ADMA Biologics, Inc. (Nasdaq: ADMA) (“ADMA” or the “Company”), an

end-to-end commercial biopharmaceutical company dedicated to

manufacturing, marketing and developing specialty plasma-derived

biologics, today announced an amendment to its existing senior

secured term loan with Perceptive Advisors (“Perceptive”), which

provides for an additional loan tranche of $15 million, increasing

the total size of the credit facility to $100 million.

The amended terms for the existing $85 million credit facility

additionally provide for, among other things, a two-year extension

of the interest only period through the duration of the credit

facility now maturing in March 2024, at an unchanged borrowing rate

of 11%. The newly issued loan tranche of $15 million

from Perceptive was fully drawn and used to pay the remaining

obligations under the Biotest AG subordinated note entered into in

June of 2017, at a 7% mutually agreed discount with no associated

prepayment penalties. This additional loan tranche carries the same

terms as the amended senior secured loans. There were no

modifications made to the existing revenue covenants of the credit

facility with Perceptive.

“This upsized loan amendment demonstrates Perceptive’s long-term

view for the plasma industry and ADMA’s important role as a

reliable producer of plasma-derived biologics,” said Joseph

Edelman, Chief Executive Officer and Founder of Perceptive

Advisors. “We remain committed to supporting ADMA’s business and

unlocking shareholder value that we believe has yet to be realized.

We are optimistic that the asset value of manufactured plasma and

plasma collection centers will continue to appreciate into the

future.”

“This amendment to our senior secured term loan, with its

increased size and extended maturities, strengthens our long-term

capital position and allows us to continue to execute on our

strategic priorities, including supply chain enhancement

initiatives and plasma center expansion, in addition to generating

considerable near-term and ongoing revenue growth,” stated Adam

Grossman, President and Chief Executive Officer of ADMA. “Despite

ongoing COVID-19 headwinds, we remain on track to achieve our

previously provided guidance for topline revenues of $250 million

or greater by 2024, and we are confident that we are

well-positioned to achieve profitability prior to the new 2024

maturity date of the loan. The continued support from Perceptive,

who remains our largest equity holder, is a testament to the

shareholder value that we believe will be created as we execute on

these corporate objectives and establish ADMA as the only fully

integrated American plasma fractionator.”

“Perceptive is pleased to provide additional capital to support

ADMA’s near-term revenue and profitability growth strategy,” stated

Sam Chawla, Portfolio Manager at Perceptive. “The Company has made

significant progress and has met all of our goals and objectives to

date. We look forward to seeing ADMA’s continued progress and

supporting the Company’s mission and value creating business

objectives, focused on improving healthcare options for patients at

risk of infectious diseases.”

The Perceptive credit amendment has an interest-only term with a

maturity date of March 1, 2024. Borrowings under the Perceptive

credit agreement bear interest at a rate per annum equal to 7.5%

plus the greater of one-month LIBOR and 3.5%. ADMA will also issue

a warrant to Perceptive to purchase 2,390,000 shares of the

Company’s common stock at the lower of ADMA’s closing share price

on the date of the amendment and the 10-day VWAP ahead of

closing.

The debt financing disclosed in this press release is not all

inclusive and, as such, the statements in this press release are

qualified in their entirety by reference to the description of the

debt financing transaction and corresponding exhibits, which are

included in a Current Report on Form 8-K filed concurrently with

this press release by ADMA with the Securities and Exchange

Commission.

About Perceptive Advisors

(Perceptive)

Founded in 1999, Perceptive Advisors is a leading healthcare

focused investment firm with over $8.5 billion of regulatory assets

under management as of October 29, 2020. Since inception,

Perceptive Advisors has focused on supporting progress in the life

sciences industry by identifying opportunities and directing

financial resources toward the most promising technologies in

modern healthcare. For more information about Perceptive,

visit www.perceptivelife.com.

About ADMA Biologics, Inc. (ADMA)

ADMA Biologics is an end-to-end American commercial

biopharmaceutical company dedicated to manufacturing, marketing and

developing specialty plasma-derived biologics for the treatment of

immunodeficient patients at risk for infection and others at risk

for certain infectious diseases. ADMA currently manufactures and

markets three United States Food and Drug Administration (FDA)

approved plasma-derived biologics for the treatment of immune

deficiencies and the prevention of certain infectious diseases:

BIVIGAM® (immune globulin intravenous, human) for the treatment of

primary humoral immunodeficiency (PI); ASCENIV™ (immune globulin

intravenous, human – slra 10% liquid) for the treatment of PI; and

NABI-HB® (hepatitis B immune globulin, human) to provide enhanced

immunity against the hepatitis B virus. ADMA manufactures its

immune globulin products at its FDA-licensed plasma fractionation

and purification facility located in Boca Raton, Florida. Through

its ADMA BioCenters subsidiary, ADMA also operates as an

FDA-approved source plasma collector in the U.S., which provides a

portion of its blood plasma for the manufacture of its products.

ADMA’s mission is to manufacture, market and develop specialty

plasma-derived, human immune globulins targeted to niche patient

populations for the treatment and prevention of certain infectious

diseases and management of immune compromised patient populations

who suffer from an underlying immune deficiency, or who may be

immune compromised for other medical reasons. ADMA has received

U.S. Patents: 9,107,906, 9,714,283, 9,815,886, 9,969,793 and

10,259,865 related to certain aspects of its products and product

candidates. For more information, please visit

www.admabiologics.com.

Cautionary Note Regarding Forward-Looking

StatementsThis press release contains “forward-looking

statements” pursuant to the safe harbor provisions of the Private

Securities Litigation Reform Act of 1995, about ADMA Biologics,

Inc. (“we,” “our” or the “Company”). Forward-looking statements

include, without limitation, any statement that may predict,

forecast, indicate, or imply future results, performance or

achievements, and may contain such words as “estimate,” “project,”

“intend,” “forecast,” “target,” “anticipate,” “plan,” “planning,”

“expect,” “believe,” “will,” “should,” “could,” “would,” “may,” or,

in each case, their negative, or words or expressions of similar

meaning. These forward-looking statements also include, but are not

limited to, statements about ADMA’s future results of operations;

timing of revenue and profitability; execution of corporate

objectives and achievement of goals; realization of shareholder

value; and future appreciation of the asset value of manufactured

plasma and plasma collection centers. Actual events or results may

differ materially from those described in this document due to a

number of important factors. Current and prospective security

holders are cautioned that there also can be no assurance that the

forward-looking statements included in this press release will

prove to be accurate. Except to the extent required by applicable

laws or rules, ADMA does not undertake any obligation to update any

forward-looking statements or to announce revisions to any of the

forward-looking statements. Forward-looking statements are subject

to many risks, uncertainties and other factors that could cause our

actual results, and the timing of certain events, to differ

materially from any future results expressed or implied by the

forward-looking statements, including, but not limited to, the

risks and uncertainties described in our filings with the U.S.

Securities and Exchange Commission, including our most recent

reports on Form 10-K, 10-Q and 8-K, and any amendments thereto.

COMPANY

CONTACT: Skyler BloomDirector,

Investor Relations and Corporate Strategy | 201-478-5552 |

sbloom@admabio.com

INVESTOR RELATIONS CONTACT:Sam

MartinManaging Director, Argot Partners | 212-600-1902 |

sam@argotpartners.com

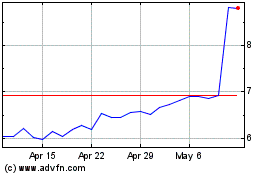

Adma Biologics (NASDAQ:ADMA)

Historical Stock Chart

From Mar 2024 to Apr 2024

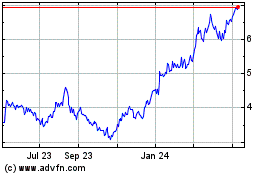

Adma Biologics (NASDAQ:ADMA)

Historical Stock Chart

From Apr 2023 to Apr 2024