Current Report Filing (8-k)

July 18 2022 - 4:59PM

Edgar (US Regulatory)

0001648087

false

0001648087

2022-07-12

2022-07-12

0001648087

AREB:CommonStock0.001ParValueMember

2022-07-12

2022-07-12

0001648087

AREB:CommonStockPurchaseWarrantsMember

2022-07-12

2022-07-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported) July 12, 2022

AMERICAN

REBEL HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-41267 |

|

47-3892903 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

909

18th Avenue South, Suite A

Nashville,

Tennessee |

|

37212 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (833) 267-3235

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

AREB |

|

The

Nasdaq Stock Market LLC |

| Common

Stock Purchase Warrants |

|

AREBW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Forward-Looking

Statements

Certain

statements either contained in or incorporated by reference into this Current Report on Form 8-K, other than purely historical information,

by the Registrant and any statements relating to the Registrant’s business and expected operating results, and the assumptions

upon which those statements are based, are “forward-looking statements.” These forward-looking statements generally include

statements that are predictive in nature and depend upon or refer to future events or conditions, and include words such as “believes,”

“plans,” “anticipates,” “projects,” “estimates,” “expects,” “intends,”

“strategy,” “future,” “opportunity,” “may,” “should,” “could,”

“potential,” or similar expressions. The forward-looking statements contained in this filing are based on current expectations

and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking

statements. This Current Report should be read in conjunction with the risks and cautionary statements discussed or identified in the

Registrant’s public filings with the SEC from time to time, including the Registrant’s most recent Annual Report on Form

10-K for the year ended December 31, 2021, and Quarterly Reports on Form 10-Q. The Registrant’s stockholders and investors are

cautioned not to unduly rely on these forward-looking statements. The forward-looking statements speak only as of the date hereof and,

other than as required by applicable law, the Registrant expressly disclaims any intent or obligation to update or revise publicly these

forward-looking information or statements.

Item

1.01 Entry into Material Definitive Agreement.

As

previously reported by American Rebel Holdings, Inc. (the “Company”), on July 7, 2022, the Company entered into a securities

purchase agreement (the “Purchase Agreement”) with one institutional buyer appearing on the signature page thereto (the “Buyer”)

for the purchase and sale of, subject to customary closing conditions, (i) an aggregate of 509,311 shares (the “Common Shares”)

of the Company’s common stock, par value $0.001 per share (the “Common Stock”), (ii) prefunded warrants (the “Prefunded

Warrants”) that are exercisable into 11,202,401 shares of Common Stock (the “Prefunded Warrant Shares”) and (iii) warrants

(the “Warrants”) to initially acquire up to 23,423,424 shares of Common Stock (the “Warrant Shares”) (representing

200% of the Common Shares and Prefunded Warrant Shares) in a private placement offering (the “Private Placement”).

The

closing of the Private Placement occurred on July 12, 2022. EF Hutton, a division of Benchmark Investments, LLC (the “Placement

Agent”) acted as the sole placement agent for the Company in connection with the Private Placement. Pursuant to that certain Engagement

Letter, dated as of July 8, 2022, between the Company and the Placement Agent, the Placement Agent is entitled to a cash fee of 10% of

the gross proceeds of the Private Placement and the reimbursement of certain Placement Agent fees and expenses, including, but not limited

to, up to $125,000 for fees and expenses including “road show”, diligence, and reasonable legal fees and disbursements for

the Placement Agent’s counsel.

The

foregoing summaries of the terms of the Purchase Agreement, the Warrant, the Prefunded Warrant, the Registration Rights Agreement and

the Engagement Letter are subject to, and qualified in their entirety by, the forms of such documents, which are filed herewith as Exhibits

10.1, 10.2, 10.3, 10.4 and 10.5, respectively, and are incorporated herein by reference.

Item

3.02 Unregistered Sale of Securities

The

applicable information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference in this Item 3.02. The

Common Shares, Prefunded Warrants and Warrants will be issued without prior registration in reliance upon the exemption from registration

provided by Section 4(a)(2) of the Securities Act, and Rule 506(D) of Regulation D thereunder.

Item

8.01 Other Events.

On

July 12, 2022, the Company issued a press release announcing the closing of the Private Placement. A copy of the press release is attached

as Exhibit 99.1 hereto and is incorporated herein by reference.

Item

9.01 Financial Statements and Exhibits.

Exhibit

Number |

|

Description |

| 10.1# |

|

Securities Purchase Agreement, dated July 7, 2022, between American Rebel Holdings, Inc. and the Armistice Capital Master Fund Ltd. (incorporated herein by reference to Exhibit 10.1 to Current Report on Form 8-K filed with the Securities and Exchange Commission on July 8, 2022) |

| 10.2 |

|

Form of Warrant (incorporated herein by reference to Exhibit 10.2 to Current Report on Form 8-K filed with the Securities and Exchange Commission on July 8, 2022) |

| 10.3 |

|

Form of Prefunded Warrant (incorporated herein by reference to Exhibit 10.3 to Current Report on Form 8-K filed with the Securities and Exchange Commission on July 8, 2022) |

| 10.4 |

|

Form of Registration Rights Agreement (incorporated herein by reference to Exhibit 10.4 to Current Report on Form 8-K filed with the Securities and Exchange Commission on July 8, 2022) |

| 10.5 |

|

Engagement Letter, dated July 8, 2022, between American Rebel Holdings, Inc. and EF Hutton. |

| 99.1 |

|

Press Release |

| 104 |

|

Cover

Page Interactive Data File |

#

Certain schedules and exhibits have been omitted pursuant to Item 601(A)(5) of Regulation S-K. The Company will furnish supplementally

copies of omitted schedules and exhibits to the Securities and Exchange Commission or its staff upon its request.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934 the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

AMERICAN

REBEL HOLDINGS, INC. |

| |

|

|

| Date:

July 18, 2022 |

By:

|

/s/

Charles A. Ross, Jr. |

| |

|

Charles

A. Ross, Jr.

Chief

Executive Officer |

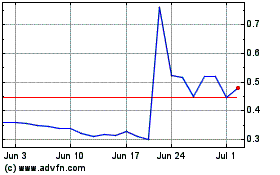

American Rebel (NASDAQ:AREB)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Rebel (NASDAQ:AREB)

Historical Stock Chart

From Apr 2023 to Apr 2024