Current Report Filing (8-k)

September 30 2020 - 4:22PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 25, 2020

Air T, Inc.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

|

001-35476

|

|

52-1206400

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

5930 Balsom Ridge Road

Denver, North Carolina 28037__________

(Address of Principal Executive Offices, and Zip Code)

________________(828) 464-8741__________________

Registrant’s Telephone Number, Including Area Code

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

|

|

|

|

|

|

|

|

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

AIRT

|

NASDAQ Global Market

|

|

Alpha Income Preferred Securities (also referred to as 8% Cumulative Capital Securities) (“AIP”)

|

AIRTP

|

NASDAQ Global Market

|

|

Warrant to purchase AIP

|

AIRTW

|

NASDAQ Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

To the extent responsive, the information included in Item 2.03 is incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant

On September 25, 2020, Contrail Aviation Support, LLC (“CAS”), a 79%-owned subsidiary Air T, Inc. (the “Company”) entered into a Third Amendment to Supplement #2 to Master Loan Agreement dated June 24, 2019 with ONB (as amended, restated, supplemented or otherwise modified from time to time, including, but not limited to, by Supplements thereto)(the “Third Amendment”). The material changes within the Third Amendment are: (a) to extend the date for compliance with the resting period provisions of Section 2.4(b) to September 5, 2021; and (b) to extend the date for compliance with the required quarterly cash flow coverage ratio covenant in Section 4.1 such that CAS shall commence compliance with the covenant commencing on March 31, 2022 and on the last day of each fiscal quarter thereafter.

In addition, the Third Amendment adds an event of default to the Master Loan Agreement if CAS does not enter into Supplement #8 to the Master Loan Agreement and Term Note G in substantially the form attached as Exhibit A to the Third Amendment and consummate the transactions contemplated therein by December 31, 2020. Supplement #8 and Term Note G relate to a $43,598,000 loan to be extended pursuant to, and intended to comply with, the requirements of the Main Street Priority Loan Facility Program established by the U.S. Federal Reserve. The contemplated loan proceeds are to be used as working capital to support the operations of CAS in the ordinary course of business and the indebtedness incurred would be subject to the terms and provisions of the Master Loan Agreement. The principal terms of the contemplated loan are: (a) interest on the loan would accrue at a floating rate of LIBOR plus 3.00% and interest would be payable commencing on a date certain in 2021; (b) principal payments would be due in 2023 (15%) and 2024 (15%), with the remainder due on the loan maturity date in 2025; (c) the loan would not be guaranteed; and, (c) a 2% origination fee would be due on funding of the loan. The loan is also expected to contain affirmative covenants as to cash flow coverage and tangible net worth. Because the loan transaction has not yet been completed, no assurance can be given at this time that this financing will be completed and funded or that the terms of the loan will be as described above.

The foregoing summary of the terms of the Third Amendment and Exhibit A thereto do not purport to be complete and are qualified in their entirety by reference to the documents which are filed as Exhibit 10.1 hereto which are incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: September 30, 2020

AIR T, INC.

By: /s/ Brian Ochocki

Brian Ochocki, Chief Financial Officer

20422282v2

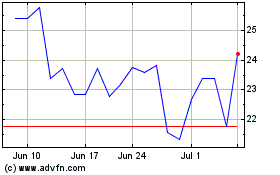

Air T (NASDAQ:AIRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

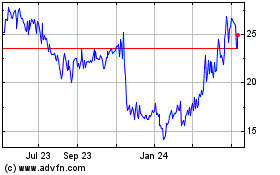

Air T (NASDAQ:AIRT)

Historical Stock Chart

From Apr 2023 to Apr 2024