UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

under the Securities Exchange Act of 1934

March 2022

Commission file number: 001-36288

Akari Therapeutics, Plc

(Translation of registrant's name into English)

75/76 Wimpole Street

London W1G 9RT

United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulations S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulations S-T Rule 101(b)(7): ¨

CONTENTS

On March 2, 2022, Akari Therapeutics,

Plc (the “Company”) entered into an Executive Employment Agreement (the “Employment Agreement”) with Ms. Rachelle

Jacques pursuant to which Ms. Jacques will serve as the President and Chief Executive Officer of the Company, effective as of a date no

later than May 28, 2022 (the “Start Date”). Pursuant to the Employment Agreement, the Board of Directors of the Company (the

“Board”) will also appoint Ms. Jacques as a Class B director of the Company, effective as of the Start Date until the 2022

annual meeting of the Company’s shareholders.

The Employment Agreement has

an indefinite term and either party may terminate it by giving at least 30 days’ prior written notice for any reason or for no particular

reason. Termination of Ms. Jacques’s employment for any reason will constitute her resignation from the Board (or committee thereof),

if she is serving as a director (or a committee member) at that time.

Under the Employment Agreement,

Ms. Jacques’s annual base salary is $600,000, which is subject to review on an annual basis. Ms. Jacques is also eligible to receive

(i) an annual cash bonus with a target of 50% of base salary, provided that the actual amount of such bonus shall be based on the achievement

of performance goals established by the executive chairman of the Board and the Board and (ii) commencing with annual long-term incentive

awards to senior executives in 2023, an award under the Company’s equity incentive plan not less frequently than annually with a

target grant value of 100% of Ms. Jacques’s annual base salary in 2023 and thereafter otherwise commensurate with awards to executives in similarly situated companies as recommended by a reputable compensation consultant engaged by the Board. Any cash bonus for a year in which Ms. Jacques is employed for less than the full year will be prorated. The Employment Agreement

also provides that Ms. Jacques is entitled following the Start Date to (i) if such start date is on or before March 28, 2022, (x) a one-time

cash bonus of $650,000, which is subject to partial repayment in the event that Ms. Jacques’s employment is terminated by her without

good reason or by the Company for cause in the first two years and (y) restricted stock units having a value, on the basis of the last

closing price of an American Depositary Share (an “ADS”) on Nasdaq before the Start Date, of $262,000 and (ii) a stock option

to purchase an amount of ordinary shares in the Company (which may be held through ADSs) equal to 4% of the Company’s issued share

capital on the Start Date under the Company’s Amended and Restated 2014 Equity Incentive Plan. The option will have a term of ten

years with an exercise price equal to the closing price of the grant date and will vest ratably on an semiannual basis over four years,

beginning on the grant date, subject to customary provisions pertaining to Ms. Jacques’s continued employment with the Company (including

in the event of a change of control) and disability or death. Additionally, Ms. Jacques shall be entitled to receive restricted stock

units having a value, on the basis of the last closing price of an ADS on Nasdaq before the respective anniversary date, of $446,000 on

each of the first and second anniversaries of the Start Date. All of the above restricted stock unit awards will vest over two-year periods;

in the event of a change of control, involuntary termination without cause, resignation for good reason or termination due to death or

disability, vesting of these awards will be fully accelerated or, if they have not yet been granted, Ms. Jacques will receive a cash lump

payment equal to their value.

Upon termination of Ms. Jacques’s

employment by the Company for cause or by Ms. Jacques without good reason or in the case of Ms. Jacques’s disability or death, she

shall be entitled to any accrued but unpaid base salary, expense reimbursement and vested and accrued benefits. Additionally, in the case

of Ms. Jacques’s death or disability, Ms. Jacques or her estate or beneficiaries shall be entitled to receive (i) any unpaid annual

bonus relating to the previous year and (ii) the target annual performance bonus to which Ms. Jacques might have been entitled for the

year in which the employment terminates on a pro rata basis based on number of days employed.

Upon termination of Ms. Jacques’s

employment without cause, or by Ms. Jacques for good reason, in addition to any accrued but unpaid base salary, expense reimbursement

and vested and accrued benefits, she shall be entitled to receive (i) the sum of the annual base salary and target annual performance

bonus in effect for the year in which the date of Ms. Jacques’s termination occurs, (ii) any unpaid annual bonus relating to

the previous year and (iii) the target annual performance bonus to which Ms. Jacques might have been entitled for the year in which the

employment terminates on a pro rata basis based on number of days employed. In any such instance of termination, Ms. Jacques shall also

be entitled to reimbursement for any monthly COBRA premium paid by Ms. Jacques on her behalf and on behalf of her dependents until the

earliest of (i) 12 months following the date of termination, (ii) the date on which Ms. Jacques is no longer eligible to receive such

coverage, the (iii) the date on which Ms. Jacques becomes eligible to receive similar coverage from another employer or other source.

Upon termination of Ms. Jacques’s

employment by us without cause or by Ms. Jacques for good reason within eighteen months of a change of control, in addition to any accrued

but unpaid base salary, expense reimbursement and vested and accrued benefits, she shall be entitled to receive an amount equal to (i)

the sum of the annual base salary and target annual performance bonus in effect for the year in which the date of Ms. Jacques’s

termination occurs (or, if greater, the previous year), (ii) any unpaid annual bonus relating to the previous year and (iii) the target

annual performance bonus to which Ms. Jacques might have been entitled for the year in which the employment terminates (or, if greater,

the previous year). In such instance of termination, Ms. Jacques shall also be entitled

to reimbursement for any monthly COBRA premium paid by Ms. Jacques on her behalf and on behalf of her dependents until the earliest of

(i) 12 months following the date of termination, (ii) the date on which Ms. Jacques is no longer eligible to receive such coverage, and

the (iii) the date on which Ms. Jacques becomes eligible to receive similar coverage from another employer or other source.

The Employment Agreement also

contains restrictive covenants for the Company’s benefit and Ms. Jacques is required to maintain the confidentiality of our confidential

information.

The foregoing summary of the

Employment Agreement is subject to, and qualified in its entirety by, a copy of the Employment Agreement, which shall be filed as an exhibit

to the Company’s Annual Report on Form 20-F for the year ended December 31, 2021.

Prior to joining the Company,

Ms. Jacques served as CEO of Enzyvant Therapeutics where she focused investments and capabilities to develop and commercialize transformative

regenerative therapies for rare diseases since February 2019. Under her leadership, Enzyvant received FDA approval for its lead asset,

a one-time tissue based regenerative therapy. It is one of the first three FDA-approved products with the Regenerative Medicine Advanced

Therapy (RMAT) designation. Prior to Enzyvant, Ms. Jacques served from 2017 to 2019 as the Senior Vice President and Global Complement

Franchise Head at Alexion, where she was responsible for global franchise strategy development and execution across the therapeutic areas

of hematology, nephrology, and neurology, including the global ULTOMIRIS launch strategy and preparedness. From 2013 to 2017, she was

Vice President of U.S. Hematology Marketing at Shire, which acquired Baxalta in 2016, and served as Vice President of Business Operations

at Baxalta after its spinoff from Baxter. Ms. Jacques held multiple leadership positions at Baxter, including Vice President of Finance,

U.S. BioScience Business. Earlier in her career, she served in various roles at Dow Corning Corporation, including operational management

positions in the U.S., Europe, and China. Ms. Jacques currently serves on the Board of Directors of Corbus Pharmaceuticals and uniQure.

She is co-chair of the Alliance for Regenerative Medicine (ARM) Tissue Engineering & Biomaterials Committee and is a founding member

of the ARM Action for Equality Task Force.

Outgoing Chief Executive Officer,

Clive Richardson, will continue to serve the Company, supporting Rachelle to accelerate business development and ensuring a smooth transition.

He will resign as a director of the Company with effect from the Start Date.

On March 2, 2022, the Company

issued a press release announcing the appointment of Ms. Jacques. A copy of the press release is attached hereto as Exhibit 99.1, and

is incorporated herein by reference.

The information contained

in this report and the statement in the first paragraph of Exhibit 99.1 is hereby incorporated by reference into all effective registration

statements filed by the Company under the Securities Act of 1933.

Exhibit No.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Akari Therapeutics, Plc |

| |

(Registrant) |

| |

|

|

| |

|

|

| |

By: |

/s/ Clive Richardson |

| |

Name: |

Clive Richardson |

| |

|

Chief Executive Officer and Chief Operating Officer |

Date: March 4, 2022

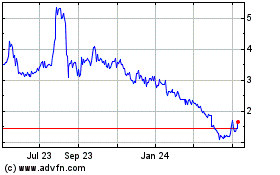

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Mar 2024 to Apr 2024

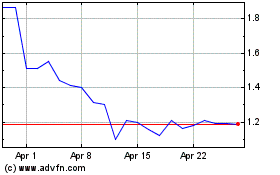

Akari Therapeutics (NASDAQ:AKTX)

Historical Stock Chart

From Apr 2023 to Apr 2024