter, up 6% compared with last year and slightly ahead of nearly

$6.2 billion that analysts expected for the period, according to

FactSet.

Volumes rose 13% year over year, helped by drugs such as Otezla,

a treatment for plaque psoriasis that Amgen acquired in November.

The drug generated $561 million in sales for the quarter, the

company said.

But sales and volumes for other Amgen products were hampered by

the coronavirus, which kept many people in the U.S. and other

markets at home starting this spring and out of doctors'

offices.

Lower interactions between patients and doctors as the

coronavirus spread has emerged as a challenge for companies focused

on health. Several big health-care companies, including insurer

Humana Inc. and Walgreens Boots Alliance Inc., have partnered on an

advertising campaign aimed at encouraging people to return to

medical providers.

"The pandemic interrupted many physician-patient interactions,

which led to delays in diagnosis and treatment with varying degrees

of impact across our portfolio," Amgen said Tuesday.

Sales of Enbrel, a medicine used to treat rheumatoid arthritis

and other conditions, fell 9% in the quarter to $1.25 billion amid

competition and due to the pandemic, Amgen said. Enbrel is the

company's biggest drug by sales.

Amgen reported second-quarter net income of $1.8 billion, or

$3.05 a share, down from $2.18 billion, or $3.57 a share, the year

earlier.

Operating expenses were up 22% in the quarter, as Amgen absorbed

Otezla, which it purchased last November for $13.4 billion from

Celgene Corp. as part of Celgene's merger Bristol-Myers Squibb Co.

Amgen said it recorded higher amortization expenses related to the

drug.

Earnings following adjustments rose to $4.25 a share for the

quarter and were ahead of the $3.82 a share consensus estimate.

Amgen also said Tuesday it is developing therapeutic antibodies

that may be complementary with other antibodies directed against

the coronavirus.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

July 28, 2020 16:16 ET (20:16 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

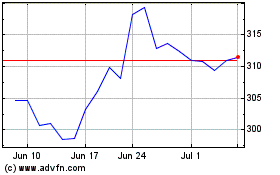

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Amgen (NASDAQ:AMGN)

Historical Stock Chart

From Apr 2023 to Apr 2024