REDUCE-IT™ Study On-Track for Reporting Top-Line

Results by the End of September 2018

Amarin Corporation plc (NASDAQ:AMRN), a biopharmaceutical

company focused on the commercialization and development of

therapeutics to improve cardiovascular health, today announced

financial results for the three and six months ended June 30, 2018,

and provided an update on company operations.

Key Amarin achievements since its last quarterly

report include:

- R&D progress: The Vascepa

cardiovascular outcomes study, REDUCE-IT™, is designed to provide

data to support a significantly expanded market opportunity for

Vascepa® (icosapent ethyl). The company announced that, as

expected, it is making progress towards completion of this

important study. The company reiterated that it anticipates

reporting top-line results from REDUCE-IT before the end of

September 2018.

- U.S. revenue growth: Recognized

$52.5 million in net product revenue from Vascepa sales in Q2 2018

compared to $44.9 million in Q2 2017, an increase of 17%.

- U.S. prescription growth: Increased

normalized prescriptions for Vascepa by 22% and 24% compared to Q2

2017 based on data from Symphony Health Solutions and IQVIA,

respectively.

- International development:

Announced regulatory approval for Vascepa in the United Arab

Emirates. Announced a strategic collaboration with Mochida

Pharmaceutical Co., Ltd. to further develop preventative healthcare

solutions on a worldwide basis through continued innovation,

research and development of product opportunities based on the

unique properties of eicosapentaenoic acid (EPA).

- Intellectual property: Announced a

settlement agreement with Teva Pharmaceuticals USA, Inc. that

resolves Amarin’s previously reported Vascepa patent litigation as

it relates to Teva’s abbreviated new drug application seeking U.S.

Food and Drug Administration approval of generic forms of Vascepa

capsules.

- Cash balance: As of June 30, 2018, Amarin had a cash balance of

$102.3 million.

“There is an urgent need to help more patients,

and it is becoming increasingly evident that lowering cholesterol

is not enough,” stated John F. Thero, president and chief executive

officer. “After decades of decline in the death rate from

cardiovascular disease, the number of deaths from cardiovascular

disease is rising again in spite of increased statin use and

increased focus on other LDL-lowering therapies.1 Vascepa could

potentially be used for tens of millions of at-risk patients. We

look forward with excitement to very soon having the results of the

landmark REDUCE-IT study to report.”

REDUCE-IT Cardiovascular Outcomes

Study

The Vascepa cardiovascular outcomes study,

REDUCE-IT, is progressing closer to completion with top-line

results from the study anticipated to be reported before the end of

September 2018. Amarin commented that final vital status data now

has been secured for more than 99.5% of the 8,175 patients enrolled

in the study. Consistent with late stage activities for large

outcomes studies, efforts remain ongoing to adjudicate reported

events, including major adverse cardiovascular events (MACE) within

the primary endpoint that could not be adjudicated until after the

last patient visits occurred. Efforts are also underway to complete

the review of data for consistency and completeness across the more

than 35,000 patient years in the trial, with emphasis on resolving

remaining data queries to contribute to a robust and accurate

database.

Amarin continues to be intentionally blinded to

the results of the study and will remain blinded to such results

until after the study is completed and the database is locked.

Furthermore, all parties associated with the REDUCE-IT study,

including the contract research organizations, independent review

committees, clinical sites and patients, remain blinded to the

final results of the study. As previously stated, once the

REDUCE-IT database is locked, consistent with other outcomes

studies, the company and a team of experts plan to confidentially

review and analyze the data and promptly announce top-line results

publicly. Broader reporting of results is targeted for a scientific

conference in Q4 2018. The time between locking the database

and reporting top-line results is intended to be as brief as is

possible to support both timely and accurate reporting of the

results. Consistent with the practices of most other companies,

Amarin does not plan to separately announce the date the

database is locked. Rather, the company will focus on reporting the

top-line results promptly after top-line results are known

following database lock. Amarin’s anticipation of reporting

top-line results before the end of September 2018 is consistent

with the end of study wind-down timing periods observed for other

large outcomes studies.

Company Preparations for REDUCE-IT

Conclusion

Amarin continues to prepare its commercial

infrastructure for the announcement of the results of the REDUCE-IT

study, including recent promotion of three high performing district

sales managers to newly defined roles as regional directors in

preparation for potential rapid sales force expansion and

increasing levels of available Vascepa inventory. As previously

stated, during 2018 we anticipate incremental inventory increases

prior to REDUCE-IT results of up to approximately $10 million. As

of June 30, 2018, we had increased inventory levels during 2018 by

approximately half of the target increase amount with the balance

of the increase scheduled for coming months.

Financial Update

Net product revenue for the three months ended

June 30, 2018 and 2017 was $52.5 million and $44.9 million,

respectively. Net product revenue for the six months ended June 30,

2018 and 2017 was $96.3 million and $79.3 million, respectively.

The increase in net product revenue was primarily attributable to

increases in new and recurring prescriptions of Vascepa.

During the second quarter, based on data from

Symphony Health Solutions and IQVIA, Amarin experienced continued

prescription growth and increase in Vascepa market share,

particularly among detailed physicians. These sources both reported

estimated normalized total Vascepa prescriptions of approximately

430,000 for the three months ended June 30, 2018, representing

growth of approximately 22% and 24%, respectively, over levels

estimated by these sources for the same three months of the prior

year.

Despite record levels of estimated Vascepa

prescriptions reported by these third-party sources for the second

quarter of 2018 and record levels of physicians reported to have

prescribed Vascepa during the same period, Vascepa growth during

this period appears to have been limited by patients lost to

therapy during the first quarter of 2018 who did not resume filling

Vascepa prescriptions during the second quarter of 2018. As

previously described, beginning of the year insurance deductibles

increased in 2018 under various health insurance plans. This

industry-wide phenomenon, which is particularly impactful to

prescriptions for therapies addressing asymptomatic medical

conditions, resulted in some patients not filling prescriptions

early in 2018. Once patients cease filling prescriptions, they

become less prone, or unable, to resume filling prescriptions until

they again visit their doctors. Net pricing of Vascepa in the

second quarter of 2018 is relatively consistent with the prior year

and channel inventory levels remain in the ordinary range.

Licensing revenues recognized by the company

were $0.2 million and $0.6 million in the six months ended June 30,

2018 and 2017, respectively, related to timing of milestones and

other factors impacting revenue recognition for licensing fees

under agreements for the commercialization of Vascepa outside the

United States.

Cost of goods sold for the three months ended

June 30, 2018 and 2017 was $12.8 million and $11.4 million,

respectively. Cost of goods sold for the six months ended

June 30, 2018 and 2017 was $23.5 million and $19.6 million,

respectively. Gross margin on net product revenue for the three and

six months ended June 30, 2018 and 2017 was 76% and 75%,

respectively.

Selling, general and administrative (SG&A)

expenses in the six months ended June 30, 2018 and 2017 were $97.4

million and $65.7 million, respectively, an increase of 48%. This

increase is due primarily to increased promotional activities,

including commercial spend for anticipated expansion following

successful REDUCE-IT results, and increased co-promotion fees

calculated on increased gross profit resulting from higher net

product revenue, including an accrual of $6.8 million for

co-promotion tail payments. The tail co-promotion fees, which are

calculated as a percentage of the 2018 co-promotion fee, are

payable in 2019 through 2021. SG&A expenses for the six months

ended June 30, 2018 also include $2.0 million related to the

settlement agreement with Teva Pharmaceuticals USA, Inc. which

resolved Amarin’s previously reported Vascepa patent litigation

related to Teva’s abbreviated new drug application (ANDA) seeking

U.S. Food and Drug Administration approval of generic forms of

Vascepa capsules. As previously disclosed, ANDA-related patent

litigation continues in the United States District Court for the

District of Nevada with West-Ward Pharmaceuticals Corp. and Dr.

Reddy’s Laboratories, Inc. and their affiliated entities.

Research and development (R&D) expenses in

the six months ended June 30, 2018 and 2017 were $29.9 million and

$24.5 million, respectively, an increase of 22%. This increase in

expense is primarily driven by the timing of REDUCE-IT and related

costs and the recording of $2.7 million in expense related to the

company’s previously announced strategic collaboration with Mochida

Pharmaceutical Co., Ltd. We continue to anticipate that our

level of spending on R&D will decline after completion of the

REDUCE-IT and initial publication of results from this important

study.

Under U.S. GAAP, Amarin reported a net loss of $34.2 million in the

three months ended June 30, 2018, or basic and diluted loss per

share of $0.12. This net loss included $3.6 million in non-cash

stock-based compensation expense. Amarin reported a net loss of

$13.6 million in the second quarter of 2017, or basic and diluted

loss per share of $0.05. This net loss included $3.6 million in

non-cash stock-based compensation expense.

Under GAAP, Amarin reported a net loss of $58.3

million in the six months ended June 30, 2018, or basic and diluted

loss per share of $0.20. This net loss included $7.4 million in

non-cash stock-based compensation expense. For the six months ended

June 30, 2017, Amarin reported a net loss of $34.6 million, or

basic and diluted loss per share of $0.13. This net loss included

$7.0 million in non-cash stock-based compensation expense.

Excluding non-cash gains or losses for

stock-based compensation, non-GAAP adjusted net loss was $30.6

million for the second quarter of 2018, or non-GAAP adjusted basic

and diluted loss per share of $0.10, compared to non-GAAP adjusted

net loss of $10.0 million for the second quarter of 2017, or

non-GAAP adjusted basic and diluted loss per share of $0.04.

Excluding non-cash gains or losses for

stock-based compensation, non-GAAP adjusted net loss was $50.9

million for the six months ended June 30, 2018, or non-GAAP

adjusted basic and diluted loss per share of $0.18, compared to

non-GAAP adjusted net loss of $27.6 million for the six months

ended June 30, 2017, or non-GAAP adjusted basic and diluted loss

per share of $0.10.

Amarin reported cash and cash equivalents of

$102.3 million as of June 30, 2018. Net cash flows for the six

months ended June 30, 2018, excluding the $70.0 million in net

proceeds from the equity offering completed in the first quarter,

was negative $41.4 million. Net cash flows for the same period was

positive $9.3 million excluding cash outflows associated with

financing and REDUCE-IT. More specifically, net cash flow was

positive for this period excluding finance related proceeds and

expenses (interest and royalty), excluding research and development

payments (most of which relates to the REDUCE-IT study), excluding

payments made in preparation for expansion upon positive REDUCE-IT

results, and excluding the one-time payment made related to the

settlement agreement with Teva Pharmaceuticals USA, Inc.

As of June 30, 2018, the company had $50.3

million in net accounts receivable ($67.0 million in gross accounts

receivable before allowances and reserves) and $40.1 million in

inventory.

As of June 30, 2018, Amarin had approximately

293.9 million American Depository Shares (ADSs) and ordinary shares

outstanding, 32.8 million common share equivalents of Series A

Convertible Preferred Shares outstanding and approximately 25.3

million equivalent shares underlying stock options at a

weighted-average exercise price of $3.35, as well as 12.2 million

equivalent shares underlying restricted or deferred stock

units.

Conference Call and Webcast

Information

Amarin will host a conference call

at 7:30 a.m. ET today, August 1, 2018. The

call will be webcast live with slides and accessible through the

investor relations section of the company’s website at

www.amarincorp.com. The call can also be heard via telephone by

dialing 877-407-8033. A replay of the call will be made available

for a period of two weeks following the conference call. To hear a

replay of the call, dial 877-481-4010 (inside the United States) or

919-882-2331 (outside the United States). A replay of the call will

also be available through the company's website shortly after the

call. For both dial-in numbers please use conference ID 34827.

Use of Non-GAAP Adjusted Financial

Information

Included in this press release are non-GAAP

adjusted financial information as defined by U.S. Securities and

Exchange Commission Regulation G. The GAAP financial measure most

directly comparable to each non-GAAP adjusted financial measure

used or discussed, and a reconciliation of the differences between

each non-GAAP adjusted financial measure and the comparable GAAP

financial measure, is included in this press release after the

condensed consolidated financial statements.

Non-GAAP adjusted net loss was derived by taking

GAAP net loss and adjusting it for non-cash stock-based

compensation expense. Management uses these non-GAAP adjusted

financial measures for internal reporting and forecasting purposes,

when publicly providing its business outlook, to evaluate the

company’s performance and to evaluate and compensate the company’s

executives. The company has provided these non-GAAP financial

measures in addition to GAAP financial results because it believes

that these non-GAAP adjusted financial measures provide investors

with a better understanding of the company’s historical results

from its core business operations.

While management believes that these non-GAAP

adjusted financial measures provide useful supplemental information

to investors regarding the underlying performance of the company’s

business operations, investors are reminded to consider these

non-GAAP measures in addition to, and not as a substitute for,

financial performance measures prepared in accordance with GAAP.

Non-GAAP measures have limitations in that they do not reflect all

of the amounts associated with the company’s results of operations

as determined in accordance with GAAP. In addition, it should be

noted that these non-GAAP financial measures may be different from

non-GAAP measures used by other companies, and management may

utilize other measures to illustrate performance in the future.

About Amarin

Amarin Corporation plc is a biopharmaceutical

company focused on the commercialization and development of

therapeutics to improve cardiovascular health. Amarin's

product development program leverages its extensive experience in

lipid science and the potential therapeutic benefits of

polyunsaturated fatty acids. Vascepa® (icosapent ethyl),

Amarin's first FDA-approved product, is a highly-pure, EPA omega-3

fatty acid product available by prescription. For more

information about Vascepa visit www.vascepa.com. For more

information about Amarin visit www.amarincorp.com.

About REDUCE-IT

Amarin's clinical development program for

Vascepa includes a trial known as the REDUCE-IT cardiovascular

outcomes study, an 8,175-patient study commenced in 2011. REDUCE-IT

is the first multinational cardiovascular outcomes study evaluating

the effect of prescription pure EPA therapy, or any

triglyceride-lowering therapy, as an add-on to statins in patients

with high cardiovascular risk who, despite stable statin therapy,

have elevated triglyceride levels (150-499 mg/dL). A large portion

of the male and female patients enrolled in this outcomes study are

anticipated to also be diagnosed with type 2 diabetes. As reported

previously, Amarin expects to announce top-line results of this

important study before the end of Q3 2018. The REDUCE-IT

trial is being conducted under a Special Protocol Assessment

agreement with the U.S. Food and Drug Administration.

Additional information on clinical studies of

Vascepa can be found at www.clinicaltrials.gov.

About VASCEPA® (icosapent ethyl)

Capsules

Vascepa® (icosapent ethyl) capsules are a

single-molecule prescription product consisting of the omega-3 acid

commonly known as EPA in ethyl-ester form. Vascepa is not fish oil,

but is derived from fish through a stringent and complex

FDA-regulated manufacturing process designed to effectively

eliminate impurities and isolate and protect the single molecule

active ingredient. Vascepa, known in scientific literature as

AMR101, has been designated a new chemical entity by the FDA.

Amarin has been issued multiple patents internationally based on

the unique clinical profile of Vascepa, including the drug’s

ability to lower triglyceride levels in relevant patient

populations without raising LDL-cholesterol levels.

FDA-approved indication and usage

- Vascepa (icosapent ethyl) is

indicated as an adjunct to diet to reduce triglyceride (TG) levels

in adult patients with severe (≥500 mg/dL)

hypertriglyceridemia.

- The effect of Vascepa on the risk

for pancreatitis and cardiovascular mortality and morbidity in

patients with severe hypertriglyceridemia has not been

determined.

Important safety information for Vascepa

- Vascepa is contraindicated in

patients with known hypersensitivity (e.g., anaphylactic reaction)

to Vascepa or any of its components.

- Use with caution in patients with

known hypersensitivity to fish and/or shellfish.

- The most common reported adverse

reaction (incidence > 2% and greater than placebo) was

arthralgia (2.3% for Vascepa, 1.0% for placebo). There was no

reported adverse reaction > 3% and greater than placebo.

- Patients receiving treatment with

Vascepa and other drugs affecting coagulation (e.g., anti-platelet

agents) should be monitored periodically.

- In patients with hepatic

impairment, monitor ALT and AST levels periodically during

therapy.

- Patients should be advised to

swallow Vascepa capsules whole; not to break open, crush, dissolve,

or chew Vascepa.

- Adverse events and product

complaints may be reported by calling 1-855-VASCEPA or the FDA at

1-800-FDA-1088.

FULL VASCEPA PRESCRIBING INFORMATION CAN BE

FOUND AT WWW.VASCEPA.COM.

Vascepa has been approved for use by the United

States Food and Drug Administration (FDA) as an adjunct to diet to

reduce triglyceride levels in adult patients with severe (≥500

mg/dL) hypertriglyceridemia. Nothing in this press release should

be construed as promoting the use of Vascepa in any indication that

has not been approved by the FDA.

About Cardiovascular

Disease

Worldwide, cardiovascular disease (CVD) remains

the #1 killer of men and women. In the United States, CVD leads to

one in every three deaths – one death approximately every 38

seconds – with annual treatment cost in excess of $500 billion.1,

2

Beyond the cardiovascular risk associated with

LDL-C, genetic, epidemiologic, clinical and real-world data suggest

that patients with elevated triglycerides (TG) (fats in the blood),

and TG-rich lipoproteins, are at increased risk for cardiovascular

disease. 3, 4, 5, 6

Leading clinical investigations seeking to

address cardiovascular risk reduction beyond lowering LDL-C focus

on interrupting the atherosclerotic process (e.g., plaque formation

and instability) by beneficially affecting other lipid, lipoprotein

and inflammation biomarkers and cellular functions thought to be

related to atherosclerosis and cardiovascular events.

Forward-Looking Statements

This press release contains forward-looking

statements, including expectations regarding adjudication of MACE

events, results and related timing and announcements with respect

to Amarin's REDUCE-IT cardiovascular outcomes study; expectations

related to the final outcomes of the REDUCE-IT study and the

anticipated successful completion of the REDUCE-IT study; and

statements regarding the potential and therapeutic benefits of

Vascepa. These forward-looking statements are not promises or

guarantees and involve substantial risks and uncertainties. In

particular, as disclosed in filings with the U.S. Securities and

Exchange Commission, Amarin's ability to effectively develop and

commercialize Vascepa will depend in part on its ability to

continue to effectively finance its business, efforts of third

parties, its ability to create market demand for Vascepa through

education, marketing and sales activities, to achieve increased

market acceptance of Vascepa, to receive adequate levels of

reimbursement from third-party payers, to develop and maintain a

consistent source of commercial supply at a competitive price, to

comply with legal and regulatory requirements in connection with

the sale and promotion of Vascepa and to maintain patent protection

for Vascepa. Among the factors that could cause actual results to

differ materially from those described or projected herein include

the following: uncertainties associated generally with research and

development, clinical trials and related regulatory approvals; the

risk that related cost may increase beyond expectations; the risk

that future legal determinations and interactions with regulatory

authorities may impact Vascepa marketing and sales rights and

efforts; the risk that Vascepa may not show clinically meaningful

effects in REDUCE-IT or support regulatory approvals for

cardiovascular risk reduction; and the risk that patents may not be

upheld in anticipated patent litigation. A further list and

description of these risks, uncertainties and other risks

associated with an investment in Amarin can be found in Amarin’s

filings with the U.S. Securities and Exchange Commission, including

its most recent Quarterly Report on Form 10-Q. Existing and

prospective investors are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

hereof. Amarin undertakes no obligation to update or revise

the information contained in this press release, whether as a

result of new information, future events or circumstances or

otherwise.

Availability of Other Information About

Amarin

Investors and others should note that Amarin

communicates with its investors and the public using the company

website (www.amarincorp.com), the investor relations website

(investor.amarincorp.com), including but not limited to investor

presentations and investor FAQs, Securities and Exchange Commission

filings, press releases, public conference calls and

webcasts. The information that Amarin posts on these channels

and websites could be deemed to be material information. As a

result, Amarin encourages investors, the media, and others

interested in Amarin to review the information that is posted on

these channels, including the investor relations website, on a

regular basis. This list of channels may be updated from time

to time on Amarin’s investor relations website and may include

social media channels. The contents of Amarin’s website or

these channels, or any other website that may be accessed from its

website or these channels, shall not be deemed incorporated by

reference in any filing under the Securities Act of 1933.

References

1 American Heart Association. 2018. Disease and

Stroke Statistics-2018 Update.

2 American Heart Association. 2017.

Cardiovascular disease: A costly burden for America projections

through 2035.

3 Budoff M. Triglycerides and triglyceride-rich

lipoproteins in the causal pathway of cardiovascular disease. Am J

Cardiol. 2016;118:138-145.

4 Toth PP, Granowitz C, Hull M, et al. High

triglycerides increase cardiovascular events, medical costs, and

resource utilization in a real-world analysis of statin-treated

patients with high cardiovascular risk and well-controlled

low-density lipoprotein cholesterol [abstract]. Circulation.

2017;136(suppl 1):A15187.

5 Nordestgaard BG. Triglyceride-rich

lipoproteins and atherosclerotic cardiovascular disease - New

insights from epidemiology, genetics, and biology. Circ Res.

2016;118:547-563.

6 Nordestgaard BG, Varbo A. Triglycerides and

cardiovascular disease. Lancet. 2014; 384: 626–635.

Amarin Contact Information

Investor Relations:Elisabeth Schwartz Investor

Relations and Corporate Communications Amarin Corporation plc

In U.S.: +1 (908) 719-1315 investor.relations@amarincorp.com

Lee M. Stern Trout Group In U.S.: +1 (646) 378-2992

lstern@troutgroup.com Media Inquiries: Christy Maginn

Burson-Marsteller In U.S.: +1 (646) 280-5210

Christy.Maginn@bm.com

| |

| CONSOLIDATED BALANCE SHEET

DATA |

| (U.S. GAAP) |

| Unaudited |

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

June 30, 2018 |

|

December 31, 2017 |

|

|

|

(in thousands) |

|

ASSETS |

|

|

|

|

| Current

Assets: |

|

|

|

|

| Cash and

cash equivalents |

|

$ |

102,257 |

|

|

$ |

73,637 |

|

|

Restricted cash |

|

|

600 |

|

|

|

600 |

|

| Accounts

receivable, net |

|

|

50,309 |

|

|

|

45,318 |

|

|

Inventory, net |

|

|

40,093 |

|

|

|

30,260 |

|

| Prepaid

and other current assets |

|

|

2,878 |

|

|

|

3,455 |

|

| Total

current assets |

|

|

196,137 |

|

|

|

153,270 |

|

| |

|

|

|

|

|

|

|

|

| Property,

plant and equipment, net |

|

|

17 |

|

|

|

28 |

|

| Other

long-term assets |

|

|

174 |

|

|

|

174 |

|

|

Intangible asset, net |

|

|

7,803 |

|

|

|

8,126 |

|

|

TOTAL ASSETS |

|

$ |

204,131 |

|

|

$ |

161,598 |

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

| Current

Liabilities: |

|

|

|

|

| Accounts

payable |

|

$ |

34,471 |

|

|

$ |

25,155 |

|

| Accrued

expenses and other current liabilities |

|

|

73,753 |

|

|

|

58,902 |

|

| Current

portion of exchangeable senior notes, net of discount |

|

|

481 |

|

|

|

481 |

|

| Current

portion of long-term debt from royalty-bearing instrument |

|

|

27,876 |

|

|

|

22,348 |

|

| Deferred

revenue, current |

|

|

1,056 |

|

|

|

1,644 |

|

| Total

current liabilities |

|

|

137,637 |

|

|

|

108,530 |

|

| |

|

|

|

|

|

|

|

|

| Long-Term

Liabilities: |

|

|

|

|

|

Exchangeable senior notes, net of discount |

|

|

29,103 |

|

|

|

28,992 |

|

| Long-term

debt from royalty-bearing instrument |

|

|

59,564 |

|

|

|

70,834 |

|

| Deferred

revenue, long-term |

|

|

17,750 |

|

|

|

17,192 |

|

| Other

long-term liabilities |

|

|

6,764 |

|

|

|

1,150 |

|

| Total

liabilities |

|

|

250,818 |

|

|

|

226,698 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ Deficit: |

|

|

|

|

| Preferred Stock |

|

|

24,364 |

|

|

|

24,364 |

|

| Common stock |

|

|

225,507 |

|

|

|

208,768 |

|

|

Additional paid-in capital |

|

|

1,040,743 |

|

|

|

977,866 |

|

| Treasury stock |

|

|

(6,909 |

) |

|

|

(4,229 |

) |

|

Accumulated deficit |

|

|

(1,330,392 |

) |

|

|

(1,271,869 |

) |

| Total

stockholders’ deficit |

|

|

(46,687 |

) |

|

|

(65,100 |

) |

| |

|

|

|

|

|

|

|

|

| TOTAL

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

$ |

204,131 |

|

|

$ |

161,598 |

|

| CONSOLIDATED STATEMENTS OF

OPERATIONS DATA |

| (U.S. GAAP) |

| Unaudited |

| |

|

|

|

|

|

|

|

|

| |

|

Three months ended June 30, |

|

Six months ended June 30, |

| |

|

(in thousands, except per share

amounts) |

|

(in thousands, except per share

amounts) |

| |

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| Product revenue, net |

$ |

52,537 |

|

|

$ |

44,948 |

|

|

$ |

96,313 |

|

|

$ |

79,292 |

|

| Licensing revenue |

|

106 |

|

|

|

293 |

|

|

|

248 |

|

|

|

586 |

|

| Total

revenue, net |

|

52,643 |

|

|

|

45,241 |

|

|

|

96,561 |

|

|

|

79,878 |

|

| Less: Cost of goods sold |

|

12,846 |

|

|

|

11,401 |

|

|

|

23,494 |

|

|

|

19,599 |

|

| Gross margin |

|

39,797 |

|

|

|

33,840 |

|

|

|

73,067 |

|

|

|

60,279 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

| Selling,

general and administrative (1) |

|

53,944 |

|

|

|

31,545 |

|

|

|

97,350 |

|

|

|

65,716 |

|

| Research

and development (1) |

|

18,159 |

|

|

|

13,694 |

|

|

|

29,921 |

|

|

|

24,517 |

|

| Total

operating expenses |

|

72,103 |

|

|

|

45,239 |

|

|

|

127,271 |

|

|

|

90,233 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating loss |

|

(32,306 |

) |

|

|

(11,399 |

) |

|

|

(54,204 |

) |

|

|

(29,954 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

(1,773 |

) |

|

|

(2,315 |

) |

|

|

(4,025 |

) |

|

|

(4,696 |

) |

| Other (expense) income, net |

|

(131 |

) |

|

|

80 |

|

|

|

(76 |

) |

|

|

75 |

|

| Loss from operations before taxes |

|

(34,210 |

) |

|

|

(13,634 |

) |

|

|

(58,305 |

) |

|

|

(34,575 |

) |

| (Provision for) benefit from income taxes |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net loss |

$ |

(34,210 |

) |

|

$ |

(13,634 |

) |

|

$ |

(58,305 |

) |

|

$ |

(34,575 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss per share: |

|

|

|

|

|

|

|

| Basic |

$ |

(0.12 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.13 |

) |

|

Diluted |

$ |

(0.12 |

) |

|

$ |

(0.05 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.13 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

| Basic |

|

293,662 |

|

|

|

270,725 |

|

|

|

289,458 |

|

|

|

270,445 |

|

|

Diluted |

|

293,662 |

|

|

|

270,725 |

|

|

|

289,458 |

|

|

|

270,445 |

|

| |

|

|

|

|

|

|

|

|

|

(1 |

) |

Excluding non-cash stock-based compensation,

selling, general and administrative expenses were $50,878 and

$28,478 for the three months ended June 30, 2018 and 2017,

respectively, and research and development expenses were $17,607

and $13,136, respectively, for the same periods. Excluding non-cash

stock-based compensation as well as co-promotion fees paid to the

company's U.S. co-promotion partner, selling, general and

administrative expenses were $40,594 and $23,909 for the three

months ended June 30, 2018 and 2017, respectively. |

| RECONCILIATION OF NON-GAAP NET

LOSS |

| Unaudited |

| |

|

|

|

|

|

|

|

|

| |

|

Three months ended June

30, |

|

Six months ended June

30, |

| |

|

(in thousands, except per share

amounts) |

|

(in thousands, except per share

amounts) |

| |

|

|

2018 |

|

|

|

2017 |

|

|

|

2018 |

|

|

|

2017 |

|

| Net loss for EPS1 - GAAP |

$ |

(34,210 |

) |

|

$ |

(13,634 |

) |

|

$ |

(58,305 |

) |

|

$ |

(34,575 |

) |

|

|

Non-cash stock-based compensation expense |

|

3,618 |

|

|

|

3,625 |

|

|

|

7,381 |

|

|

|

6,976 |

|

| Adjusted net loss for EPS1 - non-GAAP |

$ |

(30,592 |

) |

|

$ |

(10,009 |

) |

|

$ |

(50,924 |

) |

|

$ |

(27,599 |

) |

| |

|

|

|

|

|

|

|

|

| 1basic and diluted |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Loss per share: |

|

|

|

|

|

|

|

| Basic and diluted - non-GAAP |

$ |

(0.10 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.10 |

) |

| |

|

|

|

|

|

|

|

|

| Weighted average shares: |

|

|

|

|

|

|

|

| Basic and

diluted |

|

293,662 |

|

|

|

270,725 |

|

|

|

289,458 |

|

|

|

270,445 |

|

| |

|

|

|

|

|

|

|

|

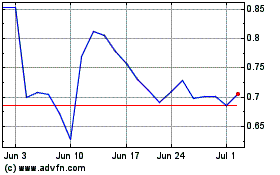

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Mar 2024 to Apr 2024

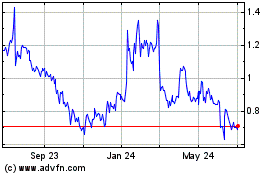

Amarin (NASDAQ:AMRN)

Historical Stock Chart

From Apr 2023 to Apr 2024