0001653087false00016530872025-02-262025-02-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 26, 2025 |

Alector, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38792 |

82-2933343 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

131 Oyster Point Blvd. Suite 600 |

|

South San Francisco, California |

|

94080 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (415) 231-5660 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock |

|

ALEC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 26, 2025, Alector, Inc. (the “Company”) announced its financial results for the quarter ended December 31, 2024. A press release announcing these results, which is attached hereto as Exhibit 99.1, is incorporated herein by reference.

All of the information furnished in Item 2.02 and Item 9.01 (including Exhibit 99.1) shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

ALECTOR, INC. |

|

|

|

|

Date: |

February 26, 2025 |

By: |

/s/ Arnon Rosenthal |

|

|

|

Arnon Rosenthal, Ph.D.

Co-founder and Chief Executive Officer |

Alector Reports Fourth Quarter and Full Year 2024 Financial Results

and Provides Business Update

Topline data from the pivotal INFRONT-3 Phase 3 clinical trial of latozinemab in FTD-GRN expected by Q4 2025

Anticipate completing enrollment in the PROGRESS-AD Phase 2 clinical trial of AL101/GSK4527226 in participants with early Alzheimer’s disease by mid-2025

Applying Alector Brain Carrier to advance therapeutic candidates, including those targeting amyloid beta and replacing GCase

$413.4 million in cash, cash equivalents and investments provide runway through 2026

Management to host conference call and webcast today at 4:30 p.m. ET/1:30 p.m. PT

South San Francisco, Calif., February 26, 2025 -- Alector, Inc. (Nasdaq: ALEC), a late-stage clinical biotechnology company focused on developing therapies to counteract the devastating progression of neurodegeneration, today reported fourth quarter and full year 2024 financial results and recent portfolio and business updates. As of December 31, 2024, Alector’s cash, cash equivalents and investments totaled $413.4 million.

“Alector is entering a potentially transformative period for the company, as we continue to advance our clinical programs toward key milestones while also driving the development of our wholly owned, early-stage pipeline,” said Arnon Rosenthal, Ph.D., Chief Executive Officer of Alector. “We look forward to reporting topline data from the pivotal INFRONT-3 Phase 3 trial of latozinemab targeting frontotemporal dementia with a granulin gene mutation by the fourth quarter. Additionally, we expect to complete enrollment in the PROGRESS-AD Phase 2 trial of AL101/GSK4527226 in participants with early Alzheimer’s disease by mid-2025. With our broad and diverse portfolio of genetically validated drug candidates for the treatment of neurodegenerative diseases, backed by a strong financial position that will fund operations through 2026, Alector is well-positioned to advance our mission to deliver transformative therapies for patients with neurodegenerative brain disorders.”

Sara Kenkare-Mitra, Ph.D., President and Head of Research and Development at Alector, added, “We are making significant progress in advancing Alector’s preclinical and research pipeline. By leveraging our expertise in neuroscience and drug discovery, and selectively applying our proprietary Alector Brain Carrier technology platform, we are able to enhance brain delivery and biodistribution of therapeutic cargo to potentially improve safety and efficacy. We are currently

selecting lead candidates for two programs, ADP037-ABC, targeting amyloid beta, and ADP050-ABC, replacing GCase. We aim to advance these programs toward IND-enabling studies later this year, with plans to enter the clinic in 2026.”

Recent Clinical Updates

Progranulin Programs (latozinemab (AL001) and AL101/GSK4527226) Being Developed in Collaboration with GSK

Latozinemab

•The pivotal, randomized, double-blind, placebo-controlled INFRONT-3 Phase 3 clinical trial of latozinemab targeting frontotemporal dementia with a granulin gene mutation (FTD-GRN) is ongoing. Topline data are anticipated by the fourth quarter of 2025.

•Latozinemab is a novel investigational human monoclonal antibody (mAb) designed to block and downregulate the sortilin receptor to elevate the level of progranulin (PGRN) in the brain. It has been granted Orphan Drug, Breakthrough Therapy and Fast Track designations, and the company believes it is the most advanced PGRN-elevating candidate in development for this condition.

AL101/GSK4527226

•PROGRESS-AD, a global, randomized, double-blind, placebo-controlled Phase 2 clinical trial evaluating AL101/GSK4527226 in early Alzheimer’s disease (AD) continues to enroll well, with substantial progress toward its target enrollment of 282 participants. Alector and GSK plan to complete trial enrollment by mid-2025.

•AL101/GSK4527226 is an investigational human mAb designed to block and downregulate the sortilin receptor to elevate the level of PGRN in the brain in a manner that is similar to investigational latozinemab but with different pharmacokinetic and pharmacodynamic properties, making it suitable for the potential treatment of more prevalent neurodegenerative diseases.

Preclinical and Research Pipeline

Alector is advancing a preclinical and early research pipeline focused on removing toxic proteins, replacing deficient proteins, and restoring immune and nerve cell function. Leveraging its deep expertise in drug development and proprietary technologies, including protein engineering, antibody discovery, and its Alector Brain Carrier (ABC) platform for blood-brain barrier transport, the company is progressing a curated portfolio of programs targeting genetically validated disease mechanisms. This approach has led to a suite of innovative programs with the potential to make a significant impact on neurodegeneration.

•ADP037-ABC is a proprietary anti-amyloid beta (Aβ) antibody paired with the company’s ABC for the treatment of AD. It is designed to remove brain Aβ plaques, with the potential to reduce the incidence and/or severity of amyloid-related imaging abnormalities (ARIA) and enable subcutaneous delivery. It targets a validated epitope, specific to brain Aβ plaques, combined with an optimized antibody constant region to enhance phagocytosis of Aβ plaques. By leveraging ABC technology, ADP037-ABC aims to clear Aβ efficiently, thereby reducing plaque accumulation and potentially slowing disease progression while minimizing ARIA.

•ADP050-ABC is a GCase replacement therapy paired with the company’s proprietary ABC for GBA gene mutation carriers with Parkinson’s disease (PD) and Lewy body dementia. In these patients, mutations in the GBA gene lead to deficient GCase activity. ADP050-ABC uses Alector-engineered GCase, which is proprietary and has been designed to have a longer half-life and to break down glucocerebroside, a lipid that accumulates in neurons and contributes to neurodegeneration. This mechanism aims to reduce cellular dysfunction and slow disease progression.

•ADP056 is a Reelin modulator designed to block tau pathology and promote synaptic function in AD. Reelin, a large, secreted protein, regulates neuronal function and tau accumulation. Gain-of-function Reelin variants protect against familial AD through a mechanism that appears to uncouple amyloid and tau pathology. ADP056 is designed to mimic these protective effects of the Reelin mutation.

•ADP063-ABC and ADP064-ABC are therapeutic candidates paired with the company’s proprietary ABC that target tau pathology in AD through distinct approaches. First, ADP063-ABC will focus on combining a proprietary anti-tau antibody directed to a validated tau epitope with ABC and an optimized antibody constant region. It is designed to block the spread of tau aggregates and has the potential for subcutaneous delivery. Second, ADP064-ABC will focus on using an anti-tau siRNA combined with ABC, which aims to prevent the synthesis of the tau mRNA and protein. Both approaches seek to leverage a highly brain-penetrant approach to remove toxic tau and potentially slow cognitive decline in AD.

•In December 2024, Alector and co-recipient University of Luxembourg were awarded a $1.7 million grant from The Michael J. Fox Foundation for Parkinson’s Research (MJFF) for collaborative research on glycoprotein nonmetastatic melanoma protein B (GPNMB), a PD target.

•Alector plans to hold an educational webinar in the second quarter of 2025 to present additional preclinical data on the company’s anti-amyloid beta and GCase programs, as well as advancements in ABC.

TREM2 Program (AL002)

•On April 5, 2025, Alector plans to present the results from the INVOKE-2 Phase 2 clinical trial, which evaluated the safety and efficacy of AL002, a TREM2 agonist, in individuals with early AD, during an oral presentation at the AD/PD™ 2025 International Conference on Alzheimer’s and Parkinson’s Diseases, taking place in Vienna, Austria. While the trial did not meet its primary endpoint, Alector remains committed to advancing the understanding of AD pathophysiology and the development of effective therapeutics for the disease.

Fourth Quarter 2024 Financial Results

Revenue. Collaboration revenue for the quarter ended December 31, 2024, was $54.2 million, compared to $15.2 million for the same period in 2023. Collaboration revenue for the year ended December 31, 2024, was $100.6 million, compared to $97.1 million for the same period in 2023. The increase in year-over-year collaborative revenue was primarily due to an increase in revenue recognized for the AL002 and latozinemab programs. Collaboration revenue under the AbbVie Agreement was fully recognized as of December 31, 2024.

R&D Expenses. Total research and development expenses for the quarter ended December 31, 2024, were $46.5 million, compared to $47.7 million for the quarter ended December 31, 2023. Total research and development expenses for the year ended December 31, 2024, were $185.9 million compared to $192.1 million for the same period in 2023. The decrease in year-over-year R&D expenses was mainly due to the Company’s strategy to prioritize selected programs.

G&A Expenses. Total general and administrative expenses for the quarter ended December 31, 2024, were $15.0 million compared to $14.9 million for the quarter ended December 31, 2023. Total general and administrative expenses for the year ended December 31, 2024, were $59.6 million compared to $56.7 million for the year ended December 31, 2023. The increase in year-over-year G&A expenses is primarily due to the impairment of the right-of-use asset and the leasehold improvements as the Company approved a plan to transition operations from our laboratory and offices in Newark, California to our South San Francisco Headquarters.

Net Loss. For the quarter ended December 31, 2024, Alector reported a net loss of $2.1 million, or $0.02 net loss per share, compared to a net loss of $41.4 million, or $0.49 net loss per share, for the same period in 2023. For the year ended December 31, 2024, Alector reported a net loss of $119.0 million or $1.23 net loss per share, compared to a net loss of $130.4 million or $1.56 net loss per share, for the same period in 2023.

Cash Position. Cash, cash equivalents, and investments were $413.4 million as of December 31, 2024. Management expects that this will be sufficient to fund current operations through 2026.

2025 Guidance. Management anticipates, for the year ending 2025, collaboration revenue to be between $5 million and $15 million, total research and development expenses to be between $175 million and $185 million, and total general and administrative expenses to be between $55 million and $65 million.

Fourth Quarter and Full Year 2024 Conference Call

Alector’s management team will host a conference call to discuss Alector’s results for the fourth quarter and full year 2024, as well as provide a business update. The conference call will be webcast and accessible via the investor relations section of Alector’s website at www.alector.com.

To access the call, please use the following information:

Date: Wednesday, February 26, 2025

Time: 4:30 p.m. ET, 1:30 p.m. PT

The event will be webcast live under the investor relations section of Alector’s website at https://investors.alector.com/events-and-presentations/events and following the event a replay will be archived there for 30 days. Interested parties participating by phone will need to register using this online form. After registering for dial-in details, all phone participants will receive an auto-generated e-mail containing a link to the dial-in number along with a personal PIN number to use to access the event by phone.

About Alector

Alector is a late-stage clinical biotechnology company focused on developing therapies to counteract the devastating progression of neurodegenerative diseases. Leveraging the principles of genetics, immunology, and neuroscience, the company is advancing a portfolio of genetically validated programs that aim to remove toxic proteins, replace missing proteins, and restore immune and nerve cell function. Supported by biomarkers, Alector’s product candidates seek to treat a range of indications, including frontotemporal dementia, Alzheimer’s disease, Parkinson's disease, and Lewy body dementia. The company is also developing Alector Brain Carrier (ABC), a proprietary blood-brain barrier platform, which is being selectively applied to its next-generation product candidates and research pipeline. ABC aims to enhance the delivery of therapeutics, achieve deeper brain penetration and efficacy at lower doses, and ultimately improve patient outcomes while reducing costs. Alector is headquartered in South San Francisco, California. For more information, please visit www.alector.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements in this press release

include, but are not limited to, statements regarding our business plans, business strategy, product candidates, blood-brain barrier technology platform, research and preclinical pipeline, planned and ongoing preclinical studies and clinical trials, anticipated timing of and detail regarding release of data for INFRONT-3, expected milestones, expectations of our collaborations, expectations of our interactions with regulatory authorities, and financial and cash guidance. Such statements are subject to numerous risks and uncertainties, including but not limited to risks and uncertainties as set forth in Alector’s Quarterly Report on Form 10-K filed for 2024, with the Securities and Exchange Commission (“SEC”), as well as the other documents Alector files from time to time with the SEC. These documents contain and identify important factors that could cause the actual results for Alector to differ materially from those contained in Alector’s forward-looking statements. Any forward-looking statements contained in this press release speak only as of the date hereof, and Alector specifically disclaims any obligation to update any forward-looking statement, except as required by law.

Selected Consolidated Balance Sheet Data

(in thousands)

|

|

|

|

|

|

|

|

|

December 31, |

|

December 31, |

|

|

2024 |

|

2023 |

|

|

|

|

|

|

|

Cash, cash equivalents, and marketable securities |

|

$ |

413,397 |

|

$ |

548,861 |

Total assets |

|

|

468,303 |

|

|

621,827 |

Total current liabilities (excluding deferred revenue) |

|

|

101,396 |

|

|

94,973 |

Deferred revenue (including current portion) |

|

|

195,832 |

|

|

293,820 |

Total liabilities |

|

|

341,503 |

|

|

487,669 |

Total stockholders’ equity |

|

|

126,800 |

|

|

134,158 |

Consolidated Statement of Operations Data

(in thousands, except share and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

December 31, |

|

|

Twelve Months Ended

December 31, |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

Collaboration revenue |

|

$ |

54,240 |

|

|

$ |

15,190 |

|

|

$ |

100,558 |

|

|

$ |

97,062 |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

46,461 |

|

|

|

47,723 |

|

|

|

185,940 |

|

|

|

192,115 |

General and administrative |

|

|

15,028 |

|

|

|

14,920 |

|

|

|

59,615 |

|

|

|

56,687 |

Total operating expenses |

|

|

61,489 |

|

|

|

62,643 |

|

|

|

245,555 |

|

|

|

248,802 |

Loss from operations |

|

|

(7,249) |

|

|

|

(47,453) |

|

|

|

(144,997) |

|

|

|

(151,740) |

Other income, net |

|

|

5,223 |

|

|

|

7,685 |

|

|

|

26,076 |

|

|

|

26,561 |

Net loss before income tax |

|

|

(2,026) |

|

|

|

(39,768) |

|

|

|

(118,921) |

|

|

|

(125,179) |

Income tax expense |

|

|

48 |

|

|

|

1,666 |

|

|

|

128 |

|

|

|

5,212 |

Net loss |

|

$ |

(2,074) |

|

|

$ |

(41,434) |

|

|

$ |

(119,049) |

|

|

$ |

(130,391) |

Net loss per share, basic and diluted |

|

$ |

(0.02) |

|

|

$ |

(0.49) |

|

|

$ |

(1.23) |

|

|

$ |

(1.56) |

Shares used in computing net loss per share basic and diluted |

|

|

98,319,416 |

|

|

|

84,384,151 |

|

|

|

96,588,177 |

|

|

|

83,733,730 |

Alector Contacts:

Alector

Katie Hogan

202-549-0557

katie.hogan@alector.com

Argot Partners (media)

David Rosen

(212) 600-1494

alector@argotpartners.com

Argot Partners (investors)

Laura Perry

212-600-1902

alector@argotpartners.com

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

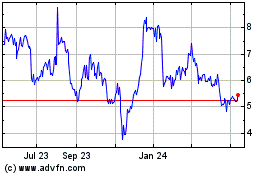

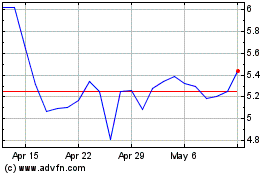

Alector (NASDAQ:ALEC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Alector (NASDAQ:ALEC)

Historical Stock Chart

From Feb 2024 to Feb 2025