Chip Stocks Are Back on the Menu

September 24 2019 - 4:28PM

Dow Jones News

By Paul Vigna

Apple Inc.'s new iPhone, sure to be a welcome present for kids

and parents this holiday season, also could potentially be a gift

for semiconductor stocks too.

Revenue and billings at two key companies, Taiwan Semiconductor

Manufacturing Co. and United Microelectronics Corp., appear to have

turned a corner in the past few months. That may in turn end up

being a signal to the entire industry.

While the Philadelphia Semiconductor Index is up 12% from a year

ago, a number of stocks haven't fared as well. ADRs of Taiwan

Semiconductor have dropped 1.3% over the past 12 months, while ADRs

of United Micro are off 16%, shares of Nvidia Corp. are down 35%

and Advanced Micro Devices Inc. has fallen 8.7%.

Semiconductor chips are a staple, in everything from teddy bears

to the International Space Station. But the industry is still tied

to economic winds. Chip makers have been struggling with the crash

of the cryptocurrency sector in 2018, a weak global economy and the

Trump-sparked trade war between the U.S. and China.

Through July, global semiconductor sales were down 16% from a

year ago, according to the Semiconductor Industry Association.

While orders related to the new iPhone are an obvious boon for

the industry, they may also be a sign that a long downturn in chip

orders may be bottoming out, said Andrew Zatlin, an independent

analyst who runs a firm called SouthBay Research in San Mateo,

Calif.

In a July conference call, United Micro projected that wafer

shipments in the third quarter would rise 2% to 4%. Taiwan

Semiconductor, in its July conference call, projected that

sequentially, third quarter revenue would rise 18%.

Part of that is because of Apple's latest iPhone, and the

upcoming holiday season. "But that is soaking up excess inventory,"

Mr. Zatlin said. Because chip inventories across the industry tend

to be lean to begin with, if existing inventory is being used on

the iPhone, more chips will be needed for everything else.

United Micro and Taiwan Semiconductor are "great" barometers of

demand, Mr. Zatlin said. The kinds of chips they make,

microprocessors, aren't variable, like, for example, memory chips.

Microprocessors go into every device, so if orders for

microprocessors are rising, sales of devices must be, too.

"A bottom has been reached and demand is set to rise," he said,

something that will likely show up in the global supply chain in

the first quarter of next year.

Write to Paul Vigna at paul.vigna@wsj.com

(END) Dow Jones Newswires

September 24, 2019 16:13 ET (20:13 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

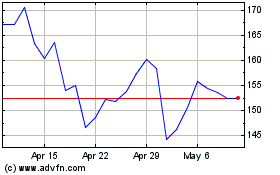

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Apr 2023 to Apr 2024