Aeterna Zentaris Reports Second Quarter 2018 Financial and Operating Results

August 09 2018 - 4:19PM

Aeterna Zentaris Inc. (NASDAQ:

AEZS) (TSX: AEZS), a

biopharmaceutical company engaged in developing and commercializing

pharmaceutical products, today reported financial and operating

results for the second quarter ended June 30, 2018.

All Amounts are in U.S. Dollars

Recent Key Developments

- The Company’s U.S. and Canadian out-licensing partner,

Strongbridge Biopharma plc (NASDAQ: SBBP) officially launched our

product Macrilen™ (macimorelin) in the United States effective July

23, 2018. Macrilen™ is the first and only FDA-approved oral ghrelin

receptor agonist to be administered in the diagnosis of patients

with adult growth hormone deficiency (AGHD) in the United

States.

- The Company successfully submitted its required response to the

European Medicines Agency (EMA) for the use of macimorelin for the

evaluation of AGHD in July 2018.

- The Company continues to respond to out-licensing and other

commercial partners for other markets globally.

- The Company’s financial condition remains strong with $19.9

million of cash and cash equivalents and

no debt.

Commenting on recent key developments, Michael

V. Ward, President and Chief Executive Officer for Aeterna

Zentaris, stated, "We are very pleased with the continued progress

being made by the Company in achieving our growth strategy of

maximizing the global value of macimorelin. We are also very

pleased with the launch of Macrilen™ in the United States."

Second Quarter Financial

Highlights

- Cash $19.9 million

- Revenues $0.2 million

- Research and Development (“R&D") Costs $1.0

million

- General and Administrative (“G&A") Expenses $2.0

million

- Net loss $2.6 million

The Company will host a conference call to

discuss these results on Friday, August 10, 2018, at 8:30 a.m.,

Eastern Time. Participants may access the conference call by

telephone using the following dial-in numbers:

- Toll-Free: 877-407-8029, Confirmation #13681858

- Toll: 201-689-8029, Confirmation #13681858

A replay of the conference call will also be

available on the Company’s website for a period of 30 days. For

reference, the Management’s Discussion and Analysis of Financial

Condition and Results of Operations for the second quarter 2018, as

well as the Company’s audited consolidated financial statements as

at June 30, 2018, 2017, 2016 and 2015, can be found

at www.zentaris.com in the "Investors" section.

About Aeterna Zentaris Inc.

Aeterna Zentaris Inc. is a biopharmaceutical company focused on

developing and commercializing, principally through out-licensing

arrangements, Macrilen™ (macimorelin), an oral ghrelin receptor

agonist, to be administered in the diagnosis of patients with adult

growth hormone deficiency. Aeterna Zentaris has licensed

Macrilen™ (macimorelin) to Strongbridge Biopharma plc in the United

States and Canada. For more information, visit

www.zentaris.com.

Forward-Looking Statements

This press release contains forward-looking

statements (as defined by applicable securities legislation) made

pursuant to the safe-harbor provision of the U.S. Securities

Litigation Reform Act of 1995, which reflect our current

expectations regarding future events. Forward-looking

statements may include, but are not limited to statements preceded

by, followed by, or that include the words "will," "expects,"

"believes," "intends," "would," "could," "may," "anticipates," and

similar terms that relate to future events, performance, or our

results. Forward-looking statements involve known and unknown

risks and uncertainties, including those discussed in this press

release and in our Annual Report on Form 20-F, under the caption

"Key Information - Risk Factors" filed with the relevant Canadian

securities regulatory authorities in lieu of an annual information

form and with the U.S. Securities and Exchange Commission ("SEC").

Known and unknown risks and uncertainties could cause our actual

results to differ materially from those in forward-looking

statements. Such risks and uncertainties include, among others, our

now heavy dependence on the success of Macrilen™ (macimorelin) and

related out-licensing arrangements and the continued availability

of funds and resources to successfully launch the product, the

ability of Aeterna Zentaris to enter into out-licensing,

development, manufacturing and marketing and distribution

agreements with other pharmaceutical companies and keep such

agreements in effect, reliance on third parties for the

manufacturing and commercialization of our product candidates,

potential disputes with third parties, leading to delays in or

termination of the manufacturing, development, out-licensing or

commercialization of our product candidates, or resulting in

significant litigation or arbitration, and, more generally,

uncertainties related to the regulatory process, our ability to

efficiently commercialize or out-license Macrilen™

(macimorelin), the degree of market acceptance of Macrilen™

(macimorelin), our ability to obtain necessary approvals from the

relevant regulatory authorities to enable us to use the desired

brand names for our products, the impact of securities class action

litigation, the litigation involving two of our former officers,

litigation brought by Cogas Consulting, LLC, or other litigation,

on our cash flow, results of operations and financial position; any

evaluation of potential strategic alternatives to maximize

potential future growth and stakeholder value may not result in any

such alternative being pursued, and even if pursued, may not result

in the anticipated benefits, our ability to take advantage of

business opportunities in the pharmaceutical industry, our ability

to protect our intellectual property, the potential of liability

arising from shareholder lawsuits and general changes in economic

conditions. Investors should consult our quarterly and annual

filings with the Canadian and U.S. securities commissions for

additional information on risks and uncertainties. Given these

uncertainties and risk factors, readers are cautioned not to place

undue reliance on these forward-looking statements. We

disclaim any obligation to update any such factors or to publicly

announce any revisions to any of the forward-looking statements

contained herein to reflect future results, events or developments,

unless required to do so by a governmental authority or applicable

law.

Contacts:

Aeterna Zentaris Inc. James Clavijo Chief Financial Officer

IR@aezsinc.com 843-900-3201

Condensed Interim Consolidated

Statements of Comprehensive Income (Loss)

Information

| |

|

|

|

|

| |

|

Three months endedJune 30, |

|

Six months endedJune 30, |

| (in thousands, except

share and per share data) |

|

2018 |

|

2017 |

|

2018 |

|

2017 |

| |

|

$ |

|

$ |

|

$ |

|

$ |

|

Revenues |

|

|

|

|

|

|

|

|

| Sales commission and

other |

|

79 |

|

|

131 |

|

|

169 |

|

|

284 |

|

| Licensing revenue |

|

89 |

|

|

112 |

|

|

24,657 |

|

|

220 |

|

| Total revenues |

|

168 |

|

|

243 |

|

|

24,826 |

|

|

504 |

|

| |

|

|

|

|

|

|

|

|

| Cost of goods

sold |

|

197 |

|

|

— |

|

|

197 |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

| Research and

development costs |

|

974 |

|

|

3,599 |

|

|

1,807 |

|

|

6,054 |

|

| General and

administrative expenses |

|

2,004 |

|

|

1,874 |

|

|

4,790 |

|

|

3,755 |

|

| Selling expenses |

|

497 |

|

|

1,449 |

|

|

2,138 |

|

|

2,991 |

|

| Total operating

expenses |

|

3,475 |

|

|

6,922 |

|

|

8,735 |

|

|

12,800 |

|

| (Loss) income

from operations |

|

(3,504 |

) |

|

(6,679 |

) |

|

15,894 |

|

|

(12,296 |

) |

| |

|

|

|

|

|

|

|

|

| Gain due to changes in

foreign currency exchange rates |

|

677 |

|

|

196 |

|

|

725 |

|

|

261 |

|

| Change in fair value of

warrant liability |

|

(134 |

) |

|

3,914 |

|

|

1,694 |

|

|

5,317 |

|

| Other finance

income |

|

126 |

|

|

19 |

|

|

144 |

|

|

37 |

|

| Net finance

income |

|

669 |

|

|

4,129 |

|

|

2,563 |

|

|

5,615 |

|

| (Loss) income before

income taxes |

|

(2,835 |

) |

|

(2,550 |

) |

|

18,457 |

|

|

(6,681 |

) |

| Income taxes |

|

233 |

|

|

— |

|

|

(6,635 |

) |

|

— |

|

| Net (loss)

income |

|

(2,602 |

) |

|

(2,550 |

) |

|

11,822 |

|

|

(6,681 |

) |

| Other

comprehensive income (loss): |

|

|

|

|

|

|

|

|

| Items that may be

reclassified subsequently to profit or loss: |

|

|

|

|

|

|

|

|

| Foreign

currency translation adjustments |

|

(28 |

) |

|

(659 |

) |

|

(250 |

) |

|

(792 |

) |

| Items that will not be

reclassified to profit or loss: |

|

|

|

|

|

|

|

|

| Actuarial

gain on defined benefit plans |

|

205 |

|

|

194 |

|

|

205 |

|

|

635 |

|

| Comprehensive

(loss) income |

|

(2,425 |

) |

|

(3,015 |

) |

|

11,777 |

|

|

(6,838 |

) |

| Net (loss)

income per share (basic) |

|

(0.16 |

) |

|

(0.18 |

) |

|

0.72 |

|

|

(0.49 |

) |

| Net (loss)

income per share (diluted) |

|

(0.16 |

) |

|

(0.18 |

) |

|

0.70 |

|

|

(0.49 |

) |

| Weighted

average number of shares outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

16,440,760 |

|

|

14,086,508 |

|

|

16,440,760 |

|

|

13,776,045 |

|

| Diluted |

|

16,440,760 |

|

|

14,086,508 |

|

|

16,489,364 |

|

|

13,776,045 |

|

|

|

Condensed Interim Consolidated Statement of

Financial Position Information

| |

|

|

|

|

| (in thousands, except

share and per share data) |

|

As at June 30, |

|

As at December 31, |

| |

|

2018 |

|

2017 |

| |

|

$ |

|

$ |

| Cash and cash

equivalents |

|

19,946 |

|

7,780 |

| Trade and other

receivables and other current assets |

|

1,367 |

|

958 |

| Inventory |

|

1,397 |

|

643 |

| Restricted cash

equivalents |

|

373 |

|

381 |

| Property, plant and

equipment |

|

75 |

|

101 |

| Deferred tax

assets |

|

— |

|

3,479 |

| Other non-current

assets |

|

8,476 |

|

8,853 |

| Total

assets |

|

31,634 |

|

22,195 |

| Payables and other

current liabilities |

|

2,146 |

|

2,987 |

| Current portion of

deferred revenues |

|

— |

|

486 |

| Warrant liability |

|

2,203 |

|

3,897 |

| Provision for

restructuring costs |

|

566 |

|

2,296 |

| Taxes payable |

|

2,904 |

|

— |

| Non-financial

non-current liabilities |

|

14,305 |

|

15,312 |

| Total

liabilities |

|

22,124 |

|

24,978 |

| Shareholders'

equity (deficiency) |

|

9,510 |

|

(2,783) |

| Total

liabilities and shareholders' equity (deficiency) |

|

31,634 |

|

22,195 |

| |

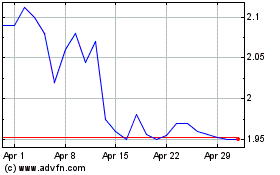

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Mar 2024 to Apr 2024

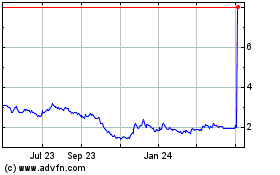

Aeterna Zentaris (NASDAQ:AEZS)

Historical Stock Chart

From Apr 2023 to Apr 2024