SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☐

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Under Rule 14a-12

Air T, Inc.

(Name of Registrant as specified in its charter)

(Name of person(s) filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1)Amount previously paid:

(2)Form, Schedule or Registration Statement No.:

(3)Filing party:

(4)Date filed:

Air T, Inc.

5930 Balsom Ridge Road, Denver, NC 28037 Telephone: (828) 464-8741 FAX: (704) 489-9960

July 20, 2020

To Our Stockholders:

Attached for your information and review, a copy of Air T, Inc.’s 2020 Annual Report, Notice and Proxy Statement for our Annual Meeting of Stockholders to be held Wednesday, August 12, 2020, accompanying proxy card and return envelope.

The accompanying Proxy Statement provides you with a summary of the proposals on which our stockholders will vote at the annual meeting. Your vote is important regardless of the number of shares you hold. To ensure your representation at the meeting, please complete, sign, date and return your enclosed proxy card as soon as possible in the postage-paid envelope provided. If your shares are held in “street name” by your broker or other nominee, only that holder can vote your shares, and the vote cannot be cast unless you provide instructions to your broker. You should follow instructions provided by your broker regarding how to instruct your broker to vote your shares. If you choose to attend the annual meeting, you may revoke your proxy and personally cast your votes at the annual meeting.

We are closely monitoring developments regarding COVID-19 to determine if changes to our annual meeting are necessary or appropriate. If we decide to make any change, such as to hold the meeting solely or principally by remote communication, we will announce the change in advance and post details, including instructions on how stockholders can participate, on our website and file them with the SEC. We also recommend that you visit the website to confirm the status of the annual meeting before planning to attend in person.

Stockholder matters, including a transfer of shares, missing stock certificates, or changes of address can be directed to the Company’s transfer agent at the following mailing address, email address and telephone number:

American Stock Transfer and Trust Company

Operations Center

6201 15th Avenue

Brooklyn, NY 11219

Email address: info@amstock.com

Telephone Number: 1-800-937-5449

If you should have a question or require an additional copy of the documents mentioned above, please contact me directly at 828-464-8741.

Sincerely,

Nick Swenson

President and Chief Executive Officer

Enclosures

AIR T, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON AUGUST 12, 2020

To Our Stockholders:

On behalf of the Board of Directors and management of Air T, Inc. (the “Company”), we cordially invite you to our annual meeting of stockholders. The meeting will be held at our executive office at 5000 West 36th Street, Minneapolis, Minnesota 55416 on Wednesday, August 12, 2020 at 8:30 a.m. local time, for the purpose of considering and acting on the following matters:

1.Elect as directors the six (6) nominees named in the accompanying proxy statement to hold office until the next annual meeting of stockholders and until their respective successors are elected and qualified;

2.To approve, on an advisory basis, the compensation paid to the Company’s named executive officers as disclosed in the accompanying proxy statement;

3.To ratify the appointment of Deloitte & Touche LLP as the independent registered public accounting firm of the Company for the fiscal year ending March 31, 2021; and

4.To transact such other business as may properly come before the meeting, or any adjournment or adjournments thereof.

Only stockholders of record as of the close of business on July 6, 2020 are entitled to notice of and to vote at the annual meeting and adjournments thereof. You may examine a list of those stockholders at our executive office at 5000 West 36th Street, Minneapolis, Minnesota 55416, during the 10-day period preceding the annual meeting. Each share of our outstanding common stock will entitle the holder to one vote on each matter that properly comes before the annual meeting.

Please see the Notice of Annual Meeting of Shareholders and the Notice of Internet Availability that was mailed to shareholders on or about July 20, 2020. The Proxy Statement, form of Proxy and 2020 Annual Report have been made available online. The Proxy Statement contains a more extensive discussion of each proposal, and therefore you should read the Proxy Statement carefully.

The accompanying proxy statement provides you with a summary of the proposals on which our stockholders will vote at the annual meeting. We encourage you to read this entire document before voting.

Your vote is important no matter how large or small your holdings may be. To ensure your representation at the meeting, please complete, sign, date and return your enclosed proxy card as soon as possible in the postage-paid envelope provided. If your shares are held in “street name” by your broker or other nominee, only that holder can vote your shares, and your vote cannot be cast unless you provide instructions to your broker. You should follow instructions provided by your broker regarding how to instruct your broker to vote your shares. If you choose to attend the annual meeting, you may revoke your proxy and personally cast your votes at the annual meeting.

The 2020 Annual Report of the Company also accompanies this notice and is available on the Company’s website.

By Order of the Board of Directors

Nick Swenson

President and Chief Executive Officer

July 20, 2020

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON AUGUST 12, 2020

This notice, the accompanying proxy statement and proxy and the Air T, Inc. 2020 Annual Report to Stockholders, which includes the Air T Inc.’s Annual Report on Form 10-K for the fiscal year ended March 31, 2020, are available at http://www.airt.net/investors/annual-meeting-materials Additionally, and in accordance with the rules of the Securities and Exchange Commission, stockholders may access these materials at the website indicated in the Notice of Internet Availability of Proxy Materials that you receive in connection with this notice and the accompanying proxy statement.

[Intentionally left blank.]

Air T, Inc.

5930 Balsom Ridge Road

Denver, North Carolina 28037

Telephone (828) 464-8741

PROXY STATEMENT

The enclosed proxy is solicited on behalf of the Board of Directors of Air T, Inc. (referred to as the “Company”) in connection with the annual meeting of stockholders of the Company to be held on Wednesday, August 12, 2020 at 8:30 a.m. at 5000 West 36th Street, Minneapolis, Minnesota 55416. The proxy is for use at the meeting if you do not attend or if you wish to vote your shares by proxy even if you do attend. You may revoke your proxy at any time before it is exercised by:

•giving a written notice of revocation to the Secretary of the Company,

•submitting a proxy having a later date, or

•appearing at the meeting and requesting to vote in person.

All shares represented by valid proxies and not revoked before they are voted will be voted as specified. If no specification is made, proxies will be voted “FOR” electing all nominees for director listed on the proxy in Item 1, “FOR” the resolution approving, on an advisory basis, the compensation paid to the Company’s named executive officers as disclosed in this proxy statement, and “FOR” ratifying Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2021.

The Board of Directors knows of no matters, other than those stated above, to be presented for consideration at the annual meeting. If, however, other matters properly come before the annual meeting or any adjournment thereof, it is the intention of the persons named in the accompanying proxy to vote such proxy in accordance with their best judgment on any such matters. The persons named in the accompanying proxy may also, if it is deemed advisable, vote such proxy to adjourn the annual meeting from time to time, including if there is not a quorum on the date set for the annual meeting.

This proxy statement, the enclosed proxy card and the Company’s 2020 Annual Report to Stockholders are being first made available to our stockholders on or about July 20, 2020. The Annual Report does not constitute “soliciting material” and is not to be deemed “filed” with the Securities and Exchange Commission.

The Company will pay the costs of preparing this proxy statement and of soliciting proxies in the enclosed form. Our officers, directors and employees may solicit proxies personally, by telephone, mail or facsimile, or via the Internet. These individuals will not receive any additional compensation for their solicitation efforts. You may also be solicited by means of press releases issued by the Company, postings on our website, www.airt.net, and advertisements in periodicals. In addition, upon request we will reimburse banks, brokers and other nominees representing beneficial owners of shares for their expenses in forwarding voting materials to their customers who are beneficial owners and in obtaining voting instructions.

VOTING

Only stockholders of record at the close of business on July 6, 2020 will be entitled to vote at the annual meeting or any adjournment or adjournments thereof. The number of outstanding shares entitled to vote at the stockholders meeting is 2,881,868. The presence of a majority of the outstanding shares of the Company’s Common Stock, par value $.25 per share (the “Common Stock”), represented in person or by proxy at the meeting will constitute a quorum necessary to conduct business at the meeting.

How to Vote

If you are a registered stockholder, you may vote your shares by mail by completing, signing, dating and returning a proxy card or you may vote your shares in person by attending the meeting and voting your shares at the meeting. Even if you plan to attend the meeting, the Company encourages you to vote your shares by proxy. If you choose to attend the meeting, please bring proof of stock ownership and proof of identification to the meeting.

If you are a beneficial stockholder and your broker holds your shares in its name, your broker may provide you alternative methods of providing your voting instructions, including by Internet or telephone. This depends on the voting process of the broker through which you hold the shares. Please follow their directions carefully.

Voting of Shares Held Through Brokers

If you are a beneficial stockholder and your broker holds your shares in its name, your broker cannot vote your shares on the following matters if you do not timely provide instructions for voting your shares:

•the election of directors; and

•the advisory vote on approval of the compensation paid to the Company’s named executive officers.

If your shares are maintained through an account with a broker, it is likely that your broker holds your shares in its name, and you should contact your broker if you are uncertain whether your broker holds your shares in its name. Shares not voted by brokers on these matters if timely voting instructions are not provided are referred to as “broker non-votes.” However, your broker may vote your shares on any other matter that may be presented to the stockholders for a vote at the meeting, including the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm, if the broker does not receive voting instructions from you.

If your broker holds your shares in its name, for you to vote those shares you must provide voting instructions to the broker through which you hold the shares. Please follow their directions carefully. If you want to vote shares held by your broker in its name at the meeting, you must request a legal proxy from your broker and present that proxy, together with proof of identification, at the meeting.

Required Voting Thresholds for Matters to be Considered at the Meeting

Directors will be elected by a plurality of the votes cast—that is, the six (6) nominees receiving the most votes will be elected as directors. Cumulative voting is not allowed. Accordingly, abstentions and broker non-votes will not affect the outcome of the election of directors.

The ratification of the appointment of the independent registered public accounting firm for the fiscal year ending March 31, 2021, requires the affirmative vote of a majority of the shares present or represented at the meeting and entitled to vote. On such matter, an abstention will have the same effect as a negative vote but, because shares held by brokers will not be considered entitled to vote on matters as to which the brokers withhold authority, a broker non-vote, if applicable, will have no effect on the vote on this matter.

Each of the other matters coming before the meeting, including the advisory vote on compensation paid to the Company’s named executive officers, the Company will consider that our shareholders will approve of the compensation for named executive officers as disclosed in this Proxy Statement if there are more “FOR” votes than the total of “AGAINST” and “ABSTAIN” votes.

Changing Your Vote

Even after you have submitted your vote, you may revoke your proxy and change your vote at any time before voting begins at the annual meeting. If you are a registered stockholder, you may do this by:

•timely delivering to the Company’s Secretary, or at the meeting, a later dated signed proxy card or

•by voting your shares in person if you attend the meeting.

Your attendance at the meeting will not automatically revoke your proxy; you must specifically revoke it.

If your broker holds your shares in its name, you should contact your bank, broker or other nominee to find out how to revoke your proxy. If you have obtained a legal proxy from your nominee giving you the right to vote your shares, you may vote by attending the meeting and voting in person or by sending in an executed proxy with your legal proxy form.

CERTAIN BENEFICIAL OWNERS OF COMMON STOCK

The following table sets forth information regarding the beneficial ownership (determined in accordance with Rule 13d-3 of the Securities and Exchange Commission) of shares of Common Stock, par value $.25 per share, of the Company as of July 6, 2020 by each person that beneficially owns five percent or more of the shares of Common Stock. Each person named in the table has sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned, except as otherwise set forth in the notes to the table.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Beneficial Owner

|

Amount of Beneficial Ownership as of July 6, 2020

|

Percent of Class(1)

|

|

AO Partners I, L.P. et al.(2)

5000 W. 36th Street, Suite 130

Minneapolis, Minnesota 55416

|

1,264,563

|

43.82%

|

|

Farnam Street Partners, L.P. et al.(3)

3033 Excelsior Boulevard, Suite 320

Minneapolis, Minnesota 55416

|

400,057

|

13.88%

|

|

Renaissance Technologies LLC et al.(4)

800 Third Avenue

New York, New York 10022

|

211,311

|

7.33%

|

(1)Based upon 2,881,868 shares outstanding on July 6, 2020.

(2)Based on a Schedule 13D/A filed by AO Partners I, LP, etc dated April 1, 2020 that references shares held by AO Partners I, L.P. (“AO Partners Fund”) and indirectly by AO Partners, LLC (“AO Partners”) as General Partner. AO Partners Fund and AO Partners have shared power to direct the voting and disposition of 883,557 shares. Nicholas Swenson as Managing Member of AO Partners disclaims beneficial ownership of such shares, except as to his pecuniary interest therein. Nicholas Swenson has sole power to direct the voting and disposition of 157,899 shares held directly (which includes 3,750 shares purchasable upon the exercise of stock options granted to him by the Company for his service on the Company’s Board of Directors and 94,438 shares held by a wholly-owned corporation), and Groveland Capital, LLC and Groveland DST, LLC have shared power to direct the voting and disposition of 53,301 shares and 169,806 shares respectively.

(3)Based on a Schedule 13D/A filed on March 31, 2020 by Raymond Cabillot, Peter Haeg, Farnam Street Partners, L.P. (“FSP”), FS Special Opportunities Fund I, L.P. (“FS Special,” and collectively with FSP, the “Farnam Funds”) and Farnam Street Capital, Inc. (“FSC”). Raymond E. Cabillot and Peter O. Haeg, reported that FSP has sole voting and dispositive power with respect to 350,313 shares and, FS Special has sole voting and dispositive power with respect to 38,602 shares. Messrs. Cabillot and Haeg, as officers of FSC, the general partner of the Farnam Funds, share voting and dispositive power over all of the shares of Company common stock held by the Farnam Funds. Mr. Cabillot and Mr. Haeg individually own 7,500 shares and 3,642 shares of Company common stock, respectively.

(4)Based solely on a Schedule 13G/A filed on February 13, 2020 by Renaissance Technologies LLC and Renaissance Technologies Holdings Corporation, reporting that, as of December 31, 2019, each has sole power to direct the voting and disposition of 211,311 shares.

PROPOSAL 1 -- ELECTION OF DIRECTORS

Under the Company’s certificate of incorporation and by-laws, directors are elected at each annual meeting and hold office until their respective successors are elected and have qualified. The Board of Directors has established the number of directors constituting the Board of Directors at six (6). Accordingly, up to six (6) directors may be elected at the annual meeting.

The following sets forth certain information with respect to the individuals who are nominated by the Board of Directors, upon recommendation of its Nominating Committee, for election to the Board of Directors at the annual meeting. Each of the following nominees is currently a director of the Company. For each nominee we have disclosed the particular experience, qualifications, attributes, or skills that led the Board to conclude that the nominee should serve as a director.

Raymond Cabillot, age 57, was elected as a director of the Company in November 2016 and as Lead Independent Director of the Company in 2019. Since 1998, Mr. Cabillot has served as Chief Executive Officer and director of Farnam Street Capital, Inc., the General Partner of Farnam Street Partners L.P., a private investment partnership.

Prior to his service at Farnam Street Capital, Mr. Cabillot was a Senior Research Analyst at Piper Jaffrey, Inc., an investment bank and asset management firm, from 1989 to 1997. Early in his career, Mr. Cabillot worked for Prudential Capital Corporation as an Associate Investment Manager and as an Investment Manager. Mr. Cabillot has served on the board of directors of Oxbridge Re Holdings Limited, a specialty property and casualty reinsurer, since 2013, and Pro-Dex, Inc., a manufacturer of surgical, dental, and scientific instruments, since 2013. Mr. Cabillot also served as Chairman of the Board of O.I. Corporation, a manufacturer of chemical analysis and monitoring products, from 2007 through 2010. Mr. Cabillot earned his BA with a double major in economics and chemistry from St. Olaf College and an MBA from the University of Minnesota. He is a Chartered Financial Analyst.

Mr. Cabillot was elected to the Board and as Lead Independent Director for his strong analytical skills and over 25 years’ experience as a financial analyst and investment manager. His prior service as a public company director and chairman also brings valuable corporate governance experience to the Board.

William Foudray, age 50, was elected as a director of the Company in August 2013. Mr. Foudray has served as Executive Vice President of Vantage Financial, LLC, an equipment leasing and finance company, since he co-founded that firm in August 2011. Mr. Foudray served in various executive capacities, including as Vice President of Operations, Chief Financial Officer and Executive Vice President, of Fidelity National Capital, Inc., a third-party technology leasing firm and then subsidiary of Fidelity National Financial, Inc., from 1999 until the sale of that company in 2009 to Winthrop Resources Corporation and as Vice President of Winthrop Resources Corporation, a technology leasing company, from 2009 to July 2011.

Mr. Foudray’s experience in the leasing business, including in the equipment leasing business provides the Board with valuable insight with respect to opportunities to expand leasing activities of the Company’s businesses. In addition, Mr. Foudray’s experience as an executive officer of a significant operating business and as a former chief financial officer add to the Board’s expertise in operational and financial matters.

Gary Kohler, age 63, was elected as a director of the Company in September 2014. Mr. Kohler has served as Chief Investment Officer, portfolio manager and Managing Partner of Blue Clay Capital Management, LLC, an investment management firm, since January 1, 2012. Mr. Kohler served as a portfolio manager and partner of Whitebox Advisors, LLC, an investment management firm, from January 2000 to December 2011. Mr. Kohler served in various capacities, including portfolio manager and Vice President, of Okabena Company, a private investment advisory firm, from 1984 to 1997.

Mr. Kohler’s experience in investing and managing investments in a wide variety of businesses during his over 25-year career in the field of investment management services provides the Board with additional depth in financial, analytical and investment expertise.

Peter McClung, age 50, was elected as a director of the Company in December 2017. Mr. McClung is an experienced business executive and expert in developing sales and marketing strategies based on customer insights. Mr. McClung has over 20 years’ experience building and leading teams to grow revenue, profitability and market share in a variety of industries. He spent the first part of his career as a sales and marketing executive in roles of increasing responsibility with Novartis, BASF, and UnitedHealth Group. In 2009, Mr. McClung formed a business strategy consulting firm, which expanded into a full-service branding agency in 2013, called welcometoseven.com. In 2016, Mr. McClung became CEO of The Jump Group, LLC, a joint venture technology company with welcometoseven.com and venture capital investors.

The Board nominated Mr. McClung because of his expertise in the areas of strategy, marketing and sales, in addition to his experience as both an entrepreneur as well as a senior leader in several Fortune 500 companies.

Nicholas Swenson, age 51, has served as a director of the Company since August 2012 and as Chairman of the Board of Directors since August 2013. In October 2013, Mr. Nick Swenson was appointed as the interim President and Chief Executive Officer of the Company and was appointed as President and Chief Executive Officer of the Company in February 2014. Mr. Nick Swenson is also the managing member of AO Partners, LLC which is the general partner of AO Partners I, L.P., an investment fund. Mr. Nick Swenson previously served as a portfolio manager and partner of Whitebox Advisors, LLC, an investment management firm. Mr. Nick Swenson serves as a director and Chairman of the Board of Pro-Dex, Inc., as a director of Delphax Technologies Inc., and formerly served as a director of Insignia Systems, Inc.

The Board believes that Mr. Nick Swenson’s position as Chief Executive Officer of the Company provides the Board with unique insight regarding Company-wide issues.

In addition, Mr. Nick Swenson’s financial, analytical and investment experience and skills provide the Board of Directors with additional expertise in these areas and, as a representative of the Company’s largest stockholder, he provides additional stockholder perspectives to the Board of Directors.

Travis Swenson, age 42, was elected as a director of the Company in December 2017. Mr. Travis Swenson currently serves as the Global Head of Client Accounting Services at WeWork. Prior to joining WeWork, Mr. Swenson was the Senior Managing Director, Americas Leader of Real Estate Accounting Services, of CBRE, Inc., a commercial real estate services firm, which he joined in February 2013. Preceding this role, Mr. Swenson served as a Senior Manager with the Capital Markets Advisory practice of Deloitte & Touche LLP. Preceding this role, he was with financial services audit and tax practices of Deloitte & Touche LLP, which he joined in September 2000. Over the course of his professional career, he has focused on strategic consulting, auditing, tax, corporate finance, capital markets, and mergers and acquisitions. He is a certified public accountant, licensed in both Minnesota and California.

Mr. Travis Swenson is not related to Nicholas Swenson, the Company’s Chairman of the Board, President and Chief Executive Officer.

Mr. Travis Swenson’s professional experience, including his accounting expertise and managerial skills, both with a Big Four accounting firm and a large commercial real estate services firm, provides the Board with expertise in a variety of important areas, including accounting and merger and acquisition matters, as well as managerial insight.

The Board of Directors recommends a vote “FOR” all of the nominees listed above for election as directors (Item 1 on the enclosed proxy card).

The Board of Directors believes that the Board as a whole should encompass a range of skill and expertise enabling it to provide sound guidance with respect to the Company’s operations and interests. In addition to considering a candidate’s background and accomplishments, candidates are reviewed in the context of the current composition of the Board and the evolving needs of the Company and its businesses. The Company’s policy is to have at least a majority of Directors qualify as “independent,” and only two of the six (6) nominees (Messrs. Nick Swenson and Kohler) do not qualify as “independent.”

The Board does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board as the Board believes it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. The Board has determined that having the same person serve as Chief Executive Officer and Chairman of the Board is in the best interests of the Company’s stockholders at this time. The Board has created the role of Lead Independent Director to lead executive sessions, act as an intermediary between the other “independent” directors and the Chairman, to act in the Chairman’s place should he be unavailable, and to act as a liaison between the stockholders and the Board of Directors. The Board has appointed Raymond Cabillot as its Lead Independent Director.

Director Compensation

During the fiscal year ended March 31, 2020, each non-employee director received a director’s fee of $1,500 per month and an attendance fee of $750 for each meeting of the Board of Directors or a committee thereof, including a Special Committee. Members of the Audit Committee received, in lieu of the meeting fee, a monthly fee of $1,750, while the Chairman of the Audit Committee received a monthly fee of $2,600. The Lead Independent Director receives a stipend of $500 per month.

The following table sets forth the compensation earned by each of the Company’s non-employee directors in the fiscal year ended March 31, 2020. All compensation was paid in cash.

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Total ($)(1)

|

|

Raymond Cabillot

|

|

30,250

|

|

Seth Barkett

|

|

22,500

|

|

William Foudray

|

|

24,000

|

|

Gary Kohler

|

|

22,500

|

|

Peter McClung

|

|

47,250

|

|

Travis Swenson

|

|

55,200

|

(1) Does not include $32,750 paid to former director Andrew Stumpf during the fiscal year ended March 31, 2020. Mr. Stumpf resigned from the Board effective November 23, 2019. Also does not include amounts paid to Mr. Barkett pursuant to a consulting agreement.

The Company has engaged RDA Capital Advisors, LLC to assist the Company and its subsidiaries with respect to designated projects, including evaluating merger and acquisition opportunities, developing financial planning and analysis capabilities, evaluating investment opportunities, and providing operational and strategic advice and coordination services for a consulting fee of $5,000 per month and his compensation of $50,000 as interim Chief Financial Officer from April 18, 2019 through July 8, 2019. Messr. Barkett elected to not stand for reelection to the Board.

Committees of the Board of Directors

The Board of Directors has three standing committees: the Audit Committee, the Compensation Committee, and the Nominating Committee. The Board of Directors presently expects that the membership of each committee will remain the same following the Annual Meeting.

The Audit Committee currently consists of Messrs. Travis Swenson, McClung and Cabillot, with Mr. Travis Swenson serving as chairman. The Audit Committee met 4 times during the fiscal year. The authority and responsibilities of the Audit Committee are set forth in a charter adopted by the Board of Directors. A copy of the current Charter is available on the Company’s website (www.airt.net) on the “Corporate Governance” page under the “Investors” tab. The principal functions of the Audit Committee, included in the charter, are to select and retain the firm of independent auditors to serve the Company each fiscal year, to review and approve the scope, fees and results of the audit performed by the independent auditors, to review the adequacy of the Company’s system of internal accounting controls, to review and periodically discuss with the independent auditor all significant relationships that may affect the auditor’s independence, to meet at least quarterly to review the Company’s financial results with management and the independent auditors prior to the release of quarterly financial information, to prepare and issue to the Board of Directors annually a summary report suitable for submission to the stockholders, to discuss with management and the independent auditor policies with respect to risk assessment and risk management, significant risks or exposures of the Company and the steps that have been taken to minimize such risks, and to establish procedures for the receipt, retention and treatment of complaints regarding accounting internal controls and auditing matters, including confidential, anonymous submissions by employees. The Company has certified to NASDAQ the Company’s compliance with NASDAQ’s audit committee charter requirements and compliance with the audit committee structure and composition requirements. In addition, the Board of Directors has determined that Travis Swenson is an “audit committee financial expert,” as that term is defined under the rules of the Securities and Exchange Commission.

The Compensation Committee currently consists of Messrs. McClung and Swenson with Mr. McClung serving as chairman. The authority and responsibilities of the Compensation Committee are set forth in a charter adopted by the Board of Directors. A copy of the current Charter is available on the Company’s website (www.airt.net) on the “Corporate Governance” page under the “Investors” tab. The principal functions of the Compensation Committee, included in the charter, are to evaluate, develop, approve and report to the Board regarding the Company’s overall compensation philosophy and strategy, including the balance among various components of compensation, such as base salaries, cash-based and equity-based incentive compensation, and other benefits, to determine, or recommend to the Board for its determination, the compensation, including salary, bonus, incentive and equity compensation to be paid to the Chief Executive Officer and the other executive officers, to review director fees and other compensation paid to non-employee members of the Board on a periodic basis and effect, or recommend to the Board, any changes it deems appropriate, to periodically review equity-based and other incentive plans and revise such plans, or recommend revisions or new plans to the Board, to determine and recommend to the Board for approval any performance targets and participation levels for management in any incentive plan for which such targets and levels are to be set, to review and approve all formal employment agreements with the executive officers, and to review the Company’s overall compensation policies and practices for all employees as they relate to the Company’s risk. The Company has certified to NASDAQ the Company’s compliance with NASDAQ’s compensation committee charter and compliance with the compensation committee structure and composition requirements. The Compensation Committee met twice during the fiscal year.

The Nominating Committee currently consists of Messrs. Cabillot, Foudray and McClung, with Mr. McClung serving as chairman. The Nominating Committee is charged with identifying candidates for election to the Board of Directors, reviewing their skills, characteristics and experience and recommending nominees to the Board for approval, as well as recommending the functions and the membership of the committees of the Board of Directors.The charter of the Nominating Committee is available on the Company’s website (www.airt.net) on the “Corporate Governance” page under the “Investors” tab. The Nominating Committee met once during the fiscal year.

Director Independence

The Board of Directors has determined that none of the members of the Board of Directors (other than Mr. Nick Swenson, the Company’s Chief Executive Officer, and Messrs. Kohler) has any relationship that, in the Board’s opinion, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director, and that each of these individuals is “independent” within the meaning of the rules of the NASDAQ Global Market. All of the members of the Company’s Audit Committee, Compensation Committee and Nominating Committee are independent directors under these standards. In addition, the Board of Directors has determined that the members of the Audit and Compensation Committees meet the additional standards of independence applicable to members of such committees.

The Board of Directors concluded that Mr. Kohler is not independent in light of the Company’s December 2017 acquisition of the assets of Blue Clay Capital Management, LLC, an investment management firm based in Minneapolis, Minnesota. Mr. Kohler was the sole owner of Blue Clay Capital and in connection with such acquisition, a subsidiary of the Company replaced Blue Clay Capital as the managing general partner of certain investment funds and Mr. Kohler remains employed by Blue Clay as its Chief Investment Officer in return for an annual salary of $50,000 (reduced to $45,000 after 8/15/19) plus variable compensation based on the management and incentive fees to be paid to the subsidiary by certain of these investment funds and eligibility to participate in discretionary annual bonuses.

Board’s Role in Risk Oversight

As discussed above, the Audit Committee assists the Board with respect to risk assessment and risk management, including monitoring significant risks or exposures of the Company and the steps that have been taken to minimize such risks. The Audit Committee is comprised entirely of independent directors. The Audit Committee is also charged with monitoring the Company’s “whistleblower hotline” which permits complaints or concerns regarding legal compliance, accounting, internal controls and auditing matters to be submitted by interested persons, including employees, confidentially and anonymously. In addition, the Compensation Committee is charged with assisting the Board in reviewing the Company’s overall compensation policies and practices for all employees as they relate to the Company’s risk. The Compensation Committee is also comprised of all independent directors.

Attendance of Meetings

During the fiscal year ended March 31, 2020, the Board of Directors met five (5) times. Each of the directors attended at least 75% of all of the meetings of the Board of Directors and committees thereof on which such director served during such period. The Company does not have a policy with respect to attendance of members of the Board of Directors at the annual meeting of stockholders. Historically, few, if any, stockholders have attended the Company’s annual meeting of stockholders. We encourage, but do not require, our Board members to attend the annual meeting of stockholders. Last year, seven (7) directors attended the annual meeting, including all directors standing for election.

Director Qualifications and Nominations

The Nominating Committee has adopted a policy that candidates nominated for election or re-election to the Board of Directors generally should meet the following qualifications:

•candidates should possess broad training and experience at the policymaking level in business, government, education, technology or philanthropy;

•candidates should possess expertise that is useful to the Company and complementary to the background and experience of other members of the Board of Directors, so that an optimal balance in Board membership can be achieved and maintained;

•candidates should be of the highest integrity, possess strength of character and the mature judgment essential to effective decision making;

•candidates should be willing to devote the required amount of time to the work of the Board of Directors and one or more of its committees;

•candidates should be willing to serve on the Board of Directors over a period of several years to allow for the development of sound knowledge of the Company and its principal operations; and

•candidates should be without any significant conflict of interest or legal impediment with regard to service on the Board of Directors.

The Nominating Committee seeks directors with experience in areas relevant to the Company’s businesses. The Nominating Committee also seeks other key attributes that are important to an effective board: integrity and high ethical standards; sound judgment; analytical skills; and the commitment to devote the necessary time and energy to the service on the Board and its Committees. The Company does not have a policy with regard to the consideration of diversity in identifying director nominees. The Nominating Committee seeks out appropriate candidates, principally by canvassing current directors for suggestions. The Nominating Committee evaluates candidates on the basis of the above qualifications and other criteria that may vary from time to time. The Nominating Committee does not have a formal policy on the consideration of director candidates recommended by stockholders. The Board of Directors believes that such a formal policy is unnecessary and that the issue is more appropriately dealt with on a case-by-case basis.

There have been no changes to the procedures by which security holders may recommend nominees to the Company’s Board of Directors since the date of the Company’s proxy statement for its annual meeting of stockholders held on August 14, 2019.

Director and Executive Officer Stock Ownership

The following table sets forth information regarding the beneficial ownership of shares of Common Stock of the Company as of July 6, 2020 by each director, director nominee and named executive officer of the Company (as listed in the Summary Compensation Table, below) and by all directors and executive officers of the Company as a group. Each person named in the table has sole voting and investment power with respect to all shares of Common Stock shown as beneficially owned, except as otherwise set forth in the notes to the table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares and Percent of Common Stock Beneficially Owned as of July 6, 2020

|

|

|

Name

|

Position with Company

|

No. of Shares(1)

|

Percent

|

|

Raymond Cabillot

|

Director

|

(3)400,057

|

13.88%

|

|

Seth Barkett

|

Director(2)

|

4,500

|

*

|

|

William Foudray

|

Director

|

7,500

|

*

|

|

Gary Kohler

|

Director

|

18,103

|

*

|

|

Peter McClung

|

Director

|

—

|

—

|

|

Travis Swenson

|

Director

|

—

|

—

|

|

Andrew Stumpf

|

Former Director

|

—

|

—

|

|

Candice Otey (4)

|

Former Chief Accounting Officer

|

—

|

—

|

|

Brett Reynolds(5)

|

Former Chief Financial Officer, Senior Vice President

|

__

|

—

|

|

Brian Ochocki

|

Chief Financial Officer/ Principal Accounting Officer and Treasurer

|

—

|

—

|

|

Nicholas Swenson

|

President, Chief Executive Officer and Chairman of the Board

|

(4)1,264,563

|

43.82%

|

|

|

|

|

|

|

All current directors, nominees, and executive officers as a group (6 persons)

|

|

(3)(4)1,694,723

|

58.65%

|

|

*Less than one percent.

|

|

|

|

(1)Includes shares which the following executive officers and directors have the right to acquire within 60 days through the exercise of stock options issued by Air T: Mr. Foudray, 3,750 shares; Mr. Nick Swenson, 3,750 shares; and all directors, nominees, and executive officers as a group, 7,500 shares.

(2)Messr. Barkett has elected to not stand for reelection to the Board.

(3)Includes 350,313 shares held by Farnam Street Partners, L.P. and 36,602 shares held by FS Special Opportunities Fund I, LP. Mr. Cabillot is an officer of Farnam Street Capital, Inc., the general partner of Farnam Street Partners, L.P. and FS Special Opportunities Fund I, L.P. Messrs. Cabillot and Peter O. Haeg, as officers of FSC, the general partner of the Farnam Funds, share voting and dispositive power over all of the shares of Company common stock held by the Farnam Funds. Mr. Cabillot and Mr. Haeg individually own 7,500 shares and 3,642 shares of Company common stock, respectively.

(4)Includes shares held by AO Partners I, L.P. (“AO Partners Fund”) and indirectly by AO Partners I, L.P., and indirectly by AO Partners, LLC (“AO Partners”) as General Partner. AO Partners Fund and AO Partners have shared power to direct the voting and disposition of 883,557 shares. Nicholas Swenson as Managing Member of AO Partners disclaims beneficial ownership of such shares, except as to his pecuniary interest therein. Nicholas Swenson has sole power to direct the voting and disposition of 157,899 shares held directly (includes 3,750 shares purchasable upon the exercise of stock options granted to him by the Company for his service on the Company’s Board of Directors as noted in Note 1 above and 94,438 shares held by a wholly-owned corporation), and Groveland Capital, LLC and Groveland DST, LLC have shared power to direct the voting and disposition of 53,301 shares and 169,806 shares respectively.

(5)Ms. Otey acted as Chief Financial Officer until May 7, 2018 and as Chief Accounting Officer of the Company until April 18, 2019.

(6)Mr. Reynolds acted as Chief Financial Officer and Senior Vice President of the Company from May 7, 2018 until April 12, 2019.

CERTAIN TRANSACTIONS

On December 15, 2017, BCCM, Inc. (“BCCM”), a newly-formed, wholly-owned subsidiary of the Company, completed the acquisition of Blue Clay Capital Management, LLC (“Blue Clay Capital”), an investment management firm based in Minneapolis, Minnesota. In connection with the transaction, BCCM acquired the assets of, and assumed certain liabilities of, Blue Clay Capital in return for payment to Blue Clay Capital of $1.00, subject to adjustment for Blue Clay Capital’s net working capital as of the closing date. The fair value of the assets acquired and liabilities assumed in connection with the transaction are provisional. Gary S. Kohler, a director of the Company, was the sole owner of Blue Clay Capital. In connection with the acquisition, Mr. Kohler entered into an employment agreement with Blue Clay Capital and has served as its Chief Investment Officer in return for an annual salary of $50,000 (reduced to $45,000 after 8/15/19) plus variable compensation based on the management and incentive fees to be paid to the subsidiary by certain of these investment funds and eligibility to participate in discretionary annual bonuses. Mr. Kohler also received a bonus payment of $9,000 in April 2019.

Nick Swenson, Chief Executive Officer and President, is also the majority shareholder of Cadillac Castings, Inc. (“CCI”). On November 8, 2019, the Company made an investment of $2.8 million to purchase a 19.90% ownership stake in CCI. As of March 31, 2020, Mr. Swenson has 69% of ownership interests in CCI.

EXECUTIVE OFFICERS

The current executive officers of the Company are Nick Swenson and Brian Ochocki. Biographical information regarding Mr. Nick Swenson is included in “Proposal 1 – Election of Directors.”

Brian Ochocki – age 52, Mr. Ochocki became the Company’s Chief Financial Officer/Principal Accounting Officer and Treasurer on July 8, 2019. Mr. Ochocki has over twenty years of experience as a results-oriented senior financial executive within multiple industries. From May 2018 until he commenced working with the Company, he was the Chief Financial Officer of Indigo Signworks, Inc., a custom sign manufacturer and installer. Prior to that position, he worked with Holiday Companies for 13 years, most recently as the Vice President of Energy, Logistics, and Transportation from 2016 to 2018, and formerly as the Vice President of Financial Planning and Analysis from 2005 to 2016. Mr. Ochocki previously served in various finance positions at Northwest Airlines, Inc. for seven years, Goldman, Sachs & Co. for two years, and KPMG for five years.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

To the Company’s knowledge, based solely on review of the copies of reports under Section 16(a) of the Securities Exchange Act of 1934 that have been furnished to the Company and written representations that no other reports were required, during the fiscal year ended March 31, 2020 all executive officers, directors and greater than ten-percent beneficial owners have complied with all applicable Section 16(a) filing requirements.

PROPOSAL 2 – ADVISORY VOTE ON EXECUTIVE COMPENSATION

Pursuant to the provisions of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”), the Company is providing stockholders with the opportunity to cast an advisory vote on compensation to the executive officers named in the Summary Compensation Table as reported in this proxy statement. Accordingly, the following resolution will be presented to the stockholders at the annual meeting:

“Resolved, that the stockholders hereby approve, on an advisory basis, the compensation paid to the Company’s named executive officers as disclosed, pursuant to Item 402 of Regulation S-K of the Securities and Exchange Commission, in the Company’s proxy statement for the 2020 annual meeting of stockholders.”

This vote is advisory and nonbinding on the Company. The Board of Directors and the Compensation Committee, which is comprised of a majority of independent directors, expect to take into account the outcome of the vote when considering future executive compensation decisions.

The Company’s named executive officers are those officers listed in the Summary Compensation Table appearing in this proxy statement, who are Nicholas Swenson, Chief Executive Officer, and Brian Ochocki, Chief Financial Officer/Chief Accounting Officer and Treasurer.

The Board of Directors recommends a vote “FOR” the adoption of the resolution approving, on an advisory basis, the compensation paid to the Company’s named executive officers as disclosed in this proxy statement (Item 2 on the enclosed proxy card).

The objectives of the Company’s compensation plan for its executive officers (other than Mr. Nick Swenson) is to offer incentives for superior performance and to provide compensation in amounts and in forms that are sufficient to attract and retain management personnel capable of effectively managing the Company’s businesses. The compensation of Mr. Nick Swenson is, at his request, limited to an annual salary of $50,000. Mr. Nick Swenson does not participate in any bonus or equity compensation plans and also does not participate in any employee benefit plan.

The compensation of the executive officers is determined by the Compensation Committee under authority delegated to it by the Board of Directors. The Compensation Committee consults with the Chief Executive Officer in evaluating and setting the compensation of the other executive officers.

The Company has paid modest levels of compensation. The elements of the total compensation paid to executives, other than Mr. Nick Swenson, under the Company’s policy are:

• base salary,

• annual cash incentive, and

• retirement, health and welfare and other benefits.

Base Salary

Base salaries are not linked to the performance of the Company and are intended to provide the executive officers a relatively secure baseline level of compensation. The Compensation Committee periodically reviews base salary levels and adjusts base salaries as deemed necessary, but not necessarily annually. During the review and adjustment process, the Compensation Committee considers:

• individual performance;

• recommendations of the Chief Executive Officer with respect to the base salaries of other executive officers;

• the duties and responsibilities of each executive officer position;

• their current compensation level;

• the relationship of executive officer pay to the base salaries of senior officers and other employees of the Company; and

• whether the base salary levels are competitive.

At Mr. Nick Swenson’s request, the Compensation Committee set his annual salary rate, which commenced on April 1, 2014, at a below-market rate of $50,000. Mr. Ochocki’s annual salary rate, which commenced July 8, 2019 was $220,000.

Incentive and Bonus Compensation

The named executive officers are eligible to receive annual incentive compensation based on the Company’s overall financial performance and a subjective evaluation of individual performance. At Mr. Nick Swenson’s request, he does not receive any annual incentive compensation. In addition, named executive officers other than Mr. Nick Swenson, are eligible to receive discretionary bonuses from time to time based on individual performance in achieving important Company milestones. Because of the subjective evaluation used in determining this compensation, it is all reported as bonus in the accompanying Summary Compensation Table.

The Company’s former Chief Financial Officer Mr. Reynolds received a warrant to purchase 25,000 shares of Company Common Stock as a condition of his employment. The warrant was issued November 30, 2018 and was scheduled to expire November 30, 2028. All of the shares were forfeited upon Mr. Reynolds’ resignation of employment effective April 12, 2019.

Retirement and Other Benefits

The named executive officers are eligible to participate in certain employee benefit plans sponsored by the Company, which are described below. At his request, Mr. Nick Swenson does not participate in these plans.

The Company sponsors the Air T, Inc. 401(k) Plan (the “401(k) Plan”), a tax-qualified Code Section 401(k) retirement savings plan, for the benefit of substantially all of its employees, including the executive officers. The 401(k) Plan encourages saving for retirement by enabling participants to make contributions on a pre-tax basis and to defer taxation on earnings on funds contributed to the 401(k) Plan. The Company makes matching contributions to the 401(k) Plan. The named executive officers are also eligible to participate in group health, life and other welfare benefit plans on the same terms and conditions that apply to other employees. The named executive officers do not receive better insurance programs, vacation schedules or holidays than other employees of equal employment tenure.

The Company does not maintain any non-qualified deferred compensation plans that would allow executives to elect to defer receipt (and taxation) of their base salaries, bonuses, annual incentive plan payments or other compensation.

EXECUTIVE OFFICER COMPENSATION

Mr. Nick Swenson, Mr. Reynolds and Mr. Ochocki are the only individuals who served as executive officers of the Company during the most recent fiscal year. The following table sets forth a summary of the compensation paid to them during the two most recent fiscal years.

SUMMARY COMPENSATION TABLE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal Position

|

Year

|

Salary ($)

|

Bonus ($)

|

Non-equity Incentive Plan Compensation ($)

|

Change in Pension Value and Non-qualified Deferred Compensation Earnings ($)

|

All Other Compensation ($)

|

Total ($)

|

|

|

|

|

|

|

|

|

|

|

Nicholas Swenson Chief Executive Officer

|

2020

|

50,000

|

250(2)

|

0

|

0

|

0

|

50,250

|

|

|

2019

|

50,000

|

0

|

0

|

0

|

0

|

50,000

|

|

|

|

|

|

|

|

|

|

|

Brian Ochocki(1) Chief Financial Officer

|

2020

|

161,000

|

250(2)

|

0

|

0

|

0

|

161,250

|

|

|

2019

|

--

|

--

|

--

|

--

|

--

|

--

|

|

|

|

|

|

|

|

|

|

|

Brett A. Reynolds(3) Former Chief Financial Officer

|

2020

|

10,000

|

0

|

0

|

0

|

42,000

|

52,000

|

|

|

2019

|

265,000

|

150

|

0

|

0

|

0

|

265,150

|

|

|

|

|

|

|

|

|

|

(1)Mr. Ochocki was appointed Chief Financial Officer of the Company on July 8, 2019.

(2)Represents Christmas bonus payments to Mr. Swenson and Mr. Ochocki.

(3)Mr. Reynolds acted as Chief Financial Officer and Senior Vice President of the Company from May 7, 2018 until April 12, 2019.

Pursuant to the Company’s 2005 Equity Incentive Plan, which provided for the automatic award of options upon a non-employee’s initial election to the Board of Directors, on August 30, 2012 in connection with his election as a director, Mr. Nick Swenson was awarded options to acquire 3,750 shares of common stock. The exercise price of these options is $5.75 per share. The options vested one year after the date of his election and expire 10 years after the date of his election.

The Company’s former Chief Financial Officer Mr. Reynolds received a warrant to purchase 25,000 shares of Company Common Stock as a condition of his employment. The warrant was issued November 30, 2018 and was scheduled to expire November 30, 2028. All of the shares were forfeited upon Mr. Reynolds’ resignation of employment effective April 12, 2019.

OUTSTANDING EQUITY AWARDS AT FISCAL YEAR END TABLE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Option/Warrant Awards(1)

|

|

|

|

|

|

|

|

|

|

Number of Securities Underlying Unexercised Options/Warrants # Exercisable

|

|

Number of Securities Underlying Unexercised Options/Warrants # Unexercisable

|

|

Option/Warrant Exercise Price $

|

|

Option/Warrant Expiration Date

|

|

Nicholas Swenson

|

|

3,750(2)

|

|

—

|

|

5.75

|

|

8/30/2022

|

________________________

(1)All option awards were made under the Company’s 2005 Equity Incentive Plan. Under the terms of the plan, option awards were made without any corresponding transfer of consideration from the recipients.

(2)Stock options vested on August 30, 2013.

Employment Agreement and Retirement Savings Plan

Nicholas Swenson. On March 26, 2014, Nicholas Swenson and the Company entered into an Employment Agreement dated as of March 26, 2014 and effective as of April 1, 2014 providing for the terms of employment of Mr. Nick Swenson as Chief Executive Officer and President. The employment agreement provides that Mr. Nick Swenson’s employment can be terminated by the Company at any time, without advance notice, for any reason or for no reason. The agreement does not provide for any severance payment to Mr. Nick Swenson upon termination of his employment by the Company. The agreement provides for an annual salary of $50,000, commencing on April 1, 2014. The agreement provides that Mr. Nick Swenson will not participate in any bonus or equity compensation arrangement and that Mr. Nick Swenson has declined to participate in any employee benefit plan. The agreement also includes provisions regarding confidentiality, indemnification, and a covenant not to compete for one year following termination of employment.

Brian Ochocki. On June 12, 2019, Brian Ochocki and the Company entered into an Employment Agreement providing for the terms of employment of Mr. Ochocki as the Chief Financial Officer/Principal Accounting Officer and Treasurer. Under the terms of the Agreement, Mr. Ochocki will receive a base salary of $220,000 per year and will be entitled to the Company’s standard package of employee benefits. Mr. Ochocki will be entitled to a one-time $20,000 bonus if he remains employed with the Company at the timely filing of the Company’s Fiscal Year 2020 10-K. Mr. Ochocki will also be entitled to receive annual performance bonus payments, as established by the Company’s Compensation Committee and Chief Executive Officer, with a target discretionary annual performance bonus of 30% of his base salary. If the Company terminates the agreement for any reason other than Cause, Mr. Ochocki is entitled to a severance payment equal to three (3) months of base salary, which amount increases by an additional month on the second anniversary of the of Mr. Ochocki’s employment with the Company, and an additional month for every two years of employment thereafter; provided however, that the severance amount shall not exceed six (6) months. In the event a controlling interest in the Company is sold to an unaffiliated third party, the then-current severance amount shall double if the executive has a material change in duties or is terminated without cause. Unless terminated for cause, this provision remains in effect for a period of two years after any such sale event.

Brett A. Reynolds. On May 7, 2018, Brett Reynolds and the Company entered into an Employment Agreement, providing for the terms of employment of Mr. Brett Reynolds as Senior Vice President and Chief Financial Officer of the Company commencing May 7, 2018. The agreement provided for a base salary of $265,000 per year and annual performance incentive bonuses based on subjective and objective criteria. The agreement also provided for participation in the Company’s standard benefit policies and plan, reimbursement of Company expenses and the warrant described above. Mr. Reynolds resigned his employment with the Company to pursue other opportunities effective April 12, 2019. No severance or other payment was made to Mr. Reynolds upon his resignation and the stock option granted to Mr. Reynolds upon commencement of employment terminated. Mr. Reynolds is subject to customary restrictive covenants following termination including a one-year covenant not to compete.

401(k) Plan. The Company sponsors the Air T, Inc. 401(k) Plan (the “401(k) Plan”), a tax-qualified Internal Revenue Code Section 401(k) retirement savings plan, for the benefit of substantially all of its employees, including its executive officers. The 401(k) Plan encourages saving for retirement by enabling participants to make contributions on a pre-tax basis and to defer taxation on earnings on funds contributed to the 401(k) Plan. Employees are eligible to participate in the 401(k) Plan upon commencement of employment. The Company makes matching contributions to the Plan. Mr. Nick Swenson has declined participation in the 401(k) Plan.

PROPOSAL 3 -- RATIFICATION OF INDEPENDENT REGISTERED

PUBLIC ACCOUNTING FIRM

The Board of Directors recommends that the stockholders ratify the appointment of Deloitte & Touche LLP to serve as the independent registered public accounting firm for the Company and its subsidiary corporations for the fiscal year ending March 31, 2021.

If the stockholders do not ratify this appointment, the Audit Committee will consider other independent registered public accounting firms.

Deloitte & Touche LLP has served as the independent registered public accounting firm for the Company since September 27, 2018. Representatives of Deloitte & Touche LLP are expected to be present at the annual meeting and will have an opportunity to make a statement and will be available to respond to appropriate questions.

BDO USA, LLP served as the Company’s the independent registered public accounting firm for the fiscal years ended March 31, 2018 and 2017. In September 2018, the Audit Committee of the Board of Directors completed a competitive process to assess the appointment of the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2019 in which several firms were invited to submit proposals. As a result of this process and following careful deliberation, on September 27, 2018, the Audit Committee dismissed BDO USA, LLP as the Company’s independent registered public accounting firm, effective as of that same date.

BDO USA, LLP’s reports on the Company’s consolidated financial statements for the fiscal years ended March 31, 2018 and March 31, 2017 did not contain an adverse opinion or disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope or accounting principles. During such fiscal years and the subsequent interim period through September 27, 2018, there were (i) no disagreements with BDO USA, LLP on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of BDO USA, LLP, would have caused BDO USA, LLP to make reference to the subject matter of the disagreement in its report on the Company’s consolidated financial statements, and (ii) no “reportable events” as that term is defined in Item 304(a)(1)(v) of Regulation S-K (“Regulation S-K”) of the U.S. Securities and Exchange Commission.

On September 27, 2018, the Audit Committee approved appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending March 31, 2019. Deloitte & Touche LLP accepted appointment as the Company’s independent registered public accounting firm for the year ending March 31, 2019 on September 27, 2018. During the Company’s fiscal years ended March 31, 2017 and March 31, 2018 and the subsequent interim period preceding Deloitte & Touche LLP’s appointment, neither the Company nor anyone on its behalf consulted Deloitte & Touche LLP regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements, and no written report or oral advice was provided to the Company that Deloitte & Touche LLP concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was the subject of a “disagreement” or “reportable event” (within the meaning of Item 304(a) of Regulation S-K and Item 304(a)(1)(v) of Regulation S-K, respectively)

The Board of Directors recommends a vote “FOR” the proposal to ratify the selection of Deloitte & Touche LLP as independent auditors for the fiscal year ending March 31, 2021 (Item 3 on the enclosed proxy card).

Audit Committee Pre-approval of Auditor Engagements

It is the policy of the Audit Committee that all audit and permitted non-audit services provided to the Company by its independent registered public accounting firm are approved by the Audit Committee in advance. In addition, it is the Company’s practice that any invoices not covered by the annual engagement letter that are subsequently submitted by its independent registered public accounting firm are provided to the Chairman of the Audit Committee for approval prior to payment. The independent auditor, management and the Audit Committee must meet on at least an annual basis to review the plans and scope of the audit and the proposed fees of the independent auditor.

Audit Fees

The following is a summary of the fees for professional services rendered by Deloitte & Touche LLP and BDO USA, LLP for the audit of the Company’s annual financial statements for the fiscal years ended March 31, 2020 and 2019 and fees billed for other services rendered by Deloitte & Touche LLP and BDO USA, LLP during those periods:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deloitte & Touche LLP

|

|

Deloitte & Touche LLP

|

|

BDO USA, LLP

|

|

|

|

2020

|

|

2019

|

|

2019(5)

|

|

Audit Fees(1)

|

|

$886,000

|

|

$642,000

|

|

$636,500

|

|

Audit-Related Fees(2)

|

|

0

|

|

0

|

|

0

|

|

Tax Fees(3)

|

|

24,118

|

|

0

|

|

20,000

|

|

All Other Fees(4)

|

|

0

|

|

0

|

|

0

|

(1)Audit fees consist of fees incurred for professional services rendered for the audit of our annual financial statements and review of the quarterly financial statements that are provided by our independent registered public accounting firm in connection with regulatory filings or engagements.

(2)Audit-related fees relate to professional services rendered that are related to the performance of the audit or review of our financial statements and are not reported under “Audit Fees.” Audit-related fees may include fees associated with the audit of the Company’s retirement savings plan, any acquisition related work and attestations that are required by statute or regulation.

(3)Fees for professional services performed with respect to tax compliance, tax advice and tax planning. This includes preparation of original and amended tax returns for the Company and consolidated subsidiaries, refund claims, payment planning and tax audit assistance.

(4)Fees for other permitted work performed that does not fall within the categories set forth above

(5)Amount previously disclosed for the audit of the Company’s annual financial statements for the fiscal year ended March 31, 2018 was $600,000. Amount updated to represent actual fees for professional services rendered. The increase is mainly attributed to out of scope professional services rendered.

Report of the Audit Committee

The Audit Committee reviews the Company’s financial reporting process on behalf of the Board of Directors. Management has the primary responsibility for the financial statements and the reporting process. The Company’s independent registered public accounting firm is responsible for expressing an opinion on the conformity of the Company’s audited financial statements to generally accepted accounting principles.

In this context, the Audit Committee has reviewed and discussed with management and the independent registered public accounting firm the audited financial statements as of and for the year ended March 31, 2020. The Audit Committee has discussed with the independent registered public accounting firm the matters required to be discussed by Auditing Standard No. 1301, Communications with Audit Committee, as adopted by the Public Company Accounting Oversight Board and currently in effect. In addition, the Audit Committee discussed with the independent registered public accounting firm the written disclosures and letter required by Public Company Accounting Oversight Board Ethics and Independence Rule 3526, Communication with Audit Committees Concerning Independence, regarding the independent registered public accounting firm’s communication with the Audit Committee concerning independence and discussed with them their independence from the Company and its management. The Audit Committee also has considered whether the independent registered public accounting firm’s provision of non-audit services to the Company is compatible with their independence.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended March 31, 2020 for filing with the Securities and Exchange Commission.

June 26, 2020

AUDIT COMMITTEE

Travis Swenson, Chair

Peter McClung

Ray Cabillot

ADDITIONAL INFORMATION

THE COMPANY WILL FURNISH WITHOUT CHARGE TO EACH STOCKHOLDER OF THE COMPANY, AND TO EACH PERSON REPRESENTING THAT AS OF THE RECORD DATE FOR THE MEETING HE OR SHE WAS A BENEFICIAL OWNER OF SHARES ENTITLED TO BE VOTED AT THE MEETING, IF SOLICITED BY WRITTEN REQUEST, A COPY OF THE COMPANY’S 2020 ANNUAL REPORT ON FORM 10-K TO THE SECURITIES AND EXCHANGE COMMISSION, INCLUDING THE FINANCIAL STATEMENTS. SUCH WRITTEN REQUESTS SHOULD BE DIRECTED TO AIR T, INC., 5930 BALSOM RIDGE ROAD, DENVER, NORTH CAROLINA 28037, ATTENTION: CORPORATE SECRETARY.

IN ADDITION, THE COMPANY HAS A DEDICATED WEBSITE AT HTTP://WWW.AIRT.NET/INVESTORS/ANNUAL-MEETING-MATERIALS WHERE IT POSTS ALL ANNUAL MEETING MATERIALS INCLUDING THE ANNUAL REPORT ON FORM 10-K, ANNUAL REPORT AND PROXY STATEMENT.

STOCKHOLDER COMMUNICATIONS

The Board of Directors has established a process for stockholders and other interested parties to communicate with the Board of Directors or a particular director. Such individual may send a letter to Air T, Inc., Attention: Corporate Secretary, 5930 Balsom Ridge Road, Denver, North Carolina 28037. The mailing envelope should contain a clear notation indicating that the enclosed letter is a “Board Communication” or “Director Communication.” All such letters should state whether the intended recipients are all members of the Board or just certain specified individual directors. The Secretary of the Company will circulate the communications (with the exception of commercial solicitations) to the appropriate director or directors. Communications marked “Confidential” will be forwarded unopened.

STOCKHOLDER PROPOSALS AND NOMINATIONS FOR 2021 MEETING

Proposals by stockholders intended to be presented at the 2021 annual meeting of stockholders must be received by the Company’s Corporate Secretary no later than March 21, 2021 in order to be included in the proxy statement and on the proxy card that will be solicited by the Board of Directors in connection with that meeting. The inclusion of any proposal will be subject to applicable rules of the SEC. In addition, the Company’s by-laws establish an advance notice requirement for any proposal of business to be considered at an annual meeting of stockholders, including the nomination of any person for election as director. In general, written notice must be received by the Company’s Corporate Secretary at the Company’s principal executive office, 5930 Balsom Ridge Road, Denver, North Carolina 28037, not less than 90 days nor more than 120 days prior to the first anniversary of the preceding year’s annual meeting and accordingly, to be considered at the 2021 annual meeting of stockholders, proposals must be received by the Corporate Secretary no earlier than April 16, 2021 and no later than May 16, 2021. The written notices must contain specified information concerning the matter to be brought before such meeting and concerning the stockholder proposing such a matter.

Any waiver by the Company of these requirements with respect to the submission of a particular stockholder proposal shall not constitute a waiver with respect to the submission of any other stockholder proposal nor shall it obligate the Company to waive these requirements with respect to future submissions of the stockholder proposal or any other stockholder proposal. Any stockholder desiring a copy of the Company’s by-laws will be furnished one without charge upon written request to the Corporate Secretary at 5930 Balsom Ridge Drive, Denver, North Carolina 28037.

OTHER MATTERS

Individuals appointed as proxies in connection with the annual meeting of stockholders to be held in 2020 will have discretion under applicable SEC rules to vote on any proposal presented at the meeting by a stockholder unless the stockholder gives the Company written notice of the proposal no later than May 28, 2020 and other provisions of the applicable SEC rules are satisfied.

The Board of Directors knows of no other matters that may be presented at the meeting.

AIR T, INC.

July 20, 2020

[Intentionally left blank.]

AIR T, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS TO BE HELD AUGUST 12, 2020 AND PROXY STATEMENT

AUGUST 12, 2020

19337931v2

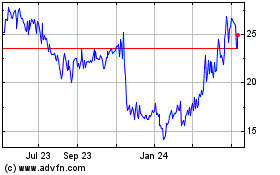

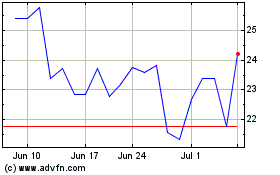

Air T (NASDAQ:AIRT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Air T (NASDAQ:AIRT)

Historical Stock Chart

From Apr 2023 to Apr 2024