UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

Date of

Report (Date of earliest event reported): March 12,

2021

|

ALSET EHOME INTERNATIONAL INC.

|

|

(Exact

name of registrant as specified in its charter)

|

|

Delaware

|

|

001-39732

|

|

83-1079861

|

|

(State

of incorporation or organization)

|

|

(Commission

File

Number)

|

|

(IRS

Employer Identification No.)

|

4800 Montgomery Lane, Suite 210

Bethesda, Maryland 20814

(Address of principal executive offices) (Zip

Code)

Registrant’s

telephone number, including area code (301) 971-3940

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2.

below):

|

☐

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading Symbol(s)

|

|

Name of Each Exchange on Which Registered

|

|

Common

Stock, $0.001 par value

|

|

AEI

|

|

The

Nasdaq Stock Market LLC

|

Indicate

by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of

1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01

Entry

into a Material Definitive Agreement.

Effective

as of March 12, 2021, Alset EHome International Inc. (the

“Company”) entered into a Securities Purchase Agreement

(the “Securities Purchase Agreement”) with Mr. Chan

Heng Fai, the founder, Chairman and Chief Executive Officer of the

Company, True Partners International Limited, LiquidValue

Development Pte Ltd. (“LVD”) and American Pacific

Bancorp, Inc. (“APB”), pursuant to which the Company

purchased from Chan Heng Fai (i) warrants (the

“Warrants”) to purchase 1,500,000,000 shares of Alset

International Limited (“Alset International”); (ii)

1,000,000 shares of LVD’s common stock, constituting all of

the issued and outstanding stock of LVD; (iii) 62,122,908 ordinary

shares in True Partners Capital Holding Limited (“True

Partner”); and (iv) 4,775,523 shares of APB’s Class B

common stock, representing 86.44% of the total issued and

outstanding common stock of APB.

The

four acquisitions set forth in the Securities Purchase Agreement

closed on March 12, 2021. The Company has issued four convertible

notes to Chan Heng Fai as follows: (i) a convertible note in the

amount of $28,363,966.42 for warrants to purchase 1,500,000,000

shares of Alset International; (ii) a convertible note in the

amount of $173,394.87 to acquire all of the outstanding capital

stock of LVD; (iii) a convertible note in the amount of

$6,729,629.29 to acquire 62,122,908 ordinary shares of True

Partners; and (iv) a convertible note in the amount of $28,653,138

for 4,775,523 Class B shares of APB. Such four notes will only

become convertible into shares of the Company’s common stock

following the approval of the Company’s shareholders. Subject

to such shareholder approval, each note shall be convertible into

shares of the Company’s common stock at a conversion price

equal to $5.59 per share (equivalent to the average five closing

per share prices of the Company’s common stock preceding

January 4, 2021). Each convertible note matures in three years, has

an interest rate of 2% per annum and the principal amount and

accrued but unpaid interest shall be payable on the maturity date,

subject to the conversion of each convertible note.

Mr.

Chan recused himself from any deliberation or vote regarding any of

the four transactions described herein. The Audit Committee of the

Company’s Board of Directors reviewed, approved and

determined that it is advisable and in the best interests of the

Company to complete the four proposed transactions described above

in connection with the Term Sheet (the “Term Sheet”)

related to such transactions set forth in the Securities Purchase

Agreement. The Company’s Board of Directors approved the Term

Sheet for such transactions on January 6, 2021, and approved the

Securities Purchase Agreement and the transactions in connection

therewith on March 12, 2021.

The

four acquisitions set forth in the Securities Purchase Agreement

closed on March 12, 2021. All of these assets were acquired from

Chan Heng Fai or entities owned by Chan Heng Fai, the

Company’s Chairman and Chief Executive Officer. Mr. Chan is

also an officer and director of each of Alset International, LVD

and APB.

Alset International Limited

Incorporated

in September 2009 and listed on the Singapore Exchange in July

2010, Alset International operates as a global enterprise involved

in (i) property development and investments, primarily in the U.S.

and Western Australia; (ii) development, research, testing,

manufacturing, licensing and distribution of biomedical products;

(iii) asset management with a primary focus medical and residential

real estate in the US; (iv) direct sales of a growing variety of

health and wellness products; and (v) information technology

businesses, including blockchain technology. The Company has

acquired warrants to purchase 1,500,000,000 shares of Alset

International with an exercise price of SGD $0.048 per share. The

Company currently owns 57.07% of Alset International. If the

Company exercises all of the Alset International warrants acquired

in this transaction, the Company’s ownership of Alset

International will increase to 76.75%.

Mr.

Chan Heng Fai is both Chairman of the Board and the Chief Executive

Officer of the Company and the Chairman and Chief Executive Officer

of its subsidiary Alset International, as well as a significant

shareholder of both the Company and Alset International. Mr. Chan

owns 186,246,600 shares of Alset International, representing

approximately 10.5% of the outstanding shares of Alset

International.

LiquidValue Development Pte Ltd.

LVD

operates in the asset management field and will be leveraged by the

Company to establish an actively managed open-ended exchange-traded

fund (“ETF”) in the U.S. focused on disruptive

investment opportunities with long-term exponential growth

potential. The Company has acquired all of the issued and

outstanding stock of LVD.

True Partner Capital Holding Limited

True

Partners operates as a fund management company in the U.S. and Hong

Kong. True Partners manages funds and provides managed accounts on

a discretionary basis using a proprietary trading platform,

offering investment management and consultancy services. True

Partners also develops and supports its trading platform and

related proprietary software and provides management services for a

portfolio of securities and futures contracts. Its fund investors

and managed accounts are primarily professional investors,

including family offices, pension funds, high-net worth

individuals, endowments/foundations, and financial institutions.

True Partners was founded in 2010 and is headquartered in Hong

Kong. True Partners is currently listed on the Hong Kong Stock

Exchange (HKSE), with over USD $1.6 billion assets under management

(AUM). Pursuant to the Securities Purchase Agreement, the Company

has acquired 62,122,908 ordinary shares in True Partners (HKG:

8657). The Company now owns 15.5% of True Partners.

American Pacific Bancorp Inc.

APB is

a bank holding company that invests in commercial banks in the U.S.

APB’s plans include injecting digital banking capabilities

into banks to provide global banking services to clients worldwide,

with the goal to increase its profitability. The Company acquired

4,775,523 shares of the Class B common stock of APB, representing

approximately 86.4% of the total common stock of APB. The Company

plans to leverage APB's infrastructure to capitalize on the growth

opportunities with Special Purpose Acquisition Companies (SPACs).

The Company intends to work with APB to form a synergistic home

financing capability that will further support the Company’s

long-term business objectives.

The

foregoing description of the Securities Purchase Agreement and the

four convertible promissory notes does not purport to be complete

and is qualified in its entirety by reference to the complete text

of the Securities Purchase Agreement and each of the convertible

promissory notes, a copy of which are filed herein as exhibits to

this Current Report on Form 8-K.

Item

2.01

Completion

of Acquisition or Disposition of Assets.

The

disclosures set forth in Item 1.01 of this Current Report are

incorporated by reference herein.

Item

3.02

Unregistered

Sales of Equity Securities.

The

disclosures set forth in Item 1.01 of this Current Report are

incorporated by reference herein.

Item

7.01

Regulation

FD Disclosure.

On

March 15, 2021, the Company issued a press release (the

“Press Release”) announcing the closing of the four

transactions described above.

A copy

of the Press Release is being furnished as Exhibit 99.1 to this

Current Report on Form 8-K. The information contained in the Press

Release shall not be deemed “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or incorporated by reference in any

filing under the Securities Act of 1933, as amended (the

“Securities Act”) or the Exchange Act, except as shall

be expressly set forth by specific reference in such a filing. The

furnishing of the information in the Press Release is not intended

to, and does not, constitute a representation that such furnishing

is required by Regulation FD or that the information contained in

the Press Release constitutes material investor information that is

not otherwise publicly available.

This

Current Report on Form 8-K and exhibits may contain these types of

statements, which are “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995, and which involve risks, uncertainties and reflect the

Registrant’s judgment as of the date of this Current Report

on Form 8-K. Forward-looking statements may relate to, among other

things, operating results and are indicated by words or phrases

such as “expects,” “should,”

“will,” and similar words or phrases. These statements

are subject to inherent uncertainties and risks that could cause

actual results to differ materially from those anticipated at the

date of this Current Report on Form 8-K. The Company disclaims any

obligation to, and will not, update any forward-looking statements

to reflect events or circumstances after the date hereof. Investors

are cautioned not to rely unduly on forward-looking statements when

evaluating the information presented within.

Item

9.01

Financial

Statements and Exhibits.

(a) Financial Statements of Business Acquired

The

Company plans to file the required financial statements of APB, on

or before May 27, 2021 on a Form 8-K/A.

(b) Pro Forma Financial Information

The

Company plans to file the required pro forma financial information

on or before May 27, 2021 on a Form 8-K/A.

(d) Exhibits.

|

Exhibit

|

|

|

|

Number

|

|

Exhibit

|

|

|

|

|

|

|

|

Securities

Purchase Agreement By and Among Alset EHome International Inc.,

Chan Heng Fai Ambrose, True Partners International Limited,

LiquidValue Development Pte Ltd. and American Pacific Bancorp, Inc.

dated March 12, 2021.

|

|

|

|

|

|

|

|

2%

Conditional Convertible Promissory Note dated March 12, 2021, in

the principal amount of $28,363,966.42.

|

|

|

|

|

|

|

|

2%

Conditional Convertible Promissory Note dated March 12, 2021, in

the principal amount of $173,394.87.

|

|

|

|

|

|

|

|

2%

Conditional Convertible Promissory Note dated March 12, 2021, in

the principal amount of $6,729,629.29.

|

|

|

|

|

|

|

|

2%

Conditional Convertible Promissory Note dated March 12, 2021, in

the principal amount of $28,653,138.00.

|

|

|

|

|

|

|

|

Press

Release dated March 15, 2021.

|

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant

has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

ALSET EHOME INTERNATIONAL INC.

|

|

|

|

|

|

|

|

Date:

March 18, 2021

|

By:

|

/s/ Rongguo Wei

|

|

|

|

|

Name:

Rongguo Wei

|

|

|

|

|

Title:

Co-Chief Financial Officer

|

|

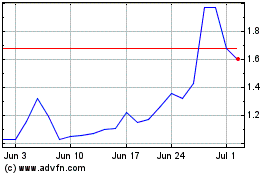

Alset (NASDAQ:AEI)

Historical Stock Chart

From Mar 2024 to Apr 2024

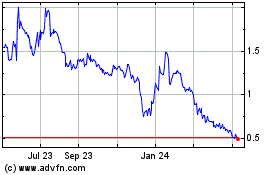

Alset (NASDAQ:AEI)

Historical Stock Chart

From Apr 2023 to Apr 2024