UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form

6-K

Report

of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange

Act of 1934

June 2022

Commission file number: 001-36288

Akari Therapeutics, Plc

(Translation of registrant's name into English)

75/76 Wimpole Street

London

W1G 9RT

United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulations S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulations S-T Rule 101(b)(7): ¨

CONTENTS

On June 9,

2022, Akari Therapeutics, Plc (the “Company”) entered into an Executive Employment Agreement (the “Employment Agreement”)

with Ms. Melissa Bradford-Klug pursuant to which Ms. Bradford-Klug will serve as the Chief Operating Officer of the Company, reporting

to Rachelle Jacques, President and Chief Executive Officer of the Company, effective as of July 1, 2022 (the “Start Date”).

The Employment

Agreement has an indefinite term and either party may terminate it by giving at least 30 days’ prior written notice for any reason

or for no particular reason.

Under the

Employment Agreement, Ms. Bradford-Klug’s annual base salary is $440,000 (the “Base Salary”), which is subject to review

on an annual basis. Ms. Bradford-Klug is also eligible to receive (i) an annual cash bonus with a target of 45% of base salary, provided

that the actual amount of such bonus shall be based on the achievement of performance goals established between Ms. Bradford-Klug and

Ms. Jacques, and agreed to with the Board of Directors of the Company (the “Board”), and further provided that the annual

bonus for 2022 shall be pro-rated based on the number of days employed during the year; (ii) a performance bonus in the amount of $200,000

based upon the achievement of key milestones to be agreed to between Ms. Bradford-Klug and Ms. Jacques, and payable in two equal installments,

with the first payable following initial milestone achievement and 50% paid following subsequent milestone achievements(s); and (iii)

a stock option to purchase an amount of ordinary shares in the Company (which may be acquired through ADSs) equal to 40,000,000 of the

Company’s ordinary shares (the “Option”). The Option will be subject to the terms and conditions of the Company’s

Amended and Restated 2014 Equity Incentive Plan and shall be granted in two increments, with the first 50% granted within 30 days of the

Start Date and the second granted six months after the Start Date. The Option shall vest ratably on a semiannual basis over four years

from the grant date, such that it will be fully vested on the fourth anniversary of the grant date.

Upon termination

of Ms. Bradford-Klug’s employment by the Company for any reason, she will receive earned but unpaid Base Salary and, if applicable,

(i) any accrued but unused vacation, through the date of termination, and (ii) the amount of any documented expenses properly incurred

on behalf of the Company prior to any such termination and not yet reimbursed (the “Accrued Obligations”). In addition, if

Ms. Bradford-Klug’s employment is terminated without cause outside of a change in control period, for cause or by Ms. Bradford-Klug

without good reason or in the case of Ms. Bradford-Klug’s disability or death, she shall be entitled to any accrued but unpaid Base

Salary, expense reimbursement and vested and accrued benefits. Additionally, in the case of Ms. Bradford-Klug’s death or disability,

Ms. Bradford-Klug or her estate or beneficiaries shall be entitled to receive (i) any unpaid annual bonus relating to the previous year

and (ii) the target annual performance bonus to which Ms. Bradford-Klug might have been entitled for the year in which the employment

terminates on a pro rata basis based on number of days employed.

Upon termination

of Ms. Bradford-Klug’s employment without cause, which does not occur within 12 months of a change of control, in addition to the

Accrued Obligations, and subject to her timely executing a separation agreement and release in a form and manner satisfactory to the Company,

she shall be entitled to receive (i) the sum of 12 months of the Base Salary and target annual performance bonus for the same time period,

payable as salary continuation and (ii) reimbursement for any monthly COBRA premium paid by Ms. Bradford-Klug on her behalf until the

earliest of (x) 12 months following the date of termination, (y) the date on which Ms. Bradford-Klug is no longer eligible to receive

such coverage, or (z) the date on which Ms. Bradford-Klug becomes eligible to receive similar coverage from another employer or other

source.

Upon termination

of Ms. Bradford-Klug’s employment by us without cause or by Ms. Bradford-Klug for good reason within 12 months of a change of control,

in addition to the Accrued Obligations and subject to her timely executing a separation agreement and release in a form and manner satisfactory

to the Company, she shall be entitled instead to receive an amount equal to (i) the sum of the Base Salary and target annual performance

bonus in effect for the year in which the date of Ms. Braford-Klug’s termination occurs, payable as salary continuation; (ii) reimbursement

for any monthly COBRA premium paid by Ms. Bradford-Klug on her behalf until the earliest of (x) 12 months following the date of termination,

(y) the date on which Ms. Bradford-Klug is no longer eligible to receive such coverage, or (z) the date on which Ms. Bradford-Klug becomes

eligible to receive similar coverage from another employer or other source; and (iii) all of Ms. Bradford-Klug’s time-based stock

options and other stock-based awards subject to time-based vesting shall immediately accelerate and become fully exercisable or nonforfeitable

as of the later of (x) the termination date or (y) the effective date of the separation agreement and release.

The Employment Agreement

also contains restrictive covenants for the Company’s benefit, and Ms. Bradford-Klug is required to maintain the confidentiality

of our confidential information.

The foregoing

summary of the Employment Agreement is subject to, and qualified in its entirety by, a copy of the Employment Agreement, which shall be

filed as an exhibit to the Company’s Annual Report on Form 20-F for the year ended December 31, 2022.

Prior to joining the

Company, Ms. Bradford-Klug was President and Chief Business Officer at RareStone Group, where she led identification and execution of

strategic transactions for rare disease development programs for the China market. As co-founder and Chief Executive Officer of the women’s

health startup, Mayfield Pharmaceuticals (now Harrow Health), she created the company’s strategy, secured funding, drove clinical

development and oversaw operations. Ms. Bradford-Klug has a strong track record of successful fundraising, global acquisitions, licensing,

and development collaborations. She has held senior strategy and corporate/business development roles at Keryx Biopharmaceuticals, AMAG

Pharmaceuticals, Mallinckrodt and Baxter International. She also has held commercial and research and development positions at Eli Lilly

and Company and Monsanto. Ms. Bradford-Klug is a member of the MassBio Board of Directors and Gender Diversity Committee and is a MassConnect

mentor. She holds a Bachelor of Science degree in chemistry from Maryville University in St. Louis, Missouri and an MBA from DePaul University

in Chicago, Illinois.

On June 13,

2022, the Company issued a press release announcing the appointment of Ms. Bradford-Klug. A copy of the press release is attached hereto

as Exhibit 99.1 and is incorporated herein by reference.

The information

contained in this report and the statement in the first paragraph of Exhibit 99.1 is hereby incorporated by reference into all effective

registration statements filed by the Company under the Securities Act of 1933.

Exhibit No.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Akari Therapeutics, Plc |

| |

(Registrant) |

| |

|

|

| |

|

|

| |

By: |

/s/ Rachelle Jacques |

| |

Name: |

Rachelle Jacques |

| |

Title: |

President and Chief Executive

Officer |

Date: June 15, 2022

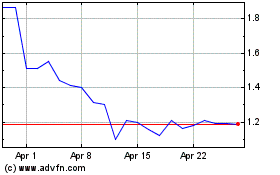

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

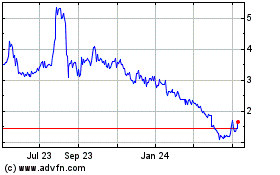

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024