By Alison Sider

Airlines are ramping up pressure on Boeing Co. to help

compensate them for lost revenue and higher costs as the grounding

of the plane maker's 737 MAX aircraft stretches into its eighth

month.

Southwest Airlines Co. Chief Executive Gary Kelly said on

Thursday he is unhappy that the airline has been forced to shrink

this year, and said settling up with Boeing is one of his top

priorities, along with getting the MAX back in the air flying

passengers.

The grounding has been costly for Southwest and other carriers

that fly the MAX. Southwest said the grounding reduced its

operating income by $435 million in the first nine months of the

year and by $210 million in the third quarter. The airline expects

the impact to spill into 2020.

Southwest, the largest carrier of U.S. domestic passengers, only

flies variants of the 737, a strategy that has made it one of

Boeing's most important customers and leaves the company

particularly reliant on the U.S. manufacturer.

Mr. Kelly said Thursday the MAX grounding has forced the company

to examine shifting from an all-Boeing fleet -- something it has

resisted due to the cost savings and operational advantages of

flying only one kind of plane.

"I don't know that we've ever focused on it with that kind of

intensity, " he said, adding that the company will likely start

reviewing the fleet next year.

A Boeing spokesman said the plane maker values its decades-long

relationships with customers, including Southwest, and is sorry for

the disruption.

"While we do not comment on our arrangements with particular

customers, we will continue to work closely with them to reach a

fair and reasonable outcome," the spokesman said.

American Airlines Group Inc., which also reported third-quarter

results Thursday, said it expects the grounding to drag down its

full-year pretax profits by $540 million, up from the $400 million

impact it previously anticipated.

Meanwhile, Norwegian Air Shuttle ASA increased its estimate of

lost profits this year from the grounding of its 737 MAX fleet by

around 40% to 1 billion Norwegian krone, about $110 million.

American Airlines Chief Executive Doug Parker said he wants to

ensure that ultimately Boeing's shareholders -- not American's --

would pay for what he described as Boeing's failures. The plane

maker currently estimates compensation could cost it $6.1 billion,

which could include discounts and services as well as cash

payments.

Still, Southwest and American said strong demand for travel

helped boost revenue during the quarter, even though they have had

to curtail growth plans. Mr. Kelly said bookings are healthy,

bolstering Southwest's outlook even though the airline won't be

able to fly as much as it planned to during the coming holiday

season.

American's revenue grew 3% during the quarter. But the airline

lowered the high end of its full-year adjusted-earnings guidance to

$5.50 a share from $6 a share. The low end of the range is $4.50 a

share.

American shares closed up nearly 4% at $29.41, and Southwest

rose almost 6% to $56.29.

The MAX has been grounded globally since March following a

second fatal crash in less than five months, forcing airlines to

cancel thousands of flights and miss out on the revenue they would

have brought in.

Airlines that fly the MAX have spent much of the year waiting

for Boeing to make software fixes and for regulators to sign off.

The plane's expected return has slipped several times, with each

delay requiring carriers to cancel flights and rebuild

schedules.

The past week has been particularly tumultuous, with lawmakers

and regulators raising fresh concerns about how the MAX was

developed and certified. Some worried that the disclosure of a

former Boeing pilot's internal messages, suggesting he had

encountered trouble during tests in a simulator in 2016 and had

unknowingly misled regulators in his work on the MAX, could derail

progress toward the plane's return to service.

Mark Forkner, the former Boeing pilot, now works at Southwest.

Mr. Kelly said Thursday that the messages are unrelated to Mr.

Forkner's work as a first officer and that Mr. Forker is by all

accounts a "very fine man and does a fine job for us."

Boeing on Wednesday said that it still believes it can secure

regulatory approval for the return of the MAX this year. Airlines

say it may take another month or two to work through training and

prepare stored planes to fly, and the carriers aren't taking their

chances with holiday travel schedules. American and United Airlines

Holdings Inc., which also flies the MAX, have removed the plane

from their schedules until January, while Southwest has taken it

out until February.

Mr. Parker said Boeing's belief that the MAX will be certified

to fly again this year is encouraging but probably a best-case

scenario, given previous delays. American plans to phase the MAX

back in slowly, beginning with just five planes starting in

mid-January.

"We're frustrated," he said, adding that the current timing

could change again.

For travelers, the grounding has meant fewer flight options and

other inconveniences, like changes to long-planned trips as the

MAX's return date has been pushed out.

Some analysts have said the absence of the MAX likely resulted

in fares that were higher than they otherwise would have been.

Investors have started to become anxious that whenever the MAX

does return to service, it will result in a flood of new capacity

hitting the market when travel demand may ebb if the economy

falters.

At the same time, airlines' costs are poised to climb due to new

labor deals being worked out.

Southwest posted earnings of $659 million, or $1.23 a share, up

from $615 million, or $1.08 a share, in the comparable quarter last

year. Analysts polled by FactSet were expecting $1.09 a share.

American reported a profit of $425 million, or 96 cents a share,

up from $372 million, or 81 cents a share, a year earlier. Adjusted

earnings were $1.42 a share, ahead of the $1.40 a share analysts

were expecting.

--Patrick Thomas and Dave Sebastian contributed to this

article.

Write to Alison Sider at alison.sider@wsj.com

(END) Dow Jones Newswires

October 24, 2019 16:47 ET (20:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

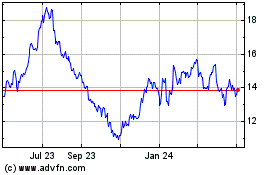

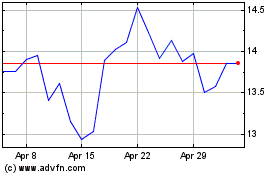

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024