Filed Pursuant to Rule 424(b)(3)

Registration No. 333-239783

PROSPECTUS

AKERNA CORP.

1,647,287 SHARES OF COMMON STOCK

Akerna Corp. (“Akerna”) will issue

from time to time an aggregate of 1,647,287 our shares of common stock, par value $0.0001, in exchange for 1,647,287 redeemable preferred

shares (the “Exchangeable Shares”) of Akerna Canada Ample Exchange Inc., a company existing under the laws of the Province

of Ontario and a wholly owned subsidiary of Akerna (“Exchangeco”). Exchangeco issued the Exchangeable Shares to shareholders

of Ample Organics Inc., an Ontario corporation (“Ample”), on July 7, 2020. The shareholders of Ample received the Exchangeable

Shares in connection with the arrangement by and between Ample, Exchangeco and Akerna under a plan of arrangement in accordance with

Section 182 of the Business Corporations Act (Ontario). These shareholders of Exchangeco may exchange the exchangeable shares

for shares of our common stock on a one-for-one basis at any time following effectiveness of the registration statement of which this

prospectus is a part.

We will not receive any proceeds from the exchange

of Exchangeable Shares for shares of our common stock.

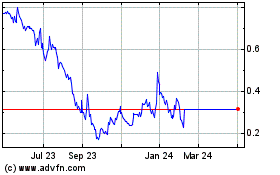

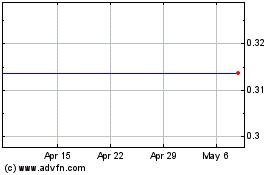

Our common stock trades on the Nasdaq Capital

Market under the symbol “KERN”. On May 20, 2021, the last reported sale price of the common stock on the Nasdaq Capital Market

was $3.65 per share.

Investing in our common stock involves risks.

See “Risk Factors” beginning on page 4.

These securities have not been approved

or disapproved by the SEC or any state securities commission nor has the SEC or any state securities commission passed upon the accuracy

or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

PROSPECTUS DATED JUNE 2, 2021

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

The registration statement of which this prospectus

forms a part that we have filed with the Securities and Exchange Commission, or SEC, includes and incorporates by reference exhibits

that provide more detail of the matters discussed in this prospectus. You should read this prospectus together with the documents incorporated

herein by reference under “Documents Incorporated by Reference” and the additional information described below under “Where

You Can Find More Information.”

You should rely only on the information contained

in or incorporated by reference in this prospectus and in any free writing prospectus prepared by or on behalf of us.

We have not authorized anyone to provide you with information different from, or in addition to, that contained in or incorporated

by reference in this prospectus or any related free writing prospectus. This prospectus is an offer to sell only the securities

offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in or incorporated

by reference in this prospectus is current only as of its date. Our business, financial condition, results of operations and

prospects may have changed since that date.

We are not offering to sell or seeking offers

to purchase these securities in any jurisdiction where the offer or sale is not permitted. We have not done anything that would permit

this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than

in the United States. Persons outside the United States who come into possession of this prospectus and any free writing prospectus related

to this offering in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions relating

to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

Unless otherwise indicated, any reference to

Akerna, or as “we”, “us”, or “our” refers to Akerna Corp. and its consolidated subsidiaries (“Akerna”

or the “Company”).

SUMMARY

The following highlights certain

information contained elsewhere in this prospectus. It does not contain all the details concerning the Offering, including information

that may be important to you. You should carefully review this entire prospectus including the section entitled “Risk Factors”

and the financial statement incorporated herein by reference. See “Documents Incorporated by Reference” and “Where

You Can Find More Information.”

Summary of Our Business

Akerna is the leading provider of enterprise

software solutions within the cannabis industry. Cannabis businesses face significant complexity due to the stringent regulations and

restrictions that shift based on regional, state, and national governing bodies. As the first to market more than ten years

ago, Akerna’s family of software platforms enable regulatory compliance and inventory management across the entire

supply chain. When the legal cannabis market started to grow, we identified a need for organic material tracking and regulatory compliance

software as a service (SaaS) solution customized specifically for the unique needs of the industry. By providing an integrated ecosystem

of applications and services that enables compliance, regulation, consumer safety and taxation, Akerna is building the technology

backbone of the cannabis industry. While designed specifically for the unique needs of the cannabis market, our solutions are adaptable

for other industries requiring government regulatory oversight, or where the tracking of organic materials from seed or plant to end

products is desired.

Executing upon our expansion strategy, we acquire

complementary cannabis brands to grow the scope of Akerna’s cannabis ecosystem. Throughout 2019 and 2020, we integrated four new

brands into the Akerna product and service offering. Our first acquisition, solo sciences, was initiated in the fall of 2019, with the

full acquisition completed in July 2020. We added Trellis Solutions to our portfolio on April 10, 2020 and finalized the acquisition

of Ample Organics and Last Call Analytics on July 7, 2020. Through our growing family of companies, Akerna provides highly

versatile platforms that equip our clients with a central data management system for tracking regulated products. Our solutions also

provide clients with integrated security, transparency, and scalability capabilities, all while maintaining compliance with their governing

regulations.

On the commercial side, our products help

state-licensed businesses operate in compliance with applicable regional laws. Our integrated ecosystem provides integrations with third-party

vendors and add-ons that enhance the capabilities of our commercial software platforms. On the regulatory side, we provide track

and trace solutions that allow state governments to monitor compliance of licensed cannabis businesses. To date, our software has

helped monitor the compliance of more than $20 billion in legal cannabis. While our software facilitates the success of legal cannabis

businesses, we do not handle any cannabis-related material, do not process cannabis sales transactions within the United States,

and our revenue is generated from a fixed-fee based subscription model and is not related to the type or amount of sales made by

our clients.

We drive revenue growth through the development

of our product line, our acquisitions and from continued expansion of the cannabis, hemp, and CBD industry. Businesses across the

regulated cannabis industry use our solutions. The brand recognition of our existing products, our ability

to provide services in all areas of the seed-to-sale life cycle, and our wealth of relevant experience attracts cultivation, manufacturing,

and dispensary clients who are seeking comprehensive business optimization solutions. Our software solutions are designed to be

scalable, and while mid-market and smaller customers have historically been our primary target segment, we are focused

on extending our customer reach to address the needs of the emerging enterprise level operator. We believe these larger multi-state/multi-vertical

operations represent significant long-term future growth opportunities as the cannabis industry continues to consolidate at a rapid rate.

The sophistication of our platform accommodates the complexities of both multi-vertical and multi-state business needs, making us critical

partners and allowing us to cultivate long-term, successful relationships with our clients.

Our principal executive offices are located at

1550 Larimer Street #246, Denver, Colorado 80202, and our telephone number is (888) 932-6537 and our Internet website address is www.akerna.com.

The information on our website is not a part of, or incorporated in, this prospectus.

The Arrangement

On December 18, 2019, we entered into an

arrangement agreement, as amended by the Amendment to Arrangement Agreement, dated February 28, 2020 (“Amendment to Arrangement

Agreement”), Amendment No. 2 to Arrangement Agreement dated May 26, 2020 (“Amendment No. 2 to Arrangement Agreement), and

Amendment No. 3 to Arrangement Agreement dated June 1, 2020 (“Amendment No. 3 to Arrangement Agreement”) (the “Arrangement

Agreement”), among us, Exchangeco and Ample, pursuant to which we through Exchangeco agreed to acquire all of the issued and outstanding

equity of Ample (the “Arrangement”).

On July 7, 2020, the Arrangement was consummated

by way of a court-approved plan of arrangement under Ontario law (the “Plan of Arrangement”) and Ample became our indirect

wholly-owned subsidiary.

Pursuant to the Arrangement Agreement and the

Plan of Arrangement, on the closing date, holders of Ample common shares (the “Ample Shares”) received a number of Exchangeable

Shares equal to the number of Ample Shares multiplied by the exchange ratio of 0.0524 (the “Exchange Ratio”). In the aggregate,

Ample shareholders received 3,294,574 Exchangeable Shares. The Exchange Ratio was agreed to on December 18, 2019, and was not adjusted

for any subsequent changes in market price of our common stock, par value $0.0001 per share (the “Akerna Shares”) or the

Ample Shares prior to the closing date.

Ample’s shareholders adopted and approved

the Arrangement Agreement and the Plan of Arrangement on June 26, 2020. Akerna’s shareholders approved the issuance of the Akerna

Shares (including the Akerna shares issuable upon exchange of the Exchangeable Shares and shares issuable pursuant to the CVRs) in connection

with the Arrangement on June 26, 2020. The Ontario Superior Court of Justice issued a final order approving the Plan of Arrangement on

June 30, 2020.

The Exchangeable Shares were issued as part of

the Arrangement pursuant to Section 3(a)(10) of the Securities Act, based on the final order of the Ontario Superior Court of Justice.

Exchangeable Shares

The Exchangeable Shares are exchangeable for

shares of common stock, par value $0.0001 per share, of Akerna on a 1:1 basis, as determined in accordance with the Arrangement Agreement.

The Exchangeable Shares are intended to be substantially economically equivalent to shares of common stock of Akerna. The rights, privileges,

restrictions and conditions attaching to the Exchangeable Shares and the related special voting stock are described herein under the

headings “The Exchangeable Shares” and “Description of Company Capital Stock—Special Voting Stock” respectively,

and in the terms of our plan of arrangement with Ample, which is included in the Arrangement Agreement filed as an exhibit to the registration

statement of which this prospectus forms a part.

Of the 3,294,574 Exchangeable Shares that

were issued to former Ample shareholders in connection with the consummation of the Arrangement, an aggregate of 658,915 Exchangeable

Shares were issued as “Closing Consideration” and an aggregate of 2,635,659 Exchangeable Shares, constituting part of the

“Escrowed Consideration” were issued into escrow pursuant to an escrow agreement (the “Escrow Agreement”), entered

into on July 7, 2020 by and among the Company, Purchaser, John Prentice, as Shareholder Representative, and Odyssey Trust Company. Under

the Escrow Agreement, subject to unresolved claims, if any, by the Company under the Arrangement Agreement in respect of fraud, the Escrowed

Consideration shall be released to former Ample shareholders upon the six-, nine-, and twelve-month anniversaries of the Closing Date

in accordance with the following schedule -- 988,372 shares on the six-month anniversary, 823,643 shares on the nine-month anniversary,

and 823,644 shares on the twelve-month anniversary. As of the date hereof, 1,647,287 shares of common stock of Akerna have been

issued on conversion of Exchangeable Shares.

The Offering

|

Common stock offered herein:

|

|

1,647,287 shares of common stock of Akerna, par value

$0.0001, in exchange for the 1,647,287 Exchangeable Shares upon exchange by the holders thereof pursuant to their terms

|

|

|

|

|

|

Common stock outstanding (1):

|

|

24,136,076 shares of common stock

|

|

|

|

|

|

Common stock outstanding after the offering (1):

|

|

25,783,363 shares of common Stock

|

|

|

|

|

|

Use of Proceeds:

|

|

We will not receive any proceeds from the issuance of shares of our

common stock upon the exchange of Exchangeable Shares.

|

|

|

|

|

|

Listing of Common Stock:

|

|

Our common Stock is listed on the Nasdaq Capital Market under the symbol

“KERN”.

|

|

|

|

|

|

Dividend policy:

|

|

We currently intend to retain any future earnings to fund the development

and growth of our business. Therefore, we do not currently anticipate paying cash dividends on our common stock.

|

|

|

|

|

|

Risk Factors:

|

|

An investment in our company is highly speculative and involves a significant degree of risk. See

“Risk Factors” on page 4 of this prospectus and other information included in this prospectus for a discussion of factors

you should carefully consider before deciding to invest in shares of our common stock.

|

|

|

(1)

|

The number of shares of common stock shown above

to be outstanding before and after this offering is based on the 24,136,076 shares outstanding as of May 17, 2021. The number of

shares of common stock outstanding after this offering assumes that all the Exchangeable Shares are exchanged for shares of common

stock. The number of shares of common stock outstanding excludes 4,282,552 shares of common stock reserved for issuance upon conversion

of our outstanding senior secured convertible notes, 5,813,804 shares of our common stock issuable upon exercise of our outstanding

warrants, 914,258 shares of common stock underlying restricted stock units that are issued and outstanding but remain subject

to vesting conditions and 501,435 shares available for issuance upon grant of awards under our 2019 long term equity incentive plan.

|

RISK

FACTORS

An investment in our common stock involves

a high degree of risk. You should carefully consider the risks described below and discussed under the section captioned “Risk

Factors” contained in our transition report on Form 10-KT for the six-month transition period ended December 31, 2020, and in our

quarterly report on Form 10-Q for the period ended March 31, 2021, which reports are incorporated by reference in this prospectus, together

with all of the other information included in this prospectus or incorporated by reference herein, including any documents subsequently

filed and incorporated by reference, before making an investment decision with regard to our securities. See “Documents Incorporated

by Reference” and “Where You Can Find More Information” below.

The statements contained in this prospectus

that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results

to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs,

our business, financial condition or results of operations could suffer.

Summary of Risk Factors

The following is a short description of the

risks and uncertainties you should carefully consider in evaluating our business and us which are more fully described in our transition

report on Form 10-K for the six-month transition period ended December 31, 2020 and in our quarterly report on Form 10-Q for the period

ended March 31, 2021, which reports are incorporated by reference in this propsectus. The factors listed below and in the transition

report and quarterly report, represent certain important factors that we believe could cause our business results to differ. These factors

are not intended to represent a complete list of the general or specific risks that may affect us. It should be recognized that other

risks may be significant, presently or in the future, and the risks set forth below may affect us to a greater extent than indicated.

If any of the following risks occur, our business, financial condition or results of operations could be materially and adversely affected.

Risks Relating

to Our Financial Condition and Operating History

|

|

●

|

We have a history of losses, expect to continue to incur losses in the near term and may not achieve or

sustain profitability in the future.

|

|

|

●

|

We have a relatively short operating history, which makes it difficult to evaluate our business and future

prospects.

|

|

|

●

|

Our long-term results of operations are difficult to predict and depend on the commercial success of our

clients, the continued growth of the cannabis industry generally, and the regulatory environment within which the cannabis industry operates.

|

|

|

●

|

Direct

and indirect consequences of the COVID-19 pandemic may have material adverse consequences.

|

Risks Related to the Cannabis Industry

|

|

●

|

As a company whose clients operate in the cannabis industry,

we face many unique and evolving risks.

|

|

|

o

|

Marijuana remains illegal under United States federal law

|

|

|

o

|

Uncertainty of federal enforcement

|

|

|

o

|

We could become subject to racketeering laws

|

|

|

o

|

Banking regulations could limit access to banking services and expose us to risk

|

|

|

o

|

Dividends and distributions could be prevented if our receipt of payments from clients is deemed to

be proceeds of crime

|

|

|

o

|

Further legislative development beneficial to our operations is not guaranteed

|

|

|

o

|

The cannabis industry could face strong opposition from other industries

|

|

|

o

|

The legality of marijuana could be reversed in one or more states

|

|

|

o

|

Changing legislation and evolving interpretations of the law

|

|

|

o

|

Dependence on client licensing

|

|

|

●

|

The cannabis industry is an evolving industry and we must anticipate and respond to changes.

|

Risks related to Our

Business

|

|

●

|

A significant portion of our business is and is expected to be, from government contracts, which present

certain unique risks.

|

|

|

●

|

Our operations may be adversely affected by disruptions to our information technology, or IT, systems,

including disruptions from cybersecurity breaches of our IT infrastructure.

|

|

|

●

|

Privacy regulation is an evolving area and compliance with applicable

privacy regulations may increase our operating costs or adversely impact our ability to service our clients and market our products and

services.

|

|

|

●

|

We rely on third parties for certain services made available

to users of our platforms, which could limit our control over the quality of the user experience and our cost of providing services.

|

|

|

●

|

Acquisitions and integration issues may expose us to risks.

|

|

|

●

|

To grow and be successful, we need to attract and retain qualified

personnel.

|

|

|

●

|

We are smaller and less diversified than many of our potential

competitors.

|

|

|

●

|

Our business and stock price may suffer as a result of our limited

public company operating experience and if securities or industry analysts do not publish or cease publishing research or reports about

us, our business, or our market, or if they change their recommendations regarding our common stock in an adverse manner, the price and

trading volume of our common stock could decline.

|

Risks related to Intellectual Property

|

|

●

|

Protecting and defending against intellectual property claims

may have a material adverse effect on our business.

|

|

|

●

|

Our success depends in part upon our ability to protect our

core technology and intellectual property.

|

|

|

●

|

Others may assert intellectual property infringement claims

against us.

|

|

|

●

|

Protecting and defending against intellectual property claims may have a material adverse effect on our

business.

|

|

|

●

|

Our success depends in part upon our ability to protect our core technology and intellectual property.

|

|

|

●

|

Others may assert intellectual property infringement claims against us.

|

Risks related to Our

Charter Documents

|

|

●

|

Anti-takeover provisions contained in our amended and restated certificate of incorporation and amended

and restated bylaws, as well as provisions of Delaware law, could impair a takeover attempt and limit the price investors might be willing

to pay in the future for our common stock and could entrench management.

|

|

|

●

|

Our corporate opportunity provisions in our Amended and Restated Certificate of Incorporation could enable

management to benefit from corporate opportunities that might otherwise be available to us.

|

|

|

●

|

Our amended and restated certificate of incorporation provides,

subject to limited exceptions, that the Court of Chancery of the State of Delaware will be the sole and exclusive forum for certain stockholder

litigation matters, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our

directors, officers, employees or stockholders.

|

Risks Relating to our Convertible Debt

|

|

●

|

The issuance of shares of our common stock pursuant to our convertible

notes may result in significant dilution to our stockholders.

|

|

|

●

|

Our obligations to the holders of our convertible notes are

secured by a security interest in substantially all of our assets, if we default on those obligations, the convertible note holders could

foreclose on our assets.

|

|

|

●

|

The holders of the convertible notes have certain additional

rights upon an event of default under such convertible notes, which could harm our business, financial condition, and results of operations

and could require us to reduce or cease our operations.

|

Risks Relating to our Accounting for Certain

Warrants

|

|

●

|

Certain of our warrants are accounted for as a warrant liability and are recorded at fair value upon issuance

with any changes in fair value each period reported in our statement of operations, which may have an adverse effect on the market price

of our securities.

|

|

|

●

|

We may face additional risks, including regulatory, litigation, stockholder or other actions and negative

impacts on our stock price, as a result of the material weakness in our internal control over financial reporting and revisions to our

financial statements.

|

Risks Relating to Our Common Stock

|

|

●

|

We may seek to raise additional funds, finance acquisitions,

or develop strategic relationships by issuing securities that would dilute investors' ownership. Depending on the terms available to

us, if these activities result in significant dilution, it may negatively impact the trading price of our shares of common stock.

|

|

|

●

|

Warrants are exercisable for our common stock, which could increase the number of shares eligible for

future resale in the public market and result in dilution to our stockholders.

|

|

|

●

|

The market price of our shares of common stock is particularly

volatile given our status as a relatively new public company with a generally small and thinly traded public float, which could lead

to wide fluctuations in our share price. Stockholders may be unable to sell their shares of common stock at or above their purchase price,

which may result in substantial losses to them.

|

|

|

●

|

The market price of our common stock is still likely to be

highly volatile and subject to wide fluctuations, and stockholders may be unable to resell shares of common stock at or above the price

at which they are acquired.

|

|

|

●

|

We have not paid dividends in the past and do not expect

to pay dividends for the foreseeable future, and any return on investment may be limited to potential future appreciation in the value

of our common stock.

|

General Risks

|

|

●

|

We may not be able to timely and effectively implement controls

and procedures required by Section 404 of the Sarbanes-Oxley Act of 2002.

|

|

|

●

|

Failure to remediate material weaknesses in internal controls over financial reporting could result in

material misstatements in our financial statements.

|

|

|

●

|

The requirements of being a public company may strain our resources and divert management’s attention.

|

|

|

●

|

We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements

applicable to emerging growth companies will make our shares of common stock less attractive to investors.

|

|

|

●

|

Our ability to utilize our net operating loss carryforwards

and certain other tax attributes may be limited.

|

|

|

●

|

Our operations could be adversely affected by events outside

of our control, such as natural disasters, wars, or health epidemics.

|

FORWARD-LOOKING

STATEMENTS

This prospectus, the documents incorporated by

reference herein and the exhibits attached hereto contain “forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995, including statements regarding future events or our future results of operations, financial condition,

business, strategies, financial needs, and the plans and objectives of management, are forward-looking statements. In some cases forward-looking

statements can be identified because they contain words such as “anticipate,” “believe,” “continue,”

“could,” “estimate,” “expect,” “intend,” “may,” “might,” “likely,”

“plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,”

“will,” “would,” or similar expressions and the negatives of those terms. Forward-looking statements are based

on information available to our management as of the date of this prospectus and our management’s good faith belief as of such date

with respect to future events and are subject to a number of risks, uncertainties, and assumptions that could cause actual performance

or results to differ materially from those expressed in or suggested by the forward-looking statements, in particular the substantial

risks and uncertainties related to the ongoing COVID-19 pandemic. Important factors that could cause such differences include, but are

not limited to:

|

|

●

|

our ability to sustain our revenue growth rate, to achieve or maintain

profitability, and to effectively manage our anticipated growth;

|

|

|

|

|

|

|

●

|

our short operating history makes it difficult to evaluate our business

and future prospects;

|

|

|

|

|

|

|

●

|

our dependence on the commercial success of our clients, the continued

growth of the cannabis industry and the regulatory environment in which the cannabis industry operates;

|

|

|

|

|

|

|

●

|

our ability to attract new clients on a cost-effective basis and the

extent to which existing clients renew and upgrade their subscriptions;

|

|

|

|

|

|

|

●

|

the timing of our introduction of new solutions or updates to existing

solutions;

|

|

|

|

|

|

|

●

|

our ability to successfully diversify our solutions by developing or

introducing new solutions or acquiring and integrating additional businesses, products, services, or content;

|

|

|

|

|

|

|

●

|

our ability to respond to changes within the cannabis industry;

|

|

|

|

|

|

|

●

|

the effects of adverse changes in, or the enforcement of, federal laws

regarding our clients’ cannabis operations or our receipt of proceeds from such operations;

|

|

|

|

|

|

|

●

|

our ability to manage unique risks and uncertainties related to government

contracts;

|

|

|

|

|

|

|

●

|

our ability to manage and protect our information technology systems;

|

|

|

|

|

|

|

●

|

our ability to maintain and expand our strategic relationships with

third parties;

|

|

|

|

|

|

|

●

|

our ability to deliver our solutions to clients without disruption

or delay;

|

|

|

|

|

|

|

●

|

our exposure to liability from errors, delays, fraud, or system failures,

which may not be covered by insurance;

|

|

|

|

|

|

|

●

|

our ability to expand our international reach;

|

|

|

|

|

|

|

●

|

our ability to retain or recruit officers, key employees, and directors;

|

|

|

|

|

|

|

●

|

our ability to raise additional capital or obtain financing in the

future;

|

|

|

|

|

|

|

●

|

our ability to successfully integrate acquired businesses with Akerna’s

business within anticipated timelines and at their expected costs;

|

|

|

●

|

our ability to complete planned acquisitions on time or at all due to failure to obtain stockholder approval or governmental or regulatory clearances, or the failure to satisfy other conditions to completion, or the failure of completion for any other reason;

|

|

|

|

|

|

|

●

|

our response to adverse developments in the general market, business, economic, labor, regulatory, and political conditions, including worldwide demand for cannabis and the spot price and long-term contract price of cannabis;

|

|

|

|

|

|

|

●

|

our response to competitive risks;

|

|

|

|

|

|

|

●

|

our ability to protect our intellectual property;

|

|

|

|

|

|

|

●

|

the market reaction to negative publicity regarding cannabis;

|

|

|

|

|

|

|

●

|

our ability to manage the requirements of being a public company;

|

|

|

|

|

|

|

●

|

our ability to service our convertible debt;

|

|

|

|

|

|

|

●

|

our accounting treatment of certain of our private warrants;

|

|

|

|

|

|

|

●

|

our ability to effectively manage any disruptions to our business and/or any negative impact to our financial performance caused by the economic and social effects of the COVID-19 pandemic and measures taken in response; and

|

|

|

|

|

|

|

●

|

other factors discussed in other sections of this prospectus, including the section titled “Risk Factors,” and in the Company’s transition report for the six-month period ended December 31, 2020 on Form 10-KT and quarterly report for the period ended March 31, 2021 on Form 10-Q, incorporated herein by reference, including the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated

or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made.

We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of

such statements or to reflect the occurrence of anticipated or unanticipated events.

We qualify all the forward-looking statements

contained in this prospectus by the foregoing cautionary statements.

RECENT

DEVELOPMENTS

Ample Acquisition

On December 18, 2019, we entered into an

arrangement agreement, as amended by the Amendment to Arrangement Agreement, dated February 28, 2020 (“Amendment to Arrangement

Agreement”), Amendment No. 2 to Arrangement Agreement dated May 26, 2020 (“Amendment No. 2 to Arrangement Agreement), and

Amendment No. 3 to Arrangement Agreement dated June 1, 2020 (“Amendment No. 3 to Arrangement Agreement”) (collectively, the

“Arrangement Agreement”), among us, Exchangeco, John Prentice and Ample, pursuant to which we through Exchangeco agreed to

acquire all of the issued and outstanding equity of Ample (the “Arrangement”).

On July 7, 2020, the Arrangement was consummated

by way of a court-approved plan of arrangement under Ontario law (the “Plan of Arrangement”) and Ample became our indirect

wholly-owned subsidiary.

Pursuant to the Arrangement Agreement and the

Plan of Arrangement, on the closing date, holders of Ample common shares (the “Ample Shares”) received a number of Exchangeable

Shares equal to the number of Ample Shares multiplied by the exchange ratio of 0.0524 (the “Exchange Ratio”). In the aggregate,

Ample shareholders received 3,294,574 Exchangeable Shares. The Exchange Ratio was agreed to on December 18, 2019, and was not adjusted

for any subsequent changes in market price of our common stock, par value $0.0001 per share (the “Akerna Shares”) or the

Ample Shares prior to the closing date. The Exchangeable Shares are exchangeable for shares of our common stock on a 1:1 basis, as determined

in accordance with the Arrangement Agreement.

Ample’s shareholders adopted and approved

the Arrangement Agreement and the Plan of Arrangement on June 26, 2020. Akerna’s shareholders approved the issuance of the Akerna

Shares (including the Akerna shares issuable upon exchange of the Exchangeable Shares and shares issuable pursuant to the Contingent

Value Rights) in connection with the Arrangement on June 26, 2020. The Ontario Superior Court of Justice issued a final order approving

the Plan of Arrangement on June 30, 2020.

The Exchangeable Shares were issued as part of

the Arrangement pursuant to Section 3(a)(10) of the Securities Act, based on the final order of the Ontario Superior Court of Justice.

Of the 3,294,574 Exchangeable Shares that

were issued to former Ample shareholders in connection with the consummation of the Arrangement, an aggregate of 658,915 Exchangeable

Shares were issued as “Closing Consideration” and an aggregate of 2,635,659 Exchangeable Shares, constituting part of the

“Escrowed Consideration” were issued into escrow pursuant to an escrow agreement (the “Escrow Agreement”), entered

into on July 7, 2020 by and among the Company, ExchangeCo, John Prentice, as Shareholder Representative, and Odyssey Trust Company. Under

the Escrow Agreement, subject to unresolved claims by the Company under the Arrangement Agreement in respect of fraud, the Escrowed Consideration

shall be released to former Ample shareholders upon the six-, nine-, and twelve-month anniversaries of the Closing Date in accordance

with the following schedule -- 988,372 shares on the six-month anniversary, 823,643 shares on the nine-month anniversary, and 823,644

shares on the twelve-month anniversary. As of the date hereof, 1,647,287 shares of common stock of Akerna have been issued on conversion

of Exchangeable Shares.

In addition to the Exchangeable Shares, each

Ample shareholder, immediately prior to the time at which the Arrangement became effective received one Contingent Value Right (each

a “CVR” and collectively the “CVRs”). Each CVR entitles the holder to receive a portion of Deferred Consideration

(as defined in the Arrangement Agreement) that the initial holder of such CVR is entitled to receive in its capacity as an Ample shareholder,

with an aggregate of up to CAD$10,000,000 additional Exchangeable Shares issuable to the holders of the CVRs subject to downward adjustment

pursuant to the Arrangement Agreement. Pursuant to the Rights Indenture entered into on July 7, 2020 by and among Akerna, Exchangeco,

John Prentice as Shareholder Representative and Odyssey Trust Company, holders of CVRs shall be entitled to additional Exchangeable Shares

if certain revenue targets are achieved by Ample during the twelve month period following effectiveness of the Arrangement.

On July 7, 2020, we, entered into (i) an Exchangeable

Share Support Agreement together with Exchangeco, Akerna Canada Holdings Inc., a corporation existing under the laws of the Province

of Ontario, and John Prentice, as Shareholder Representative, and (ii) a Voting and Exchange Trust Agreement (the “Voting and Exchange

Trust Agreement”) with Exchangeco, Akerna Canada Holdings Inc. and Odyssey Trust Company (the “Trustee”) solely for

the purpose of ensuring that each Exchangeable Share is substantially the economic and voting equivalent of a share of common stock of

Akerna, and, following the registration of the shares of common stock issuable upon exchange of the Exchangeable Shares and the CVRs

with the Securities and Exchange Commission (the “Commission”), ensuring that each Exchangeable Share is exchangeable on

a one-for-one basis for a share of common stock of Akerna, subject to certain limitations set forth therein. Together, the Voting and

Exchange Trust Agreement and the Support Agreement set forth the terms governing the Exchangeable Shares. Through the Voting and Exchange

Trust Agreement and the issuance by Akerna to the Trustee of a special voting share, each holder of Exchangeable Shares effectively has

the ability to cast votes along with holders of shares of our common stock.

Equity Financing

On October 28, 2020,

we entered into subscription agreements with certain investors (the “Investors”) relating to the sale and issuance by the

Company of 5,000,000 shares of common stock of the Company, par value $0.0001, at a price of $2.40 per share (the “Equity Offering”).

The Offering closed on October 30, 2020.

In addition, on October

28, 2020,we entered into a placement agency agreement with A.G.P./Alliance Global Partners (the “Placement Agent”), pursuant

to which the Placement Agent agreed to act as the Company’s agent for the sale of the shares to the public in the Equity Offering

on a best efforts basis. The Company agreed to pay the Placement Agent a cash fee equal to 7% of the gross proceeds from the Equity Offering

and to reimburse the Placement Agent for up to $60,000 of its reasonable out-of-pocket expenses.

Acquisition of

Veridian

On March 10, 2021, we entered into an Agreement

and Plan of Reorganization (the “Viridian Agreement”) with Navigator Acquisition Corp., a Delaware corporation (“Seller”),

and Viridian Sciences, Inc., a Delaware company (“Viridian”), whereby we acquired 100% of the issued and outstanding capital

stock of Viridian from Seller for 1,000,000 shares of Akerna common stock valued at $6.00 per share (the “Transaction”).

The Agreement provides for a contingent payment

of shares of Akerna’s common stock equal to up to $1,000,000 payable after the one-year period following the closing of the Transaction

based upon certain revenue achievements set forth in the Agreement. A portion of the Share Consideration (as defined in the Agreement)

in an amount equal to 100,000 shares of Akerna common stock valued at $6.00 per share in cash was deposited into an escrow account to

satisfy certain net working capital adjustments and indemnification obligations of Seller.

We closed the acquisition of Veridian on April

1, 2021.

Transition Period

On September 25, 2020, our Board of Directors

adopted resolutions pursuant to Article XII of our Bylaws to change the Company’s fiscal year end from June 30 to December 31,

effective for the year ending December 31, 2020.

USE

OF PROCEEDS

We will not receive any proceeds from the issuance

of shares of our common stock on the exchange of Exchangeable Shares.

DIVIDEND POLICY

We do not intend to pay dividends for the foreseeable

future. In addition, our ability to pay dividends is restricted by agreements governing Akerna’s and its subsidiaries’ debt,

including the Company’s senior secured convertible notes. See “Risk Factors” above.

DESCRIPTION

OF COMPANY CAPITAL STOCK

As of May 17, 2021, our authorized share capital

consists of 75,000,000 shares of Common Stock, $0.0001 par value per share, of which 24,136,07 shares of common stock are issued and outstanding,

5,000,000 shares of preferred stock, $0.0001 par value per share, of which none are issued and outstanding and one share of special voting

stock, of which one share is outstanding. We are a Delaware corporation and our affairs are governed by our Amended and Restated Certificate

of Incorporation and Amended and Restated By-laws. The following are summaries of material provisions of our Amended and Restated Certificate

of Incorporation and Amended and Restated By-laws insofar as they relate to the material terms of our common stock. Complete copies of

our Amended and Restated Certificate of Incorporation and Amended and Restated By-laws are filed as exhibits to our public filings.

Common Stock

All outstanding shares of common stock are of

the same class and have equal rights and attributes. The holders of common stock are entitled to one vote per share on all matters submitted

to a vote of our stockholders. Subject to the prior rights of all classes or series of stock at the time outstanding having prior rights

as to dividends or other distributions, all stockholders are entitled to share equally in dividends, if any, as may be declared from

time to time by the Board of Directors out of funds legally available. Subject to the prior rights of creditors of Akerna and the holders

of all classes or series of stock at the time outstanding having prior rights as to distributions upon liquidation, dissolution or winding

up of Akerna, in the event of liquidation, the holders of common stock are entitled to share ratably in all assets remaining after payment

of all liabilities. The stockholders do not have cumulative, preemptive rights, or subscription rights.

Special Voting Share

The special voting share has a par value of $0.0001

per share. The special voting share entitles the holder thereof to an aggregate number of votes equal to the number of the Exchangeable

Shares issued and outstanding from time to time and that are not owned by us or our subsidiaries. Except as otherwise provided herein

or by law, the holder of the special voting share and the holders of our common stock will vote together as a single class on all matters

submitted to a vote of Akerna’s shareholders. With respect to all meetings of shareholders of Akerna at which holders of Akerna

shares are entitled to vote, each registered holder of Exchangeable Shares shall be entitled to instruct the trustee holding the special

voting share to cast and exercise, in the manner instructed, that number of votes equal to the “Equivalent Vote Amount” for

each Exchangeable Share owned of record by such holder of Exchangeable Shares at the close of business on the record date established

by Akerna or by applicable law for such meeting, in respect of each matter, question, proposal or proposition to be voted on at such

meeting. At such time as the special voting share has no votes attached to it, the special voting share shall be automatically cancelled.

Exchangeable Shares

The Exchangeable Shares of Exchangeco are intended

to be substantially economically equivalent to shares of our common stock. The rights, privileges, restrictions and conditions attaching

to the Exchangeable Shares of Exchangeco include the following:

|

|

●

|

any holder of Exchangeable Shares of Exchangeco

is entitled to require Exchangeco to redeem any or all of the Exchangeable Shares registered in his/her name in exchange for one

share of our common stock for each Exchangeable Share presented and surrendered;

|

|

|

●

|

in the event Akerna declares a dividend on its

common stock, the holders of Exchangeable Shares of Exchangeco are entitled to receive from Exchangeco the same dividend, or an economically

equivalent dividend, on their Exchangeable Shares;

|

|

|

●

|

the holders of the Exchangeable Shares of Exchangeco

are not entitled to receive notice of or to attend any meeting of the shareholders of Exchangeco or to vote at any such meeting,

except as required by law or as specifically provided in the Exchangeable Share conditions; and

|

|

|

|

|

|

|

●

|

the holders of Exchangeable Shares of Exchangeco

are entitled to instruct the Trustee to vote the special voting stock as described above.

|

Of the 3,294,574 Exchangeable Shares that

were issued to former Ample shareholders in connection with the consummation of the Arrangement, an aggregate of 658,915 Exchangeable

Shares were issued as “Closing Consideration” and an aggregate of 2,635,659 Exchangeable Shares, constituting part of the

“Escrowed Consideration” were issued into escrow pursuant to an escrow agreement (the “Escrow Agreement”), entered

into on July 7, 2020 by and among the Company, ExchangeCo, John Prentice, as Shareholder Representative, and Odyssey Trust Company. Under

the Escrow Agreement, subject to unresolved claims by the Company under the Arrangement Agreement in respect of fraud, the Escrowed Consideration

shall be released to former Ample shareholders upon the six-, nine-, and twelve-month anniversaries of the Closing Date in accordance

with the following schedule -- 988,372 shares on the six-month anniversary, 823,643 shares on the nine-month anniversary, and 823,644

shares on the twelve-month anniversary. As of the date hereof, 1,647,287 shares of common stock of Akerna have been issued on conversion

of Exchangeable Shares.

CVRs

In addition to the Exchangeable Shares, each

Ample shareholder, immediately prior to the time at which the Arrangement became effective received one CVR. Each CVR entitles the holder

to receive a portion of Deferred Consideration (as defined in the Arrangement Agreement) that the initial holder of such CVR is entitled

to receive in its capacity as an Ample shareholder, with an aggregate of up to CAD$10,000,000 additional Exchangeable Shares issuable

to the holders of the CVRs subject to downward adjustment pursuant to the Arrangement Agreement. Pursuant to the Rights Indenture entered

into on July 7, 2020 by and among Akerna, Exchangeco, John Prentice as Shareholder Representative and Odyssey Trust Company, holders

of CVRs shall be entitled to additional Exchangeable Shares if certain revenue targets are achieved by Ample during the twelve month

period following effectiveness of the Arrangement.

Registration Rights

We have granted registration rights under

the Securities Act to certain holders of our common stock in relation to our acquisitions of Solo, Trellis and Ample. In relation to

Ample, we agreed to file and maintain, until no Exchangeable Shares remain outstanding, a registration statement regarding the exchange

of the Exchangeable Shares into shares of our common stock pursuant to their terms. In relation thereto, we filed a registration statement

on Form S-1 on July 9, 2020 (333-239783) which was brought effective on August 14, 2020. In relation to Trellis, we agreed to file a

registration statement registering the resale of shares of certain of the shares of common stock held by the former shareholders of Trellis,

totaling 314,684 shares. In relation thereto, we filed a registration statement on Form S-1 on August 7, 2020 (333-242474) registering

the resale of 314,684 shares of our common stock, which was brought effective on August 14, 2020. In relation to Solo, we have agreed

to use of commercially reasonable efforts to file a registration statement to register the resale of 2,000,000 shares of common stock

held by the former shareholders of Solo. In relation thereto, we filed a registration statement on Form S-1 on January 15, 2021 (333-252178)

registering the resale of 2,717,245 shares of our common stock related to the Solo transaction (such registration statement also acted

as a post-effective amendment to the Trellis registration statement and a prior registration statement on S-3 for the resale of shares),

which was brought effective on January 25, 2021. We may also be required in the future to file amendments to these registration statements

to maintain effectiveness.

Election of Directors

Our Class I Directors held office until the

2019 annual meeting of stockholders and were reelected at such meeting. Our Class II Directors held office until the 2020 annual meeting

of stockholders and were reelected at such meeting. Our Class III Directors hold office until the 2021 annual meeting of stockholders

and are eligible for reelection at such meeting. Directors are elected by a plurality of the votes cast at the annual meeting by the

holders of Common Stock present in person or represented by proxy and entitled to vote at such meeting. There is no cumulative voting

for directors.

Anti-Takeover Provisions

Our Amended and Restated

Certificate of Incorporation contains provisions that may discourage unsolicited takeover proposals that stockholders may consider to

be in their best interests. We are also subject to anti-takeover provisions under Delaware law, which could delay or prevent a change

of control. Together these provisions may make more difficult the removal of management and may discourage transactions that otherwise

could involve payment of a premium over prevailing market prices for our securities.

These provisions:

|

|

●

|

create a staggered Board of Directors making it more difficult for

stockholders to remove a majority of the Board of Directors and take control;

|

|

|

●

|

grant the Board of Directors the ability to designate the terms of

and issue new series of preferred shares, which can be created and issued by the Board of Directors without prior stockholder approval,

with rights senior to those of the common stock;

|

|

|

●

|

impose limitations on our stockholders’ ability to call special

stockholder meetings;

|

|

|

●

|

make it more difficult the removal of management and may discourage

transactions that otherwise could involve payment of a premium over prevailing market prices for our securities.

|

CERTAIN

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS

The

following is a general discussion of certain material U.S. federal income tax considerations relating to the purchase, ownership and

disposition of our common stock. This discussion is based on current provisions of the Internal Revenue Code of 1986, as amended (the

“Internal Revenue Code”), existing and proposed U.S. Treasury Regulations promulgated or proposed thereunder and current

administrative and judicial interpretations thereof, all as in effect as of the date of this prospectus and all of which are subject

to change or to differing interpretation, possibly with retroactive effect. We have not sought and will not seek any rulings from the

Internal Revenue Service (the “IRS”), or opinion of counsel, regarding the matters discussed below. There can be no assurance

that the IRS or a court will not take a contrary position.

This

discussion is limited to U.S. holders and non-U.S. holders who hold our common stock as a capital asset within the meaning of Section 1221

of the Internal Revenue Code (generally, as property held for investment). This discussion does not address all aspects of U.S. federal

income taxation, such as the U.S. alternative minimum income tax and the additional tax on net investment income, nor does it address

any aspect of state, local or non-U.S. taxes, or U.S. federal taxes other than income taxes, such as federal estate and gift taxes. Except

as provided below, this summary does not address tax reporting requirements. This discussion does not consider any specific facts or

circumstances that may apply to a holder and does not address the special tax considerations that may be applicable to particular holders,

such as:

|

|

●

|

tax-exempt

organizations;

|

|

|

●

|

banks

or other financial institutions;

|

|

|

●

|

brokers

or dealers in securities or foreign currency;

|

|

|

●

|

traders

in securities who elect to apply a mark-to-market method of accounting;

|

|

|

●

|

real

estate investment trusts, regulated investment companies or mutual funds;

|

|

|

●

|

controlled

foreign corporations;

|

|

|

●

|

passive

foreign investment companies;

|

|

|

●

|

persons

that own (directly, indirectly or constructively) more than 5% of the total voting power or total value of our common stock;

|

|

|

●

|

corporations

that accumulate earnings to avoid U.S. federal income tax;

|

|

|

●

|

certain

former citizens or long-term residents of the United States;

|

|

|

●

|

persons

that have a “functional currency” other than the U.S. dollar;

|

|

|

●

|

persons

that acquire our common stock as compensation for services;

|

|

|

●

|

owners

that hold our stock as part of a straddle, hedge, conversion transaction, synthetic security or other integrated investment;

|

|

|

●

|

holders

subject to special accounting rules;

|

|

|

●

|

partnerships

or other entities treated as partnerships for U.S. federal income tax purposes.

|

If

any entity taxable as a partnership for U.S. federal income tax purposes holds our common stock, the U.S. federal income tax treatment

of a partner in the partnership generally will depend on the status of the partner, the activities of the partnership and certain determinations

made at the partner level. A partner in a partnership or other pass-through entity that holds our common stock should consult his, her

or its own tax advisor regarding the applicable tax consequences.

For

purposes of this discussion, the term “U.S. holder” means a beneficial owner of our common stock that is, for U.S. federal

income tax purposes:

|

|

●

|

an

individual who is a citizen or resident of the United States;

|

|

|

●

|

a

corporation created or organized in or under the laws of the United States, any state thereof or the District of Columbia;

|

|

|

●

|

an

estate the income of which is subject to U.S. federal income taxation regardless of its source; or

|

|

|

●

|

a

trust, if (1) a U.S. court is able to exercise primary supervision over the administration of the trust and one or more U.S. persons

have authority to control all substantial decisions of the trust or (2) the trust has a valid election to be treated as a U.S. person

under applicable U.S. Treasury Regulations.

|

A

“non-U.S. holder” is a beneficial owner of our common stock that is neither a U.S. holder nor a partnership (or other entity

treated as a partnership for U.S. federal income tax purposes).

Prospective

investors should consult their own tax advisors regarding the U.S. federal, state, local and non-U.S. income and other tax considerations

of the purchase, ownership and disposition of our common stock.

U.S.

Holders

Distributions

on Common Stock

If

we pay distributions of cash or property with respect to our common stock, those distributions generally will constitute dividends for

U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal

income tax principles. If a distribution exceeds our current and accumulated earnings and profits, the excess will be treated as a tax-free

return of the U.S. holder’s investment, up to such holder’s adjusted tax basis in its shares of our common stock. Any remaining

excess will be treated as capital gain, subject to the tax treatment described below under the heading “U.S. Holders—Gain

on Sale, Exchange or Other Taxable Disposition.”

Dividends

we pay to a U.S. holder that is a taxable corporation generally will qualify for the dividends received deduction if the requisite holding

period is satisfied. With certain exceptions (including, but not limited to, dividends treated as investment income for purposes of investment

interest deduction limitations), and provided certain holding period requirements are met, dividends we pay to a non-corporate U.S. holder

generally will constitute “qualified dividends” that will be subject to tax at the maximum tax rate accorded to long-term

capital gains.

Gain

on Sale, Exchange or Other Taxable Disposition

Upon

the sale or other taxable disposition of common shares, a U.S. holder generally will recognize capital gain or loss in an amount equal

to the difference between (a) the amount of cash plus the fair market value of any property received and (b) such U.S. holder’s

tax basis in such common shares sold or otherwise disposed of. Such gain or loss generally will be long-term capital gain or loss if,

at the time of the sale or other disposition, the common shares have been held by the U.S. holder for more than one year. Preferential

tax rates may apply to long-term capital gain of a U.S. holder that is an individual, estate, or trust. Deductions for capital losses

are subject to significant limitations.

Non-U.S.

Holders

Distributions

on Common Stock

If

we pay distributions of cash or property with respect to our common stock, those distributions generally will constitute dividends for

U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal

income tax principles. If a distribution exceeds our current and accumulated earnings and profits, the excess will be treated as a tax-free

return of the non-U.S. holder’s investment, up to such holder’s tax basis in its shares of our common stock. Any remaining

excess will be treated as capital gain, subject to the tax treatment described below under the heading “Non-U.S. Holders —Gain

on Sale, Exchange or Other Taxable Disposition.” Dividends paid to a non-U.S. holder generally will be subject to withholding of

U.S. federal income tax at a 30% rate, or such lower rate as may be specified by an applicable income tax treaty between the United States

and such holder’s country of residence. In the case of any constructive distribution, it is possible that this tax would be withheld

from any amount owed to the non-U.S. holder, including, but not limited to, distributions of cash, common stock or sales proceeds subsequently

paid or credited to that holder. If we are unable to determine, at the time of payment of a distribution, whether the distribution will

constitute a dividend, we may nonetheless choose to withhold any U.S. federal income tax on the distribution as permitted by U.S. Treasury

Regulations.

Distributions

that are treated as effectively connected with a trade or business conducted by a non-U.S. holder within the United States are generally

not subject to the 30% withholding tax if the non-U.S. holder provides a properly executed IRS Form W-8ECI stating that the distributions

are not subject to withholding because they are effectively connected with the non-U.S. holder’s conduct of a trade or business

in the United States. If a non-U.S. holder is engaged in a trade or business in the United States and the distribution is effectively

connected with the conduct of that trade or business, the distribution will generally have the consequences described above for a U.S.

holder (subject to any modification provided under an applicable income tax treaty). Any U.S. effectively connected income received by

a non-U.S. holder that is treated as a corporation for U.S. federal income tax purposes may also, under certain circumstances, be subject

to an additional “branch profits tax” at a 30% rate (or such lower rate as may be specified by an applicable income tax treaty).

A

non-U.S. holder who claims the benefit of an applicable income tax treaty between the United States and such holder’s country of

residence generally will be required to provide a properly executed IRS Form W-8BEN or W-8BEN-E, as applicable, and satisfy applicable

certification and other requirements. A non-U.S. holder that is eligible for a reduced rate of U.S. withholding tax under an income tax

treaty generally may obtain a refund or credit of any excess amounts withheld by timely filing an appropriate claim with the IRS. Non-U.S.

holders should consult their own tax advisors regarding their entitlement to benefits under a relevant income tax treaty.

Gain

on Sale, Exchange or Other Taxable Disposition

Subject

to the discussions below in “—Information Reporting and Backup Withholding” and “—Foreign Account Tax Compliance

Act,” a non-U.S. holder generally will not be subject to U.S. federal income tax on gain recognized on a sale, exchange or

other taxable disposition of our common stock unless:

|

|

●

|

the

gain is effectively connected with the non-U.S. holder’s conduct of a trade or business in the United States and, if an applicable

income tax treaty so provides, the gain is attributable to a permanent establishment maintained by the non-U.S. holder in the United

States; in these cases, the non-U.S. holder will be taxed on a net income basis at the regular graduated rates and in the manner applicable

to a U.S. holder, and, if the non-U.S. holder is a corporation, an additional branch profits tax at a rate of 30%, or a lower rate as

may be specified by an applicable income tax treaty, may also apply;

|

|

|

●

|

the

non-U.S. holder is an individual present in the United States for 183 days or more in the taxable year of the disposition and certain

other conditions are met, in which case the non-U.S. holder will be subject to a 30% tax (or such lower rate as may be specified by an

applicable income tax treaty) on the amount by which such non-U.S. holder’s capital gains allocable to U.S. sources exceed

capital losses allocable to U.S. sources during the taxable year of the disposition; or

|

|

|

●

|

our

common stock constitutes “U.S. real property interests” by reason of our being or having been a “U.S. real property

holding corporation” during the shorter of the five-year period ending on the date of the disposition or the period that the non-U.S.

holder held our common stock. Generally, a domestic corporation is a “U.S. real property holding corporation” if the fair

market value of its “U.S. real property interests” (within the meaning of the Internal Revenue Code) equals or exceeds 50%

of the sum of the fair market value of its U.S. and worldwide real property interests plus its other assets used or held for use in a

trade or business. We believe that we are not currently, and we do not anticipate becoming, a “U.S. real property holding corporation”

for U.S. federal income tax purposes. However, because the determination of whether we are a U.S. real property holding corporation depends

on the fair market value of our U.S. real property interests relative to the fair market value of our U.S. and worldwide real property

interests plus our other assets used or held for use in a trade or business, there can be no assurance that we will not become a U.S.

real property holding corporation in the future. Even if we become a U.S. real property holding corporation, as long as our common stock

is regularly traded on an established securities market under the rules set forth in the Treasury Regulations, common stock held by a

non-U.S. holder will be treated as U.S. real property interests only if such non-U.S. holder actually (directly or indirectly) or constructively

holds more than five percent of the total voting power or total value of such regularly traded common stock at any time during the shorter

of the five-year period preceding such non-U.S. holder’s disposition of, or holding period for, our common stock.

|

Information

Reporting and Backup Withholding

Distributions

on, and the payment of the proceeds of a disposition of, our common stock generally will be subject to information reporting if made

within the United States or through certain U.S.-related financial intermediaries. Information returns are required to be filed with

the IRS and copies of information returns may be made available to the tax authorities of the country in which a holder resides or is

incorporated under the provisions of a specific treaty or agreement.

Backup

withholding may also apply if the holder fails to provide certification of exempt status or a correct U.S. taxpayer identification number

and otherwise comply with the applicable backup withholding requirements. Generally, a holder will not be subject to backup withholding

if it provides a properly completed and executed IRS Form W-9 or appropriate IRS Form W-8, as applicable. Backup withholding

is not an additional tax. Amounts withheld under the backup withholding rules may be refunded or credited against the holder’s

U.S. federal income tax liability, if any, provided certain information is timely filed with the IRS.

Foreign

Account Tax Compliance Act

Sections

1471 through 1474 of the Code (commonly referred to as “FATCA”) impose a separate reporting regime and potentially a 30%

withholding tax on certain payments, including payments of dividends on our common shares. Withholding under FATCA generally applies

to payments made to or through a foreign entity if such entity fails to satisfy certain disclosure and reporting rules. These rules generally

require (i) in the case of a foreign financial institution, that the financial institution agree to identify and provide information

in respect of financial accounts held (directly or indirectly) by U.S. persons and U.S.-owned entities, and, in certain instances, to

withhold on payments to account holders that fail to provide the required information, and (ii) in the case of a non-financial foreign

entity, that the entity either identify and provide information in respect of its substantial U.S. owners or certify that it has no such

U.S. owners.

FATCA

withholding also potentially applies to payments of gross proceeds from the sale or other disposition of our common shares. Proposed

regulations, however, would eliminate FATCA withholding on such payments, and the U.S. Treasury Department has indicated that taxpayers

may rely on this aspect of the proposed regulations until final regulations are issued.

Non-U.S.

Holders typically will be required to furnish certifications (generally on the applicable IRS Form W-8) or other documentation to provide

the information required by FATCA or to establish compliance with or an exemption from withholding under FATCA. FATCA withholding may

apply where payments are made through a non-U.S. intermediary that is not FATCA compliant, even where the Non-U.S. Holder satisfies the

holder’s own FATCA obligations.

The

United States and a number of other jurisdictions have entered into intergovernmental agreements to facilitate the implementation of

FATCA. Any applicable intergovernmental agreement may alter one or more of the FATCA information reporting and withholding requirements.

You are encouraged to consult with your own tax advisor regarding the possible implications of FATCA on your investment in our common

shares, including the applicability of any intergovernmental agreements.

PLAN

OF DISTRIBUTION

The common stock offered under this prospectus

will be issued in exchange for Exchangeable Shares. No broker, dealer or underwriter has been engaged in connection with soliciting the

exchange and no commission or other compensation will be paid to any person in connection with the solicitation of the exchange. Exchangeco

issued the Exchangeable Shares to shareholders of Ample, on July 7, 2020. The shareholders of Ample received the Exchangeable Shares

in connection with the arrangement by and between Ample, Exchangeco and Akerna under a plan of arrangement in accordance with Section 182

of the Business Corporations Act (Ontario). The Ontario Superior Court of Justice issued a final order approving the plan of arrangement

on June 30, 2020. The Exchangeable Shares were issued pursuant to Section 3(a)(10) of the Securities Act, based on the final order of

the Ontario Superior Court of Justice.

EXPERTS

The consolidated financial statements of Akerna

as of December 31, 2020, June 30, 2020 and 2019, for the six months ended December 31, 2020 and for each of the two years in the period

ended June 30, 2020 included in our transition report on Form 10-KT which is incorporated herein by reference, have been audited by Marcum

LLP, independent registered public accounting firm, as set forth in their report thereon, which is incorporated herein by reference,

and are included in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

The financial statements of Solo as of December

31, 2019 and 2018 and for years then ended included in our current report on Form 8-K as filed with the SEC on May 29, 2020 and incorporated

herein by reference, have been audited by Marcum LLP, independent auditors, as set forth in their report thereon, which is incorporated

herein by refernce, and are included in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

The consolidated financial statements of Ample

as of December 31, 2019 and 2018 and for years then ended included in our current report on Form 8-K as filed with the SEC on July 8,

2020 and incorporated herein by reference, have been audited by Ernst & Young LLP, independent auditors, as set forth in their report

thereon, which is incorporated herein by reference, which report includes an explanatory paragraph as to the ability of Ample to continue

as a going concern as described in Note 1 to the financial statements, and are included in reliance on such report given upon such firm

as experts in accounting and auditing.

LEGAL

MATTERS

The validity of the securities offered hereby

have been passed upon for Akerna by Dorsey & Whitney LLP.

DOCUMENTS INCORPORATED BY REFERENCE

The SEC allows us to “incorporate by

reference” information we file with the SEC. This means that we can disclose important information to you by referring

you to those documents. Any information we reference in this manner is considered part of this prospectus. Information we

file with the SEC after the date of this prospectus will automatically update and, to the extent inconsistent, supersede the information

contained in this prospectus.

The following documents have been filed by

us with the SEC, are specifically incorporated by reference into, and form an integral part of, this prospectus.

|

|

(a)

|

our Transition Report on Form 10-KT

for the six-month period ended December 31, 2021, which report contains our audited consolidated

financial statements and the notes thereto as of December 31, 2020 and June 30, 2020 and

2019 and for the six-month transition period ended December 31, 2020 and for the fiscal years

ended June 30, 2020 and 2019, together with the auditors’ report thereon and the related

management’s discussion and analysis of financial condition and results of operations

for the six-month period ended December 31, 2020 and the fiscal years ended June 30, 2020

and 2019, as filed with the SEC on March 31, 2021;

|

|

|

(b)

|

our Proxy Statement on Schedule 14A

in connection with our June 7, 2021 annual general meeting of stockholders, to the extent

such information is specifically incorporated by reference into Part III of our Transition

Report on Form 10-KT for the fiscal year ended December 31, 2020, as filed with the SEC on

April 27, 2021;

|

|

|

(c)

|

our Quarterly Report on Form 10-Q