Current Report Filing (8-k)

October 08 2020 - 7:01AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 6, 2020

ADVAXIS,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-36138

|

|

02-0563870

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

305

College Road East

Princeton,

New Jersey

|

|

08540

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (609) 452-9813

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

stock, par value $0.001 per share

|

|

ADXS

|

|

Nasdaq

Global Select Market

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act

of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company [ ]

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Item

1.02 Termination of a Material Definitive Agreement.

On

October 6, 2020, Advaxis, Inc. (the “Company”) received a notice (the “Notice”) from Aratana Therapeutics,

Inc. (“Aratana”), dated September 17, 2020, indicating that Aratana is terminating the Exclusive License Agreement,

dated March 19, 2014, by and between Aratana and the Company (the “Agreement”) and that such termination of the Agreement

will be effective on December 21, 2020. Other than in respect of the Agreement, there is no material relationship between the

Company and Aratana.

Under

the Agreement, the Company granted Aratana an exclusive, worldwide, royalty-bearing license, with the right to sublicense, certain

of the Company’s proprietary technology to enable Aratana to develop and commercialize animal health products targeted for

treatment of osteosarcoma and other cancer indications in animals. Aratana paid an upfront payment to the Company in the amount

of $1 million upon signing of the Aratana Agreement. The Agreement also required Aratana to pay the Company (a) up to $36.5

million based on the achievement of milestones relating to the advancement of products through the approval process with the United

States Department of Agriculture in the United States and the relevant regulatory authorities in the European Union, and up to

an additional $15 million in cumulative sales milestones based on achievement of gross sales revenue targets for sales of any

and all products for use in non-human animal health applications, or the Aratana Field (regardless of therapeutic area), and (b)

tiered royalties starting at 5% and going up to 10%, paid based on net sales of any and all products (regardless of therapeutic

area) in the Aratana Field in the United States. The Agreement required royalties for sales of products outside of the United

States to be paid at a rate equal to half of the royalty rate payable by Aratana on net sales of products in the United States

(starting at 2.5% and going up to 5%). The Agreement also required Aratana to pay the Company 50% of all sublicense royalties

received by Aratana and its affiliates. In fiscal year 2019, the Company received approximately $8,000 in royalty revenue from

Aratana.

The

Notice of termination follows Aratana’s acquisition by Elanco Animal Health Incorporated, effective July 18, 2019.

The

Company will not incur any early termination penalties as a result of the termination. Aratana will be required to make all payments

to the Company that would have otherwise been payable under the Agreement through the effective date of the termination.

The

foregoing summary of the material terms of the Agreement is qualified in its entirety by the complete terms and conditions of

the Agreement, filed with the Securities and Exchange Commission on June 10, 2014 as Exhibit 10.1 to the Company’s Quarterly

Report on Form 10-Q.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

October

8, 2020

|

ADVAXIS,

INC.

|

|

|

|

|

|

|

By:

|

/s/

Kenneth A. Berlin

|

|

|

Name:

|

Kenneth

A. Berlin

|

|

|

Title:

|

President

and Chief Executive Officer

|

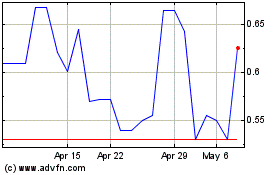

Ayala Pharmaceuticals (QX) (USOTC:ADXS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ayala Pharmaceuticals (QX) (USOTC:ADXS)

Historical Stock Chart

From Apr 2023 to Apr 2024