|

|

SUMMARY

This summary highlights information contained in other parts of

this prospectus supplement. Because it is only a summary, it does

not contain all of the information that you should consider before

investing in shares of our common stock and it is qualified in its

entirety by, and should be read in conjunction with, the more

detailed information appearing elsewhere in this prospectus

supplement, the accompanying prospectus, any applicable free

writing prospectus and the documents incorporated by reference

herein and therein. You should read all such documents carefully,

especially the risk factors and our financial statements and the

related notes included or incorporated by reference herein or

therein, before deciding to buy shares of our common stock. Unless

the context requires otherwise, references in this prospectus to

“AREC,” the “Company,” “we,”

“us” and “our” refer to American Resources

Corporation.

Overview

We are

a producer of primarily high-quality, metallurgical coal in eastern

Kentucky. Through its wholly-owned subsidiary Quest Energy, AREC

has coal mining and coal processing operations substantially all

located in eastern Kentucky. A majority of our domestic and

international target customer base includes blast furnace steel

mills and coke plants, as well as international metallurgical coal

consumers, domestic electricity generation utilities, and other

industrial customers.

AREC

currently has six coal mining and processing operating

subsidiaries: McCoy Elkhorn Coal LLC (doing business as McCoy

Elkhorn Coal Company) (McCoy Elkhorn), Knott County Coal LLC (Knott

County Coal), Deane Mining, LLC (Deane Mining), Wyoming County Coal

LLC (Wyoming County), Perry County Resources LLC (Perry County),

and Quest Processing LLC (Quest Processing), all located in eastern

Kentucky and western West Virginia within the Central Appalachian

coal basin. The coal deposits under control by the Company are

generally comprise of metallurgical coal (used for steel making),

pulverized coal injections (used in the steel making process) and

high-BTU, low sulfur, low moisture bituminous coal used for a

variety of uses within several industries, including industrial

customers, and specialty products.

Current Production

We

achieved initial commercial production of metallurgical coal in

September 2016 from our McCoy Elkhorn Mine #15 and from our McCoy

Elkhorn Carnegie 1 Mine in March 2017. In October 2017 we achieved

commercial production of thermal coal from our Deane Mining Access

Energy Mine and from our Deane Mining Razorblade Surface Mine in

May 2018. We believe that we will be able to take advantage of

recent increases in U.S. and global benchmark metallurgical and

thermal coal prices and intend to opportunistically increase the

amount of our projected production that is directed to the export

market to capture favorable differentials between domestic and

global benchmark prices. We commenced operations of two out of six

of our internally owned preparation plants in July of 2016 (Bevins

#1 and Bevins #2 Prep Plants at McCoy Elkhorn), with a third

preparation plant commencing operation in October 2017 (Mill Creek

Prep Plant at Deane Mining). In late 2019 we acquired the Perry

County complex. In early 2020, we idled our mines and facilities

due to the adverse market effects Covid-19 global pandemic Pursuant

to the definitions in Paragraph (a) (4) of the Securities and

Exchange Commission's Industry Guide 7, our coal has not been

classified as either “proven” or “probable”

and as a result, do not have any “proven” or

“probable” reserves under such definition, and our

company and its business activities are deemed to be in the

exploration stage until mineral reserves are defined on our

properties.

Our Company Background

We

began our Company on October 2, 2013 and changed our name from

Natural Gas Fueling and Conversion Inc. to NGFC Equities, Inc. on

February 25, 2015, and then changed our name from NGFC Equities,

Inc. to American Resources Corporation on February 17, 2017. On

January 5, 2017, ARC executed a Share Exchange Agreement between

the Company and Quest Energy Inc., a private company incorporated

in the State of Indiana with offices at 9002 Technology Lane,

Fishers IN 46038, and due to the fulfillment of various conditions

precedent to closing of the transaction, the control of the Company

was transferred to the Quest Energy shareholders on February 7,

2017 resulting in Quest Energy becoming a wholly-owned subsidiary

of ARC. Our telephone number is (317) 855-9926 and our website

address is www.americanresourcescorp.com. Neither

our website nor any information contained on, or accessible

through, our website is part of this prospectus.

Implications of being an Emerging Growth Company

As a company with less than $1.07 billion in revenue during

our last fiscal year, we qualify as an “emerging growth

company” as defined in the Jumpstart Our Business Startups

Act of 2012, or the JOBS Act. For so long as we remain an emerging

growth company, we are permitted and intend to rely on exemptions

from specified disclosure requirements that are applicable to other

public companies that are not emerging growth companies. These

exemptions include:

●

not

being required to comply with the auditor attestation requirements

in the assessment of our internal control over financial

reporting;

●

not

being required to comply with any requirement that may be adopted

by the Public Company Accounting Oversight Board regarding

mandatory audit firm rotation or a supplement to the

auditor’s report providing additional information about the

audit and the financial statements;

●

reduced

disclosure obligations regarding executive compensation;

and

●

exemptions

from the requirements of holding a nonbinding advisory vote on

executive compensation and shareholder approval of any golden

parachute payments not previously approved.

|

|

|

|

We

may choose to take advantage of some, but not all, of the available

exemptions. We have taken advantage of some reduced reporting

burdens in this prospectus supplement, the accompanying prospectus

and the documents incorporated by reference herein and therein.

Accordingly, such information may be different than the information

you receive from other public companies in which you hold

stock.

In

addition, the JOBS Act provides that an emerging growth company can

take advantage of an extended transition period for complying with

new or revised accounting standards. This provision allows an

emerging growth company to delay the adoption of some accounting

standards until those standards would otherwise apply to private

companies. We have irrevocably elected not to avail ourselves of

this exemption from new or revised accounting standards and,

therefore, we will be subject to the same new or revised accounting

standards as other public companies that are not emerging growth

companies.

SUMMARY

OF OFFERING TERMS

|

|

|

|

|

|

|

Common Stock offered by the Company

|

5,200,000

shares of Common

Stock.

|

|

|

|

|

Offering price per share of Common Stock

|

$2.50

|

|

|

|

|

Common Stock outstanding immediately prior to this

offering(1)

|

31,838,495

shares

|

|

|

|

|

Common Stock to be outstanding immediately after this

offering(1)

|

37,038,495

shares.

|

|

|

|

|

Use of proceeds

|

We estimate that the net proceeds from this

offering will be approximately $12,090,000 after deducting Placement Agent commissions and

other estimated offering expenses payable by us. The Company will

use the proceeds of this offering to initiate coal production on

certain permits the Company owns, act upon certain acquisition

opportunities, particularly those that are in close proximity to

our current operations, capital expenditures, the repayment of

indebtedness outstanding, working capital, and other general

corporate purposes. We have not yet made final investment decisions

with respect to any of these potential projects and we cannot

currently allocate specific percentages of the net proceeds that we

may use for the purposes described

above.

|

|

|

|

|

Listing and trading symbol

|

“AREC”.

|

|

|

|

|

Risk factors

|

You should carefully read and consider the information set forth

under the heading “Risk Factors” and all other

information set forth in this prospectus before deciding to invest

in our common stock.

|

|

|

1)

The number of

shares of our Common Stock outstanding before and after the

completion of this Offering is based on 31,838,495 shares of our

Common Stock outstanding as of the date of this prospectus

supplement, and excludes the following: :

(a)

72,895 shares of

common stock issued on October 8, 2020 as the result of various

warrant exercises.

RISK

FACTORS

Investing in our securities involves a high degree of risk. Before

making an investment decision, you should carefully consider the

discussion of risks and uncertainties under the heading “Risk

Factors” contained in our Annual Report on Form 10-K for the

fiscal year ended December 31, 2019, which is incorporated by

reference in this prospectus supplement and the accompanying

prospectus, and under similar headings in our subsequently filed

quarterly reports on Form 10-Q and annual reports on Form 10-K, as

well as the other risks and uncertainties described in any

applicable free writing prospectus and in the other documents

incorporated by reference in this prospectus supplement and the

accompanying prospectus. See the sections entitled “Where You

Can Find More Information” and “Incorporation of

Certain Information by Reference” in this prospectus

supplement and the accompanying prospectus. The risks and

uncertainties we discuss in the documents incorporated by reference

in this prospectus are those we currently believe may materially

affect us. Additional risks and uncertainties not presently known

to us or that we currently believe are immaterial also may also

materially and adversely affect our business, financial condition

and results of operations.

|

|

Risks related to this offering

Management will have broad discretion as to the use of the proceeds

from this offering, and we may not use the proceeds

effectively.

Our management will have broad discretion with respect to the use

of proceeds of this offering, including for any of the purposes

described in the section of this prospectus supplement titled

“Use of Proceeds.” You will be relying on the judgment

of our management regarding the application of the proceeds of this

offering. The results and effectiveness of the use of proceeds are

uncertain, and we could spend the proceeds in ways that you do not

agree with or that do not improve our results of operations or

enhance the value of our common stock. Our failure to apply these

funds effectively could have a material adverse effect on our

business, delay the development of our product candidates and cause

the price of our common stock to decline.

You will experience immediate and substantial dilution in the net

tangible book value per share of the common stock you

purchase.

Since the public offering price for our common stock in this

offering is substantially higher than the net tangible book value

per share of our common stock outstanding prior to this offering,

you will suffer immediate and substantial dilution in the net

tangible book value of the common stock you purchase in this

offering. Based on the public offering price of $2.50

per share, investors purchasing shares

of common stock in this offering will incur an increase in net

tangible book value of .51 per

share in the as adjusted net tangible book value. See the section

titled “Dilution” below for a more detailed discussion

of the dilution you will incur if you purchase shares in this

offering.

Future sales of our common stock by us or our existing stockholders

could cause the market price of our common stock to decline

significantly, even if our business is doing well.

Sales of a substantial number of shares of our common stock in the

public market could occur at any time. These sales, or the

perception in the market that such sales may occur, could reduce

the market price of our common stock.

We, our executive officers and directors have entered

into lock-up agreements with the Placement Agent under

which we and they have agreed, subject to certain exceptions, not

to sell, directly or indirectly, any shares of our common stock

without the permission of the Placement Agent for a period

of one hundred eighty (180) days following the date of this prospectus

supplement. We refer to such period as

the lock-up period. When the lock-up period

expires, we, our executive officers and directors will be able to

sell shares of common stock in the public market, subject to

compliance with applicable securities laws restrictions. In

addition, the Placement Agent may, in their sole discretion,

release all or some portion of the shares of common stock subject

to lock-up agreements at any time and for any reason.

Sales of a substantial number of such shares of common stock upon

expiration of the lock-up or otherwise, the perception

that such sales may occur, or early release of these agreements,

could cause the market price of our common stock to fall or make it

more difficult for you to sell your common stock at a time and

price that you deem appropriate.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement (including any documents incorporated by

reference herein) contains statements with respect to us which

constitute “forward-looking statements” within the

meaning of Section 27A of the Securities Act, and Section 21E of

the Securities Exchange Act of 1934, as amended, and are intended

to be covered by the “safe harbor” created by those

sections. Forward-looking statements, which are based on certain

assumptions and reflect our plans, estimates and beliefs, can

generally be identified by the use of forward-looking terms such as

“believes,” “expects,” “may,”

“will,” “should,” “could,”

“seek,” “intends,” “plans,”

“estimates,” “anticipates” or other

comparable terms. These forward-looking statements include, but are

not limited to, statements concerning future events, our future

financial performance, business strategy and plans and objectives

of management for future operations. Our actual results could

differ materially from those discussed in the forward-looking

statements. Factors that could cause or contribute to these

differences include those discussed in “Risk Factors”

in this prospectus supplement and the documents incorporated by

reference herein.

We

caution readers not to place undue reliance upon any such

forward-looking statements, which speak only as of the date they

are made. We disclaim any obligation, except as specifically

required by law and the rules of the SEC, to publicly update or

revise any such statements to reflect any change in company

expectations or in events, conditions or circumstances on which any

such statements may be based, or that may affect the likelihood

that actual results will differ from those set forth in the

forward-looking statements.

You

should read this prospectus supplement, the accompanying

prospectus, and the documents that we incorporate by reference

herein and therein and have filed as exhibits to the registration

statement of which this prospectus supplement is part, completely

and with the understanding that our actual future results may be

materially different from what we expect. You should assume that

the information appearing in this prospectus supplement is accurate

as of the date on the cover of this prospectus supplement only. Our

business, financial condition, results of operations and prospects

may change. We may not update these forward-looking statements,

even though our situation may change in the future, unless we have

obligations under the federal securities laws to update and

disclose material developments related to previously disclosed

information. We qualify all of the information presented in this

prospectus supplement, and particularly our forward-looking

statements, by these cautionary statements.

USE OF PROCEEDS

We

estimate the proceeds to us before expenses from this offering will

be $13,000,000, based on a public offering price of $2.50 per share

of Common Stock. We estimate the total expenses of this offering

will be $910,000. We intend to use the net proceeds from this

offering to initiate coal production on certain permits the Company

owns, act upon certain acquisition opportunities, particularly

those that are in close proximity to our current operations,

capital expenditures, the repayment of indebtedness outstanding,

working capital, and other general corporate purposes. We have not

yet made final investment decisions with respect to any of these

potential projects and we cannot currently allocate specific

percentages of the net proceeds that we may use for the purposes

described above.

DILUTION

If you

invest in this offering, your ownership interest will be

immediately diluted to the extent of the difference between the

public offering price per share and the as adjusted net tangible

book value per share after giving effect to this offering. We

calculate net tangible book value per share by dividing the net

tangible book value, which is the total tangible assets less total

liabilities, by the number of outstanding shares of our common

stock. Dilution represents the difference between the portion of

the amount per share paid by purchasers of shares in this offering

and the as adjusted net tangible book value per share of our Common

Stock immediately after giving effect to this offering. Our net

tangible book value as of June 30, 2020 was approximately

$(34,487,887), or $(1.29) per share.

After

giving effect to the sale of 5,200,000 shares of common stock in

this offering at the public offering price of $2.50 per share, and

after deducting the Placement Agent commissions and estimated

offering expenses payable by us, our as adjusted net tangible book

value would have been approximately $(21,487,887) million, or

approximately $(0.78) per share of common stock, as of June 30,

2020. This represents an immediate increase in net tangible book

value of approximately $0.51 per share to existing stockholders and

an immediate increase in net tangible book value of approximately

$0.51 per share to new investors.

The

following table illustrates this per share dilution based on shares

outstanding as of June 30, 2020:

|

Public offering

price per share

|

$2.50

|

|

Historical net

tangible book value per share as of June 30, 2020

|

$(1.29)

|

|

Increase in net

tangible book value per share after this offering

|

$0.51

|

|

As-Adjusted Net

tangible book value per share as of June 30, 2020 after this

offering

|

$(0.78)

|

|

Dilution per share

to investors participating in this offering

|

$0.51

|

The

above discussion and table excludes the following as of June 30,

2020.

(a)

The

issuance of 22,714 shares of Class A Common Stock on September 18,

2020 pursuant to a conversion of $23,850.03 of convertible

debt

(b)

The

issuance of 1,794,164 shares of Class A Common Stock between July

6, 2020 and October 8, 2020 pursuant to warrant

exercises.

To the

extent that any of our outstanding options or warrants are

exercised or we issue additional shares of common stock in the

future, there will be further dilution to investors participating

in this offering.

CAPITALIZATION

The following table summarizes our capitalization

and cash and cash equivalents as of June 30, 2020 and our

capitalization as of June 30, 2020 on an as-adjusted basis, to take

into account the sale of 5,200,000 shares of Common Stock in this

offering at a public offering price of $2.50 per share. You should read the following table in

conjunction with “Use of Proceeds” in this prospectus

supplement and our consolidated financial statements and the notes

thereto incorporated by reference in this prospectus supplement and

the accompanying prospectus:

|

|

As of June 30,

2020 (unaudited)

|

|

|

|

|

|

Cash & Cash

Equivalents

|

$1,618,582

|

$14,618,582

|

|

|

|

|

|

Long Term

Debt

|

19,249,131

|

19,249,131

|

|

Reclamation

Liability

|

14,981,814

|

14,981,814

|

|

Total Long Term

Debt and Reclamation Liability:

|

$34,230,945

|

34,230,945

|

|

|

|

|

|

Class A Common

stock, $0.0001 par value, 230,000,000 shares authorized, 27,410,512

shares issued and outstanding

|

2,603

|

2,880

|

|

Additional paid in

capital

|

90,611,151

|

103,610,901

|

|

Accumulated

deficit

|

(125,101,641)

|

(125,101,641)

|

|

Total

stockholders’ equity (deficit)

|

(34,487,887)

|

(21,487,860)

|

|

Total

capitalization

|

(256,942)

|

12,683,085

|

The above discussion and table excludes the following as of June

30, 2020:

(a)

The

issuance of 22,714 shares of Class A Common Stock on September 18,

2020 pursuant to a conversion of $23,850.03 of convertible

debt

(b)

The

issuance of 1,794,164 shares of Class A Common Stock between July

6, 2020 and October 8, 2020 pursuant to warrant

exercises.

DESCRIPTION OF THE SECURITIES WE ARE OFFERING

General

As of the date of this prospectus, under our amended and restated

articles of incorporation, as amended, we have the authority to

issue 230,000,000 shares of Class A Common Stock, par value $0.0001

per share, and 5,000,000 shares of Series A Preferred stock, par

value $0.0001 per share. As of October 7, 2020, there were 31,838,495 shares of our Class

A Common Stock issued and outstanding and no shares of preferred

stock issued and outstanding.

We are offering 5,200,000 shares of our Common Stock.

Class A Common Stock

Each outstanding share of Common Stock entitles the holder to one

vote, either in person or by proxy, on all matters submitted to a

vote of stockholders, including the election of directors. There is

no cumulative voting in the election of directors. Subject to

preferences which may be applicable to any outstanding shares of

preferred stock from time to time, holders of our common stock have

equal ratable rights to such dividends as may be declared from time

to time by our Board of Directors out of funds legally available

therefor. In the event of any liquidation, dissolution or

winding-up of our affairs, holders of common stock will be entitled

to share ratably in our remaining assets after provision for

payment of amounts owed to creditors and preferences applicable to

any outstanding shares of preferred stock. All outstanding shares

of Common Stock are fully paid and nonassessable.

PLAN OF DISTRIBUTION

Kingswood

Capital Markets, division of Benchmark Investments, Inc., which we

refer to as the Placement Agent, has agreed to act as the placement

agent in connection with this offering. The Placement Agent is not

purchasing or selling shares of common stock offered by this

prospectus supplement, nor is the Placement Agent required to

arrange the purchase or sale of any specific number or dollar

amount of common stock, but has agreed to use its “reasonable

best efforts” to arrange for the sale of all of the common

stock offered hereby. We have entered into a securities purchase

agreement with the investors pursuant to which we will sell to the

investors 5,200,000 shares of common stock in this takedown from

our shelf registration statement. We negotiated the price for the

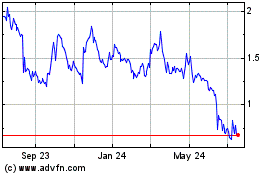

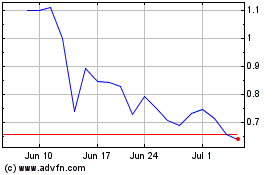

securities offered in this offering with the investors. The factors

considered in determining the price included the recent market

price of our common stock, the general condition of the securities

market at the time of this offering, the history of, and the

prospects, for the industry in which we compete, our past and

present operations, and our prospects for future

revenues.

We

entered into securities purchase agreements directly with investors

on October 7, 2020, and we will only sell to investors who have

entered into a securities purchase agreements.

We

expect to deliver the shares of common stock being offered pursuant

to this prospectus supplement on or about October 9, 2020, subject

to customary closing conditions.

We

have agreed to pay the Placement Agent a fee equal to the sum of

6.0% of the aggregate purchase price paid by the investors placed

by the Placement Agent. We have also agreed to reimburse the

Placement Agent up to $50,000 for the reasonable and accounted fees

and expenses of legal counsel.

The

following table shows per common stock and total cash Placement

Agent’s fees we will pay to the Placement Agent in connection

with the sale of the common stock pursuant to this prospectus

supplement and the accompanying prospectus assuming the purchase of

all of the common stock offered hereby:

|

|

|

|

|

Offering

Price

|

$2.50

|

13,000,000

|

|

Placement

Agent’s Fees

|

$0.15

|

780,000

|

|

Non-accountable

expense allowance (1%)

|

$0.025

|

130,000

|

|

Proceeds, before

expenses, to us

|

$2.325

|

12,030,000

|

As of the date of this prospectus, under our amended and restated

articles of incorporation, as amended, we have the authority to

issue 230,000,000 shares of Class A Common Stock, par value $0.0001

per share, and 5,000,000 shares of Series A Preferred stock, par

value $0.0001 per share. As of October 7, 2020, there were 31,838,495 shares of our Class

A Common Stock issued and outstanding and no shares of preferred

stock issued and outstanding.

Indemnification

We

have agreed to indemnify the Placement Agent and specified other

persons against certain civil liabilities, including liabilities

under the Securities Act, and the Securities Exchange Act of 1934,

as amended, or the Exchange Act, and to contribute to payments that

the placement agent may be required to make in respect of such

liabilities.

The

Placement Agent may be deemed to be an underwriter within the

meaning of Section 2(a)(11) of the Securities Act, and any

commissions received by it, and any profit realized on the resale

of the common stock and warrants sold by it while acting as

principal, might be deemed to be underwriting discounts or

commissions under the Securities Act. As an underwriter, the

placement agent would be required to comply with the Securities Act

and the Securities Exchange Act of 1934, as amended, or Exchange

Act, including without limitation, Rule 10b-5 and Regulation M

under the Exchange Act. These rules and regulations may limit the

timing of purchases and sales of common stock by the placement

agent acting as principal. Under these rules and regulations, the

Placement Agent:

●

may not engage in

any stabilization activity in connection with our securities;

and

●

may not bid for or

purchase any of our securities, or attempt to induce any person to

purchase any of our securities, other than as permitted under the

Exchange Act, until it has completed its participation in the

distribution in the securities offered by this prospectus

supplement.

Relationships

The

Placement Agent and its affiliates may have provided us and our

affiliates in the past and may provide from time to time in the

future certain commercial banking, financial advisory, investment

banking and other services for us and such affiliates in the

ordinary course of their business, for which they have received and

may continue to receive customary fees and commissions. In

addition, from time to time, the placement agent and its affiliates

may effect transactions for their own account or the account of

customers, and hold on behalf of themselves or their customers,

long or short positions in our debt or equity securities or loans,

and may do so in the future. However, except as disclosed in this

prospectus supplement, we have no present arrangements with the

placement agent for any further services.

Listing

Our

Common Stock is listed on the Nasdaq Capital Market under the

symbol “AREC”.

Transfer Agent and Registrar

The

transfer agent and registrar for our Common Stock is Vstock

Transfer, LLC located at 18 Lafayette Place Woodmere, NY 11598,

phone number 212-828-8436.

LEGAL MATTERS

The

validity of the securities offered hereby will be passed upon by

Law Office of Clifford J. Hunt, P.A. The law firm’s

principal, Clifford J. Hunt, Esquire, is the beneficial owner of

1,721 shares of our Common Stock. The Placement Agent is being

represented by Loeb & Loeb LLP, 345 Park Avenue, New York,

NY.

EXPERTS

The

consolidated financial statements of American Resources Corporation

as of December 31, 2019 and 2018 and for each of the years then

ended incorporated by reference in this prospectus and in the

registration statement of which this prospectus forms a part have

been so included in reliance on the report of MaloneBailey, LLP, an

independent registered public accounting firm, as set forth in

their report which is incorporated by reference in this prospectus

and elsewhere in the registration statement, given on the authority

of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We file

annual, quarterly and current reports, proxy statements and other

information with the SEC. Through our website at www.americanresourcescorp.com, you may

access, free of charge, our filings, as soon as reasonably

practical after we electronically file them with or furnish them to

the SEC. The information contained on, or accessible through, our

website is not incorporated by reference in, and is not a part of

this prospectus or any accompanying prospectus supplement. Our SEC

filings are also available to the public from the SEC’s

website at www.sec.gov.

This

prospectus is part of a registration statement on Form S-3 that we

filed with the SEC to register the securities to be offered hereby.

This prospectus does not contain all of the information included in

the registration statement, including certain exhibits and

schedules. You may obtain the registration statement and exhibits

to the registration statement from the SEC at the address listed

above or from the SEC’s website listed above.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC

allows us to incorporate by reference the information we file with

the SEC, which means that we can disclose important information to

you by referring you to those documents. The information that we

incorporate by reference is considered to be part of this

prospectus. Information that we file with the SEC in the future and

incorporate by reference in this prospectus automatically updates

and supersedes previously filed information as

applicable.

We

incorporate by reference into this prospectus the following

documents filed by us with the SEC, other than any portion of any

such documents that is not deemed “filed” under the

Exchange Act in accordance with the Exchange Act and applicable SEC

rules:

●

our Annual Report

on Form 10-K/A for the year ended December 31, 2019, filed with the

SEC on June 1, 2020;

●

our Quarterly

Report on Form 10-Q for the quarter ended March 31, 2020 filed with

the SEC on June 17, 2020;

●

our Quarterly

Report on Form 10-Q for the quarter ended June 30, 2020 filed with

the SEC on July 23, 2020;

●

our Current Reports

on Form 8-K or Form 8-K/A, filed on January 3, 2019, February 20,

2019, February 22, 2019, March 8, 2019, April 17, 2019, April 26,

2019, May 3, 2019, May 29, 2019June 5, 2019, June 11, 2019, June

14, 2019, June 17, 2019, June 18, 2019, June 27, 2019, July 22,

2019, August 13, 2019, August 21, 2019, August 27, 2019, September

6, 2019, September 9, 2019, September 13, 2019, September 25, 2019,

September 27, 2019, October 1, 2019, October 3, 2019, October 11,

2019, November 8, 2019, November 18, 2019, December 9, 2019,

December 31, 2019, January 15, 2020, January 28, 2020, February 24,

2020, March 6, 2020, March 13, 2020, March 23, 2020, March 27,

2020, April 2, 2020, April 2, 2020, April 8, 2020, April 13, 2020,

April 14, 2020, April 17, 2020, April 24, 2020, May 13, 2020, May

14, 2020, June 2, 2020, June 8, 2020, June 11, 2020, June 19, 2020,

July 6, 2020, July 8, 2020, July 20, 2020, July 24, 2020, August

10, 2020, September 17, 2020, October 1, 2020, and October 7,

2020;

●

the description of

our Common Stock contained in our registration statement on Form

8-A filed on February 14, 2019 pursuant to Section 12 of the

Exchange Act, including any subsequent amendment or report filed

for the purpose of updating that description.

In

addition, all documents subsequently filed by us pursuant to

Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the

termination of the offering, will be deemed to be incorporated

herein by reference and to be a part of this registration statement

from the date of filing of such documents.

This

prospectus does not, however, incorporate by reference any

documents or portions thereof, whether specifically listed above or

furnished by us in the future, that are not deemed

“filed” with the SEC, including information

“furnished” pursuant to Items 2.02, 7.01 and 9.01 of

Form 8-K.

Any

statement contained in a document incorporated or deemed to be

incorporated by reference herein shall be deemed to be modified or

superseded for purposes of this prospectus to the extent that a

statement contained herein or in any subsequently filed document

that is also incorporated by reference herein modifies or replaces

such statement. Any statements so modified or superseded shall not

be deemed, except as so modified or superseded, to constitute a

part of this prospectus.

Any

information incorporated by reference herein is available to you

without charge upon written or oral request. If you would like a

copy of any of this information, please submit your request to us

at the following address:

American

Resources Corporation

Attn:

Gregory Q. Jensen

9002

Technology Lane

Fishers,

IN 4038

(317)

855-9926

PROSPECTUS

AMERICAN RESOURCES CORPORATION

$100,000,000

Common Stock

Warrants

Units

————————————————————

We are

American Resources Corporation (“ARC” or the

“Company”), a corporation incorporated under the laws

of the State of Florida. This prospectus relates to the public

offer and sale of our Class A Common Stock, warrants and units that

we may offer and sell from time to time, in one or more series or

issuances and on terms that we will determine at the time of the

offering, any combination of the securities described in this

prospectus, up to an aggregate amount of $100,000,000.

This

prospectus provides you with a general description of the

securities we may offer and sell. We will provide specific terms of

any offering in a supplement to this prospectus. Any prospectus

supplement may also add, update, or change information contained in

this prospectus. You should carefully read this prospectus and the

applicable prospectus supplement, as well as the documents

incorporated by reference in this prospectus before you invest in

any of our securities.

We may

offer the securities from time through public or private

transactions, and in the case of our Common Stock, on or off the

Nasdaq Capital Market, at prevailing market prices or at privately

negotiate prices. These securities may be offered and sold in the

same offering or in separate offerings, to or through underwriters,

dealers and agents, or directly to purchasers. The names of any

underwriters, dealers, or agents involved in the sale of our

securities registered hereunder and any applicable fees,

commissions, or discounts will be described in the applicable

prospectus supplement. Our net proceeds from the sale of securities

will also be set forth in the applicable prospectus

supplement.

This

prospectus may not be used to consummate a sale of our securities

unless accompanied by the applicable prospectus

supplement.

Our

Common Stock is listed on the Nasdaq Capital Market under the

symbol “AREC”.

As of

April 5, 2019, the aggregate market value of our outstanding Common

Stock held by non-affiliates was approximately $47,912,448, which

was calculated based on 11,629,235 shares of outstanding Common

Stock held by non-affiliates and on a price per share of $4.12, the

closing price of our Common Stock on April 5, 2019. Pursuant to

General Instruction I.B.6 of Form S-3, in no event will we sell the

shelf securities in a public primary offering with a value

exceeding more than one-third of the aggregate market value of our

Common Stock held by non-affiliates in any 12-month period so long

as the aggregate market value of our outstanding Common Stock held

by non-affiliates remains below $75 million. During the 12 calendar

months prior to and including the date of this prospectus, we have

not offered or sold any securities pursuant to General Instruction

I.B.6 of Form S-3.

Investing

in our securities involves a high degree of risk. See “Risk

Factors” beginning on page 1 of this prospectus for a

discussion of information that should be considered in connection

with an investment in our securities.

————————————————————

Neither

the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or

passed upon the adequacy or accuracy of this prospectus. Any

representation to the contrary is a criminal offense.

The date of this prospectus is June 4, 2019.

TABLE OF CONTENTS

|

|

|

|

|

Page

|

|

|

|

|

ABOUT

THIS PROSPECTUS

|

vi

|

|

RISK

FACTORS

|

1

|

|

FORWARD-LOOKING

STATEMENTS

|

1

|

|

OUR

COMPANY

|

2

|

|

DILUTION

|

3

|

|

USE OF

PROCEEDS

|

3

|

|

DESCRIPTION

OF CLASS A COMMON STOCK

|

3

|

|

DESCRIPTION

OF WARRANTS

|

7

|

|

DESCRIPTION

OF UNITS

|

10

|

|

PLAN

OF DISTRIBUTION

|

11

|

|

LEGAL

MATTERS

|

13

|

|

EXPERTS

|

13

|

|

WHERE

YOU CAN FIND MORE INFORMATION

|

13

|

|

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

|

13

|

ABOUT THIS PROSPECTUS

This

prospectus is part of a registration statement that we filed with

the Securities and Exchange Commission, or the SEC, utilizing a

“shelf” registration process. Under this shelf

registration process, we may sell the securities described in this

prospectus in one or more offerings, up to a total dollar amount of

$100,000,000. This prospectus provides you with general information

regarding the securities we may offer. We will provide a prospectus

supplement that contains specific information about any offering by

us with respect to the securities registered

hereunder.

The

prospectus supplement also may add, update, or change information

contained in the prospectus. You should read both this prospectus

and the prospectus supplement related to any offering as well as

additional information described under the headings “Where

You Can Find More Information” and “Incorporation of

Certain Information by Reference.”

We are

offering to sell, and seeking offers to buy, securities only in

jurisdictions where offers and sales are permitted. The information

contained in this prospectus and in any accompanying prospectus

supplement is accurate only as of the dates set forth on their

respective covers, regardless of the time of delivery of this

prospectus or any prospectus supplement or of any sale of our

securities. Our business, financial condition, results of

operations, and prospects may have changed since those dates. We

have not authorized anyone to provide you with information

different from that contained or incorporated by reference in this

prospectus or any accompanying prospectus supplement or any

“free writing prospectus.” You should rely only on the

information contained or incorporated by reference in this

prospectus or any accompanying prospectus supplement or related

“free writing prospectus.” To the extent there is a

conflict between the information contained in this prospectus and

the prospectus supplement, you should rely on the information in

the prospectus supplement, provided that if any statement in one of

these documents is inconsistent with a statement in another

document having a later date — for example, a document

incorporated by reference into this prospectus or any prospectus

supplement — the statement in the document having the later

date modifies or supersedes the earlier statement.

Unless

the context otherwise requires, the terms “Company,”

“we,” “us,” or “our” refer to

American Resources Corporation, a Florida corporation, and its

consolidated subsidiaries.

Investing in our

securities involves a high degree of risk. Before making an

investment decision, you should carefully consider the discussion

of risks and uncertainties under the heading “Risk

Factors” contained in our Annual Report on Form 10-K for the

fiscal year ended December 31, 2018, which is incorporated by

reference in this prospectus, and under similar headings in our

subsequently filed quarterly reports on Form 10-Q and annual

reports on Form 10-K, as well as the other risks and uncertainties

described in any applicable prospectus supplement or free writing

prospectus and in the other documents incorporated by reference in

this prospectus. See the sections entitled “Where You Can

Find More Information” and “Incorporation of Certain

Information by Reference” in this prospectus. The risks and

uncertainties we discuss in the documents incorporated by reference

in this prospectus are those we currently believe may materially

affect us. Additional risks and uncertainties not presently known

to us or that we currently believe are immaterial also may also

materially and adversely affect our business, financial condition

and results of operations.

FORWARD-LOOKING STATEMENTS

This

prospectus, any applicable prospectus supplement and the documents

and information incorporated by reference herein and therein may

contain “forward-looking statements.” Forward-looking

statements may include, but are not limited to, statements relating

to our objectives, plans and strategies as well as statements,

other than historical facts, that address activities, events, or

developments that we intend, expect, project, believe or anticipate

will or may occur in the future. These statements are often

characterized by terminology such as “may,”

“will,” “should,” “expects,”

“plans,” “anticipates,”

“could,” “intends,” “target,”

“projects,” “contemplates,”

“believes,” “estimates,”

“predicts,” “potential,” “goal”

or “continue” or the negative of these terms or other

similar expressions.

Forward-looking

statements are based on assumptions and assessments made in light

of our experience and perception of historical trends, current

conditions, expected future developments and other factors believed

to be appropriate. Forward-looking statements are not guarantees of

future performance and are subject to risks and uncertainties, many

of which are outside of our control. You should not place undue

reliance on these forward-looking statements, which reflect our

view only as of the date of this prospectus, and we undertake no

obligation to update these forward-looking statements in the

future, except as required by applicable law.

Factors

could cause actual results to differ materially from those

indicated by the forward-looking statements include those factors

described under the caption “Risk Factors” in our

Annual Report on Form 10-K for the fiscal year ended December 31,

2018, which is incorporated by reference in this prospectus, and

under similar headings in our subsequently filed quarterly reports

on Form 10-Q and annual reports on Form 10-K, as well as the other

risks and uncertainties described in any applicable prospectus

supplement or free writing prospectus and in the other documents

incorporated by reference in this prospectus.

OUR COMPANY

Overview

We are

a producer of primarily high-quality, metallurgical coal in eastern

Kentucky. We began our Company on October 2, 2013 and changed our

name from Natural Gas Fueling and Conversion Inc. to NGFC Equities,

Inc. on February 25, 2015, and then changed our name from NGFC

Equities, Inc. to American Resources Corporation on February 17,

2017. On January 5, 2017, ARC executed a Share Exchange Agreement

between the Company and Quest Energy Inc., a private company

incorporated in the State of Indiana with offices at 9002

Technology Lane, Fishers IN 46038, and due to the fulfillment of

various conditions precedent to closing of the transaction, the

control of the Company was transferred to the Quest Energy

shareholders on February 7, 2017 resulting in Quest Energy becoming

a wholly-owned subsidiary of ARC. Through its wholly-owned

subsidiary Quest Energy, which is an Indiana corporation founded in

June 2015, ARC was able to acquire coal mining and coal processing

operations, substantially all located in eastern Kentucky. A

majority of our domestic and international target customer base

includes blast furnace steel mills and coke plants, as well as

international metallurgical coal consumers, domestic electricity

generation utilities, and other industrial customers.

ARC

currently has six coal mining and processing operating

subsidiaries: McCoy Elkhorn Coal LLC (doing business as McCoy

Elkhorn Coal Company) (McCoy Elkhorn), Knott County Coal LLC (Knott

County Coal), Deane Mining, LLC (Deane Mining) and Wyoming County

Coal LLC (Wyoming County), Quest Processing LLC (Quest Processing)

located in eastern Kentucky and western West Virginia within the

Central Appalachian coal basin, and ERC Mining Indiana Corporation

(ERC) located in southwest Indiana within the Illinois coal basin.

The coal deposits under control by the Company are generally

comprise of metallurgical coal (used for steel making), pulverized

coal injections (used in the steel making process) and high-BTU,

low sulfur, low moisture bituminous coal used for a variety of uses

within several industries, including industrial customers,

specialty products and thermal coal used for electricity

generation.

Current Production

We

achieved initial commercial production of metallurgical coal in

September 2016 from our McCoy Elkhorn Mine #15 and from our McCoy

Elkhorn Carnegie 1 Mine in March 2017. In October 2017 we achieved

commercial production of thermal coal from our Deane Mining Access

Energy Mine and from our Deane Mining Razorblade Surface Mine in

May 2018. We believe that we will be able to take advantage of

recent increases in U.S. and global benchmark metallurgical and

thermal coal prices and intend to opportunistically increase the

amount of our projected production that is directed to the export

market to capture favorable differentials between domestic and

global benchmark prices. The Company commenced operations of two

out of four of its internally owned preparation plants in July of

2016 (Bevins #1 and Bevins #2 Prep Plants at McCoy Elkhorn), with a

third preparation plant commencing operation in October 2017 (Mill

Creek Prep Plant at Deane Mining). Pursuant to the definitions in

Paragraph (a) (4) of the Securities and Exchange Commission's

Industry Guide 7, our coal has not been classified as either

“proven” or “probable” and as a result, do

not have any “proven” or “probable”

reserves under such definition, and our company and its business

activities are deemed to be in the exploration stage until mineral

reserves are defined on our properties.

Our Company Background

We

began our Company on October 2, 2013 and changed our name from

Natural Gas Fueling and Conversion Inc. to NGFC Equities, Inc. on

February 25, 2015, and then changed our name from NGFC Equities,

Inc. to American Resources Corporation on February 17, 2017. On

January 5, 2017, ARC executed a Share Exchange Agreement between

the Company and Quest Energy Inc., a private company incorporated

in the State of Indiana with offices at 9002 Technology Lane,

Fishers IN 46038, and due to the fulfillment of various conditions

precedent to closing of the transaction, the control of the Company

was transferred to the Quest Energy shareholders on February 7,

2017 resulting in Quest Energy becoming a wholly-owned subsidiary

of ARC. Our telephone number is (317) 855-9926 and our website

address is www.americanresourcescorp.com. Neither

our website nor any information contained on, or accessible

through, our website is part of this prospectus.

DILUTION

We will

set forth in a prospectus supplement the following information

regarding any material dilution of the equity interests of

investors purchasing securities in an offering under this

prospectus and the related prospectus supplement:

●

the net tangible

book value per share of our equity securities before and after the

offering;

●

the amount of the

increase in such net tangible book value per share attributable to

the cash payments made by purchasers in the offering;

and

●

the amount of the

immediate dilution from the public offering price which will be

absorbed by such purchasers.

USE OF PROCEEDS

Except

as may be otherwise set forth in any prospectus supplement

accompanying this prospectus, we will use the net proceeds we

receive from sales of securities offered hereby for general

corporate purposes, which may include capital expenditures,

acquisitions, the repayment of indebtedness outstanding from time

to time and for working capital, and repurchases of our Common

Stock or other securities. When specific securities are offered,

the prospectus supplement relating thereto will set forth our

intended use of the net proceeds that we receive from the sale of

such securities.

DESCRIPTION OF COMMON STOCK

This

section describes the general terms of our Class A Common Stock,

par value $0.0001 per share, which may also be referred to herein

as “Common Stock”. A prospectus supplement may provide

information that is different from this prospectus. If the

information in the prospectus supplement with respect to our Common

Stock being offered differs from this prospectus, you should rely

on the information in the prospectus supplement. A copy of our

amended and restated articles of incorporation, as amended, has

been incorporated by reference from our filings with the SEC as an

exhibit to the registration statement of which this prospectus

forms a part. Our Common Stock and the rights of the holders of our

Common Stock are subject to the applicable provisions of the

Florida Business Corporation Act, which we sometimes refer to in

this section as “Florida law,” our amended and restated

articles of incorporation, as amended, our bylaws, the rights of

the holders of our preferred stock, if any, and the agreements

described below.

Under

our amended and restated articles of incorporation, as amended, we

have the authority to issue 230,000,000 shares of Common Stock, par

value $0.0001 per share, and 30,000,000 shares of preferred stock,

par value $0.0001 per share. As of March 31, 2019, there were

23,316,197 shares of our Common Stock issued and outstanding and no

shares of preferred stock issued and outstanding.

Effective

January 18, 2017, we amended our articles of incorporation to

create a new Series A Preferred Stock. Effective February 20, 2017,

we amended our articles of incorporation to change our name to

American Resources Corporation. Effective March 21, 2017, we

amended our articles of incorporation to create a new Series B

Preferred Stock. Effective November 8, 2018 we amended our articles

of incorporation to create a new Series C Preferred Stock and

modify the Series A Preferred Stock voting ratio.

The

table below presents earnings per share as previously reported in

our Annual Report on Form 10-K for the year ended December 31,

2018.

|

|

|

|

|

|

|

|

Earnings Per

Share

|

|

|

|

Basic and

diluted:

|

|

|

|

As previously

reported

|

$(3.69)

|

$(16.39)

|

The

following description of our Common Stock, and any description of

our Common Stock in a prospectus supplement, may not be complete

and is subject to, and qualified in its entirety by reference to,

Florida law and the actual terms and provisions contained in our

amended and restated articles of incorporation and our bylaws, each

as amended from time to time.

Voting Rights

The

holders of our Common Stock are generally entitled to one vote for

each share held on all matters submitted to a vote of the

shareholders and do not have any cumulative voting rights. Unless

otherwise required by Florida law, once a quorum is present,

matters presented to shareholders, except for the election of

directors, will be approved by a majority of the votes cast. The

election of directors is determined by a plurality of the votes

cast.

Dividends

Holders

of our Common Stock are entitled to receive dividends if, as and

when declared by the board of directors, or the Board, out of funds

legally available for that purpose, subject to preferences that may

apply to any preferred stock that we issue.

Liquidation Rights

In the

event of our dissolution or liquidation, after satisfaction of all

our debts and liabilities and distributions to the holders of any

preferred stock that we may issue in the future, of amounts to

which they are preferentially entitled, the holders of Common Stock

will be entitled to share ratably in the distribution of assets to

the shareholders.

Other Provisions

There

are no cumulative, subscription or preemptive rights to subscribe

for any additional securities which we may issue, and there are no

redemption provisions, conversion provisions or sinking fund

provisions applicable to the Common Stock. The rights of holders of

Common Stock are subject to the rights, privileges, preferences and

priorities of any class or series of preferred stock that may be

issued in the future.

Our

amended and restated articles of incorporation, as amended, and

bylaws do not restrict the ability of a holder of our Common Stock

to transfer his or her shares of our Common Stock.

Shares of Common Stock Reserved for Issuance

As of

March 31, 2019, we had reserved for issuance:

●

an aggregate of

5,957,557 shares of our Common Stock issuable upon the exercise of

outstanding warrants and employee options;

Preferred Stock

Under

our amended and restated articles of incorporation, as amended, we

are authorized to issue up to 30,000,000 shares of preferred stock,

par value $0.0001 per share, in one or more series. We are

authorized to issue preferred stock with such designation, rights

and preferences as may be determined from time to time by our

Board. Accordingly, the Board is empowered, without shareholder

approval, to issue preferred stock with dividend, liquidation,

conversion, voting or other rights which could adversely affect the

voting power or other rights of the holders of our Common Stock

and, in certain instances, could adversely affect the market price

of our Common Stock. As of March 31, 2019, there are no shares of

preferred stock issued or outstanding.

Series A Preferred Stock

On

January 18, 2017, we designated 5,000,000 shares of preferred stock

as Series A Preferred Stock, par value $0.0001 per share, which may

be issued from time to time by the board of directors. As of March

31, 2019, there are no shares of Series A Preferred stock issued or

outstanding.

Series C Preferred Stock

On

November 8, 2018, we designated 20,000,000 shares of preferred

stock as Series C Preferred Stock, par value $0.0001 per share,

which may be issued from time to time by the board of directors. As

of March 31, 2019, there are no shares of Series C Preferred stock

issued or outstanding.

Anti-takeover Effects of our Amended and Restated Articles of

Incorporation and Bylaws

As

described above, our amended and restated articles of

incorporation, as amended, provide that our Board may issue

preferred stock with such designation, rights and preferences as

may be determined from time to time by our Board. Our preferred

stock could be issued quickly and utilized, under certain

circumstances, as a method of discouraging, delaying or preventing

a change in control of the Company or make removal of management

more difficult. Our amended and restated articles of incorporation,

as amended, and our bylaws provide that special meetings may be

called only by a unanimous vote of the Board.

Florida Anti-Takeover Statute

As a

Florida corporation, we are subject to certain anti-takeover

provisions that apply to public corporations under Florida law.

Pursuant to Section 607.0901 of the Florida Business Corporation

Act, a publicly held Florida corporation may not engage in a broad

range of business combinations or other extraordinary corporate

transactions with an interested shareholder without the approval of

the holders of two-thirds of the voting shares of the corporation

(excluding shares held by the interested shareholder),

unless:

●

the transaction is

approved by a majority of disinterested directors before the

shareholder becomes an interested shareholder;

●

the interested

shareholder has owned at least 80% of the corporation’s

outstanding voting shares for at least five years preceding the

announcement date of any such business combination;

●

the interested

shareholder is the beneficial owner of at least 90% of the

outstanding voting shares of the corporation, exclusive of shares

acquired directly from the corporation in a transaction not

approved by a majority of the disinterested directors;

or

●

the consideration

paid to the holders of the corporation’s voting stock is at

least equal to certain fair price criteria.

An

interested shareholder is defined as a person who together with

affiliates and associates beneficially owns more than 10% of a

corporation’s outstanding voting shares. We have not made an

election in our amended and restated articles of incorporation, as

amended, to opt out of Section 607.0901.

In

addition, we are subject to Section 607.0902 of the Florida

Business Corporation Act, which prohibits the voting of shares in a

publicly held Florida corporation that are acquired in a control

share acquisition unless (i) our Board approved such acquisition

prior to its consummation or (ii) after such acquisition, in lieu

of prior approval by our Board, the holders of a majority of the

corporation’s voting shares, exclusive of shares owned by

officers of the corporation, employee directors or the acquiring

party, approve the granting of voting rights as to the shares

acquired in the control share acquisition. A control share

acquisition is defined as an acquisition that immediately

thereafter entitles the acquiring party to 20% or more of the total

voting power in an election of directors.

Indemnification

Both

our amended and restated articles of incorporation, as amended, and

bylaws provide for indemnification of our directors and officers to

the fullest extent permitted by Florida law.

Listing

Our

Common Stock is listed on the Nasdaq Capital Market under the

symbol “AREC”.

Transfer Agent and Registrar

The

transfer agent and registrar for our Common Stock is Vstock

Transfer, LLC located at 18 Lafayette Place Woodmere, NY 11598,

phone number 212-828-8436.

DESCRIPTION OF WARRANTS

General

We may

issue warrants to purchase shares of Common Stock. The warrants may

be issued independently or together with shares of Common Stock

offered by this prospectus and may be attached to or separate from

those shares of Common Stock.

While

the terms we have summarized below will generally apply to any

future warrants we may offer under this prospectus, we will

describe the particular terms of any warrants that we may offer in

more detail in the applicable prospectus supplement. The terms of

any warrants we offer under a prospectus supplement may differ from

the terms we describe below.

We may

issue the warrants under a warrant agreement, which we will enter

into with a warrant agent to be selected by us. Each warrant agent

will act solely as our agent under the applicable warrant agreement

and will not assume any obligation or relationship of agency or

trust with any holder of any warrant. A single bank or trust

company may act as warrant agent for more than one issue of

warrants. A warrant agent will have no duty or responsibility in

case of any default by us under the applicable warrant agreement or

warrant, including any duty or responsibility to initiate any

proceedings at law or otherwise, or to make any demand upon us. Any

holder of a warrant may, without the consent of the related warrant

agent or the holder of any other warrant, enforce by appropriate

legal action its right to exercise, and receive the Common Stock

purchasable upon exercise of, its warrants.

We will

incorporate by reference into the registration statement of which

this prospectus forms a part the form of warrant agreement,

including a form of warrant certificate, that describes the terms

of the series of warrants we are offering before the issuance of

the related series of warrants. The following summaries of material

provisions of the warrants and the warrant agreements are subject

to, and qualified in their entirety by reference to, all the

provisions of the warrant agreement applicable to a particular

series of warrants. We urge you to read the applicable prospectus

supplements related to the warrants that we sell under this

prospectus, as well as the complete warrant agreements that contain

the terms of the warrants.

We will

set forth in the applicable prospectus supplement the terms of the

warrants in respect of which this prospectus is being delivered,

including, when applicable, the following:

●

the title of the

warrants;

●

the aggregate

number of the warrants;

●

the price or prices

at which the warrants will be issued;

●

the designation,

number, and terms of shares of Common Stock purchasable upon

exercise of the warrants;

●

the date, if any,

on and after which the warrants and the related Common Stock will

be separately transferable;

●

the price at which

each share of Common Stock purchasable upon exercise of the

warrants may be purchased;

●

the date on which

the right to exercise the warrants will commence and the date on

which such right will expire;

●

the minimum or

maximum amount of the warrants that may be exercised at any one

time;

●

any information

with respect to book-entry procedures;

●

the effect of any

merger, consolidation, sale, or other disposition of our business

on the warrant agreement and the warrants;

●

any other terms of

the warrants, including terms, procedures, and limitations relating

to the transferability, exchange, and exercise of such

warrants;

●

the terms of any

rights to redeem or call, or accelerate the expiration of, the

warrants;

●

the date on which

the right to exercise the warrants begins and the date on which

that right expires;

●

the material U.S.

federal income tax consequences of holding or exercising the

warrants; and

●

any other specific

terms, preferences, rights, or limitations of, or restrictions on,

the warrants.

Unless

specified in an applicable prospectus supplement, warrants will be

in registered form only.

A

holder of warrant certificates may exchange them for new

certificates of different denominations, present them for

registration of transfer, and exercise them at the corporate trust

office of the warrant agent or any other office indicated in the

applicable prospectus supplement. Until any warrants are exercised,

holders of the warrants will not have any rights of holders of the

underlying Common Stock, including any rights to receive dividends

or to exercise any voting rights, except to the extent set forth

under the heading “Warrant Adjustments”

below.

Exercise of Warrants

Each

warrant will entitle the holder to purchase for cash shares of

Common Stock at the applicable exercise price set forth in, or

determined as described in, the applicable prospectus supplement.

Warrants may be exercised at any time up to the close of business

on the expiration date set forth in the applicable prospectus

supplement. After the close of business on the expiration date,

unexercised warrants will become void.

Warrants may be

exercised by delivering to the corporation trust office of the

warrant agent or any other officer indicated in the applicable

prospectus supplement (a) the warrant certificate properly

completed and duly executed and (b) payment of the amount due upon

exercise. As soon as practicable following exercise, we will

forward the shares of Common Stock. If less than all of the

warrants represented by a warrant certificate are exercised, a new

warrant certificate will be issued for the remaining warrants. If

we so indicate in the applicable prospectus supplement, holders of

the warrants may surrender securities as all or a part of the

exercise price for the warrants.

Amendments and Supplements to the Warrant Agreements

We may

amend or supplement a warrant agreement without the consent of the

holders of the applicable warrants to cure ambiguities in the

warrant agreement, to cure or correct a defective provision in the

warrant agreement, or to provide for other matters under the

warrant agreement that we and the warrant agent deem necessary or

desirable, so long as, in each case, such amendments or supplements

do not materially and adversely affect the interests of the holders

of the warrants.

Warrant Adjustments

Unless

the applicable prospectus supplement states otherwise, the exercise

price of, and the number of shares of Common Stock covered by a

warrant will be adjusted proportionately if we subdivide or combine

our Common Stock. In addition, unless the prospectus supplement

states otherwise, if we, without payment:

●

issue capital stock

or other securities convertible into or exchangeable for Common

Stock, or any rights to subscribe for, purchase, or otherwise

acquire Common Stock, as a dividend or distribution to holders of

our Common Stock;

●

pay any cash to

holders of our Common Stock other than a cash dividend paid out of

our current or retained earnings;

●

issue any evidence

of our indebtedness or rights to subscribe for or purchase our

indebtedness to holders of our Common Stock; or

●

issue Common Stock

or additional stock or other securities or property to holders of

our Common Stock by way of spinoff, split-up, reclassification,

combination of shares, or similar corporate

rearrangement,

then

the holders of warrants will be entitled to receive upon exercise

of the warrants, in addition to the shares of Common Stock

otherwise receivable upon exercise of the warrants and without

paying any additional consideration, the amount of stock and other

securities and property such holders would have been entitled to

receive had they held the Common Stock issuable under the warrants

on the dates on which holders of those securities received or

became entitled to receive such additional stock and other

securities and property.

Except

as stated above, the exercise price and number of securities

covered by a warrant, and the amounts of other securities or

property to be received, if any, upon exercise of those warrants,

will not be adjusted or provided for if we issue those securities

or any securities convertible into or exchangeable for those

securities, or securities carrying the right to purchase those

securities or securities convertible into or exchangeable for those

securities.

Holders

of warrants may have additional rights under the following

circumstances:

●

certain

reclassifications, capital reorganizations, or changes of the

Common Stock;

●

certain share

exchanges, mergers, or similar transactions involving us and which

result in changes of the Common Stock; or

●

certain sales or

dispositions to another entity of all or substantially all of our

property and assets.

If one

of the above transactions occurs and holders of our Common Stock

are entitled to receive stock, securities, or other property with

respect to or in exchange for their shares of Common Stock, the

holders of the warrants then outstanding, as applicable, will be

entitled to receive upon exercise of their warrants the kind and

amount of shares of stock and other securities or property that

they would have received upon the applicable transaction if they

had exercised their warrants immediately before the

transaction.

Outstanding Warrants and Options

As of

March 31, 2019, we had outstanding:

●

an aggregate of

5,275,727 of our Common Stock issuable upon the exercise of

outstanding warrants with exercise prices ranging from

$ $0.01

to $ $11.44

per share and expiration dates ranging from April 29, 2019 to

January 24, 2024; and

●

an aggregate of

681,830 of our Common Stock issuable upon the exercise of

outstanding employee and director options with an exercise price of

$1.00 per share and an expiration date of September 10,

2025.

DESCRIPTION OF UNITS

The

following description, together with the additional information we

include in any applicable prospectus supplement, summarizes the

material terms and provisions of the units that we may offer under

this prospectus. Units may be offered independently or together

with Common Stock and warrants offered by any prospectus

supplement, and may be attached to or separate from those

securities. While the terms we have summarized below will generally

apply to any future units that we may offer under this prospectus,

we will describe the particular terms of any series of units that

we may offer in more detail in the applicable prospectus

supplement. The terms of any units offered under a prospectus

supplement may differ from the terms described below.

We will

incorporate by reference into the registration statement of which