Amended Statement of Beneficial Ownership (sc 13d/a)

February 28 2023 - 11:20AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 12)*

|

Amarin Corporation plc

|

|

(Name of Issuer)

|

| |

|

Ordinary Shares, par value 50 pence per share

|

|

(Title of Class of Securities)

|

| |

|

023111206

|

|

(CUSIP Number)

|

| |

|

Mark DiPaolo

Senior Partner, General Counsel

Sarissa Capital Management LP

660 Steamboat Road

Greenwich, CT 06830

203-302-2330

|

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

|

| |

|

February 28, 2023

|

|

(Date of Event which Requires Filing of this Statement)

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), 13d-1(f) or 13d-1(g),

check the following box.

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for other parties to whom copies

are to be sent.

*The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures

provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that

section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 023111206

|

SCHEDULE 13D

|

Page 2 of 4 Pages

|

This Amendment No. 12 to Schedule 13D (“Amendment No. 12”) relates to American Depositary Shares (“ADS(s)”), each ADS representing one ordinary share, par value 50 pence per share (the “Ordinary Shares”), issued by

Amarin Corporation plc, a company incorporated under the laws of England and Wales (the “Issuer”), and amends the initial statement on Schedule 13D filed with the Securities and Exchange Commission (the “SEC”) on January 24, 2022 (the “Initial

Schedule 13D”), as amended by Amendment No. 1 to Schedule 13D filed on June 3, 2022, Amendment No. 2 to Schedule 13D filed on June 16, 2022, Amendment No. 3 to Schedule 13D filed on October 11, 2022, Amendment No. 4 to Schedule 13D filed on January

11, 2023, Amendment No. 5 to Schedule 13D filed on January 19, 2023, Amendment No. 6 to Schedule 13D filed on February 8, 2023, Amendment No. 7 to Schedule 13D filed on February 10, 2023, Amendment No. 8 to Schedule 13D filed on February 14, 2023,

Amendment No. 9 to Schedule 13D filed on February 15, 2023, Amendment No. 10 to Schedule 13D filed on February 21, 2023 and Amendment No. 11 to Schedule 13D filed on February 27, 2023 (the Initial Schedule 13D as so amended, the “Schedule 13D”). All

capitalized terms contained herein but not otherwise defined shall have the meanings ascribed to such terms in the Schedule 13D.

This Amendment No. 12 is being filed to amend Item 4 and Item 7 as follows:

Item 4. Purpose of Transaction. Item 4 of the Schedule 13D is hereby amended to include the following:

On February 28, 2023, Sarissa Capital issued the press release attached as Exhibit 15 hereto.

Item 7. Material to Be Filed as Exhibits. Item 7 of the Schedule 13D is hereby amended to include the following:

Exhibit 15 – Press Release, February 28, 2023

|

CUSIP No. 023111206

|

SCHEDULE 13D

|

Page 3 of 4 Pages

|

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

|

Dated: February 28, 2023

|

|

| |

|

|

|

SARISSA CAPITAL MANAGEMENT LP

|

|

| |

|

|

|

By:

|

/s/ Mark DiPaolo

|

|

| |

Name: Mark DiPaolo

|

|

| |

Title: Senior Partner, General Counsel

|

|

| |

|

|

|

/s/ Alexander J. Denner

|

|

|

Alexander J. Denner

|

|

| |

|

|

|

/s/ Louis Sterling III

|

|

|

Louis Sterling III

|

|

|

CUSIP No. 023111206

|

SCHEDULE 13D

|

Page 4 of 4 Pages

|

INDEX TO EXHIBITS

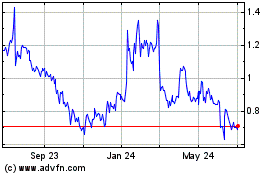

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

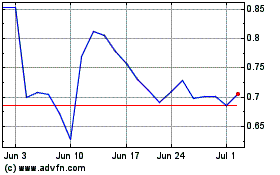

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024