0001648087

false

P5Y

P5Y

P3Y

P3Y

P3Y

P3Y

P3Y

P3Y

P3Y

P3Y

P3Y

P3Y

P3Y

P3Y

P3Y

P3Y

P5Y

P2Y

P5Y

P3Y

P3Y

P3Y

P5Y

P3Y

P5Y

0001648087

2022-01-01

2022-03-31

0001648087

2021-12-31

0001648087

2020-12-31

0001648087

us-gaap:PreferredClassAMember

2021-12-31

0001648087

us-gaap:PreferredClassAMember

2020-12-31

0001648087

us-gaap:PreferredClassBMember

2021-12-31

0001648087

us-gaap:PreferredClassBMember

2020-12-31

0001648087

2022-03-31

0001648087

us-gaap:PreferredClassAMember

2022-03-31

0001648087

us-gaap:PreferredClassBMember

2022-03-31

0001648087

2021-01-01

2021-12-31

0001648087

2020-01-01

2020-12-31

0001648087

2021-01-01

2021-03-31

0001648087

us-gaap:CommonStockMember

2019-12-31

0001648087

us-gaap:PreferredStockMember

2019-12-31

0001648087

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001648087

us-gaap:RetainedEarningsMember

2019-12-31

0001648087

2019-12-31

0001648087

us-gaap:CommonStockMember

2020-12-31

0001648087

us-gaap:PreferredStockMember

2020-12-31

0001648087

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001648087

us-gaap:RetainedEarningsMember

2020-12-31

0001648087

us-gaap:CommonStockMember

2021-12-31

0001648087

us-gaap:PreferredStockMember

2021-12-31

0001648087

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001648087

us-gaap:RetainedEarningsMember

2021-12-31

0001648087

us-gaap:CommonStockMember

2020-01-01

2020-12-31

0001648087

us-gaap:PreferredStockMember

2020-01-01

2020-12-31

0001648087

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-12-31

0001648087

us-gaap:RetainedEarningsMember

2020-01-01

2020-12-31

0001648087

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001648087

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001648087

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001648087

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001648087

us-gaap:CommonStockMember

2021-01-01

2021-03-31

0001648087

us-gaap:PreferredStockMember

2021-01-01

2021-03-31

0001648087

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-03-31

0001648087

us-gaap:RetainedEarningsMember

2021-01-01

2021-03-31

0001648087

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001648087

us-gaap:PreferredStockMember

2022-01-01

2022-03-31

0001648087

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001648087

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001648087

us-gaap:CommonStockMember

2021-03-31

0001648087

us-gaap:PreferredStockMember

2021-03-31

0001648087

us-gaap:AdditionalPaidInCapitalMember

2021-03-31

0001648087

us-gaap:RetainedEarningsMember

2021-03-31

0001648087

2021-03-31

0001648087

us-gaap:CommonStockMember

2022-03-31

0001648087

us-gaap:PreferredStockMember

2022-03-31

0001648087

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001648087

us-gaap:RetainedEarningsMember

2022-03-31

0001648087

us-gaap:WarrantMember

2020-01-01

2020-12-31

0001648087

AREB:TwentySixInvestorsMember

2020-01-01

2020-12-31

0001648087

AREB:TwentySixInvestorsMember

2020-12-31

0001648087

srt:MinimumMember

2020-01-01

2020-12-31

0001648087

srt:MaximumMember

2020-01-01

2020-12-31

0001648087

us-gaap:SupplierConcentrationRiskMember

AREB:PurchasedMember

AREB:ThirdPartyVendorMember

2021-01-01

2021-12-31

0001648087

AREB:ThirdPartyVendorMember

2021-12-31

0001648087

AREB:ThirdPartyVendorMember

2020-12-31

0001648087

AREB:TwentySixInvestorsMember

2022-01-01

2022-03-31

0001648087

AREB:TwentySixInvestorsMember

2022-03-31

0001648087

srt:MinimumMember

2022-01-01

2022-03-31

0001648087

srt:MaximumMember

2022-01-01

2022-03-31

0001648087

us-gaap:WarrantMember

2022-03-31

0001648087

AREB:WarrantOneMember

2022-03-31

0001648087

us-gaap:MachineryAndEquipmentMember

2021-12-31

0001648087

us-gaap:MachineryAndEquipmentMember

2020-12-31

0001648087

us-gaap:VehiclesMember

2021-12-31

0001648087

us-gaap:VehiclesMember

2020-12-31

0001648087

us-gaap:MachineryAndEquipmentMember

2022-03-31

0001648087

us-gaap:VehiclesMember

2022-03-31

0001648087

AREB:SoleOfficerAndDirectorMember

2016-01-01

2016-12-31

0001648087

AREB:SoleOfficerAndDirectorMember

2020-12-31

0001648087

AREB:SoleOfficerAndDirectorMember

2021-01-01

2021-12-31

0001648087

AREB:SoleOfficerAndDirectorMember

2021-12-31

0001648087

2016-12-31

0001648087

AREB:CharlesARossJrMember

2019-01-01

2019-12-31

0001648087

AREB:CharlesARossJrMember

2021-01-01

2021-12-31

0001648087

AREB:CharlesARossJrMember

2020-01-01

2020-12-31

0001648087

srt:ChiefExecutiveOfficerMember

2022-01-01

2022-03-31

0001648087

srt:ChiefExecutiveOfficerMember

2021-01-01

2021-03-31

0001648087

srt:PresidentMember

2022-01-01

2022-03-31

0001648087

srt:PresidentMember

2021-01-01

2021-03-31

0001648087

AREB:Loan1Member

2021-12-31

0001648087

AREB:Loan1Member

2020-12-31

0001648087

us-gaap:LoansMember

2022-03-31

0001648087

us-gaap:LoansMember

2021-12-31

0001648087

AREB:Loan1Member

2020-01-01

2020-12-31

0001648087

AREB:Loan1Member

2019-01-01

2019-12-31

0001648087

AREB:ConvertibleDebenture1Member

2019-12-31

0001648087

us-gaap:LoansMember

2021-01-01

2021-12-31

0001648087

us-gaap:LoansMember

2022-01-01

2022-03-31

0001648087

AREB:ConvertibleDebentureMember

2022-03-31

0001648087

AREB:ConvertibleDebentureMember

2021-12-31

0001648087

us-gaap:ShortTermDebtMember

2020-12-31

0001648087

us-gaap:ShortTermDebtMember

2020-01-01

2020-12-31

0001648087

AREB:NotesPayableMember

2020-01-01

2020-12-31

0001648087

AREB:SecuredPromissoryNoteMember

2021-01-01

2021-12-31

0001648087

AREB:ShortTermNotesMember

2021-01-01

2021-12-31

0001648087

AREB:OnJuly62017Member

2021-12-31

0001648087

AREB:OnJuly62017Member

2020-12-31

0001648087

us-gaap:ShortTermDebtMember

2021-09-30

0001648087

AREB:ShortTermDebtOneMember

2021-01-01

2021-09-30

0001648087

AREB:ShortTermDebtOneMember

us-gaap:CommonStockMember

2021-01-01

2021-09-30

0001648087

AREB:ProfessionalAndConsultingFeesMember

2020-02-01

2020-02-28

0001648087

AREB:ConsultingFeesAndInterestExpenseMember

2020-06-01

2020-06-30

0001648087

AREB:ConsultingFeesAndInterestExpenseMember

2020-08-01

2020-08-31

0001648087

AREB:ConsultingFeesAndInterestExpenseMember

2020-10-01

2020-10-31

0001648087

AREB:ConsultingFeesAndInterestExpenseMember

2020-05-01

2020-05-31

0001648087

AREB:ShortTermLoansMember

2020-01-01

2020-12-31

0001648087

AREB:ShortTermLoansMember

2020-12-31

0001648087

AREB:ShortTermNotesMember

2020-01-01

2020-12-31

0001648087

AREB:ProfessionalAndConsultingFeesMember

2020-01-01

2020-12-31

0001648087

2021-01-04

2021-01-05

0001648087

2021-01-05

0001648087

AREB:SubscriptionAgreementMember

2021-01-11

2021-01-12

0001648087

AREB:SubscriptionAgreementMember

2021-01-12

0001648087

AREB:OneYearPromissoryNoteMember

2021-03-04

0001648087

AREB:SubscriptionAgreementMember

2021-03-01

2021-03-05

0001648087

AREB:SubscriptionAgreementMember

2021-03-05

0001648087

AREB:NotesPayableMember

2021-03-10

0001648087

AREB:NotesPayableOneMember

2021-03-10

0001648087

2021-03-01

2021-03-10

0001648087

2021-03-10

0001648087

us-gaap:BridgeLoanMember

AREB:RonaldASmithMember

2021-04-09

0001648087

AREB:TwoEmploymentAgreementsMember

2021-04-08

2021-04-09

0001648087

AREB:TwoEmploymentAgreementsMember

AREB:ChiefExecutiveOfficerAndPresidentMember

2021-04-08

2021-04-09

0001648087

us-gaap:ServiceMember

2021-04-19

2021-04-20

0001648087

2021-04-21

2021-04-22

0001648087

2021-04-22

0001648087

2021-06-10

2021-06-11

0001648087

2021-06-14

0001648087

us-gaap:SeriesBPreferredStockMember

2021-06-10

2021-06-11

0001648087

AREB:AccreditedInvestorMember

2021-06-12

0001648087

2021-06-13

2021-06-14

0001648087

us-gaap:SeriesBPreferredStockMember

2021-06-13

2021-06-14

0001648087

us-gaap:WarrantMember

2021-06-14

0001648087

2021-06-13

2021-06-15

0001648087

2021-06-15

0001648087

us-gaap:SeriesBPreferredStockMember

2021-06-13

2021-06-15

0001648087

us-gaap:WarrantMember

2021-06-15

0001648087

AREB:OutstandingNoteMember

2021-06-13

2021-06-15

0001648087

AREB:OutstandingNoteMember

2021-06-15

0001648087

us-gaap:SeriesBPreferredStockMember

AREB:OutstandingNoteMember

2021-06-13

2021-06-15

0001648087

us-gaap:WarrantMember

AREB:OutstandingNoteMember

2021-06-15

0001648087

2021-06-17

2021-06-18

0001648087

2021-06-18

0001648087

us-gaap:SeriesBPreferredStockMember

2021-06-17

2021-06-18

0001648087

AREB:AccreditedInvestorMember

us-gaap:WarrantMember

2021-06-18

0001648087

2021-06-20

2021-06-21

0001648087

2021-06-21

0001648087

us-gaap:SeriesBPreferredStockMember

2021-06-20

2021-06-21

0001648087

us-gaap:WarrantMember

2021-06-21

0001648087

2021-06-27

2021-06-28

0001648087

2021-06-28

0001648087

us-gaap:SeriesBPreferredStockMember

2021-06-27

2021-06-28

0001648087

AREB:AccreditedInvestorMember

us-gaap:WarrantMember

2021-06-28

0001648087

2021-06-27

2021-06-29

0001648087

2021-06-29

0001648087

us-gaap:SeriesBPreferredStockMember

2021-06-27

2021-06-29

0001648087

AREB:AccreditedInvestorMember

us-gaap:WarrantMember

2021-06-29

0001648087

AREB:OutstandingNoteMember

2021-06-27

2021-06-29

0001648087

AREB:OutstandingNoteMember

2021-06-29

0001648087

AREB:OutstandingNoteMember

us-gaap:SeriesBPreferredStockMember

2021-06-27

2021-06-29

0001648087

AREB:OutstandingNoteMember

us-gaap:WarrantMember

2021-06-29

0001648087

us-gaap:NoteWarrantMember

2021-06-27

2021-06-30

0001648087

us-gaap:NoteWarrantMember

2021-06-30

0001648087

us-gaap:NoteWarrantMember

us-gaap:SeriesBPreferredStockMember

2021-06-27

2021-06-30

0001648087

AREB:AccreditedInvestorMember

us-gaap:WarrantMember

2021-06-30

0001648087

AREB:NoteWarrantOneMember

2021-06-27

2021-06-30

0001648087

AREB:NoteWarrantOneMember

2021-06-30

0001648087

AREB:NoteWarrantOneMember

us-gaap:SeriesBPreferredStockMember

2021-06-27

2021-06-30

0001648087

AREB:AccreditedInvestorMember

AREB:WarrantOneMember

2021-06-30

0001648087

AREB:OutstandingNoteMember

2021-07-20

2021-07-21

0001648087

2021-07-20

2021-07-22

0001648087

2021-07-24

2021-07-25

0001648087

2021-07-24

2021-07-26

0001648087

2021-07-26

0001648087

us-gaap:SeriesBPreferredStockMember

2021-07-24

2021-07-26

0001648087

AREB:SubscriptionAgreementMember

AREB:AccreditedInvestorMember

2021-07-26

0001648087

us-gaap:SeriesBPreferredStockMember

2021-07-28

2021-07-29

0001648087

AREB:TwoThousandTwentyOneLongTermIncentivePlanMember

2021-07-28

2021-07-30

0001648087

AREB:TwoThousandTwentyOneLongTermIncentivePlanMember

2021-08-02

2021-08-03

0001648087

AREB:TwoThousandTwentyOneLongTermIncentivePlanMember

2021-08-02

2021-08-04

0001648087

AREB:OutstandingNoteMember

2021-08-11

2021-08-12

0001648087

us-gaap:SeriesBPreferredStockMember

2021-08-17

2021-08-18

0001648087

2021-09-07

2021-09-08

0001648087

AREB:OutstandingNoteMember

2021-09-07

2021-09-08

0001648087

2021-09-20

2021-09-21

0001648087

AREB:NoteOneMember

2021-09-20

2021-09-21

0001648087

2021-09-29

2021-09-30

0001648087

AREB:OutstandingNoteMember

2021-08-29

2021-08-30

0001648087

AREB:OutstandingNotesMember

2021-08-29

2021-08-30

0001648087

2021-10-24

2021-10-25

0001648087

AREB:AccreditedInvestorMember

2021-10-25

0001648087

AREB:OutstandingNoteMember

2021-10-28

2021-10-29

0001648087

AREB:TwoThousandTwentyOneLongTermIncentivePlanMember

2021-10-28

2021-10-29

0001648087

AREB:TwoThousandTwentyOneLongTermIncentivePlanMember

2021-12-01

2021-12-02

0001648087

AREB:OutstandingNotesMember

2021-12-01

2021-12-02

0001648087

AREB:ThreeOutstandingNotesMember

2021-08-29

2021-08-30

0001648087

us-gaap:SeriesBPreferredStockMember

2021-12-01

2021-12-02

0001648087

2021-12-01

2021-12-02

0001648087

2022-02-06

2022-02-07

0001648087

us-gaap:SeriesBPreferredStockMember

2022-02-01

2022-02-03

0001648087

us-gaap:CommonStockMember

2022-02-01

2022-02-03

0001648087

us-gaap:CommonStockMember

2022-02-01

2022-02-03

0001648087

us-gaap:CommonStockMember

us-gaap:SubscriptionArrangementMember

2022-02-08

2022-02-10

0001648087

us-gaap:SubscriptionArrangementMember

us-gaap:CommonStockMember

2022-02-10

0001648087

us-gaap:SeriesBPreferredStockMember

2022-03-31

0001648087

us-gaap:SeriesBPreferredStockMember

2021-12-31

0001648087

2020-10-31

0001648087

2020-11-30

0001648087

2021-04-30

0001648087

2020-06-30

0001648087

2021-07-31

0001648087

2021-08-31

0001648087

2021-09-30

0001648087

2021-10-31

0001648087

us-gaap:MeasurementInputSharePriceMember

2021-12-31

0001648087

us-gaap:MeasurementInputSharePriceMember

2020-12-31

0001648087

us-gaap:MeasurementInputExpectedTermMember

2021-12-31

0001648087

us-gaap:MeasurementInputExpectedTermMember

2020-12-31

0001648087

us-gaap:MeasurementInputPriceVolatilityMember

2021-12-31

0001648087

us-gaap:MeasurementInputPriceVolatilityMember

2020-12-31

0001648087

us-gaap:MeasurementInputExpectedDividendRateMember

2021-12-31

0001648087

us-gaap:MeasurementInputExpectedDividendRateMember

2020-12-31

0001648087

us-gaap:MeasurementInputRiskFreeInterestRateMember

2021-12-31

0001648087

us-gaap:MeasurementInputRiskFreeInterestRateMember

2020-12-31

0001648087

us-gaap:MeasurementInputSharePriceMember

2022-03-31

0001648087

us-gaap:MeasurementInputExercisePriceMember

2022-03-31

0001648087

us-gaap:MeasurementInputExercisePriceMember

2021-12-31

0001648087

us-gaap:MeasurementInputExpectedTermMember

2022-03-31

0001648087

us-gaap:MeasurementInputPriceVolatilityMember

2022-03-31

0001648087

us-gaap:MeasurementInputExpectedDividendRateMember

2022-03-31

0001648087

us-gaap:MeasurementInputRiskFreeInterestRateMember

2022-03-31

0001648087

2019-01-01

2019-12-31

0001648087

us-gaap:SubsequentEventMember

2022-01-29

2022-02-02

0001648087

us-gaap:SubsequentEventMember

AREB:ConsultingAgreementMember

2022-01-29

2022-02-02

0001648087

us-gaap:SubsequentEventMember

AREB:SeriesBConvertiblePreferredMember

2022-02-01

2022-02-03

0001648087

us-gaap:SubsequentEventMember

us-gaap:CommonStockMember

2022-02-01

2022-02-03

0001648087

us-gaap:SubsequentEventMember

AREB:TwoOutstandingNotesMember

2022-02-01

2022-02-03

0001648087

us-gaap:SubsequentEventMember

AREB:PublicOfferingMember

2022-02-08

2022-02-09

0001648087

us-gaap:SubsequentEventMember

AREB:PublicOfferingMember

2022-02-09

0001648087

us-gaap:SubsequentEventMember

AREB:PromissoryNoteMember

2022-02-01

2022-02-28

0001648087

us-gaap:SubsequentEventMember

2022-03-30

0001648087

us-gaap:SubsequentEventMember

AREB:NashvilleMember

AREB:TwoYearLeaseAgreementMember

2022-04-06

0001648087

us-gaap:SubsequentEventMember

AREB:NashvilleMember

AREB:TwoYearLeaseAgreementMember

2022-04-05

2022-04-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

utr:sqft

As

filed with the Securities and Exchange Commission on August 5, 2022

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

AMERICAN

REBEL HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

7372 |

|

47-3892903 |

(State

or other jurisdiction

of incorporation

or organization) |

|

(Primary

Standard Industrial

Classification

Code Number) |

|

(I.R.S.

Employer

Identification

Number) |

909

18th Avenue South, Suite A

Nashville,

Tennessee, 37212

(833)

267-3235

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Charles

A. Ross, Jr.

Chief

Executive Officer

909

18th Avenue South, Suite A

Nashville,

Tennessee, 37212

(833)

267-3235

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies

to:

Joseph

Lucosky, Esq.

Adele

Hogan, Esq.

Lucosky

Brookman LLP

101

Wood Avenue South

Woodbridge,

New Jersey 08830 |

Telephone:

(732) 395-4400

APPROXIMATE

DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: From time to time after the effective date of this registration statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933 check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Securities Exchange Act of 1934.

| Large

accelerated filer ☐ |

Accelerated

filer ☐ |

| Non-accelerated

filer ☒ |

Smaller

reporting company ☒ |

| |

Emerging

growth company ☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act or until the registration statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION, DATED AUGUST 5, 2022 |

AMERICAN

REBEL HOLDINGS, INC.

35,135,136

Shares of Common Stock

This

prospectus relates to the offering and resale of up to 35,135,136 shares of the Company’s common stock, $0.001 par value per

share (the “Common Stock”), consisting of (i) 509,311 shares of Common Stock, (ii)

11,202,401 shares of Common Stock (the “Prefunded Warrant Shares”) issuable upon exercise of prefunded warrants (the

“Prefunded Warrants”) issued to the Selling Stockholder (as defined herein) on July 7, 2022 pursuant to a securities

purchase agreement (the “Purchase Agreement”) and (iii) 23,423,424 shares of Common Stock (the “Warrant

Shares”) issuable upon exercise of warrants (the “Warrants”) issued to the Selling Stockholder on July 7, 2022

pursuant to the Purchase Agreement.

We

are not selling any shares of our Common Stock under this prospectus and will not receive any proceeds from the sale of the Shares. We

will, however, receive proceeds from any warrants that are exercised through the payment of the exercise price in cash. The Selling Stockholder

will bear all commissions and discounts, if any, attributable to the sale of the Shares. We will bear all costs, expenses and fees in

connection with the registration of the Common Stock, the Prefunded Warrant Shares and the Warrant Shares.

The Selling Stockholder may sell the shares of Common

Stock on Nasdaq, in one or more transactions otherwise than on Nasdaq, such as privately negotiated transactions, or using a combination

of these methods, and at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of

sale, or at negotiated prices. See the disclosure under the heading “Plan of Distribution” elsewhere in this prospectus for

more information about how the Selling Stockholder may sell or otherwise dispose of its shares of Common Stock hereunder.

The Selling Stockholder may sell any, all or none

of the securities offered by this prospectus and we do not know when or in what amount the Selling Stockholder may sell its shares of

Common Stock hereunder following the effective date of this registration statement.

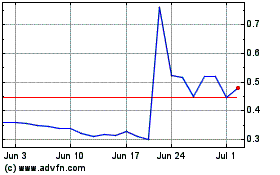

Our

Common Stock and certain existing warrants (the “Existing Warrants”) are traded on the Nasdaq Capital Market under the symbols

“AREB” and “AREBW,” respectively. On August 2, 2022, the closing price of our Common Stock as reported

on the Nasdaq Capital Market was $0.6286 per share.

This prospectus provides a general description of

the securities being offered. You should read this prospectus and the registration statement of which it forms a part before you

invest in any securities.

Investing

in our securities involves a high degree of risk. See “Risk Factors” in the section entitled “Risk Factors”

on page 5 of this prospectus for a discussion of certain risk factors that should be considered by prospective purchasers of the

Common Stock offered under this prospectus. You should carefully consider these risk factors, as well as the information contained

in this prospectus, before purchasing any of the securities offered by this prospectus.

You

should rely only on the information contained in this prospectus or any prospectus supplement or amendment hereto. We have not authorized

anyone to provide you with different information.

NEITHER

THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED

UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The

date of this prospectus is August 5, 2022.

TABLE

OF CONTENTS

You

may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide

you with different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities

other than the Common Stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an

offer to buy any Common Stock in any circumstances in which such offer or solicitation is unlawful. Neither the delivery of this prospectus

nor any sale made in connection with this prospectus shall, under any circumstances, create any implication that there has been no change

in our affairs since the date of this prospectus is correct as of any time after its date.

Unless

the context otherwise requires, we use the terms “we,” “us,” “the Company”, “American Rebel”

and “our” to refer to American Rebel Holdings, Inc. and its consolidated subsidiaries.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus contains forward-looking statements that reflect our current expectations and views of future events, all of which are subject

to risks and uncertainties. Forward-looking statements give our current expectations or forecasts of future events. You can identify

these statements by the fact that they do not relate strictly to historical or current facts. In some cases, you can identify forward-looking

statements by terminology such as “may,” “might,” “should,” “intends,” “expects,”

“plans,” “goals,” “projects,” “anticipates,” “believes,” “estimates,”

“predicts,” “potential,” or “continue” or the negative of these terms or other comparable terminology.

These forward-looking statements should be evaluated with consideration given to the risks and uncertainties inherent in our business

that could cause actual results and events to differ materially from those in the forward-looking statements.

Such

forward-looking statements are based on a series of expectations, assumptions, estimates and projections about our Company, are not guarantees

of future results or performance, and involve significant risks, uncertainties and other factors, including assumptions and projections,

for all future periods. Our actual results may differ materially from any future results expressed or implied by such forward-looking

statements. Such factors include, among others:

| |

● |

our

ability to achieve positive cash flow from operations and new business opportunities; |

| |

|

|

| |

● |

our

current reliance on a sole manufacturer and supplier for the production of our safes; |

| |

|

|

| |

● |

our

manufacturing partner’s ability to meet production demands, both quantitively and qualitatively; |

| |

|

|

| |

● |

our

ability to expand our sales organization to address effectively existing and new markets that we intend to target; |

| |

|

|

| |

● |

impact

from future regulatory, judicial, and legislative changes or developments in the U.S. and foreign countries; |

| |

|

|

| |

● |

our

ability to compete effectively in a competitive industry; |

| |

|

|

| |

● |

our

ability to identify suitable acquisition candidates to consummate acquisitions on acceptable terms, or to successfully integrate

acquisitions in connection with the execution of our growth strategy, the failure of which could disrupt our operations and adversely

impact our business and operating results; |

| |

|

|

| |

● |

our

ability to obtain funding for our operations; |

| |

|

|

| |

● |

our

creditors not accelerating debt obligations; |

| |

|

|

| |

● |

our

ability to satisfy debt obligations going forward; |

| |

|

|

| |

● |

our

ability to attract collaborators and strategic arrangements; |

| |

|

|

| |

● |

our

ability to meet the Nasdaq Capital Market continued listing requirements;

|

| |

|

|

| |

● |

our

sole manufacturer’s ability to find adequate replacement in events of shortages of components and materials, and manage chain

disruptions; |

| |

|

|

| |

● |

our

current reliance on our founder and Chief Executive Officer, Charles A, Ross; |

| |

|

|

| |

● |

general

business and economic conditions, including macroeconomic conditions such as high inflation, supply chain issues, labor issues and

issues resulting from the continuing global COVID-19 pandemic; |

| |

|

|

| |

● |

risks

associated with acquisitions, mergers and joint ventures, such as difficulties integrating businesses, uncertainty associated with

financial projections, projected synergies, restructuring, increased costs, and adverse tax consequences; |

| |

|

|

| |

● |

risks

associated with relationships with employees, vendors or key customers as a result of acquisitions of businesses, technologies or

products; |

| |

|

|

| |

● |

our

ability to close the Champion Safe Acquisition (defined below); |

| |

|

|

| |

● |

our

ability to meet our financial obligations as they become due; and |

| |

|

|

| |

● |

the

rate and degree of market acceptance and demand of our products. |

The

forward-looking statements contained in this prospectus are based on our current expectations and beliefs concerning future

developments and their potential effects on us. There can be no assurance that future developments affecting us will be those that

we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond our

control) or other assumptions that may cause actual results or performance to be materially different from those expressed or

implied by these forward-looking statements. The foregoing list of important factors does not include all such factors, nor

necessarily present them in order of importance. For additional information regarding risk factors that could affect the Company,

see “Risk Factors” beginning on page 5 of this prospectus, and as may be included from time-to-time in our reports filed

with the Securities and Exchange Commission (the “SEC”).

The

Company intends the forward-looking statements to speak only as of the time of such statements and does not undertake or plan to update

or revise such forward-looking statements as more information becomes available or to reflect changes in expectations, assumptions or

results. The Company can give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence

of, or any material adverse change in, one or more of the risk factors or risks and uncertainties referred to in this prospectus, could

materially and adversely affect our results of operations, financial condition, and liquidity, and our future performance. We undertake

no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise,

except as may be required under applicable securities laws.

Industry

Data and Forecasts

This

prospectus contains data related to the permanent and temporary safes and concealed self-defense products industry in the United States.

This industry data includes projections that are based on a number of assumptions which have been derived from industry and government

sources which we believe to be reasonable. We have not independently verified such third-party information. Industry and market data

could be inaccurate because of the method by which sources obtained their data and because information cannot be verified with complete

certainty due to the limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other

limitations and uncertainties. Industry and market data are often forecasts by industry experts best equipped to make forecasts, but

all forecasts bear a certain degree of uncertainty and should not be relied upon as facts. Such data and estimates are necessarily subject

to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” The permanent

and temporary safes and concealed self-defense products industries may not grow at the rate projected by industry data, or at all. The

failure of the industries to grow as anticipated is likely to have a material adverse effect on our business and the market price of

our Common Stock. In addition, the rapidly changing nature of the permanent and temporary safes and concealed self-defense industries

subjects any projections or estimates relating to the growth prospects or future condition of our industries to significant uncertainties.

Furthermore, if any one or more of the assumptions underlying the industry data turns out to be incorrect, actual results may, and are

likely to, differ from the projections based on these assumptions.

PROSPECTUS

SUMMARY

The

following highlights certain information contained elsewhere in this prospectus. It does not contain all the details concerning this

offering, including information that may be important to you. You should carefully review this entire prospectus including the section

entitled “Risk Factors” and the consolidated historical and consolidated pro forma financial statements and accompanying

notes contained herein. See “Where You Can Find More Information.” Unless the context otherwise requires, we use the terms

“we,” “us,” “the Company,” “American Rebel” and “our” to refer to American

Rebel Holdings, Inc. and its wholly-owned subsidiary American Rebel, Inc.

Our

Company

We

operate primarily as a marketer and designer of branded safes and personal security and self-defense products.

Additionally, we design and produce branded apparel and accessories under our American Rebel

brand. For more information with respect to our products, please see the section entitled “Business” below.

We

are committed to offering products of enduring quality that allow customers to keep their valuable belongings protected and to express

their patriotism and style, which is synonymous with the American Rebel brand.

Our

safes and personal security products are constructed primarily of U.S.-made steel and we believe our products are designed for safety,

quality, reliability, features and performance.

To

enhance the strength of our brand and drive product demand, we work with our sole supplier and manufacturer to emphasize product quality

and mechanical development in order to improve the performance and affordability of our products while providing support to our distribution

channel and consumers. We seek to sell products that offer features and benefits of higher-end safes at mid-line price ranges.

Through

our growing network of dealers, we promote and sell our products in select regional retailers and

local specialty safe, sporting goods, hunting and firearms stores, as well as online, including our website and e-commerce platforms

such as Amazon.com.

We

believe that we have the potential to continue to create a brand community presence around the core ideals and beliefs of America, in

part through our Chief Executive Officer, Charles A. “Andy” Ross, who has written, recorded and performs a number of songs

about the American spirit of independence. We believe our customers identify with the values expressed by our Chief Executive Officer

through the “American Rebel” brand.

The

Champion Safe Acquisition

On

June 29, 2022, we entered into a stock and membership interest purchase agreement with Champion Safe Co., Inc., (“Champion

Safe”), Superior Safe, LLC (“Superior Safe”), Safe Guard Security Products, LLC (“Safe Guard”), Champion

Safe De Mexico, S.A. de C.V. (“Champion Safe Mexico” and, together with Champion Safe, Superior Safe, and Safe Guard, collectively,

the “Champion Entities”) and Ray Crosby (“Seller”) (the “Champion Purchase Agreement”), pursuant

to which the we agreed to acquire all of the issued and outstanding capital stock and membership interests of the Champion Entities from

the Seller (the “Champion Safe Acquisition”).

Under

the terms of the Champion Purchase Agreement, we have agreed to pay the Seller (i) cash consideration in the amount of $9,150,000 and

(ii) cash deposits in the amount $350,000, minus (a) the

aggregate amount of all indebtedness of the Champion Entities, plus or minus the amount of the Net Working Capital Adjustment, as such

term is defined under the Champion Purchase Agreement.

In

addition, under the terms of the Champion Purchase Agreement, we shall reimburse the Seller for mutually agreed upon acquisitions and equipment purchases completed by Seller since June 30, 2021,

in the amount of approximately $400,000.

The

Champion Purchase Agreement contains customary representations and warranties by the Champion Entities and Seller. The Champion Purchase

Agreement also contains customary covenants and agreements, including with respect to the operations of the business of the Champion

Entities between signing and closing, restrictions on alternative transactions by the Champion Entities, commercially reasonable efforts

to take actions that may be necessary in order to obtain approval of the transactions with certain governmental authorities, and other

matters.

The

Champion Purchase Agreement generally prohibits Seller’s solicitation of proposals relating to alternative transactions and restricts

Seller’s ability to furnish confidential information to, or participate in any discussions or negotiations with, any third party

with respect to any alternative transaction, subject to certain limited exceptions.

The

obligations of the parties to consummate the acquisition of the Champion Entities are subject to the satisfaction or waiver of various

conditions set forth in the Champion Purchase Agreement, including, but not limited to (i) the Company obtaining sufficient financing

to consummate the acquisition, (ii) the accuracy of the representations and warranties of each party contained in the Champion Purchase

Agreement (subject to certain materiality qualifications), (iii) each party’s compliance with or performance of the covenants and

agreements in the Champion Purchase Agreement in all material respects, and (iv) entry by Champion Safe into employment and non-competition

agreements with certain employees of the Champion Entities, including the Seller. The closing date for the acquisition is set to be on

or before August 31, 2022 (subject to an extension to September 30, 2022, as set forth in the Champion Purchase Agreement), subject to

customary closing conditions.

The

Champion Purchase Agreement contains termination rights for the Champion Entities and Seller, including if the transactions are not consummated

within 60 days after the date of the Champion Purchase Agreement, which may be extended by the mutual consent of the parties.

The

acquisition is anticipated to close in August 2022. We cannot provide assurance that the Champion

Safe Acquisition will be completed on the terms or timeline currently contemplated, or at all.

About

Champion Safe

Based

in Provo, Utah and founded in 1999, Champion Safe is what we believe to be one of the premier designers, manufacturers and marketers

of home and gun safes in North America. Champion Safe Co. has three safe lines, which we

believe feature some of the most secure and highest quality gun safes.

Following

the acquisition, we plan to continue to operate Champion Safe in substantially the same manner as it currently operates pre-acquisition.

Champion Safe will enter into a three-year employment agreement with Ray Crosby to continue in his position as CEO, concurrent

with closing of the acquisition. Ray Crosby is a foundational figure in the safe business with over 40 years of experience in the industry.

Ray co-founded Fort Knox Safe in 1982 and Liberty Safe, in 1988, which was sold to a middle market private investment firm for $147.5

million.

We

plan to expand our manufacturing throughput to fill our significant backlog of orders and aggressively open new dealer accounts with

the support of proceeds from this offering. As a division of our combined company, Champion Safe will shift its emphasis to

growing revenue and increasing profitability for the combined company.

Recent Developments

The Champion Safe Acquisition

On June 29, 2022, we entered into the Champion Purchase

Agreement with Champion Entities and the Seller, pursuant to which we agreed to acquire all of the issued and outstanding capital stock

and membership interests of the Champion Entities from the Seller. For more information, see “Prospectus Summary—The Champion

Safe Acquisition.”

July 2022 Private Placement

On July 12, 2022, we entered into a securities purchase

agreement (the “Purchase Agreement”) with Armistice Capital Master Fund Ltd. (the “Selling Stockholder”) for the

purchase and sale of $12,887,976.31 of securities, consisting of (i) 509,311 shares of Common Stock at $1.11 per share, (ii) prefunded

warrants (the “Prefunded Warrants”) that are exercisable into 11,202,401 shares of Common Stock (the “Prefunded Warrant

Shares”) at $1.10 per Prefunded Warrant, and (iii) immediately exercisable warrants to purchase up to 23,423,424 shares of Common

Stock (the “Warrant Shares”) at an initial exercise price of $0.86 per share, subject to adjustments as set forth therein,

and will expire five years from the date of issuance.

The Company intends to use the net proceeds from the

private placement primarily to fund the planned acquisition of Champion Safe, as well as for general working capital and administrative

purposes.

Risks

Affecting Us

Our

business is subject to numerous risks and uncertainties, including those discussed in the section titled “Risk Factors” beginning

on page 5 and elsewhere in this prospectus. These risks include the following:

| |

● |

we

currently do not own a manufacturing facility, and future acquisition and operation of new

manufacturing facilities might prove unsuccessful and could fail;

|

| |

● |

as

we currently rely on a sole third-party manufacturer for our safes production, our compromised operational capacity may affect our

ability to meet the demand for our safes, which in turn may affect our generation of revenue; |

| |

|

|

| |

● |

our

success depends, in part, on our ability to introduce new products that track customer preferences; |

| |

|

|

| |

● |

maintaining

and strengthening our brand to generate and maintain ongoing demand for our products; |

| |

|

|

| |

● |

as

a significant portion of our revenues is derived by demand for our safes and personal security products for firearms storage purposes,

we depend on the regulation of firearms and ammunition storage, as well as various economic, social and political factors; |

| |

|

|

| |

● |

shortages

of components and materials, as well as supply chain disruptions, may delay or reduce our sales and increase our costs, thereby harming

our results of operations; |

| |

|

|

| |

● |

we

do not have long-term purchase commitments from our customers, and their ability to cancel, reduce, or delay orders could reduce

our revenue and increase our costs; |

| |

|

|

| |

● |

we

face a high degree of market competition that could result in our losing or failing to gain market share; |

| |

|

|

| |

● |

the

inability to efficiently manage our operations; |

| |

|

|

| |

● |

the

inability to achieve future operating results; |

| |

|

|

| |

● |

the

inability of management to effectively implement our strategies and business plans; |

| |

|

|

| |

● |

given

our limited corporate history it is difficult to evaluate our business and future prospects and increases the risks associated with

an investment in our securities; |

| |

|

|

| |

● |

the

loss of our founder and Chief Executive Officer, Charles A, Ross, could harm our business; |

| |

|

|

| |

● |

our

inability to service our existing and future indebtedness or other liabilities, the failure of which could result in insolvency proceedings

and result in a total loss of your equity investment; |

| |

|

|

| |

● |

our

inability to raise additional financing for working capital; |

| |

|

|

| |

● |

the

unavailability of funds for capital expenditures; |

| |

|

|

| |

● |

our

inability to access lending, capital markets and other sources of liquidity, if needed, on reasonable terms, or at all, or obtain

amendments, extensions and waivers of financial maintenance covenants, among other material terms; |

| |

|

|

| |

● |

our

ability to continue as a going concern absent obtaining adequate new debt or equity financing, raising additional funds and achieving

sufficient sales levels; |

| |

|

|

| |

● |

our

ability to expand our e-commerce business and sales organization to effectively address existing and new markets that we intend to

target, and to generate sufficient revenue in those targeted markets to support operations; |

| |

|

|

| |

● |

our

inability to generate significant cash flow from sales of our products, which could lead to a substantial increase in indebtedness

and negatively impact our ability to comply with the financial covenants, as applicable, in our debt agreements; |

| |

|

|

| |

● |

war,

terrorism, other acts of violence or natural or manmade disasters such as a pandemic, epidemic,

outbreak of an infectious disease or other public health crisis - such as COVID-19 - may affect the markets in which the Company

operates, as well as global economic, market and political conditions; |

| |

|

|

| |

● |

our

ability to identify suitable acquisition candidates to consummate acquisitions on acceptable terms, or to successfully integrate

acquisitions in connection with the execution of our growth strategy, the failure of which could disrupt our operations and adversely

impact our business and operating results; |

| |

|

|

| |

● |

applicable

laws and changing legal and regulatory requirements, including U.S. GAAP changes, could harm our business and financial results; |

| |

|

|

| |

● |

if

we are unable to protect our intellectual property, we may lose a competitive advantage or incur substantial litigation costs to

protect our rights; |

| |

|

|

| |

● |

the

fact that our accounting policies and methods are fundamental to how we report our financial condition and results of operations,

and they may require management to make estimates about matters that are inherently uncertain; |

| |

|

|

| |

● |

significant

dilution resulting from our financing activities; |

| |

|

|

| |

● |

our

Management has control over key decision-making matters as a result of their control of a majority of our voting stock; |

| |

|

|

| |

●

|

the

actions and initiatives taken by both current and potential competitors; and |

| |

|

|

| |

●

|

the

other risks and uncertainties detailed in this report. |

Corporate

Information

Our

principal executive offices are located at 909 18th Avenue South, Suite A, Nashville, Tennessee. Our telephone number is (833)

267-3235. Our website address is www.americanrebel.com. The information contained on, or that can be accessed through, our website is

not a part of this prospectus. Investors should not rely on any such information in deciding whether to purchase our securities.

THE

OFFERING

| Issuer |

|

American

Rebel Holdings, Inc. |

| |

|

|

| Offered

Securities(1) |

|

35,135,136

shares of our Common Stock. |

| |

|

|

| Common

Stock outstanding prior to this offering |

|

5,250,632

shares of Common Stock outstanding as of August 2, 2022. |

| |

|

|

| Common

Stock outstanding after completion of this offering |

|

39,876,457

shares of Common Stock, assuming the exercise

of all 11,202,401 shares of Prefunded Warrant Shares and 23,423,424 shares of Warrant Shares. |

| |

|

|

| Terms of the Offering |

|

The Selling Stockholder will determine when and how they will sell the

Common Stock offered in this prospectus. |

| |

|

|

| Use

of proceeds |

|

We

are not selling any securities under this prospectus. We will not receive any proceeds from the resale of the Common Stock by the

selling stockholder. We will, however, receive proceeds from any warrants that are exercised through the payment of the exercise

price in cash. |

| |

|

|

| Risk

Factors |

|

See

“Risk Factors” beginning on page 5 and the other information contained in this prospectus for a discussion of factors

you should carefully consider before investing in our securities. |

| |

|

|

| Market

for Common Stock |

|

Our

Common Stock is traded on the Nasdaq Capital Markets under the symbols “AREB”. |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. You should carefully consider and evaluate all of the information contained in this

prospectus before you decide to purchase any Units, Warrants or Common Stock pursuant to this offering. The risks and uncertainties described

in this prospectus are not the only ones we may face. Additional risks and uncertainties that we do not presently know about or that

we currently believe are not material may also adversely affect our business, business prospects, results of operations or financial

condition. Any of the risks and uncertainties set forth herein, could materially and adversely affect our business, results of operations

and financial condition.

RISKS

RELATED TO OUR BUSINESS AND INDUSTRY

We

currently do not own a manufacturing facility, and rely on a sole manufacturer and supplier for the production of our safes; while we

have obtained favorable financing arrangements in the past from this manufacturer and supplier, there is no assurance that a future supplier

would provide similar favorable financing arrangements

We

currently rely on a sole manufacturer and supplier for the production of our safes. We do not have

control over the operations of the facilities of the third-party manufacturer that we use. While we may acquire our own manufacturing

facility in the future, or acquire our sole manufacturer, to provide us greater flexibility and control over our products manufacturing

needs, the operation of such a future plant might prove unsuccessful and fail.

The

manufacturer of our safes has extended favorable financing arrangements in the past, but there is no assurance that a future supplier

would provide similar favorable financing arrangements. Therefore, the continued supply and manufacturing of our sales by our

sole manufacturer and supplier are critical to our success. Any event that causes a disruption of the operation of our safes’ sole

manufacturer for even a relatively short period of time would adversely affect our ability to ship and deliver our safes and other products

and to provide service to our customers. We have previously experienced, including during the first months after the spread of COVID-19

pandemic, and may in the future experience, launch and production ramp up delays for our products as a result of disruption at our supplier’s

manufacturing partners.

Additionally,

we have fully qualified only a very limited number of suppliers in the past and have limited flexibility in changing suppliers. Any disruption

in the supply of our branded safes from our supplier could limit the availability of our sales and negatively impact our revenues. In

the long term, we intend to supplement safes manufactured by our supplier with safes manufactured by us, which we believe will be more

efficient and result in a greater manufacturing volume and under our control. Our efforts to develop and manufacture such safes, however,

have required and may require significant investments, and there can be no assurance that we will be able to achieve these targets in

the timeframes that we have planned or at all. If we are unable to do so, we may have to curtail our planned safes or procure additional

safes from suppliers at potentially greater costs, either of which may harm our business and operating results.

Furthermore,

the cost of safes, whether manufactured by our supplier or by us, depends in part upon the prices and availability of raw manufacturing

materials such as steel, locks, fireboard, hinges, pins and other metals. The prices for these materials fluctuate and their available

supply may be unstable, depending on market conditions and global demand for these materials, including as a result of increased global

production of electric vehicles and energy storage products. Any reduced availability of these materials may impact our access to these

parts and any increases in their prices may reduce our profitability if we cannot recoup the increased costs through increased safe prices.

Moreover, any such attempts to increase product prices may harm our brand, prospects and operating results.

Our

success depends upon our ability to introduce new products that track customer preferences.

Our

success depends upon our ability to introduce new products that track consumer preferences. Our efforts to introduce new products into

the market may not be successful, and new products that we introduce may not result in customer or market acceptance. We develop new

products that we believe will match consumer preferences. The development of a new product is a lengthy and costly process and may not

result in the development of a marketable or profitable product. Failure to develop new products that are attractive to consumers could

decrease our sales, operating margins, and market share and could adversely affect our business, operating results, and financial condition.

Our

business depends on maintaining and strengthening our brand, as well as our reputation as a producer of high-quality goods, to maintain

and generate ongoing demand for our products, and any harm to our brand could result in a significant reduction in such demand which

could materially adversely affect our results of operations.

The

“American Rebel” name and brand image are integral to the growth of our business, as well as to the implementation of our

strategies for expanding our business. Our success depends on the value and reputation of our brand, which, in turn, depends on factors

such as the quality, design, performance, functionality and durability of our products, e-commerce sales and retail partner floor spaces,

our communication activities, including advertising, social media and public relations, and our management of the customer experience,

including direct interfaces through customer service. Maintaining, promoting, and positioning our brand are important to expanding our

customer base and will depend largely on the success of our marketing and merchandising efforts and our ability to provide consistent,

high-quality consumer experiences. To sustain long-term growth, we must continue to successfully promote our products to consumers, as

well as other individuals, who value and identify with our brand.

Ineffective

marketing, negative publicity, product diversion to unauthorized distribution channels, product or manufacturing defects, and those and

other factors could rapidly and severely diminish customer confidence in us. Maintaining and enhancing our brand image are important

to expanding our customer base. If we are unable to maintain or enhance our brand in current or new markets, or if we fail to continue

to successfully market and sell our products to our existing customers or expand our customer base, our growth strategy and results of

operations could be harmed.

Additionally,

independent third parties and consumers often review our products as well as those of our competitors. Perceptions of our offerings in

the marketplace may be significantly influenced by these reviews, which are disseminated via various media, including the Internet. If

reviews of our products are negative, or less positive as compared to those of our competitors, our brand may be adversely affected and

our results of operations materially harmed.

As

a significant portion of our revenues is derived by demand for our safes and personal security products for firearms storage purposes,

we depend on the availability and regulation of firearm/ammunition storage, as well as various economic, social and political factors.

Our

performance is influenced by a variety of economic, social, and political factors. General economic conditions and consumer spending

patterns can negatively impact our operating results. Economic uncertainty, unfavorable employment levels, declines in consumer confidence,

increases in consumer debt levels, increased commodity prices, and other economic factors may affect consumer spending on discretionary

items and adversely affect the demand for our products. In times of economic uncertainty, consumers tend to defer expenditures for discretionary

items, which affects demand for our products. Any substantial deterioration in general economic conditions that diminish consumer confidence

or discretionary income could reduce our sales and adversely affect our operating results. Economic conditions also affect governmental

political and budgetary policies. As a result, economic conditions also can have an effect on the sale of our products to law enforcement,

government, and military customers.

Political

and other factors also can affect our performance. Concerns about presidential, congressional, and state elections and legislature and

policy shifts resulting from those elections can affect the demand for our products. As most of our revenue is generated from sales of

safes, which are purchased in large numbers for firearms storage, speculation surrounding control of firearms, firearm products, and

ammunition at the federal, state, and local level and heightened fears of terrorism and crime can affect consumer demand for our products.

Often, such concerns result in an increase in near-term consumer demand and subsequent softening of demand when such concerns subside.

Inventory levels in excess of customer demand may negatively impact operating results and cash flow.

Federal

and state legislatures frequently consider legislation relating to the regulation of firearms, including amendment or repeal of existing

legislation. Existing laws may also be affected by future judicial rulings and interpretations firearm products, ammunition, and safe

gun storage. If such restrictive changes to legislation develop, we could find it difficult, expensive, or even impossible to comply

with them, impeding new product development and distribution of existing products.

Shortages

of components and materials, as well as supply chain disruptions, may delay or reduce our sales and increase our costs, thereby harming

our results of operations.

The

inability to obtain sufficient quantities of raw materials and components, including those necessary for the production of our products

could result in reduced or delayed sales or lost orders. Any delay in or loss of sales or orders could adversely impact our operating

results. Many of the materials used in the production of our products are available only from a limited number of suppliers. We do not

have long-term supply contracts with any suppliers. As a result, we could be subject to increased costs, supply interruptions, and difficulties

in obtaining raw materials and components.

Our

reliance on third-party suppliers for various raw materials and components for our products exposes us to volatility in the availability,

quality, and price of these raw materials and components. Our orders with certain of our suppliers may represent a very small portion

of their total orders. As a result, they may not give priority to our business, leading to potential delays in or cancellation of our

orders. A disruption in deliveries from our third-party suppliers, capacity constraints, production disruptions, price increases, or

decreased availability of raw materials or commodities could have an adverse effect on our ability to meet our commitments to customers

or increase our operating costs. Quality issues experienced by third party suppliers can also adversely affect the quality and effectiveness

of our products and result in liability and reputational harm.

We

do not have long-term purchase commitments from our customers, and their ability to cancel, reduce, or delay orders could reduce our

revenue and increase our costs.

Our

customers do not provide us with firm, long-term volume purchase commitments, but instead issue purchase orders for our products as needed.

As a result, customers can cancel purchase orders or reduce or delay orders at any time. The cancellation, delay, or reduction of customer

purchase orders could result in reduced sales, excess inventory, unabsorbed overhead, and reduced income from operations.

We

often schedule internal production levels and place orders for products with third party manufacturers before receiving firm orders from

our customers. Therefore, if we fail to accurately forecast customer demand, we may experience excess inventory levels or a shortage

of products to deliver to our customers. Factors that could affect our ability to accurately forecast demand for our products include

the following:

| |

● |

an

increase or decrease in consumer demand for our products or for the products of our competitors; |

| |

|

|

| |

● |

our

failure to accurately forecast consumer acceptance of new products; |

| |

|

|

| |

● |

new

product introductions by us or our competitors; |

| |

|

|

| |

● |

changes

in our relationships within our distribution channels; |

| |

|

|

| |

● |

changes

in general market conditions or other factors, which may result in cancellations of orders or a reduction or increase in the rate

of reorders placed by retailers; |

| |

|

|

| |

● |

changes

in laws and regulations governing the activities for which we sell products, such as hunting and shooting sports; and |

| |

|

|

| |

● |

changes

in laws and regulations regarding the possession and sale of medical or recreational controlled- substances. |

Inventory

levels in excess of consumer demand may result in inventory write-downs and the sale of excess inventory at discounted prices, which

could have an adverse effect on our business, operating results, and financial condition. If we underestimate demand for our products,

our suppliers may not be able to react quickly enough to meet consumer demand, resulting in delays in the shipment of products and lost

revenue, and damage to our reputation and customer and consumer relationships. We may not be able to manage inventory levels successfully

to meet future order and reorder requirements.

We

face intense competition that could result in our losing or failing to gain market share and suffering reduced sales.

We

operate in intensely competitive markets that are characterized by price erosion and competition from major domestic and international

companies. Competition in the markets in which we operate is based on a number of factors, including price, quality, performance, reliability,

styling, product features, and warranties, and sales and marketing programs. This intense competition could result in pricing pressures,

lower sales, reduced margins, and lower market share.

Our

competitors include nationwide safe manufacturers and various smaller manufacturers and importers. Most of our competitors have greater

market recognition, larger customer bases, and substantially greater financial, technical, marketing, distribution, and other resources

than we possess and that afford them competitive advantages. As a result, they may be able to devote greater resources to the promotion

and sale of products, to invest more funds in intellectual property and product development, to negotiate lower prices for raw materials

and components, to deliver competitive products at lower prices, and to introduce new products and respond to consumer requirements more

quickly than we can.

Our

competitors could introduce products with superior features at lower prices than our products and could also bundle existing or new products

with other more established products to compete with us. Certain of our competitors may be willing to reduce prices and accept lower

profit margins to compete with us. Our competitors could also gain market share by acquiring or forming strategic alliances with other

competitors.

Finally,

we may face additional sources of competition in the future because new distribution methods offered by the Internet and electronic commerce

have removed many of the barriers to entry historically faced by start-up companies. Retailers also demand that suppliers reduce their

prices on products, which could lead to lower margins. Any of the foregoing effects could cause our sales to decline, which would harm

our financial position and results of operations.

Our

ability to compete successfully depends on a number of factors, both within and outside our control. These factors include the following:

| |

● |

our

success in developing, producing, marketing, and successfully selling new products; |

| |

|

|

| |

● |

our

ability to efficiently manage our operations; |

| |

|

|

| |

● |

our

ability to implement our strategies and business plans; |

| |

|

|

| |

● |

our

ability to achieve future operating results; |

| |

|

|

| |

● |

our

ability to address the needs of our consumer customers; |

| |

|

|

| |

● |

the

pricing, quality, performance, and reliability of our products; |

| |

|

|

| |

● |

the

quality of our customer service; |

| |

|

|

| |

● |

the

efficiency of our production; and |

| |

|

|

| |

● |

product

or technology introductions by our competitors. |

Because

we believe technological and functional distinctions among competing products in our markets are perceived by many end-user consumers

to be relatively modest, effectiveness in marketing and manufacturing are particularly important competitive factors in our business.

We

have a limited operating history on which you can evaluate our company.

We

have a limited operating history on which you can evaluate our company. The corporate entity has existed since 2014 and started engaging

in its current primary business operations in April 2019. As a result, our business will be subject to many of the problems, expenses,

delays, and risks inherent in the establishment of a relatively new business enterprise.

We

have a limited operating history upon which an evaluation of our business plan or performance and prospects can be made. Our business

and prospects must be considered in the light of the potential problems, delays, uncertainties and complications encountered in connection

with a newly established business and creating a new line of products. The risks include, in part, the possibility that we will not be

able to develop functional and scalable products, or that although functional and scalable, our products and will not be economical to

market; that our competitors hold proprietary rights that preclude us from marketing such products; that our competitors market a superior

or equivalent product; that our competitors have such a significant advantage in brand recognition that our products will not be considered

by potential customers; that we are not able to upgrade and enhance our technologies and products to accommodate new features as the

market evolves; or the failure to receive necessary regulatory clearances for our products. To successfully introduce and market our

products at a profit, we must establish brand name recognition and competitive advantages for our products. There are no assurances that

we can successfully address these challenges. If it is unsuccessful, we and our business, financial condition and operating results could

be materially and adversely affected.

The

current and future expense levels are based largely on estimates of planned operations and future revenues. It is difficult to accurately

forecast future revenues because our business is relatively new, and our market is rapidly developing. If our forecasts prove incorrect,

the business, operating results and our financial condition will be materially and adversely affected. Moreover, we may be unable to

adjust our spending in a timely manner to compensate for any unanticipated reduction in revenue. As a result, any significant reduction

in revenues would immediately and adversely affect our business, financial condition and operating results.

We

are highly dependent on Charles A. Ross, our Chief Executive Officer. The loss of our Chief Executive Officer, whose knowledge, leadership

and industry reputational upon which we rely, could harm our ability to execute our business plan.

We

are highly dependent on Charles A. Ross, our Chief Executive Officer, Chairman of our Board of Directors and a large stockholder. Our

success depends heavily upon the continued contributions of Mr. Ross, whose leadership, industry reputation entrepreneurial background

and creative marketing skills may be difficult to replace at this stage in our business development, and on our ability to attract and

retain similarly positioned prominent leaders. If we were to lose the services of our Chief Executive Officer, our ability to execute

our business plan may be harmed and we may be forced to limit operations until such time as we could hire suitable replacements.

We

cannot predict when we will achieve profitability.

We

have not been profitable and cannot predict when or if we will achieve profitability. We have experienced net losses since our inception

in December 2014.

We

cannot predict when we will achieve profitability, if ever. Our inability to become profitable may force us to curtail or temporarily

discontinue our research and development programs and our day-to-day operations. Furthermore, there can be no assurance that profitability,

if achieved, can be sustained on an ongoing basis. As of December 31, 2021, we had an accumulated deficit of $26,969,657.

We

have limited financial resources. Our independent registered auditors’ report includes an explanatory paragraph stating that there

is substantial doubt about our ability to continue as a going concern.

As

a result of our deficiency in working capital at December 31, 2021 and other factors, our auditors have included a paragraph in their

audit report regarding substantial doubt about our ability to continue as a going concern. Our plans in this regard are to increase product