Registration

No. 333-239783

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 1

FORM

S-1

REGISTRATION

STATEMENT UNDER THE SECURITIES ACT OF 1933

AKERNA

CORP.

(Exact

Name of Registrant as Specified in its Charter)

|

Delaware

|

|

7374

|

|

83-2242651

|

|

(State

or other jurisdiction of

incorporation

or organization)

|

|

Primary

Standard Industrial

Classification

Code Number)

|

|

(I.R.S.

Employer

Identification

No.)

|

1550 Larimer Street

#246

Denver,

Colorado 80202

(Address,

including zip code, and telephone number,

including

area code, of principal executive offices)

Corporation

Service Company

251

Little Falls Drive

Wilmington,

Delaware 19808

(Address,

including zip code, and telephone number,

including

area code, of agent for service)

Copies

to:

|

Jason

K Brenkert, Esq.

Dorsey

& Whitney LLP

1400

Wewatta Street, Suite 400

Denver,

Colorado 80202

Telephone:

(303) 352-1133

Fax

Number: (303) 629-3450

|

From

time to time after the effective date of this registration statement

(Approximate

date of commencement of proposed sale to public)

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933 check the following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier registration statement for the

same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large

accelerated filer

|

☐

|

Accelerated

filer

|

☐

|

|

Non-accelerated

filer

|

☒

|

Smaller

reporting company

|

☒

|

|

|

Emerging

Growth Company

|

☒

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

EXPLANATORY

NOTE

Akerna Corp. (“Akerna”, the “registrant”,

“we” or “our”) hereby filed this Post-Effective Amendment No. 1 to its Registration Statement on Form S-1

(No. 333-239783) to update the prospectus contained therein to (i) reflect that 627,225 shares of common stock were previously

issued upon conversion of Exchangeable Shares leaving 2,667,349 shares of common stock issuable upon conversion, (ii) add its financial

statements for the fiscal year ended June 30, 2020 and for the three-month period ended September 30, 2020, (iii) update the related

management’s discussion and analysis of financial condition and results of operations (iv) to reflect recent material events

and (v) update unaudited pro forma financial information.

Pursuant

to Rule 416, this Registration Statement also covers additional securities that may be offered as a result of anti-dilution provisions

regarding stock splits, stock dividends, or similar transactions relating to the shares of common stock issuable upon exchange

of redeemable preferred shares covered by this registration statement.

The

Registrant previously paid a registration fee of $3,369.77 in connection with the filing of the initial registration statement

on Form S-1 (No. 333-239783) filed with the Securities and Exchange Commission on July 9, 2020, to register the 3,294,574 shares

of common stock.

We

hereby amend this registration statement on such date or dates as may be necessary to delay our effective date until we will file

a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance

with Section 8(a) of the Securities Act of 1933 or until this Registration Statement will become effective on such date as the

Securities and Exchange Commission, in accordance with Section 8(a) may determine.

The

information in this prospectus is not complete and may be changed. Akerna Corp. may not sell the securities until the Registration

Statement filed with the Securities and Exchange Commission, of which this prospectus is a part, is effective. This prospectus

is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or

sale is not permitted.

Subject

to Completion: Dated January 7, 2021

PRELIMINARY

PROSPECTUS

AKERNA

CORP.

2,667,349

SHARES OF COMMON STOCK

Akerna Corp. (“Akerna”) will issue from time to

time an aggregate of 2,667,349 our shares of common stock, par value $0.0001, in exchange for 2,667,349 redeemable preferred shares

(the “Exchangeable Shares”) of Akerna Canada Ample Exchange Inc., a company existing under the laws of the Province

of Ontario and a wholly owned subsidiary of Akerna (“Exchangeco”). Exchangeco issued the Exchangeable Shares to shareholders

of Ample Organics Inc., an Ontario corporation (“Ample”), on July 7, 2020. The shareholders of Ample received the Exchangeable

Shares in connection with the arrangement by and between Ample, Exchangeco and Akerna under a plan of arrangement in accordance

with Section 182 of the Business Corporations Act (Ontario). These shareholders of Exchangeco may exchange the exchangeable

shares for shares of our common stock on a one-for-one basis at any time following effectiveness of the registration statement

of which this Prospectus is a part.

We

will not receive any proceeds from the exchange of Exchangeable Shares for shares of our common stock.

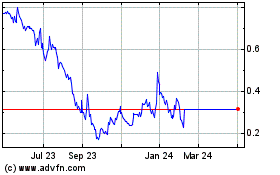

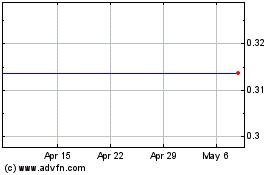

Our common stock trades on the Nasdaq Capital

Market under the symbol “KERN”. On January 7, 2021, the last reported sale price of the common stock on the Nasdaq

Capital Market was $4.93 per share.

Investing

in our common stock involves risks. See “Risk Factors” beginning on page 7.

These

securities have not been approved or disapproved by the SEC or any state securities commission nor has the SEC or any state securities

commission passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

PROSPECTUS

DATED , 2021

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

The

registration statement of which this prospectus forms a part that we have filed with the Securities and Exchange Commission, or

SEC, includes and incorporates by reference exhibits that provide more detail of the matters discussed in this prospectus. You

should read this prospectus and the related exhibits filed with the SEC, together with the additional information described under

the heading “Where You Can Find More Information.”

You

should rely only on the information contained in or incorporated by reference in this prospectus and in any free

writing prospectus prepared by or on behalf of us. We have not authorized anyone to provide you with information different from,

or in addition to, that contained in or incorporated by reference in this prospectus or any related free writing

prospectus. This prospectus is an offer to sell only the securities offered hereby but only under circumstances and in jurisdictions

where it is lawful to do so. The information contained in or incorporated by reference in this prospectus is current

only as of its date. Our business, financial condition, results of operations and prospects may have changed since that date.

We

are not offering to sell or seeking offers to purchase these securities in any jurisdiction where the offer or sale is not permitted.

We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction

where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession

of this prospectus and any free writing prospectus related to this offering in jurisdictions outside the United States are required

to inform themselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and

any such free writing prospectus applicable to that jurisdiction.

Unless

otherwise indicated, any reference to Akerna, or as “we”, “us”, or “our” refers to Akerna

Corp. and its consolidated subsidiaries (“Akerna” or the “Company”).

SUMMARY

The

following highlights certain information contained elsewhere in this prospectus. It does not contain all the details concerning

the Offering, including information that may be important to you. You should carefully review this entire prospectus including

the section entitled “Risk Factors” and the consolidated historical and pro forma financial statements and accompanying

notes contained herein. See “Where You Can Find More Information.”

Summary

of Our Business

We

are a leading provider of enterprise software solutions that enable regulatory compliance and inventory management. Our proprietary

software platforms are adaptable for industries in which interfacing with government regulatory agencies for compliance purposes

is required, or where the tracking of organic materials from seed or plant to end products is desired. Ten years ago, we identified

a need for organic material tracking and regulatory compliance software as a service, or SaaS, solutions in the growing cannabis

and cannabidiol, or CBD, industry. We now seek to create the backbone on which the cannabis industry is built by providing an

integrated ecosystem of applications and services that enable compliance, regulation and taxation. We develop products intended to

help state-licensed businesses operate in compliance with applicable laws and to assist states in monitoring licensed businesses’

compliance with state regulations. We provide commercial software platforms to state and federally licensed businesses and our

regulatory software platform to government regulatory agencies. Our integrated ecosystem provided additional integrations

and add-ons that enhance the capabilities of our commercial software platforms. Although we have helped monitor legal compliance

for more than $20 billion in cannabis sales to date, we do not handle any cannabis-related material, do not process cannabis sales

transactions within the United States, and our revenue generation is not related to the type or amount of sales made by our clients,

as revenues are generated by us on a fixed-fee based subscription model.

Executing

upon the expansion strategy detailed by CEO Jessica Billingsley in 2019, we have acquired competitive brands Ample Organics,

or Ample, on July 7, 2020 and Trellis Solutions, or Trellis, on April 10, 2020. These additions to the Akerna family

of brands add two well-known seed-to-sale software options with reputable experience and significant market share. Ample Organics,

the leading Health Canada approved software for Canadian Licensed Producers, or LPs, has majority market share in Canada,

the only G7 country with federally legal cannabis. Trellis also brings a streamlined solution for Cultivators, Manufacturers,

and Distributors, trusted by some of California’s largest brands.

Through

the Akerna family companies, MJ Freeway, or MJF, Ample, and Trellis, we provide highly-versatile platforms that provide

our clients with a central data management system for tracking regulated products – from seed to initial plant growth to

the product to the final sale of the product to a patient or consumer – representing the complete supply chain, using a

global unique identifier method. Our platforms also provide clients with integrated security, transparency, and scalability capabilities.

These capabilities allow our state-licensed clients to control inventory, operate efficiently in a fast-changing industry and

comply with state, local, and federal (in countries such as Canada, Italy, Macedonia, and Colombia) regulation at all times, and

allows our government regulatory clients to effectively and cost-efficiently monitor licensees and ensure commercial businesses

are complying with their states’ regulations.

We

generate revenue from software sales and by providing consulting services as follows:

|

|

●

|

Commercial

Software Products – MJ Platform® is our SaaS offering for state and legally-licensed businesses.

MJ Platform is an Enterprise Resource Planning, or ERP, compliance system specific to the cannabis industry, including state-legal

marijuana, hemp, and CBD industry. MJ Platform is comprised of integrated modules designed to meet the regulations and

inventory management needs of cannabis and hemp CBD cultivators, manufacturers, distributors, and retailers, but has applications

in other industries.

|

|

|

|

Following

our acquisition of Ample in July 2020, the Ample suite of products includes AmpleOrganics,

a seed-to-sale SaaS cannabis compliance offering for Canadian Licensed Producers; AmplePayments,

a payment processing offering; AmpleCare, an API-first middleware solution

that allows for the submission of both patient registration documents and medical documents

in a secure electronic format to licensed producers using the AmpleOrganics seed-to-sale

platform; and AmpleLearn, an education and training platform designed to educate

and onboard personnel working within a licensed cannabis company.

Trellis’

seed-to-sale SaaS offering features inventory tracking to manage a licensee’s cannabis inventory from

cultivation to extraction and sale. The Trellis product is designed to meet the needs of smaller licensees.

|

|

|

|

|

|

|

●

|

Government

Regulatory Software Products – Leaf Data Systems is our SaaS product for government agencies. Leaf Data Systems is a

compliance tracking system designed to give regulators visibility into the activity of licensed cannabis businesses in their

jurisdictions. We are serving three clients for Leaf Data Systems, the Commonwealth of Pennsylvania, the State of Washington

and the State of Utah. The Commonwealth of Pennsylvania and the State of Utah both require licensed cannabis operators to

also use MJ Platform to report their compliance information. The State of Utah mandates the use of solodTM to provenance

plants and products throughout the compliance supply chain.

|

|

|

|

|

|

|

●

|

Consulting

Services Contracts – We provide consulting services to cannabis industry operators

interested in entering the cannabis industry and in integrating our platforms into their

respective operations and systems. We consult with clients on a wide range of areas to

help them successfully maintain compliance with state law. We work with clients to efficiently

comply with state requirements in connection with the launch and operations of their

cannabis businesses. Our management team and key personnel have broad experience gained

from working with numerous cannabis operations. Our consulting team has experience in

most aspects of cannabis operations in most verticals (e.g., cultivation, processing,

distribution, manufacturing, and retail). Our service providers understand the intricacies

of the varying regulations governing cannabis in each jurisdiction and, to the extent

necessary, modify the professional services based on the jurisdiction.

We

provide project-focused consulting services to clients that are initiating or expanding their cannabis businesses or are

interested in data consulting engagements with respect to the legal cannabis industry. Our advisory engagements include

service offerings focused on compliance requirement assessments, readiness and best practices, compliance monitoring systems,

application processes, inspection readiness, and business plan and compliance reviews. We typically provide our consulting

services to clients in emerging markets that are seeking consultation on newly introduced licensing regimes and assistance

with the regulatory compliant build-out of operations in newly legal states.

|

|

|

|

|

|

|

●

|

Business

Intelligence and Data Analytics Products—Akerna Business Intelligence is an Infrastructure as a Service (IaS) tool which

delivers supply chain analytics for the cannabis, hemp, and CBD industry. Last Call Analytics provides a subscription analytics

tool for alcohol brands to analyze their retail sales analytics.

|

We

also resell a limited number of printers for printing compliance product labels and scales that are National Type Evaluation Program

certified legal for trade. Revenue from these resale activities ranged from 1% to 2% of total revenue in the years ended June

30, 2020, and June 30, 2019. Beginning in our fiscal year 2020, we entered into a revenue-sharing arrangement with a printer supplier,

as a result, we expect our revenue and cost of sales related to this activity to decrease in the future.

Following

our acquisition of solo sciences, inc., or Solo, in January 2020, we sell a cannabis tracking technology that provides our clients

with seed-to-sale-to-self data throughout a product’s lifecycle.

We

drive commercial software revenue growth by leveraging our reputation, as well as benefiting from continued growth in the cannabis,

hemp, and CBD industries. We believe we are well known in these industries and the brand recognition of our existing products,

our ability to provide services in all areas of the seed-to-sale life cycle, and our wealth of relevant experience attracts operating

cultivation, manufacturing, and dispensary clients who are seeking comprehensive services as well as attracting newly formed

clients as they enter into existing markets or newly legalized markets. We also experience revenue growth in states and countries

with an established market by providing a solution to operators seeking to vertically integrate and improve their business processes.

We provide not only a vertically integrated solution across the cannabis, hemp, and CBD supply chain, but also provide a business

intelligence capture, MJ Analytics, which provides operators with timely information about their business to allow them to run

their businesses efficiently. This business intelligence capture is derived from the suite of services we provide and sets

us apart from competitors.

Through

our ecosystem strategy including acquisition, investment, and partnership strategies, we are creating the backbone on which the

cannabis industry is built, enabling compliance, regulation, and taxation. With the Akerna family of companies, we are able

to provide our new and existing clients with full transparency through the tracking of organic matter from seed-to-sale. We believe

our integrated ecosystem creates further value by providing additional integrations and add-ons that enhance the capabilities

and experience of our full client base. For example:

|

|

●

|

our

integration with tier one ERP software providers supplying sophisticated accounting solutions that collect and store business

transactions to satisfy external reporting requirements;

|

|

|

|

|

|

|

●

|

our

integration with over 85 partners to provide full-service solutions at all points in the cannabis business life cycle, including

compliance, hardware, banking, accounting, online ordering, payment solutions, CRM and loyalty, delivery, and business analytics;

|

|

|

|

|

|

|

●

|

our

license with ZolTrain provides our MJ Platform clients with training modules to educate their staff and improve the patient

/consumer experience by pairing education with product information both in person and through digital channels;

|

|

|

|

|

|

|

●

|

our

Leaf Data Systems track-and-trace solution specifically customized for the State of Utah to include an electronic verification

system and inventory control system, implements solo*TAGTM, the world’s first cryptographically-secure, cannabis

product authentication system, exclusively for governments as an alternative to radio-frequency identification, or RFID, tracking;

and

|

|

|

|

|

|

|

●

|

MJ

Analytics, a next-generation analytics platform that offers Enterprise-level data tools and provides users with what we believe

to be unparalleled access and insight into the cannabis supply chain, from seed to sale.

|

We

use our years of experience, proprietary databases, and resources to identify trends and predict changes in the cannabis industry

in order to evolve our products and better assist our clients in operating in compliance with the applicable laws of their jurisdictions

and capitalizing on commercial opportunities within the applicable regulatory framework, with accuracy, efficiency, and geographic

specificity. Following our July 2020 acquisition of Ample Organics, we have four data products: The MJ Analytics, or MJA; and Akerna Acumen

Business Insights, which both leverage the extensive data captured in each of MJ Platform’s cultivation, E&I, distribution,

and retail modules; AmpleData, which leverages data obtained through Canadian regulated retail channels; and Last Call Analytics,

which provides retail sales analytics for alcohol brands. MJA gives MJ Platform clients access to aggregated data across their

organization to keep track of emerging legal and commercial trends, allowing for informed actionable insights at various levels

within the organization, including room, location, state, brand, and administration. MJ Platform allows users to align their operational

data from three vantage points: in real-time, past trends, and predictive future. These proprietary databases assist users in

making important decisions in real-time with respect to product monitoring, tracking, planning, and pricing.

Our principal executive offices are located at 1550 Larimer

Street #246, Denver, Colorado 80202, and our telephone number is (888) 932-6537 and our Internet website address is www.akerna.com.

The information on our website is not a part of, or incorporated in, this prospectus.

The

Arrangement

On

December 18, 2019, we entered into an arrangement agreement, as amended by the Amendment to Arrangement Agreement, dated

February 28, 2020 (“Amendment to Arrangement Agreement”), Amendment No. 2 to Arrangement Agreement dated May 26, 2020

(“Amendment No. 2 to Arrangement Agreement), and Amendment No. 3 to Arrangement Agreement dated June 1, 2020 (“Amendment

No. 3 to Arrangement Agreement”) (the “Arrangement Agreement”), among us, Exchangeco and Ample, pursuant to

which we through Exchangeco agreed to acquire all of the issued and outstanding equity of Ample (the “Arrangement”).

On

July 7, 2020, the Arrangement was consummated by way of a court-approved plan of arrangement under Ontario law (the “Plan

of Arrangement”) and Ample became our indirect wholly-owned subsidiary.

Pursuant

to the Arrangement Agreement and the Plan of Arrangement, on the closing date, holders of Ample common shares (the “Ample

Shares”) received a number of Exchangeable Shares equal to the number of Ample Shares multiplied by the exchange ratio of

0.0524 (the “Exchange Ratio”). In the aggregate, Ample shareholders received 3,294,574 Exchangeable Shares. The Exchange

Ratio was agreed to on December 18, 2019, and was not adjusted for any subsequent changes in market price of our common stock,

par value $0.0001 per share (the “Akerna Shares”) or the Ample Shares prior to the closing date.

Ample’s

shareholders adopted and approved the Arrangement Agreement and the Plan of Arrangement on June 26, 2020. Akerna’s shareholders

approved the issuance of the Akerna Shares (including the Akerna shares issuable upon exchange of the Exchangeable Shares and

shares issuable pursuant to the CVRs) in connection with the Arrangement on June 26, 2020. The Ontario Superior Court of Justice

issued a final order approving the Plan of Arrangement on June 30, 2020.

The

Exchangeable Shares were issued as part of the Arrangement pursuant to Section 3(a)(10) of the Securities Act, based on the final

order of the Ontario Superior Court of Justice.

Exchangeable

Shares

The

Exchangeable Shares are exchangeable for shares of common stock, par value $0.0001 per share, of Akerna on a 1:1 basis, as determined

in accordance with the Arrangement Agreement. The Exchangeable Shares are intended to be substantially economically equivalent

to shares of common stock of Akerna. The rights, privileges, restrictions and conditions attaching to the Exchangeable Shares

and the related special voting stock are described herein under the headings “The Exchangeable Shares” and “Description

of Company Capital Stock—Special Voting Stock” respectively, and in the terms of our plan of arrangement with Ample,

which is included in the Arrangement Agreement filed as an exhibit to the registration statement of which this Prospectus forms

a part.

Of the 3,294,574 Exchangeable Shares that were issued to former

Ample shareholders in connection with the consummation of the Arrangement, an aggregate of 658,915 Exchangeable Shares were issued

as “Closing Consideration” and an aggregate of 2,635,659 Exchangeable Shares, constituting part of the “Escrowed

Consideration” were issued into escrow pursuant to an escrow agreement (the “Escrow Agreement”), entered into

on July 7, 2020 by and among the Company, Purchaser, John Prentice, as Shareholder Representative, and Odyssey Trust Company. Under

the Escrow Agreement, subject to unresolved claims, if any, by the Company under the Arrangement Agreement in respect of fraud,

the Escrowed Consideration shall be released to former Ample shareholders upon the six-, nine-, and twelve-month anniversaries

of the Closing Date in accordance with the following schedule -- 988,372 shares on the six-month anniversary, 823,643 shares on

the nine-month anniversary, and 823,644 shares on the twelve-month anniversary. As of the date hereof, 627,225 shares of common

stock of Akerna have been issued on conversion of Exchangeable Shares.

The

Offering

|

Common

stock offered herein:

|

|

2,667,349

shares of common stock of Akerna, par value $0.0001, in exchange for the 2,667,349 Exchangeable Shares upon exchange by the holders

thereof pursuant to their terms

|

|

|

|

|

|

Common

stock outstanding (1):

|

|

20,128,995 shares of common stock

|

|

|

|

|

|

Common

stock outstanding after the offering (1):

|

|

22,796,344 shares of common Stock

|

|

|

|

|

|

Use

of Proceeds:

|

|

We

will not receive any proceeds from the issuance of shares of our common stock upon the exchange of Exchangeable Shares.

|

|

|

|

|

|

Listing

of Common Stock:

|

|

Our

common Stock is listed on the Nasdaq Capital Market under the symbol “KERN”.

|

|

|

|

|

|

Dividend

policy:

|

|

We

currently intend to retain any future earnings to fund the development and growth of our business. Therefore, we do not currently

anticipate paying cash dividends on our common stock.

|

|

|

|

|

|

Risk

Factors:

|

|

An

investment in our company is highly speculative and involves a significant degree of risk. See “Risk Factors”

on page 7 of this Prospectus and other information included in this Prospectus for a discussion of factors you should carefully

consider before deciding to invest in shares of our common stock.

|

|

|

(1)

|

The number of shares of common stock shown above to be outstanding

before and after this offering is based on the 20,128,995 shares outstanding as of January 7, 2021. The number of shares of common

stock outstanding after this offering assumes that all the Exchangeable Shares are exchanged for shares of common stock. The number

of shares of common stock outstanding excludes 8,182,596 shares of common stock reserved for issuance upon conversion of our outstanding

senior secured convertible notes, 5,874,439 shares of our common stock issuable upon exercise of our outstanding warrants, 824,143

shares of common stock underlying restricted stock units that are issued and outstanding but remain subject to vesting conditions

and 590,615 shares available for issuance upon grant of awards under our 2019 long term equity incentive plan.

|

Selected

Financial Data

The

selected financial information presented below as of and for the periods indicated is derived from our financial statements contained

elsewhere in this Prospectus and should be read in conjunction with those financial statements.

|

Statement of Operations Data

|

|

Year Ended

June 30,

2020

|

|

|

Year Ended

June 30,

2019

|

|

|

Three Months Ended

September 30,

2020

(Unaudited)

|

|

|

Three Months Ended

September 30,

2019

(Unaudited)

|

|

|

Total revenues

|

|

$

|

12,573,276

|

|

|

$

|

10,823,117

|

|

|

$

|

3,714,442

|

|

|

$

|

3,192,890

|

|

|

Cost of revenues

|

|

$

|

6,209,724

|

|

|

$

|

4,633,844

|

|

|

$

|

1,739,937

|

|

|

$

|

1,379,701

|

|

|

Gross profit

|

|

$

|

6,363,522

|

|

|

$

|

6,189,273

|

|

|

$

|

1,974,067

|

|

|

$

|

1,813,189

|

|

|

Total operating expenses

|

|

$

|

23,635,403

|

|

|

$

|

18,701,619

|

|

|

$

|

7,497,537

|

|

|

$

|

4,212,616

|

|

|

Loss from operations

|

|

$

|

(17,271,851

|

)

|

|

$

|

(12,512,346

|

)

|

|

$

|

(5,523,470

|

)

|

|

$

|

(2,399,427

|

)

|

|

Net loss

|

|

$

|

(16,384,104

|

)

|

|

$

|

(12,403,215

|

)

|

|

$

|

(4,750,691

|

)

|

|

$

|

(2,326,332

|

)

|

|

Basic and diluted net loss per common share

|

|

$

|

(1.31

|

)

|

|

$

|

(2.05

|

)

|

|

$

|

(0.34

|

)

|

|

$

|

(0.21

|

)

|

|

Basic and diluted weighted average common stock outstanding

|

|

|

11,860,212

|

|

|

|

6,045,382

|

|

|

|

14,058,412

|

|

|

|

10,879,112

|

|

|

Balance Sheet Data

|

|

At

June 30,

2020

|

|

|

At

June 30,

2019

|

|

|

At

September 30,

2020

(Unaudited)

|

|

|

Total current assets

|

|

$

|

27,732,703

|

|

|

$

|

24,202,237

|

|

|

$

|

19,032,696

|

|

|

Total assets

|

|

$

|

58,529,619

|

|

|

$

|

24,202,237

|

|

|

$

|

81,334,782

|

|

|

Total current liabilities

|

|

$

|

11,754,977

|

|

|

$

|

2,442,503

|

|

|

$

|

18,131,627

|

|

|

Total liabilities

|

|

$

|

21,955,213

|

|

|

$

|

2,442,503

|

|

|

$

|

23,613,226

|

|

|

Accumulated deficit

|

|

$

|

(41,101,091

|

)

|

|

$

|

(25,566,746

|

)

|

|

$

|

(45,842,967

|

)

|

|

Total stockholders’ equity

|

|

$

|

31,870,154

|

|

|

$

|

21,759,734

|

|

|

$

|

57,721,556

|

|

Selected

Unaudited Pro Forma Condensed Combined Financial Data

The selected unaudited pro forma condensed combined financial

data presented below for the periods indicated is derived from the unaudited pro forma condensed combined statements of operations

for the year ended June 30, 2020 contained elsewhere in this prospectus and should be read in conjunction with such financial

information and accompanying notes and are based on the historical financial statements of Akerna, solo sciences inc. (“Solo”),

and Ample Organic Inc. (“Ample”), giving effect to the acquisition of Solo, the exercise of the Solo Option, the acquisition

of Ample. The Company’s statement of operations for the three months ended September 30, 2020 contains the combined operations of the

Company, Solo and Ample for that period. While Ample wasn’t acquired until July 7, 2020, the impact of the seven (7) days

at the beginning of the period was determined to be immaterial by the Company and therefore separate pro forma condensed combined

financial data for that period is not presented herein.

|

Statement of Operations Data

|

|

Pro forma

Combined for the

Year Ended

June 30,

2020

(Unaudited)

|

|

|

Total net revenue

|

|

$

|

18,314,055

|

|

|

Cost of revenue

|

|

$

|

8,691,649

|

|

|

Gross profit

|

|

$

|

9,622,406

|

|

|

Total operating expenses

|

|

$

|

33,652,676

|

|

|

Loss from operations

|

|

$

|

(24,030,270

|

)

|

|

Net loss

|

|

$

|

(23,124,605

|

)

|

|

Basic and diluted net loss per common share

|

|

$

|

(1.69

|

)

|

|

Basic and diluted shares used in computing loss per share

|

|

|

13,720,458

|

|

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. You should carefully consider the risks described below,

together with all of the other information included in this prospectus, before making an investment decision with regard to our

securities. The statements contained in this prospectus that are not historic facts are forward-looking statements that are subject

to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking

statements. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer.

In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

You

should carefully consider the following risk factors in evaluating our business and us. The factors listed below and in the prospectus,

represent certain important factors that we believe could cause our business results to differ. These factors are not intended

to represent a complete list of the general or specific risks that may affect us. It should be recognized that other risks may

be significant, presently or in the future, and the risks set forth below may affect us to a greater extent than indicated. If

any of the following risks occur, our business, financial condition or results of operations could be materially and adversely

affected.

Risks

Relating to Us

We

have a history of losses, expect to continue to incur losses in the near term and may not achieve or sustain profitability in

the future.

We

have incurred significant losses in each fiscal year since our inception in 2010. We have experienced net losses of approximately

$16.4 million and $12.4 million for the years ended June 30, 2020 and June 30, 2019, respectively,

and approximately $4.7 million for the period ended September 30, 2020. These losses have been due to the substantial investments

we have made to develop our monitoring and compliance platforms and related software, marketing these products to government regulatory

agencies and commercial businesses, and growing our infrastructure to support the increased business. We expect to continue to

invest in the further development of our platforms, software, and related product offerings and to grow both our government regulatory

and commercial business client base. As a result, we expect our operating expenses to increase in the future due to expected increased

sales and marketing expenses, operational costs, product development costs, and general and administrative costs and, therefore,

our operating losses will continue or even increase at least through the near term. In addition, because we are now a public company,

we will incur significant legal, accounting, and other expenses that MJF did not incur as a non-public company. Furthermore, to

the extent that we are successful in increasing our client base, we will also incur increased expenses because costs associated

with generating and supporting client agreements are generally incurred upfront, while revenue is generally recognized ratably

over the term of the agreement. You should not rely upon our recent revenue growth as indicative of future performance. We may

not reach profitability in the near future or at any specific time in the future. If and when our operations do become profitable,

we may not sustain profitability.

We

have a relatively short operating history, which makes it difficult to evaluate our business and future prospects.

We

have a relatively short operating history, which makes it difficult to evaluate our business and future prospects. Our wholly-owned

subsidiary, MJF, has been in existence since 2010, and much of our revenue growth has occurred during the past three years. We

have encountered, and will continue to encounter, risks and difficulties frequently experienced by growing companies in rapidly

changing industries, including those related to:

|

|

●

|

market

acceptance of our current and future products and services;

|

|

|

|

|

|

|

●

|

changing

regulatory environments and costs associated with compliance;

|

|

|

●

|

our

ability to compete with other companies offering similar products and services;

|

|

|

|

|

|

|

●

|

our

ability to effectively market our products and services and attract new clients;

|

|

|

|

|

|

|

●

|

existing

client retention rates and the ability to upsell clients;

|

|

|

●

|

the

amount and timing of operating expenses, particularly sales and marketing expenses, related to the maintenance and expansion

of our business, operations, and infrastructure;

|

|

|

|

|

|

|

●

|

our

ability to control costs, including operating expenses;

|

|

|

|

|

|

|

●

|

our

ability to manage organic growth and growth fueled by acquisitions;

|

|

|

|

|

|

|

●

|

public

perception and acceptance of cannabis-related products and services generally; and

|

|

|

|

|

|

|

●

|

general

economic conditions and events.

|

If

we do not manage these risks successfully, our business and financial performance will be adversely affected.

Our

long-term results of operations are difficult to predict and depend on the commercial success of our clients, the continued growth

of the cannabis industry generally, and the regulatory environment within which the cannabis industry operates.

Our

offers of products and services globally to help government regulatory agencies and commercial businesses monitor regulatory compliance

and operate efficiently and successfully in compliance with applicable state laws. Our long-term results will directly depend

on the continued growth of the legalized cannabis industry (and public acceptance of cannabis-related products) and the ability

of our current and future clients to successfully market their own products and services. If the legalized cannabis marketplace

does not continue to grow because the public does not increasingly accept cannabis-related products or government regulators adopt

laws, rules, or regulations that terminate or diminish the ability for commercial businesses to develop, market, and sell cannabis-related

products, our business and financial performance would be materially adversely affected. Additionally, even if the cannabis marketplace

continues to grow rapidly, and government regulation allows for the free-market development of this industry, products, and services

competitive with those offered by us may enjoy better market acceptance.

The

legalized cannabis industry may not continue to grow, and the regulatory environment may not remain favorable to participants

in the industry. More generally, our products and services may not experience growing market acceptance, which would adversely

impact our ability to grow revenue.

As

a company whose clients operate in the cannabis industry, we face many unique and evolving risks.

We

currently serve government and private clients with respect to their tracking, monitoring, and compliance needs as they operate

in the growing cannabis industry. Any risks related to the cannabis industry that may adversely affect our clients and potential

clients may, in turn, adversely affect demand for our products. Specific risks faced by companies operating in the cannabis industry

include, but are not limited to, the following:

Marijuana

remains illegal under United States federal law

Marijuana

is a Schedule-I controlled substance under the Controlled Substances Act, or CSA, and is illegal under federal law. It remains

illegal under United States federal law to grow, cultivate, sell or possess marijuana for any purpose or to assist or conspire

with those who do so. Additionally, 21 U.S.C. 856 makes it illegal to “knowingly open, lease, rent, use, or maintain any

place, whether permanently or temporarily, for the purpose of manufacturing, distributing, or using any controlled substance.”

Even in those states in which the use of marijuana has been authorized, its use remains a violation of federal law. Since federal

law criminalizing the use of marijuana is not preempted by state laws that legalize its use, strict enforcement of federal

law regarding marijuana would likely result in our clients’ inability to proceed with their operations, which would adversely

affect demands for our products.

Uncertainty

of federal enforcement

On

January 4, 2018, Attorney General Sessions rescinded the previously issued memoranda (known as the Cole Memorandum) from the U.S.

Department of Justice (“DOJ”) that had de-prioritized the enforcement of federal law against marijuana users and businesses

that comply with state marijuana laws, adding uncertainty to the question of how the federal government will choose to enforce

federal laws regarding marijuana. Attorney General Sessions issued a memorandum to all United States Attorneys in which the DOJ

affirmatively rescinded the previous guidance as to marijuana enforcement, calling such guidance “unnecessary.” This

one-page memorandum was vague in nature, stating that federal prosecutors should use established principles in setting their law

enforcement priorities. Under previous administrations, the DOJ indicated that those users and suppliers of medical marijuana

who complied with state laws, which required compliance with certain criteria, would not be prosecuted. On November 7, 2018,

Jeff Sessions resigned from his position as Attorney General. The current Attorney General, William Barr, has not indicated any

change in enforcement priority for state-compliant marijuana businesses, however, substantial uncertainty regarding federal enforcement

remains. Regardless, the federal government has always reserved the right to enforce federal law regarding the sale and disbursement

of medical or recreational marijuana, even if state law sanctioned such sale and disbursement. Although the rescission of the

Cole Memorandum does not necessarily indicate that marijuana industry prosecutions are now affirmatively a priority for the DOJ,

there can be no assurance that the federal government will not enforce such laws in the future. As a result, it is now unclear

if the DOJ will seek to enforce the CSA against those users and suppliers who comply with state marijuana laws.

In

2014, Congress passed a spending bill, or the 2015 Appropriations Bill, containing a provision , or the Appropriations Rider,

blocking federal funds and resources allocated under the 2015 Appropriations Bill from being used to “prevent such States

from implementing their own State medical marijuana law.” The Appropriations Rider provided a budgetary constraint on the

federal government from interfering with the ability of states to administer their medical marijuana laws, although it did not

codify federal protections for medical marijuana patients and producers. Moreover, despite the Appropriations Rider, the DOJ maintains

that it can still prosecute violations of the federal marijuana ban and continue cases already in the courts. However, the Ninth

Circuit Court of Appeals and other courts have interpreted the language to mean that the DOL cannot prosecute medical marijuana

operators complying strictly with state medical marijuana laws. Additionally, the Appropriations Rider must be re-enacted

every year. The Appropriations Rider was renewed on December 20, 2019 through the signing of the fiscal year 2020 omnibus spending

bill, effective through September 30, 2020, continued re-authorization of the Appropriations Rider cannot be guaranteed. If Congress

should pass a 2021 budget rather than an extension of the 2020 budget, it would need to renew the Appropriations Rider at such

time, and there can be no assurance that the Appropriations Rider would be renewed at such time. Additionally, in the event of

Congress failing either to pass a 2021 budget or an extension of the 2020 budget in the form of a “continuing resolution,”

a government shutdown would result, and the Appropriations Rider would no longer be in force. If the Appropriation Rider is no

longer in effect, the risk of federal enforcement and override of state medical marijuana laws would increase.

Despite

Attorney General Sessions’ rescission of the Cole Memorandum, the Department of the Treasury, Financial Crimes Enforcement

Network, has not rescinded the “FinCEN Memo” dated February 14, 2014, which de-prioritizes enforcement of the Bank

Secrecy Act against financial institutions and marijuana-related businesses which utilize them. This memo appears to be a standalone

document and is presumptively still in effect. At any time, however, the Department of the Treasury, Financial Crimes Enforcement

Network, could elect to rescind the FinCEN Memo. This would make it more difficult for us and our clients and potential clients

to access the U.S. banking systems and conduct financial transactions, which would adversely affect our operations.

We

could become subject to racketeering laws

While

we do not grow, handle, process or sell cannabis or cannabis-derived products, our receipt of funds from clients that do conduct

such operations in violation of federal law exposes us to risks related to federal racketeering laws. The Racketeer Influenced

Corrupt Organizations Act (“RICO”) is a federal statute providing criminal penalties in addition to a civil cause

of action for acts performed as part of an ongoing criminal organization. Under RICO, it is unlawful for any person who has received

income derived from a pattern of racketeering activity (which includes most felonious violations of the CSA), to use or invest

any of that income in the acquisition of any interest, or the establishment or operation of, any enterprise which is engaged in

interstate commerce. RICO also authorizes private parties whose properties or businesses are harmed by such patterns of racketeering

activity to initiate a civil action against the individuals involved. Although RICO suits against the cannabis industry are rare,

a few cannabis businesses have been subject to a civil RICO action. Any violation of RICO could result in significant fines, penalties,

administrative sanctions, convictions or settlements arising from civil proceedings conducted by either the federal government

or private citizens or criminal charges, including but not limited to, seizure of assets, disgorgement of profits, cessation of

our business activities or divestiture.

Banking

regulations could limit access to banking services and expose us to risk

Our

receipt of payments from clients engaged in state-legal cannabis operations could also subject us to the consequences of a variety

of federal laws and regulations that involve money laundering, financial record keeping and proceeds of crime, including the Bank

Secrecy Act, as amended by Title III of the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept

and Obstruct Terrorism Act of 2001 (USA PATRIOT Act) and any related or similar rules, regulations or guidelines, issued, administered

or enforced by the federal government. Since we obtain fund in connection with activities that are illegal under the CSA, banks

and other financial institutions providing services to us risk violation of federal anti money laundering statutes (18 U.S.C.

§§ 1956 and 1957), the unlicensed money-remitter statute (18 U.S.C. § 1960) and the Bank Secrecy Act, among other

applicable federal statutes. Banks often refuse to provide banking services to businesses involved in the cannabis industry due

to the present state of federal laws and regulations governing financial institutions. The inability to open bank accounts may

make it difficult for us or our clients to operate and our client’s reliance on cash can result in a heightened risk of

theft, which could harm their businesses and, in turn, harm our business. Additionally, some courts have denied marijuana-related

businesses bankruptcy protection, thus, making it very difficult for lenders to recoup their investments, which may limit the

willingness of banks to lend to our clients and to us. The lack of banking and financial services presents unique and significant

challenges to businesses in the cannabis industry and we may experience similar difficulties in obtaining and maintaining regular

banking and financial services because of the activities of our clients.

Dividends

and distributions could be prevented if our receipt of payments from clients is deemed to be proceeds of crime

In

the event that any of our operations, or any proceeds thereof, any dividends or distributions therefrom, or any profits or revenues

accruing from such operations were found to be in violation of money laundering legislation or otherwise, such transactions may

be viewed as proceeds of crime under one or more federal statutes or any other applicable legislation. This could restrict or

otherwise jeopardize our ability to declare or pay dividends or effect other distributions. Furthermore, while we have no current

intention to declare or pay dividends in the foreseeable future, in the event that a determination was made that our proceeds

from operations (or any future operations) could reasonably be shown to constitute proceeds of crime, we may decide or be required

to suspend declaring or paying dividends without advance notice and for an indefinite period of time.

Further

legislative development beneficial to our operations is not guaranteed

Among

other things, our business involves the provision of an online platform that provides monitoring and tracking of those involved

in the cultivation, distribution, manufacture, storage, transportation, and/or sale of medical and adult-use cannabis products

in compliance with applicable state law. The success of our business depends on the continued development of the cannabis industry

and the activity of commercial business and government regulatory agencies within the industry. The continued development of the

cannabis industry is dependent upon continued legislative and regulatory authorization of cannabis at the state level and a continued

laissez-faire approach by federal enforcement agencies. Any number of factors could slow or halt progress in this area. Further

regulatory progress beneficial to the industry cannot be assured. While there may be ample public support for legislative action,

numerous factors impact the legislative and regulatory process, including election results, scientific findings or general public

events. Any one of these factors could slow or halt progressive legislation relating to cannabis and the current tolerance for

the use of cannabis by consumers, which could adversely affect the demand for our product and operations.

The

cannabis industry could face strong opposition from other industries

We

believe that established businesses in other industries may have a strong economic interest in opposing the development of the

cannabis industry. Cannabis may be seen by companies in other industries as an attractive alternative to their products, including

recreational marijuana as an alternative to alcohol, and medical marijuana as an alternative to various commercial pharmaceuticals.

Many industries that could view the emerging cannabis industry as an economic threat are well established, with vast economic

and federal and state lobbying resources. It is possible that companies within these industries could use their resources to attempt

to slow or reverse legislation legalizing cannabis. Any inroads these companies make in halting or impeding legislative initiatives

that would be beneficial to the cannabis industry could have a detrimental impact on our clients and, in turn on our operations.

The

legality of marijuana could be reversed in one or more states

The

voters or legislatures of states in which marijuana has already been legalized could potentially repeal applicable laws that permit

the operation of both medical and retail marijuana businesses. These actions might force businesses, including those that are

our clients, to cease operations in one or more states entirely.

Changing

legislation and evolving interpretations of the law

Laws

and regulations affecting the medical and adult-use marijuana industry are constantly changing, which could detrimentally affect

our clients and, in turn, our operations. Local, state, and federal marijuana laws and regulations are broad in scope and subject

to evolving interpretations, which could require our clients and thus us to incur substantial costs associated with modification

of operations to ensure such clients’ compliance. In addition, violations of these laws, or allegations of such violations,

could disrupt our clients’ business and result in a material adverse effect on our operations. In addition, it is possible

that regulations may be enacted in the future that will limit the amount of cannabis growth or related products that our commercial

clients are authorized to produce. We cannot predict the nature of any future laws, regulations, interpretations, or applications,

nor can we determine what effect additional governmental regulations or administrative policies and procedures, when and if promulgated,

could have on our operations.

Dependence

on client licensing

Our

business is dependent on our clients obtaining various licenses from various municipalities and state licensing agencies. There

can be no assurance that any or all licenses necessary for our clients to operate their businesses will be obtained, retained

or renewed. If a licensing body were to determine that a client of ours had violated applicable rules and regulations, there is

a risk the license granted to that client could be revoked, which could adversely affect our operations. There can be no assurance

that our existing clients will be able to retain their licenses going forward, or that new licenses will be granted to existing

and new market entrants.

Insurance

risks

In

the United States, many marijuana-related businesses are subject to a lack of adequate insurance coverage. In addition, many insurance

companies may deny claims for any loss relating to marijuana or marijuana-related operations based on their illegality under federal

law, noting that a contract for an illegal transaction is unenforceable.

The

cannabis industry is an evolving industry and we must anticipate and respond to changes.

The

cannabis industry is not yet well-developed, and many aspects of this industry’s development and evolution cannot be accurately

predicted. While we have attempted to identify any risks specific to the cannabis industry, you should carefully consider that

there are other risks that cannot be foreseen or are not described in this Annual Report, which could materially and adversely

affect our business and financial performance. We expect that the cannabis market and our business will evolve in ways that are

difficult to predict. For example, it is anticipated that over time, we will reach a point in most markets where we have achieved

a market penetration level in which new client acquisitions are less productive, and the continued growth of our revenue will

require more focus on increasing the rate at which existing clients purchase products and services across our platforms. Our long-term

success will depend on our ability to successfully adjust our strategy to meet the changing market dynamics. If we are unable

to successfully adapt to changes in the cannabis industry, our operations could be adversely affected.

A

significant portion of our business is and is expected to be, from government contracts, which present certain unique risks.

Contracts

for the Leaf Data Systems with government agencies in Pennsylvania, Washington, and Utah represented 39% of our revenue for the

fiscal year ended June 30, 2020. In order to obtain a government contract for the Leaf Data Systems, we are required to follow

a competitive bidding process in each state where we seek a contract. Government contracts have very specific compliance requirements

that often require contractors to invest material time and money to prepare a bid to ensure that our technology, processes, and

staff meet these specific requirements. After expenditures of such time and money, there is no assurance that the bid will result

in an award of a contract. Further, even if a contract is awarded, there are strict procedures that government agencies follow

when it comes to reimbursement of the costs incurred in the course of fulfilling contracts. Accordingly, it is possible that some

or all costs might not be reimbursed under a government contract as contemplated by us.

Government

agencies also typically audit and investigate government contractors. These agencies review a contractor’s performance under

its contracts, its cost structure, its business systems, and compliance with applicable laws, regulations, and standards. If an

audit or investigation uncovers improper or illegal activities, we may be subject to civil or criminal penalties and administrative

sanctions, including reductions of the value of contracts, contract modifications or terminations, forfeiture of profits, suspension

of payments, penalties, fines, and suspension, or prohibition from doing business with the government. In addition, we could suffer

serious reputational harm if allegations of impropriety were made against us. Any such imposition of penalties, or the loss of

such government contracts, could materially adversely affect our business, financial condition, results of operations, and growth

prospects.

There

also is typically a longer window of liability under government contracts than private contracts, and the government can seek

claims after the contract has ended and payments under the contract have been made. The terms of government contracts may also

require the sharing of proprietary information, processes, software, and research and development efforts with the government.

Additionally, government employees are required to follow certain protocols to ensure there is no appearance of impropriety in

the bidding process. As a result, bidders on government contracts must ensure that there is no appearance of favoritism, gift-giving,

bribery, or the exertion of other influences in the bidding process. Any finding of the same can result in fines to the bidder

and cancellation of contracts. The applicable state government generally has the ability to terminate our contract, in whole or

in part, without prior notice, for convenience or for default based on performance. If a government contract were to be terminated

for convenience, we generally would be protected by provisions covering reimbursement for costs incurred on the contract and profit

on those costs, but not the anticipated profit that would have been earned had the contract been completed. The state government

also has the ability to stop work under a contract for a limited period of time for its convenience.

We

cannot assure you that we will be successful in navigating the government contract bidding process or that we will be able to

maintain our existing government contracts or obtain additional government contracts in the future.

Our

operations may be adversely affected by disruptions to our information technology, or IT, systems, including disruptions from

cybersecurity breaches of our IT infrastructure.

We

rely on information technology networks and systems, including those of third-party service providers, to process, transmit, and

store electronic information. In particular, we depend on our information technology infrastructure for a variety of functions,

including financial reporting, data management, project development, and email communications. Any of these systems may be susceptible

to outages due to fire, floods, power loss, telecommunications failures, terrorist attacks, sabotage, and similar events. Global

cybersecurity threats and incidents can range from uncoordinated individual attempts to gain unauthorized access to our information

technology systems to sophisticated and targeted measures known as advanced persistent threats. The ever-increasing use and evolution

of technology, including cloud-based computing, create opportunities for the unintentional dissemination or intentional destruction

of confidential information stored in our systems or in non-encrypted portable media or storage devices. We could also experience

a business interruption, information theft of confidential information, or reputational damage from industrial espionage attacks,

malware, or other cyber-attacks, which may compromise our system infrastructure or lead to data leakage, either internally or

at our third-party providers. Despite the implementation of network security measures and disaster recovery plans, our systems

and those of third parties on which we rely may also be vulnerable to computer viruses, break-ins, and similar disruptions. If

we or our vendors are unable (or are perceived as unable) to prevent such outages and breaches, our operations may be disrupted,

and our business reputation could be adversely affected.

We

expect that risks and exposures related to cybersecurity attacks will remain high for the foreseeable future due to the rapidly

evolving nature and sophistication of these threats.

Privacy

regulation is an evolving area and compliance with applicable privacy regulations may increase our operating costs or adversely

impact our ability to service our clients and market our products and services.

Because

we store, processes, and use data, some of which contains personal information, we are subject to complex and evolving federal,

state, and foreign laws and regulations (including Canada’s Cannabis Act and related regulations and the European Union’s

general data protection regulation, or GDPR) regarding privacy, data protection, and other matters. While we believe we are currently

in compliance with applicable laws and regulations, many of these laws and regulations are subject to change and uncertain interpretation,

and could result in investigations, claims, changes to our business practices, increased cost of operations, and declines in user

growth, retention, or engagement, any of which could seriously harm our business.

We

rely on third parties for certain services made available to users of our platforms, which could limit our control over the quality

of the user experience and our cost of providing services.

Some

of the applications and services available through the Leaf Data System and MJ Platform are provided through relationships with

third-party service providers. We do not typically have any direct control over these third-party service providers. These third-party

service providers could experience service outages, data loss, privacy breaches, including cyber-attacks, and other events relating

to the applications and services they provide that could diminish the utility of these services and which could harm users thereof.

The MJ Platform itself does not depend on any third-party software or applications and is based entirely on open source technologies

and custom programming. The MJ Platform, however, is hosted by Amazon Web Services, a third-party service provider. There are

readily available alternative hosting services available should we desire or need to move to a different web host. Certain ancillary

services provided by us also uses the services of third-party providers, for which, we believe, there are readily available alternatives

on comparable economic terms. Offering integrated platforms, such as the Leaf Data System and MJ Platform which rely, in part,

on the services of other providers lessens the control that we have over the total client experience. Should the third-party service

providers we rely upon not deliver at standards we expect and desires, acceptance of our platforms could suffer, which would have

an adverse effect on our business and financial performance. Further, we cannot be assured of entering into agreements with such

third-party service providers on economically favorable terms.

Acquisitions

and integration issues may expose us to risks.

Our

business strategy includes making targeted acquisitions. Any acquisition that we make may be of significant size, may change the

scale of our business and operations, and may expose us to new geographic, political, operating, financial, and geological risks.

Our success in our acquisition activities depends on our ability to identify suitable acquisition candidates, negotiate acceptable

terms for any such acquisition, and integrate the acquired operations successfully with our own. Any acquisitions would be accompanied

by risks. For example, there may be significant changes in our market value after we have committed to complete the transaction

and have established the purchase price or exchange ratio; a potential targeted acquisition’s business and prospects may

prove to be below expectations; we may have difficulty integrating and assimilating the operations and personnel of any acquired

companies, realizing anticipated synergies and maximizing the financial and strategic position of the combined enterprise and

maintaining uniform standards, policies, and controls across the organization; the integration of the acquired business or assets

may disrupt our ongoing business and our relationships with employees, clients, suppliers, and contractors; and the acquired business

or assets may have unknown liabilities that may be significant. If we choose to use equity securities as consideration for such

an acquisition, existing shareholders may suffer dilution. Alternatively, we may choose to finance any such acquisition with our

existing resources. There can be no assurance that we would be successful in overcoming these risks or any other problems encountered

in connection with such acquisitions. To grow and be successful, we need to attract and retain qualified personnel.

We

recently acquired three separate operating companies: Solo, Trellis Solutions Inc., an Ontario corporation (“Trellis”),

and Ample. We may not be able to successfully integrate all three of these businesses into our operations, including assimilating

the operations and personnel of each of these companies. If we do not successfully integrate these businesses we may not maximize

the anticipated benefits of these acquisitions and efforts to complete such integration may have an adverse impact on our results

of operations by distracting management and other key personnel, increasing costs of operations, or exposing us to additional

liabilities.

In

any future acquisitions, we may not be able to successfully integrate acquired personnel, operations, and technologies, or effectively

manage the combined business following the acquisition. We also may not achieve the anticipated benefits from future acquisitions

due to a number of factors, including: (a) an inability to integrate or benefit from acquisitions in a profitable manner;

(b) unanticipated costs or liabilities associated with the acquisition; (c) the incurrence of acquisition-related costs;

(d) the diversion of management’s attention from other business concerns; (e) the loss of our or the acquired

business’ key employees; or (f) the issuance of dilutive equity securities, the incurrence of debt, or the use of cash

to fund such acquisitions.

To

grow and be successful, we need to attract and retain qualified personnel.

Our

growth and success will depend to a significant extent on our ability to identify, attract, hire, train, and retain qualified

professional, creative, technical, and managerial personnel. Competition for experienced and qualified talent in the cannabis

industry can be intense. We may not be successful in identifying, attracting, hiring, training, and retaining such personnel in

the future. If we are unable to hire, assimilate, and retain qualified personnel in the future, such inability could adversely

affect our operations.

We

are smaller and less diversified than many of our potential competitors.

While

we believe we are a leading provider in the software solutions segment of the cannabis industry, there are general software design

and integrated business platform companies seeking to provide online and software-based business solutions and operations integration

to clients in numerous industries. The continued growth of the cannabis industry will likely attract some of these existing companies

and incentivize them to produce solutions that are competitive with those offered by us. Many of these potential competitors are

a part of large diversified corporate groups with a variety of other operations and expansive resources. We may not be able to

successfully compete with larger enterprises devoting significant resources to compete in our target market space, which may negatively

affect operations.

Protecting

and defending against intellectual property claims may have a material adverse effect on our business.

Our

ability to compete depends, in part, upon successful protection of our intellectual property relating to our Leaf Data Systems

and MJ Platform, and intellectual property acquired in business combinations, such as Solo, Trellis, and Ample. We seek to protect

our proprietary and intellectual property rights through patent applications, available copyright and trademark laws, nondisclosure

agreements, and licensing and distribution arrangements with reputable companies in our target markets. While patent protection

for inventions related to cannabis and cannabis-related products is available, there are substantial difficulties faced in the

patent process by cannabis-related businesses. Further, patent applications may be rejected for numerous other reasons beyond

those related to the cannabis industry, including that the subject matter of the application is found to be non-patentable. Our

previous patent applications were denied and while we are continuing to pursue such applications and believe they are with merit,

there can be no assurance that patents will be issued on these applications. The failure to be awarded patents on our technology