Current Report Filing (8-k)

March 02 2023 - 4:48PM

Edgar (US Regulatory)

AMBARELLA INC RI false 0001280263 0001280263 2023-02-24 2023-02-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

February 24, 2023

Date of Report (date of earliest event reported)

AMBARELLA, INC.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

| Cayman Islands |

|

001-35667 |

|

98-0459628 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I. R. S. Employer Identification No.) |

3101 Jay Street

Santa Clara, CA 95054

(Address of principal executive offices)

Registrant’s telephone number, including area code: (408) 734-8888

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Ordinary Shares, $0.00045 par value |

|

AMBA |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

Fiscal Year 2024 Annual Bonus Plan

On February 24, 2023, the Compensation Committee of the Board of Directors (the “Compensation Committee”) of Ambarella, Inc. (the “Company”) approved a Fiscal Year 2024 Annual Bonus Plan (the “FY2024 Bonus Plan”). The Company’s executive team members, including executive officers Feng-Ming Wang, Brian White, Les Kohn, Chan Lee, Christopher Day, John Ju, and Yun-Lung Chen, are eligible to participate in the FY2024 Bonus Plan. The Board of Directors also approved a bonus target under the FY2024 Bonus Plan for Feng-Ming Wang, the Company’s Chief Executive Officer, of 100% of his fiscal year 2024 annual base salary. Bonus targets for other executives range from 40% to 75% of annual base salary. The FY2024 Bonus Plan establishes an aggregate target bonus pool that is approximately 17% smaller than the target bonus pool under the fiscal year 2023 bonus plan. The actual aggregate amount of the bonus pool under the FY2024 Bonus Plan will be determined by the Compensation Committee or the Board of Directors following completion of fiscal year 2024 based upon the Company’s fiscal year 2024 performance against revenue, operating profit, and certain non-financial operational objectives established by the Compensation Committee. The performance weightings for the executive management team are 1/3 for the revenue metric, 1/3 for the operating profit metric and 1/3 for the non-financial operational objectives. On-target performance is intended to result in an aggregate bonus pool payout at target levels. Above target performance is intended to result in aggregate bonus pool payouts above target levels, with a maximum payout equal to 150% of the annual targeted bonus pool payout, absent approval otherwise by the Board of Directors or the Compensation Committee. Failure to achieve threshold performance levels will result in no funding of the bonus pool, while performance between threshold and target levels will be determined by liner interpolation. The Compensation Committee and the Board of Directors have discretion to individually apportion from such bonus pool and pay bonuses, if any, to individual executives that are based on achievement of corporate goals and individual objectives. Any bonus plan payouts will be made no later than two and one-half months following the end of the Company’s fiscal year 2024, and generally are subject to continued employment through the payment date. The Compensation Committee and the Board of Directors have discretion to reduce, eliminate or increase the size of the bonus pool and the individual bonuses.

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Dated: March 2, 2023 |

|

|

|

Ambarella, Inc. |

|

|

|

|

|

|

|

|

|

|

/s/ Michael Morehead |

|

|

|

|

|

|

Michael Morehead General Counsel |

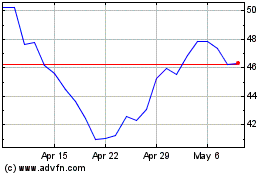

Ambarella (NASDAQ:AMBA)

Historical Stock Chart

From Mar 2024 to Apr 2024

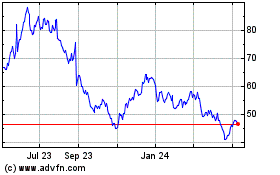

Ambarella (NASDAQ:AMBA)

Historical Stock Chart

From Apr 2023 to Apr 2024