Current Report Filing (8-k)

June 22 2020 - 6:19AM

Edgar (US Regulatory)

falsefalse00000062010000004515NASDAQ 0000006201 2020-06-21 2020-06-21 0000006201 srt:SubsidiariesMember 2020-06-21 2020-06-21

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 21, 2020

AMERICAN AIRLINES GROUP INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(State or other Jurisdiction

|

|

|

|

|

|

|

|

|

1 Skyview Drive, Fort Worth, Texas

|

|

|

1 Skyview Drive, Fort Worth, Texas

|

|

|

(Address of principal executive offices)

|

|

|

Registrant’s telephone number, including area code:

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, $0.01 par value per share

|

|

|

|

The Nasdaq Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule

12b-2

of the Securities Exchange Act of 1934.

Emerging growth company

☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

On June 21, 2020, American Airlines Group Inc. (“AAG”) issued a press release announcing its intention to commence (i) an underwritten public offering of $750 million of shares of its common stock (the “Common Stock Offering”) and (ii) an underwritten public offering of $750 million aggregate principal amount of convertible senior notes due 2025 (the “Convertible Senior Notes Offering”). American Airlines, Inc. (“AAI” and, together with AAG, the “Companies”) also issued a press release announcing its intention to commence a private offering of $1.5 billion aggregate principal amount of secured senior notes due 2025 (the “Senior Secured Notes Offering”) and to enter into a new $500 million term loan facility due 2024 (the “New Term Loan Facility”). A copy of AAG’s press release with respect to the Common Stock Offering and the Convertible Senior Notes Offering is filed as Exhibit 99.1 to this Current Report on Form

8-K

and a copy of AAI’s press release with respect to the Senior Secured Notes Offering and the New Term Loan Facility is filed as Exhibit 99.2 to this Current Report on Form

8-K,

and, in each case, is incorporated herein by reference.

On June 22, 2020, in connection with the Common Stock Offering and the Convertible Senior Notes Offering, AAG filed with the Securities and Exchange Commission (i) a preliminary prospectus supplement to its effective shelf registration statement on Form

S-3

(File No.

333-236503)

pursuant to Rule 424(b)(5) under the Securities Act of 1933, as amended (the “Securities Act”), relating to the Common Stock Offering and (ii) a preliminary prospectus supplement to its effective shelf registration statement on Form

S-3

(File No.

333-236503)

pursuant to Rule 424(b)(5) under the Securities Act relating to the Convertible Senior Notes Offering.

In connection with the transactions described above, the Companies are filing the updated risk factors attached hereto as Exhibit 99.3.

As previously reported, AAG has applied for a secured loan in the amount of approximately $4.75 billion through the loan program under the Coronavirus Aid, Relief, and Economic Security Act. The loan program continues to progress, and AAG presently expects to obtain a binding commitment for the loan in June 2020. However, AAG has not yet finalized the terms of a binding commitment or a definitive agreement related to this loan, and thus final terms and conditions and closing remain subject to ongoing negotiation, entry by the parties into definitive documentation and satisfaction of closing conditions.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cover page interactive data file (embedded within the Inline XBRL document).

|

Cautionary Statement Regarding Forward-Looking Statements

Certain of the statements contained in this report should be considered forward-looking statements within the meaning of the Securities Act, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. These forward-looking statements may be identified by words such as “may,” “will,” “expect,” “intend,” “anticipate,” “believe,” “estimate,” “plan,” “project,” “could,” “should,” “would,” “continue,” “seek,” “target,” “guidance,” “outlook,” “if current trends continue,” “optimistic,” “forecast” and other similar words. Such statements include, but are not limited to, statements about the Companies’ plans, objectives, expectations, intentions, estimates and strategies for the future, and other statements that are not historical facts. These forward-looking statements are based on the Companies’ current objectives, beliefs and expectations, and

they are subject to significant risks and uncertainties that may cause actual results and financial position and timing of certain events to differ materially from the information in the forward-looking statements. These risks and uncertainties include, but are not limited to, those set forth in the Companies’ Quarterly Report on Form

10-Q

for the three months ended March 31, 2020 (especially in Part I, Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations and Part II, Item 1A. Risk Factors), as updated by Exhibit 99.3 attached hereto, and other risks and uncertainties listed from time to time in the Companies’ other filings with the Securities and Exchange Commission. There may be other factors of which the Companies are not currently aware that may affect matters discussed in the forward-looking statements and may also cause actual results to differ materially from those discussed. In particular, the consequences of the coronavirus outbreak to economic conditions and the travel industry in general and the financial position and operating results of the Companies in particular have been material, are changing rapidly, and cannot be predicted. The Companies do not assume any obligation to publicly update or supplement any forward-looking statement to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements other than as required by law. Any forward-looking statements speak only as of the date hereof or as of the dates indicated in the statement.

Pursuant to the requirements of the Securities Exchange Act of 1934, American Airlines Group Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

American Airlines Group Inc.

|

|

|

|

|

|

|

|

Date: June 22, 2020

|

|

By:

|

|

/s/ Derek J. Kerr

|

|

|

|

|

|

Derek J. Kerr

|

|

|

|

|

|

Executive Vice President and

Chief Financial Officer

|

Pursuant to the requirements of the Securities Exchange Act of 1934, American Airlines, Inc. has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: June 22, 2020

|

|

By:

|

|

/s/ Derek J. Kerr

|

|

|

|

|

|

Derek J. Kerr

|

|

|

|

|

|

Executive Vice President and

Chief Financial Officer

|

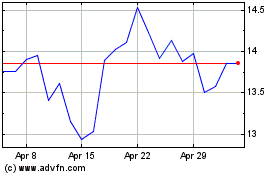

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

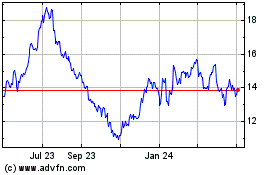

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024