Statement of Beneficial Ownership (sc 13d)

February 04 2022 - 8:31AM

Edgar (US Regulatory)

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

SCHEDULE 13D

|

|

|

INFORMATION TO BE INCLUDED IN STATEMENTS FILED PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

RULE 13d-2(a)

|

|

|

|

Under the Securities Exchange Act of 1934

|

|

(Amendment No. __)*

|

|

|

|

ADMA Biologics,

Inc.

|

|

(Name of Issuer)

|

|

|

|

Common Stock, par

value $0.0001 per share

|

|

(Title of Class of Securities)

|

|

|

|

000899104

|

|

(CUSIP Number)

|

|

|

|

David Johnson

|

|

Caligan Partners LP

|

|

590 Madison Avenue

|

|

New York, NY 10022

|

|

(646) 859-8204

|

|

|

|

Eleazer Klein, Esq.

|

|

Adriana Schwartz, Esq.

|

|

Schulte Roth & Zabel LLP

|

|

919 Third Avenue

|

|

New York, NY 10022

|

|

(212) 756-2000

|

|

(Name, Address and Telephone Number of Person

|

|

Authorized to Receive Notices and Communications)

|

|

|

|

February 3, 2022

|

|

(Date of Event Which Requires Filing of This Statement)

|

|

|

If the filing person has previously filed a statement on Schedule 13G to

report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or

Rule 13d-1(g), check the following box. [ ]

(Page 1 of 7 Pages)

______________________________

* The remainder of this cover page shall be filled out for a reporting

person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing

information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall

not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however,

see the Notes).

|

CUSIP No. 000899104

|

SCHEDULE 13D

|

Page 2 of 7 Pages

|

|

1

|

NAME OF REPORTING PERSON

Caligan Partners LP

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

10,893,237 shares of Common Stock

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

10,893,237 shares of Common Stock

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

10,893,237 shares of Common Stock

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.6%

|

|

14

|

TYPE OF REPORTING PERSON

IA, PN

|

|

|

|

|

|

|

|

CUSIP No. 000899104

|

SCHEDULE 13D

|

Page 3 of 7 Pages

|

|

1

|

NAME OF REPORTING PERSON

David Johnson

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨ (b) x

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

AF

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

-0-

|

|

8

|

SHARED VOTING POWER

10,893,237 shares of Common Stock

|

|

9

|

SOLE DISPOSITIVE POWER

-0-

|

|

10

|

SHARED DISPOSITIVE POWER

10,893,237 shares of Common Stock

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

10,893,237 shares of Common Stock

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

5.6%

|

|

14

|

TYPE OF REPORTING PERSON

IN

|

|

|

|

|

|

|

|

CUSIP No. 000899104

|

SCHEDULE 13D

|

Page 4 of 7 Pages

|

|

Item 1.

|

SECURITY AND ISSUER

|

|

|

|

|

|

This statement on Schedule 13D (the “Schedule 13D”) relates to the shares of the Common Stock, par value $0.0001 per share (the “Common Stock”), of ADMA Biologics, Inc., a Delaware corporation (the “Issuer”). The Issuer’s principal executive offices are located at 465 State Route 17, Ramsey, New Jersey 07446.

|

|

Item 2.

|

IDENTITY AND BACKGROUND

|

|

(a)

|

This statement is filed by:

|

|

|

|

|

|

(i) Caligan Partners LP, a Delaware limited partnership (“Caligan”), which serves indirectly as the investment manager to Caligan Partners Master Fund LP, a Cayman Islands limited partnership (the “Caligan Fund”), and managed accounts (the “Caligan Accounts”), with respect to the shares of Common Stock held by the Caligan Fund and the Caligan Accounts; and

|

|

|

|

|

|

(ii) David Johnson, the Partner of Caligan and Managing

Member of Caligan Partners GP LLC, the general partner of Caligan (“Mr. Johnson”, together with Caligan and Caligan

Partners GP, LLC, the “Caligan Parties”), with respect to the shares of Common Stock held by the Caligan Fund and the

Caligan Accounts.

|

|

|

Each of the foregoing is referred to as a “Reporting Person” and collectively as the “Reporting Persons.”

|

|

|

|

|

(b)

|

The principal business address of each of the Caligan Parties is 590 Madison Avenue, New York, New York 10022.

|

|

|

|

|

(c)

|

The principal business of each of the Caligan Parties is investment management.

|

|

|

|

|

(d)

|

During the last five years, none of the Caligan Parties have been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

|

|

|

|

|

(e)

|

During the last five years, none of the Caligan Parties have been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and, as a result of such proceeding, was, or is subject to, a judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, Federal or State securities laws or finding any violation with respect to such laws.

|

|

|

|

|

(f)

|

Caligan is a Delaware limited partnership. Mr. Johnson is a United States citizen. Caligan Partners GP LLC is a Delaware limited liability company.

|

|

Item 3.

|

SOURCE AND AMOUNT OF FUNDS OR OTHER CONSIDERATION

|

|

|

|

|

|

The Reporting Persons used a total of approximately $14,126,851.78 (excluding brokerage commissions) to acquire the Common Stock reported herein. The source of the funds used to acquire the Common Stock reported herein was the working capital of the Caligan Fund and the Caligan Accounts.

|

|

CUSIP No. 000899104

|

SCHEDULE 13D

|

Page 5 of 7 Pages

|

|

Item 4.

|

PURPOSE OF TRANSACTION

|

|

|

|

|

|

The Reporting Persons believe the securities of the Issuer are undervalued and represent an attractive investment opportunity. The Reporting Persons may consider, explore and/or develop plans and/or make proposals (whether preliminary or firm) with respect to, among other things, potential changes in, the Issuer’s operations, management, organizational documents, the composition of the board of directors of the Issuer (the “Board”), ownership, capital or corporate structure, dividend policy, and strategy and plans of the Issuer, as well as a potential strategic review or sale process involving the Issuer or certain of the Issuer’s businesses or assets, including transactions in which the Reporting Persons may seek to participate and potentially engage in. The Reporting Persons intend to communicate with the Issuer’s management and Board about a broad range of operational and strategic matters (including the matters set forth above) and to communicate with other shareholders or third parties, including potential acquirers, service providers and financing sources regarding the foregoing. The Reporting Persons may exchange information with any such persons pursuant to appropriate confidentiality or similar agreements which may include customary standstill provisions. They may also take steps to explore and prepare for various plans and actions, and propose transactions, before forming an intention to engage in such plans or actions or proceed with such transactions.

|

|

|

|

|

|

The Reporting Persons intend to review their investment in the Issuer on a continuing basis and depending upon various factors, including without limitation, the Issuer’s financial position and strategic direction, the outcome of any discussions referenced above, overall market conditions, other available investment opportunities, and the availability of securities of the Issuer at prices that would make the purchase or sale of such securities desirable, the Reporting Persons may endeavor (i) to increase or decrease their position in the Issuer through, among other things, the purchase or sale of Common Stock and/or other equity, debt, derivative securities or other instruments that are convertible into Common Stock, or are based upon or relate to the value of the Common Stock or the Issuer (collectively, the “Securities”) on the open market or in private transactions, including through a trading plan created under Rule 10b5-1(c) or otherwise, on such terms and at such times as the Reporting Persons may deem advisable and/or (ii) to enter into transactions that increase or hedge its economic exposure to the Common Stock or other Securities without affecting their beneficial ownership of the shares of Common Stock or other Securities. In addition, the Reporting Persons may, at any time and from time to time, (i) review or reconsider its position and/or change its purpose and/or formulate plans or proposals with respect thereto and (ii) propose or consider one or more of the actions described in subparagraphs (a) - (j) of Item 4 of Schedule 13D.

|

|

CUSIP No. 000899104

|

SCHEDULE 13D

|

Page 6 of 7 Pages

|

|

Item 5.

|

INTEREST IN SECURITIES OF THE ISSUER

|

|

|

|

|

(a)

|

See rows (11) and (13) of the cover pages to this Schedule 13D for the aggregate number of and percentages of the shares of Common Stock beneficially owned by each Reporting Person. The percentages set forth in this Schedule 13D are based upon 195,813,817 shares of Common Stock outstanding as of November 5, 2021, as reported in the Issuer’s Quarterly Report on Form 10-Q for the quarterly period ended September 30, 2021 filed with the Securities and Exchange Commission on November 10, 2021.

|

|

|

|

|

(b)

|

See rows (7) through (10) of the cover pages to this Schedule 13D for the number of shares of Common Stock as to which each Reporting Person has the sole or shared power to vote or direct the vote and sole or shared power to dispose or to direct the disposition.

|

|

|

|

|

(c)

|

Information concerning transactions in the shares of Common Stock reported herein effected during the past sixty (60) days is set forth in Annex A, which is attached hereto and is incorporated herein by reference. All of the transactions in the shares of Common Stock listed therein were effected in the open market through various brokerage entities.

|

|

|

|

|

(d)

|

No person (other than the Reporting Persons, the Caligan Fund and the Caligan Accounts) is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the shares of Common Stock reported herein.

|

|

|

|

|

(e)

|

Not applicable.

|

|

Item 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

|

|

|

|

|

|

The Reporting Persons are parties to an agreement

with respect to the joint filing of this Schedule 13D and any amendments thereto. A copy of such agreement is attached as Exhibit A

to this Schedule 13D and is incorporated by reference herein.

Other than the joint filing agreement, there are no

contracts, arrangements, understandings or relationship among the Reporting Persons or between the Reporting Persons and any other person

with respect to the Securities of the Issuer.

|

|

Item 7.

|

MATERIAL TO BE FILED AS EXHIBITS

|

|

|

|

|

Exhibit A:

|

Joint Filing Agreement

|

|

CUSIP No. 000899104

|

SCHEDULE 13D

|

Page 7 of 7 Pages

|

SIGNATURES

After reasonable inquiry and to the best of his

or its knowledge and belief, the undersigned certifies that the information set forth in this statement is true, complete and correct.

Dated: February 4, 2022

|

|

CALIGAN PARTNERS LP

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ David Johnson

|

|

|

Name:

|

David Johnson

|

|

|

Title:

|

Partner

|

|

|

|

|

|

|

|

|

/s/ David Johnson

|

|

|

DAVID JOHNSON

|

|

|

|

Annex A

Transactions in the Shares of Common Stock of the

Issuer During the Past Sixty (60) Days

The following tables set forth all transactions in

the shares of Common Stock reported herein effected in the past sixty (60) days. Except as noted below, all such transactions were effected

by the Reporting Persons in the open market through brokers and the price per share excludes commissions.

|

Trade Date

|

Shares Purchased (Sold)

|

Price Per Share ($)

|

|

|

|

|

|

1/31/2022

|

375,397

|

1.43

|

|

2/1/2022

|

829,537

|

1.58

|

|

2/2/2022

|

530,470

|

1.58

|

|

2/3/2022

|

1,736,035

|

1.54

|

EXHIBIT A

Joint Filing Agreement

PURSUANT TO RULE 13d-1(k)

The undersigned acknowledge and

agree that the foregoing statement on Schedule 13D is filed on behalf of each of the undersigned and that all subsequent amendments to

this statement on Schedule 13D may be filed on behalf of each of the undersigned without the necessity of filing additional joint filing

agreements. The undersigned acknowledge that each shall be responsible for the timely filing of such amendments, and for the completeness

and accuracy of the information concerning him, her or it contained herein and therein, but shall not be responsible for the completeness

and accuracy of the information concerning the others, except to the extent that he, she or it knows that such information is inaccurate.

Dated: February 4, 2022

|

|

CALIGAN PARTNERS LP

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ David Johnson

|

|

|

Name:

|

David Johnson

|

|

|

Title:

|

Partner

|

|

|

|

|

|

|

|

|

/s/ David Johnson

|

|

|

DAVID JOHNSON

|

|

|

|

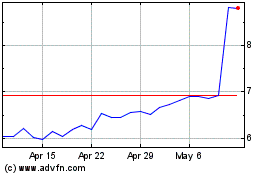

Adma Biologics (NASDAQ:ADMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

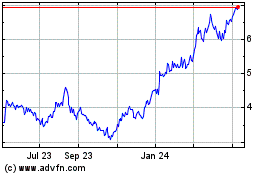

Adma Biologics (NASDAQ:ADMA)

Historical Stock Chart

From Apr 2023 to Apr 2024