This prospectus relates to the resale from time

to time of up to 1,666,668 shares of Adial Pharmaceuticals, Inc. common stock, par value $0.001 per share, by the selling stockholders

identified in this prospectus or in supplements to this prospectus or its transferees. The shares offered for resale consist of an

aggregate of 166,668 shares of common stock that were purchased by the selling stockholders on July 6, 2021 in a private placement transaction

pursuant to the terms of securities purchase agreements, dated July 6, 2021, we entered into with each of the selling stockholders, as

investors in such private placement transaction (collectively, the “Securities Purchase Agreements”), and an aggregate of

1,500,000 shares that the selling stockholders have committed to purchase and that will be issued and sold to them in a second tranche

of purchases under the Securities Purchase Agreements, which second tranche purchase will occur on the second business day following the

effective date of the registration statement of which this prospectus forms a part. We are filing the registration statement on Form S-3,

of which this prospectus forms a part, to fulfill our contractual obligations with the selling stockholders to provide for the resale

by the selling stockholders of all of the shares of common stock that have been and will be purchased by them in both tranches of purchases

in the private placement transaction pursuant to the Securities Purchase Agreements. See “Selling Stockholders” beginning

on page 12 of this prospectus for more information about the selling stockholders. The registration of the shares of common stock to

which this prospectus relates does not require the selling stockholders to sell any of its shares of our common stock.

We are not offering any shares of common stock

under this prospectus and will not receive any proceeds from the sale or other disposition of the shares covered hereby; however, we have

received an aggregate of $500,002 from the sale of an aggregate of 166,668 shares that the selling stockholders have purchased in the

first tranche purchase under the Securities Purchase Agreements, and we expect to receive an additional aggregate amount of $4,500,000

from the sale of an aggregate of 1,500,000 additional shares that the selling stockholders are committed to purchase in the second tranche

purchase under the Securities Purchase Agreements on the second business day following the effective date of the registration statement

of which this prospectus forms a part.

The selling stockholders may from time to time

sell, transfer or otherwise dispose of any or all of their shares of common stock in a number of different ways at fixed prices, at prevailing

market prices at the time of the sale, at varying prices determined at the time of sale or at negotiated prices, as described in more

detail in this prospectus. We will bear all costs, expenses and fees in connection with the registration of the shares of common stock

included in this prospectus. The selling stockholders will pay or assume discounts, commissions, fees of underwriters, selling brokers

or dealer managers and similar expenses, if any, incurred for the sale of shares of our common stock included in this prospectus. For

more information, see “Plan of Distribution” beginning on page 21 of this prospectus for more information about how the selling

stockholders may sell their shares of common stock.

No underwriter or other person has been engaged

to facilitate the sale of the shares of common stock in this offering. The selling stockholders, individually but not severally, and any

broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning

of the Securities Act of 1933, as amended (the “Securities Act”), and any commission paid, or any discounts or concessions

allowed to, any such broker-dealer may be deemed to be underwriting commissions or discounts under the Securities Act.

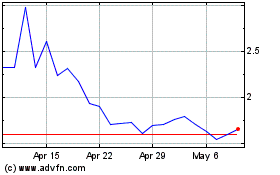

Our common stock is listed on the Nasdaq Capital

Market under the symbol “ADIL.” Our warrants that we issued in our initial public offering are listed on the Nasdaq Capital

Market under the symbol “ADILW.” On July 15, 2021, the last reported sale price of our common stock and our warrants on the

Nasdaq Capital Market was $2.49 per share and $0.77 per warrant, respectively.

We are an “emerging growth company”

as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and, as such, elect to comply with

certain reduced public company reporting requirements for future filings.

PROSPECTUS SUMMARY

This summary highlights some information

about us and selected information contained elsewhere in this prospectus and in the documents we incorporate by reference. This

summary does not contain all of the information you should consider before investing in our common stock. You should read this

entire prospectus and the documents incorporated by reference carefully, especially the risks of investing in our common stock

discussed under and incorporated by reference in “Risk Factors” on page 8 of this prospectus, along with our

consolidated financial statements and notes to those consolidated financial statements and the other information incorporated by

reference in this prospectus, before making an investment decision.

Overview

We are a clinical-stage biopharmaceutical

company focused on the development of therapeutics for the treatment or prevention of addiction and related disorders. Our lead investigational

new drug product, AD04, is being developed as a therapeutic agent for the treatment of alcohol use disorder (“AUD”). In January

2021, we expanded our portfolio in the field of addiction with the acquisition of Purnovate, LLC, and we continue to explore opportunities

to expand our portfolio in the field of addiction and related disorders, both through internal development and through acquisitions. Our

vision is to create the world’s leading addiction focused pharmaceutical company.

AUD is characterized by an urge to consume

alcohol and an inability to control the levels of consumption. We have commenced the landmark ONWARD™ pivotal Phase 3

clinical trial using AD04 for the potential treatment of AUD in subjects with certain target genotypes. As of this filing, all 25 planned

clinical sites were actively enrolling patients, and the ONWARD trial was 90% enrolled. The trial is expected to be completed by the first

quarter of 2022. We believe our approach is unique in that it targets the serotonin system and individualizes the treatment of AUD, through

the use of genetic screening (i.e., a companion diagnostic genetic biomarker). We have created an investigational companion diagnostic

biomarker test for the genetic screening of patients with certain biomarkers that, as reported in the American Journal of Psychiatry

(Johnson, et. al. 2011 & 2013), we believe will benefit from treatment with AD04. Our strategy is to integrate the pre-treatment genetic

screening into AD04’s label to create a patient-specific treatment in one integrated therapeutic offering. AD04, is dependent on

a successful development, approval, and commercialization of a genetic test, which is expected to be classified as a companion diagnostic

and will require clearance or approval of the FDA prior to commercialization. Our goal is to develop a genetically targeted, effective

and safe product candidate to treat AUD by reducing or eliminating the patients’ consumption of alcohol.

We have a worldwide, exclusive license from

the University of Virginia Patent Foundation (d.b.a. the Licensing & Venture Group) (“UVA LVG”), which is the licensing

arm of the University of Virginia, to commercialize our investigational drug candidate, AD04, subject to Food and Drug Administration

(“FDA”) approval of the product, based upon three separate patent application families, with patents issued in over 40 jurisdictions,

including seven issued patents in the U.S. Our investigational agent has been used in several investigator-sponsored trials and we possess

or have rights to use toxicology, pharmacokinetic and other preclinical and clinical data that supports our landmark ONWARD pivotal Phase

3 clinical trial. Our therapeutic agent was the product candidate used in a University of Virginia investigator sponsored Phase 2b clinical

trial of 283 patients. In this Phase 2b clinical trial, ultra-low dose ondansetron, the active pharmaceutical agent in AD04, showed a

statistically significant difference between ondansetron and placebo for both the primary endpoint and secondary endpoint, which were

reduction in severity of drinking measured in drinks per drinking day (1.71 drinks/drinking day; p=0.0042), and reduction in frequency

of drinking measured in days of abstinence/no drinking (11.56%; p=0.0352), respectively. Additionally, and importantly, the Phase 2b results

showed a significant decrease in the percentage of heavy drinking days (11.08%; p=0.0445) with a “heavy drinking day” defined

as a day with four (4) or more alcoholic drinks for women or five (5) or more alcoholic drinks for men consumed in the same day.

The active pharmaceutical agent in AD04,

our lead investigational new drug product, is ondansetron, which is also the active ingredient in Zofran®, which was granted

FDA approval in 1991 for nausea and vomiting post-operatively and after chemotherapy or radiation treatment and is now commercially available

in generic form. In studies of Zofran®, conducted as part of its FDA review process, ondansetron was given acutely at dosages

up to almost 100 times the dosage expected to be formulated in AD04 with the highest doses of Zofran® given intravenously

(“i.v.”), which results in approximately 160% of the exposure level as oral dosing. Even at high doses given i.v. the studies

found that ondansetron is well-tolerated and results in few adverse side effects at the currently marketed doses, which reach more than

80 times the AD04 dose and are given i.v. The formulation dosage of ondansetron used in our drug candidate (and expected to be used by

us in our Phase 3 clinical trials) has the potential advantage that it contains a much lower concentration of ondansetron than the generic

formulation/dosage that has been used in prior clinical trials, is dosed orally, and is available with use of a companion diagnostic genetic

biomarker. Our development plan for AD04 is designed to demonstrate both the efficacy of AD04 in the genetically targeted population and

the safety of ondansetron when administered chronically at the AD04 dosage. However, to the best of our knowledge, no comprehensive clinical

study has been performed to date that has evaluated the safety profile of ondansetron at any dosage for long-term use as anticipated in

our ongoing and planned clinical trials.

According to the National Institute of Alcohol

Abuse and Alcoholism (the “NIAAA”) and the Journal of the American Medical Association (“JAMA”), in the United

States alone, approximately 35 million people each year have AUD (such number is based upon the 2012 data provided in Grant et. al. the

JAMA 2015 publication and has been adjusted to reflect a compound annual growth rate of 1.13%, which is the growth rate reported by U.S.

Census Bureau for the general adult population from 2012-2017), resulting in significant health, social and financial costs with excessive

alcohol use being the third leading cause of preventable death and is responsible for 31% of driving fatalities in the United States (NIAAA

Alcohol Facts & Statistics). AUD contributes to over 200 different diseases and 10% of children live with a person that has an alcohol

problem. According to the American Society of Clinical Oncologists, 5-6% of new cancers and cancer deaths globally are directly attributable

to alcohol. And, The Lancet published that alcohol is the leading cause of death in people ages 15-49 globally, with the World

Health Organization reporting that 3 million deaths a year are due to harmful alcohol use. The Centers for Disease Control (the “CDC”)

has reported that AUD costs the U.S. economy about $250 billion annually, with heavy drinking accounting for greater than 75% of the social

and health related costs. Despite this, according to the article in the JAMA 2015 publication, only 7.7% of patients (i.e., approximately

2.7 million people) with AUD are estimated to have been treated in any way and only 3.6% by a physician (i.e., approximately 1.3 million

people). In addition, according to the JAMA 2017 publication, the problem in the United States appears to be growing with almost a 50%

increase in AUD prevalence between 2002 and 2013.

AUD is characterized by an urge to consume

alcohol and an inability to control the levels of consumption. Until the publication of the fifth revision of the Diagnostic and Statistical

Manual of Mental Disorders in 2013 (the “DSM-5”), AUD was broken into “alcohol dependence” and “alcohol

abuse”. More broadly, overdrinking due to the inability to moderate drinking is called alcohol addiction and is often called “alcoholism”,

sometimes pejoratively.

Since ondansetron is already manufactured

for generic sale, the active ingredient for AD04 is readily available from several manufacturers, and we have contracted with a U.S. manufacturer

to acquire ondansetron at a cost expected to be under $0.01 per dose. Clinical trial material (“CTM”) has already been manufactured

for the ONWARD Phase 3 trial. The CTM has demonstrated good stability after four years with the stability studies to date.

We have also developed the manufacturing

process at a third-party vendor to produce tablets at what we expect will serve for commercial scale production (i.e., greater than 1

million tablets per batch), also at a cost expected to be less than $0.01 per dose. A proprietary packaging process has been developed,

which appears to extend the stability of the drug product. Packaging costs are expected to be less than $0.05 per dose. We do not have

a written commitment for supply of either the tablets or the packaging and believe that alternative suppliers are available to whom we

can transfer the processes that have been developed.

Methods for the companion diagnostic genetic

test have been developed as a blood test, and we established the test with a third-party vendor capable of supporting the ONWARD Phase

3 clinical trial. Additionally, we have built validation and possible approval of the companion diagnostic into the Phase 3 program, including

that we plan to store blood samples for all patients in the event additional genetic testing is required by regulatory authorities.

Recent Developments

Private Placement

On July 6, 2021, we entered into Securities Purchase Agreements

(the “Securities Purchase Agreements”) with each of Bespoke Growth Partners, Inc. (“Bespoke”), a company controlled

by Mark Peikin, the Company’s non-executive Chief Strategy Officer (who is neither an executive officer not director of our company),

Keystone Capital Partners, LLC (“Keystone”) and Richard Gilliam, a private investor (“Gilliam”) (collectively,

the “Investors,” and each an “Investor”), pursuant to which: (i) Bespoke has agreed to purchase an aggregate of

833,334 shares of our common stock at a purchase price of $3.00 per share for aggregate gross proceeds of $2,500,002; (ii) Keystone has

agreed to purchase an aggregate of 500,000 shares of our common stock at a purchase price of $3.00 per share for aggregate gross proceeds

of $1,500,000 and (iii) Gilliam has agreed to purchase an aggregate of 333,334 shares of our common stock at a purchase price of $3.00

per share for aggregate gross proceeds of $1,000,002.

Under the terms of the Securities Purchase

Agreements: (i) Bespoke purchased 83,334 shares of our common stock and agreed to purchase an additional 750,000 shares of our common

stock upon the effectiveness of the Registration Statement; (ii) Keystone purchased 50,000 shares of our common stock and agreed to purchase

an additional 450,000 shares of our common stock upon the effectiveness of the Registration Statement and (iii) Gilliam purchased 33,334

shares of our common stock and agreed to purchase an additional 300,000 shares of our common stock upon the effectiveness of the Registration

Statement. The Securities Purchase Agreement provides that until thirty (30) days

after the effective date of this Registration Statement, if we issue or sell any shares of common stock at a price that is less than $3.00

(a “Dilutive Share Issuance”), subject to certain exceptions, then we are required to pay each Investor as a penalty an amount

in cash equal to the number of shares of common stock purchased by such Investor multiplied by the difference between the greater of the

price per share of common stock paid in the Dilutive Share Issuance and $2.48.

In connection with the Securities Purchase

Agreements, we entered into Registration Rights Agreements (“Registration Rights Agreements”), dated July 6, 2021, with each

of the Investors pursuant to which we were obligated to file a registration statement (the “Registration Statement”) with

the SEC within thirty (30) days following the date of the Registration Rights Agreement, and use all commercially reasonable efforts to

have the Registration Statement declared effective by the SEC within thirty (30) days after the Registration Statement is filed (or, in

the event of a “full review” by the SEC, within sixty (60) days after the Registration Statement is filed).

The Securities Purchase Agreements and the

Registration Rights Agreements contain customary representations, warranties, conditions and indemnification obligations of the parties,

which were made only for purposes of such Securities Purchase Agreements and Registration Rights Agreements as of specific dates and solely

for the benefit of the parties. The Securities Purchase Agreements and Registration Rights Agreements may be subject to limitations agreed

upon by the contracting parties.

Equity Line Sale

On July 14, 2021, under the terms of an equity purchase agreement,

we sold 205,762 shares of common stock to Keystone at a price of $2.43 per share for total proceeds of $500,000.

Share Issuance

One July 14, 2021, we issued 20,000 shares

to consultant under the terms of a consulting agreement at a total cost of $54,600.

Emerging Growth Company

We are an emerging growth company under the

JOBS ACT, which was enacted in April 2012. We shall continue to be deemed an emerging growth company until the earliest of:

|

|

(i)

|

the

last day of the fiscal year in which we have total annual gross revenues of $1.07 billion or more;

|

|

|

(ii)

|

the

last day of the fiscal year of the issuer following the fifth anniversary of the date of the first sale of common equity securities of

the issuer pursuant to an effective registration statement;

|

|

|

(iii)

|

the

date on which we have issued more than $1.0 billion in non-convertible debt, during the previous 3-year period, issued; or

|

|

|

(iv)

|

the

date on which we are deemed to be a large accelerated filer.

|

As an emerging growth company, we are subject

to reduced public company reporting requirements and are exempt from Section 404(b) of Sarbanes Oxley. Section 404(a) requires issuers

to publish information in their annual reports concerning the scope and adequacy of the internal control structure and procedures for

financial reporting. Section 404(b) requires that the registered accounting firm shall, in the same report, attest to and report on the

assessment on the effectiveness of the internal control structure and procedures for financial reporting.

As an emerging growth company, we are also

exempt from Section 14A (a) and (b) of the Exchange Act, which requires the shareholder approval, on an advisory basis, of executive compensation

and golden parachutes.

We have elected to use the extended transition

period for complying with new or revised accounting standards under Section 102(b)(2) of the Jobs Act, that allows us to delay the adoption

of new or revised accounting standards that have different effective dates for public and private companies until those standards apply

to private companies. As a result of this election, our financial statements may not be comparable to companies that comply with public

company effective dates.

Corporate Information

ADial Pharmaceuticals, L.L.C. was formed

as a Virginia limited liability company in November 2010. ADial Pharmaceuticals, L.L.C. converted from a Virginia limited liability company

into a Virginia corporation on October 3, 2017, and then reincorporated in Delaware on October 11, 2017 by merging the Virginia Corporation

with and into Adial Pharmaceuticals, Inc., a Delaware corporation that was incorporated on October 5, 2017 as a wholly owned subsidiary

of the Virginia corporation. We refer to this as the corporate conversion/reincorporation. In connection with the corporate conversion/reincorporation,

each unit of ADial Pharmaceuticals, L.L.C. was converted into shares of common stock of the Virginia corporation and then into shares

of common stock of Adial Pharmaceuticals, Inc., the members of ADial Pharmaceuticals, L.L.C. became stockholders of Adial Pharmaceuticals,

Inc. and Adial Pharmaceuticals, Inc. succeeded to the business of ADial Pharmaceuticals, L.L.C. The Company has one wholly owned subsidiary,

Purnovate, Inc.

Our principal executive offices are located

at 1180 Seminole Trail, Suite 495, Charlottesville Virginia 22901, and our telephone number is (434) 422-9800. Our website address is

www.adialpharma.com. Information contained in our website does not form part of this Annual Report on Form 10-K and is intended

for informational purposes only.

Additional Information

For additional information related to our

business and operations, please refer to the reports incorporated herein by reference, including our 2020 Form 10-K, our Quarterly Report

on Form 10-Q for the quarterly period ended March 31, 2021 as filed with the SEC on May 17, 2021 and our Current Reports on Form 8-K as

filed with the SEC, as described in the section entitled “Incorporation of Certain Documents By Reference” in this prospectus.

This prospectus and the information incorporated

by reference into this prospectus contain references to our trademarks and to trademarks belonging to other entities. Solely for convenience,

trademarks and trade names referred to in this prospectus and the information incorporated by reference into this prospectus, including

logos, artwork, and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate,

in any way, that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to

these trademarks and trade names. We do not intend our use or display of other companies’ trade names or trademarks to imply a relationship

with, or endorsement or sponsorship of us by, any other company.

Summary Risk Factors

Our business faces significant risks and

uncertainties of which investors should be aware before making a decision to invest in our common stock. If any of the following risks

are realized, our business, financial condition and results of operations could be materially and adversely affected. The following

is a summary of the more significant risks relating to the Company. A more detailed description of our risk factors set forth under

the caption “Risk Factors” in this prospectus.

Risks Relating to our Company

|

|

●

|

We have a limited operating history with which to compare, have incurred significant losses since our inception, and expect to incur substantial and increasing losses for the foreseeable future.

|

|

|

|

|

|

|

●

|

We currently have no product revenues and may not generate revenue at any time in the near future, if at all.

|

|

|

|

|

|

|

●

|

We and our independent registered accounting firm have expressed substantial doubt about our ability to continue as a going concern.

|

|

|

|

|

|

|

●

|

We will need to secure additional financing, which may not be available to us on favorable terms, if at all.

|

|

|

|

|

|

|

●

|

We have identified weaknesses in our internal controls, and it cannot be assured that these weaknesses will be effectively remediated or that additional material weaknesses will not occur in the future.

|

|

|

|

|

|

|

●

|

We rely on a license to use various technologies that are material to our business and there is no guarantee that such license agreements won’t be terminated, or that other rights necessary to commercialize our products will be available to us on acceptable terms or at all.

|

|

|

|

|

|

|

●

|

Our business is dependent upon the success of our lead product candidate, AD04, which requires significant additional clinical testing before we can seek regulatory approval and potentially launch commercial sales.

|

|

|

|

|

|

|

●

|

The active ingredient of our product candidate, ondansetron, is currently available in generic form and has been shown to have adverse effects on patients.

|

|

|

|

|

|

|

●

|

Coronavirus or other global health crises could adversely impact our business, including our clinical trials.

|

|

|

|

|

|

|

●

|

While there exists a large body of evidence supporting the safety of our primary API, ondansetron, under short-term use, there are currently no long-term use clinical safety data available.

|

|

|

●

|

All of our current data for our lead product candidate are the result of Phase 2 clinical trials conducted by third parties and do not necessarily provide sufficient evidence that our products are viable as potential pharmaceutical products.

|

|

|

|

|

|

|

●

|

The FDA and/or EMA may not accept our planned Phase 3 endpoints for final approval of AD04 and may determine additional clinical trials are required for approval of AD04.

|

|

|

●

|

Our lead investigational product, AD04, is dependent on a successful development, approval, and commercialization of a genetic test, which is expected to be classified as a companion diagnostic, which may not attain regulatory approval.

|

|

|

|

|

|

|

●

|

We have limited experience as a company conducting clinical trials, any may experience delays in our clinical trials and may fail to demonstrate adequately the safety and efficacy of AD04 or any future product candidates.

|

|

|

|

|

|

|

●

|

Our product candidate and the product candidates of Purnovate are in the early stages of development and there is uncertainty as to market acceptance of our technology and product candidates.

|

Risks Relating to our Acquisition of Purnovate

|

|

●

|

The combined company may not experience the anticipated strategic benefits of the Acquisition and we may be unable to successfully integrate the Purnovate businesses.

|

|

|

|

|

|

|

●

|

Purnovate has a limited operating history upon which to evaluate its ability to commercialize its products.

|

Risks Relating to our Business and Industry

|

|

●

|

We must obtain and maintain regulatory approvals in every jurisdiction in which we intend to sell our product candidate and the regulatory approval in one jurisdiction does not guarantee the approval in another jurisdiction.

|

|

|

|

|

|

|

●

|

AD04 and any future product candidates may cause undesirable side effects or have other properties that could halt their clinical development, prevent their regulatory approval, limit their commercial potential or result in significant negative consequences such as incurring product liability lawsuits

|

|

|

|

|

|

|

●

|

We will continue to be subject to ongoing and extensive regulatory requirements even after regulatory approval, and compliance with such regulatory requirements cannot be assured.

|

|

|

|

|

|

|

●

|

Our employees, independent contractors, consultants, commercial partners and vendors may engage in misconduct or other improper activities, including noncompliance with regulatory standards and requirements.

|

|

|

|

|

|

|

●

|

We have no experience selling, marketing or distributing products and have no internal capability to do so.

|

|

|

|

|

|

|

●

|

We may not be successful in establishing and maintaining strategic partnerships.

|

|

|

|

|

|

|

●

|

We have limited protection for our intellectual property. Our licensed patents and proprietary rights may not prevent us from infringing on the rights of others or prohibit potential competitors from commercializing products.

|

|

|

|

|

|

|

●

|

We may be involved in lawsuits to protect or enforce the patents of our licensors, which could be expensive, time-consuming and unsuccessful.

|

|

|

|

|

|

|

●

|

We rely on key executive officers and scientific, regulatory and medical advisors, and their knowledge of our business and technical expertise would be difficult to replace.

|

|

|

|

|

|

|

●

|

Certain of our officers may have a conflict of interest.

|

Risks Related to our Securities and Investing

in our Securities

|

|

●

|

Certain of our shareholders have sufficient voting power to make corporate governance decisions that could have a significant influence on us and the other stockholders.

|

|

|

|

|

|

|

●

|

We have never paid dividends and have no plans to pay dividends in the foreseeable future.

|

|

|

|

|

|

|

●

|

Our failure to meet the continued listing requirements of The Nasdaq Capital Market could result in a de-listing of our common stock.

|

|

|

|

|

|

|

●

|

Our stock price has fluctuated in the past, has recently been volatile and may be volatile in the future, and as a result, investors in our common stock could incur substantial losses.

|

|

|

|

|

|

|

●

|

Our need for future financing may result in the issuance of additional securities which will cause investors to experience dilution.

|

|

|

|

|

|

|

●

|

Provisions in our corporate charter documents and under Delaware law could make an acquisition of our company, which may be beneficial to our stockholders, more difficult and may prevent attempts by our stockholders to replace or remove our current management.

|

|

|

|

|

|

|

●

|

Our Certificate of Incorporation and our bylaws provide that the Court of Chancery of the State of Delaware will be the exclusive forum for certain types of state actions that may be initiated by our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers, or employees.

|

|

|

|

|

|

|

●

|

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

|

THE OFFERING

|

Common Stock offered by

us in this offering

|

|

We are not selling any shares of common stock pursuant to this prospectus.

|

|

|

|

|

|

Common Stock

offered by

the selling

stockholders

|

|

Up to 1,666,668 shares of common stock.

|

|

|

|

|

|

Terms of the offering

|

|

The

selling stockholders will determine when and how they will sell the common stock offered in this prospectus, as described

in “Plan of Distribution” on page 21 of this prospectus.

|

|

|

|

|

|

Use of Proceeds

|

|

The

selling stockholders will receive all of the proceeds from the sale of shares of common stock offered from time to time pursuant to

this prospectus. Accordingly, we will not receive any proceeds from the sale of shares of common stock that may be sold from time to

time pursuant to this prospectus; however, we have received aggregate gross proceeds of $500,002 from the sale of an aggregate of

166,668 to the selling stockholders on July 6, 2021 under the Securities Purchase Agreements and expect to receive aggregate gross

proceeds of $4,500,000 from the sale of an aggregate of 1,500,000 additional shares, which the selling stockholders have committed

to purchase in a second tranche purchase that will occur on the second business day following the effective date of the registration

statement of which this prospectus forms a part. We intend to use the proceeds that we receive for working capital purposes,

acquisitions and other strategic purposes. See “Use of Proceeds” on page 10 of this prospectus.

|

|

|

|

|

|

Risk factors

|

|

You should read the “Risk Factors” section of this prospectus on page 8 and the information incorporated by reference therein for a discussion of factors to consider before deciding to purchase shares of our common stock.

|

|

|

|

|

|

Nasdaq Capital Market symbol

|

|

Our common stock is listed on the Nasdaq Capital Market under the symbol

“ADIL.” Our warrants are listed on the Nasdaq Capital Market under the symbol “ADILW.” On July 15, 2021, the last

reported sale price of our common stock and warrants on the Nasdaq Capital Market was $2.49 per share and $0.77 per warrant, respectively.

|

RISK FACTORS

An investment in our common stock involves a high

degree of risk. Before deciding whether to invest in our common stock, you should consider carefully the risks and uncertainties described

in the section captioned “Risk Factors” contained in our Annual Report on Form 10-K for the fiscal year ended December 31,

2020 filed with the SEC on March 22, 2021 and other filings we make with the SEC from time to time, which are incorporated by reference

herein in their entirety, together with other information in this prospectus and the information incorporated by reference herein. For

a description of these reports and documents, and information about where you can find them, see “Where You Can Find More Information”

and “Incorporation of Certain Documents By Reference.” Additional risks not presently known or that we presently consider

to be immaterial could subsequently materially and adversely affect our and the information incorporated by reference herein. If any of

these risks actually occurs, our business, financial condition, results of operations or cash flow could suffer materially. In such event,

the trading price of our common stock could decline, and you might lose all or part of your investment.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated

by reference herein contain forward-looking statements that are based on current management expectations. Statements other than statements

of historical fact included in this prospectus, including statements about us and the future growth and anticipated operating results

and cash expenditures, are forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). When used in this prospectus the words “anticipate,” “objective,”

“may,” “might,” “should,” “could,” “can,” “intend,” “expect,”

“believe,” “estimate,” “predict,” “potential,” “plan” or the negative of these

and similar expressions identify forward-looking statements. These statements reflect our current views with respect to uncertain future

events and are based on imprecise estimates and assumptions and subject to risk and uncertainties. Given these uncertainties, you should

not place undue reliance on these forward-looking statements. While we believe our plans, intentions and expectations reflected in those

forward-looking statements are reasonable, these plans, intentions or expectations may not be achieved. Our actual results, performance

or achievements could differ materially from those contemplated, expressed or implied by the forward-looking statements contained in,

or incorporated by reference into, this prospectus for a variety of reasons. Those risks and uncertainties include, among others:

|

|

●

|

our

ability to implement our business plan;

|

|

|

●

|

our ability to raise additional capital to meet our liquidity needs;

|

|

|

●

|

our ability to generate product revenues;

|

|

|

●

|

our ability to achieve profitability;

|

|

|

●

|

our ability to satisfy U.S. (including FDA) and international regulatory requirements;

|

|

|

●

|

our ability to obtain market acceptance of our technology and products;

|

|

|

●

|

our ability to compete in the market;

|

|

|

●

|

our ability to advance our clinical trials;

|

|

|

●

|

our ability to fund, design and implement clinical trials;

|

|

|

●

|

our ability to demonstrate that our lead product candidate is safe for human use and effective for indicated uses;

|

|

|

●

|

our ability to gain acceptance of physicians and patients for use of our lead product;

|

|

|

●

|

our dependency on third-party researchers, manufacturers and payors;

|

|

|

●

|

our ability to establish and maintain strategic partnerships, including for the distribution of our lead product and any future products that we may acquire;

|

|

|

●

|

our ability to attract and retain a sufficient qualified personnel;

|

|

|

●

|

our ability to obtain or maintain patents or other appropriate protection for the intellectual property;

|

|

|

●

|

our dependency on the intellectual property licensed to us or possessed by third parties;

|

|

|

●

|

our ability to adequately support future growth;

|

|

|

●

|

potential product liability or intellectual property infringement claims;

|

|

|

|

|

|

|

●

|

our ability to successfully integrate

the Purnovate business into our business; and

|

|

|

●

|

disruption or delay of our ongoing clinical trial, disruption of our corporate operations or those of our critical vendors, or general significant disruption to the global economy as a resulting of ongoing the COVID-19 pandemic.

|

We urge investors to review carefully risks contained

in the section of this prospectus entitled “Risk Factors” above as well as other risks and factors identified from time to

time in our SEC filings in evaluating the forward-looking statements contained in this prospectus. We caution investors not to place significant

reliance on forward-looking statements contained in this document; such statements need to be evaluated in light of all the information

contained herein.

All forward-looking statements attributable to

us or persons acting on our behalf are expressly qualified in their entirety by the risk factors and other cautionary statements set forth,

or incorporated by reference, in this prospectus. Other than as required by applicable securities laws, we are under no obligation, and

we do not intend, to update any forward-looking statement, whether as result of new information, future events or otherwise.

USE OF PROCEEDS

The selling stockholders will receive all of the

proceeds of the sale of shares of common stock offered from time to time pursuant to this prospectus. Accordingly, we will not receive

any proceeds from the sale of shares of common stock that may be sold from time to time pursuant to this prospectus; however, we have

received aggregate gross proceeds of $500,002 from the sale of an aggregate of 166,668 to the selling stockholders on July 6, 2021 under

the Securities Purchase Agreements and expect to receive aggregate gross proceeds of $4,500,000 from the sale of an aggregate of 1,500,000

additional shares, which the three selling stockholders have committed to purchase in a second tranche purchase that will occur on the

second business day following the effective date of the registration statement of which this prospectus forms a part. We intend to use

the proceeds that we receive for working capital purposes, acquisitions and other strategic purposes.

We will bear the out-of-pocket costs, expenses

and fees incurred in connection with the registration of shares of our common stock to be sold by the selling stockholders pursuant to

this prospectus. Other than registration expenses, the selling stockholders will bear underwriting discounts, commissions, placement agent

fees or other similar expenses payable with respect to sales of shares of our common stock.

DIVIDEND POLICY

We do not anticipate paying dividends on our common

stock. We currently intend to retain all of our future earnings, if any, to finance the growth and development of our business. We are

not subject to any legal restrictions respecting the payment of dividends, except that we may not pay dividends if the payment would render

us insolvent. Any future determination as to the payment of cash dividends on our common stock will be at our board of directors’

discretion and will depend on our financial condition, operating results, capital requirements and other factors that our board of directors

considers to be relevant.

SELLING STOCKHOLDERS

This prospectus covers the resale or other disposition

by the selling stockholders identified in the table below of up to an aggregate of 1,666,668 shares of our common stock issuable. These

shares have been or will be acquired by the selling stockholders in the private placement transaction described above under the heading

“Prospectus Summary––Private Placement.”

On July 6, 2021, we entered into Securities Purchase

Agreements with each of Bespoke, a company controlled by Mark Peikin, our non-executive Chief Strategy Officer, Keystone, and Gilliam

(collectively, the “Investors,” and each an “Investor”), pursuant to which: (i) Bespoke has agreed to purchase

an aggregate of 833,334 shares of the Company’s common stock at a purchase price of $3.00 per share for aggregate gross proceeds

of $2,500,002; (ii) Keystone has agreed to purchase an aggregate of 500,000 shares of the Company’s common stock at a purchase price

of $3.00 per share for aggregate gross proceeds of $1,500,000; and (iii) Gilliam has agreed to purchase an aggregate of 333,334 shares

of the Company’s common stock at a purchase price of $3.00 per share for gross proceeds of $1,000,002. On July 6, 2021, under

the Securities Purchase Agreements we sold an aggregate of 166,668 shares of our common stock for $3.00 per share to the selling stockholders

for aggregate gross proceeds to us of $500,002, as follows: (i) 83,334 shares were purchased by Bespoke for a total purchase price of

$250,000, (ii) 50,000 shares were purchased by Keystone for a total purchase price of $150,000 and (iii) 33,334 shares were purchased

by Gilliam for a total purchase price of $100,002. Under the terms of the Securities Purchase Agreements, the selling stockholders agreed

to purchase an aggregate of 1,500,000 additional shares of our common stock at a price of $3.00 per share in a second tranche purchase

that will occur on the second business day after the effective date of the registration statement of which this prospectus is a part,

as follows: (i) Bespoke agreed to purchase 750,000 additional shares of our common stock in the second tranche purchase for a purchase

price of $2,250,000, (ii) Keystone agreed to purchase 450,000 additional shares of our common stock in the second tranche purchase for

a purchase price of $1,350,000 and (iii) Gilliam agreed to purchase 300,000 additional shares of our common stock in the second tranche

purchase for a purchase price of $900,000.

In connection with the Securities Purchase Agreements,

the Company entered into Registration Rights Agreements), dated July 6, 2021, with each of the Investors pursuant to which the Company

is obligated to file a registration statement (the “Registration Statement”) with the U.S. Securities and Exchange Commission

(the “SEC”) within thirty (30) days following the date of the Registration Rights Agreement, and use all commercially reasonable

efforts to have the Registration Statement declared effective by the SEC within thirty (30) days after the Registration Statement is filed

(or, in the event of a “full review” by the SEC, within sixty (60) days after the Registration Statement is filed).

Bespoke is a company controlled by Mark Peikin,

our non-executive Chief Strategy Officer. In the last three years, Bespoke has been issued 250,000 shares of our common stock as compensation

for services provided. Bespoke purchased 357,143 shares of our common stock on September 21, 2020 for an aggregate purchase price of $500,000

in a private placement transaction. In addition, on March 11, 2021 we engaged in a private placements of our common stock and entered

into a Securities Purchase Agreement (the “March SPA”) and Registration Rights Agreement (the “March Registration Rights

Agreement”) with certain investors that included Bespoke pursuant to which Bespoke agreed to purchase an aggregate of 336,667 shares

of our common stock at a purchase price of $3.00 per shares for a total purchase price of $1,010,001. Pursuant

to the Registration Rights Agreement (the “April RRA”), we filed a registration statement on Form S-3 with the SEC on April

20, 2020 to register the resale of shares of our common stock that have been or may be issued and sold to Bespoke and the other investors

under the March SPA, which registration statement was declared effective by the SEC on May 26, 2021. Pursuant to the terms

of the March SPA, on March 12, 2021, Bespoke purchased and was issued 33,667 shares of our common stock for a total purchase price of

$101,001 and on May 28, 2021, Bespoke purchased 303,000 shares of our common stock for a total purchase price of $909,000. None of the

shares of common stock that were issued as compensation or purchased by Bespoke on September 21, 2020 or that were issued pursuant to

the March SPA are included in the registration statement of which this prospectus is a part.

On November 18, 2020, we entered into a Common

Stock Purchase Agreement (the “Keystone Purchase Agreement”) and a Registration Rights Agreement (the “Keystone Registration

Rights Agreement”) with Keystone. Pursuant to the Keystone Purchase Agreement, we have the right to sell to Keystone Capital up

to $15,000,000 of our common stock from time to time during the term of the Purchase Agreement. Upon signing the Keystone Purchase Agreement

and the Registration Rights Agreement, we issued to Keystone 175,000 shares of common stock in consideration of its commitment to purchase

our common stock at our direction from time to time under the Keystone Purchase Agreement. As of the date of this prospectus, we have

sold an aggregate of 1,645,907 shares of common stock to Keystone in sales we made pursuant to the Keystone Purchase Agreement and received

aggregate gross proceeds of $3,850,000 from such sales. All of such issuances and sales of our common stock to Keystone under the Keystone

Purchase Agreement are made in reliance upon exemptions from the registration requirements of the Securities Act afforded by Section 4(a)(2)

of the Securities Act and Rule 506(b) of Regulation D thereunder, as well as exemptions from registration or qualification under applicable

state securities laws. Pursuant to the Keystone Registration Rights Agreement, we filed a registration statement on Form S-1 with the

SEC on December 4, 2020 to register the resale of shares of our common stock that have been or may be issued and sold to Keystone under

the Keystone Purchase Agreement, which was declared effective by the SEC on December 15, 2020. In addition, Keystone was one of the investors

in our March private placement and on March 11, 2021 we entered into the March SPA and March RRA with Keystone pursuant to which Keystone

agreed to purchase an aggregate of 333,334 shares of our common stock at a purchase price of $3.00 per shares for a total purchase price

of $1,000,002. The registration statement on Form S-3 that we filed with the SEC on April 20, 2020,

which was declared effective by the SEC on May 26, 2021, included the 333,334 shares issued and at that time to be issued to Keystone

under the March SPA. Pursuant to the terms of the March SPA, on March 12, 2021, Keystone purchased and was issued 33,334 shares

of our common stock for a total purchase price of $100,002 and on June 1, 2021, Keystone purchased and was issued 300,000 shares of our

common stock for a total purchase price of $900,000. None of the shares of common stock that have been or may be issued and sold to Keystone

under the Keystone Purchase Agreement or the March SPA are included in the registration statement of which this prospectus is a part.

Kermit Anderson, one of our Directors, manages

Richard Gilliam’s family office.

Other than as described herein and the documents

incorporated by reference herein, we have not had a material relationship with any of the selling stockholders during the last three years.

The number of shares of common stock beneficially

owned by the selling stockholders has been determined in accordance with Rule 13d-3 under the Exchange Act and includes, for such purpose,

shares of common stock that the selling stockholders has the right to acquire within 60 days of July 15, 2021. The maximum number of shares

of common stock and percentage of shares of common stock beneficially owned by the selling stockholders after the offering shown in the

table below assumes all of the offered shares are sold by the selling stockholders and is based on an aggregate of 20,298,156 shares of

our common stock, which includes an aggregate of 18,798,156 shares of our outstanding on July 15, 2021, and includes the 1,500,000 shares

of common stock that the selling stockholders have committed to purchase in a second tranche purchase pursuant to the terms of the Securities

Purchase Agreements.

All information with respect to the ownership

of the shares of common stock by the selling stockholders has been furnished by or on behalf of the selling stockholders. We believe,

based on information supplied by the selling stockholders, that except as may otherwise be indicated in the footnotes to the table below,

the selling stockholders have sole voting and dispositive power with respect to the shares of common stock reported as beneficially owned

by it. Because the selling stockholders identified in the table may sell some or all of the shares of common stock beneficially owned

by it and covered by this prospectus, and because there are currently no agreements, arrangements or understandings with respect to the

sale of any of the shares of common stock, no estimate can be given as to the number of shares of common stock available for resale hereby

that will be held by the selling stockholders upon termination of this offering. In addition, the selling stockholders may have sold,

transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, the shares of

common stock they beneficially own in transactions exempt from the registration requirements of the Securities Act after the date on which

they provided the information set forth in the table below. We have, therefore, assumed for the purposes of the following table, that

the selling stockholders will sell all of the shares of common stock that it owns or may own beneficially that are covered by this prospectus,

but will not sell any other shares of our common stock that they presently own that are not covered by this prospectus.

|

|

|

Number of Shares of

Common Stock Beneficially Owned

Prior to

|

|

|

Maximum

Number of

Shares of

Common

Stock that may be

Offered

|

|

|

Number of Shares of

Common

Stock Owned

Beneficially Owned After

|

|

|

Percent

Beneficial Ownership

After

|

|

|

Name of Selling Stockholder

|

|

Offering

|

|

|

for Resale

|

|

|

Offering

|

|

|

Offering

|

|

|

Bespoke Growth Partners, Inc.(1)

|

|

|

741,638

|

(2)

|

|

|

833,334

|

(3)

|

|

|

658,304

|

|

|

|

3.24

|

%

|

|

Keystone Capital Partners, LLC(4)

|

|

|

377,507

|

(5)

|

|

|

500,000

|

(6)

|

|

|

327,507

|

|

|

|

1.61

|

%

|

|

Richard Gilliam(7)

|

|

|

294,233

|

(8)

|

|

|

333,334

|

(9)

|

|

|

260,899

|

|

|

|

1.28

|

%

|

|

*

|

Represents beneficial ownership of less than 1% of the outstanding shares of our common stock.

|

|

(1)

|

The address for Bespoke Growth Partners, Inc. is 1875 N.W. Corporate Boulevard, Suite 290 Boca Raton, Florida 33431.

|

|

(2)

|

The shares beneficially owned by Bespoke Growth Partners consist of 741,638 shares of common stock which include: (i) 83,334 shares of our common stock purchased by Bespoke on July 6, 2021 under the Securities Purchase Agreement for a total purchase price of $250,002, all of which shares are being registered for resale in the registration statement of which this prospectus is a part and (ii) 658,304 shares of our common stock owned by Bespoke, none of which 658,304 shares are being registered for resale in the registration statement of which this prospectus is a part. In accordance with Rule 13d-3(d) under the Exchange Act, we have excluded from the number of shares beneficially owned prior to the offering all of the 750,000 additional shares of common stock that Bespoke has committed to purchase from us in a second tranche purchase under the Securities Purchase Agreement; however, we have included in the maximum number of shares of common stock that may be offered for resale the 750,000 additional shares of common stock that Bespoke has committed to purchase in a second tranche purchase pursuant to the terms of the Securities Purchase Agreement, because Bespoke’s obligation to purchase such 750,000 additional shares of common stock is subject to conditions set forth in the Securities Purchase Agreement, the satisfaction of which are entirely outside of Bespoke’s control, including the registration statement that includes this prospectus becoming and remaining effective. Such 750,000 additional shares that Bespoke has committed to purchase in a second tranche purchase subject to the terms and conditions of the Securities Purchase Agreement are, however, being registered for resale in the registration statement of which this prospectus is a part together with the 83,334 shares of common stock purchased by Bespoke on July 6, 2021 and beneficially owned by Bespoke immediately prior to this offering.

|

|

|

(3)

|

The maximum number of shares that may be offered for resale

by Bespoke through this prospectus consist of: (i) 83,334 shares of our common stock purchased by Bespoke on July 6, 2021 under the Securities

Purchase Agreement for a total purchase price of $250,002 and (ii) the 750,000 additional shares of common stock that Bespoke has committed

to purchase from us in a second tranche purchase under the Securities Purchase Agreement that will occur on the second business day after

the effective date of the registration statement of which this prospectus is a part

|

|

|

(4)

|

The business address of Keystone Capital Partners, LLC is 139

Fulton Street, Suite 412, New York, New York 10038. Keystone Capital Partners, LLC’s principal business is that of a private investor.

Ranz Group, LLC, a Delaware limited liability company, is the managing member of Keystone Capital Partners, LLC and the beneficial owner

of 97% of the membership interests in Keystone Capital Partners, LLC. Fredric G. Zaino is the managing member of Ranz Group, LLC and

has sole voting control and investment discretion over securities beneficially owned directly by Keystone Capital, LLC and indirectly

by Ranz Group, LLC. We have been advised that none of Mr. Zaino, Ranz Group, LLC or Keystone Capital Partners, LLC is a member of the

Financial Industry Regulatory Authority, or FINRA, or an independent broker-dealer, or an affiliate or associated person of a FINRA member

or independent broker-dealer. The foregoing should not be construed in and of itself as an admission by Mr. Zaino as to beneficial ownership

of the securities beneficially owned directly by Keystone Capital Partners, LLC and indirectly by Ranz Group, LLC.

|

|

(5)

|

The shares beneficially owned by

Keystone prior to the offering consist of: (i) 50,000 shares of our common stock purchased by Keystone on July 6, 2021 under the

Securities Purchase Agreement for a total purchase price of $150,000, all of which shares are being registered for resale in the

registration statement of which this prospectus is a part, and (ii) 327,507 shares of our common stock owned by Keystone, none of

which 327,507 shares are being registered for resale in the registration statement of which this prospectus is a part. In accordance

with Rule 13d-3(d) under the Exchange Act, we have excluded from the number of shares beneficially owned prior to the offering all

of the 450,000 additional shares of common stock that Keystone has committed to purchase from us in a second tranche purchase under

the Securities Purchase Agreement, because Keystone’s obligation to purchase such 450,000 additional shares of common stock is

subject to conditions set forth in the Securities Purchase Agreement, the satisfaction of which are entirely outside of

Keystone’s control, including the registration statement that includes this prospectus becoming and remaining effective. Such

450,000 additional shares that Keystone has committed to purchase in a second tranche purchase subject to the terms and conditions

of the Securities Purchase Agreement are, however, being registered for resale by Keystone in the registration statement of which

this prospectus is a part together with the 50,000 shares of common stock purchased by Keystone on July 6, 2021 and beneficially

owned by Keystone immediately prior to this offering.

|

|

(6)

|

The maximum number of shares that may

be offered for resale by Keystone through this prospectus consist of: (i) 50,000 shares of our common stock purchased by Keystone on July

6, 2021 under the Securities Purchase Agreement for a total purchase price of $500,000 and (ii) the 450,000 additional shares of common

stock that Keystone has committed to purchase from us in a second tranche purchase under the Securities Purchase Agreement that will occur

on the second business day after the effective date of the registration statement of which this prospectus is a part.

|

|

|

(7)

|

The address for Richard Gilliam is 650 Peter Jefferson Parkway,

Suite 230, Charlottesville, VA 22911.

|

|

(8)

|

The shares beneficially owned by Gilliam

prior to the offering consist of: (i) 33,334 shares of our common stock purchased by Gilliam on July 6, 2021 under the Securities Purchase

Agreement for a total purchase price of $100,002, all of which shares are being registered for resale in the registration statement of

which this prospectus is a part, 146,409 shares of common stock owned by Gilliam, none of which 146,409 shares are being registered for

resale in the registration statement of which this prospectus is a part, and (iii) warrants to purchase 114,490 shares of our common stock

owned by Gilliam, none of which 114,490 shares underlying the warrants are being registered for resale in the registration statement of

which this prospectus is a part. In accordance with Rule 13d-3(d) under the Exchange Act, we have excluded from the number of shares beneficially

owned prior to the offering all of the 300,000 additional shares of common stock that Gilliam has committed to purchase from us in a second

tranche purchase under the Securities Purchase Agreement, because Gilliam’s obligation to purchase such 300,000 additional shares

of common stock is subject to conditions set forth in the Securities Purchase Agreement, the satisfaction of which are entirely outside

of Gilliam’s control, including the registration statement that includes this prospectus becoming and remaining effective. Such

300,000 additional shares that Gilliam has committed to purchase in a second tranche purchase subject to the terms and conditions of the

Securities Purchase Agreement are, however, being registered for resale by Gilliam in the registration statement of which this prospectus

is a part together with the 33,334 shares of common stock purchased by Gilliam on July 6, 2021 and beneficially owned by Gilliam immediately

prior to this offering.

|

|

|

|

|

(9)

|

The maximum number of shares that may

be offered for resale by Gilliam through this prospectus consist of: (i) 33,334 shares of our common stock purchased by Gilliam on July

6, 2021 under the Securities Purchase Agreement for a total purchase price of $100,002 and (ii) the 300,000 additional shares of common

stock that Gilliam has committed to purchase from us in a second tranche purchase under the Securities Purchase Agreement that will occur

on the second business day after the effective date of the registration statement of which this prospectus is a part

|

DETERMINATION OF OFFERING PRICE

The prices at which the shares of common stock

covered by this prospectus may actually be sold by the selling stockholders will be determined by prevailing market prices for shares

of our common stock at the time of sale, by negotiations between the selling stockholders and buyers of our common stock or as otherwise

described in “Plan of Distribution.”

DESCRIPTION OF CAPITAL STOCK

The following description of our capital stock

and the provisions of our certificate of incorporation and our bylaws are summaries and are qualified by reference to the certificate

of incorporation and the bylaws. We have filed copies of these documents with the SEC as exhibits to our registration statement of which

this prospectus forms a part.

General

As of the date of this prospectus, our authorized

capital stock consists of 50,000,000 shares of common stock, par value $0.001 per share, and 5,000,000 shares of preferred stock, par

value $0.001 per share.

Common Stock

For a description of our capital stock, please

see the Description of Securities included as Exhibit 4.19 to our Annual Report on Form 10-K for the year ended December 31, 2020, filed

with the SEC on March 22, 2021, which is incorporated by reference herein. See “Incorporation of Certain Documents by Reference”

and “Where You Can Find More Information.”

Common stock outstanding. As of July 15,

2021, there were 18,798,156 shares of our common stock outstanding.

Voting rights. The holders of common stock

are entitled to one vote per share on all matters to be voted upon by the stockholders, except on matters relating solely to terms of

preferred stock. Stockholders do not have cumulative voting rights.

Dividend rights. Subject to preferences

that may be applicable to any outstanding preferred stock, the holders of common stock are entitled to receive ratably such dividends,

if any, as may be declared from time to time by the board of directors out of funds legally available therefor. See “Dividend Policy.”

Rights upon liquidation. In the event of

our liquidation, dissolution or winding up, the holders of common stock are entitled to share ratably in all assets remaining after payment

of liabilities, subject to prior distribution rights of preferred stock, if any, then outstanding.

Other rights. The holders of our common

stock have no preemptive or conversion rights or other subscription rights. There are no redemption or sinking fund provisions applicable

to our common stock.

Preferred Stock

There are no shares of our preferred stock outstanding

as of the date of this prospectus.

Our board of directors has the authority to issue

preferred stock in one or more classes or series and to fix the designations, powers, preferences and rights, and the qualifications,

limitations or restrictions thereof, including dividend rights, conversion right, voting rights, terms of redemption, liquidation preferences

and the number of shares constituting any class or series, without further vote or action by the stockholders. Although we have no present

plans to issue any shares of preferred stock, the issuance of shares of preferred stock, or the issuance of rights to purchase such shares,

could decrease the amount of earnings and assets available for distribution to the holders of common stock, could adversely affect the

rights and powers, including voting rights, of the common stock, and could have the effect of delaying, deterring or preventing a change

of control of us or an unsolicited acquisition proposal. To date, no preferred stock has been issued.

Warrants

At the date of this prospectus, we had outstanding

warrants to purchase 7,957,225 shares of common stock at exercise prices ranging from $0.005 to $7.634 (with a weighted average exercise

price of $4.83) and expiration dates from July 31, 2023 to December 31, 2031.

Anti-Takeover Effects of Delaware Law

The provisions of Delaware law, our certificate

of incorporation and our bylaws described below may have the effect of delaying, deferring or discouraging another party from acquiring

control of us.

Section 203 of the Delaware General Corporation

Law

We are subject to Section 203 of the Delaware

General Corporation Law, which prohibits a Delaware corporation from engaging in any business combination with any interested stockholder

for a period of three years after the date that such stockholder became an interested stockholder, with the following exceptions:

|

|

●

|

before such date, the board of directors of the corporation approved either the business combination or the transaction that resulted in the stockholder becoming an interested stockholder;

|

|

|

|

|

|

|

|

upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction began, excluding for purposes of determining the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned (i) by persons who are directors and also officers and (ii) employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or

|

|

|

|

|

|

|

●

|

on or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting of the stockholders, and not by written consent, by the affirmative vote of at least sixty-six and two-thirds percent (66 2/3%) of the outstanding voting stock that is not owned by the interested stockholder.

|

In general, Section 203 defines business combination to include the

following:

|

|

●

|

any merger or consolidation involving the corporation and the interested stockholder;

|

|

|

|

|

|

|

●

|

any sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder;

|

|

|

|

|

|

|

●

|

subject to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder;

|

|

|

|

|

|

|

●

|

any transaction involving the corporation that has the effect of increasing the proportionate share of the stock or any class or series of the corporation beneficially owned by the interested stockholder; or

|

|

|

|

|

|

|

●

|

the receipt by the interested stockholder of the benefit of any loss, advances, guarantees, pledges or other financial benefits by or through the corporation.

|

Certificate of Incorporation and Bylaws

Our certificate of incorporation and bylaws provide

that:

|

|

●

|

our board of directors is divided into three classes, one class of which is elected each year by our stockholders with the directors in each class to serve for a three-year term;

|

|

|

|

|

|

|

●

|

the authorized number of directors can be changed only by resolution of our board of directors;

|

|

|

|

|

|

|

●

|

directors may be removed only by the affirmative vote of the holders of at least 60% of our voting stock, whether for cause or without cause;

|

|

|

|

|

|

|

●

|

our bylaws may be amended or repealed by our board of directors or by the affirmative vote of sixty-six and two-thirds percent (66 2/3%) of our stockholders;

|

|

|

|

|

|

|

●

|

stockholders may not call special meetings of the stockholders or fill vacancies on the board of directors;

|

|

|

|

|

|

|

●

|

our board of directors will be authorized to issue, without stockholder approval, preferred stock, the rights of which will be determined at the discretion of the board of directors and that, if issued, could operate as a “poison pill” to dilute the stock ownership of a potential hostile acquirer to prevent an acquisition that our board of directors does not approve;

|

|

|

|

|

|

|

●

|

our stockholders do not have cumulative voting rights, and therefore our stockholders holding a majority of the shares of common stock outstanding will be able to elect all of our directors; and

|

|

|

|

|

|

|

●

|

our stockholders must comply with advance notice provisions to bring business before or nominate directors for election at a stockholder meeting.

|

Board Classification

Our board of directors is divided into three classes,

one class of which is elected each year by our stockholders. The directors in each class will serve for a three-year term. For more information

on the classified board, see “Management—Board of Directors and Executive Officers.” The classification of our board

of directors and the limitations on the ability of our stockholders to remove directors could make it more difficult for a third-party

to acquire, or discourage a third-party from seeking to acquire, control of us.

Potential Effects of Authorized but Unissued

Stock

We have shares of common stock and preferred stock

available for future issuance without stockholder approval. We may utilize these additional shares for a variety of corporate purposes,

including future public offerings to raise additional capital, to facilitate corporate acquisitions or payment as a dividend on the capital

stock.

The existence of unissued and unreserved common

stock and preferred stock may enable our board of directors to issue shares to persons friendly to current management or to issue preferred

stock with terms that could render more difficult or discourage a third-party attempt to obtain control of us by means of a merger, tender

offer, proxy contest or otherwise, thereby protecting the continuity of our management. In addition, the board of directors has the discretion

to determine designations, rights, preferences, privileges and restrictions, including voting rights, dividend rights, conversion rights,

redemption privileges and liquidation preferences of each series of preferred stock, all to the fullest extent permissible under the Delaware

General Corporation Law and subject to any limitations set forth in our certificate of incorporation. The purpose of authorizing the board

of directors to issue preferred stock and to determine the rights and preferences applicable to such preferred stock is to eliminate delays

associated with a stockholder vote on specific issuances. The issuance of preferred stock, while providing desirable flexibility in connection

with possible financings, acquisitions and other corporate purposes, could have the effect of making it more difficult for a third party

to acquire, or could discourage a third party from acquiring, a majority of our outstanding voting stock.

Limitations of Director Liability and Indemnification

of Directors, Officers and Employees

Our certificate of incorporation limits the liability

of directors to the maximum extent permitted by Delaware law. Delaware law provides that directors of a corporation will not be personally

liable for monetary damages for breach of their fiduciary duties as directors, except for liability for any:

|

|

●

|

breach of their duty of loyalty to us or our stockholders;

|

|

|

|

|

|

|

●

|

act or omission not in good faith or that involves intentional misconduct or a knowing violation of law;

|

|

|

|

|

|