Amended Current Report Filing (8-k/a)

November 05 2019 - 5:29PM

Edgar (US Regulatory)

AMARIN CORP PLCUK

true

0000897448

0000897448

2019-11-05

2019-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K/A

(Amendment No. 1)

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 5, 2019

Amarin Corporation plc

(Exact name of registrant as specified in its charter)

|

|

|

|

|

England and Wales

|

0-21392

|

Not applicable

|

|

(State or other jurisdiction

of incorporation)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

77 Sir John Rogerson’s Quay, Block C,

Grand Canal Docklands, Dublin 2, Ireland

|

Not applicable

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: +353 1 6699 020

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol

|

Name of each exchange on which registered

|

|

American Depositary Shares (ADS(s)), each ADS representing the right to receive one (1) Ordinary Share of Amarin Corporation plc

|

AMRN

|

NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

Amarin Corporation plc (the “Company”) is filing this Amendment No. 1 to the Current Report on Form 8-K solely to correct a clerical error in the consolidated statement of operations data and the reconciliation of GAAP net income (loss) included in a press release issued on November 5, 2019 announcing its financial results for the three and nine months ended September 30, 2019 (the “Press Release”), which was furnished as Exhibit 99.1 to the Company’s Current Report on Form 8-K dated November 5, 2019 (the “Original Form 8-K”). While the Company’s Form 10-Q for the quarter ended September 30, 2019 and the Press Release accurately reflect the Company’s financial performance, due to a clerical error, the Original Form 8-K incorrectly presented certain financial data in the consolidated statement of operations data and the reconciliation of GAAP net income (loss) for the three and nine months ended September 30, 2019. Except as amended below, all other information in the Original Form 8-K remains unchanged.

Item 2.02Results of Operations and Financial Condition

On November 5, 2019, the Company issued the Original Form 8-K announcing its financial results for the three and nine months ended September 30, 2019. The following presents the corrected consolidated statement of operations data and the reconciliation of

GAAP net income (loss) for the three and nine months ended September 30, 2019, which shall be deemed to amend and restate the corresponding sections in the Original Form 8-K.

|

CONSOLIDATED STATEMENTS OF OPERATIONS DATA

|

|

|

(U.S. GAAP)

|

|

|

Unaudited

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30,

|

|

|

Nine months ended September 30,

|

|

|

|

|

(in thousands, except per share amounts)

|

|

|

(in thousands, except per share amounts)

|

|

|

|

|

2019

|

|

|

2018

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product revenue, net

|

$

|

112,250

|

|

|

$

|

54,973

|

|

|

$

|

285,347

|

|

|

$

|

151,286

|

|

|

Licensing revenue

|

|

158

|

|

|

|

350

|

|

|

|

1,131

|

|

|

|

598

|

|

|

Total revenue, net

|

|

112,408

|

|

|

|

55,323

|

|

|

|

286,478

|

|

|

|

151,884

|

|

|

Less: Cost of goods sold

|

|

25,444

|

|

|

|

13,541

|

|

|

|

65,354

|

|

|

|

37,035

|

|

|

Gross margin

|

|

86,964

|

|

|

|

41,782

|

|

|

|

221,124

|

|

|

|

114,849

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative (1)

|

|

82,559

|

|

|

|

49,960

|

|

|

|

227,598

|

|

|

|

147,310

|

|

|

Research and development (1)

|

|

8,923

|

|

|

|

14,072

|

|

|

|

23,295

|

|

|

|

43,993

|

|

|

Total operating expenses

|

|

91,482

|

|

|

|

64,032

|

|

|

|

250,893

|

|

|

|

191,303

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss

|

|

(4,518

|

)

|

|

|

(22,250

|

)

|

|

|

(29,769

|

)

|

|

|

(76,454

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income (expense), net

|

|

1,146

|

|

|

|

(2,163

|

)

|

|

|

238

|

|

|

|

(6,188

|

)

|

|

Other expense, net

|

|

(90

|

)

|

|

|

(58

|

)

|

|

|

(182

|

)

|

|

|

(134

|

)

|

|

Loss from operations before taxes

|

|

(3,462

|

)

|

|

|

(24,471

|

)

|

|

|

(29,713

|

)

|

|

|

(82,776

|

)

|

|

(Provision for) benefit from income taxes

|

—

|

|

|

—

|

|

|

—

|

|

|

—

|

|

|

Net loss

|

$

|

(3,462

|

)

|

|

$

|

(24,471

|

)

|

|

$

|

(29,713

|

)

|

|

$

|

(82,776

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

$

|

(0.01

|

)

|

|

$

|

(0.08

|

)

|

|

$

|

(0.09

|

)

|

|

$

|

(0.28

|

)

|

|

Diluted

|

$

|

(0.01

|

)

|

|

$

|

(0.08

|

)

|

|

$

|

(0.09

|

)

|

|

$

|

(0.28

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

350,994

|

|

|

|

295,595

|

|

|

|

336,938

|

|

|

|

291,526

|

|

|

Diluted

|

|

350,994

|

|

|

|

295,595

|

|

|

|

336,938

|

|

|

|

291,526

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Excluding non-cash stock-based compensation, selling, general and administrative expenses were $75,803 and $44,357 for the three months ended September 30, 2019 and 2018, respectively, and research and development expenses were $7,716 and $13,024, respectively, for the same periods. Excluding non-cash stock-based compensation as well as co-promotion fees paid to the company's U.S. co-promotion partner, selling, general and administrative expenses were $75,803 and $33,200 for the three months ended September 30, 2019 and 2018, respectively.

|

|

|

|

|

|

|

RECONCILIATION OF NON-GAAP NET INCOME (LOSS)

|

|

|

Unaudited

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended September 30,

|

|

|

Nine months ended September 30,

|

|

|

|

|

(in thousands, except per share amounts)

|

|

|

(in thousands, except per share amounts)

|

|

|

|

|

2019

|

|

|

2018

|

|

|

2019

|

|

|

2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss for EPS1 - GAAP

|

|

$

|

(3,462

|

)

|

|

|

$

|

(24,471

|

)

|

|

|

$

|

(29,713

|

)

|

|

|

$

|

(82,776

|

)

|

|

|

Non-cash stock-based compensation expense

|

|

|

7,963

|

|

|

|

|

6,651

|

|

|

|

|

22,729

|

|

|

|

|

14,032

|

|

|

Adjusted net income (loss) for EPS1 - non-GAAP

|

|

$

|

4,501

|

|

|

|

$

|

(17,820

|

)

|

|

|

$

|

(6,984

|

)

|

|

|

$

|

(68,744

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1basic and diluted

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic - non-GAAP

|

|

$

|

0.01

|

|

|

|

$

|

(0.06

|

)

|

|

|

$

|

(0.02

|

)

|

|

|

$

|

(0.24

|

)

|

|

Diluted - non-GAAP

|

|

|

0.01

|

|

|

|

|

(0.06

|

)

|

|

|

|

(0.02

|

)

|

|

|

|

(0.24

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

350,994

|

|

|

|

|

295,595

|

|

|

|

|

336,938

|

|

|

|

|

291,526

|

|

|

Diluted

|

|

|

392,612

|

|

|

|

|

295,595

|

|

|

|

|

336,938

|

|

|

|

|

291,526

|

|

The information in this report furnished pursuant to Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section. It may only be incorporated by reference in another filing under the Exchange Act or the Securities Act of 1933, as amended, if such subsequent filing specifically references the information furnished pursuant to Item 2.02 of this report.

Item 9.01Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

Exhibit No.

|

Description

|

|

|

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

* * *

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Date: November 5, 2019

|

|

Amarin Corporation plc

|

|

|

|

|

|

|

|

|

By:

|

/s/ John F. Thero

|

|

|

|

|

John F. Thero

|

|

|

|

|

President and Chief Executive Officer

|

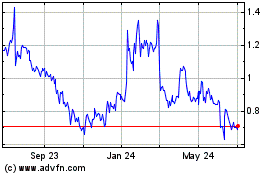

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

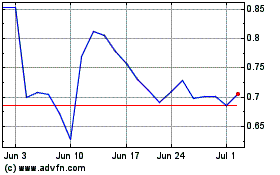

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024