Current Report Filing (8-k)

October 02 2020 - 6:00AM

Edgar (US Regulatory)

0001362468false00013624682020-09-292020-09-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

_____________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 29, 2020

Allegiant Travel Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nevada

|

|

001-33166

|

20-4745737

|

|

|

|

|

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

1201 North Town Center Drive

|

|

|

89144

|

|

Las Vegas,

|

Nevada

|

|

|

|

|

|

|

|

|

(Address of principal executive offices)

|

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (702) 851-7300

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as in Rule 405 of the Securities Act of 193 (Section 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 Financial Information

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

Allegiant Travel Company (the “Company”), through its wholly-owned subsidiaries, on September 29, 2020, received proceeds of $84.0 million under loans secured by a discreet pool of CFM spare engines and A320 family aircraft. The loans will amortize over 72 months with minimal balloon payments due at maturity. Proceeds from the transaction were used to cover capital expenditures and to repay $11.7 million under the Company’s warehouse revolving credit facility.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Allegiant Travel Company has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date: October 1, 2020

|

ALLEGIANT TRAVEL COMPANY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Gregory C. Anderson

|

|

|

|

Name:

|

Gregory C. Anderson

|

|

|

|

Title:

|

Chief Financial Officer

|

|

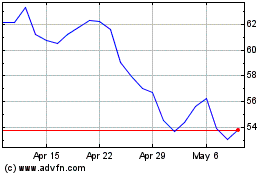

Allegiant Travel (NASDAQ:ALGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

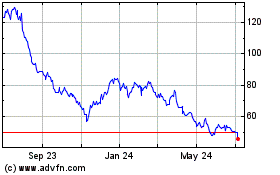

Allegiant Travel (NASDAQ:ALGT)

Historical Stock Chart

From Apr 2023 to Apr 2024