Current Report Filing (8-k)

March 05 2021 - 9:47AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 4, 2021

ADVAXIS,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-36138

|

|

02-0563870

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

305

College Road East

Princeton,

New Jersey

|

|

08540

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (609) 452-9813

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

stock, par value $0.001 per share

|

|

ADXS

|

|

Nasdaq

Capital Market

|

|

Preferred

Stock Purchase Right

|

|

-

|

|

Nasdaq

Capital Market

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act

of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

|

Item

5.03

|

Amendments

to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

On

March 4, 2021, the Board of Directors (the “Board”) of Advaxis, Inc. (the “Company”)

approved the Second Amended and Restated By-Laws of the Company, which became effective immediately.

The

Company recently received a stockholder demand letter relating to the Company’s annual meeting of stockholders held on May

4, 2020 (the “2020 Annual Meeting”), which alleged that, under the voting standard generally applicable to

questions brought before a meeting of stockholders, as set forth in the Company’s then current by-laws, broker non-votes

were required to be treated as a vote “against” any such question. Although the Company does not believe that the

interpretation of the then-current by-laws were correct, the Company determined that, in order to avoid any uncertainty and to

avoid the cost and expense of any disputes involving the issue, it would be advisable and in the best interests of the Company

and its stockholders to adopt the Second Amended and Restated By-Laws of the Company in order to clarify the voting standard.

Accordingly,

the Board amended the voting standard generally applicable to questions brought before any meeting of stockholders, as set forth

in the first sentence of Section 5 of the Second Amended and Restated By-Laws. As amended, this sentence reads as follows: “Unless

otherwise required by law, the Certificate of Incorporation or the By-Laws, in all matters other than the election of directors,

the affirmative vote of the majority of shares present in person or represented by proxy at the meeting and entitled to vote on

the subject matter shall be the act of the stockholders.” Because stock subject to a broker non-vote is not entitled to

vote on the questions with respect to which the broker non-vote occurs, the Second Amended and Restated By-Laws make plain that

broker non-votes will have no effect on the outcome of such questions.

The

foregoing description of the Second Amended and Restated By-Laws does not purport to be complete and is qualified entirely by

reference to the full text of the Second Amended and Restated By-Laws, which is attached as Exhibit 3.1 hereto and is incorporated

by reference herein.

Item

8.01

The

Board has also determined that it would be advisable and in the best interests of the Company and its stockholders to re-submit

to the Company’s stockholders for ratification a proposal previously considered at the 2020 Annual Meeting to approve an

amendment to the Company’s 2015 Incentive Plan (the “2020 Plan Amendment”) to increase the total number

of shares of common stock authorized for issuance thereunder from 877,744 shares to 6,000,000 shares. The Company will file a

preliminary and definitive proxy statement on Schedule 14A in connection with the solicitation of proxies for the Company’s

2021 Annual Meeting of Stockholders (the “2021 Annual Meeting”), to be called for, among other items,

the purpose of considering the ratification and approval of the 2020 Plan Amendment (the “Plan Amendment Ratification

Proposal”).

If

the Plan Amendment Ratification Proposal is not approved by the affirmative vote of the majority of shares present in person or

represented by proxy at the Company’s 2021 Annual Meeting and entitled to vote on the subject matter, the 2020 Plan Amendment

will be deemed to have not been approved by our stockholders at the 2020 Annual Meeting. In such case, the 2020 Plan Amendment

will be considered void and the total number of shares of common stock authorized for issuance under the 2015 Incentive Plan will

revert back to 877,744 shares, thereby requiring the Company to rescind any awards granted pursuant to the 2015 Incentive Plan

that would cause the number of shares of common stock issued under the 2015 Incentive Plan to exceed the 877,744 share limitation.

|

Item

9.01

|

Financial

Statements and Exhibits

|

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

March

5, 2021

|

ADVAXIS,

INC.

|

|

|

|

|

|

|

By:

|

/s/

Kenneth A. Berlin

|

|

|

Name:

|

Kenneth

A. Berlin

|

|

|

Title:

|

Chief

Executive Officer

|

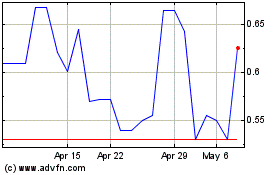

Ayala Pharmaceuticals (QX) (USOTC:ADXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ayala Pharmaceuticals (QX) (USOTC:ADXS)

Historical Stock Chart

From Apr 2023 to Apr 2024