Stocks Waver Ahead of Fed Decision

October 30 2019 - 10:02AM

Dow Jones News

By Will Horner

Global stocks wavered amid a raft of major corporate earnings

Wednesday as investors also awaited the Federal Reserve's decision

on interest rates.

The Dow Jones Industrial Average traded up 6 points in early New

York trading, while the S&P 500 and the Nasdaq Composite added

less than 0.1%.

General Electric raised its cash-flow outlook for the year,

sending its shares more than 8% higher in premarket trading.

Johnson & Johnson shares rose 2.8% off hours after it said

Tuesday that a test of its baby powder didn't find traces of

asbestos, rebutting U.S. regulators' claims about the product.

Stryker dropped 3.2% after mounting expenses led to a drop in

the medical-device maker's earnings. Advanced Micro Devices fell

1.4%. The chip maker issued a forecast for the current quarter late

Tuesday that was slightly lower than expected.

A raft of major U.S. companies, including Apple, Facebook, Lyft

and Starbucks, are poised to report through the day. There is also

widespread expectation that the central bank will cut interest

rates by a quarter of a percentage point after markets close.

While many investors see the 0.25% rate cut as a foregone

conclusion, they will look closely to see how the central bank

frames the cut and what signals Chairman Jerome Powell provides

about monetary policy, according to Geoffrey Yu, head of the U.K.

office of UBS's investment arm.

"The market is looking for signs about how committed the Fed is

to support policy further," Mr. Yu said. "Everybody knows the Fed

has room to lower rates further, the question is how willing are

they?"

Meanwhile, the pan-continental Stoxx Europe 600 index was also

mostly flat, with some of the region's biggest banks posting

declines.

Shares of troubled German lender Deutsche Bank fell 5.7%, their

biggest drop since December, after it said efforts to overhaul its

global operations had taken a large chunk out of its revenue. Banco

Santander declined 5% as third-quarter profit fell 75%.

Fiat Chrysler Automobiles and Peugeot maker PSA Group surged

after the companies confirmed they were discussing a merger that

would create the world's fourth-largest auto maker by volume. Fiat

shares rose 9.5% in Milan and PSA gained 5.4%. Rival Renault, which

had previously received an offer to combine its operations with

Fiat, slumped 4.7%.

In the U.K., major stock indexes slipped after lawmakers agreed

to hold an early election on Dec. 12 in an attempt to break the

stalemate over Brexit. The FTSE 250 gauge slipped 0.4%, while the

yield on U.K. government bonds fell to 0.696%. Bond yields fall as

prices rise. The British pound ticked up 0.2%.

In Asia, the Shanghai Composite Index fell 0.5%, while Japan's

Nikkei 225 gauge dropped 0.6%.

(END) Dow Jones Newswires

October 30, 2019 09:47 ET (13:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

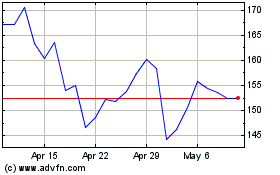

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Apr 2023 to Apr 2024